Infographics

Biodiversity & Environment

New Target to Reduce Air Pollution

For Prelims: National Clean Air Programme, Central Pollution Control Board

For Mains: Environmental Pollution & Degradation

Why in News?

Recently, the Centre has set a new target of a 40% reduction in particulate matter concentration in cities covered under the National Clean Air Programme (NCAP) by 2026, updating the earlier goal of 20 to 30% reduction by 2024.

What is the National Clean Air Programme?

- About:

- It was launched by the Ministry of Environment, Forests and Climate Change (MoEFCC) in January 2019.

- It is the first-ever effort in the country to frame a national framework for air quality management with a time-bound reduction target.

- It seeks to cut the concentration of coarse (particulate matter of diameter 10 micrometer or less, or PM10) and fine particles (particulate matter of diameter 2.5 micrometer or less, or PM2.5) by at least 20% in the next five years, with 2017 as the base year for comparison.

- It covers 132 non-attainment cities which were identified by the Central Pollution Control Board (CPCB).

- Non-attainment cities are those that have fallen short of the National Ambient Air Quality Standards (NAAQS) for over five years.

- NAAQs are the standards for ambient air quality with reference to various identified pollutant notified by the CPCB under the Air (Prevention and Control of Pollution) Act, 1981. List of pollutants under NAAQS: PM10, PM2.5, SO2, NO2, CO, NH3, Ozone, Lead, Benzene, Benzo-Pyrene, Arsenic and Nickel.

- Non-attainment cities are those that have fallen short of the National Ambient Air Quality Standards (NAAQS) for over five years.

- Objective:

- To augment and evolve effective and proficient ambient air quality monitoring networks across the country.

- To have efficient data dissemination and public outreach mechanisms for timely measures for prevention and mitigation of air pollution.

- To have a feasible management plan for prevention, control and abatement of air pollution.

What are Initiatives taken by India for Controlling Air Pollution?

- System of Air Quality and Weather Forecasting and Research (SAFAR) Portal

- Air Quality Index: AQI has been developed for eight pollutants viz. PM2.5, PM10, Ammonia, Lead, nitrogen oxides, sulphur dioxide, ozone, and carbon monoxide.

- Graded Response Action Plan (for Delhi)

- For Reducing Vehicular Pollution:

- BS-VI Vehicles,

- Push for Electric Vehicles (EVs),

- Odd-Even Policy as an emergency measure (for Delhi)

- New Commission for Air Quality Management

- Subsidy to farmers for buying Turbo Happy Seeder (THS) Machine for reducing stubble burning.

- National Air Quality Monitoring Programme (NAMP):

- Under NAMP, four air pollutants viz. SO2, NO2, PM10, and PM2.5 have been identified for regular monitoring at all locations.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. In the cities of our country, which among the following atmospheric gases are normally considered in calculating the value of Air Quality Index? (2016)

- Carbon dioxide

- Carbon monoxide

- Nitrogen dioxide

- Sulfur dioxide

- Methane

Select the correct answer using the code given below:

(a) 1, 2 and 3 only

(b) 2, 3 and 4 only

(c) 1, 4 and 5 only

(d) 1, 2, 3, 4 and 5

Ans: (b)

Exp:

- National Air Quality Index (AQI) is a tool for effective communication of air quality status to people in terms which are easy to understand. It transforms complex air quality data of various pollutants into a single number (index value), nomenclature and colour.

- There are six AQI categories, namely Good, Satisfactory, Moderately Polluted, Poor, Very Poor, and Severe.

- It considers eight pollutants namely:

- Carbon Monoxide (CO), hence, 2 is correct.

- Nitrogen Dioxide (NO2), hence, 3 is correct.

- Sulphur Dioxide (SO2), hence, 4 is correct.

- Ozone (O3),

- PM 2.5,

- PM 10,

- Ammonia (NH3),

- Lead (Pb).

- Therefore, option (b) is the correct answer.

Mains

Q. Describe the key points of the revised Global Air Quality Guidelines (AQGs) recently released by the World Health Organisation (WHO). How are these different from its last update in 2005? What changes in India’s National Clean Air Programme are required to achieve revised standards? (2021)

Governance

Abortion Rights for Single Women

For Prelims: Abortion Law, Medical Termination of Pregnancy MTP (2021), Reproductive Rights.

