Indian Economy

Air India Disinvestment

- 09 Oct 2021

- 4 min read

Why in News

Recently, the government approved the highest price bid of Talace Pvt Ltd, a wholly owned subsidiary of Tata Sons Pvt. Ltd for sale (Disinvesting) of 100% equity shareholding of Government of India in Air India (AI).

- The Tatas will own 100% stake in AI, as also 100% in its international low-cost arm Air India Express and 50% in the ground handling joint venture, AI SATS.

Key Points

- Reasons for Disinvestment:

- It is hoped that with AI passing into the private sector, its operations and costs will get streamlined, services on board will improve and basic services like wi-fi will also be made available.

- A strong international carrier in India will give a boost to the large airports built in Delhi, Hyderabad, Mumbai and Bengaluru which along with AI will be able to win back some of the tourist dollars from Indians travelling abroad who are currently travelling on foreign carriers.

- A successful turnaround of Air India could also help the Indian economy as it is a well-established fact that aviation has a multiplier effect on the economy.

- There is a pressure on the government to raise resources to support the economic recovery and meet expectations of higher outlays for healthcare.

- Significance:

- It will save taxpayers money from paying for daily losses of AI.

- It will help push other tough decisions the government is keen on taking.

- It will possibly give the option of flying one more low-cost carrier domestically.

Disinvestment

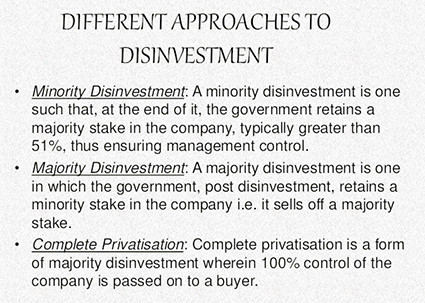

- Disinvestment means sale or liquidation of assets by the government, usually Central and state public sector enterprises, projects, or other fixed assets.

- The government undertakes disinvestment to reduce the fiscal burden on the exchequer, or to raise money for meeting specific needs, such as to bridge the revenue shortfall from other regular sources.

- Strategic disinvestment is the transfer of the ownership and control of a public sector entity to some other entity (mostly to a private sector entity).

- Unlike the simple disinvestment, strategic sale implies a kind of privatization.

- The disinvestment commission defines strategic sale as the sale of a substantial portion of the Government shareholding of a central public sector enterprises (CPSE) of upto 50%, or such higher percentage as the competent authority may determine, along with transfer of management control.

- The Department of Investment and Public Asset Management (DIPAM) under the Ministry of Finance is the nodal department for the strategic stake sale in the Public Sector Undertakings (PSUs).

- Strategic disinvestment in India has been guided by the basic economic principle that the government should not be in the business to engage itself in manufacturing/producing goods and services in sectors where competitive markets have come of age.

- The economic potential of such entities may be better discovered in the hands of the strategic investors due to various factors, e.g. infusion of capital, technology up-gradation and efficient management practices etc.