Heatwaves as a Notified Disaster

For Prelims: Heatwaves, Indian Meteorological Department (IMD), Global Warming, Urban heat island effect, National Disaster Management Authority, Greenhouse gases, Aerosols, Sendai Framework for Disaster Risk Reduction, National Action Plan for Climate Change, Nature-based solutions, Passive cooling technology

For Mains: Criteria for Heatwaves, Strategies to Mitigate the Impacts of Heat Waves in India

Why in News?

India's recent heatwave crisis has resurfaced the debate about adding heat waves to the list of notified disasters covered by the Disaster Management (DM) Act of 2005 instead of only a natural disaster.

What are Heat Waves?

- About:

- A Heat Wave is a period of abnormally high temperatures that occurs during the summer season in India.

- Heat Waves typically occur between March and June, and in rare cases extend till July.

- IMD Criteria for Defining Heatwaves:

|

Criteria |

Details |

| Based on |

|

|

Physiography of the Region |

|

|

Based on Departure from Normal Maximum Temperature |

|

|

Based on Actual Maximum Temperature |

|

|

Declaration Criteria |

|

What are the Causes of Heatwaves?

- Prevalence of Hot and Dry Air: A large region of hot and dry air acts as a reservoir of heat. Prevailing winds then transport this hot air to other areas, further elevating temperatures.

- Absence of Moisture: Moisture in the air retains heat and prevents it from escaping while dry air allows solar radiation to reach the ground more readily and radiate back out at night with minimal trapping, resulting in a quicker increase in daytime temperatures.

- Cloudless Skies: Clouds act as a shield, reflecting sunlight back into space and preventing it from heating the Earth's surface. A clear, cloudless sky allows for maximum solar radiation to reach the ground, intensifying heating.

- Large Amplitude Anticyclonic Flow: Anti-cyclones are large-scale atmospheric circulation patterns characterized by sinking air.

- This sinking air compresses and warms adiabatically (heats up without gaining heat), contributing to rising temperatures at the surface.

- Geographical Considerations: Heat waves are more frequent in regions with arid or semi-arid climates, such as Northwest India. Prevailing westerly winds during summer months can spread heat waves eastward and southward.

- Climate Change: Global warming is increasing the frequency and intensity of heat waves. Rising baseline temperatures create a more conducive environment for these events to occur.

What are the Impacts of Heatwaves?

- On Health: Heat waves can lead to dehydration, heat cramps, heat exhaustion, and heat stroke.

- Symptoms include swelling, fainting, fever, fatigue, weakness, dizziness, and excessive sweating. Heat stroke can cause high body temperatures, delirium, seizures, or coma and can be fatal.

- As per the data from the National Crime Records Bureau (NCRB), 730 deaths occurred due to heat-related causes in 2023.

- On Water Resources: These can exacerbate water scarcity issues in India by quickly drying up water bodies, reducing water availability for agriculture and domestic use, and increasing competition for water resources.

- Example: Most of the major reservoirs in the southern States are filled to only 25% of their capacity or less.

- On Energy: Heatwaves can increase electricity demand for cooling purposes, leading to strain on power grids and potential blackouts.

- This can disrupt economic activities, affect productivity, and impact vulnerable populations who may not have access to reliable electricity for cooling during heat waves.

- Crops and Livestock: Heat stress is a major problem for agriculture, negatively affecting both crops and livestock.

- In crops, high temperatures hinder their ability to use sunlight for energy, reducing growth and overall yield.

- For livestock, heat stress disrupts various physiological functions and behaviours, with the severity depending on the animal's breed and environment.

- Wild/Forest Fires: The Forest Survey of India has estimated that 21.4% area under forest is vulnerable to forest fires.

NDMA Guidelines for Heatwaves:

- Avoid going out in the sun, especially between 12.00 noon and 3.00 p.m.

- Drink sufficient water as often as possible.

- Wear lightweight, light-coloured, loose, and porous cotton clothes. Use protective goggles, an umbrella/hat, shoes or chappals while going out in sun.

- Avoid alcohol, tea, coffee and carbonated soft drinks, which dehydrate the body.

- Avoid high-protein food and do not eat stale food.

- Use ORS, homemade drinks like lassi, torani (rice water), lemon water, buttermilk, etc. which helps to rehydrate the body.

- Keep animals in the shade and give them plenty of water to drink.

- Keep your home cool, use curtains, shutters or sunshade and open windows at night.

- Use fans, damp clothing and take bath in cold water frequently.

What are Needs and Challenges Related to Heat Waves as a Notified Disaster?

- Notified Disasters:

- Disaster refers to a catastrophic event arising from natural or human-made causes. This event results in significant loss of life, property damage, environmental degradation, or a combination of these.

- A notified disaster is one that has been officially recognized by the government, typically defined in a legal framework like the Disaster Management Act, of 2005.

- Currently, 13 categories of disasters are notified under this Act. These include cyclones, drought, earthquakes, fire, flood, tsunami, hailstorm, landslide, avalanche, cloudburst, pest attack, frost and cold waves. and Covid 19.

- Financial Assistance: Being designated a notified disaster makes the affected region eligible for financial aid from the 2 funds set up under the DM Act, the National Disaster Response Fund (NDRF) at the national level and the State Disaster Response Fund (SDRF) at the state.

- Challenge in Adding Heat Waves in DM Act:

- Finance Commission Reluctance: The Finance Commissions have not been entirely convinced about including heatwaves as a notified disaster.

- The 15th Finance Commission allows states to utilise up to 10% of SDRF funds for "local disasters" such as lightning or heatwaves, which states can notify on their own.

- Huge Financial Implications: The government has to provide monetary compensation (Rs 4 lakh) for every life lost due to a notified disaster. This could be a huge burden given the large number of heat-related deaths.

- Estimating Deaths: In most cases, heat itself does not claim lives directly. Most people die due to other pre-existing conditions made worse by extreme heat, making it difficult to ascertain the exact cause.

