Carbon Credits | 22 Nov 2024

For Prelims: Carbon credits, Carbon markets, Hydrofluorocarbon, Paris Agreement, Kyoto Protocol, Greenhouse gases, Greenwashing

For Mains: Carbon Markets and Their Effectiveness, Environmental Integrity and Greenwashing in Carbon Markets, Carbon Credit Market in India

Why in News?

A recent study in Nature journal reveals that only 16% of carbon credits result in actual emissions reductions, casting doubt on the effectiveness of carbon markets.

- As the 29th Conference of the Parties to the United Nations Framework Convention on Climate Change (COP29) prioritizes new carbon trading mechanisms, this study raises critical concerns about the reliability of emissions reduction claims.

What are the Key Highlights of the Study?

- Ineffectiveness of Carbon Credits: The study analyzed projects generating carbon credits equivalent to one billion tonnes of Carbon dioxide(CO2) under Kyoto Protocol, 1997 mechanisms, and revealed that only 16% of these credits corresponded to actual emissions reductions.

- HFC-23 Abatement Success: The most effective emissions reductions were observed in projects focused on the elimination of Hydrofluorocarbon (HFC)-23, a potent greenhouse gas.

- Around 68% of credits from these projects resulted in actual emissions cuts, making them the most successful among the projects reviewed.

- Challenges with Other Projects: Avoided deforestation projects only resulted in a 25% effectiveness rate.

- An "avoided deforestation project" is a conservation effort that protects forests from being cleared, preventing the release of CO2 that would occur if the trees were cut down.

- Solar cooker deployment projects showed even lower effectiveness, with just 11% of credits leading to emissions reductions.

