Farm Loan Waiver | 11 Feb 2022

For Prelims: Non-Performing Assets, Agriculture Sector, Farm Loan Waiver.

For Mains: Banking Sector & NBFCs, Issues Relating to Development, Government Policies & Interventions, Growth & Development, Farm Loan Waivers and Related Issues.

Why in News?

Recently, the congress (political party) has promised a Waiver for Farm Loans for the 2022 Uttar Pradesh Assembly election.

What is a Farm Loan Waiver?

- Farm loan waivers are customised schemes announced by states to help the peasants.

- When there is a poor monsoon or natural calamity, farmers may be unable to repay loans. The rural distress in such situations often prompts States or the Centre to offer relief — reduction or complete waiver of loans.

- Essentially, the Centre or States take over the liability of farmers and repay the banks. Waivers are usually selective — only certain loan types, categories of farmers or loan sources may qualify.

- Loan waivers, originally intended for a one-time settlement. However, the past two decades have seen such schemes announced with increasing regularity, signalling the chronic distress of the agricultural sector in India.

- Though these demands seem more legitimate in the wake of the loss of livelihood due to lockdown amid Covid-19, yet such loan waivers may prove detrimental to the banking system and credit culture.

What is the History of Farm Loan Waivers in India?

- The first recorded instance of granting loans to peasants in medieval India dates back to the regime of Muhammad-bin-Tughluq (1325-51) so as to ameliorate the distress suffered by villagers.

- However, faced with rebellion and famine, these loans were written off by Firoz Shah Tughluq, the subsequent ruler.

- There have only been two nationwide loan waiver programmes in India after Independence: in 1990 and 2008.

- The first nationwide farm-loan waiver in independent India was implemented in 1990 by the VP Singh-led government. It cost the exchequer Rs 10,000 crore.

- In 2008, the Agricultural Debt Waiver and Debt Relief Scheme, implemented by the UPA government, involved an outgo of Rs 71,680 crore.

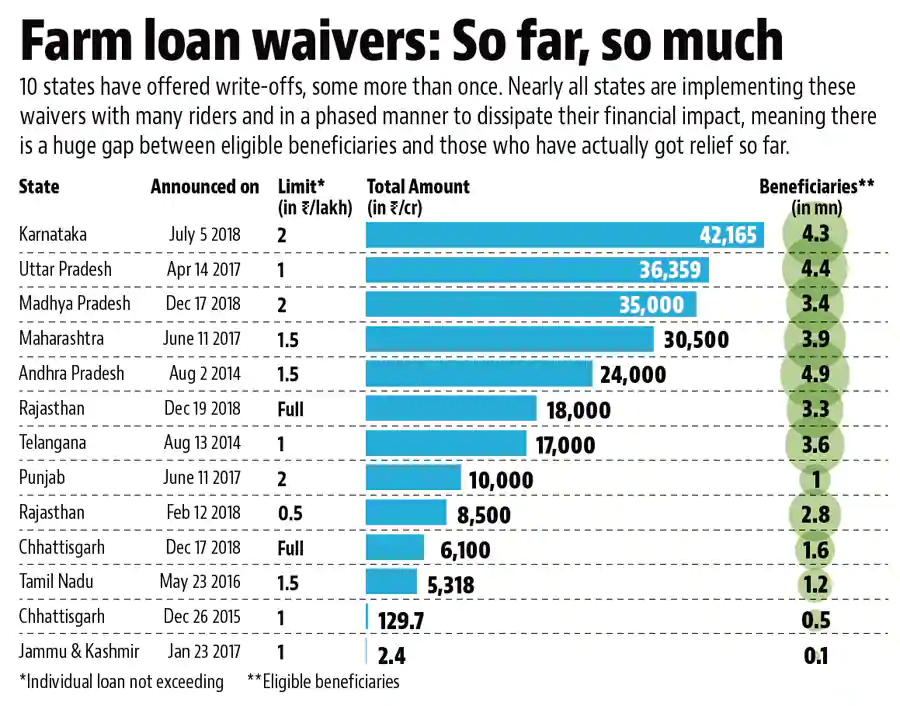

- Since then, there has been a wave of such schemes by different State governments.

What is the Rationale Behind Waiving Off Farm Loans?

- Small Land Holding: More than 85% of small and marginal farmers in India possess less than 1-2 hectares of holdings and lack basic inputs for farming.

- Dependency on Monsoon: In India, the crop yield and production are highly dependent on monsoon.

- Need of Credit: In this context, the credit is a critical resource to farming households for carrying out crop production and meeting consumption & daily-life expenses.

- Debt Trap: Farmers invest heavily in crops by taking loans. If the crop fails due to lack of rains or insufficient market demand, farmers will get trapped in debt. Due to this, there has been an increase in farmer suicides.

- Thereby, waiving farm loans address this humanitarian crisis.

What are the Issues Related to Farm Loan Waivers?

- Reputational Consequences: Loan waiver schemes will disrupt credit discipline as farm loan waivers may act as a temporary solution and can prove to be a moral hazard in future.

- This is because those farmers who can afford to pay their loans might not pay it expecting a waiver.

- Free Rider Problem: Some farmers may take loans even if there is no need, in the hope of the next loan waiver scheme. This will impact the farmers who are genuinely in need of loans.

- Decline in Formal Access to Credit: After the implementation of debt waiver schemes and subsequent losses to the banking industry, banks will be reluctant to lend further to the farm sector.

- This leads to a rise in farmer’s dependence on informal sector lenders.

- Impact on Banking Sector: A report by the Indian Council for Research on International Economic Relations stated that the 2008 farm-loan waiver led to three-fold increase in non-performing assets of commercial banks between 2009–2010 and 2012–2013.

- This further affects credit-deposit ratio and risk-weighted capital adequacy ratio, return on assets and economic value of equity of banks.

- This downgrades the ratings of banks in particular and destabilises the functioning of the credit market in general.

- Against the Interests of Depositors: Banks receive money from the depositors and lend money to borrowers under different contracts and agreements.

- Thus, the loss to the bank, due to loan waivers, is directly or indirectly against the interests of the depositors.

- Moreover, banks being custodians of depositors’ money, need to be guided primarily by the protection of depositors’ interests.

What Should be the Way Forward for Farm Loan Waivers?

- It appears that loan waiving can provide a short-term relief to a limited section of farmers, it has a meagre chance of bringing farmers out of the vicious cycle of indebtedness.

- There is no concrete evidence on reduction in agrarian distress following the first spell of all-India farm loan waiver in 2008. In the longer run, strengthening the repayment capacity of the farmers by improving and stabilising their income is the only way to keep them out of distress.

- Lasting solutions like building irrigation capabilities and cold storage chains, increased crop insurance coverage, farm infrastructure building, tech-enabled productivity improvement and opening the sector to market forces and open trade can help the farmers in the long run as a better option.

- Agrarian distress and farmers’ income will be addressed much better if States undertake and sincerely implement long-pending reforms in the agriculture sector with urgency.

- Alternatively, waiving only a portion of the loan instead of placing a cap on the quantum of loan waiver will be an improvement towards averting moral hazards.

- There is also a need for creative engagement through which the surplus workers in the farming sector can be taken away to more productive sectors and farming can be made more profitable and sustainable for all the people.