- Potential Exhaustion of Disaster Funds: The financial allocations to SDRF and NDRF, though substantial, may become insufficient if heatwaves and other local disasters like lightning are added to the notified list.

- Finance Commission Reluctance: The Finance Commissions have not been entirely convinced about including heatwaves as a notified disaster.

- Need for Notifying Heatwaves as Natural Disaster:

- Improved Resource Allocation: Notifying heatwave would unlock dedicated funding and resources for mitigation strategies, early warning systems, and improved healthcare preparedness.

- Effective Action Plans: It would encourage states to develop comprehensive Heat Action Plans, outlining clear protocols for public awareness, cooling centres, and support for vulnerable populations.

- Notifying heat waves can lead to reporting more death cases due to financial incentives (Rs 4 Lakh).

- Increasing Intensity and Frequency: Heatwaves are becoming more common and severe. The IMD reports a rise in "heatwave days" across the country. There are 23 states, which are vulnerable to heatwaves.

What is a Heat Action Plan?

- A Heat Action Plan (HAP) is a comprehensive strategy developed by governments or organisations to mitigate the health risks associated with extreme heat events.

- It includes measures to protect vulnerable populations, provide information and resources, and coordinate responses during heatwaves.

- They outline short-term measures, including alerts and inter-departmental coordination, to reduce human casualties. HAPs entail long-term strategies like infrastructure upgrades such as cool roofs and enhanced greenery to prepare for future heat waves based on data analysis.

- Odisha first developed a Heat Action Plan in 1999 following more than 2,000 Heat Wave deaths in 1998. Following this, the first city-level Action Plan was developed by Ahmedabad in 2013 following the severe Heat Wave in 2010.

- The NDMA and IMD are working with 23 States to develop HAPs. There is no centralised database on HAPs, but at least 23 HAPs exist at the State and city level, with a few States, such as Odisha and Maharashtra, laying out district-level HAPs.

|

Drishti Mains Question: Discuss the factors contributing to the increased frequency and intensity of heatwaves and measures that can be taken at the national and local levels to mitigate their impact. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. What are the possible limitations of India in mitigating global warming at present and in the immediate future? (2010)

- Appropriate alternate technologies are not sufficiently available.

- India cannot invest huge funds in research and development.

- Many developed countries have already set up their polluting industries in India.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (a)

Mains

Q: Bring out the causes for the formation of heat islands in the urban habitat of the world.

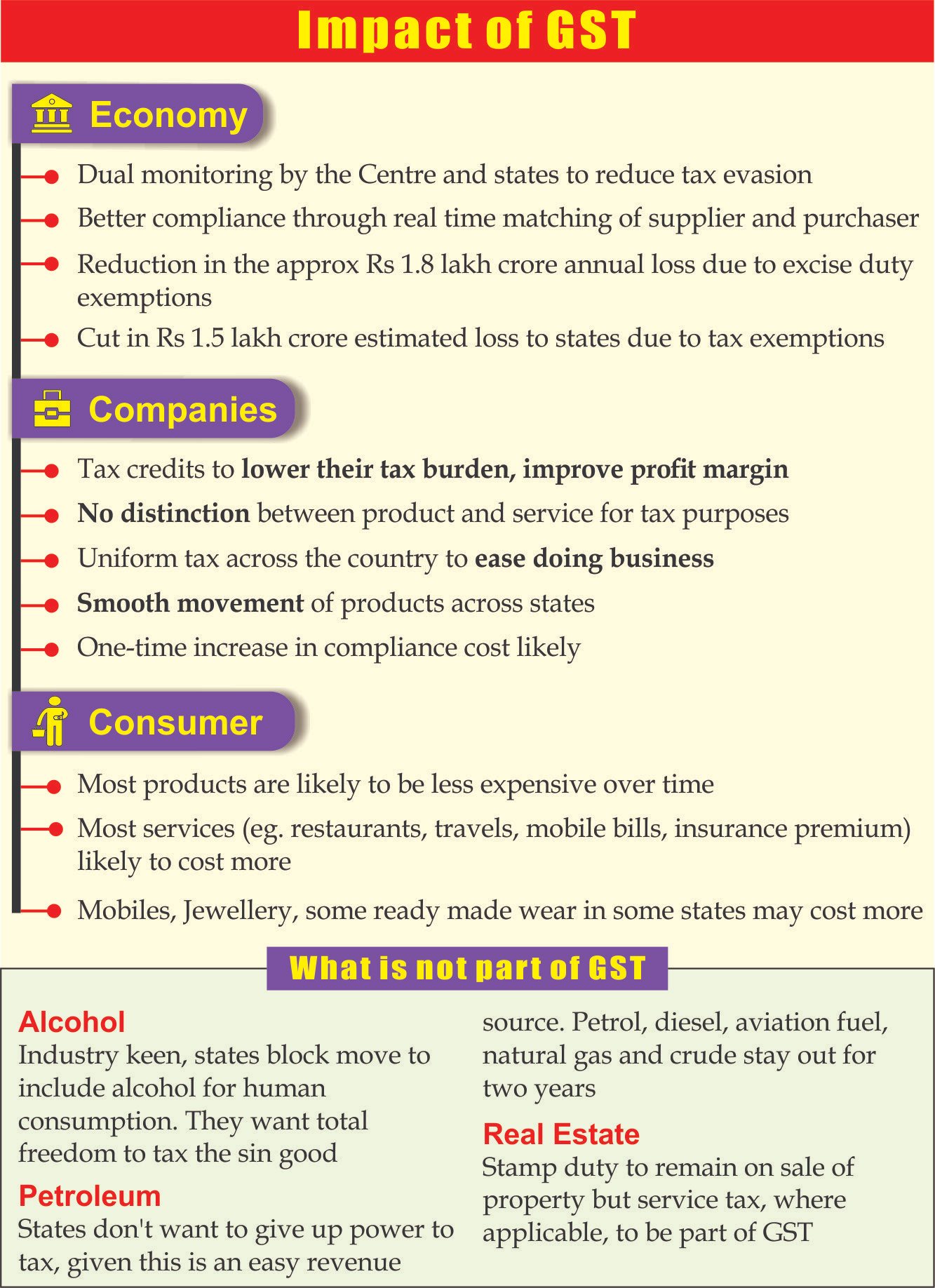

53rd GST Council Meeting

For Prelims: Goods and Services Tax (GST) Council, GST Appellate Tribunals, Prevention of Money Laundering Act, Enforcement Directorate, Aadhar.

