Critical Minerals’ Conundrum

This editorial is based on “Why Minerals Are Critical” which was published in Indian Express on 05/03/2024. The article discusses that having access to critical minerals is insufficient. Processing them and manufacturing the final product also requires access to technology. This process entails a gestation period of approximately 15 years or longer.

For Prelims: Critical Minerals, Mining Sector, Rare Earth Metals, Mines and Minerals (Development and Regulation) Act, 1957, Geological Survey of India (GSI), Electric vehicles, Renewable energy, Mineral Security Partnership.

For Mains: Significance of Critical Minerals for India, Mineral Distribution in India.

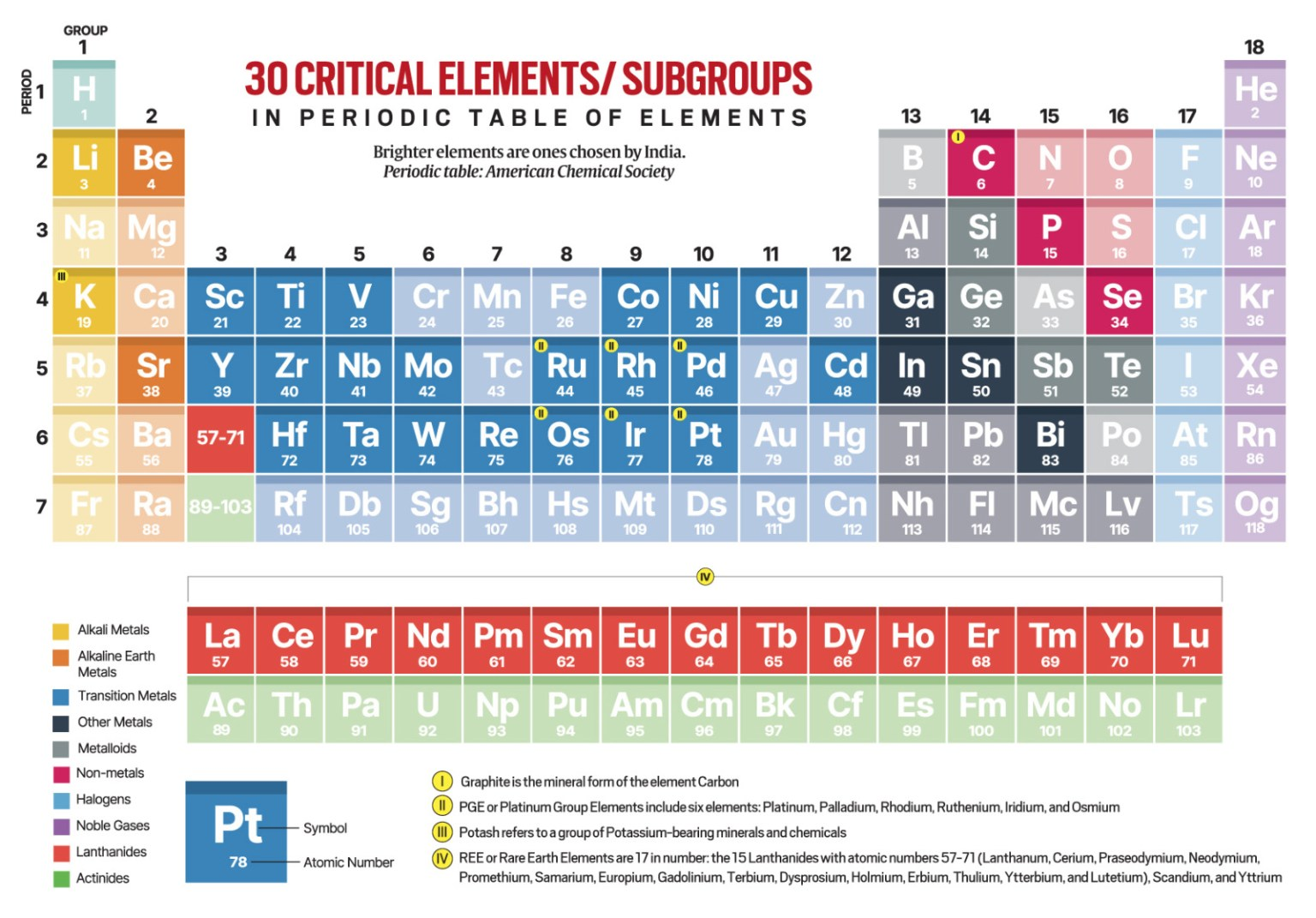

Two important steps have been taken by the government of India in the year 2023 on the subject of critical minerals. The first was to identify a list of 30 critical minerals (apart from rare earths, which are clearly identified in the periodic table) in July 2023 and the second was to amend the existing mining laws in November 2023 to allow private sector participation in the auction of 20 blocks of critical minerals/rare earths.

Note

Mines and Minerals (Development and Regulation) Amendment Act, 2023:

- Under the original Act, auction of concessions is undertaken by the state governments, except in certain specified cases.

- The amended Act, 2023 adds that auction for composite licence and mining lease for specified critical and strategic minerals will be conducted by the central government.

- These minerals include lithium, cobalt, nickel, phosphate, potash, tin, phosphate, and potash. However, concessions will still be granted by the state government.

Rare Earth Elements (REEs):