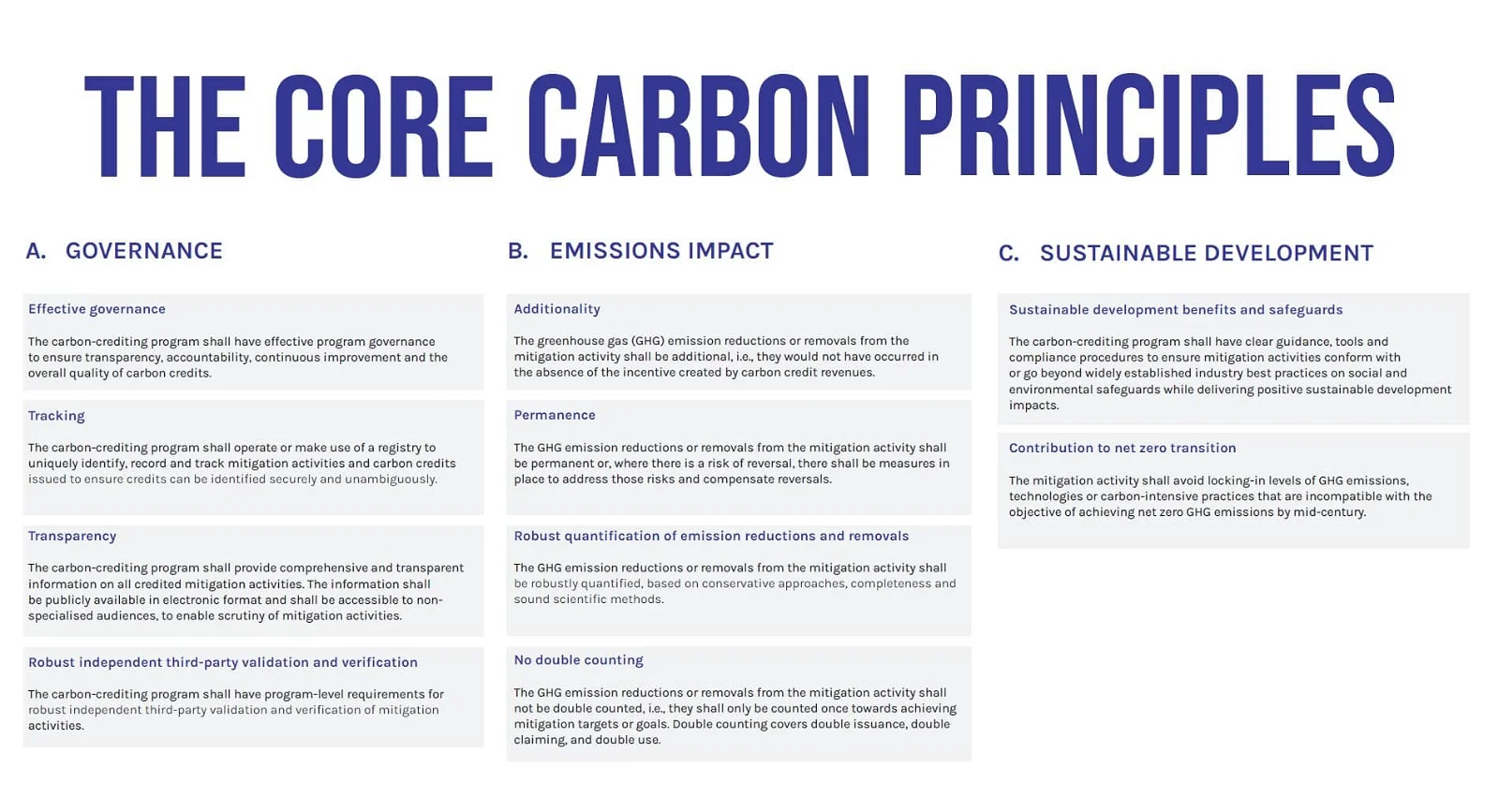

- Flaws in Assessing Additionality: The study found that many projects under the Kyoto Protocol failed the "additionality" rule, meaning emissions reductions could have occurred without the revenue from carbon credits.

- Additionality requires projects to reduce emissions beyond what would have happened in a business-as-usual scenario.

- The study highlighted flaws in current assessments, with many Kyoto mechanisms issuing credits for non-additional reductions, undermining emission claims.

- These issues emphasise the need for more robust carbon trade mechanisms under the Paris Agreement, 2015 with progress expected at COP29 in Baku.

- Recommendations: The study calls for stricter eligibility criteria and improved standards and methodologies to quantify emission reductions.

- Projects with a high likelihood of additionality should be prioritised.

- The study stresses the need for robust carbon trading mechanisms under the Paris Agreement, with safeguards to ensure credits reflect real emissions reductions.

What are Carbon Credits?

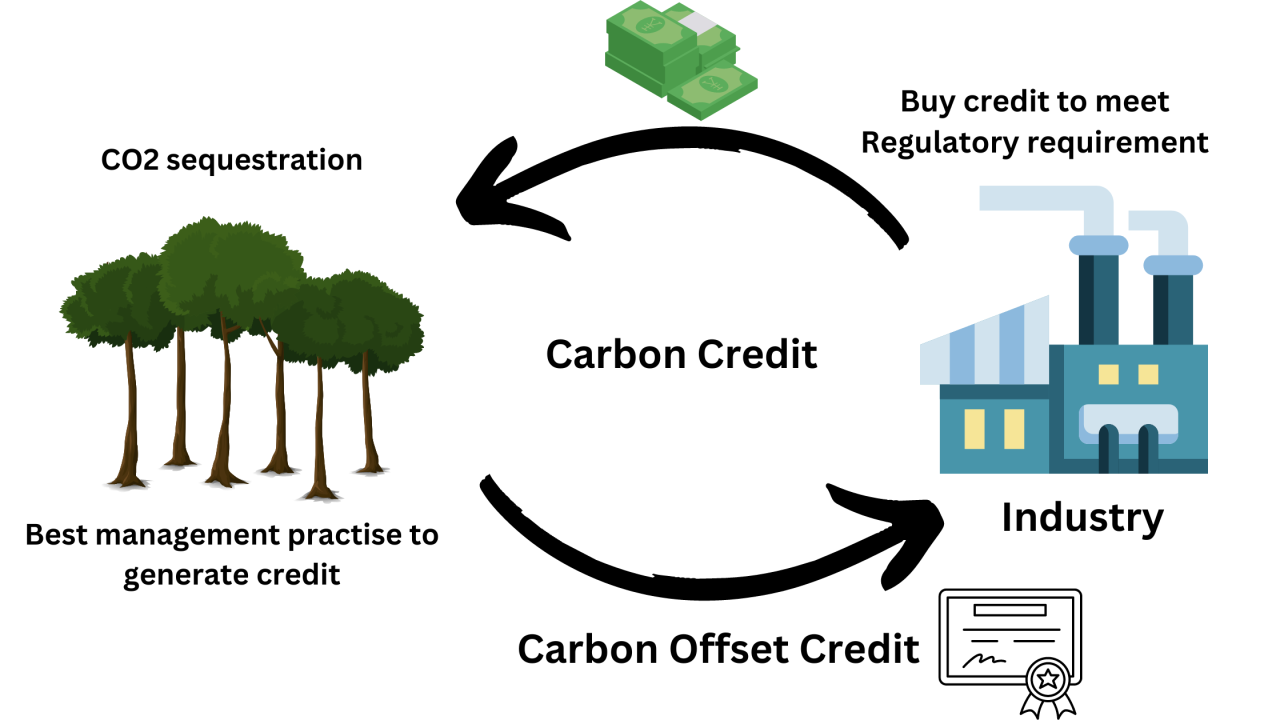

- About: Carbon credits, or carbon offsets, refer to carbon emissions reductions or removals, measured in tonnes of carbon dioxide equivalent (tCO2e).

