India’s Mining Potential

This editorial is based on “Incentivising mineral exploration” which was published in Financial Express on 21/07/2023. It talks about the scope of exploring India’s potential in the mining sector and the corresponding challenges.

For Prelims: India’s mining industry, Mines and Minerals (Development and Regulation) Act, 1957 (MMDR Act), Critical Minerals for India, rare earth elements (REE)

For Mains: India’s economic liberalisation and Mining sector, Significance of India’s mining sector – scope and challenges

Minerals are precious natural resources that serve as essential raw materials for fundamental industries. The growth of the mining industry is essential for the overall industrial development of a nation.

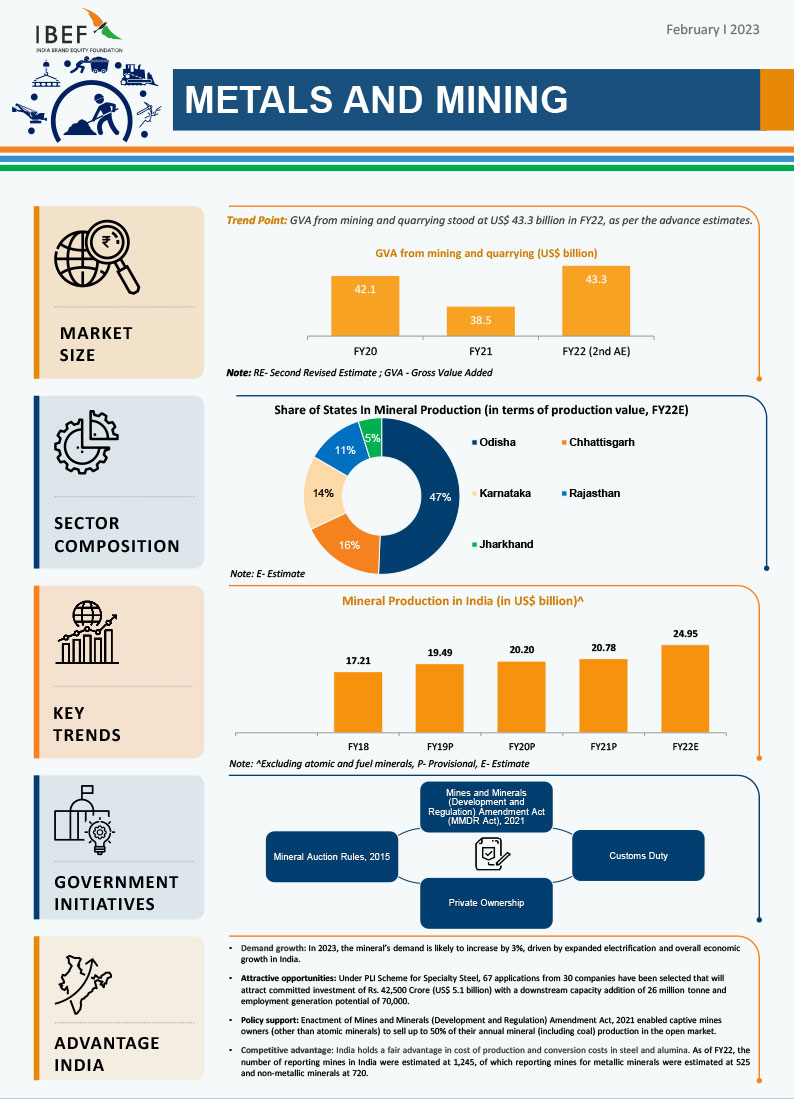

India’s mining industry has the potential to significantly impact GDP growth, foreign exchange earnings, and give end-use industries like building, infrastructure, automotive, and electricity, among others, a competitive edge by obtaining essential raw materials at reasonable rates.

With robust domestic demand and rising interest among global manufacturers to relocate plants to India, there is a terrific opportunity to emerge as a global hub for manufacturing. India’s enormous potential in minerals and metals add to the country’s allure. However, despite India's huge mineral deposits, its mining sector is still suffering from legacy issues.

What is the Scenario of India’s Mining Sector?

- Brief History of Privatisation:

- India’s economic liberalisation in the early 1990s and the National Mineral Policy of 1993 paved the way for private investment for mineral exploration in India.

- As per the new norms, private companies could apply for exploration permits in India under the First Come First Serve (FCFS) system, granting them the right to explore and subsequently mine or sell any discovered minerals.

- A 2011 report by the working group (under 12th FYP) highlighted the importance of the FCFS system in encouraging private investment in mineral exploration.

- However, the SC in its 2012 judgement, held that the FCFS method of natural resource allocation was susceptible to manipulation, favouritism and misuse, further adding that with high risks and huge investments, auctions would deter private investment.

