Indian Economy

Government's Long-Term Fiscal Discipline

This editorial is based on “Stability Over Political Gestures” which was published in Indian Express on 02/02/2024. The article discusses the fiscal strategy of a government in response to economic conditions, emphasizing the importance of counter-cyclical fiscal measures.

For Prelims: Gross Domestic Product (GDP), Make in India, Fiscal Deficit, Special Economic Zones (SEZs), Budget 2022-23, Faster Adoption and Manufacturing of Hybrid and Electric Vehicle in India (FAME - India), Industry 4.0, Production-Linked Incentive (PLI), PM Gati Shakti- National Master Plan, Bharatmala Project, Sagarmala Project.

For Mains: Significance and benefits of prudent fiscal management on the growth of the economy in the long-term.

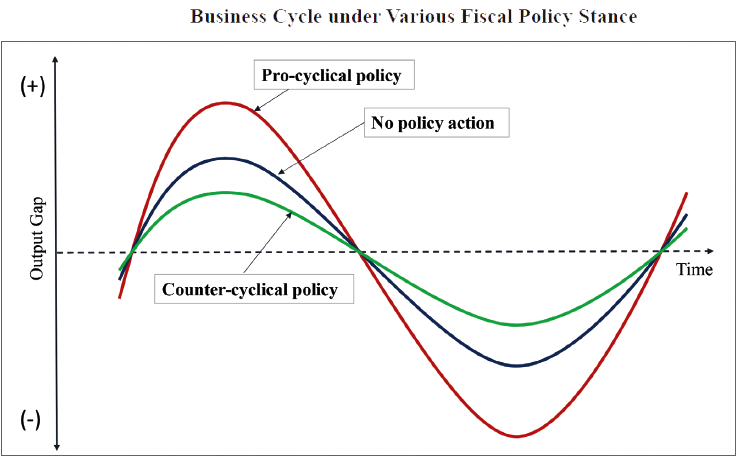

Economic theory suggests that governments should spend more when private firms and households do not feel confident and hold back spending. Once the latter feels confident, the government should roll back its expenditure. This counter-cyclical fiscal strategy smoothens growth and makes it more sustainable.

While governments, especially democratically elected ones, find the first part easy to do, they are generally reluctant to step back when the economy recovers. The Government of India through its Interim Budget 2024 seems to be bucking this trend by adopting sound fiscal strategies.

What is the Cyclicality of the Fiscal Policy?

- The cyclicality of the fiscal policy refers to a change in the direction of government expenditure and taxes based on economic conditions.

- These pertain to decisions by policymakers based on the fluctuations in economic growth. There are two types of cyclical fiscal policies - counter-cyclical and procyclical.

- Counter-cyclical Fiscal Policy:

- Counter-cyclical fiscal policy refers to the steps taken by the government that go against the direction of the economic or business cycle.

- Thus, in a recession or slowdown, the government increases expenditure and reduces taxes to create a demand that can drive an economic boom.

- In a Recession:

- The government takes the route of expansionary fiscal policy i.e. the government expenditure is increased and taxes are reduced. This increases the consumption potential of the economy and helps soften the recession.

- In an Economic Boom:

- The government takes the route of contractionary fiscal policy i.e. the government expenditure is decreased and taxes are increased. This decreases the consumption potential of the economy and helps moderate the boom.

- Procyclical Fiscal Policy:

- Procyclical fiscal policy, in contrast to its countercyclical counterpart, amplifies the existing economic trends.

- In a Recession:

- Government spending decreases and taxes increase. This further reduces aggregate demand, deepening the recession and leading to higher unemployment and slower economic growth.

- This approach can be seen as cutting back when times are already tough, making it harder for businesses and individuals to recover.

- In an Economic Boom:

- Government spending increases and taxes decrease. This fuels the boom, potentially leading to overheating, inflation, and asset bubbles.

- While it might seem appealing to enjoy the extra spending in good times, it can create vulnerabilities and make the inevitable downturn even more severe.

- Counter-cyclical Fiscal Policy:

What are the Counter-Cyclical Fiscal Priorities for the Government in 2024?

