PM Poshan Scheme

Why in News

Recently, the Union Cabinet has approved the Prime Minister POSHAN scheme or PM-POSHAN for providing one hot cooked meal in Government and Government-aided schools.

- The scheme will replace the existing national programme for mid-day meal in schools or Mid-day Meal Scheme.

- It has been launched for an initial period of five years (2021-22 to 2025-26).

Mid-day Meal Scheme

- The Mid-day Meal Scheme (under the Ministry of Education) is a centrally sponsored scheme which was launched in 1995.

- It is considered as the world’s largest school meal programme aimed to attain the goal of universalization of primary education.

- Provides cooked meals to every child within the age group of six to fourteen years studying in classes I to VIII who enrolls and attends the school.

- If the Mid-Day Meal is not provided in school on any school day due to non-availability of food grains or any other reason, the State Government shall pay food security allowance by 15th of the succeeding month.

Key Points

- PM POSHAN:

- Coverage:

- The scheme will cover 11.8 crore students enrolled in classes 1 to 8 in over 11.2 lakh schools across the country.

- Primary (1-5) and upper primary (6-8) schoolchildren are currently entitled to 100 grams and 150 grams of food grains per working day each, to ensure a minimum of 700 calories.

- The scheme will be extended to students studying in pre-primary or Balvatikas running in government and government aided primary schools.

- Balvatika is the pre-school that was started in government schools last year to include children aged younger than six years in the formal education system.

- The scheme will cover 11.8 crore students enrolled in classes 1 to 8 in over 11.2 lakh schools across the country.

- Nutritional Gardens:

- The government will promote nutritional gardens in schools. The gardens are being provided to offer additional micro-nutrients to students.

- Supplementary Nutrition:

- The new scheme has a provision for supplementary nutrition for children in aspirational districts and those with high prevalence of anaemia.

- It does away with the restriction on the part of the Centre to provide funds only for wheat, rice, pulses and vegetables.

- Currently, if a state decides to add any component like milk or eggs to the menu, the Centre does not bear the additional cost. Now that restriction has been lifted.

- The new scheme has a provision for supplementary nutrition for children in aspirational districts and those with high prevalence of anaemia.

- Tithi Bhojan Concept:

- The concept of TithiBhojan will be encouraged extensively.

- TithiBhojan is a community participation programme in which people provide special food to children on special occasions/festivals.

- Direct Benefit Transfer (DBT):

- The central government will ensure Direct Benefit Transfer (DBT) from states to schools, which will use it to cover cooking costs.

- Earlier money was allocated to the states, which then included their share of the money before sending it to a nodal midday meal scheme authority at district and tehsil levels.

- This is to ensure no leakages at the level of district administration and other authorities.

- The central government will ensure Direct Benefit Transfer (DBT) from states to schools, which will use it to cover cooking costs.

- Nutrition Expert:

- A nutrition expert is to be appointed in each school whose responsibility is to ensure that health aspects such as Body Mass Index (BMI), weight and haemoglobin levels are addressed.

- Social Audit of the Scheme:

- A social audit of the scheme has also been mandated for each school in each state to study the implementation of the scheme, which was so far not being done by all states.

- The Ministry of Education will also engage college and university students to monitor the scheme at a local level.

- Fund Sharing:

- The Centre will bear Rs. 54,061 crore of the total estimated cost of Rs 1.3 lakh crore, with the states paying Rs 31,733 crore (Rs 45,000 crore will be released by the Centre as subsidies for food grains).

- Vocal for Local for Atmanirbhar Bharat:

- Involvement of Farmers Producer Organizations (FPO) and Women Self Help Groups in implementation of the scheme will be encouraged.

- Use of locally grown traditional food items for a fillip to local economic growth will be encouraged.

- Coverage:

- Challenges:

- Meeting Nutrition Targets:

- As per the Global Nutrition Report 2020, India is among 88 countries that are likely to miss global nutrition targets by 2025.

- Serious ‘Hunger’ Level:

- India has been ranked at 94 among 107 countries in the Global Hunger Index (GHI) 2020. India has a level of hunger that is “serious”.

- Menace of Malnutrition:

- According to the National Family Health Survey-5, several states across the country have reversed course and recorded worsening levels of child malnutrition.

- India is home to about 30% of the world’s stunted children and nearly 50% of severely wasted children under the age of five.

- Others:

- Corrupt practices and Caste Bias and Discrimination in serving food.

