Indian Economy

Observing India-Mauritius Tax Treaty

This editorial is based on “Paying Their Fair Share” which was published in Indian Express on 23/04/2024. The article examines tax treaties and investments, with a focus on the India-Mauritius Tax Treaty. It discusses recent amendments to the treaty and their implications for both countries.

For Prelims: Central Board of Direct Taxes, Advance Pricing Agreements (APAs), Double Taxation Avoidance Agreement, Tax evasion, Comprehensive Economic Cooperation and Partnership Agreement (CECPA), Tax Avoidance.

For Mains: Significance of APAs in ensuring tax certainty, Double Taxation Avoidance Agreements and their significance.

Tax treaties are integral to cross-border investment relations as they define the treatment of incomes that arise in one country accruing to a resident of another country. Their design is also a reflection of the underlying power equation. Developing countries often negotiate treaties that cede greater taxing rights in the hope of higher investments. India-Mauritius Tax Treaty and the recent amendments succinctly underscore and incorporate these aspects and also underline the importance treaty harbours for India in the long run.

Whether it is legitimate for third countries to avail of such benefits by routing investments through the preferential jurisdiction has been discussed widely. In the Union of India v. Azadi Bachao, the Court was of the view that treaty shopping is a necessary evil for a developing economy. Two decades on, the norm and legal frameworks have changed dramatically.

The Base Erosion and Profit Shifting programme (BEPS) was to end the use of low-tax jurisdictions for tax avoidance. Since then the OECD — that was tasked with the redesign of international tax laws to push forward such reform — has developed a set of best practices under 15 action points. One among these was the multilateral instrument (MLI) that allowed countries the option to select tax treaties and provisions therein that would be amended suitably and swiftly. The instrument received wide support.

Note

Stopping Investors from Treaty Shopping - One of the Key OECD’s 15 Action Points:

- Tax treaties, also known as double taxation avoidance agreements (DTAAs) or tax conventions, are agreements between two countries that aim to prevent taxpayers from being taxed on the same income by both countries.

- These treaties help in eliminating or reducing double taxation, promoting cross-border trade and investment, and enhancing cooperation between countries in tax matters.

- One of the key reforms initiated by OECD was the inclusion of a provision for prevention treaty abuse as a minimum standard and an amendment of the preamble to the treaties.

- The latter is to prevent non-taxation or reduced taxation through tax evasion, including treaty-shopping arrangements that provide benefits to residents of other jurisdictions and anti-abuse rules that will enable tax administrations to deny treaty benefits in certain circumstances.

- In more than 1,100 treaties signed by countries, a broad anti-avoidance rule or principal purpose test (PPT) has been opted for. India is among the signatories to the MLI and in line with its position, the recent amendment to the India-Mauritius treaty signals the keenness to plug the well-known loophole.

- The latter is to prevent non-taxation or reduced taxation through tax evasion, including treaty-shopping arrangements that provide benefits to residents of other jurisdictions and anti-abuse rules that will enable tax administrations to deny treaty benefits in certain circumstances.

What are Double Taxation Avoidance Agreements (DTAAs)?

- About:

- It is an agreement that has been signed between India and other countries. According to the agreement, an individual earning an income in another country while being a resident of another country does not have to pay two (double) taxes on the same income.

- Objectives:

- The tax rules of every country has two main components -

- Tax on foreign income

- Tax on non-residents

- The Tax on foreign income arises when the resident or company of a country earns income in another country. For instance, if an Indian individual, earns an income in USA, it is called a foreign income. Since this foreign income is a part of the individual who is resident in India, it should be taxed in India.

- Tax on non-residents is incurred when a resident of another country earns an income domestically. So, in the above example, if a USA citizen, earns some income in India, so the income earned In India would be taxed in both countries.

- The tax rules of every country has two main components -

- Working Principles - DTAA Works on Two Principles:

- The source rule is when the income is taxed in the country of origin whether you are a resident of the country or not.

- The resident rule specifies that the income would be taxed in the country where you reside, irrespective of the income's origin.

- In India, the residence rule is followed. This means that one's international income would be taxed in the country where s/he is a resident. If one is an Indian resident, international income would be taxed in India. If, on the other hand, if one is an NRI, Indian income would be taxed in the resident country as well as in India. However, s/he can claim the benefit as per the provisions of the DTAA.

