Governance

RERA is Retroactive: SC

- 19 Nov 2021

- 8 min read

Why in News

Recently, the Supreme Court (SC) interpreted that the Real Estate (Regulation and Development) Act, 2016 (RERA) is retroactive.

- The SC’s ruling is aimed at protecting homebuyers, the ruling brings a major relief for the buyers, speeds up the resolution process, and makes it difficult for state governments to dilute the intent of the law.

Key Points

- Retroactive Implementation:

- The SC affirmed that the provisions of the RERA 2016 are applicable to projects that were ongoing and for whom completion certificates were not obtained at the time of the enactment of the law.

- Under the Act, registration of real estate projects was mandatory.

- It mandated that for projects that were ongoing on the date of commencement of the Act, specifically projects for which the completion certificate had not been issued, the promoters shall be under obligation to make an application to the authority for registration of the project.

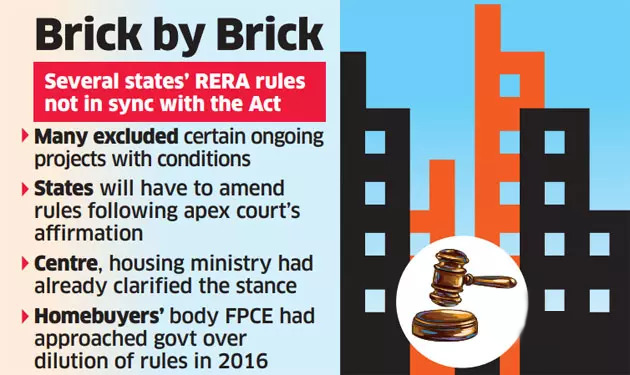

- Regulations of RERA authorities in states including Uttar Pradesh, Haryana, Punjab, Karnataka, Telangana and Tamil Nadu are currently not in line with this position and may need to amend their rules to ensure all ongoing projects get covered under RERA.

- The SC affirmed that the provisions of the RERA 2016 are applicable to projects that were ongoing and for whom completion certificates were not obtained at the time of the enactment of the law.

- Recovery of Invested Amount:

- SC also held that the amount invested by the allottees, along with interest as quantified by the regulatory authority or the adjudicating officer, can be recovered as arrears of land revenue from the builders.

- The builders had contended that homebuyers are only entitled to recover interest or penalty as arrears of land.

- However, taking into consideration the scheme of the Act, the court observed, what is to be returned to the allottee is his own life savings. The amount with interest as computed/quantified by the authority becomes recoverable and such arrear becomes enforceable in law.

- SC also held that the amount invested by the allottees, along with interest as quantified by the regulatory authority or the adjudicating officer, can be recovered as arrears of land revenue from the builders.

- Penalty for Developers:

- It is mandatory for real estate developers to deposit at least 30% of the penalty ordered by the regulator, or the full amount as the case may be, before they challenge any RERA order. This is expected to ensure that only genuine appeals are filed and homebuyers’ interests are protected.

- SC noted that the obligation cast upon the promoter of pre-deposit under the Act, in no circumstance can be said to be in violation of Article 14 (Equality before law) or Article 19 1(g)(freedom to practise any profession, or to carry on any occupation, trade or business) of the Constitution of India.

- Builders/promoters who are in appeal are required to make the predeposit to get the appeal entertained by the Appellate Tribunal.

- A promoter is defined as a person who is entrusted with the task of promoting the project (real estate project), which was developed or constructed by the developer.

- The intention of the legislature appears to be to ensure that the rights of the decree holder (the successful party) is to be protected and only genuine bonafide appeals are to be entertained.

- SC noted that the obligation cast upon the promoter of pre-deposit under the Act, in no circumstance can be said to be in violation of Article 14 (Equality before law) or Article 19 1(g)(freedom to practise any profession, or to carry on any occupation, trade or business) of the Constitution of India.

- It is mandatory for real estate developers to deposit at least 30% of the penalty ordered by the regulator, or the full amount as the case may be, before they challenge any RERA order. This is expected to ensure that only genuine appeals are filed and homebuyers’ interests are protected.

Real Estate Regulation and Development Act, 2016

- Need:

- Securing the Largest Investment Sector: Regulation of the real estate sector was under discussion since 2013, and the RERA Act eventually came into being in 2016. Data show that more than 77% of the total assets of an average Indian household are held in real estate, and it’s the single largest investment of an individual in his lifetime.

- Creating Accountability: Prior to the law, the real estate and housing sector was largely unregulated, with the consequence that consumers were unable to hold builders and developers accountable.

- The Consumer Protection Act, 1986 was inadequate to address the needs of homebuyers.

- RERA was introduced with the objective of ensuring greater accountability towards consumers, to reduce frauds and delays, and to set up a fast track dispute resolution mechanism.

- Major Provisions:

- Establishment of state level regulatory authorities- Real Estate Regulatory Authority (RERA): The Act provides for State governments to establish more than one regulatory authority with the following mandate:

- Register and maintain a database of real estate projects; publish it on its website for public viewing,

- Protection of interest of promoters, buyers and real estate agents

- Development of sustainable and affordable housing,

- Render advice to the government and ensure compliance with its Regulations and the Act.

- Establishment of Real Estate Appellate Tribunal- Decisions of RERAs can be appealed in these tribunals.

- Mandatory Registration: All projects with plot size of minimum 500 sq.mt or eight apartments need to be registered with Regulatory Authorities.

- Deposits: Depositing 70% of the funds collected from buyers in a separate escrow bank account for construction of that project only.

- Liability: Developer’s liability to repair structural defects for five years.

- Penal interest in case of default: Both promoter and buyer are liable to pay an equal rate of interest in case of any default from either side.

- Cap on Advance Payments: A promoter cannot accept more than 10% of the cost of the plot, apartment or building as an advance payment or an application fee from a person without first entering into an agreement for sale.

- Carpet Area: Defines Carpet Area as net usable floor area of flat. Buyers will be charged for the carpet area and not the super built-up area.

- Punishment: Imprisonment of up to three years for developers and up to one year in case of agents and buyers for violation of orders of Appellate Tribunals and Regulatory Authorities.

- Establishment of state level regulatory authorities- Real Estate Regulatory Authority (RERA): The Act provides for State governments to establish more than one regulatory authority with the following mandate:

- Implementation of the Act:

- 34 states/Union Territories have notified rules under RERA, while its implementation in Nagaland is under process.

- West Bengal has enacted its own legislation — West Bengal Housing Industry Regulation Act, 2017 (HIRA) — instead of notifying rules under RERA.

- 30 States/UTs have set up Real Estate Regulatory Authorities, and 26 have set up Real Estate Appellate Tribunals, as per the latest data available with the Ministry of Housing and Urban Affairs.