For Mains: Abortion Rights for Single Women, Medical Termination of Pregnancy MTP Act (2021) and its Significance.

Why in News?

Recently, the Supreme Court has allowed all women in the country, regardless of marital status, can undergo an abortion up to 24 weeks into pregnancy to access safe and legal abortion care.

What is the SC’s Ruling?

- Ruled over an Old Law:

- It has ruled over a 51-year-old abortion law (The Medical Termination of Pregnancy Act of 1971) which bars unmarried women from terminating pregnancies which are up to 24-weeks old.

- The Medical Termination of Pregnancy Act of 1971 and its Rules of 2003 prohibit unmarried women who are between 20 weeks to 24 weeks pregnant to abort with the help of registered medical practitioners.

- The latest amendment to the MTP Act was made in 2021.

- It has ruled over a 51-year-old abortion law (The Medical Termination of Pregnancy Act of 1971) which bars unmarried women from terminating pregnancies which are up to 24-weeks old.

- Right to Choose under Article 21:

- Court held that the rights of reproductive autonomy, dignity and privacy under Article 21 of the Constitution gives an unmarried woman the right of choice as to whether or not to bear a child on a similar footing as that of a married woman.

- Right to Equality under Article 14:

- Prohibiting single or unmarried pregnant women with pregnancies between 20 and 24 weeks from accessing abortion while allowing married women with the same term of pregnancy to access the care was violative of the right to equality before law and equal protection (Article 14).

- A single woman may have suffered the same “change in material circumstances” as a married pregnant woman. She may have been abandoned or without a job or been a victim of violence during her pregnancy.

- Not Constitutionally Sustainable:

- Artificial distinction between married and unmarried women is not constitutionally sustainable.

- The benefits of law extend equally to single and married women.

- Extended the Ambit of Reproductive RIghts:

- The term Reproductive Right is not restricted to having or not having children.

- Reproductive rights’ of women included a “constellation of rights, entitlements and freedoms for women”.

- Reproductive rights include the right to access education and information about contraception and sexual health, right to choose safe and legal abortion and right to reproductive health care.

- Views on Marital Rape:

- For the sole purpose of the MTP Act, the meaning of rape must include marital rape to marshal a woman’s right to reproductive and decisional autonomy.

What is India’s Abortion Law?

- Historical Perspective:

- Until the 1960s, abortion was illegal in India and a woman could face three years of imprisonment and/or a fine under Section 312 of the Indian Penal Code (IPC).

- It was in the mid-1960s that the government set up the Shantilal Shah Committee and asked the group, headed by Dr Shantilal Shah, to look into the matter of abortions and decide if India needed a law for the same.

- Based on the report of the Shantilal Shah Committee, a medical termination bill was introduced in Lok Sabha and Rajya Sabha and was passed by Parliament in August 1971.

- The Medical Termination of Pregnancy (MTP) Act, 1971 came into force on 1st of April 1972 and applied to all of India except the state of Jammu and Kashmir.

- Also, Section 312 of the Indian Penal Code, 1860, criminalises voluntarily “causing miscarriage” even when the miscarriage is with the pregnant woman’s consent, except when the miscarriage is caused to save the woman’s life.

- This means that the woman herself, or anyone else including a medical practitioner, could be prosecuted for an abortion.

- About:

- Medical Termination of Pregnancy (MTP) Act, 1971 act allowed pregnancy termination by a medical practitioner in two stages:

- A single doctor's opinion was necessary for abortions up to 12 weeks after conception.

- For pregnancies between 12 to 20 weeks old, the opinion of two doctors was required to determine if the continuance of the pregnancy would involve a risk to the life of the pregnant woman or of grave injury to her physical or mental health or if there is a substantial risk that if the child were born, it would suffer from such physical or mental abnormalities as to be seriously “handicapped” before agreeing to terminate the woman’s pregnancy.

- Medical Termination of Pregnancy (MTP) Act, 1971 act allowed pregnancy termination by a medical practitioner in two stages:

- Recent Amendments:

- In 2021, Parliament amended the law to allow for abortions based on the advice of one doctor for pregnancies up to 20 weeks.

- The modified law needs the opinion of two doctors for pregnancies between 20 and 24 weeks.

