Governance

SC Strikes Down Electoral Bonds Scheme

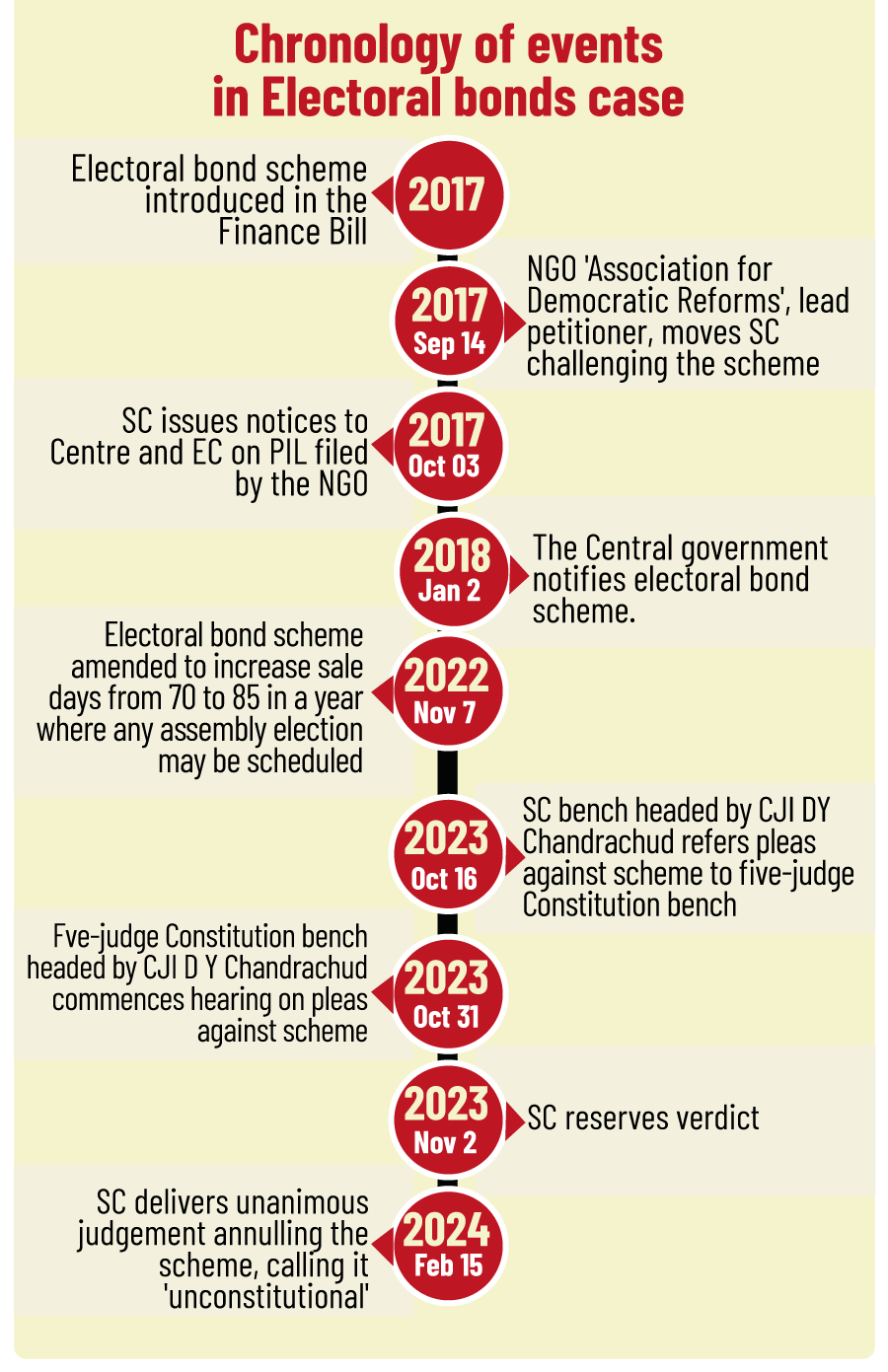

This editorial is based on “Democracy’s Guardian Angel” which was published in Indian Express on 16/02/2024. The article addresses the Supreme Court of India's decision to strike down the Electoral Bonds Scheme, citing a violation of the right to information. The court rejected the government's arguments, emphasizing that the Constitution cannot ignore potential misuse.

