Health Insurance for India’s Missing Middle | 01 Nov 2021

Why in News

Recently, NITI Aayog has released a comprehensive report titled Health Insurance for India’s Missing Middle.

- The report brings out the gaps in the health insurance coverage across the Indian population and offers solutions to address the situation.

Key Points

- Importance of Health Insurance:

- Health insurance is a mechanism of pooling the high level of Out of Pocket expenditure (OOPE) in India to provide greater financial protection against health shocks.

- Pre-payment through health insurance emerges as an important tool for risk-pooling and safeguarding against catastrophic (and often impoverishing) expenditure from health shocks.

- Moreover, pre-paid pooled funds can also improve the efficiency of healthcare provision.

- Health Insurance: Need And Landscape

- Achieving Universal Health Coverage: Expansion of health insurance coverage is a vital step, and a pathway in India’s effort to achieve Universal Health Coverage (UHC).

- Low Government expenditure on health has constrained the capacity and quality of healthcare services in the public sector.

- It diverts the majority of individuals – about two-thirds – to seek treatment in the costlier private sector.

- High Out-of-Pocket Expenditure: India’s health sector is characterized by low Government expenditure on health, high out-of-pocket expenditure (OOPE), and low financial protection for adverse health events.

- The private sector is characterized by high OOPE, leading to low financial protection

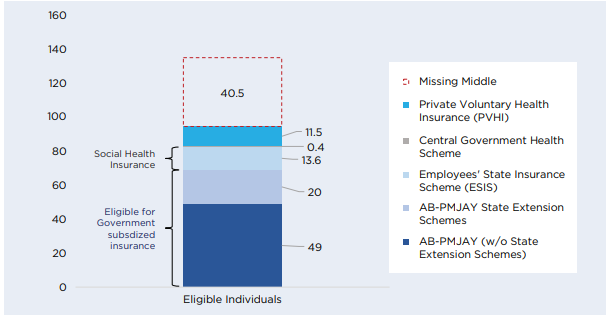

- Missing Middle: According to the report, at least 30% of the population, or 40 crore individuals (referred as the missing middle in this report) are devoid of any financial protection for health.

- The Ayushman Bharat – Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) and various State Government extension schemes, provide comprehensive hospitalization cover to the bottom 50% of the population.

- Around the top 20% of the population – 25 crore individuals – are covered through social health insurance, and private voluntary health insurance.

- Existing Health Insurance, But not Suitable For The Missing Middle:

- In the absence of a low-cost health insurance product, the missing middle remains uncovered despite the ability to pay nominal premiums.

- Affordable contributory products such as Employees' State Insurance Corporation (ESIC), and Government subsidized insurance including AB-PMJAY are closed products.

- They are not available to the general population due to the risk of adverse selection.

- Achieving Universal Health Coverage: Expansion of health insurance coverage is a vital step, and a pathway in India’s effort to achieve Universal Health Coverage (UHC).

- Recommended Insurance Models: The report has recommended three models for increasing the health insurance coverage in the country:

- Creation of a Large and Diversified Risk Pool: The success of a private voluntary contributory health insurance product requires creation of a large and diversified risk pool.

- For this to happen the Government should build consumer awareness of health insurance through Information Education Communication campaigns.

- Developing a Modified, Standardized Health Insurance Product: The cost of health insurance i.e., the premium needs to come down, in line with the affordability of the missing middle.

- For example, Aarogya Sanjeevani can be made affordable.

- Aarogya Sanjeevani is a standardised health insurance product launched by the Insurance Regulatory Development Authority of India (IRDAI) in April 2020.

- Government Subsidized Health Insurance: This model can be utilized for segments of the missing middle which remain uncovered, due to limited ability to pay for the voluntary contributory models outlined above.

- In the medium-term, once the supply-side and utilization of PMJAY is strengthened, their infrastructure can be leveraged to allow voluntary contributions to the missing middle.

- Government can provide public data and infrastructure as a public good to reduce operational and distribution costs of insurers.

- Creation of a Large and Diversified Risk Pool: The success of a private voluntary contributory health insurance product requires creation of a large and diversified risk pool.

Way Forward

- Integrated Approach: A combination of the three models, phased in at different times, can ensure coverage for the missing middle population.

- Outreach Strategy: Government databases such as National Food Security Act (NFSA), Pradhan Mantri Suraksha Bima Yojana, or the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) for agricultural households can be shared with private insurers after taking consent from these households.

- This will increase the outreach of insurance products with the needy section of the population.