- Further, for pregnancies between 20 and 24 weeks, rules specified seven categories of women who would be eligible for seeking termination under section 3B of rules prescribed under the MTP Act,

- Survivors of sexual assault or rape or incest,

- Minors,

- Change of marital status during the ongoing pregnancy (widowhood and divorce),

- Women with physical disabilities (major disability as per criteria laid down under the Rights of Persons with Disabilities Act, 2016)

- Mentally ill women including mental retardation,

- The foetal malformation that has a substantial risk of being incompatible with life or if the child is born it may suffer from such physical or mental abnormalities to be seriously handicapped, and

- Women with pregnancy in humanitarian settings or disasters or emergencies may be declared by the Government.

- In 2021, Parliament amended the law to allow for abortions based on the advice of one doctor for pregnancies up to 20 weeks.

What are the Concerns?

- Cases of Unsafe Abortions:

- Unsafe abortions are the third leading cause of maternal mortality in India, and close to 8 women die from causes related to unsafe abortions each day, according to the United Nations Population Fund (UNFPA)'s State of the World Population Report 2022.

- The women outside marriages and in poor families are left with no choice but to use unsafe or illegal ways to abort unwanted pregnancies.

- Shortage of Medical Expert in Rural India:

- According to a 2018 study in the Lancet, 15.6 million abortions were accessed every year in India as of 2015.

- The MTP Act requires abortion to be performed only by doctors with specialisation in gynaecology or obstetrics.

- However, the Ministry of Health and Family Welfare’s 2019-20 report on Rural Health Statistics indicates that there is a 70% shortage of obstetrician-gynaecologists in rural India.

- Illicit Abortions leading to Maternal Mortality:

- As the law does not permit abortion at will, it pushes women to access illicit abortions under unsafe conditions, thus result in maternal mortality.

Way Forward

- India's legal framework on abortion is largely considered progressive, especially in comparison to many countries including the United States where abortion restrictions are severely restricted — both historically, and at present.

- Further, there is a need for a serious rethink in public policy making, also accommodating all the stakeholders to focus on women and their reproductive rights, rather than drawing red lines those medical practitioners cannot cross while performing abortions.

Governance

Scheme Special Assistance to States for Capital Investment

For Prelims: Scheme Special Assistance to States for Capital Investment, PM Gati Shakti Master Plan,PM Gram Sadak Yojana, Optical Fibre Cable

For Mains: Government Policies & Interventions, Growth & Development, Infrastructure

Why in News?

Recently, the Government has launched a Scheme Special Assistance to States for Capital Investment for 2022-23.

What is the Scheme Special Assistance to States for Capital Investment?

- About:

- Under this Scheme, financial assistance is provided to the States Governments in the form of 50-year interest free loan for capital investment projects.

- For the 2022-23 Financial Year (FY) a total financial assistance of Rs 1 lakh crore would be given to states.

- The loan under the scheme would be over and above the normal borrowing ceiling allowed to states for FY 2022-23 and should be spent in the same year.

- Eligible Parts of the Scheme:

- New or ongoing projects or for settling pending bills in ongoing capital projects.

- States may submit projects of higher value than the funds allocated, indicating their preference/priority.

- Different Parts of the Scheme:

- For capital works (PM Gati Shakti Master Plan will receive priority), PM Gati Shakti related expenditure, PM Gram Sadak Yojana, Incentives for digitisation, Optical Fibre Cable, Urban reforms, Disinvestment and monetisation.

- Exclusion: Projects with capital outlay of less than 5 crore (2 crore for North East) and repair and maintenance projects irrespective of capital outlay are not eligible

What is Capital Expenditure?

- Meaning:

- Capital expenditure is the money spent by the government on the development of machinery, equipment, building, health facilities, education, etc.

- It also includes the expenditure incurred on acquiring fixed assets like land and investment by the government that gives profits or dividends in future.

- Along with the creation of assets, repayment of loan is also capital expenditure, as it reduces liability.

- Capital spending is associated with investment or development spending, where expenditure has benefits extending years into the future.

- Significance:

- Capital expenditure is long-term in nature and allows the economy to generate revenue for many years by adding or improving production facilities and boosting operational efficiency.

- It also increases labour participation, takes stock of the economy and raises its capacity to produce more in future.

- Different from Revenue Expenditure:

- Unlike capital expenditure, which creates assets for the future, revenue expenditure is one that neither creates assets nor reduces any liability of the government.

