Economy

Navigating Gig Economy's Social Safety Net

This editorial is based on “Social Security to Gig Workers” which was published in The Hindu BusinessLine on 13/06/2023. It talks about the need to provide social security to gig economy workers and the main challenges in ensuring the same.

For Prelims: Gig Economy, Code on Social Security (2020),Employee Provident Fund,Niti Aayog, Digital Economy

For Mains: Gig workers and the challenge of social security, ensuring social security benefits for Gig workers

In the digital age, the advent of widespread digitisation has propelled the gig economy to unprecedented heights, forever altering the landscape of commerce. As technological advancements revolutionised the way people connect, consume, and create, a perfect storm brewed when the Covid-19 pandemic struck, leaving traditional industries reeling.

Amidst the chaos, the gig economy emerged as a silver lining, offering individuals the opportunity to harness their skills and talents independently, while meeting the evolving demands of a rapidly changing world.

However, as this new era of work unfolded, a pressing issue emerged for these gig workers - social security. The very flexibility and freedom that attracted countless gig workers came at a cost, leaving them largely oblivious to the traditional safety nets enjoyed by their counterparts.

As the gig economy continued to flourish, the quest for a sustainable solution to ensure the well-being of its workers became a pressing concern for both individuals and society at large.

What is a Gig Economy and Who is a Gig Worker?

- Gig Economy: A free market system in which temporary positions are common and organisations contract with independent workers for short-term engagements.

- Gig Worker: A person who performs work or participates in a gig work arrangement and earns from such activities outside of traditional employer-employee relationship.

What is the Scenario of the Gig Economy in India?

- Growth Scenario:

- As per the Economic Survey 2020–21, India has emerged as one of the world’s largest countries for flexi staffing, or gig workers.

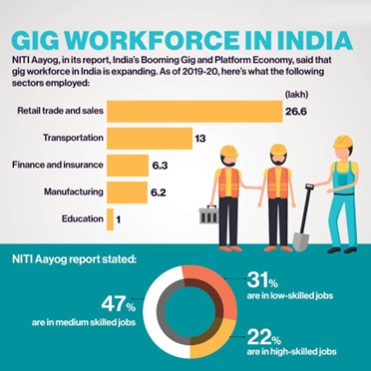

- As per Niti Aayog’s report on Gig Economy, the latter employs approximately 7.7 million workers, with the number expected to rise to 23.5 million by 2029-30, comprising around 4% of overall livelihood in the country.

- Currently, about 31% of gig work is in low skilled jobs such as cab driving and food delivery, 47% in medium-skilled jobs such as plumbing and beauty services, and 22% in high skilled jobs such as graphic design and tutoring.

- Social Security - A Major Issue:

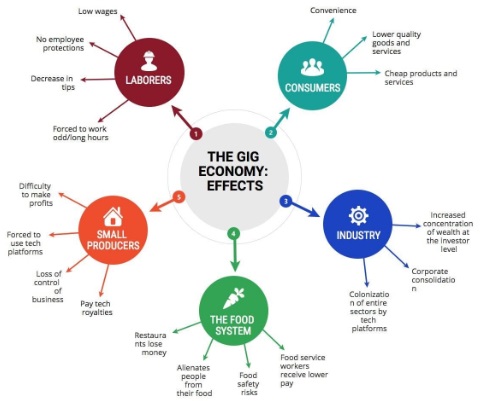

- Gig workers are often excluded from social security and labour legislation due to their ambiguous employment status.

- Social security and other basic labour rights like minimum wage, limits on working hours, etc. hinge on “employee” status, the independent contractor status of gig workers excludes them from getting such benefits and legal protections.

- Government’s Initiatives:

- The Code on Social Security (2020) contains a separate section on ‘gig economy’ and imposes an obligation on gig employers to contribute to a Social Security Fund to be handled by a government-led board.

- The Code on Wages, 2019, provides for universal minimum wage and floor wage across organised and unorganised sectors, including gig workers.

Why is it Essential to Provide Social Security Benefits to Gig Workers?

- Economic Security: The ‘demand-based only’ nature of the sector results in lack of job security and uncertainty attached to the continuity of income making it even more reasonable to provide social security benefits like unemployment insurance, disability coverage, and retirement savings programs.

