Important Facts For Prelims

Bima Sugam

- 25 Sep 2023

- 5 min read

Why in News?

Recently, the Insurance Regulatory and Development Authority of India (IRDAI) has formed a steering committee to act as the apex decision-making body for the creation of its ambitious ‘Bima Sugam’ online platform.

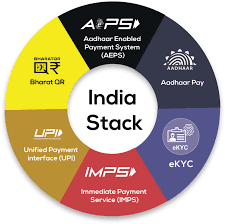

- IRDAI says Bima Sugam is an electronic marketplace protocol which would universalise and democratize insurance. This protocol will be connected with India Stack.

What is Bima Sugam?

- About:

- It’s an online platform where customers can choose a suitable scheme from multiple options given by various companies.

- All insurance requirements, including those for life, health, and general insurance (including motor and travel) will be met by Bima Sugam.

- Features:

- It will simplify and digitize the insurance marketplace— right from buying policies, to renewals, claim settlement, and agent and policy portability.

- It will assist consumers with all insurance related queries.

- Role:

- The proposed platform would act as a single window for the policyholder to manage his/her insurance coverage.

- It will provide end-to-end solutions for customers’ insurance needs i.e., purchase, service, and settlement.

- Utility:

- It will facilitate insurance companies to access the validated and authentic data from various touch points on a real-time basis.

- The platform will interface for the intermediaries and agents to sell policies and provide services to policyholders, among others, and reduce paperwork.

- Stakeholders:

- Life insurance and general insurance companies will own a 47.5% stake each, while brokers and agent bodies will own 2.5% each in Bima Sugam Platform.

What is IRDAI?

- IRDAI, founded in 1999, is a regulatory body created with the aim of protecting the interests of insurance customers.

- It is a statutory body under the IRDA Act 1999 and is under the jurisdiction of the Ministry of Finance.

- It regulates and sees to the development of the insurance industry while monitoring insurance-related activities.

- The powers and functions of the Authority are laid down in the IRDAI Act, 1999 and Insurance Act, 1938.

What is India Stack?

- About:

- India Stack is a set of APIs (Application programming interface) that allows governments, businesses, startups and developers to utilize a unique digital Infrastructure to solve India’s hard problems towards presence-less, paperless, and cashless service delivery.

- It aims to unlock the economic primitives of identity, data, and payments at population scale.

- Features:

- Digital transactions through India Stack often have lower transaction costs compared to traditional methods. This benefits businesses, consumers, and the government by reducing the cost of conducting various transactions.

- Bridging the wealth gaps and building an efficient and resilient digital economy that drives economic growth and social development.

- Components:

- The key components of INDIA STACK include Aadhaar (unique biometric-based identification system), Unified Payments Interface (UPI) for instant digital payments, and Digital Locker for secure storage of personal documents.

UPSC Civil Services Examination Previous Year’s Question (PYQs)

Prelims:

Q. Consider the following statements: (2018)

- Aadhaar card can be used as a proof of citizenship or domicile.

- Once issued, Aadhaar number cannot be deactivated or omitted by the Issuing Authority.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (d)

Exp:

- The Aadhaar platform helps service providers authenticate identity of residents electronically, in a safe and quick manner, making service delivery more cost effective and efficient. According to the GoI and UIDAI, Aadhaar is not proof of citizenship.

- However, UIDAI has also published a set of contingencies when the Aadhaar issued by it is liable for rejection. An Aadhaar with mixed or anomalous biometric information or multiple names in a single name (like Urf or Alias) can be deactivated. Aadhaar can also get deactivated upon non-usage of the same for three consecutive years.