- Salaries of employees, interest payment on past debt, subsidies, pension, etc, fall under the category of revenue expenditure. It is recurring in nature.

UPSC Civil Services Examination Previous Year Question (PYQ)

Q. Which of the following is/are included in the capital budget of the Government of India? (2016)

- Expenditure on acquisition of assets like roads, buildings, machinery, etc.

- Loans received from foreign governments

- Loans and advances granted to the States and Union Territories

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)

Exp:

- Capital Budget: It may be defined as the part of the budget, which deals with the capital receipts and capital expenditures of the government.

- Capital Receipts: Capital receipts refer to those receipts which either create a liability or cause a reduction in the assets of the government. Generally, non-revenue receipts of the government are known as capital receipts. These include loan recovery, borrowings by the government (loan from market and foreign countries and multilateral institutions), other receipts of the government like postal deposits, provident fund, etc. Hence, statement 2 is correct.

- Capital Expenditure: An expenditure which either creates an asset (e.g., construction of road, school) or reduces liability (e.g., repayment of the loan) is called capital expenditure. These include loan disbursal by the government (loans and advances granted to the States and Union Territories), loan repayments by the government, expenditure on acquisition of assets like roads, buildings, machinery, etc., capital expenditure of government on defence, general services, and other liabilities. Hence, statements 1 and 3 are correct.

- Therefore, option (d) is the correct answer.

Internal Security

Ban on PFI

For Prelims: Popular Front of India, Unlawful Activities (Prevention) Act

For Mains: Government Intervention in managing internal security, Tackling Terrorism

Why in News?

The Government of India has banned the Popular Front of India and its affiliates for five years under the Unlawful Activities (Prevention) Act 1967 for having terror links.

What is the Popular Front of India?

- The PFI was created in 2007 through the merger of three Muslim organisations in southern India namely the National Democratic Front in Kerala, the Karnataka Forum for Dignity, and the Manitha Neethi Pasarai in Tamil Nadu.

- The formation of the PFI was formally announced at a rally in Bengaluru during what was called the “Empower India Conference” on 16th February, 2007.

What did the Centre Banned PFI?

- About Ban:

- The Ministry of Home Affairs declared the PFI an “unlawful association” along with its associates which includes :

- Rehab India Foundation (RIF), Campus Front of India (CFI), All India Imams Council (AIIC), National Confederation of Human Rights Organisation (NCHRO), National Women’s Front, Junior Front, Empower India Foundation and Rehab Foundation, Kerala”.

- The Ministry of Home Affairs declared the PFI an “unlawful association” along with its associates which includes :

- Reason for the Ban:

- According to the government, some of the PFI’s founding members are leaders of the Students Islamic Movement of India (SIMI) and the PFI also has linkages with Jamaat-ul-Mujahideen Bangladesh (JMB), both of which are proscribed organisations.

- There had been a number of instances of international linkages of PFI with Global Terrorist Groups like Islamic State of Iraq and Syria (ISIS).

What is the Unlawful Activities (Prevention) Act?

- About:

- Originally enacted in 1967, the UAPA was amended to be modelled as an anti-terror law in 2004 and 2008.

- In August 2019, Parliament cleared the Unlawful Activities (Prevention) Amendment Bill, 2019 to designate individuals as terrorists on certain grounds provided in the Act.

- In order to deal with terrorism crimes, it deviates from ordinary legal procedures and creates an exceptional regime where constitutional safeguards of the accused are curtailed.

- Provisions:

- Section 7:

- Section 7 of the UAPA gives the government the power to “prohibit use of funds” by an “unlawful association”.

- It says that after an organisation is banned and the Centre is satisfied after an enquiry that “any person has custody of any moneys, securities or credits which are being used or are intended to be used for the purpose of the unlawful association, the Central Government may, by order in writing, prohibit such person from paying, delivering, transferring or otherwise dealing in any manner whatsoever with such moneys, securities or credits or with any other moneys, securities or credits which may come into his custody after the making of the order”.

- It also gives powers to law enforcement agencies to search premises of such organisations and to examine their books of account.

- Section 8:

- Section 8 of the UAPA gives powers to the Centre to “notify any place which in its opinion is used for the purpose of such unlawful association”.

- The “place” here includes a house or a building, or a part thereof, or even a tent or a vessel.