- More Productive Workforce: Lack of access to employer-sponsored health insurance and other healthcare benefits leaves gig workers vulnerable to unexpected medical expenses; prioritising their health and well-being will create a healthier and more productive workforce.

- Equity in Opportunities: Exemption from traditional employment protections creates disparities where gig workers face exploitative working conditions and inadequate compensation. Providing social security benefits will level the playing field.

- Long-term Financial Security: Without employer-sponsored retirement plans, gig workers may struggle to save enough for their future. Enabling gig workers to save for retirement will reduce the risk of future financial hardship and dependence on public assistance programs.

What are the Main Challenges in Providing Social Security Benefits to Gig Workers?

- Classification: The nature of the gig sector makes providing social security benefits to gig workers a Herculean task. Blurred boundaries between self-employment and dependent-employment, and freedom to work for multiple firms or quit at will, make it difficult to determine the extent of company obligations towards gig workers.

- Excess Flexibility: The gig economy is characterised by its flexibility, allowing workers to choose when, where, and how much they work. Designing social security benefits that accommodate this flexibility and meet the diverse needs of gig workers is a complex task.

- Funding and Cost Distribution: Traditional social security systems rely on employer and employee contributions, with employers typically bearing a significant portion of the costs. In the gig economy, where workers are often self-employed, identifying appropriate funding mechanisms becomes complex.

- Coordination and Data Sharing: Efficient data sharing and coordination among gig platforms, government agencies, and financial institutions are necessary to accurately assess gig workers' earnings, contributions, and eligibility for various social security programs. However, as gig workers often work for multiple platforms or clients, it becomes challenging to coordinate and ensure proper coverage.

- Education and Awareness: Many gig workers may not fully understand their rights and entitlements regarding social security benefits. Raising awareness and providing education about the importance of social security, eligibility criteria, and the application process is a challenging task.

What can be done to Ensure Social Security of Gig Workers?

- Implementing CSS 2020: Although the Code on Social Security (2020) contains provisions for gig workers, the rules are yet to be framed by the States and not much has moved in terms of instituting the Board. These should thus be taken up expeditiously by the government.

- The UK has instituted a model by categorising gig workers as “workers,” which is a category between employees and the self-employed. This secures them a minimum wage, paid holidays, retirement benefit plans, and health insurance.

- Similarly, in Indonesia, they are entitled to accident, health, and death insurance. India can emulate these examples.

- Expanding Employer Responsibilities: Strong support for gig workers should come from the gig companies that themselves benefit from this agile and low-cost work arrangement. While the popular practice is to classify gig workers as self-employed or independent contractors, in practice, this may not be appropriate.

- For instance, many companies use an array of performance-control measures that forbid gig workers from entering into direct contracts with clients. In such cases, they must be provided equal benefits as that of a regular employee.

- Wider Health Coverage: Only a few firms in India provide on-work accident insurance; this should be taken up by all employers.

- With respect to health insurance, some apps provide options for workers to sign up with designated third-party insurers on a subscription model. This, however, does not seem to be enough given their low health coverage.

- Helping workers save for a rainy day or retirement should also be taken seriously by companies. One way this could be done is through minimal voluntary contribution by customers that could go into a corpus fund (similar to business trusts handling their EPF).

- Government Support: The government should invest in systematically increasing exports in high-skill gig work such as in the education, financial advisory, legal, medicine or customer management sectors; by making it easier for Indian gig workers to access global markets.

- Also, it would require collaboration between governments, gig platforms, and labour organisations to establish fair and transparent mechanisms for sharing the responsibility of providing social security benefits.

Conclusion

There is an urgent need to focus on the regulation of gig work in India, as it is expected to engage more than a million people in the coming decade. Further delay in instituting a regulatory framework for gig workers will impact India’s booming digital economy and its workers.

The government must engage in tripartite consultations to understand the nuances of the gig economy and formulate an appropriate legal framework that balances the economic growth of businesses with the welfare of gig workers.

|

Drishti Mains Question: What are the key barriers preventing gig economy workers from accessing and maximising social security benefits and how can these barriers be effectively addressed? |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Mains:

Q. Examine the role of ‘Gig Economy’ in the process of empowerment of women in India. (2021)

-min.jpg)