For Prelims: Electoral Bonds, Supreme Court (SC), Representation of the People Act, 1951, Election Commission of India (ECI), Finance Act 2017, Articles 19, 14, and 21.

For Mains: Effects of Electoral Bonds on the election process, Issues Arising Out of Design & Implementation of Electoral Bonds.

The five-member Constitution Bench, of Supreme Court (SC) in a unanimous verdict, upheld every challenge to every aspect in the electoral bonds case, declaring the scheme unconstitutional. It ordered the SBI to stop issuing electoral bonds immediately and submit all information of the bonds sold, and the names of all the donors and recipients, to the Election Commission of India (ECI).

What is the Electoral Bond Scheme?

- Electoral Bonds:

- Electoral bonds are money instruments like promissory notes, which can be bought by companies and individuals in India from the State Bank of India (SBI) and donated to a political party, which can then encash these bonds.

- The bonds are only redeemable in the designated account of a registered political party.

- A person being an individual can buy bonds, either singly or jointly with other individuals.

- Electoral Bond Scheme:

- Electoral Bonds Scheme was launched in 2018 to cleanse political funding in India.

- The central idea behind the electoral bonds scheme was to bring about transparency in electoral funding in India.

- The government had described the scheme as an “electoral reform” in a country moving towards a “cashless-digital economy”.

- Amendments Made to the Scheme in 2022:

- Additional Period of 15 Days:

- Introduced a new para, stating that an additional period of fifteen days shall be specified by the Central Government in the year of general elections to the Legislative Assembly of States and Union territories with Legislature.

- In 2018, when the Electoral Bond Scheme was introduced, these bonds were made available for a period of 10 days each in January, April, July and October, as may be specified by the central government.

- An additional period of 30 days was to be specified by the Central Government in the year of the General election to the House of People (Lok Sabha).

- Validity:

- The Electoral Bonds shall be valid for fifteen calendar days from the date of issue and no payment shall be made to any payee Political Party if the Electoral Bond is deposited after expiry of the validity period.

- The Electoral Bond deposited by an eligible Political Party in its account shall be credited on the same day.

- Eligibility:

- Only the political parties registered under Section 29A of the Representation of the People Act, 1951 (RPA, 1951) which secured at least 1% of votes polled in the last General Election to the Lok Sabha or the State Legislative Assembly are eligible to receive Electoral Bonds.

- Additional Period of 15 Days:

Why did SC Strike Down the Electoral Bonds Scheme?

- Violation of the Right to Information:

- The court held that the scheme by permitting anonymous political donations infringed upon the fundamental right to information under Article 19(1)(a) of the Constitution.

- It pointed out that such a right is not only restricted to fulfilling the freedom of speech and expression but plays a key role in furthering participatory democracy by holding the government accountable. Thus, it is not just a means to an end but an end in itself.

- It highlighted that economic inequality leads to differing levels of political engagement because of the deep association between money and politics. As a result, there is a legitimate possibility that financial contribution to a political party would lead to quid pro quo arrangements.

- The court held that the scheme by permitting anonymous political donations infringed upon the fundamental right to information under Article 19(1)(a) of the Constitution.

- Not Proportionally Justified to Curb Black Money:

- Relying on the proportionality test laid down in its 2017 verdict in the KS Puttaswamy case which upheld the right to privacy, it underscored that the government did not adopt the least restrictive method to achieve its objective.

- As examples of such least restrictive methods, the Chief Justice cited the ₹20,000 cap on anonymous donations and the concept of Electoral Trusts which facilitate the collection of political contributions from donors.

- The court also agreed with the contentions of the petitioners that since the purpose of curbing black money cannot be traced to any of the reasonable restrictions elucidated under Article 19(2), it cannot be said to be a legitimate purpose for restricting the fundamental right to information.

- Relying on the proportionality test laid down in its 2017 verdict in the KS Puttaswamy case which upheld the right to privacy, it underscored that the government did not adopt the least restrictive method to achieve its objective.