- Meeting Nutrition Targets:

- Other Related Government Initiatives:

Contempt of Court

Why in News

Recently, the Supreme Court held that its power to punish for contempt under Article 129 is a constitutional power, which cannot be done away with even by any law.

Key Points

- Highlights of the Judgment:

- The power to punish for contempt is a constitutional power vested in this court which cannot be abridged or taken away even by legislative enactment.

- Article 142 (2) states that “subject to the provisions of any law made in this behalf by Parliament” the Supreme Court shall have all and every power to make any order on punishment of any contempt of itself.

- However, Article 129 lays down that the Supreme Court shall be a court of record, and shall have all the powers of such a court, including the power to punish for contempt.

- The comparison of the two provisions show that whereas the founding fathers felt that the powers under clause (2) of Article 142 could be subject to any law made by the Parliament, there is no such restriction as far as Article 129 is concerned.

- It emphasised that the rationale behind the contempt jurisdiction is to maintain the dignity of the institution of judicial forums.

- About ‘Contempt of Court’:

- Contempt of court is the power of the court to protect its own majesty and respect. The power is regulated but not restricted in the Contempt of Courts Act, 1971.

- The expression ‘contempt of court’ has not been defined by the Constitution.

- However, Article 129 of the Constitution conferred on the Supreme Court the power to punish contempt of itself.

- Article 215 conferred a corresponding power on the High Courts.

- The Contempt of Courts Act, 1971 defines both civil and criminal contempt.

- Civil contempt refers to wilful disobedience to any judgment of the court.

- Criminal contempt can be invoked if an act:

- Tends to scandalise or lower the authority of the court.

- Tends to interfere with the due course of any judicial proceeding.

- Obstruct the administration of justice.

- Contempt of court is the power of the court to protect its own majesty and respect. The power is regulated but not restricted in the Contempt of Courts Act, 1971.

- Related Issues Regarding:

- Open-Ended Terms: Section 5 of the Act provides that “fair criticism” or “fair comment” on the merits of a finally decided case would not amount to contempt.

- However, the determination of what is “fair” is left to the interpretation of judges.

- This open-ended interpretation sometimes compromise freedom of speech and expression under Article 19.

- Violating Principle of Natural Justice: The judges may often be seen to be acting in their own cause, thus violating the principles of natural justice and adversely affecting the public confidence they seek to preserve through the proceeding.

- Open-Ended Terms: Section 5 of the Act provides that “fair criticism” or “fair comment” on the merits of a finally decided case would not amount to contempt.

Way Forward

- Freedom of speech is the most fundamental of the fundamental rights and the restrictions thereupon have to be minimal.

- The law of contempt of court can impose only such restrictions as are needed to sustain the legitimacy of the judicial institutions.

- Therefore, rules and guidelines must be framed defining the process that superior courts must employ while taking criminal contempt action, keeping in mind principles of natural justice and fairness.

Special Category Status

Why in News

Recently, the Bihar Government has asserted that it has not dropped the demand of special category status to Bihar.

Key Points

- About Special Category Status (SCS):

- Special category status is a classification given by the Centre to assist development of states that face geographical and socio-economic disadvantages.

- This classification was done on the recommendations of the Fifth Finance Commission in 1969.

- It was based on the Gadgil formula. The parameters for SCS were:

- Hilly Terrain;

- Low Population Density And/Or Sizeable Share of Tribal Population;

- Strategic Location along Borders With Neighbouring Countries;

- Economic and Infrastructure Backwardness; and

- Nonviable Nature of State finances.

- SCS was first accorded in 1969 to Jammu and Kashmir, Assam and Nagaland. Since then eight more states have been included (Arunachal Pradesh, Himachal Pradesh, Manipur, Meghalaya, Mizoram, Sikkim, Tripura and Uttarakhand).

- There is no provision of SCS in the Constitution.

- Special Category Status for plan assistance was granted in the past by the National Development Council to the States that are characterized by a number of features necessitating special consideration.

- Now, it is done by the central government.

- The 14th Finance Commission has done away with the 'special category status' for states, except for the Northeastern and three hill states.

- Instead, it suggested that the resource gap of each state be filled through ‘tax devolution’, urging the Centre to increase the states' share of tax revenues from 32% to 42%, which has been implemented since 2015.