- Section 8 of the UAPA gives powers to the Centre to “notify any place which in its opinion is used for the purpose of such unlawful association”.

- Section 10:

- Section 10 of the UAPA criminalises membership of a banned organisation.

- It says that “being a member of a banned organisation would be punishable with an imprisonment of two years and may extend to life imprisonment or even death in certain circumstances”.

- It also applies to any person who aids the objectives of the banned organisation.

- Section 7:

- UAPA Tribunal:

- About:

- The UAPA provides for a tribunal under a High Court judge to be constituted by the government for its bans to have long-term legal sanctity.

- Orders to declare an organisation as “unlawful” are issued by the Centre under Section 3 of the UAPA.

- The provision says that “no such notification shall have effect until the tribunal has, by an order made under Section 4, confirmed the declaration made therein and the order is published in the Official Gazette”.

- A government order would not come into effect until the tribunal has confirmed it.

- In exceptional circumstances, the notification can come into effect immediately once the reasons for it are recorded in writing. The tribunal can endorse or reject it.

- Powers:

- The tribunal has power to regulate its own procedure, including the place at which it holds its sittings. Thus, it can hold hearings in different states for allegations pertaining to those states.

- To make inquiries, the tribunal has the same powers as vested in a civil court under the Code of Civil Procedure, 1908.

- About:

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. Indian government has recently strengthed the anti-terrorism laws by amending the Unlawful Activities (Prevention) Act, (UAPA), 1967 and the NIA Act. Analyze the changes in the context of prevailing security environment while discussing scope and reasons for opposing the UAPA by human rights organizations. (2019)

Governance

Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY)

For Prelims: Pradhan Mantri Garib Kalyan Anna Yojana (PM-GKAY), National Food Security Act 2013, Public Distribution System (PDS), National Food Security Mission, One Nation One Ration Card (ONORC).

For Mains: Impacts of Pradhan Mantri Garib Kalyan Anna Yojana (PM-GKAY) on India's Food Security.

Why in News?

Recently, The Central government announced an extension of the Pradhan Mantri Garib Kalyan Anna Yojana (PM-GKAY) for another three months until December 2022.

What is PM-GKAY?

- About:

- PMGKAY is a part of the Pradhan Mantri Garib Kalyan Package (PMGKP) to help the poor fight the battle against Covid-19.

- The scheme aimed at providing each person who is covered under the National Food Security Act 2013 with an additional 5 kg grains (wheat or rice) for free, in addition to the 5 kg of subsidised foodgrain already provided through the Public Distribution System (PDS).

- It was initially announced for a three-month period (April, May and June 2020), covering 80 crore ration cardholders. Later it was extended till September 2022.

- Its nodal Ministry is the Ministry of Finance.

- The benefit of the free ration can be availed through portability by any migrant labour or beneficiary under the One Nation One Ration Card (ONORC) plan from nearly 5 lakh ration shops across the country.

- Cost: The overall expenditure of PMGKAY will be about Rs. 3.91 lakh crore for all the phases.

- Challenges: The beneficiaries of the National Food Security Act are based on the last census (2011). The number of food-insecure people has increased since then and they remain uncovered.

- Issues:

- Expensive: It’s very expensive for the government to sustain and increases the need for an abundant supply of cheap grains. In 2022, India has had to restrict exports of wheat and rice after erratic weather hurt harvest, adding to pressure on food prices, and rattling global agricultural markets.

- Increase Fiscal Deficit: It could pose a risk to the government’s target to further narrow the fiscal deficit to 6.4% of gross domestic product.

- Inflation: The decision on the program could also affect inflation. The prices of rice and wheat, which make up about 10% of India’s retail inflation, are seeing an uptick due to lower production amid a heatwave and patchy monsoon.

What are the Related Initiatives Introduced by the Government?

- National Food Security Mission

- Rashtriya Krishi Vikas Yojana (RKVY)

- Integrated Schemes on Oilseeds, Pulses, Palm oil and Maize (ISOPOM)

- Pradhan Mantri Fasal Bima Yojana

- National Food Security Act (NFSA)

UPSC Civil Services Examination Previous Year Question (PYQ)

Mains

Q. What are the salient features of the National Food Security Act, 2013? How has the Food Security Bill helped in eliminating hunger and malnutrition in India? (2021)

Indian Economy

Skill Development in India

For Prelims: 13th FICCI Global Skills Summit 2022, New Education Policy (NEP), UN Sustainable Development Goal 4, National Skill Development Corporation (NSDC), Pradhan Mantri Kaushal Vikas Yojana, SANKALP programme, STRIVE project.

