53rd GST Council Meeting | 25 Jun 2024

For Prelims: Goods and Services Tax (GST) Council, GST Appellate Tribunals, Prevention of Money Laundering Act, Enforcement Directorate, Aadhar.

For Mains: Outcomes of 51st GST Council Meeting, Issues related with GST Council, Functions of GST Council.

Why in News?

Recently, the 53rd meeting of the Goods and Services Tax (GST) Council has approved several measures to ease compliance for small businesses, exempting hostel accommodation, Railway services etc.

- It also agreed to reconvene in August 2024 to discuss restructuring the multiple tax rates under the seven-year GST.

What are the Key Highlights of the 53rd GST Council Meeting?

- Aadhaar-based Biometric Authentication: The council announced the rollout of biometric-based Aadhaar authentication on a national level to combat fraudulent input tax credit claims made through fake invoices. This is aimed at enhancing tax compliance.

- Exemption for Hostel Accommodation: Hostel accommodation services outside educational institutions are exempt from GST for rents up to Rs 20,000 per person per month, making it more affordable for students and the working class.

- This exemption applies only for stays up to 90 days, whereas previously such rents incurred 12% GST.

- Indian Railways Services: GST exemption on platform tickets, aiming to ease the financial burden on passengers. This decision is part of broader efforts to make railway services more affordable.

- Reduction in GST Rate on Cartons: The GST rate on various types of carton boxes was reduced from 18% to 12%. This change is intended to benefit both manufacturers and consumers by lowering the overall cost of these essential packaging materials.

- GST Reduction on Milk Cans and Solar Cookers: A uniform GST rate of 12% was announced for all milk cans, regardless of whether they are made of steel, iron, or aluminium.

- Waiver of Interest and Penalties for Non-Fraudulent Cases:

- The council has recommended waiving interest and penalties for demand notices issued under Section 73 of the GST Act, which applies to cases that do not involve fraud, suppression, or misstatements.

- New Monetary Limits for Filing Appeals: The GST Council has recommended new monetary thresholds for filing appeals by the department in various courts which are Rs 20 lakh for the GST Appellate Tribunal, Rs 1 crore for High Court, and Rs 2 crore for the Supreme Court for filing appeals by the department.

- The aim is to reduce government litigation.

- Central Support and Conditional Loans to States: The government introduced the 'Scheme for Special Assistance to States for Capital Investment', where some loans are conditional on states implementing citizen-centric reforms and capital projects, urging states to meet the criteria to access these loans.

