Indian Economy

Payment Revolution in India

This article is based on “The billion standard”, which was published in The Indian Express on 07/02/2020. It talks about the status of digital payments in India.

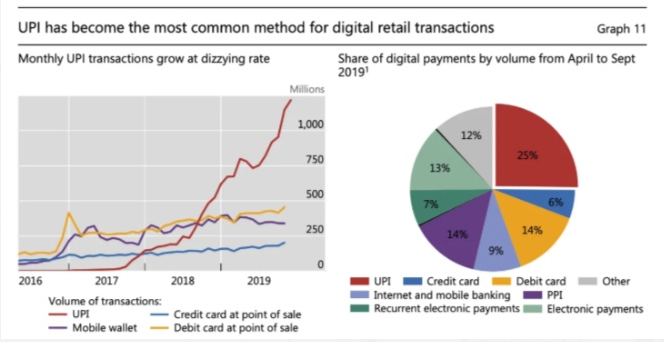

Recently, digital payments in India touched a new high by reaching a billion monthly digital payment transactions on the Universal Payment Interface (UPI). Payment on UPI platform rose from 0.1 million in October 2016 to 1.3 billion in January 2020.

Significance of this payment revolution in India lies in the fact that Google has written a letter to the US Federal Reserve, asking them to learn from Indian digital payments.

Payment Revolution in India

India was long a financially excluded nation — only 17% of Indians had a bank account in 2011. According to the World Bank, it would have taken 50 more years for 80% of Indians to get a bank account at the pre-2011 speed.

Reasons for this Payment Revolution

- India’s payment revolution comes from:

- Political Will: A clear vision for shifting the system from low volume, high value and high cost to high volume, low value and low cost. This can be seen through Jan Dhana Yojana and Aadhaar embedding.

- A Proactive Central Bank: Reserve Bank of India (RBI) created a non-profit market participant entity and levelling the playing field between non-banks and banks.

- A paper by the Bank for International Settlements (‘The Design of Digital Financial Infrastructure: Lessons From India’) suggests that India demonstrates how “a central bank can be proactive and equal partners with private sector counterparts when it comes to fostering technological innovation in finance”.

- Use of Technology: Aimed at balancing trade-off like ease-of-use vs fraud prevention. This can be seen through UPI.

- Elements of Revolution:

- Launch of Aadhaar. Aadhaar put simply is one of the biggest depositories of biometric data in the world.

- In 2010, the Indian government decided it would take full digital fingerprints and an iris scan from each citizen to create a digital identity.

- About 1.2 billion Indians now have a digital identity.

- Aadhaar has provided a solid foundation for banking the unbanked (financial inclusion).

- Aadhaar acted as an “identity rail” i.e. giving banks and Fintech companies a secure means to identify would-be customers -- and the government and businesses an easy way to pay them.

- Role of National Payments Corporation of India (NPCI)

- National Payments Corporation of India (NPCI), an umbrella organisation for operating retail payments and settlement systems in India, is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007, for creating a robust Payment & Settlement Infrastructure in India.

- It has been incorporated as a “Not for Profit” Company under the provisions of Section 25 of Companies Act 1956 (now Section 8 of Companies Act 2013).

- NPCI together with the RBI and Indian Banks Association (IBA) has established a platform called UPI.

- UPI, in turn, acted as a “payments rail”, it gives those players access to infrastructure that enables the transfer of funds.

- UPI provides a payment experience that is mobile-based, low-cost, 24/7, instant, convenient, interoperable, fintech friendly, inside banking, and safe.

- Launch of Aadhaar. Aadhaar put simply is one of the biggest depositories of biometric data in the world.

What is UPI?

- India has taken a major step towards achieving a cashless economy with the advent of the Unified Payment Interface (UPI).

- UPI is a single platform that merges various banking services and features under one umbrella.

- It also caters to the “Peer to Peer” collect request which can be scheduled and paid as per requirement and convenience.

- UPI turns smartphones into a virtual debit card. It allows real-time bank-to-bank payments to be made using a mobile number or virtual payment address (UPI ID).

- UPI has made the money transfer process a lot easier. as there is no need to remember the receiver’s account number, account type, IFSC, and bank name.

- Instead, money transfer can be made only by knowing Aadhaar number, mobile phone number registered with the bank account, or UPI ID.

- A UPI ID is a unique identification for a bank account that can be used to send and receive funds.

How is UPI different to regular payments?

- Regular payments are based on overlay systems (with payments going through correspondent banking networks).

- More banking layers mean less efficiency, higher cost and higher barriers to entry.

- Also, by going through a publicly-regulated payments system settled in fiat money, overlay systems offer more security.

- UPI is both cheap and enables instant payments as it is interoperable.

- Interoperability means allowing individuals to manage money residing in several accounts from a single bank or payment service app on their phone.

- This increases competition between banks by enabling people to switch funds cheaply.

Lessons that can be Learnt from UPI

- Interoperability of UPI can be replicated in education, healthcare, and government services. This is likely to be a harbinger of large scale multi-domain collaborative innovation.

- This collaborative approach can create ecosystems that overcome the execution deficit of government, the trust deficit of private companies, and the scale deficit of nonprofits.

- UPI's success and its endorsement by Google, certify that India doesn’t need to be Western or Chinese to be modern.

- Complementary government interventions are also important for the success of the initiative of such magnitude.

Way Forward

In Order to Boost Digital Payments in India:

- The central government must deadline digitising all its payments.

- The RBI must implement the 100-plus action items arising from its own Vision 2021 document and the Nandan Nilekani Committee for Deepening Digital Payments.

- RBI must also make UPI and RuPay fit for use in our $70 billion inward remittances that currently come through exploitative financial institutions.

- The RBI must replicate the design of UPI (sustainable private and public competition) in bank credit as credit-to-GDP ratio (ratio of the magnitude of loans given by financial institutions in an economy to the GDP of the country) in India is low i.e. 50% against 300% in China.

- However, this needs to be complemented by raising India's human capital and technology game in regulation and supervision, issuing more private bank licences, facilitating management changes in old private banks and human capital revolution at PSU banks.

- Also, digitisation of the economy needs to be backed up by a strong data protection law.

|

Drishti Mains Question Explain how digital transactions on the Universal Payment Interface (UPI) has brought payment revolution in India. |