For Mains: Outcomes of 51st GST Council Meeting, Issues related with GST Council, Functions of GST Council.

Why in News?

Recently, the 53rd meeting of the Goods and Services Tax (GST) Council has approved several measures to ease compliance for small businesses, exempting hostel accommodation, Railway services etc.

- It also agreed to reconvene in August 2024 to discuss restructuring the multiple tax rates under the seven-year GST.

What are the Key Highlights of the 53rd GST Council Meeting?

- Aadhaar-based Biometric Authentication: The council announced the rollout of biometric-based Aadhaar authentication on a national level to combat fraudulent input tax credit claims made through fake invoices. This is aimed at enhancing tax compliance.

- Exemption for Hostel Accommodation: Hostel accommodation services outside educational institutions are exempt from GST for rents up to Rs 20,000 per person per month, making it more affordable for students and the working class.

- This exemption applies only for stays up to 90 days, whereas previously such rents incurred 12% GST.

- Indian Railways Services: GST exemption on platform tickets, aiming to ease the financial burden on passengers. This decision is part of broader efforts to make railway services more affordable.

- Reduction in GST Rate on Cartons: The GST rate on various types of carton boxes was reduced from 18% to 12%. This change is intended to benefit both manufacturers and consumers by lowering the overall cost of these essential packaging materials.

- GST Reduction on Milk Cans and Solar Cookers: A uniform GST rate of 12% was announced for all milk cans, regardless of whether they are made of steel, iron, or aluminium.

- Waiver of Interest and Penalties for Non-Fraudulent Cases:

- The council has recommended waiving interest and penalties for demand notices issued under Section 73 of the GST Act, which applies to cases that do not involve fraud, suppression, or misstatements.

- New Monetary Limits for Filing Appeals: The GST Council has recommended new monetary thresholds for filing appeals by the department in various courts which are Rs 20 lakh for the GST Appellate Tribunal, Rs 1 crore for High Court, and Rs 2 crore for the Supreme Court for filing appeals by the department.

- The aim is to reduce government litigation.

- Central Support and Conditional Loans to States: The government introduced the 'Scheme for Special Assistance to States for Capital Investment', where some loans are conditional on states implementing citizen-centric reforms and capital projects, urging states to meet the criteria to access these loans.

- Petrol and Diesel under GST: The central government expressed its intent to bring petrol and diesel under the GST regime, pending consensus among states on the applicable tax rate.

- This is viewed as a step towards uniform taxation of fuel across the country.

Note

- Goods and Services Tax (GST) is a value-added (Ad valorem) tax system that is levied on the supply of goods and services in India.

- It is a comprehensive indirect tax that was introduced in India on 1st July 2017, through the 101st Constitution Amendment Act, 2016, with the slogan of ‘One Nation One Tax’.

What is the GST Council?

- About:

- The GST Council is a constitutional body responsible for making recommendations on issues related to the implementation of the Goods and Services Tax (GST) in India.

- It was set up to simplify the existing tax structure in India, where both the Centre and states levied multiple taxes making it more uniform across the country.

- Constitutional Provisions:

- The 101st Amendment Act, of 2016 paved the way for the introduction of GST.

- The Amendment Act inserted a new Article 279-A in the Constitution, which empowers the President to constitute a GST Council or by an order.

- Accordingly, the President issued the order in 2016 and constituted the Goods and Services Tax Council.

- Members:

- The members of the Council include the Union Finance Minister (Chairperson), the Union Minister of State (Finance) from the Centre.

- Each state can nominate a minister in-charge of finance or taxation or any other minister as a member.

- Functions:

- Article 279A (4) empowers the Council for making recommendations to the Union and the states on important GST-related issues such as the goods and services that may be subject to or exempted from GST, model GST laws, and GST rates.

- It decides on various rate slabs of GST and whether they need to be modified for certain product categories.

- The Council also considers special rates for raising additional resources during natural calamities/disasters and special provisions for certain States.

- Working:

- The GST Council reaches decisions in its meetings by a majority of at least three-fourths of the weighted votes of the members present and voting.

- A quorum of 50% of the total members is required to conduct a meeting.

- The Central Government's vote carries a weightage of one-third of the total votes cast in a meeting.

- The votes of all state governments combined have a weightage of two-thirds of the total votes cast.

- The recommendations of the GST Council were earlier considered binding, but in 2022 the Supreme Court in Union of India v. Mohit Minerals Pvt. Ltd Case ruled that they are not binding, as both Parliament and State legislatures have "simultaneous" power to legislate on GST.

|

Drishti Mains Question: Discuss the objectives and the key features of the GST framework. Analyse the advantages and challenges of the GST system and suggest measures to address the challenges for its successful implementation. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q1. Consider the following items: (2018)

- Cereal grains hulled

- Chicken eggs cooked

- Fish processed and canned

- Newspapers containing advertising material

Which of the above items is/are exempted under GST (Good and Services Tax)?

(a) 1 only

(b) 2 and 3 only

(c) 1, 2 and 4 only

(d) 1, 2, 3 and 4

Ans: (c)

Q2. What is/are the most likely advantages of implementing ‘Goods and Services Tax (GST)’? (2017)

- It will replace multiple taxes collected by multiple authorities and will thus create a single market in India.

- It will drastically reduce the ‘Current Account Deficit’ of India and will enable it to increase its foreign exchange reserves.

