Science & Technology

India’s Pharma Sector

This article is based on Coronavirus pandemic: Hydroxychloroquine and the balance of trade, “A drug in need”. It talks about relaxing the ban on the export of hydroxychloroquine and challenges related to India’s pharma sector.

Recently, the government has decided to partially lift the ban on the export of hydroxychloroquine (HCQ), a drug that has garnered global interest in the treatment and prevention of Covid-19. The drug drew global attention after US President Donald Trump called it a “game changer”, and proposed its use for Covid-19 cases.

Following this, India has been requested by the US and around 30 countries including Brazil and several SAARC nations for a supply of HCQ. India held that it would supply drugs to countries that needed it the most, and to neighbours who were dependent on India’s capabilities.

India’s decision to selectively allow export is a welcome step as India would be recognised as a globally responsible stakeholder in the fight against the pandemic and reaffirms India's designation of pharmacy to the world. However, Indian pharma sector faces many issues that it needs to rectify.

Hydroxychloroquine (HCQ) & Its Use

- The popular anti-parasitic medication has been available since the 1940s. It’s been used to treat malaria.

- HCQ is a derivative of chloroquine, and has fewer side-effects.

- Chloroquine works by increasing the levels of haem or heme — a substance toxic to the malarial parasite — in the blood. This kills the parasite and stops the infection from spreading.

- According to the price and drug availability watchdog, the National Pharmaceuticals Pricing Authority (NPPA), India has a production capacity of 40 metric tonnes, which means 20 crore tablets of 200 mg per month.

- The Indian Council of Medical Research (ICMR) issued an advisory recommending the use of hydroxychloroquine in asymptomatic healthcare workers treating Covid-19 patients, and also allowed doctors to prescribe it for household contacts of confirmed Covid-19 patients.

- However, the government has stressed that the drug can only be used in Covid-19 treatment on prescription.

- The drug has since been moved to a Schedule H1 status, which means patients who need the drug would have to get a fresh prescription every time they needed to purchase it.

India: Pharmacy to the World

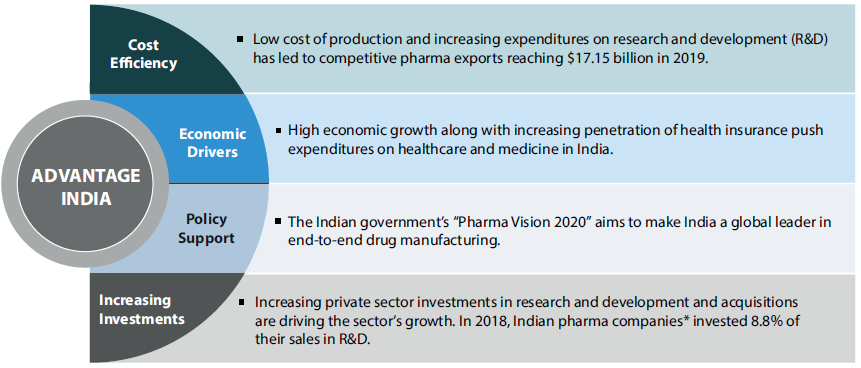

- India enjoys an important position in the global pharmaceuticals sector, as India is the largest provider of generic drugs globally.

- The Indian pharmaceutical industry meets over 50% of global demand for various vaccines, 40% of generic demand in the U.S. and 25% of all medicine in the U.K.

- Presently, over 80% of the antiretroviral drugs used globally to combat AIDS (Acquired Immune Deficiency Syndrome) are supplied by Indian pharmaceutical firms.

- In 2020, India is expected to be amongst the top three pharmaceutical markets in terms of incremental growth.

- The Indian pharmaceuticals market is the world’s third-largest in terms of volume and thirteenth-largest in terms of value. It has established itself as a global manufacturing and research hub.

- India has one of the lowest manufacturing costs in the world – lower than that of the U.S. and almost half of the cost in Europe.

- Fixed dose combination (FDC) drugs (where two or more drugs are combined in a set ratio in a single dose form) is considered an innovation of India’s national pharmaceutical industry.

- FDC are being used in the treatment of diseases like HIV, for Parkinson’s disease and in contraceptive pills.

Associated Challenges

- Dependence on China

- Despite being a leading supplier of high-quality medicines to several countries, Indian pharmaceutical industry is highly dependent on China for pharmaceutical raw materials.

- These raw materials are called the Active Pharmaceutical Ingredients (API), also known as bulk drugs. Indian drug-makers import around 70% of their total bulk drug requirements from China.

- In the past decade, India’s import of Active Pharmaceuticals Ingredients (APIs) and advanced intermediates – which are used for manufacturing formulations - has grown rapidly.

- India now depends on China fully for these ingredients to make not only advanced drugs but also essential medicines like paracetamol, metformin, aspirin and a range of antibiotics such as ciprofloxacin and amoxicillin.

- Hollowing out

- While India today is preferred low-cost producer and exporter of simpler off-patent formulations, the road taken is ‘hollowing out’ manufacturing (in raw material: API) and hampering the productive and competitive thrust of domestic firms.

- ‘Hollowing out’ refers to deterioration of a country’s manufacturing sector when producers move important activities of manufacturing to low-cost facilities overseas (China producing API at 40% cheaper rate than that of Indian manufacturer).

- Spurious Medicine

- Fake versions of high value and/or high volume brands of the pharmaceutical companies in India are adversely affecting their business performance posing another major challenge. It also creates a negative impact to the end consumer and a huge health hazard.

- However, in a study found that thousands of FDCs on the market made up of formulations never approved for marketing by the national regulator, the Central Drugs Standard Control Organisation, and that were likely to be more harmful than beneficial to patients.

- Price Capping

- Indian pharmaceutical Industry is facing pressure from both the government and the civil society to make generic medicines more affordable for a large section of the population of the country.

- Pharmaceutical companies, including the government ones, see a scope for further reduction of prices for essential medicines in India.

- However, the emphasis on low price of generic medicine impacts the net profits of pharma companies.

Way Forward

- India should look up to and invest in biotechnology. India’s biotechnology industry, comprising biopharmaceuticals, bio-services, bio agriculture, bio-industry and bioinformatics is expected to grow at an average rate of around 30% a year and reach $100 billion by 2025.

- To ensure health security of Indian people, revival of R&D and public sector API manufacturers is necessary. For example, the Council of Scientific and Industrial Research (CSIR) should be promoted to invest in R&D.

- India needs user friendly government policy for the common man to establish small scale, raw material manufacturing units/ incubators in all states of the country to improve availability of raw materials to manufacture generic drugs at affordable rates.

- There is a need for a functional testing laboratory in every state to fasten the work of specification of raw materials.

- Skilled manpower from academic institutions can be achieved through continuing education programmes.

- The regulatory policies need to be improved, especially in the area of patent, price control and to boost the pharma sector growth.

|

Drishti Mains Question India is known to be the pharmacy of the world. Do you agree? Comment. |