- Exemptions:

- In the Indian context, NRIs would not have to pay double tax on the following sources of income earned in India based on the provisions of DTAA with the respective countries:

- Salary received

- Payment for services rendered in India

- Interest on fixed deposits in India

- Income from house property which is situated in India

- Interest earned on savings bank account maintained in India

- Capital gains earned when capital assets are transferred in India

- In the Indian context, NRIs would not have to pay double tax on the following sources of income earned in India based on the provisions of DTAA with the respective countries:

What is India-Mauritius Tax Treaty?

- About:

- The India-Mauritius Tax Treaty is a bilateral agreement signed in 1982 to prevent double taxation and fiscal evasion of income taxes between the two countries. This treaty aimed to promote bilateral trade and investment by providing tax certainty to investors and avoiding the imposition of taxes on the same income by both India and Mauritius.

- Exemption to Capital Gains Tax:

- One of the key provisions of the India-Mauritius Tax Treaty was the exemption of capital gains tax in India on the sale of securities (such as shares) by Mauritian residents.

- This provision made Mauritius a preferred route for foreign investors, particularly for investing in the Indian stock market, as they could route their investments through Mauritius to benefit from the tax exemption.

- One of the key provisions of the India-Mauritius Tax Treaty was the exemption of capital gains tax in India on the sale of securities (such as shares) by Mauritian residents.

- Amendments in 2016:

- In 2016, India and Mauritius signed a revised tax agreement, which gave India the right to tax capital gains in India on transactions in shares routed through the island nation beginning April 1, 2017. However, investments made before April 2017 were grandfathered.

- Significance:

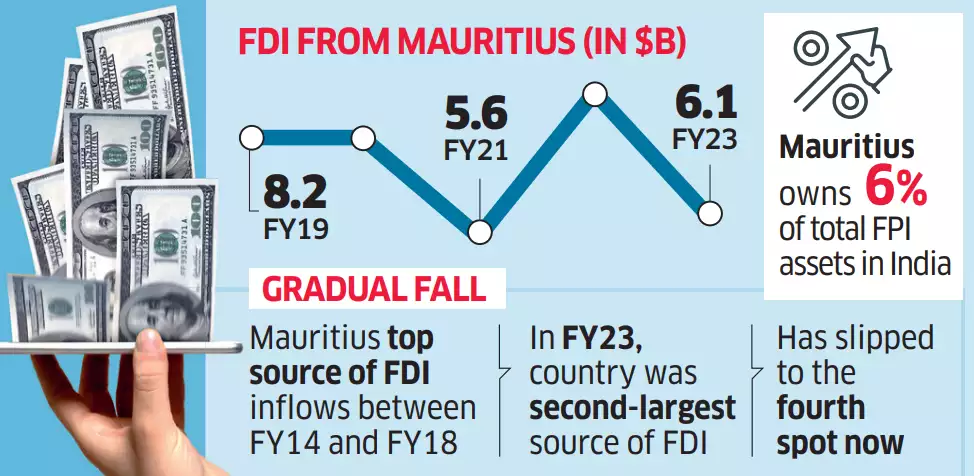

- The India-Mauritius Tax Treaty has played a significant role in facilitating investment flows between the two countries, particularly in the form of foreign direct investment (FDI) into India. The treaty has undergone amendments to address concerns related to tax evasion and ensure that it aligns with international tax norms and standards.

- Concerns in India- Mauritius Tax Treaty:

- The India-Mauritius tax treaty has been a subject matter of controversy and debate ever since it was signed over 30 years ago. Before 2017, Article 13(4) of the tax treaty exempted capital gains arising from sale of shares in an Indian company at the hands of Mauritian residents.

- Over time, concerns were raised about the potential misuse of the treaty for tax evasion and round-tripping of funds, wherein Indian residents would route their investments through Mauritius to avoid taxes in India. In response to these concerns, the treaty was amended in 2016 to address these issues.

- However, the tax treaty did not contain a general anti-abuse clause to tackle round tripping of funds or treaty-shopping arrangements.

- While India’s tax treaty with Mauritius contains provisions for exchange of tax information, any information requested has to be “foreseeably relevant” for giving effect to the tax treaty or the Income Tax Act,1961.

- In the absence of extensive, worldwide information-sharing network, wealth is usually not repatriated to India where it belongs, but shifted to new, non-collaborating secrecy jurisdictions.

- The India-Mauritius tax treaty has been a subject matter of controversy and debate ever since it was signed over 30 years ago. Before 2017, Article 13(4) of the tax treaty exempted capital gains arising from sale of shares in an Indian company at the hands of Mauritian residents.

Note

India-Mauritius Commercial Relations:

- India has been one of the largest trading partners of Mauritius since 2005.