- Right to Donor Privacy Does Not Extend to Contributions Made:

- The court pointed out that financial contributions to political parties are usually made for two reasons - as an expression of support and two, as a quid pro quo measure.

- However, it underscored that huge political contributions made by corporations and companies should not be treated at par with financial contributions made by another section of the population: a student, a daily wage worker, an artist, or a teacher.

- Thus, the Chief Justice held that the right to privacy of political affiliation does not extend to those contributions, which may be made to influence policies. It only extends to contributions made as a genuine form of political support.

- The court pointed out that financial contributions to political parties are usually made for two reasons - as an expression of support and two, as a quid pro quo measure.

- Unlimited Corporate Donations Violate Free and Fair Elections:

- The court found that the amendment made to Section 182 of the Companies Act, 2013, permitting unlimited political contributions by companies, to be manifestly arbitrary.

- The provision allows Indian companies to make financial contributions to political parties under specific conditions. However, through the Finance Act, 2017, crucial changes were introduced including the removal of the prior cap on the amount that companies can donate to political parties - 7.5% of the average profits of the preceding three fiscal years.

- Additionally, the requirement for companies to disclose the names of the political parties to which contributions were made in their Profit and Loss (P&L) accounts was also eliminated.

- The Chief Justice highlighted that Section 182 errs by treating political contributions by individuals at par with those made by companies as the latter is often made with the intent of securing benefits in return.

- The court found that the amendment made to Section 182 of the Companies Act, 2013, permitting unlimited political contributions by companies, to be manifestly arbitrary.

- Amendment to Section 29C of RPA, 1951 Quashed:

- Initially, Section 29C of the Representation of the People Act, 1951, required parties to declare all contributions higher than ₹20,000, and specify whether they were received from individual persons or companies.

- However, the Finance Act, 2017, amended this provision to create an exception wherein such a requirement would not apply to donations received through electoral bonds.

- Striking down the amendment, the court observed that the original requirement to disclose contributions of more than ₹ 20,000 effectively balanced the voters’ right to information with the right to privacy of donors especially since donations below this threshold were far less likely to influence political decisions.

- Initially, Section 29C of the Representation of the People Act, 1951, required parties to declare all contributions higher than ₹20,000, and specify whether they were received from individual persons or companies.

- Other Observations by SC:

- The SBI has been ordered to immediately stop the issuance of any further electoral bonds and furnish details of such bonds purchased by political parties since April 12, 2019, to the ECI by March 6, 2024.

- Such details must include the date of purchase of each bond, the name of the purchaser of the bond and the denomination of the bond purchased.

- The ECI shall subsequently publish all such information shared by the SBI on its official website by 13 March 2024.

- Electoral bonds that are within the validity period of fifteen days but have not yet been encashed by the political party will have to be returned following which the issuing bank will refund the amount to the purchaser’s account.

- The SBI has been ordered to immediately stop the issuance of any further electoral bonds and furnish details of such bonds purchased by political parties since April 12, 2019, to the ECI by March 6, 2024.

What were the Concerns Raised With Respect to Electoral Bonds?

- Contradicting its Basic Idea:

- The central criticism of the electoral bonds scheme is that it does the exact opposite of what it was meant to do i.e. to bring transparency to election funding.

- For example, critics argue that the anonymity of electoral bonds is only for the broader public and opposition parties.

- Possibility of Extortion:

- The fact that such bonds are sold via a government-owned bank (SBI) leaves the door open for the government to know exactly who is funding its opponents.

- This, in turn, allows the possibility for the government of the day to either extort money, especially from the big companies, or victimise them for not funding the ruling party - either way providing an unfair advantage to the party in power.

- A Blow to Democracy:

- Through an amendment to the Finance Act 2017, the Union government has exempted political parties from disclosing donations received through electoral bonds.

- This means the voters will not know which individual, company, or organization has funded which party, and to what extent. However, in a representative democracy, citizens cast their votes for the people who will represent them in Parliament.