- The concept of carbon credit, introduced in the Kyoto Protocol, 1997 and reinforced by the Paris Agreement, 2015 aims to reduce greenhouse gases (GHG) emissions through carbon trading.

- Each carbon credit permits the emission of one tonne of CO₂ or its equivalent.

- These credits are generated by projects that absorb or reduce carbon emissions and are certified by international bodies like the Verified Carbon Standard (VCS) and the Gold Standard.

- The concept of carbon credit, introduced in the Kyoto Protocol, 1997 and reinforced by the Paris Agreement, 2015 aims to reduce greenhouse gases (GHG) emissions through carbon trading.

- Carbon Markets: The carbon markets established under the Paris Agreement aim to create more robust, reliable systems for trading carbon credits and ensuring transparency in emissions reductions.

- Under Article 6 of the Paris Agreement, countries can work together, transferring carbon credits from emission-reducing projects to help other countries meet their climate goals.

- Types of Carbon Markets:

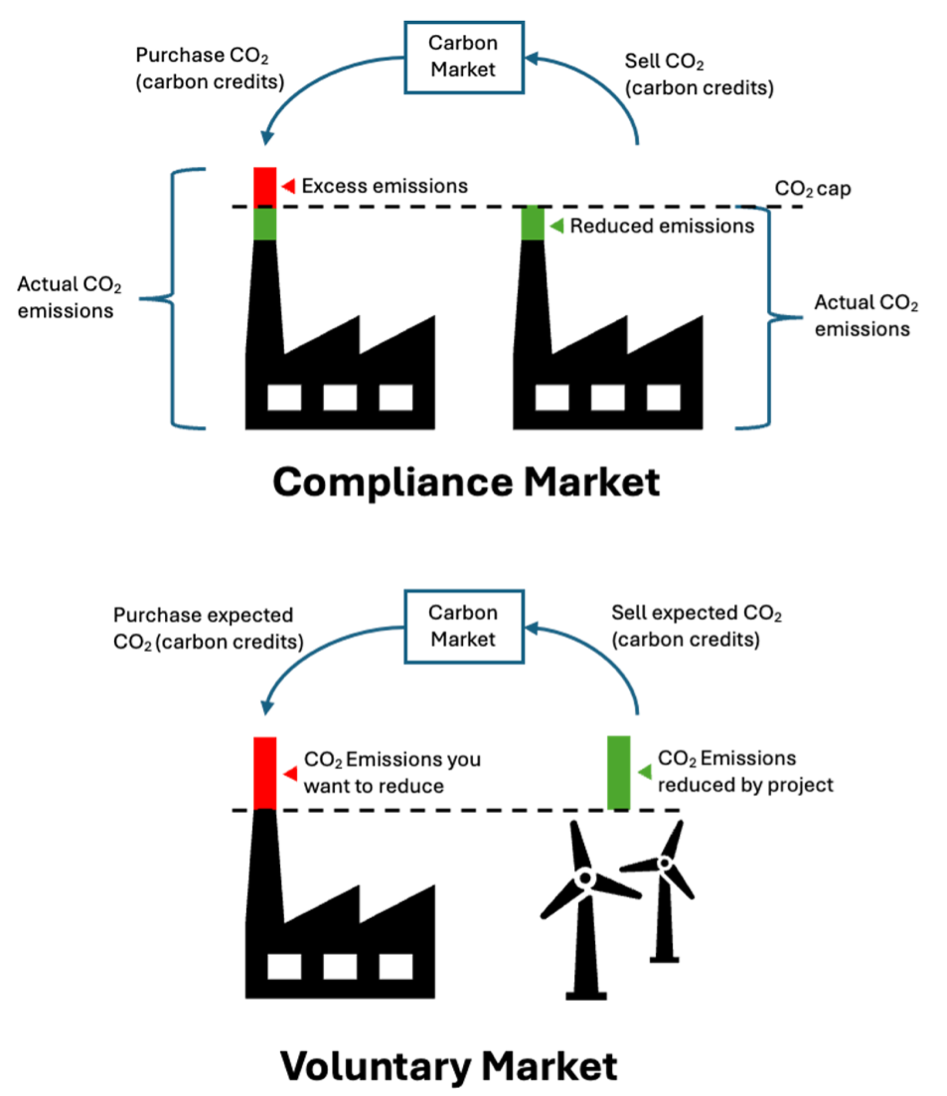

- Compliance Markets: Established through national or regional emissions trading schemes (ETS), where participants are legally obligated to meet specific emission reduction targets.

- These markets are driven by regulatory frameworks and impose penalties for non-compliance.

- Participants include governments, industries, and businesses, all of whom must meet emissions limits set by the authorities.