- It will enormously increase the growth and size of economy of India and will enable it to overtake China in the near future.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (a)

Mains

Q. Explain the rationale behind the Goods and Services Tax (Compensation to States) Act of 2017. How has COVID-19 impacted the GST compensation fund and created new federal tensions? (2020)

Q. Enumerate the indirect taxes which have been subsumed in the Goods and Services Tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017. (2019)

Q. Explain the salient features of the Constitution (One Hundred and First Amendment) Act, 2016. Do you think it is efficacious enough “to remove cascading effect of taxes and provide for the common national market for goods and services”? (2017)

Q. Discuss the rationale for introducing the Goods and Services Tax (GST) in India. Bring out critically the reasons for the delay in rollout for its regime. (2013)

Managed Care Organisations

For Prelims: Ayushman Bharat Mission, National Health Policy 2017, Managed Care Organization (MCO), International Labour Organization (ILO)

For Mains: Challenges to MCOs in India, Steps to develop MCOs in India, Universal Health Coverage (UHC)

Why in News?

Recently, a prominent healthcare chain in South India announced its venture into comprehensive health insurance, integrating insurance and healthcare provision functions under one roof, mirroring a managed care organisation (MCO).

- In a related development, an International Labour Organization (ILO) paper has also revealed that achieving universal social protection for low- and middle-income countries would necessitate an additional USD 1.4 trillion per year.

Note:

- MCOs in US: MCOs in the U.S. have predominantly served urban, high-income populations.

- Successful MCOs require significant financial clout, managerial expertise, and a well-defined beneficiary base.

What is the Background of Managed Care Organizations(MCOs)?

- About:

- An MCO is a healthcare provider whose goal is to provide appropriate, cost-effective medical treatment.

- MCOs in the US evolved from early 20th-century prepaid healthcare practices.

- Mainstreaming in the 1970s: The combination of insurance and service functions arose to manage costs, focusing on prevention, early management, and cost control with fixed premiums.

- Evolution: MCOs have diversified and penetrated deeply into the health insurance space, although robust evidence of their impact on health outcomes and preventive care is limited. They have, however, helped reduce costly hospitalisations and associated expenses.

- Development in India: Since the 1980s, India's health insurance has focused on indemnity insurance and covering hospitalisation costs, despite a large market for outpatient consultations.

Bridging the Financing Gap for Universal Health Coverage

- Global and Regional Financing Needs:

- Financing Gap: Achieving universal social protection in low- and middle-income countries requires an additional USD 1.4 trillion annually, with essential health care comprising 60.1% of this need.

- Regional Disparities: Africa faces the largest financing gap, followed by the Arab States, Latin America, and Asia.

- Strategies to Expand Fiscal Space:

- Domestic Resource Mobilisation: Progressive taxation, social security contributions, and formalising employment and enterprises are crucial.

- Fuel Subsidies: Removing explicit and implicit fuel subsidies could generate significant fiscal space.

- Debt Management: Renegotiating government debt at lower interest rates could free resources for social protection.

- Official Development Assistance (ODA): Increasing ODA is vital, especially for low-income countries where the financing gap is substantial.

What are the Challenges to MCO in India?

- Limited Reach: MCOs in India primarily target the affluent, urban population as health insurance market is skewed towards urban areas. This neglects the vast rural demographics and hinders efforts towards Universal Health Coverage (UHC).

- Informal Outpatient Care: A significant portion of healthcare in India occurs in informal outpatient settings. This lack of standardisation and regulation makes it difficult for MCOs to integrate and manage care effectively.

- Absent Standard Protocols: The widespread absence of widely accepted clinical protocols across healthcare providers creates inconsistency and reduces the quality control MCOs rely on.

- Economic Unsustainability: High operational costs and resulting unaffordable premiums for MCO plans create a financial hurdle. This discourages participation and hinders long-term viability.

- Lack of Incentives for Cost Control: The current health insurance model in India hasn't fostered a culture of consumer-driven cost control, a core principle of MCOs.

What are the Steps Needed to Develop MCOs in India?

- Focus on Rural Outreach: Partner with government initiatives like Ayushman Bharat to expand coverage and leverage existing rural healthcare infrastructure. This aligns with the National Health Policy 2017's push for UHC.

- Standardisation and Regulation: Advocate for the development and implementation of standardised clinical protocols across outpatient settings. Collaborate with the National Health Authority (NHA) for accreditation and quality control mechanisms.

- Technology and Innovation: Utilise technology to streamline processes, reduce administrative costs, and offer telemedicine services to bridge the rural-urban gap. This aligns with recommendations from the Committee on Affordable Healthcare for All.

- Value-Based Pricing: Implement value-based pricing models that reward quality care and efficient service delivery. This incentivises cost control and aligns with suggestions from NITI Aayog.

- Public-Private Partnerships: Foster public-private partnerships (PPPs) to leverage government resources and private sector expertise for broader reach and improved infrastructure.

- Data-Driven Decision-Making: Encourage data collection and analysis to track healthcare trends, identify cost-effective treatment options, and improve service delivery across MCO networks. This aligns with the vision of the National Digital Health Mission (NDHM).

Role of Public Policy in MCO Implementation

- NITI Aayog Report:

- In 2021, NITI Aayog recommended an outpatient care insurance scheme based on a subscription model to generate savings through better care integration.

- Managed care systems could streamline management protocols, consolidate dispersed practices, and emphasise preventive care, providing a sustainable solution to outpatient care coverage.

- Ayushman Bharat Mission:

- The mission announced incentives for opening hospitals in underserved areas, prioritizing PMJAY beneficiaries.

- Similar incentives could be designed for MCOs to serve PMJAY patients and private clients, expanding awareness and demand for MCOs over time.

