Indian Economy

Forex Reserves For Economic Stimulus

This article is based on “An unreliable emergency fund” which was published on the Indian Express on 01/07/2020. It talks about the prospects and challenges of using forex reserves for stimulating the economy.

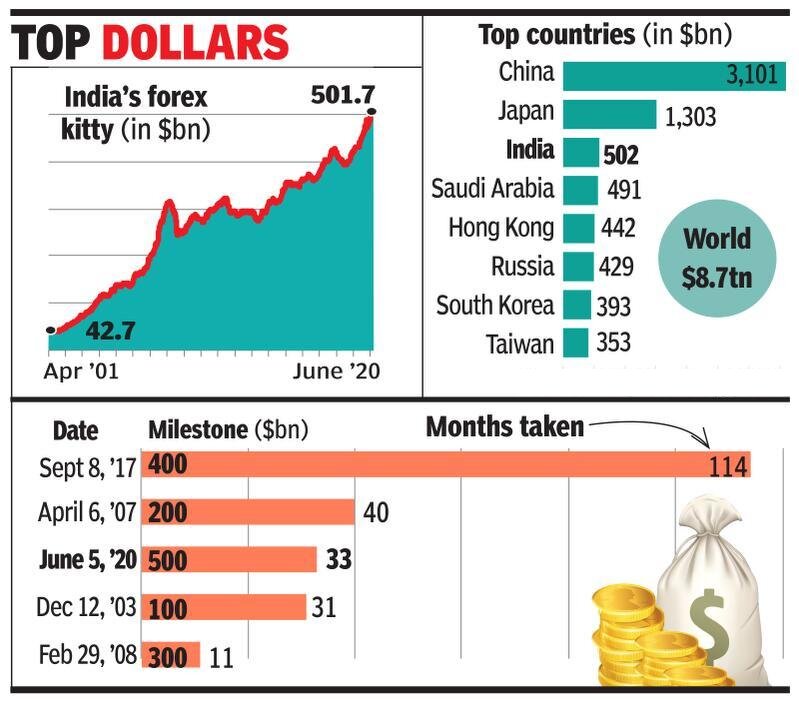

Recently, India’s forex reserves have crossed an unprecedented mark — over half trillion USD — placing India only behind China and Japan in Asia. While forex reserves amounting to import cover of six months is considered sufficient, today’s cover is enough to sustain imports up to 12 months.

Therefore, many economists are of the view of using a small portion of these forex reserves for launching another economic stimulus to help support economic growth amid Covid-19 pandemic.

However, over-reliance on forex reserves to provide economic stimulus may prove to be dangerous for the economic stability of Indian economy.

Reasons For Surge in Forex Reserves

The recent rise in forex reserves is a result of two factors:

- Spike in Foreign Institutional Investments (FIIs): Foreign institutional investors reinvested in the Indian market in May-June 2020 after they exited their positions in panic in March.

- Savings in India’s Import Bill: The global fall in fuel prices has reduced India’s oil import bill allowing it to save up forex reserves.

Case For Leveraging Forex Reserves

- Adequate Forex Reserves: Sufficiency of forex reserves is sometimes measured on how many months’ worth of imports can a country afford.

- While forex reserves amounting to import cover of six months is considered sufficient by the Reserve Bank of India (RBI), India import cover (as of June 2020) is enough to sustain imports up to 12 months.

- Adequate Contingency Arrangement: In case of a credit shock, India can mitigate any balance of payment crisis situation, as there are sufficient arrangements for foreign exchange reserves in the form of a credit line from the IMF and many Central bank liquidity swap agreements with countries like Japan.

- Leveraging Forex As a Last Resort: Tax revenues, in this fiscal year, will be affected by lower-than-expected economic activity. Also, non-tax revenue will remain subdued as the RBI has already given a huge dividend payment to the government in 2019.

- Further, in mere two months into this fiscal year and the government’s fiscal deficit stands at 58.6 per cent of the budgetary target for the current fiscal year — a result of accelerating its budgetary spending to deal with the virus.

- Thus, the lack of considerable space both on the monetary and fiscal front to support economic growth, part of the country’s forex reserves can be used for stimulating the economy.

Dangerous Side of Leveraging Forex Reserves

- A single oil price hiccup can derail India’s economy: Current low crude oil prices are due to several issues, one such is the Price war between Russia and Suadi Arabia. As soon as a common ground is agreed between the two, the crude prices will tend to rise again.

- With the rise of 1$ per barrel of crude oil prices, India has to additionally pay nearly Rs 15000 crore. Given this, India should deter using forex reserves for providing economic stimulus.

- Can’t rely on Hot money: The rise in current forex reserves is due to massive inflow of foreign institutional investments (FIIs). However, FIIs by their nature are investments based on speculation.

- Therefore, the current surge in forex reserves should not be treated of permanent nature.

- In March 2020 alone, foreign institutional investments in India fell by Rs 65,000 crore (due to coronavirus pandemic).

- Positive effect of high forex reserves on foreign inflows: High forex reserves also help India to maintain its global rating, especially in the context of falling GDP growth rate.

- The depletion in forex reserves may have a negative impact on these ratings, which in turn may reduce foreign investment inflows into India.

- Volatility in Indian Rupee: RBI has been fundamentally using India’s foreign exchange to ensure rupee stability.

- Given the fluctuation in Indian rupee vis-a-vis the dollar, the Indian rupee has become one of Asia’s worst currencies.

- Thus, RBi will be needing enough forex reserves to maintain the stability of Indian Rupee.

- Economic stimulus is ineffective without structural reforms: Even using forex reserves would not resolve all the challenges facing Indian infrastructure development.

- Issues such as land acquisition and delay in project clearances like environmental concerns that have stymied past attempts to improve infrastructure.

Conclusion

If the government intends to use forex reserves as an emergency fund, it should ensure that they do not shrink just when they are most needed. Apart from it, there is a need for separate attention to carry out structural reforms that can really pull out the Indian economy from persistent slowdown.

|

Drishti Mains Question Critically analyse the idea of using forex reserves for providing stimulus to the Indian economy. |

This editorial is based on “Indian paradox” which was published in The Times of India on July 3rd, 2020. Now watch this on our Youtube channel.