- Rare earth elements (REEs) are a group of 17 chemical elements in the periodic table, specifically the 15 lanthanides along with scandium and yttrium. Despite their name, rare earth elements are relatively abundant in the Earth's crust, but they are rarely found in concentrations that can be economically exploited.

- REEs have unique properties that make them crucial components in a wide range of modern technologies, including smartphones, electric vehicles, wind turbines, and defence systems. They are used in magnets, catalysts, phosphors, and many other applications where their specific properties are essential.

What are Critical Minerals?

- About:

- Critical minerals are those minerals that are essential for economic development and national security, the lack of availability of these minerals or concentration of extraction or processing in a few geographical locations may lead to supply chain vulnerabilities and even disruption of supplies.

- Critical minerals have no particular definition and countries identify the minerals critical to them using their own criteria.

- Critical minerals are those minerals that are essential for economic development and national security, the lack of availability of these minerals or concentration of extraction or processing in a few geographical locations may lead to supply chain vulnerabilities and even disruption of supplies.

- Declaration of Critical Minerals:

- It is a dynamic process, and it can evolve over time as new technologies, market dynamics, and geopolitical considerations emerge.

- Different countries may have their own unique lists of critical minerals based on their specific circumstances and priorities.

- The US has declared 50 minerals critical in light of their role in national security or economic development.

- Japan has identified a set of 31 minerals as critical for their economy.

- The UK considers 18 minerals critical, EU (34) and Canada (31).

- Critical Minerals for India:

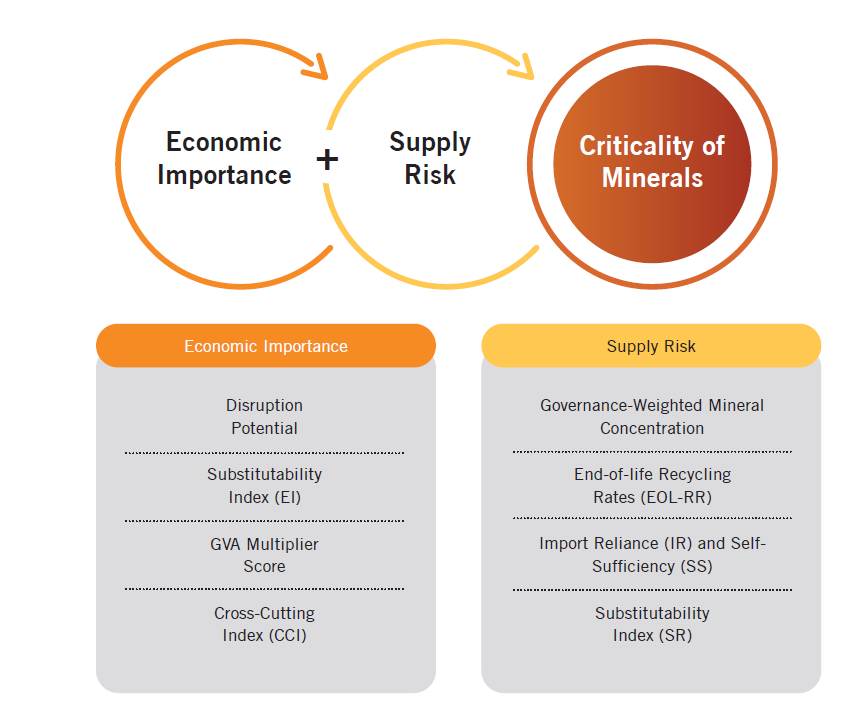

- India has identified critical minerals depending upon their disruption potential, substitutability, cross-cutting usage across different sectors, import reliance, recycling rates etc.

- Expert Committee under Ministry of Mines has identified a set of 30 critical minerals for India:

- These are Antimony, Beryllium, Bismuth, Cobalt, Copper, Gallium, Germanium, Graphite, Hafnium, Indium, Lithium, Molybdenum, Niobium, Nickel, PGE, Phosphorous, Potash, REE, Rhenium, Silicon, Strontium, Tantalum, Tellurium, Tin, Titanium, Tungsten, Vanadium, Zirconium, Selenium and Cadmium.

- The states/UTs which house these 30 identified critical minerals are Bihar, Gujarat, Jharkhand, Odisha, Tamil Nadu, Uttar Pradesh, Chhattisgarh and Jammu and Kashmir.

- Creation of Centre of Excellence for Critical Minerals (CECM) under the Ministry of Mines is also recommended by the Committee. CECM will periodically update the list of critical minerals for India and notify the critical mineral strategy from time to time.

- These are Antimony, Beryllium, Bismuth, Cobalt, Copper, Gallium, Germanium, Graphite, Hafnium, Indium, Lithium, Molybdenum, Niobium, Nickel, PGE, Phosphorous, Potash, REE, Rhenium, Silicon, Strontium, Tantalum, Tellurium, Tin, Titanium, Tungsten, Vanadium, Zirconium, Selenium and Cadmium.

What is the Current Scenario for Critical Minerals Around the Globe?

- Rapid Surge in Demand and Market Growth for Critical Minerals:

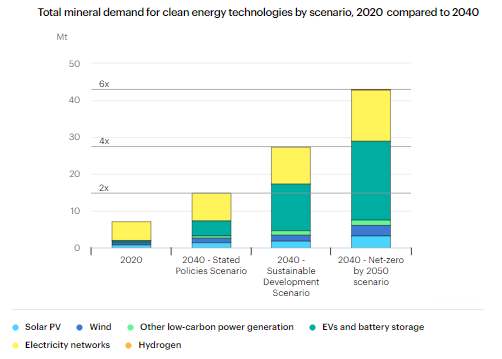

- From 2017 to 2022, the demand for lithium tripled, cobalt increased by 70%, and nickel rose by 40%, primarily driven by the energy sector.

- The International Energy Agency (IEA) has estimated that in order to meet the Paris Agreement targets, the share of clean energy technologies in the total demand for critical minerals over the next two decades would be over 40% for copper and rare earths, 60-70% for nickel and cobalt and 90% for lithium.

- In general, mineral demand for clean energy technologies would rise by at least four times by 2040 to meet the climate goals.

- Global Efforts through Policy Measures:

- The availability of critical mineral supplies will greatly impact the affordability and speed of energy transitions. To mitigate uncertain global supply chains, countries are implementing new policies to diversify their mineral supplies.

- The US, Canada, the EU and Australia have enacted regulatory legislation, while resource-rich nations like Indonesia, Namibia, and Zimbabwe have imposed restrictions on the export of unprocessed mineral ores.