Conclusion

Universal health coverage is a complex challenge that requires multifaceted solutions. Managed Care Organizations (MCOs) can significantly contribute to India's healthcare landscape. By fostering public support and gradually implementing MCOs, along with adopting comprehensive financial strategies, India can make substantial progress toward achieving universal health care.

|

Drishti Mains Question: Q. Discuss how Managed Care Organizations (MCOs) can play a pivotal role in strengthening the health system in India. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. Consider the following: (2011)

1. Right to education

2. Right to equal access to public service

3. Right to food.

Which of the above is/are Human Right/Human Rights under the “Universal Declaration of Human Rights”?

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (d)

Q. ‘SWAYAM’ an initiative of the Government of India, aims at (2016)

(a) promoting the Self Help Groups in rural areas

(b) providing financial and technical assistance to young start-up entrepreneurs

(c) promoting the education and health of adolescent girls

(d) providing affordable and quality education to the citizens for free

Ans: (d)

Mains:

Q. Appropriate local community-level healthcare intervention is a prerequisite to achieve ‘Health for All’ in India. Explain. (2018)

Post Office Act 2023

For Prelims: Post Office Act, 1898, Public Order, Emergency, Public Safety, Land Revenue, Freedom of Speech and Expression, Right to Privacy

For Mains: Significance of the Post Office Act, 2023 and its shortcomings.

Why in News?

Recently, the Post Office Act of 2023 came into force repealing the Indian Post Office Act, 1898.

What are the Key Highlights of the Post Office Act 2023?

- Interception and Detention of Items:

- Section 9: This provision allows the centre to authorise any officer to intercept or detain any postal item for reasons related to state security, foreign relations, etc.

- Items suspected of containing prohibited goods or items liable for customs duty can be handed over to customs authorities.

- Exemption from Liability:

- Section 10: The Post Office and its officers are exempt from liability for loss, misdelivery, delay, or damage during the course of providing services, except as prescribed.

- Removal of Penalties and Offences: The new Act eliminates all penalties and offences outlined in the 1898 Act, including those related to misconduct, fraud, and theft by postal officials.

- It includes provisions to recover unpaid service charges as arrears of land revenue.

- Penalty under Section 7: Every person who avails of a service provided by the Post Office shall be liable to pay the charges in respect of such service.

- Removal of Centre’s Exclusivity: The new Act removes the exclusive privilege of the Centre to convey letters, a privilege which was effectively obsolete by the rise of private courier services in the 1980s.

- The Act now explicitly brings private courier services under its regulatory ambit, recognizing the government's loss of exclusivity while expanding the scope to intercept and detain any postal article, not just letters.

- Director General of Postal Services: The new Act authorises the Director General of Postal Services to make regulations pertaining to activities essential for offering various additional services as may be prescribed by the central government, as well as for fixing charges for these services.

- It eliminates the need for parliamentary approval while revising the set charges for any services provided by post offices.

- Identifiers and Post Codes: Section 5(1) of the Act states that “The Central Government may prescribe standards for addressing on the items, address identifiers and usage of postcodes”.

- This provision is a forward-looking concept and will replace physical addresses with digital codes based on geographical coordinates for precise identification of a premise.

Indian Post Office Act, 1898

- It came into force on 1st July 1898 with the objective to consolidate and amend the law relating to the Post Offices in India.

- It provides for the regulation of the postal services offered by the central government.

- It grants the Central government exclusive privilege over conveying letters and establishes a monopoly of the Central government over conveying letters.

What are the Issues in the Post Office Act 2023?

- Regulation of Postal Services Different from Courier Services: The Consumer Protection Act, 2019 does not apply to services by India Post, but it applies to private courier services. The Post Office Act, 2023, seeking to replace the 1898 Act, retains these provisions.

- Lack of Procedural Safeguards Violates Fundamental Rights: The Bill does not specify any procedural safeguards against the interception of postal articles. This may violate the right to privacy, and the freedom of speech and expression.

- In the case of interception of telecommunications, the Supreme Court in People’s Union for Civil Liberties (PUCL) vs Union of India, 1996 held that a just and fair procedure to regulate the power of interception must exist.

- Otherwise, it is not possible to safeguard the rights of citizens under Article 19(1)(a) and Article 21.

- The Ground of ‘Emergency’ is Beyond the Reasonable Restrictions: Like 1898 Act, an emergency is not explicitly defined in the present act.

- Exemption from Liability for Lapses in Services: The Act's framework differs from railway laws, which address service complaints like loss, damage, non-delivery of goods, and fare refunds through the Railway Claims Tribunal Act of 1987.

- Removal of all Offences and Penalties: Under the 1898 Act, postal officers and others could be jailed or fined for illegally opening mail, but the 2023 Act removes these penalties, potentially harming privacy rights.

Way Forward

- Incorporate Robust Procedural Safeguards: For the interception of articles transmitted through India Post.

- This should include oversight mechanisms, judicial warrants, and adherence to constitutional principles to protect the freedom of speech, expression, and the right to privacy of individuals.

- Define the Grounds for Interception: Refine and clearly define the grounds for interception, especially the term 'emergency,' to ensure it aligns with reasonable restrictions under the Constitution.

- The Supreme Court in Distt. Registrar & Collector, Hyderabad & Anr vs Canara Bank, 2005 ruled that the right to privacy remains intact when confidential documents are given to a bank or personal items to a post office, and that privacy requires written reasons for any search and seizure.

- Balanced Liability Framework: Ensure the Post Office's accountability by setting clear rules for liability without jeopardising its independence and efficiency.

- The competent authority needs to be held accountable for any wilful misuse of interception powers, without the ‘good faith’ clause coming to their rescue.

