Indian Economy

Shaping India’s Startup Growth

This editorial is based on “Why Indian startup ecosystem needs a deep-tech compass” which was published in Hindustan Times on 08/04/2025. The article emphasises that India's startup ecosystem, while achieving remarkable growth, must shift focus from short-term ventures to high-impact sectors like deep-tech to ensure long-term economic sustainability, global competitiveness, and homegrown innovation.

For Prelims: Initial Public Offering (IPO), Startup India initiative, Startup India Seed Fund Scheme (SISFS), Credit Guarantee Scheme for Startups (CGSS). Alternative Investment Funds (AIFs), Women Entrepreneurship Platform (WEP), Atal Innovation Mission (AIM), Motor Vehicles Act, Digital Personal Data Protection Act, 2024, angel tax, Intellectual Property Rights.

For Mains: Significance of Innovation and Government Initiatives in Boosting India’s startup ecosystem.

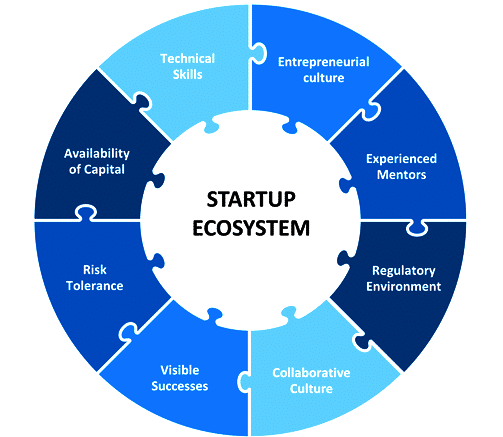

India’s startup ecosystem has experienced rapid growth, positioning itself as the third-largest in the world. With over 1.57 lakh recognized (by the Department for Promotion of Industry and Internal Trade (DPIIT)) startups and an increasing number of unicorns, India is emerging as a global leader in innovation. Government-backed initiatives, coupled with sector-specific policies and growing investor confidence, are driving this transformation. However, challenges like capital access, regulatory complexity, and scaling remain, demanding continuous reforms and strategic investments to sustain growth and create long-term value.

What is the Status of Startups in India?

- Startup: A startup refers to a newly formed business aiming for rapid scaling through innovation and technology.

- These businesses are generally aimed at addressing market gaps with disruptive products or services.

- Funding Landscape: In the first quarter of 2025, Indian startups raised $2.5 billion, showing an 8.7% increase compared to last year.

- This surge demonstrates the growing investor confidence and vibrant startup sector in India.

- IPO Surge: India's startup sector is witnessing an Initial Public Offering (IPO) boom, with 23 startups preparing for public listings in 2025.

- This surge reflects a broader investor interest in Indian-origin innovations and market-driven solutions.

- Unicorn Growth: India is home to more than 100 unicorns, startups valued at over $1 billion.

- These unicorns span diverse sectors such as fintech, health-tech, edtech, and e-commerce, proving the vast potential of the startup ecosystem.

- Regional Growth and Inclusivity: Tier-2 and Tier-3 cities are now becoming key players, contributing to 51% of the startups.

- These cities are focusing on solutions in agriculture, healthcare, and education, addressing regional challenges.

Types of Startups (Based on Valuation)

|

Type |

Valuation Range |

Description |

|

Seed Stage |

Less than $10 million |

Newly founded startups, often in pre-revenue phase, supported by seed funding or incubators. |

|

Minicorns |

$10 million to less than $100 million |

Early-growth stage startups showing potential to scale and attract larger investments. |

|

Soonicorns |

$100 million to less than $1billion |

Rapidly growing startups expected to reach unicorn status soon. |

|

Unicorns |

$1 billion or more |

Privately-held startups with a valuation of $1 billion or more. |

|

Decacorns |

$10 billion or more |

Startups valued at or above $10 billion, indicating significant market impact. |

How Have Key Initiatives and Their Achievements Strengthened India’s Startup Ecosystem?

- Startup India Initiative: Launched in 2016, the Startup India initiative aims to build a strong ecosystem for innovation and entrepreneurship.

- By simplifying compliance and offering tax benefits, over 1.57 lakh startups have benefited, increasing their access to resources.

- Fund of Funds for Startups (FFS): The FFS, with ₹10,000 crore allocated for early-stage funding, has been a cornerstone in promoting startup growth.

- By 2024, this fund enabled investments of ₹21,276 crore across 1,173 startups, significantly boosting their financial capacity.

- Startup India Seed Fund Scheme (SISFS): The SISFS, launched in 2021, supports startups through critical stages like proof of concept (feasibility test to validate an idea's potential) and prototype development (early version of product for testing design functionality).

- By 2024, ₹467.75 crore had been allocated, supporting 2,622 startups and driving their growth.

- Credit Guarantee Scheme for Startups (CGSS): CGSS facilitates access to collateral-free loans, helping startups secure funding without the burden of assets.

- As of January 2025, the scheme has guaranteed ₹604.16 crore for 209 startups, with ₹27.04 crore allocated to women-led ventures.

