Indian Economy

Boost For Textile Sector

This article is based on A boost for textile sector which was published in The Hindu Business Line on 13/09/2021. It talks about the problems of the Textile sector and the measures that should be taken to solve the issues of the sector.

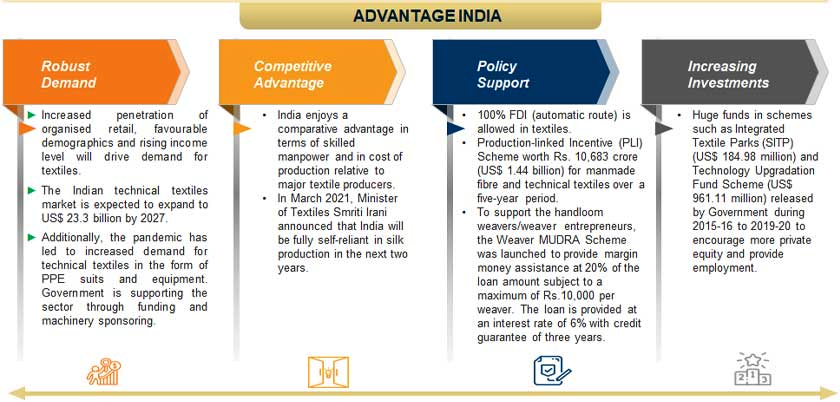

Recently, the Union cabinet has approved the Production Linked Incentive (PLI) scheme for the textile sector. PLI scheme for Textiles is part of the overall announcement of PLI Schemes for 13 sectors made earlier during the Union Budget 2021-22, with an outlay of Rs. 1.97 lakh crore.

The Indian textile and apparel sector, with USD 37 billion exports and USD 85 billion domestic consumption, is one of the largest employers in the country. Every USD 1 billion additional exports in apparel manufacturing can create 1.5 lakh new jobs.

If some adequate measures are taken on time, Indian exports can grow in double digits for the next several years, which in turn will create millions of jobs. In this context, it is imperative to remove the problems of the textile sector and take some urgent measures.

The Indian apparel sector needs scale, specialisation and competitiveness to capitalise on the emerging post-Covid opportunities in global trade.

Challenges in Textile Sector

- Highly fragmented: The Indian textile industry is highly fragmented and is being dominated by the unorganized sector and small and medium industries.

- Outdated technology: The Indian textile industry has its limitations of access to the latest technology (especially in small-scale industries) and failures to meet global standards in the highly competitive market.

- Tax structure issues: The tax structure GST (Goods and Service Tax) makes the garments expensive and uncompetitive in domestic as well as international markets. Another threat is rising labour wages and workers’ salaries.

- Stagnant exports: The export from the sector has been stagnating and remained at the USD 40-billion level for the last six years.

- Lack of scale: The apparel units in India have an average size of 100 machines which is very less in comparison with Bangladesh, which has on an average of at least 500 machines per factory.

- Lack of foreign investment: Due to challenges given above the foreign investors are not very enthusiastic about investing in the textile sector which is also one of the areas of concern.

- Though the sector has witnessed a spurt in investment during the last five years, the industry attracted Foreign Direct Investment (FDI) of only USD 3.41 billion from April 2000 to December 2019.

Way Forward

- Need for scale: Scale is important to bring down the cost of production, improve productivity levels to match global benchmarks and, thereby, cater to large orders from markets like the US.

- With right scale and technology interventions, India can match the manufacturing costs of competing countries.

- Need For Environment Friendly Manufacturing Process: With growing awareness on social and environmental issues, global buyers are looking for more compliant, sustainable and large factories to place bulk orders; these are available in China and Vietnam. Such facilities need to be created in India too.

- With a condition on incremental sales growth, the newly launched PLI scheme ensures investment from the enterprise to grow capacity on a continuous basis. India can surely build ten USD 1 billion companies in the next few years.

- Specialisation: India has built a strong ecosystem in cotton apparels, but is lagging in man-made fiber (MMF) apparel manufacturing. Global fashion is moving towards blends.

- The US annually imports around Rs. 3-lakh crore worth of MMF apparels. In this mega market, India has a share of just 2.5%.

- Hence, with a focussed approach, the sector can be aligned towards global fashion demands.

- PLI incentivises the manufacturing of MMF apparel and fabrics. Instead of providing scattered incentives to so many products, it’s time to specialise in a few products which have huge market opportunities.

- Integrated companies can invest in greenfield projects to make MMF apparel and compete with strong players like China and Vietnam in cost.

- Competitiveness: To compete with low-cost competitors, India needs to be ultra-efficient in pricing. With assured production incentives in the PLI scheme, entrepreneurs with growth aspirations will boldly invest in integrated smart factories. This can help achieve world-class productivity and manufacturing efficiency.

- Attracting capital: Only 10% of the Indian textile sector is listed on the stock exchange. The textile sector’s (excluding raw-material makers) market cap of around Rs. 2-lakh crore is hardly 1% of the BSE’s Rs. 250-lakh crore market cap.

- Many textile companies in the SME space are not participating in the stock market.

- Many textile companies in the unlisted space are demonstrating world-class sustainable practices and can attract a lot of capital if they present the right themes.

- In the past two years, the government has initiated a lot of structural reforms to bring new energy to the textile sector. PLI is one such reform and it’s time for the industry to step up and announce new projects under this scheme and move towards making India the fashion capital of the world.

Conclusion

India needs a comprehensive blueprint for the textile sector. Once that is drawn up, the country needs to move into mission mode to achieve it. In this context, the New Textiles Policy 2020 being formulated by the Centre should aim at developing a competitive textile sector which is modern, sustainable and inclusive.

|

Drishti Mains Question India needs a comprehensive blueprint for the textile sector to make it a competitive sector which is modern, sustainable and inclusive. Discuss. |