- Fiscal Discipline Targets:

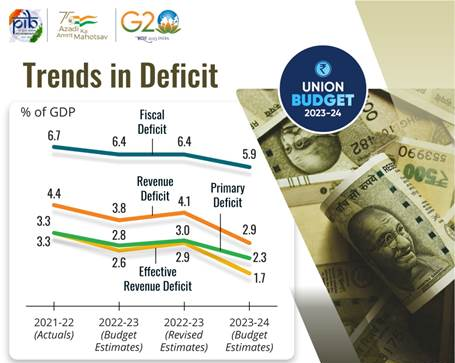

- The government prioritizes macroeconomic stability over political gestures, with a fiscal deficit target of 5.1% for FY 2024-25 and a commitment to reduce it further by FY 2025-26. Even the fiscal deficit for FY24 is estimated to be lower at 5.8% of GDP (as against budgeted 5.9%).

- This has been achieved even with much lower nominal GDP growth of 8.7% in FY24 as against budgeted growth of 10.5%.

- The tax buoyancy for FY25 is assumed at 1.1, which looks quite achievable, given the tax buoyancy of 1.4 estimated for FY24.

- The government prioritizes macroeconomic stability over political gestures, with a fiscal deficit target of 5.1% for FY 2024-25 and a commitment to reduce it further by FY 2025-26. Even the fiscal deficit for FY24 is estimated to be lower at 5.8% of GDP (as against budgeted 5.9%).

- Dealing with Interest Costs:

- Higher interest costs, reflecting past deficits, will persist due to the significant jump in the debt-to-GDP ratio during the pandemic, requiring fiscal discipline for several years.

- The gross market borrowing has been budgeted at Rs 14.1 trillion for FY25 compared to Rs 15.4 trillion estimated for FY24.

- This should help in lowering government bond yields and eventually lower the overall borrowing cost for corporates, which, in turn, will be a positive for private investment.

- Higher interest costs, reflecting past deficits, will persist due to the significant jump in the debt-to-GDP ratio during the pandemic, requiring fiscal discipline for several years.

- Quality of Spending:

- Improving spending quality is crucial to reducing the elevated debt-to-GDP ratio, limiting the state's ability to support growth, with a focus on avoiding rapid reduction to avoid hurting GDP growth.

- Calibrating Fiscal Tightening:

- The government is gradually tightening fiscal policies as confidence in economic recovery grows, from 0.5% in FY23 to 0.7% in FY25, balancing the need for growth and debt reduction.

- Encouraging Capital Expenditure:

- Year-on-year growth in capital expenditure (capex) (11%) exceeding overall spending (6%) is positive, indicating a focus on medium-term growth drivers, including interest-free loans for research.

- The interim budget has continued the thrust on capex, which is required at this point when the private sector has been lagging on the investment front.

- The central government’s capex has been budgeted to grow to Rs 11.1 lakh crore in FY25. The government has been focussing on capex for the last few years, given the strong multiplier effect it has on growth.

- Year-on-year growth in capital expenditure (capex) (11%) exceeding overall spending (6%) is positive, indicating a focus on medium-term growth drivers, including interest-free loans for research.

- Focus On Infrastructure:

- In recent years, India's fiscal policy has been characterised by a strategic focus on infrastructure development, with increased budgetary allocations to sectors like transportation, energy, and urban development.

- The capex to GDP ratio has been maintained at a high of 3.4% in FY25 (same as FY24), compared to less than 2% in the years before the pandemic. Of the total capex budgeted, around 47% is going into roads and railways in FY25.

- In recent years, India's fiscal policy has been characterised by a strategic focus on infrastructure development, with increased budgetary allocations to sectors like transportation, energy, and urban development.

- Rationalising Subsidies:

- There has been a concerted effort to rationalise subsidies, ensuring more targeted resource distribution, particularly in areas such as fuel and food subsidies.

- The total subsidy outgo has been trimmed to Rs 4.1 trillion for FY25 from Rs 4.4 trillion estimated for FY24. This takes the subsidy-to-GDP ratio to 1.3 from 1.5 in FY24 and a peak of 3.8 in the pandemic year of FY21.

- The overall subsidy burden has gone down mainly due to a reduction in fertiliser subsidies, while food and petroleum subsidies have reduced marginally compared to FY24.