- Compromising Right to Know:

- The Indian Supreme Court has long held that the “right to know”, especially in the context of elections, is an integral part of the right to freedom of expression under Article 19 of the Indian Constitution.

- Against Free & Fair Elections:

- Electoral bonds provide no details to the citizens. However, the said anonymity does not apply to the government of the day, which can always access the donor details by demanding the data from the SBI.

- This implies that the government in power can leverage this information and disrupt free and fair elections.

- Crony Capitalism:

- The electoral bonds scheme removes all pre-existing limits on political donations and effectively allows well-resourced corporations to fund elections subsequently paving the way for crony capitalism.

- Crony Capitalism: An economic system characterized by close, mutually advantageous relationships between business leaders and government officials.

- The electoral bonds scheme removes all pre-existing limits on political donations and effectively allows well-resourced corporations to fund elections subsequently paving the way for crony capitalism.

- Concerns Raised in Association for Democratic Reforms (ADR) Report, 2023:

- Analysis of Skewed Ratios of Donations and Funding Sources:

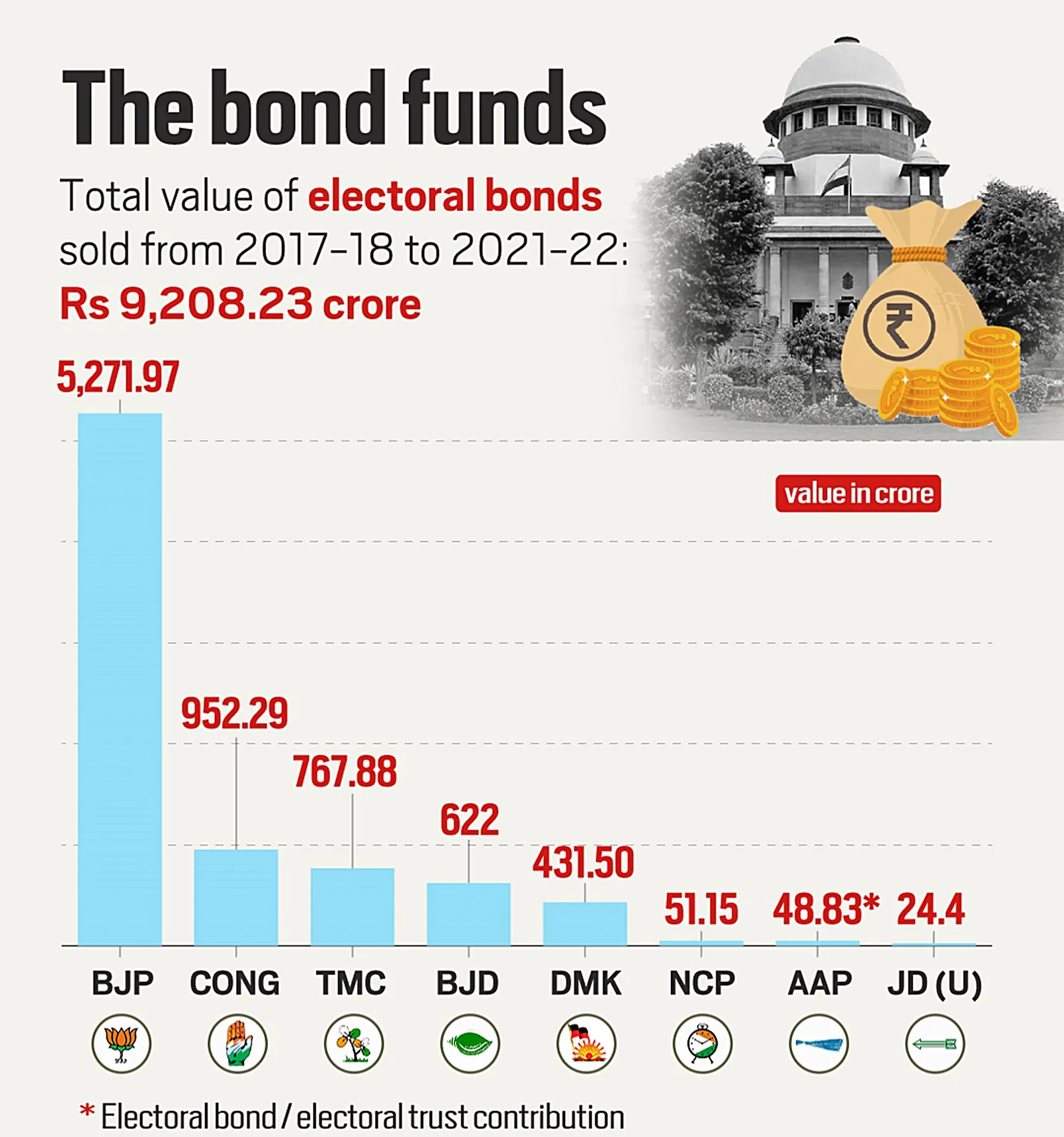

- The highest donations from Electoral Bonds, totaling Rs 3,438.8237 crore, were received in 2019-20, the year of the general elections.

- The year 2021-22, which witnessed 11 Assembly elections, saw donations worth Rs 2,664.2725 crore through Electoral Bonds.

- Out of the total donations of Rs 16,437.635 crore received by the 31 political parties analyzed, 55.90% came from Electoral Bonds, 28.07% from the corporate sector, and 16.03% from other sources.

- National and Regional Parties:

- National parties experienced a significant surge in Electoral Bond donations, witnessing a 743% increase between FY 2017-18 and FY 2021-22.

- In contrast, corporate donations to national parties increased by only 48% during the same period.

- Regional parties also witnessed a substantial proportion of their donations coming from Electoral Bonds.

- Power-Biased Donations of Electoral Bond:

- The party in power secured the highest donation among national political parties. More than 52% of the ruling party’s total donations were sourced from Electoral Bonds, amounting to Rs 5,271.9751 crore.

- Main Opposition party secured the second-highest Electoral Bond donations, with Rs 952.2955 crore (61.54% of its total donations), followed by the third largest party with Rs 767.8876 crore (93.27%).