- Concentration of Critical Minerals in Select Countries:

- These resources are concentrated in a few countries and, in the case of lithium, cobalt and rare earths, the world’s top three producing nations control well over three-fourths of global output.

- Specifically, Australia has 55% of lithium reserves, China has 60% of the rare earths, Democratic Republic of Congo (DRC) has 75% of cobalt, Indonesia has 35% of nickel, Chile has 30% of copper reserves.

- Geopolitical Tensions and Resource Nationalism:

- It is important to address these challenges because global relations between nations have become more polarised, especially due to events like the US-China trade war and the Russia-Ukraine war. These conflicts have led to sanctions and disruptions in established trade patterns.

- Supply-Demand Dynamics:

- As the prices of critical industrial metals, such as copper, are expected to increase in the coming years due to growing demand surpassing supply. This rise in material prices will likely disrupt the production costs of devices like solar panels and electric vehicles.

What is the Significance of Critical Minerals?

- As Underlined by Erstwhile Planning Commission:

- In India, some efforts were made in the past to identify the minerals that are critical for the country, including an initiative in 2011 by the Planning Commission of India that highlighted the need for the critical minerals.

- That report analysed 11 groups of minerals under categories such as metallic, nonmetallic, precious stones and metals, and strategic minerals. From 2017 to 2020, a big thrust was accorded to the study of exploration and development of rare earth elements in the country.

- In India, some efforts were made in the past to identify the minerals that are critical for the country, including an initiative in 2011 by the Planning Commission of India that highlighted the need for the critical minerals.

- Economic Development:

- Industries such as high-tech electronics, telecommunications, transport, and defence heavily rely on these minerals. Additionally, critical minerals are essential for green technologies like solar panels, wind turbines, batteries, and electric vehicles.

- Critical minerals play a significant role in decarbonisation, it is not limited to just that. They are also required for fertilisers, construction, magnets for industries, transport, consumer electronics, defence, etc.

- Given India's significant domestic demand and potential in these sectors, their growth can lead to job creation, income generation, and innovation.

- Industries such as high-tech electronics, telecommunications, transport, and defence heavily rely on these minerals. Additionally, critical minerals are essential for green technologies like solar panels, wind turbines, batteries, and electric vehicles.

- National Security:

- These minerals are vital for defence, aerospace, nuclear, and space applications, necessitating the use of high-quality and reliable materials capable of withstanding extreme conditions and performing complex functions.

- To ensure defence preparedness and self-reliance, India must secure a steady supply of critical minerals.

- Environmental Sustainability:

- As far as India is concerned, the availability of critical minerals (and rare earths) is crucial as it has massive plans to become net-zero by 2070. By 2030, India wants to set up 500 GW of non-fossil fuel power generating capacity.

- It also wants 30% of private cars, 70% of commercial vehicles and 80% of two/three wheelers to go electric. All this will not be possible without a steady source of lithium and other minerals required to manufacture batteries.

- As far as India is concerned, the availability of critical minerals (and rare earths) is crucial as it has massive plans to become net-zero by 2070. By 2030, India wants to set up 500 GW of non-fossil fuel power generating capacity.

- Promoting Industrial Activities through Vertical Integration:

- The identification of these minerals — which form part of multiple strategic value chains, including clean technologies initiatives such as zero-emission vehicles, wind turbines, solar panels; information and communication technologies, including semiconductors; and advanced manufacturing inputs and materials such as defence applications, permanent magnets, ceramics etc. — contribute significantly to industrial production and robust supply-chain networks.

- International Cooperation:

- These collaborations enable India to diversify its import sources, reduce dependency on China, and enhance mineral security and resilience. It has led to the formation of the US-led Minerals Security Partnership (MSP).

- India, too, has joined the MSP. The aim of the MSP is to bolster the critical minerals supply chain. The MSP includes countries like Australia, Canada, Sweden and Norway, which have deposits of critical minerals, and also countries like Japan and South Korea which have access to processing technology.

