Indian Economy

Mutual Funds and Emerging Indian Economy

This article is based on “Why Franklin-type fiasco will keep repeating” which was published in the Business standard on 27/04/2020. It talks about the Franklin Templeton Crisis and its impact on the overall Mutual fund market in India.

India is going through a phase of Demographic Dividend, where the working population forms nearly 65% of total population, the venture of investments in the Bond market like Mutual Fund (MF) provides for ample opportunities of growth in India’s financial sector.

However, due to the recent Franklin Templeton Crisis, the Mutual Fund industry is currently experiencing a state of flux. This incident could well trigger a systemic crisis of confidence for investors and there are concerns over its possible ripple effects on the overall financial market.

Franklin Templeton Mutual Fund Crisis

- Franklin Templeton Mutual Fund has decided to wind up six debt schemes that held more than Rs 27,000 crore.

- The fund house held that investors will not be able to redeem their investments for the time being as the fund

- house has barred both purchases and redemptions.

- This decision was taken as the value of Mutual funds was getting eroded following the lack of liquidity on account of the Covid-19 impact on markets.

- The Reserve Bank of India’s decision to open a special facility to ensure the availability of adequate liquidity for the mutual fund industry is a timely move in signalling to investors that the central bank is alert to the need to preserve financial stability in these challenging times.

- RBI has assigned ₹50,000 crore exclusively for commercial banks to lend to mutual funds. With this step, RBI wants to contain any liquidity crunch in the mutual fund market.

What is a Mutual Fund?

- A mutual fund collects money from investors and invests the money, on their behalf, in securities (debt, equity or both).

- It charges a small fee for managing the money.

- Mutual fund sectors are one of the fastest growing sectors in Indian economy that have potential for sustained future growth.

- Mutual funds make saving and investing simple and affordable. Anybody with an investible surplus of as little as a few hundred rupees can invest in mutual funds.

- The other advantages of mutual funds include professional management, diversification, variety, liquidity, convenience as well as strict government regulations and full disclosure.

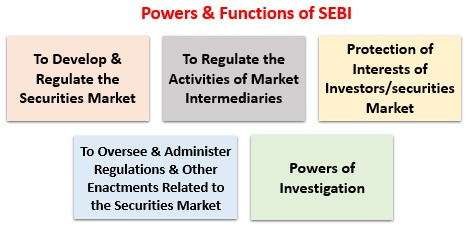

- SEBI is the regulatory body to control and regulate the securities market and mutual funds industry in India.

- Infrastructure investment Trust (InvIt) and Real estate Investment Trust (ReITs) are examples of mutual funds.

Issues Related to Mutual Fund Market

Investments Are Subject to Market Risk

- The mutual funds investment in companies even with weaker balance sheets do well during the period of higher growth rate with no undue pressure of liquidity.

- However, when there is stress in the economy, such weaker balance sheets and high leverage are the first to default.

- Further, Indian Financial markets are volatile: nearly 30% of market value of India’s stock exchange have eroded in the last 4 months.

- This lowers the attraction towards mutual funds as a lucrative investment option and affects the overall economy.

No Accountability of Credit Rating Agencies

- Fund Houses abdicate their responsibility to credit rating agencies. Based on these ratings of assets (AAA rated assets - being the most secure investment option) done by these agencies, investments are made.

- However, sometimes even the most secure investment/companies that default or engage in corrupt practices.

- Moreover, there is no accountability of these agencies.

Menace of Misinformation

- The main objective of the fund houses is asset-gathering, and don't play the fiduciary role as a trustee of other people’s money.

- Moreover, Debt investment is the specialised domain of a small group of finance professionals.

- Many investors in mutual funds don’t even understand that debt schemes are mislabelled as fixed-income schemes, which give investors the impression that they are similar to fixed deposits.

Way Forward

- SEBI should revise rules to crack down on mis-labelling and mis-selling, and segregate debt funds run for institutional and retail investors.

- Regulatory reforms, such as a simplified KYC to make onboarding hassle-free; making Aadhar interchangeable with PAN; and allowing investments on the basis of Bank KYC, should be taken.

- Technology will be the biggest enabler for growth as mutual funds are already noticing increasing traction from online channels like fintech platforms, mobile apps and websites.

- There is a need to fix the accountability of credit-rating companies and fund companies.

- This can be done by linking their income to returns and/or certain outcomes.

There is a need to engage domestic investment in India’s financial market. This will reduce dependence on the foregin investment (hot money), which in turn, will curb volatility and provide stability to Indian financial market.

|

Drishti Mains Question Discuss the challenges and solutions pertaining to the Mutual Funds market In India. |

This editorial is based on “Signalling support: On RBI relief for mutual funds” which was published in The Hindu on April 29th, 2020. Now watch this on our Youtube channel.