- Indian exports to Mauritius for FY 2022-2023 were USD 462.69 mn, while Mauritian exports to India were USD 91.50 mn, with total trade amounting to USD 554.19 mn.

- Trade between India and Mauritius has grown by 132% in the last 17 years.

- Petroleum products were the largest export item for India to Mauritius until mid-2019. Other Indian exports to Mauritius include pharmaceuticals, cereals, cotton, shrimps, prawns, and bovine meat.

- Main Mauritian exports to India include vanilla, medical devices, needles, aluminum alloys, scrap paper, refined copper, and men's cotton shirts.

- Cumulative FDI worth USD 161 billion came from Mauritius to India between 2000 - 2022, largely due to the DTAA.

- Mauritius and India signed the Comprehensive Economic Cooperation and Partnership Agreement (CECPA) in 2021.

- CECPA is the first trade agreement signed by India with an African country.

- In 2024, the Unified Payment Interface (UPI) and also RuPay card services were launched in Mauritius.

- Users in Mauritius and India will experience convenience in making transactions, both domestically and internationally, through the adoption of RuPay and UPI.

What are the Recent Amendments Made to India Mauritius Tax Treaty?

- Principal Purpose Test (PPT):

- India has signed a protocol amending the Double Taxation Avoidance Agreement (DTAA) with Mauritius to plug treaty abuse for tax evasion or avoidance. The amended pact has included what is called the Principal Purpose Test (PPT), which essentially lays out the condition that the tax benefits under the treaty will not be applicable if it is established that obtaining that duty benefit was the principal purpose of any transaction or arrangement.

- Article 27B:

- In the amended protocol, Article 27B has been introduced in the treaty defining the ‘entitlement to benefits’. The PPT will deny treaty benefits, such as the reduction of withholding tax on interest royalties and dividends, where it is established that obtaining that treaty benefit is one of the principal purposes for the party engaged in the transaction.

- Amendments to the Preamble:

- The two nations have now also amended the preamble of the treaty to incorporate the thrust on tax avoidance and evasion. The earlier objective of ‘mutual trade and investment’ has now been replaced with an intent to “eliminate double taxation” without creating opportunities for non-taxation or reduced taxation through tax evasion or avoidance including through “treaty shopping arrangements” aimed at obtaining relief provided under this treaty for the indirect benefit of residents of third jurisdictions.

- Allowing Authorities to Move Beyond Residency Certificate:

- It is expected that the amendments to the treaty allow the authorities to move beyond the residency certificate and assess the principal purpose of an arrangement or transaction. Given that 16 % of FDI inflows in 2021-22 were from Mauritius, the reform will impact the composition of flows, as was observed after the amendments in 2017 when capital gains became taxable at source in India.

- Aligning With Global Efforts:

- The recent amendment reflects India’s intent to align with global efforts against treaty abuse, under the BEPS framework - an international framework to combat tax avoidance by multinational enterprises using base erosion and profit shifting tools i.e “shifting” profits to higher tax to lower tax jurisdictions .

- Though India is yet to make any announcements regarding Pillar Two amendments (a minimum 15% corporate tax on income) in its domestic tax laws, it is anticipated that this may be announced in the July 2024 budget, after the general elections.

- The recent amendment reflects India’s intent to align with global efforts against treaty abuse, under the BEPS framework - an international framework to combat tax avoidance by multinational enterprises using base erosion and profit shifting tools i.e “shifting” profits to higher tax to lower tax jurisdictions .

Note:

Concerns Over Recent Treaty Amendments:

- There may be a surge in litigation as investors from Mauritius will be required to substantiate the commercial rationale behind their transactions now, demonstrating that the primary objective was not to take treaty benefits.

- It remains to be seen whether this amendment will extend to grandfathered investments. It is noteworthy that ongoing litigation pertaining to beneficial ownership and substance concerning Indian investments is already prevalent.

- Tax experts also said that any guidance issued by the Indian government will be required to understand the full impact of these changes on investments and tax planning strategies. The application of the PPT to grandfathered investments remains ambiguous, highlighting the need for explicit guidance from the CBDT.

- Investors are apprehensive that this will result in greater scrutiny of the capital gains tax levy and exemption, as the PPT will be applicable to past investments where investors have not made an exit yet.

What is the Significance of the Amended Treaty for India?

- Factoring in the BEPS MLI:

- After the amendments, any Indian inbound or outbound cross-border structuring of investment routed through Mauritius should factor in the BEPS MLI (Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting) impact, especially if the structuring involves availing of tax treaty benefits (in India or Mauritius). Also, this amendment applies to all incomes such as capital gains, dividends, fee for technical services, etc.