- The 2015 Amendment to the Mines and Minerals (Development and Regulation) Act, 1957 (MMDR Act) replaced the FCFS basis of mineral allocation with auctions.

- India’s economic liberalisation in the early 1990s and the National Mineral Policy of 1993 paved the way for private investment for mineral exploration in India.

- Contribution to Indian Economy:

- Mineral mining is among the most important sectors with an impact on economic growth.

- In terms of generating employment, the sector, second only to agriculture, directly and indirectly employs about 11 million people, and sustains the livelihood of about 55 million people.

- India’s Scope in Mining Sector:

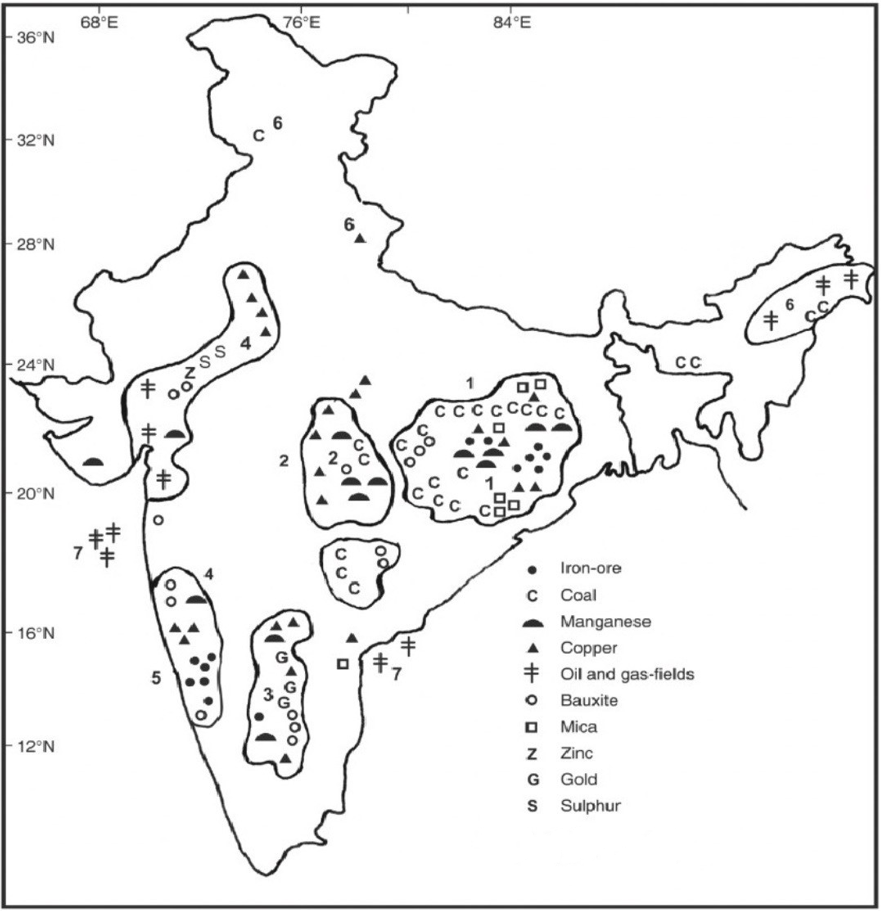

- India ranks 4th globally in terms of iron ore production and is the world's 2nd largest coal producer as of 2021.

- Combined Aluminium production (primary and secondary) in India stood at 4.1 MT per annum in FY21 becoming the 2nd largest in the world.

- In 2023, the mineral’s demand is likely to increase by 3%, driven by expanded electrification and overall economic growth in India.

- India holds a fair advantage in production and conversion costs in steel and alumina. Its strategic location enables export opportunities to develop as well as fast-developing Asian markets.

- India ranks 4th globally in terms of iron ore production and is the world's 2nd largest coal producer as of 2021.

What makes Exploring India’s Mining Potential Significant?

- For Sustainable Transport:

- India’s new-age economy is likely to be highly mineral intensive. As India’s EV sales are set to rapidly grow for the rest of this decade, demand for lithium, cobalt, nickel and graphite will be high.

- Also, the demand for iron ore in the form of steel, bauxite as a source of aluminium and copper will be high as they are used across all types of vehicles.

- For Smoother Energy Transition:

- Energy-transition minerals especially are expected to see demand explode, encouraged partly by participation in production linked incentive (PLI) schemes for advanced chemistry cell (ACC) batteries, solar PV modules, white goods and electronics manufacturing.

- For Renewable Energy:

- India’ target of 500GW non-fossil energy capacity by 2030 will be largely met by solar and wind capacity.