- Benefits to States with SCS:

- The Centre pays 90% of the funds required in a centrally-sponsored scheme to special category status states as against 60% or 75% in case of other states, while the remaining funds are provided by the state governments.

- Unspent money does not lapse and is carried forward.

- Significant concessions are provided to these states in excise and customs duties, income tax and corporate tax.

Listing of Export Credit Guarantee Corporation (ECGC)

Why in News

Recently, the Union Cabinet has approved capital infusion in the Export Credit Guarantee Corporation (ECGC) and its listing through an initial public offering.

- The government will inject Rs 4,400 crore in the ECGC over a period of five years beginning 2021-22.

- The Cabinet also approved continuation of the National Export Insurance Account (NEIA) scheme and infusion of Rs 1,650 crore Grant-in-Aid over five years.

Key Points

- About the ECGC:

- Establishment: The ECGC Ltd is wholly owned by the Ministry of Commerce and Industry.

- The Government of India had initially set up the Export Risks Insurance Corporation in 1957.

- After the introduction of insurance covers to banks during the period 1962-64, the name was changed to Export Credit & Guarantee Corporation Ltd in 1964.

- It was changed to ECGC Ltd in August 2014.

- Objectives: ECGC was established to promote exports by providing credit insurance services to exporters against non-payment risks by the overseas buyers due to commercial and political reasons.

- Significance of Capital infusion: It will enable it to expand its coverage to export-oriented industries, particularly labour-intensive sectors.

- ECGC is a market leader with around 85% market share in the export credit insurance market in India and provided support to exports worth Rs 6.02 lakh, or 28% of merchandise exports, in FY21.

- Micro, Small and Medium Enterprises (MSMEs) form 97% of the client base of ECGC.

- The process of listing ECGC on the stock market is also being initiated so that it can raise more funds.

- Establishment: The ECGC Ltd is wholly owned by the Ministry of Commerce and Industry.

- National Export Insurance Account (NEIA) Scheme:

- NEIA Trust was established in 2006 to promote project exports from India that are of strategic and national importance.

- It promotes Medium and Long Term (MLT)/project exports by extending (partial/full) support to covers issued by ECGC to MLT/project export.

- Exim Bank, in April 2011, in conjunction with ECGC Ltd., introduced a new initiative, viz. Buyer’s Credit under the NEIA scheme, under which the Bank finances and facilitates project exports from India.

Recent Export Related Initiatives

- Foreign Trade Policy (2015-20): It aims at doubling the overseas sales to $900 billion by 2019-20 and making India global, while integrating the foreign trade with “Make in India” and “Digital India Programme”.

- Remission of Duties and Taxes and Exported Products (RoDTEP): It is a WTO compatible mechanism for reimbursement of taxes/ duties/ levies, which are currently not being refunded under any other mechanism, at the central, state and local level

- ROSCTL scheme: Support to textiles sector was increased by the remission of Central/ State taxes through the ROSCTL scheme, which has now been extended till March 2024.

- Certificate of Origin: Common Digital Platform for Certificate of Origin has been launched to facilitate trade and increase FTA (Free Trade Agreement) utilization by exporters.

- Agriculture Export Policy: A comprehensive policy to provide an impetus to agricultural exports related to agriculture, horticulture, animal husbandry, fisheries and food processing sectors, is under implementation

- NIRVIK Scheme: The ECGC has introduced the Export Credit Insurance Scheme (ECIS) called NIRVIK (Niryat Rin Vikas Yojana) to enhance loan availability and ease the lending process.

- Trade Infrastructure for Export Scheme (TIES), Market Access Initiatives (MAI) Scheme and Transport and Marketing Assistance (TMA) schemes to promote trade infrastructure and marketing.

Extension of CPEC to Afghanistan

Why in News

Recently, Pakistan has discussed Taliban-led Afghanistan joining the multibillion-dollar China-Pakistan Economic Corridor (CPEC) infrastructure project.

- China has proposed construction of the Peshawar-Kabul motorway as an extension of CPEC in Afghanistan.

- Taliban takeover of Afghanistan and China emerging as a major challenge in the form of the extension of its ambitious CPEC, has raised India’s concerns on economic, political and security fronts.

Key Points

- China-Pakistan Economic Corridor:

- The CPEC is a bilateral project between Pakistan and China.

- It is intended to promote connectivity across Pakistan with a network of highways, railways, and pipelines accompanied by energy, industrial, and other infrastructure development projects.