- Minimizing Tax Avoidance:

- The amendments aim to curb tax treaty abuse and minimise avenues for tax avoidance or mitigation by integrating PPT into the said treaty. Furthermore, the omission of the phrase “for the encouragement of mutual trade and investment” in the treaty’s preamble suggests a shift in focus towards preventing tax evasion over promoting bilateral investment flows.

- Fulling the Objectives of OECD:

- In October 2021, over 135 jurisdictions agreed to implement a minimum tax regime for multinationals under ‘Pillar Two’. Following this, in December 2021, Organisation for Economic Co-operation and Development (OECD) released the Pillar Two model rules — Global Anti-Base Erosion (GloBE) rules — which will introduce a global minimum corporate tax rate set at 15%. The amended tax treaty is a first step towards implementation of GloBE rules.

- The minimum tax is proposed to apply to MNEs with revenue above Euro 750 million and is estimated to generate around USD 150 billion in additional global tax revenues annually.

- The Pillar Two also provides for a co-ordinated system of taxation of a top-up tax on profits arising in a jurisdiction whenever the effective tax rate, on a jurisdictional basis, is below the minimum rate of 15 %.

- In October 2021, over 135 jurisdictions agreed to implement a minimum tax regime for multinationals under ‘Pillar Two’. Following this, in December 2021, Organisation for Economic Co-operation and Development (OECD) released the Pillar Two model rules — Global Anti-Base Erosion (GloBE) rules — which will introduce a global minimum corporate tax rate set at 15%. The amended tax treaty is a first step towards implementation of GloBE rules.

- Applicable to All Transactions After the Notification of the Treaty:

- The text of the protocol amending the treaty states that the “provisions of the protocol shall have effect from the date of entry into force of the protocol, without regard to the date on which the taxes are levied or the taxable years to which the taxes relate”. This suggests that the PPT will apply to all transactions after the treaty gets notified, irrespective of the date of the investment itself, and has the potential to boost tax revenue for the country.

- The DTAA was a major reason for a large number of FPIs and foreign entities to route their investments in India through Mauritius, as there was no capital gains tax on sale/transfer of shares.

- The March 2017 timeline is significant in the context that the treaty was last amended in May 2016 allowing the right to tax capital gains arising from sale or transfer of shares of an Indian company acquired by a Mauritian tax resident.

- However, the government at that time had grandfathered, or in other words, exempted investments made until March 31, 2017 from such taxation.

- The text of the protocol amending the treaty states that the “provisions of the protocol shall have effect from the date of entry into force of the protocol, without regard to the date on which the taxes are levied or the taxable years to which the taxes relate”. This suggests that the PPT will apply to all transactions after the treaty gets notified, irrespective of the date of the investment itself, and has the potential to boost tax revenue for the country.

- Powers to Tax Authorities to Probe Based on Intent:

- The amending protocol to the India-Mauritius treaty may ensure that treaty benefits, which include lower withholding rates, will not be granted where it can be reasonably concluded that obtaining the benefit is one of the principal purposes of the transaction or arrangement.

- The language ensures that the tax administration can probe based on intent. This has been a particularly thorny issue with respect to financial flows from Mauritius. It is often suggested that taxpayers from other jurisdictions route their investments through Mauritius.

- The amending protocol to the India-Mauritius treaty may ensure that treaty benefits, which include lower withholding rates, will not be granted where it can be reasonably concluded that obtaining the benefit is one of the principal purposes of the transaction or arrangement.

Conclusion

International tax law is turning a new page as the treaties with serious revenue implications are now being reformed. There is also growing support for the global minimum tax that includes a proposal on the subject to tax rule (STTR). STTR is a treaty-based rule that ensures a top-up tax on low-taxed intra-group transactions that are subject to corporate tax rates below the minimum of 9 %. It is expected that these changes will further impact the current practices of using treaties to avail benefits. As India changes its tax treaties, this amendment is proof that the BEPS programme has indeed shifted the direction of policy to ensure investment decisions are not all about tax.

|

Drishti Mains Question: Discuss the ethical and economic implications of tax avoidance and evasion, and suggest measures to mitigate their adverse effects on society and the economy. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. With reference to India’s decision to levy an equalization tax of 6% on online advertisement services offered by non-resident entities, which of the following statements is/are correct? (2018)

- It is introduced as a part of the Income Tax Act.

- Non-resident entities that offer advertisement services in India can claim a tax credit in their home country under the “Double Taxation Avoidance Agreements”.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (d)