- However, the International Energy Agency says that onshore wind requires 9x more minerals than a gas-fired power plant.

- While aluminium and copper are crucial for solar power, wind power needs rare earth elements (REE), zinc, copper and aluminium.

- India’ target of 500GW non-fossil energy capacity by 2030 will be largely met by solar and wind capacity.

- For Traditional Sectors:

- Housing, infrastructure and transportation will boost demand for iron ore, bauxite, copper, limestone, chromium, zinc, etc.

- Rapid industrial development is projected to double domestic demand for iron ore, bauxite, zinc, copper, nickel, etc, by 2030.

- In the primary sector, food security depends on rock phosphate and zinc as agricultural inputs.

What are the Major Challenges in Exploring India’s Mining Potential?

- Regulatory Hurdles:

- Indian law does not let a miner own a mining lease beyond 10 km2 in area for a mineral in a state.

- Although that limit has been expanded by some states, at the Union level, this limit restricts major companies from participating in auctions.

- Inadequate Mineral Exploration:

- Another crucial obstacle is the lack of adequate mineral exploration. India’s expenditure on exploration, particularly for deep-seated minerals like copper, zinc, lead, gold, silver, etc, has been abysmally low.

- Highly Import Dependent:

- Lack of exploration and a weak focus on mining has seen India’s import bill for minerals and metals touch $157 billion in 2021-22, about 1/4th of the total imports.

- Double Taxation:

- Minerals like iron ore and bauxite also face a problem of double taxation in the form of royalty on royalty.

- As royalty is payable on the average sale price (ASP) and the law does not allow any deduction of royalty from it, mineral users end up paying royalty on royalty, which dents their cost competitiveness.

What Steps can be Taken to Make Mining in India More Favourable?

- Incentivising Domestic Exploration:

- Recently, the Ministry of Mines announced a list of 30 critical minerals essential for the growth of many sectors in India.

- These are required to manufacture green technologies such as wind turbines, solar panels, batteries, and electric vehicles.

- Incentivising domestic exploration of these critical minerals is crucial for India’s long-term goal of reaching net-zero by 2070.

- Recently, the Ministry of Mines announced a list of 30 critical minerals essential for the growth of many sectors in India.

- Shift in Exploration Models:

- To encourage exploration, there is a need to shift from the current ‘revenue maximizing’ model to an ‘exploration investment incentivizing’ model.

- This can also attract smaller explorers to India that have contributed well to the development of the mineral sector in Canada, Australia, South Africa and the US.

- Encouraging Private Companies:

- Private participation in the mining of critical minerals that have important non-atomic uses, like rare earth elements, lithium, titanium, niobium, etc, should be allowed.

- Such non-fissile minerals should be deleted from Part B of the first schedule of the Mines and Minerals (Development and Regulation) Act, 1957, which is meant for atomic minerals.

- More opportunities to private sector in exploration of critical minerals implies more mining efficiency and more self-sufficiency for India thus reducing India’s mineral import bills.

- Private participation in the mining of critical minerals that have important non-atomic uses, like rare earth elements, lithium, titanium, niobium, etc, should be allowed.

- Introducing an Independent Regulatory Body:

- The ambiguity among the different ruling parties at state and central level should not be allowed to hamper the growth of the mining sector.

- Therefore, the need is to have an independent regulating authority which should be given power to work in the larger interest of public & economic growth.

- Its purpose is to make sure that no particular side is favoured and utilisation of resources for holistic benefit of the country is maximised.

- The ambiguity among the different ruling parties at state and central level should not be allowed to hamper the growth of the mining sector.

|

Drishti Mains Question: As India strives to increase the share of manufacturing in its economy, it must expand mineral production through policy reforms that better assist in exploring India’s mining potential. Discuss. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims:

Q. With reference to the management of minor minerals in India, consider the following statements: (2019)

- Sand is a ‘minor mineral’ according to the prevailing law in the country

- State Governments have the power to grant mining leases of minor minerals, but the powers regarding the formation of rules related to the grant of minor minerals lie with the Central Government.

- State Governments have the power to frame rules to prevent illegal mining of minor minerals.

Which of the statements given above is/are correct?

(a) 1 and 3 only

(b) 2 and 3 only

(c) 3 only

(d) 1, 2 and 3

Ans: (a)

Q. What is/are the purpose/purposes of ‘District Mineral Foundations’ in India? (2016)

- Promoting mineral exploration activities in mineral-rich districts

- Protecting the interests of the persons affected by mining operations

- Authorizing State Governments to issue licences for mineral exploration

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Mains:

Q. Despite India being one of the countries of Gondwanaland, its mining industry contributes much less to its Gross Domestic Product (GDP) in percentage. Discuss. (2021)