- Analysis of Skewed Ratios of Donations and Funding Sources:

What are the Suggestions for Electoral Funding In India?

- Regulation of Donations:

- Some individuals or organisations, for instance, foreign citizens or companies, may be banned from making donations. There may also be donation limits, aimed at ensuring that a party is not captured by a few large donors — whether individuals, corporations, or civil society organisations.

- Some jurisdictions rely on contribution limits for regulating the influence of money in politics. US federal law imposes different contribution limits on different types of donors. Some other countries, such as the UK, do not impose contribution limits, but instead, rely on expenditure limits.

- Limits on Expenditure:

- Expenditure limits safeguard politics from a financial arms race. They relieve parties from the pressure of competing for money even before they start to compete for votes.

- Therefore, some jurisdictions impose an expenditure limit on political parties. For example, in the UK, political parties are not allowed to spend more than Euro 30,000 (about Rs 30 lakh) per seat.

- In the US, the Supreme Court’s expansive interpretation of the First Amendment (freedom of expression) has come in the way of legislative attempts at imposing expenditure limits.

- Providing Public Funding to Parties:

- The most commonly used method is to set predetermined criteria. For instance, in Germany, parties receive public funds on the basis of their importance within the political system.

- Generally, this is measured on the basis of the votes they received in past elections, membership fees, and the donations received from private sources. German “political party foundations” receive special state funding dedicated to their work as party-affiliated policy think tanks.

- A relatively recent experiment in public funding is that of “democracy vouchers”, which is used in local elections in Seattle, US. The government distributes a certain number of vouchers — each of which is worth a certain amount — to eligible voters.

- Voters can use these vouchers to donate to the candidate of their choice. The voucher is publicly funded, but the decision to allocate the money is the individual voter’s. Put simply, voters get to “vote” with their money before they cast their ballot.

- Disclosure Requirements:

- Disclosure as regulation rests on an assumption that the information supply and public scrutiny may influence politicians’ decisions and the electorate’s votes. However, mandatory disclosure of donations to parties is not always desirable.