- Voluntary Markets: In voluntary carbon markets, there is no formal obligation to reduce emissions.

- Participants, such as companies, cities, or regions, voluntarily engage in carbon trading to offset their emissions and meet sustainability goals, such as achieving climate neutrality or net-zero emissions.

- This is often done as part of corporate social responsibility (CSR) initiatives or to gain a market advantage by showcasing environmental responsibility.

- Compliance Markets: Established through national or regional emissions trading schemes (ETS), where participants are legally obligated to meet specific emission reduction targets.

- Benefits of Carbon Credits: Projects that aim at forest protection or sustainable land management can preserve critical habitats , animal and plant species, and promote ecosystem services. Carbon credits can also play a role in financing sustainable projects .

What are the Concerns Regarding Carbon Credits?

- Non-Adherence to Additionality: Carbon credits should only be given for projects that achieve emissions reductions beyond what would have happened naturally. This concept is known as additionality, a core principle of Carbon Credits.

- Due to lack of clear additionality rules, credits are given to projects that would have reduced the same amount of emissions anyway, making the carbon market less effective.

- Greenwashing: Some companies claim carbon credits as a way to appear environmentally responsible without making substantial changes to their operations, a practice known as greenwashing.

- This undermines the credibility of the carbon credit market and can mislead consumers and investors about the actual environmental impact.

- Market Transparency: Lack of transparency in how carbon credits are generated and traded can raise doubts about the legitimacy of the market.

- Lack of real-time tracking and independent audits weakens the system's integrity, leading to issues like double-counting emissions reductions.

- Inequitable Access: Developing countries may face barriers in accessing resources or technology to participate in carbon credit generation, limiting their ability to benefit from the market. This can perpetuate inequalities in the global climate effort.

- Key Challenges Facing India’s Carbon Credit Market:

- Industry Readiness & Compliance Costs: The high cost of monitoring and verification systems limits smaller projects in India, especially Micro, Small and Medium Enterprises (MSMEs), which generate around 110 million tonnes of CO2 annually, hindering their participation in the carbon market.

- Regulatory and Oversight Mechanisms: India’s carbon market, while still in its early stages, requires strong enforcement and an alignment with both domestic and international standards to be effective.

India’s Initiatives Related to Carbon Credit

- Nationally Determined Contributions (NDCs): India updated its NDCs in 2023 to include the establishment of a domestic carbon market.

- Energy Conservation (Amendment) Act, 2022: Provides the legal framework for the Carbon Credit Trading Scheme (CCTS). It empowers the Indian government to establish a domestic carbon market and to authorise designated agencies to issue carbon credit certificates (CCCs).

- The CCTS is a unified Indian Carbon Market (ICM) established to reduce GHG emissions through the trading of carbon credit certificates.

- Perform, Achieve and Trade (PAT) scheme

- Renewable Energy Certificates (REC)

- Green Credit Programme.

- Monitoring and Verification: The Bureau of Energy Efficiency (BEE) and the National Steering Committee for Indian Carbon Market (NSCICM) are responsible for ensuring the integrity of the carbon credits through rigorous monitoring, reporting, and verification processes.

Way Forward

- Strengthen Additionality: Implement stringent additionality criteria to ensure credits represent genuine emissions reductions.

- Ensure transparency through real-time tracking and third-party verification.

- Focus on Proven, High-Impact Projects: Prioritise projects like HFC-23 abatement that have demonstrated high emissions reduction effectiveness. Avoid low-impact projects with poor success rates.

- Establish Robust MRV Systems: Invest in scalable monitoring, reporting, and verification (MRV) systems, especially for smaller projects. Collaborate with international standards like VCS or Gold Standard to ensure credibility.

- Align with International Standards: Ensure compliance with Article 6 of the Paris Agreement and integrate global carbon market standards.

- Provide financial and technical support to developing regions to participate effectively in carbon markets.

|

Drishti Mains Question: Evaluate the concept of carbon markets. How do flaws in additionality impact the integrity of carbon credit systems?" |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Consider the following statements (2023)

Statement—I: Carbon markets are likely to be one of the most widespread tools in the fight against climate change.

Statement—II: Carbon markets transfer resources from the private sector to the State.

Which one of the following is correct in respect of the above statements?

(a) Both Statement—I and Statement—II are correct and Statement—II is the correct explanation for Statement—I

(b) Both Statement—I and Statement—II are correct and Statement—II is not the correct explanation for Statement—I

(c) Statement—I is correct but Statement—II is incorrect

(d) Statement—I is incorrect but Statement—II is correct

Ans: B

Q. The concept of carbon credit originated from which one of the following? (2009)

(a) Earth Summit, Rio de Janeiro

(b) Kyoto Protocol

(c) Montreal Protocol

(d) G-8 Summit, Heiligendamm

Ans: B