- There has been a concerted effort to rationalise subsidies, ensuring more targeted resource distribution, particularly in areas such as fuel and food subsidies.

- Boosting Rural Demand:

- For rural development, the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) has been allocated Rs 86,000 crore (the same as the revised estimate for FY24), but higher than the budgeted amount of Rs 60,000 crore for FY24.

- There has been a further boost given to rural housing, with another 2 crore houses to be built in the next five years under the PM Awas Yojana (Grameen). This is a step in the right direction for rural development, given the strong multiplier effect of the housing sector.

What are the Challenges in Adhering to Counter Cyclical Fiscal Policy?

- Issues in Debt Sustainability:

- The Economic Survey 2020-21 is right in concluding that it is the GDP growth that will be the deciding factor for debt sustainability in India and not the other way around.

- It called for breaking the intellectual anchoring that has created an asymmetric bias against fiscal policy and advocated for a Keynesian countercyclical policy response which is largely missing over an extended period in indian context.

- Lack of Balance Between Pro-Cyclical and Counter-Cyclical Policy:

- In India, a comparison between the growth rate of GDP and government final consumption expenditure (GFCE) does indicate an element of pro-cyclicality in both short and long run in the previous few years.

- But the problem is that in India, fiscal policies in good times are never fully offset in bad times and, hence, result in an incorrect deficit bias risking debt sustainability. This is potentially damaging from the viewpoint of macroeconomic stability.

- In India, a comparison between the growth rate of GDP and government final consumption expenditure (GFCE) does indicate an element of pro-cyclicality in both short and long run in the previous few years.

- Fiscal Challenges Faced By Indian States:

- Despite the reduction in fiscal deficit, Indian States still face fiscal challenges, especially in containing their revenue deficits, which have not declined proportionately with fiscal deficits.

- Revenue Related Challenges:

- The impact of the Covid-19 pandemic on the economic activity and tax collection.

- The uncertainty and volatility of GST revenue and compensation.

- The dependence on tax devolution from the Union and its formula-based allocation.

- The erosion of fiscal autonomy due to the subsumption of various taxes under GST.

- The limited scope for raising non-tax revenues such as user charges, fees, etc.

- The compliance and administrative issues in collecting own taxes such as property tax, stamp duty, etc.

- Slowing Consumption Demand:

- Private consumption, which contributes nearly 55-60% to India’s GDP, has been slowing down.

- While the reduced income growth of households has reduced urban consumption, drought/near-drought conditions in three of the past five years coupled with the collapse of food prices have taken a heavy toll on rural consumption.

- Private consumption, which contributes nearly 55-60% to India’s GDP, has been slowing down.

- Deficit Financing Concerns:

- While an unchanged fiscal deficit in a growing economy is less concerning, two major sources of deficit financing—market borrowings and small-savings schemes—pose potential challenges.

- Unaddressed Cash Balance Concerns:

- Rising inflows into small-savings schemes could lead to a higher cash balance than anticipated, potentially causing liquidity stresses in the banking system, impacting fiscal gains.

- Higher-than-normal government cash balances, as observed recently, can lead to unintended consequences, intensifying liquidity stresses and impacting the effectiveness of monetary policy.

- Rising inflows into small-savings schemes could lead to a higher cash balance than anticipated, potentially causing liquidity stresses in the banking system, impacting fiscal gains.

What Should be the Way Forward?

- Prudential Stance:

- Achieve Fiscal Consolidation: The NK Singh Committee on FRBM had envisaged a debt-to-GDP ratio of 40% for the central government and 20% for states aiming for a total of 60% general government debt-to-GDP.

- Fiscal Reforms at the State Level: The central government may promote the adoption of prudent fiscal policies by states and discourage excessive borrowing by offering rewards or incentives to states committed to fiscal discipline.

- Raise Additional Revenue:

- Enhance Tax Collection and Compliance: Improve tax administration and compliance to increase government revenue. Utilising technology for cross-matching of GST and income-tax returns can enhance tax collection efficiency and curb tax evasion.

- Administrative Streamlining: Raise additional revenue through administrative streamlining, and the adoption and better administration of new taxes.