- Addressing Unauthorised Opening: Create laws to penalise postal officers for unauthorised opening of mail and to hold individuals accountable for misconduct, fraud, and theft to protect consumer privacy.

|

Drishti Mains Question: Q. Discuss the challenges to privacy in the context of the implementation of the Post Office Act, 2023. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. Under which of the following Articles of the Constitution of India, has the Supreme Court of India placed the Right to Privacy? (2024)

(a) Article 15

(b) Article 16

(c) Article 19

(d) Article 21

Ans: (d)

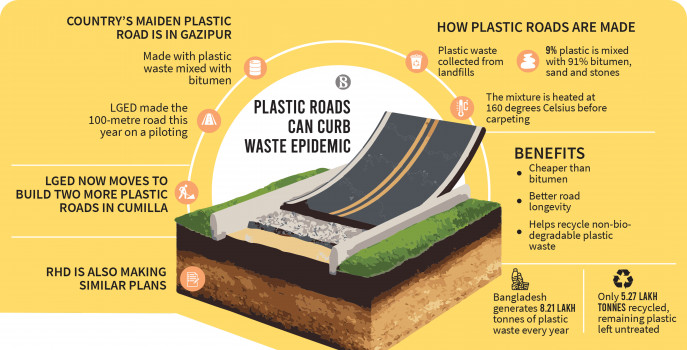

Bio-Bitumen

Why in News?

Recently, India has embarked on plans to initiate large-scale production of bio-bitumen from biomass or agricultural waste.

What is Bio-Bitumen?

- About:

- Bio-bitumen is a bio-based binder derived from renewable sources like vegetable oils, crop stubble, algae, lignin (a component of wood), or even animal manure.

- Origin and Production: Bitumen is primarily derived from the distillation of crude oil. During refining, the heavier bitumen remains after lighter components like gasoline and diesel are removed. It can also naturally occur in deposits, such as in oil sands.

- Properties and Uses of Bitumen:

- It is known for its waterproofing and adhesive properties and is extensively used in road construction (asphalt paving) and waterproofing applications in buildings and marine structures.

- Bio-bitumen can be Used in Various Ways:

- Direct Replacement: Completely replacing petroleum bitumen with bio-binder in asphalt.

- Modifier: Adding bio-materials to traditional bitumen to improve its properties.

- Rejuvenator: Restoring the elasticity and functionality of aged asphalt pavements.

- Current Bitumen Scenario in India:

- Import Dependency: India currently imports approximately half of its annual bitumen requirement, amounting to 3.21 million tonnes in the fiscal year 2023-24.

- Domestic Production: Indigenous bitumen production stood at 5.24 million tonnes during the same period.

- Increasing Consumption: Bitumen consumption has risen steadily, averaging 7.7 million tonnes annually over the past five years.

- Construction of national highways (NH) touched around 12,300 km in 2023-24 which is almost 34 km per day.

- Objectives of Bio-Bitumen Production Initiative:

- Reducing Import Dependency: The primary objective is to replace imported bitumen with domestically produced bio-bitumen over the next decade, thereby reducing foreign exchange expenditure.

- Addressing Environmental Concerns: Bio-bitumen production aims to mitigate environmental issues associated with stubble burning by utilising biomass and agricultural waste as feedstocks.

- Promoting Sustainable Practices: By leveraging bio-based materials, the initiative supports sustainable road construction practices and aligns with global environmental standards.

- Technological Development and Pilot Study: The Central Road Research Institute (CRRI) is collaborating with the Indian Institute of Petroleum to conduct a pilot study on a 1-km road stretch using bio-bitumen.

- Challenges:

- Cost-Effectiveness: Currently, bio-bitumen production can be more expensive than traditional methods.

- Long-Term Performance: More extensive field trials are needed to assess the long-term performance and durability of bio-asphalt compared to traditional pavements.

- Standardisation: Establishing clear standards and specifications for bio-bitumen is necessary for its wider adoption in the construction industry.

Other Innovation Methods in Road Construction

- Steel slag road technology is a novel method of using steel slag, the waste generated during steel production, to build more robust and more durable roads.

- For example, Steel Slag Road technology was first used in Surat.

- In Hamburg, Germany, companies developed 100% recycled asphalt pavement (RAP) to meet reduce costs, save energy, and lower carbon emissions.

- India has built more than 2,500 km of plastic roads and globally too, plastic roads are proliferating in more than 15 countries.

- For example, it is mandatory to make use of at least 10% of plastic waste for road construction in Ladakh.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. In rural road construction, the use of which of the following is preferred for ensuring environmental sustainability or to reduce carbon footprint? (2020)

1. Copper slag

2. Cold mix asphalt technology

3. Geotextiles

4. Hot mix asphalt technology

5. Portland cement

Select the correct answer using the code given below:

(a) 1, 2 and 3 only

(b) 2, 3 and 4 only

(c) 4 and 5 only

(d) 1 and 5 only

Ans: (a)

Q. In the Union Budget 2011-12, a full exemption from the basic customs duty was extended to bio-based asphalt (bioasphalt). What is the importance of this material? (2011)

1. Unlike traditional asphalt, bio-asphalt is not based on fossil fuels.

2. Bioasphalt can be made from non-renewable resources.

3. Bioasphalt can be made from organic waste materials.

4. It is eco-friendly to use bioasphalt for surfacing of the roads.

Which of the statements given above are correct?

(a) 1, 2 and 3 only

(b) 1, 3 and 4 only

(c) 2 and 4 only

(d) 1, 2, 3 and 4

Ans: (b)