- At times, donor anonymity serves a useful purpose of protecting donors. For instance, donors may face the fear of retribution or extortion by the parties in power. The threat of retaliation may, in turn, deter donors from donating money to parties of their liking.

- Many jurisdictions have struggled with striking an appropriate balance between the two legitimate concerns — transparency and anonymity. This issue was addressed by the Supreme Court in its judgment.

- The Chilean Experiment:

- Under the Chilean system of “reserved contributions”, donors could transfer to the Chilean Electoral Service the money they wished to donate to parties, and the Electoral Service would then forward the sum to the party without revealing the donor’s identity.

- If the complete anonymity system worked perfectly, the political party would not be able to ascertain the sum donated by any specific donor — and would find it extremely difficult to strike quid pro quo arrangements.

- However, it would be in the interest of donors (who want government patronage) and parties (who need money) to informally coordinate in advance to ascertain the sums donated by those donors. Indeed, as various scandals revealed in 2014-15, Chilean politicians and donors had coordinated with each other to effectively erode the system of complete anonymity.

- Balancing Transparency, Anonymity:

- One of the most prominent responses is to balance legitimate public interests in transparency and anonymity. Many jurisdictions strike this balance by allowing anonymity for small donors, while requiring disclosures of large donations.

- In the UK, a party needs to report donations received from a single source amounting to a total of more than Pounds 7,500 in a calendar year. The analogous limit in Germany is Euros 10,000.

- The argument in favour of this approach is: small donors are likely to be the least influential in the government and most vulnerable to partisan victimisation, while large donors are more likely to strike quid pro quo arrangements with parties.

- Establishing National Election Fund:

- Another option would be to establish a National Election Fund to which all donors could contribute. The funds could be allocated to parties based on their electoral performance. This would eliminate the so-called concern about donors’ reprisals.

- During the hearing, the apex court, however, flagged a new issue — the possibility of misuse of money received by political parties for activities like funding terror or violent protests, and asked the Centre whether it has any control on the end use.

What are the Recommendations on Funding of Political Parties?

- Indrajit Gupta Committee on State Funding of Elections, 1998:

- Endorsed state funding of elections to establish a fair playing field for parties with less financial resources.

- Recommended limitations:

- State funds to be allocated only to national and state parties with allotted symbols, not independent candidates.

- Initially, state funding should be provided in kind, offering certain facilities to recognised political parties and their candidates.

- Acknowledged economic constraints, advocating partial rather than full state funding.

- Election Commission's Recommendations:

- The 2004 report of the Election Commission emphasised the necessity for political parties to publish their accounts annually, allowing scrutiny by the general public and concerned entities.

- Audited accounts, ensuring accuracy, should be made public, with auditing performed by Comptroller and Auditor General-approved firms.

- The 2004 report of the Election Commission emphasised the necessity for political parties to publish their accounts annually, allowing scrutiny by the general public and concerned entities.

- Law Commission, 1999:

- Described total state funding of elections as "desirable" under the condition that political parties are prohibited from receiving funds from other sources.

- The Law Commission's 1999 report proposed amending the RPA, 1951, introducing section 78A for maintenance, audit, and publication of political party accounts, with penalties for non-compliance.

Conclusion

February 15, 2024, marks a historic day in India's democracy as the Supreme Court delivered a landmark verdict striking down the Electoral Bonds Scheme. Upholding democracy as the Constitution's basic structure, the Court found the scheme unconstitutional in a unanimous decision, addressing every challenge raised. This decision requires the government to cease issuing electoral bonds immediately and disclose all relevant information to the Election Commission of India. The Court's ruling highlights the scheme's violation of the right to information and rejects the government's arguments, emphasizing that the Constitution cannot ignore potential misuse.

|

Drishti Mains Question: Discuss the significance of the Supreme Court's decision striking down the Electoral Bonds Scheme and its implications for political funding transparency in India. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. ‘Right to Privacy’ is protected under which Article of the Constitution of India?

(a) Article 15

(b) Article 19

(c) Article 21

(d) Article 29

Ans: (c)

Mains:

Q. The Right to Information Act is not all about citizens’ empowerment alone, it essentially redefines the concept of accountability.” Discuss. (2018)