- These collaborations enable India to diversify its import sources, reduce dependency on China, and enhance mineral security and resilience. It has led to the formation of the US-led Minerals Security Partnership (MSP).

What are the Different Concerns Related to Critical Minerals in India?

- Limited Domestic Reserves:

- India has limited reserves of critical minerals such as lithium, cobalt, and other rare earth elements. Most of these minerals are imported, making India heavily dependent on other countries for its supply.

- This reliance on imports can create vulnerability in terms of price fluctuations, geopolitical factors, and supply disruptions. India heavily relies on imports for critical minerals; 100% import reliance for lithium and nickel, and 93% for copper.

- Increasing Demand for Minerals:

- The manufacturing of renewable energy technologies and the transition to electric vehicles necessitate larger quantities of minerals such as copper, manganese, zinc, lithium, cobalt, and rare earth elements.

- It is worth noting that when it comes to building a solar PV plant or a wind farm or electric vehicles, they require more minerals than their fossil fuel counterparts.

- An electric car needs six times the mineral input when compared to a conventional car and an on-shore wind plant requires nine times more mineral resources than a gas-fired plant.

- Limited Membership of the US led MSP:

- It is worth taking into account that the MSP does not include countries like Chile, DRC, Indonesia etc. (which are rich in certain critical minerals), raising concerns about its effectiveness. The basic premise of MSP is “friend shoring”, meaning moving manufacturing away from authoritarian and unfriendly states to allies.

- Challenges Posed by China:

- Major Share of Rare Earth Reserves: Not only does China have a major share of rare earth reserves, it has also completely monopolised the processing capacity of these minerals. China processes 35% of the world’s nickel, 50-70% of lithium and cobalt and nearly 90% of rare earths.

- Chinese companies have made investments in Australia, Chile, Indonesia and the DRC to source those minerals which it is not endowed with sufficiently.

- Monopolising Manufacturing of Finished products: China has also monopolised the manufacture of finished products as it supplies 78% of cathodes, 85% of anodes, 70% of battery cells and 95% of permanent magnets made from rare earths.

- Settling Political Scores Against Countries: China, incidentally, has been using its monopoly position on rare earths to settle political scores with countries like the US and Japan by restricting their exports and also the related technology.

- China’s dominant position in the business of critical minerals and its willingness to arm-twist other countries has clearly rattled the world community.

- Major Share of Rare Earth Reserves: Not only does China have a major share of rare earth reserves, it has also completely monopolised the processing capacity of these minerals. China processes 35% of the world’s nickel, 50-70% of lithium and cobalt and nearly 90% of rare earths.

- Lack of Processing and Manufacturing the Final Products:

- India has signed an agreement with Australia to jointly explore for lithium and cobalt assets in Australia. The problem is that the availability of the minerals is not enough. One needs to process it and manufacture the final product which also means access to technology.

- There is considered to be a gestation period of about 15 years or more. There is a big fear that lack of access to critical minerals may be the biggest roadblock to India’s march towards decarbonisation.

What are the Steps Required to Boost Critical Minerals Availability?

- Ensuring Resource Availability:

- Addressing the resource aspect is crucial. It is necessary to assess the availability and accessibility of critical materials required for clean energy technologies. This includes evaluating the domestic reserves of critical minerals and exploring opportunities for their sustainable extraction or sourcing from diverse international markets.

- Additionally, there should be strategies to ensure a steady supply of these materials, mitigating risks associated with potential disruptions in global supply chains.

- Financial Considerations:

- The transition to clean energy often necessitates significant investments in infrastructure development, research and development, and policy support. There is a need for financing mechanisms, incentives, and funding models that can attract both public and private investments.

- Identifying avenues for international collaborations and exploring innovative financing options will also be vital in mobilising the required capital for a successful energy transition.

- Technology as the Key Driver:

- Technology plays a critical role in achieving our energy goals. It is required for the world to focus on fostering domestic technological capabilities, promoting r&d, and fostering innovation in clean energy technologies.

- There is a need for technology transfer, collaborations with academia and industry, and the creation of an ecosystem that supports the development, adoption, and scaling up of innovative clean energy solutions.