- Disinvestment and Efficient Asset Management: Pursue disinvestment and strategic asset management to optimise government resources and reduce the need for excessive borrowing.

- Re-orient Spending in Infrastructure and Capacity Building:

- Infrastructure Investments: Prioritise investments in physical infrastructure, human capital, and green initiatives to enhance economic productivity and foster sustainable development.

- Privatisation of Loss-making PSUs: The government may think of privatising loss-making public sector undertakings (PSUs) as done in the case of Air India.

- PPP Model in Social Schemes: The government may think of a public-private partnership (PPP) model in social schemes like Deen Dayal Upadhyay Grameen Kaushalya Yojna (DDU-GKY). This may help in reducing public debt.

- Introduce Green Debt Swaps: In a green debt swap, a debtor nation and its creditors negotiate to exchange or restructure existing debt in a way that aligns with environmentally friendly and sustainable projects.

- It enables the low-income countries to redeploy part of their debt repayments to invest in measures to tackle climate change, nature protection, health, or education. With the agreement of creditors, debt swaps can help the world’s low-income countries avoid default.

- Utilise Institutional Mechanisms:

- Leveraging the Public Financial Management System (PFMS): Leveraging the PFMS to its fullest potential is integral to effective fiscal deficit management, ensuring heightened transparency and accountability in government expenditures.

- Establishment of Public Debt Management Agency (PDMA): PDMA will centralise expertise and responsibilities related to public debt management, ensuring a focused and specialised approach.

- This can lead to more effective decision-making and strategic planning in handling the complexities of public debt in the country.

- Reforming Budgetary Aspects:

- Credible Budget Assumptions: The budget's assumptions, including nominal GDP growth and tax-to-GDP ratios, are deemed credible, with improvements in personal and corporate taxes reflecting post-Covid economic rebound, and becomes important for USD 7 trillion target.

- Transparency in Budget Numbers: Efforts to enhance transparency by reducing extra-budgetary spending should continue, bringing the primary deficit in FY25 close to pre-Covid levels, and potentially below them in FY26.

- Medium-Term Fiscal Management: The government's commitment to fiscal consolidation should be aligned with medium-term fiscal management, providing predictability to the private sector and financial markets.

Conclusion

The government's commitment to a counter-cyclical fiscal strategy, prioritizing macroeconomic stability, and adhering to a lower fiscal deficit target for FY2024-25 than anticipated by economists, demonstrates a welcome trend towards medium-term fiscal management. The credible assumptions underlying the budget, including reasonable GDP growth projections and improvements in tax-to-GDP ratios, further enhance its quality. However, the potential impact of the government's financing choices, particularly in managing higher cash balances, warrants careful consideration to avoid unintended consequences on liquidity and monetary policy effectiveness.

|

Drishti Mains Question: Examine the significance of counter-cyclical fiscal policy in economic management, its challenges, and the impact on sustainable growth. |

UPSC Civil Services, Previous Year Questions (PYQ)

Prelims

Q1. In the context of governance, consider the following: (2010)

- Encouraging Foreign Direct Investment inflows

- Privatization of higher educational Institutions

- Down-sizing of bureaucracy

- Selling/offloading the shares of Public Sector Undertakings

Which of the above can be used as measures to control the fiscal deficit in India?

(a) 1, 2 and 3

(b) 2, 3 and 4

(c) 1, 2 and 4

(d) 3 and 4 only

Ans: (d)

Q2. Which one of the following is likely to be the most inflationary in its effect? (2021)

(a) Repayment of public debt

(b) Borrowing from the public to finance a budget deficit

(c) Borrowing from the banks to finance a budget deficit

(d) Creation of new money to finance a budget deficit

Ans: (d)

Q3. Which of the following is/are included in the capital budget of the Government of India? (2016)

- Expenditure on acquisition of assets like roads, buildings, machinery, etc.

- Loans received from foreign governments

- Loans and advances granted to the States and Union Territories

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)

Mains

Q1. One of the intended objectives of the Union Budget 2017-18 is to ‘transform, energise and clean India’. Analyse the measures proposed in the Budget 2017-18 to achieve the objective. (2017)

Q2. Distinguish between Capital Budget and Revenue Budget. Explain the components of both these Budgets. (2021)