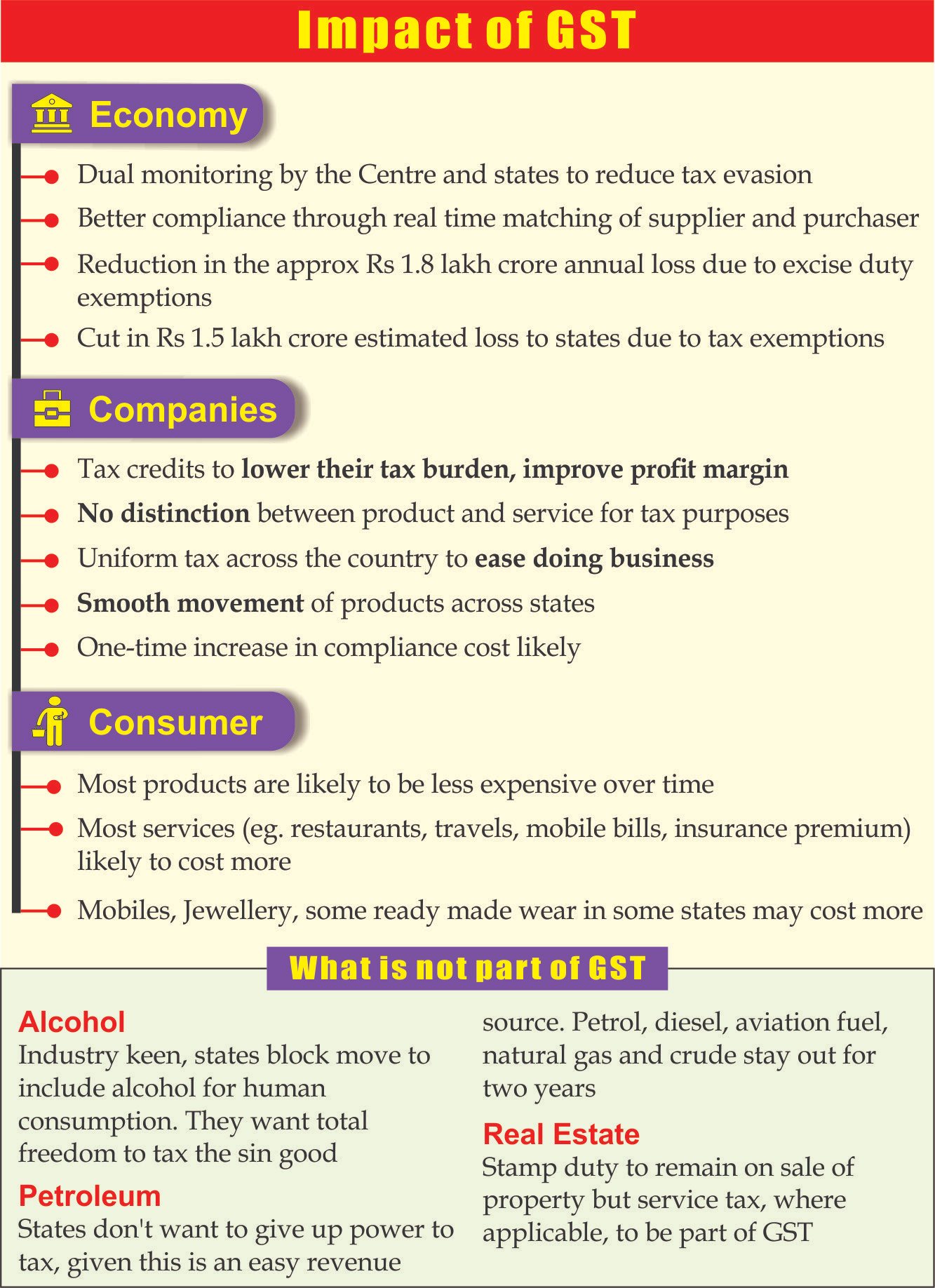

- Petrol and Diesel under GST: The central government expressed its intent to bring petrol and diesel under the GST regime, pending consensus among states on the applicable tax rate.

- This is viewed as a step towards uniform taxation of fuel across the country.

Note

- Goods and Services Tax (GST) is a value-added (Ad valorem) tax system that is levied on the supply of goods and services in India.

- It is a comprehensive indirect tax that was introduced in India on 1st July 2017, through the 101st Constitution Amendment Act, 2016, with the slogan of ‘One Nation One Tax’.

What is the GST Council?

- About:

- The GST Council is a constitutional body responsible for making recommendations on issues related to the implementation of the Goods and Services Tax (GST) in India.

- It was set up to simplify the existing tax structure in India, where both the Centre and states levied multiple taxes making it more uniform across the country.

- Constitutional Provisions:

- The 101st Amendment Act, of 2016 paved the way for the introduction of GST.

- The Amendment Act inserted a new Article 279-A in the Constitution, which empowers the President to constitute a GST Council or by an order.

- Accordingly, the President issued the order in 2016 and constituted the Goods and Services Tax Council.

- Members:

- The members of the Council include the Union Finance Minister (Chairperson), the Union Minister of State (Finance) from the Centre.

- Each state can nominate a minister in-charge of finance or taxation or any other minister as a member.

- Functions:

- Article 279A (4) empowers the Council for making recommendations to the Union and the states on important GST-related issues such as the goods and services that may be subject to or exempted from GST, model GST laws, and GST rates.

- It decides on various rate slabs of GST and whether they need to be modified for certain product categories.

- The Council also considers special rates for raising additional resources during natural calamities/disasters and special provisions for certain States.

- Working:

- The GST Council reaches decisions in its meetings by a majority of at least three-fourths of the weighted votes of the members present and voting.

- A quorum of 50% of the total members is required to conduct a meeting.

- The Central Government's vote carries a weightage of one-third of the total votes cast in a meeting.

- The votes of all state governments combined have a weightage of two-thirds of the total votes cast.

- The recommendations of the GST Council were earlier considered binding, but in 2022 the Supreme Court in Union of India v. Mohit Minerals Pvt. Ltd Case ruled that they are not binding, as both Parliament and State legislatures have "simultaneous" power to legislate on GST.

|

Drishti Mains Question: Discuss the objectives and the key features of the GST framework. Analyse the advantages and challenges of the GST system and suggest measures to address the challenges for its successful implementation. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q1. Consider the following items: (2018)

- Cereal grains hulled

- Chicken eggs cooked

- Fish processed and canned

- Newspapers containing advertising material

Which of the above items is/are exempted under GST (Good and Services Tax)?

(a) 1 only

(b) 2 and 3 only

(c) 1, 2 and 4 only

(d) 1, 2, 3 and 4

Ans: (c)

Q2. What is/are the most likely advantages of implementing ‘Goods and Services Tax (GST)’? (2017)

- It will replace multiple taxes collected by multiple authorities and will thus create a single market in India.

- It will drastically reduce the ‘Current Account Deficit’ of India and will enable it to increase its foreign exchange reserves.

- It will enormously increase the growth and size of economy of India and will enable it to overtake China in the near future.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (a)

Mains

Q. Explain the rationale behind the Goods and Services Tax (Compensation to States) Act of 2017. How has COVID-19 impacted the GST compensation fund and created new federal tensions? (2020)

Q. Enumerate the indirect taxes which have been subsumed in the Goods and Services Tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017. (2019)

Q. Explain the salient features of the Constitution (One Hundred and First Amendment) Act, 2016. Do you think it is efficacious enough “to remove cascading effect of taxes and provide for the common national market for goods and services”? (2017)

Q. Discuss the rationale for introducing the Goods and Services Tax (GST) in India. Bring out critically the reasons for the delay in rollout for its regime. (2013)