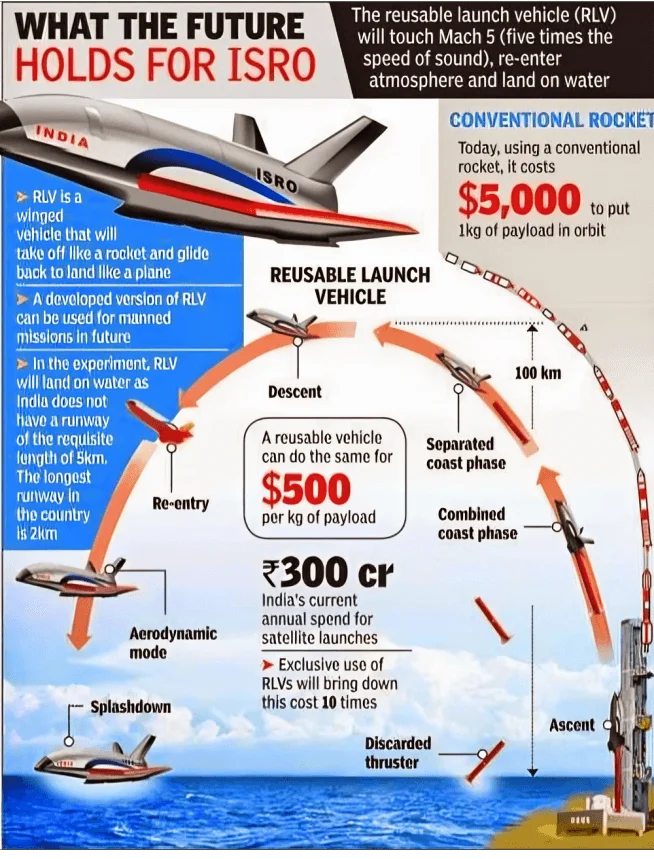

Pushpak, ISRO’s Reusable Launch Vehicle

Why in News?

Recently, the Indian Space Research Organisation (ISRO) successfully completed the third and final Reusable Launch Vehicle Landing Experiment (RLV LEX-03) for the Pushpak vehicle.

- This demonstrated the autonomous landing capability of the RLV under more challenging release conditions and severe wind conditions.

What is RLV LEX-03 Mission?

- About:

- During the RLV LEX-03 mission, the Pushpak vehicle was released from an Indian Air Force Chinook helicopter at an altitude of 4.5 km.

- From this point, the winged vehicle autonomously executed cross-range correction manoeuvres approached the runway and performed a precise horizontal landing at the runway centerline.

- The high-speed landing, exceeding 320 km/h, was successfully slowed to around 100 km/h using the vehicle's brake parachute and landing gear brakes.

- Technologies and Capabilities Demonstrated:

- Precise Landing: LEX-03 used multisensor fusion to guide the vehicle for a controlled landing.

- Autonomous Flight: The Pushpak vehicle demonstrated its ability to land itself, including correcting its course during descent.

- Reusable Design: The mission reused key parts from a previous flight, highlighting the cost-saving potential of RLVs.

- Significance:

- This mission simulated the approach and landing interface, as well as the high-speed landing conditions, for a vehicle returning from space.

- It validated ISRO's advanced guidance algorithm for longitudinal and lateral error corrections, which is essential for future Orbital Re-entry Missions.

- By testing key technologies like autonomous landing and reusable parts, it paves the way for a fully reusable launch vehicle. This could cut launch costs and make space missions more efficient.

- This mission simulated the approach and landing interface, as well as the high-speed landing conditions, for a vehicle returning from space.

What are Reusable Launch Vehicles?

- About:

- Reusable launch vehicles (RLVs) are rockets that can be used multiple times for space missions, unlike traditional expendable rockets where each stage is discarded after use.

- Different from Multi-Stage Rocket:

- In a typical multi-stage rocket, the first stage is jettisoned (discarded to lighten the load) after its fuel is consumed, while the remaining stages continue to propel the payload into orbit.

- RLVs recover and reuse the first stage. After detaching from the upper stages, the first stage uses engines or parachutes to descend and land back on Earth.

- It can then be refurbished for future launches, significantly reducing costs.

- Space Agencies Currently Using or Developing RLVs.

- SpaceX (USA): Falcon 9, with over 220 launches, 178 landings, and 155 re-flights as of May 2023.

- Blue Origin (USA): New Shepard performs suborbital flights and lands vertically.

- JAXA (Japan) and ESA (Europe): Researching reusable launch systems to reduce space access costs.

- ISRO (India): Developed the Reusable Launch Vehicle-Technology Demonstration (RLV-TD) and conducted a successful landing.

Read More: Reusable Launch Vehicle-Technology

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. With reference to India’s satellite launch vehicles, consider the following statements: (2018)

- PSLVs launch the satellites useful for Earth resources monitoring whereas GSLVs are designed mainly to launch communication satellites.

- Satellites launched by PSLV appear to remain permanently fixed in the same position in the sky, as viewed from a particular location on Earth.

- GSLV Mk III is a four-staged launch vehicle with the first and third stages using solid rocket motors, and the second and fourth stages using liquid rocket engines.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3

(c) 1 and 2

(d) 3 only

Ans: (a)

World Medical and Health Games

Recently, four Armed Forces Medical Service (AFMS) Officers have made India proud by winning a record 32 Medals in the 43rd World Medical and Health Games held in Saint-Tropez, France.

- The World Medical and Health Games also called the Olympic Games for Health Professionals.

- It is the most prestigious global sporting event within the medical community. The legacy of the World Medical and Health Games dates back to 1978.

- Over 2500 participants from more than 50 different nations participate in this event annually.

- Lt Col Sanjeev Malik, Maj Anish George, Capt Stephen Sebastian, and Capt Dania James, made history by winning 19 Gold Medals, 09 Silver Medals and 04 Bronze Medals at the event.

Kanishka Tragedy

Recently, Canada has said that the investigation into the 1985 bombing of Air India Flight 182 is still "active and ongoing".

- On 23rd June 1985, Montreal-New Delhi Air India ‘Kanishka’ Flight 182 travelling from Canada to India via London, exploded off the Irish coast killing all 329 people on board, mostly Indians.

- Another explosion at Tokyo's Narita airport killed two Japanese baggage handlers while the flight was still in the air.

- Investigators later revealed that this bomb was connected to the attack on Flight 182 and was meant for another Air India flight to Bangkok, but it detonated prematurely.

- The bombing was attributed to Sikh militants (Khalistanis) in retaliation for 'Operation Bluestar' by the Indian Army in 1984.

- 'Operation Bluestar' was a military operation ordered by the Indian government to remove Sikh militants from the Golden Temple in Amritsar.

- The Khalistan movement is a separatist movement seeking to create a homeland for Sikhs by establishing an ethno‐religious sovereign state called Khalistan in the Punjab region.