- It aims to link the Western part of China (Xinjiang province) to the Gwadar Port in Balochistan, Pakistan via Khunjerab Pass in the Northern Parts of Pakistan.

- It will pave the way for China to access the Middle East and Africa from Gwadar Port, enabling China to access the Indian Ocean.

- CPEC is a part of the Belt and Road Initiative. The BRI, launched in 2013, aims to link Southeast Asia, Central Asia, the Gulf region, Africa and Europe with a network of land and sea routes.

- India has been severely critical of the CPEC, as it passes through Pakistan-occupied Kashmir, which is a disputed territory between India and Pakistan.

- Implications of Afghanistan Joining CPEC on India:

- Filling the Void: In Afghanistan, China is trying to fill the vacuum created after the US forces left Afghanistan economically and gets its Belt and Road (BRI) initiatives going.

- Undermining Chabahar Port: The foremost concern with Afghanistan joining CPEC is that India is apprehensive of its investment in Chabahar port in Iran.

- India is wary of undermining the India–Iran–Afghanistan trilateral that gives Afghanistan access to sea via Chabahar port.

- Weakening of India’s Economic Influence: Attempts to extend CPEC to Afghanistan may undermine India’s position as economic, security and strategic partner of Afghanistan.

- India has been the biggest regional donor to Afghanistan committing more than US$2 billion for the developmental work that includes construction of roads, power plants, dams, parliament building, rural development, education, infrastructure and much more.

- With Extension of CPEC, China will play a leading role in Afghanistan overpowering India’s economic influence in Afghanistan.

- Terrorism and Strategic Concerns: Given India’s limited strategic depth in Afghanistan, China is in better position to leverage its strategic advantages in Afghanistan.

- Further, Afghanistan’s inclusion in the CPEC will definitely help in the economic development, but it will also help Pakistan gain the strategic advantage and upper hand in Afghanistan at the cost of India.

- In this situation, Pakistan may augment use of terrorism against India.

- Control of Strategic Air Base: Besides its issues with the CPEC, India will be wary of the likelihood that China may try to take over the Bagram air force base in Afghanistan.

- The Bagram airport is the biggest airport and technically well-equipped as the Americans kept it for their use till the end, instead of the Kabul airport.

- Exploitation of Rare Earth Minerals: With the extension of CPEC, China is also looking to exploit Afghanistan's rich minerals and highly lucrative rare-earth mines.

- Rare-earth metals, which are key components for a host of advanced electronic technologies and hi-tech missile guidance systems.

Way Forward

- For the success of CPEC in Afghanistan and to a large extent in Pakistan’s troublesome territories, it becomes imperative for China to stabilise the security situation in the region.

- Improved infrastructure and security situation in Afghanistan may help India to conduct its economic and trade activities in a smoother way.

- However, given the hostility of China, Pakistan and Taliban against India, Afghanistan joining CPEC will certainly be a strategic advantage for China and a loss for India.

Green Energy Push Slowed Down: Report

Why in News

According to a report, the lockdowns slowed renewable energy installations in the country and the pace of such installations is lagging India’s 2022 target.

- The report was released by the Institute for Energy Economics and Financial Analysis (IEEFA). IEEFA is a US non-profit corporation.

- India stands at 4th position in the world in terms of installed Renewable Energy capacity, 5th in solar and 4th in wind.

Key Points

- Highlights of the Report:

- Solar Energy Capacity:

- India has managed to install only 43.94 GW of solar energy capacity till 31st July 2021.

- India was to have installed 100 GW of solar energy capacity by March 2023 - 40 GW rooftop solar and 60 GW ground-mounted utility scale.

- India has managed to install only 43.94 GW of solar energy capacity till 31st July 2021.

- Green Energy Capacity:

- Only 7 GW of green energy capacity was added in FY 2020/21.

- India had set a target of 175 GW renewable power installed capacity by the end of 2022 and 450 GW by 2030.

- Only 7 GW of green energy capacity was added in FY 2020/21.

- Power Traded Amount:

- The amount of the power traded increased by 20% over 2020, by 37% compared to 2019 and by 30% over 2018.

- This led to prices on average increasing by 38% compared to 2020, by 8% compared to 2019 and by 11% over 2018.

- The amount of the power traded increased by 20% over 2020, by 37% compared to 2019 and by 30% over 2018.