- Support for Women Entrepreneurs: The government has prioritized women entrepreneurs, with 73,151 startups having at least one woman director by 2024.

- Women-led startups have received ₹3,107.11 crore in investments through Alternative Investment Funds (AIFs).

- Sector-Specific Policies: Targeted policies for sectors like biotechnology, agriculture, and renewable energy have been pivotal in fostering sectoral growth.

- These policies have attracted investments, particularly in deep-tech, where India is emerging as a global leader.

- Capacity Building Programs: The Women Entrepreneurship Platform (WEP) and Atal Innovation Mission (AIM) play vital roles in supporting startups.

- The WEP aggregates policies and awards, while AIM has established 10,000 Atal Tinkering Labs to promote entrepreneurship from a young age.

- States’ Startup Ranking: Since 2018, the DPIIT, under the Ministry of Commerce and Industry has been carrying out the States’ Start-up Ranking exercise.

- This plays a vital role in improving the business environment for startups across the country.

What Are the Challenges to the Startup Ecosystem in India?

- Access to Capital: Many startups, particularly in Tier-2 and Tier-3 cities, face challenges in securing adequate capital.

- In 2024, funding dropped significantly in these cities, with a decline from ₹2,202 crore in July 2024 to ₹202 crore in November 2024, highlighting a funding disparity.

- Regulatory Hurdles: India’s regulatory landscape creates significant challenges for startups.

- For example, the ongoing debate over categorizing app-based cab services like Ola and Uber under the Motor Vehicles Act adds uncertainty to operations.

- Compliance Burdens: The new Digital Personal Data Protection Act, 2024, increases the compliance burden for startups.

- While essential for data security, it places additional pressure on startups that are already struggling with operational efficiency.

- Scaling Issues: Scaling remains a significant barrier for many startups, with around 90% failing within five years.

- Issues such as market entry challenges and operational inefficiencies contribute to this high failure rate, preventing long-term growth.

- Competition and Market Saturation: Startups in certain sectors, especially edtech, are facing intense competition.

- The saturation of these markets, combined with unsustainable cash burn, leads to limited profitability and struggles for startups to sustain growth.

- Brain Drain and Intellectual Property: India faces a significant challenge of brain drain, where innovations are sold to foreign companies at undervalued prices.

- This leads to the loss of intellectual capital and undermines the long-term competitiveness of India’s startup ecosystem.

- Sustainability of Innovation: Startups often focus on short-term gains, leading to unsustainable models.

- In sectors like edtech, this has resulted in a post-pandemic downturn, highlighting the need for sustainable growth models that prioritize long-term value creation.

- Infrastructure Challenges: Despite the growth in Tier-2 and Tier-3 cities, poor infrastructure continues to be a barrier. ‘

- Inadequate connectivity and limited access to resources restrict the scalability of startups, making it difficult to compete globally.

How Can India Transform into a Global Leader in Innovation and Startups?

- Strengthening Deep-Tech Ecosystem: India needs to focus on nurturing deep-tech industries such as AI, robotics, and semiconductors.

- Early-stage funding must be encouraged to foster innovation in these critical sectors and position India as a global leader in technology.

- Policy Reforms and Support: The government must continue implementing and enhancing policy reforms like abolishing angel tax.

- Expanding safe harbour rules and offering additional incentives for R&D in high-tech sectors will ensure the growth and global competitiveness of Indian startups.

- Developing Tier-2 and Tier-3 Cities: Decentralizing the startup ecosystem by developing Tier-2 and Tier-3 cities as innovation hubs is essential.

- Improving infrastructure, providing lower land rates, and establishing innovation hubs will enable regional startups to thrive.

- Strengthening Intellectual Property Protection: IP protection must be strengthened to encourage innovation-driven growth.

- Fast-track patent examinations and increasing awareness of intellectual property rights will ensure that startups’ innovations remain globally competitive.

- Collaboration with Academia: Collaboration between academia and startups is essential for fostering deep-tech innovation.

- Universities can act as incubators, driving research partnerships and helping startups develop cutting-edge technologies that solve global challenges.

- Inclusive Growth Through Localized Solutions: Startups must leverage their presence in Tier-2 and Tier-3 cities to address local challenges.

- Developing solutions in agriculture, healthcare, and education will contribute to the inclusive growth of India’s startup ecosystem.

- Government Procurement and Market Opportunities: Introducing policies for government procurement from startups, similar to the US, will open significant market opportunities.

- Mandating a percentage of government contracts for startups will ensure long-term growth and sustainability.

Conclusion

India's startup ecosystem is poised for further growth with the right policy reforms and a focus on deep-tech industries. By addressing challenges and nurturing innovation, India can continue to lead globally, ensuring a future of sustainable, inclusive economic development driven by entrepreneurial success.

|

Drishti Mains Question: “India’s startup ecosystem is thriving but uneven.” Examine the opportunities, achievements and challenges in this context. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims:

Q. What does venture capital mean? (2014)

(a) A short-term capital provided to industries

(b) A long-term start-up capital provided to new entrepreneurs

(c) Funds provided to industries at times of incurring losses

(d) Funds provided for replacement and renovation of industries

Ans: (b)