For Mains: Impacts of Skill Development in India.

Why in News?

Recently, the Union Skill Development and Entrepreneurship Minister inaugurated the 13th Federation of Indian Chambers of Commerce & Industry (FICCI) Global Skills Summit 2022.

- Theme: Education to Employability - Making It Happen.

What is FICCI?

- It's a non-government, not-for-profit organisation,

- Established in 1927, it is the largest and oldest apex business organisation in India.

- It provides a platform for networking and consensus building within and across sectors and is the first port of call for Indian industry, policymakers and the international business community.

What is the Status of Skill Development in India?

- About:

- The 2015 Report on National Policy on Skill Development and Entrepreneurship estimated that only 4.7% of the total workforce in India had undergone formal skill training compared with 52% in the US, 80% in Japan, and 96% in South Korea.

- A skill gap study conducted by the National Skill Development Corporation (NSDC) over 2010-2014 indicated an additional net incremental requirement of 10.97 crores of skilled manpower in 24 key sectors by 2022.

- In addition, the 29.82 crore farm and nonfarm sector workforce needed to be skilled, reskilled, and upskilled.

- Issues:

- Overburdened Responsibility: Phase III of Pradhan Mantri Kaushal Vikas Yojana, launched to impart skills development to over 8 lakh persons in 2020-21.

- However, it suffers from excessive reliance on the District Skills Development Committees, chaired by District Collectors, who would not be able to prioritise this role, given their other assignments.

- Discontinuity in Policy Process: The National Skill Development Agency (NSDA), was created in 2013 for resolving the inter-ministerial and inter-departmental issues and eliminating duplicates of efforts of the Centre.

- However, it has been now subsumed as part of the National Council for Vocational Training (NCVT).

- This reflects not only a discontinuity in the policy process, but also some obfuscation among policymakers.

- Enormous Number of New Entrants: According to a 2019 study by the National Skills Development Corporation (NSDC), 7 crore additional people in the working age of 15-59 years are expected to enter the labor force by 2023.

- Given the sheer magnitude of youth to be skilled, it is paramount that the policy efforts are adequate in all respects.

- Employers’ Unwillingness: India’s joblessness issue is not only a skills problem; it is representative of the lack of appetite of industrialists and SMEs for recruiting.

- Due to limited access to credit because of Banks’ NPAs, the investment rate has declined and thus has a negative impact on job creation.

- Overburdened Responsibility: Phase III of Pradhan Mantri Kaushal Vikas Yojana, launched to impart skills development to over 8 lakh persons in 2020-21.

Why is there a Need for Skill Development of Workforce?

- Supply and Demand Issues: On the supply side, India is failing to create enough job opportunities; and on the demand side, professionals entering the job market are lacking in skill sets. This is resulting in a scenario of rising unemployment rates along with low employability.

- Rising Unemployment: As per the Centre for Monitoring Indian Economy (CMIE), the unemployment rate in India has been around 7% or 8% in 2022, up from about 5% five years ago.

- Further, the workforce shrank as millions of people dejected over weak job prospects pulled out, a situation that was exacerbated by Covid-19 lockdowns.

- The labor force participation rate, meaning people who are working or looking for work, has dropped to just 40% of the 900 million Indians of legal age, from 46% six years ago.

- Lack of Skills in Workforce: While keeping pace with the employment generation is one issue, the employability and productivity of those entering the labour market is another issue.

- As per the India Skills report 2015, only 37.22% of surveyed people were found employable - 34.26% among males and 37.88% among females.

- According to Periodic Labour Force Survey (PLFS) data 2019-20, 86.1% of those between 15 and 59 years had not received any vocational training. The remaining 13.9% had received training through diverse formal and informal channels.

- Demand for Skilled Workforce: The Confederation of Indian Industry (CII) had projected Incremental Human Resource Requirements till 2022 at 201 million, making the total requirement of the skilled workforce by 2023 at 300 million.

- A major share of these jobs was to be added in the manufacturing sector, with the National Manufacturing Policy (2011) targeting 100 million new jobs in manufacturing by 2022.

What are the Various Initiatives taken for Skill Development?

