Carbon Credit Trading Scheme | 17 Mar 2025

For Prelims: Perform, Achieve, and Trade (PAT) scheme, Carbon Credit Certificate, Bureau of Energy Efficiency, Carbon Market

For Mains: Carbon Credit Trading Scheme, Strengthening CCTS in India, Carbon Pricing

Why in News?

The Carbon Credit Trading Scheme (CCTS), 2023 introduced under the Energy Conservation (Amendment) Act, 2022, replaces the Perform, Achieve, and Trade (PAT) scheme to establish the Indian Carbon Market (ICM), aligning with India’s climate commitments under the Paris Agreement.

What is the Carbon Credit Trading Scheme?

- CCTS: The CCTS is a market-based mechanism introduced to regulate and trade carbon credits under the ICM.

- The CCTS aims to decarbonize the Indian economy by pricing greenhouse gas (GHG) emissions and facilitating carbon trading.

- Transition from PAT to CCTS: The PAT scheme focused on energy efficiency improvements in energy-intensive industries through Energy Saving Certificates (ESCerts).

- CCTS replaces PAT, shifting the focus from energy intensity to reducing GHG emission intensity, monitoring emissions per tonne of GHG equivalent.

- It issues Carbon Credit Certificates (CCC), each representing a one-tonne CO2 equivalent (tCO2e) reduction.

- CCTS replaces PAT, shifting the focus from energy intensity to reducing GHG emission intensity, monitoring emissions per tonne of GHG equivalent.

- Mechanisms: CCTS introduces carbon pricing through two key mechanisms to ensure comprehensive carbon reduction efforts.

- Compliance Mechanism: Mandates energy-intensive industries (e.g., Aluminium, Cement, Fertilizers, Iron & Steel) to meet sector-specific GHG reduction targets. Entities exceeding targets earn CCC, those falling short must purchase credits.

- Offset Mechanism: Allows voluntary participation from entities outside the compliance framework to earn carbon credits by reducing emissions.

- Sectors Identified: CCTS initially includes energy-intensive industries such as iron & steel, aluminium, cement, fertilizers, petroleum refineries, pulp & paper, and textiles (account for 16% of India’s total emissions).

- The power sector (40% of India's GHG emissions) may be included later.

- Regulatory Oversight: Managed by multiple government bodies, including the Bureau of Energy Efficiency (BEE) and the National Steering Committee for Indian Carbon Market (NSCICM).

- Importance of CCTS in India’s Climate Goals: India aims to cut emission intensity by 45% by 2030. The CCTS drives private sector involvement, encouraging clean technologies, renewables, and carbon capture.