Read More: 36th Anniversary of Operation Blue Star

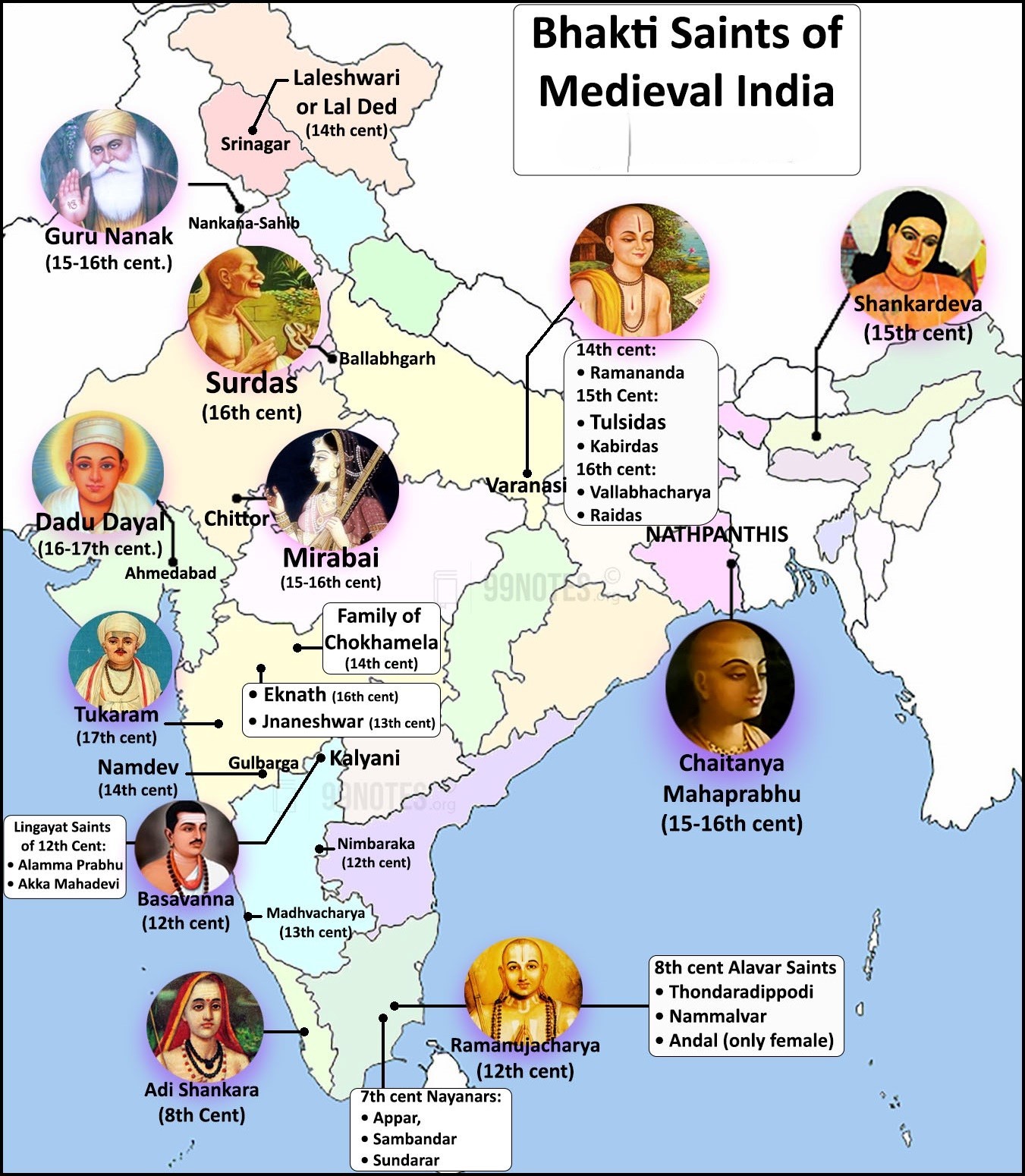

647th Birth Anniversary of Sant Kabir Das

On 22nd June 2024, the Prime Minister commemorated the 647th birth anniversary of Sant Kabir Das.

- Sant Kabir Das, a 15th-century Indian mystic poet and saint, was born in Varanasi, Uttar Pradesh to a Hindu family but was raised by a Muslim weaver couple.

- He was a notable figure in the Bhakti movement, which emphasised devotion and love for the divine.

- The Bhakti movement started in the 7th century in South India and spread to North India during the 14th and 15th centuries.

- Popular poet-saints of the Bhakti movement, like Ramananda and Kabir Das, sang devotional songs in vernacular languages.

- Kabir sought spiritual guidance from teachers such as Ramananda and Sheikh Taqi, shaping his unique philosophy.

- Kabir is revered by both Hindus and Muslims, and his followers are known as "Kabir Panthis."

- His popular literary works include Kabir Bijak (poems and verses), Kabir Parachai, Sakhi Granth, Adi Granth (Sikh), and Kabir Granthawali (Rajasthan).

- His works, written in the Brajbhasha and Awadhi dialects, significantly influenced Indian literature and the development of the Hindi language.

Read More: Sant Kabir Das Jayanti

Balon Protein

Recently, scientists have discovered a protein, called Balon, that allows a bacterium, Psychrobacter urativorans to inhibit its cellular activities in unfavourable living conditions and resume it when such living conditions improve.

- Scientists found Balon to be bound to the bacterial ribosome’s active protein synthesis centres which prevented the ribosomes from making new proteins.

- Functioning of Balon is different from other proteins that helped cells slow or shut down.

- In the case of Balon, when the bacteria’s external conditions improved, cells resumed protein synthesis.

- The discovery could help our understanding of how bacteria survive harsh environments like the Arctic permafrost.

- It will also help how members of the Psychrobacter group of bacteria that cause rotting refrigerated food survive extreme cold temperatures.

Read more: Arctic permafrost