- Pradhan Mantri Kaushal Vikas Yojana: The flagship Pradhan Mantri Kaushal Vikas Yojana (PMKVY) scheme was launched in 2015 to provide short-term training, skilling through ITIs and under the apprenticeship scheme.

- Since 2015, the government has trained over 10 million youth under this scheme.

- SANKALP and STRIVE: The SANKALP programme which focuses on the district-level skilling ecosystem and the STRIVE project which aims to improve the performance of ITIs are other significant skilling interventions.

- Initiatives from Several Ministries: Nearly 40 skill development programmes are implemented by 20 central ministries/departments. The Ministry of Skill Development and Entrepreneurship contributes about 55% of the skilling achieved.

- Initiatives by all ministries have resulted in nearly four crore people being trained through various traditional skills programmes since 2015.

- Mandatory CSR Expenditure in Skilling: Since the implementation of mandatory CSR spending under the Companies Act, 2013, corporations in India have invested over ₹100,000 crores in diverse social projects.

- Of these, about ₹6,877 crores were spent on skilling and livelihood enhancement projects. Maharashtra, Tamil Nadu, Odisha, Karnataka, and Gujarat were the top five recipient States.

- TEJAS Initiative for Skilling: Recently, TEJAS (Training for Emirates Jobs and Skills), a Skill India International Project to train overseas Indias was launched at the Dubai Expo, 2020.

- The project aims at skilling, certification and overseas employment of Indians and creating pathways to enable the Indian workforce to get equipped for skill and market requirements in the UAE.

Way Forward

Skill development is the most essential aspect of the development of our country. India has a huge ‘demographic dividend’ which means that it has a very high scope of providing skilled manpower to the labour market. This needs a coordinated effort from all stakeholders including Government agencies Industries, Educational and training institutes and Students, trainees and job seekers.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. With reference to Pradhan Mantri Kaushal Vikas Yojana, consider the following statements: (2018)

- It is the flagship scheme of the Ministry of Labour and Employment.

- It, among other things, will also impart training in soft skills, entrepreneurship, and financial and digital literacy.

- It aims to align the competencies of the unregulated workforce of the country to the National Skill Qualification Framework.

Which of the statements given above is/are correct?

(a) 1 and 3 only

(b) 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (c)

Exp:

- Pradhan Mantri Kaushal Vikas Yojana (PMKVY) is a flagship scheme for skill training of youth implemented by the Ministry of Skill Development and Entrepreneurship through the National Skill Development Corporation (NSDC). Hence, statement 1 is not correct.

- The individuals with prior learning experience or skills shall be assessed and certified under the Recognition of Prior Learning (RPL) component of the Scheme. RPL aims to align the competencies of the unregulated workforce of the country to the NSQF.

- Skill training would be based on the National Skill Qualification Framework (NSQF) and industry-led standards. Hence, statement 3 is correct.

- Apart from providing training according to the NSQF, training centres shall also impart training in soft skills, entrepreneurship, and financial and digital literacy. Hence, statement 2 is correct. Therefore, option (c) is the correct answer.

Mains

Q. “Demographic Dividend in India will remain only theoretical unless our manpower becomes more educated, aware, skilled and creative.” What measures have been taken by the government to enhance the capacity of our population to be more productive and employable? (2016)

Important Facts For Prelims

Interest Rates on Small Savings Schemes

Why in News?

Recently, the Government of India has hiked interest rates on some of the Small Savings Schemes (2-year and 3-year Time Deposits, Senior Citizens Savings Scheme and Kisan Vikas Patra) for October-December 2022.

What are Small Savings Schemes?

- About:

- Small Savings Schemes are a set of savings instruments managed by the central government with an aim to encourage citizens to save regularly irrespective of their age.

- They are popular as they not only provide returns that are generally higher than bank fixed deposits but also come with a sovereign guarantee and tax benefits.

- All deposits received under various small savings schemes are pooled in the National Small Savings Fund. The money in the fund is used by the central government to finance its fiscal deficit.

- Small Savings Schemes are a set of savings instruments managed by the central government with an aim to encourage citizens to save regularly irrespective of their age.

- Classification:

- Post office deposits:

- Savings deposit, Recurring deposit and Time deposits with 1, 2, 3 and 5 year maturities and the Monthly Income Account.