- Coal Stocks:

- It hit a new record high of 1,320 lakh tonnes (Mt) and exceeded the monthly averages of the previous five years.

- However, an analysis of the daily coal stock position exhibited a “deterioration” as more plants reported supplies were critical.

- Solar Energy Capacity:

- Suggestions:

- The challenge of India’s growing daily peak demand does not require investment in excess baseload thermal capacity.

- Instead, the electricity system needed “flexible and dynamic generation solutions” such as battery storage, pumped hydro storage, peaking gas-fired capacity and flexible operation of its existing coal fleet.

- Government should accelerate deployment of such sources to help meet peak demand and also balance the grid at a lower cost.

- Their prices were falling and so would be cost effective and a buffer against very high prices at the power exchange during peak demand.

India’s Initiatives for the Renewable Energy

Genes to Increase Grain Size of Sorghum

Why in News

Recently, as per a report from the University of Queensland (UQ), Australia, genes that can increase the grain size of sorghum have been discovered.

Key Points

- About:

- As many as 125 regions in the sorghum genome have now been identified where variation in the DNA sequence was associated with grain size and response to environmental conditions.

- New variants have also been identified that are capable of doubling grain weight.

- Significance:

- Bigger grain size can improve the usage value of the crop. Larger grains make it more digestible for both people and animals and improves processing efficiency.

- Sorghum:

- It is a versatile grain crop used for human consumption, fodder and bioenergy generation.

- The grain is popular across the world because it has a low glycaemic index, is gluten-free and nutritious.

- The lower the glycemic index of a cereal, the lower is the relative rise in blood glucose level after two hours of consuming it.

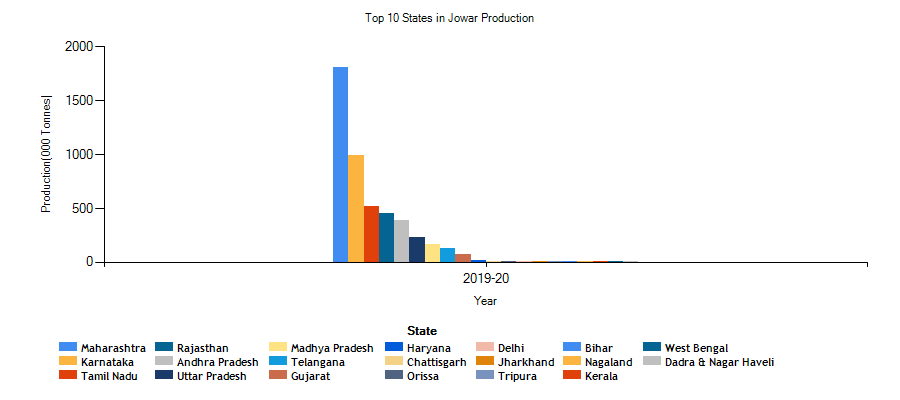

- The variety of the crop found in India is called jowar. It is said to have its origin in the country and is one of its most important food and fodder crops.

- Jowar has a dedicated All-India Coordinated Research Project since 1969.

- Sorghum plants are very hardy and can withstand high temperature and drought conditions.

- It is well adapted to semiarid regions with a minimum annual precipitation of 350-400 mm. It is grown in areas that are too hot and dry for growing maize. In India, the main sorghum belt receives an annual rainfall ranging from 400-1000 mm.

- It can grow on a wide range of soils. Medium to deep black soils are predominantly suitable for growing sorghum.

- States Producing Jowar in India:

Covid-19 Compensation

Why in News

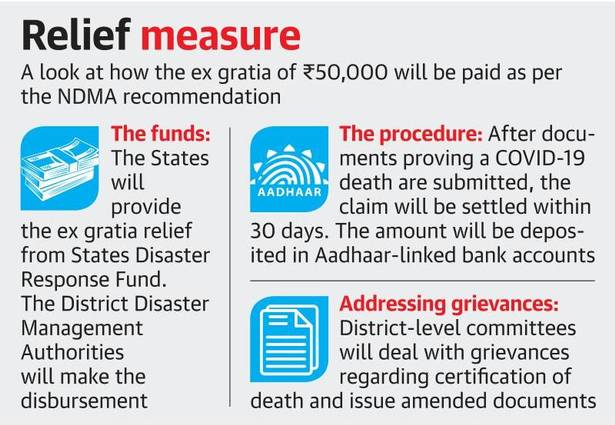

Recently, the Ministry of Home Affairs has issued orders for an ex gratia of Rs. 50,000 to the next of kin of those who died of Covid-19. The amount has been recommended by the National Disaster Management Authority (NDMA).