- Technology plays a critical role in achieving our energy goals. It is required for the world to focus on fostering domestic technological capabilities, promoting r&d, and fostering innovation in clean energy technologies.

- Setting Up a Specialised Body:

- The Expert committee, under the Ministry of Mines, called for a need for establishing a National Institute or Centre of Excellence on critical minerals on the lines of Australia’s CSIRO, which is the largest minerals research and development organisation in Australia and one of the largest in the world.

- A wing in the Ministry of Mines can be established as a Centre of Excellence for Critical Minerals adding that this proposed Centre will periodically update the list of critical minerals for India and notify the critical mineral strategy from time to time.

- The Expert committee, under the Ministry of Mines, called for a need for establishing a National Institute or Centre of Excellence on critical minerals on the lines of Australia’s CSIRO, which is the largest minerals research and development organisation in Australia and one of the largest in the world.

What are the Recent Steps Taken by India to Promote Production?

- Adopting a Robust Three-Stage Process in Identification:

- In its three-stage assessment for identifying the minerals critical to India, the panel, in the first stage, looked at the strategies of various countries such as Australia, USA, Canada, UK, Japan and South Korea.

- In the second stage of assessment, an inter ministerial consultation was carried out with different ministries to identify minerals critical to their sectors.

- The third stage assessment was to derive an empirical formula for evaluating minerals criticality, taking cognizance of the EU methodology that considers two major factors - economic importance and supply risk.

- Exploration Carried Out by GSI:

- The GSI, an attached office of the Ministry of Mines, has carried out a G3 stage mineral exploration during Field Season 2020-21 and 2021-22 in Salal-Haimna areas of Reasi district, Jammu & Kashmir, and estimated an inferred resource of 5.9 million tonnes of lithium ore.

- Based on the mapping outcome, more exploration programmes on various mineral commodities including lithium will be taken up in future in different parts of the country, including Jammu & Kashmir.

- The GSI, an attached office of the Ministry of Mines, has carried out a G3 stage mineral exploration during Field Season 2020-21 and 2021-22 in Salal-Haimna areas of Reasi district, Jammu & Kashmir, and estimated an inferred resource of 5.9 million tonnes of lithium ore.

- Setting Up Khanij Bidesh India Ltd. (KABIL):

- It is mandated to identify and acquire overseas mineral assets of critical and strategic nature such as lithium, cobalt and others so as to ensure supply side assurance.

- KABIL has initiated engagement with several state owned-organisations of the shortlisted source countries through the Ministry of External Affairs and the Indian Embassies in countries like Argentina and Australia to acquire mineral assets, including lithium, cobalt and rare earth elements.

Conclusion

The government's recent actions regarding critical minerals mark a significant step towards securing a steady supply of these essential resources. The identification of 30 critical minerals, along with amendments to mining laws to allow private sector participation, demonstrates a proactive approach to addressing potential shortages. However, challenges exist, such as the concentration of resources in a few countries and China's dominant position in processing and manufacturing. The path to decarbonisation and achieving net-zero goals by 2070 hinges significantly on overcoming these challenges and ensuring a sustainable supply of critical minerals.

|

Drishti Mains Question: Discuss the significance of critical minerals in achieving clean energy goals and the challenges faced by India in securing a steady supply of these resources. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims:

Q. Recently, there has been a concern over the short supply of a group of elements called ‘rare earth metals’. Why? (2012)

- China, which is the largest producer of these elements, has imposed some restrictions on their export.

- Other than China, Australia, Canada and Chile, these elements are not found in any country.

- Rare earth metals are essential for the manufacture of various kinds of electronic items and there is a growing demand for these elements.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (c)

Mains:

Q. Despite India being one of the countries of Gondwanaland, its mining industry contributes much less to its Gross Domestic Product (GDP) in percentage. Discuss. (2021)

Q. “In spite of adverse environmental impact, coal mining is still inevitable for development”. Discuss. (2017)