- Savings Certificates:

- National Savings Certificate:

- The interest that is earned is reinvested into the scheme every year automatically.

- Kisan Vikas Patra:

- Open to everyone, doubles the one-time investment at the end of 124 months signifying a return of 6.9% compounded annually.

- National Savings Certificate:

- Social Security Schemes:

- Public Provident Fund:

- Public Provident Fund (PPF) is a retirement savings scheme offered by the Government of India with the aim of providing a secure post-retirement life to everyone.

- Sukanya Samriddhi Account:

- It was launched in 2015 under the Beti Bachao Beti Padhao campaign exclusively for a girl child.

- The account can be opened in the name of a girl child below the age of 10 years.

- The scheme guarantees a return of 7.6% per annum and is eligible for tax benefit under Section 80C of the Income Tax Act.

- Senior Citizens Savings Scheme:

- Can be opened by anyone who is over 60 years of age.

- Public Provident Fund:

- Post office deposits:

- Determination of Rates:

- Interest rates on small savings schemes are reset on a quarterly basis, in line with the movement in benchmark government bonds of similar maturity. The rates are reviewed periodically by the Ministry of Finance.

- The Shyamala Gopinath panel (2010) constituted on the Small Saving Scheme had suggested a market-linked interest rate system for small savings schemes.

Important Facts For Prelims

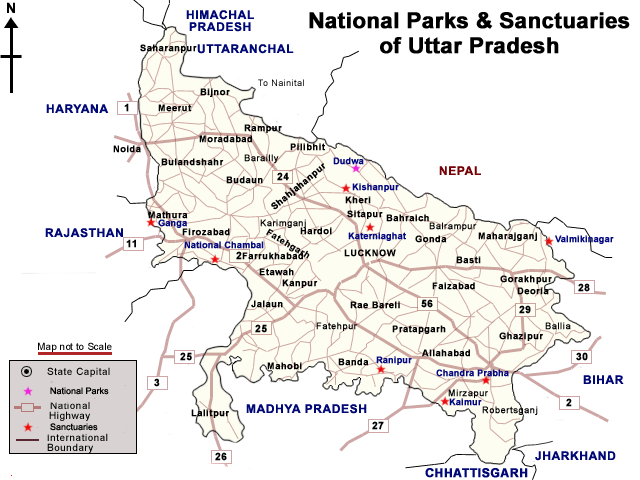

New Tiger Reserve in Uttar Pradesh

Why in News?

Recently, Uttar Pradesh (UP) approved the notification of the state’s fourth tiger reserve in the Ranipur Wildlife Sanctuary (RWS) in Chitrakoot district.

- This will be the 53rd Tiger Reserve in India.

- A Ranipur Tiger Conservation Foundation will also be established for the protection and conservation of tigers in the region.

What are the Key Highlights about Ranipur Wildlife Sanctuary (RWS)?

- About:

- RWS founded in 1977, has no resident tiger. However, it is an important corridor for the movement of tigers, according to the Status of tigers, co-predators and prey in India report by the National Tiger Conservation Authority (NTCA).

- The Ranipur Tiger Reserve will be the fourth in UP.

- It will also be the first in the Bundelkhand region of the state.

- Flora:

- There is dry deciduous forest of Bamboo, Palash, Khair, Mahua, Dhau, Saal, Tendu, etc.

- Fauna:

- Other Tiger Reserves in UP:

- Dudhwa National Park

- Pilibhit Tiger Reserve

- Amangarh Tiger Reserve

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. Which one of the following protected areas is wellknown for the conservation of a sub-species of the Indian swamp deer (Barasingha) that thrives well on hard ground and is exclusively graminivorous? (2020)

(a) Kanha National Park

(b) Manas National Park

(c) Mudumalai Wildlife Sanctuary

(d) Tal Chhapar Wildlife Sanctuary

Ans: (a)

Exp:

- Hard ground swamp deer or Barasingha (Rucervus duvaucelii), the state animal of Madhya Pradesh, is seeing a revival in the Kanha National Park and Tiger Reserve (KNPTR).

- Swamp Deer was close to extinction in the Kanha National Park. However, with the conservation efforts, the population currently numbers around 800.

- The deer is endemic to the Kanha National Park and Tiger Reserve on the Maikal Range of Satpura Hills. Measures like captive breeding and habitat improvement were used.

- Therefore, option A is the correct answer.