- The amount will be disbursed from the State Disaster Response Fund (SDRF).

- Last year, Covid-19 was notified as a disaster by the Ministry.

Key Points

- About:

- The ex gratia is applicable to the deceased, including those involved in relief operations or associated in preparedness activities “subject to the cause of death being certified as Covid-19’’.

- The assistance would be applicable from the date of the first case in the country and continue till the de-notification of Covid-19 as a disaster or till further orders, whichever is earlier.

- State Disaster Response Fund (SDRF):

- About:

- SDRF has been constituted under Section 48 (1) (a) of the Disaster Management Act, 2005.

- It was constituted based on the recommendations of the 13th Finance Commission.

- It is the primary fund available with the State governments for responses to notified disasters to meet expenditure for providing immediate relief.

- It is audited by the Comptroller and Auditor General of India (CAG) every year.

- SDRF has been constituted under Section 48 (1) (a) of the Disaster Management Act, 2005.

- Contribution:

- The Centre contributes 75% of the SDRF allocation for general category States and Union Territories and 90% for special category States and Union Territories (northeastern States, Sikkim, Uttarakhand, Himachal Pradesh, Jammu and Kashmir).

- The annual Central contribution is released in two equal installments as per the recommendation of the Finance Commission.

- Disaster (s) Covered under SDRF:

- Cyclone, drought, earthquake, fire, flood, tsunami, hailstorm, landslide, avalanche, cloudburst, pest attack, frost and cold waves.

- Local Disasters:

- A State Government may use up to 10% of the funds available under the SDRF for providing immediate relief to the victims of natural disasters that they consider to be ‘disasters’ within the local context in the State and which are not included in the notified list of disasters of the Ministry of Home Affairs.

- About:

Cyclone Gulab

Why in News

Recently, Cyclone Gulab made landfall on India’s east coast and weakened into a depression.

- Another cyclone–Shaheen–may form over the Arabian Sea from the remnant of cyclone Gulab.

Key Points

- Named By:

- Gulab was a tropical cyclone and was named by Pakistan. It affected the coasts of south Odisha north Andhra Pradesh.

- According to WMO (World Meteorological Organization) guidelines, countries in every region are supposed to give names for cyclones.

- The North Indian Ocean Region covers tropical cyclones formed over Bay of Bengal and Arabian Sea.

- The 13 members, which come under the region, are Bangladesh, India, Maldives, Myanmar, Oman, Pakistan, Sri Lanka, Thailand, Iran, Qatar, Saudi Arabia, the UAE and Yemen.

- Indian Meteorological Department (IMD), one of the six Regional Specialised Meteorological Centres (RSMC) in the world, is mandated to issue advisories and name tropical cyclones in the north Indian Ocean Region.

- It is an agency of the Ministry of Earth Sciences.

- Gulab was a tropical cyclone and was named by Pakistan. It affected the coasts of south Odisha north Andhra Pradesh.

- Occurrence:

- India has a bi-annual cyclone season that occurs between March to May and October to December. But on rare occasions, cyclones do occur in June and September months.

- Cyclone Gulab became the third cyclone of the 21st century to make landfall over the east coast in September, after tropical cyclone Daye in 2018 and Pyarr in 2005.

- Typically, tropical cyclones in the North Indian Ocean region (Bay of Bengal and Arabian Sea) develop during the pre-monsoon (April to June) and post-monsoon (October to December) periods.

- May-June and October-November are known to produce cyclones of severe intensity that affect the Indian coasts.

- India has a bi-annual cyclone season that occurs between March to May and October to December. But on rare occasions, cyclones do occur in June and September months.

- Classification:

- The IMD classifies cyclones on the basis of the Maximum Sustained Surface Wind Speed (MSW) they generate.

- The cyclones are classified as severe (MSW of 48-63 knots), very severe (MSW of 64-89 knots), extremely severe (MSW of 90-119 knots) and super cyclonic storm (MSW of 120 knots or more). One knot is equal to 1.8 kmph (kilometers per hour).

- Cyclone Gulab Falls into the severe category with maximum speed of 95 km/hr.

- Cyclones that Hit India in 2020-21: Tauktae, Yaas, Nisarga, Amphan.