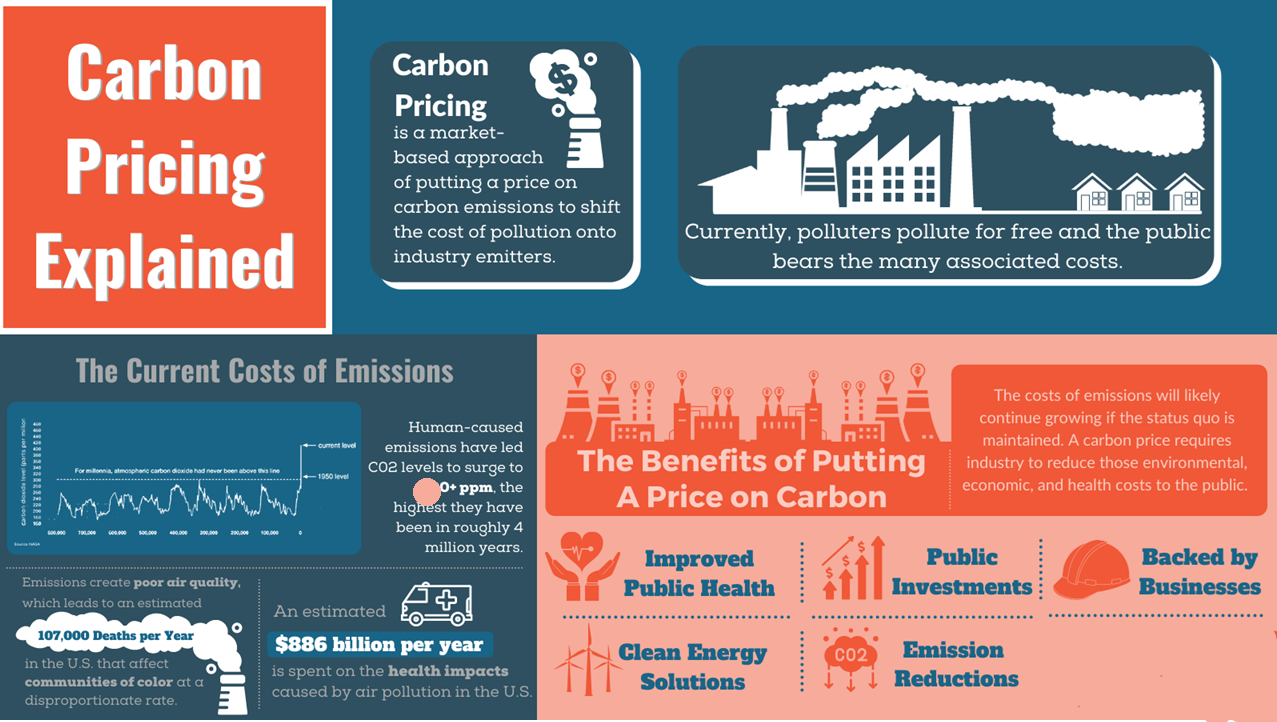

What is Carbon Pricing?

- About: Carbon pricing is an economic strategy that captures the external costs of carbon emissions (such as damage to crops, rising healthcare costs, and property losses due to extreme weather) and links them to their sources.

- This mechanism shifts the financial burden back to polluters, giving them the choice to either reduce their emissions, continue polluting and pay for it, or invest in cleaner technologies.

- Current global carbon pricing mechanisms cover 12.8 gigatonnes of CO₂ (25% of global emissions) across 89 countries.

- Mechanisms: Governments use 3 main approaches to price carbon, ensuring emissions reductions at the lowest possible societal cost.

- Emissions Trading System (ETS): Allows industries to trade emission units. It operates through two mechanisms; Cap-and-Trade and Baseline-and-Credit.

- In Cap-and-trade, a cap is set on emissions with companies below it can sell allowances, while those exceeding it must buy more.

- While Baseline-and-Credit rewards industries that reduce emissions below a set baseline by allowing them to sell credits to others.

- Carbon Tax: Unlike ETS, Carbon Tax directly sets a price on carbon emissions by charging a fixed tax per ton of CO₂.

- However, it does not guarantee a specific reduction in emissions, as industries decide whether to cut emissions or pay the tax.

- Crediting Mechanism: Allows GHG reductions from projects to generate carbon credits, which can be sold domestically or internationally for compliance or voluntary mitigation purposes.

- Emissions Trading System (ETS): Allows industries to trade emission units. It operates through two mechanisms; Cap-and-Trade and Baseline-and-Credit.

What is the Carbon Market?Click here to Read: Carbon Market |

What are the Challenges in Effective Implementation of CCTS?

- Target Setting and Carbon Pricing: Balancing emission reduction targets is crucial. Lenient targets can oversupply CCC, lowering prices, while stringent targets may increase compliance costs and inflation.

- Compliance and Enforcement Issues: Under PAT, 50% of the required ESCerts remained unpurchased, with no penalties imposed, indicating a lack of strict compliance and enforcement mechanisms in the carbon market that can impact CCTS, making it ineffective.

- CCTS may face the risk of double counting or inaccurate emissions reporting, as observed in global carbon markets.

- Delays in Credit Issuance: Delays in the issuance of credits under PAT since 2021 have reduced market confidence. Similar delays in CCTS CCC issuance could hinder participation and investment in clean energy.

- Transparency: Lack of publicly available data on industry emissions and compliance could reduce market trust.

How Can India Strengthen CCTS?

- Align with International Best Practices: Adopt lessons from the European Union (EU) ETS such as gradual tightening of caps, carbon price stability measures, and rigorous compliance frameworks.

- Build capacity for MRV (Monitoring, Reporting, and Verification) to ensure credibility.

- Robust Trading Platform: Introduce digital registries to track credits and prevent fraudulent activities.

- Ensure cross-border compatibility to avoid trade restrictions (e.g., EU’s Carbon Border Adjustment Mechanism, CBAM).

- Encourage Industry Participation: Provide incentives for early adopters, such as tax benefits for companies reducing emissions beyond compliance requirements.

- Promote investment in green technologies, renewable energy, and energy efficiency improvements.

|

Drishti Mains Question: Discuss the Carbon Credit Trading Scheme and challenges in implementing it. How can these challenges be addressed? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Consider the following statements (2023)

Statement—I: Carbon markets are likely to be one of the most widespread tools in the fight against climate change.

Statement—II: Carbon markets transfer resources from the private sector to the State.

Which one of the following is correct in respect of the above statements?

(a) Both Statement—I and Statement—II are correct and Statement—II is the correct explanation for Statement—I

(b) Both Statement—I and Statement—II are correct and Statement—II is not the correct explanation for Statement—I

(c) Statement—I is correct but Statement—II is incorrect

(d) Statement—I is incorrect but Statement—II is correct

Ans: B

Q. The concept of carbon credit originated from which one of the following? (2009)

(a) Earth Summit, Rio de Janeiro

(b) Kyoto Protocol

(c) Montreal Protocol

(d) G-8 Summit, Heiligendamm

Ans: B