Infographics

Biodiversity & Environment

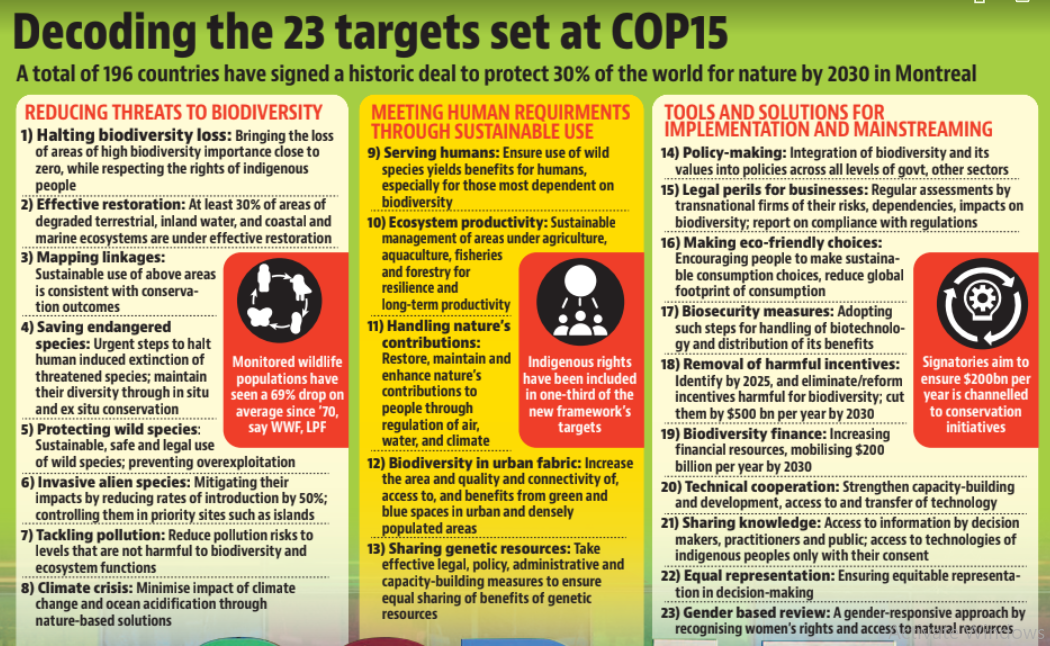

Kunming-Montreal Global Biodiversity Framework

For Prelims: UNCCD, COP15, Kunming-Montreal Global Biodiversity Framework

For Mains: Kunming-Montreal Global Biodiversity Framework, Outcomes of COP 15, Environmental Pollution & Degradation

Why in News?

Recently, at the 15th Conference of Parties (COP15) to the UN Convention on Biological Diversity “Kunming-Montreal Global Biodiversity Framework” (GBF) was adopted.

- GBF includes 4 goals and 23 targets for achievement by 2030.

- The U.N. biodiversity conference concluded in Canada's Montreal.

- The first part of COP 15 took place in Kunming, China and reinforced the commitment to address the biodiversity crisis and the Kunming Declaration was adopted by over 100 countries.

What are the Key Targets of the GBF?

- 30x30 Deal:

- Restore 30% degraded ecosystems globally (on land and sea) by 2030

- Conserve and manage 30% areas (terrestrial, inland water, and coastal and marine) by 2030

- Stop the extinction of known species, and by 2050 reduce tenfold the extinction risk and rate of all species (including unknown)

- Reduce risk from pesticides by at least 50% by 2030

- Reduce nutrients lost to the environment by at least 50% by 2030

- Reduce pollution risks and negative impacts of pollution from all sources by 2030 to levels that are not harmful to biodiversity and ecosystem functions

- Reduce global footprint of consumption by 2030, including through significantly reducing overconsumption and waste generation and halving food waste

- Sustainably manage areas under agriculture, aquaculture, fisheries, and forestry and substantially increase agroecology and other biodiversity-friendly practices

- Tackle climate change through nature-based solutions

- Reduce the rate of introduction and establishment of invasive alien species by at least 50% by 2030

- Secure the safe, legal and sustainable use and trade of wild species by 2030

- Green up urban spaces

What are the Other Major Outcomes of COP15?

- Money for Nature:

- Signatories aim to ensure USD200 billion per year is channelled to conservation initiatives, from public and private sources.

- Wealthier countries should contribute at least USD20 billions of this every year by 2025, and at least USD30 billion a year by 2030.

- Big Companies Report Impacts on Biodiversity:

- Companies should analyse and report how their operations affect and are affected by biodiversity issues.

- The parties agreed to large companies and financial institutions being subject to “requirements” to make disclosures regarding their operations, supply chains and portfolios.

- Harmful Subsidies:

- Countries committed to identify subsidies that deplete biodiversity by 2025, and then eliminate, phase out or reform them.

- They agreed to slash those incentives by at least USD500 billion a year by 2030 and increase incentives that are positive for conservation.

- Monitoring and reporting progress:

- All the agreed aims will be supported by processes to monitor progress in the future, in a bid to prevent this agreement meeting the same fate as similar targets that were agreed in Aichi, Japan, in 2010, and never met.

- National action plans will be set and reviewed, following a similar format used for greenhouse gas emissions under U.N.-led efforts to curb climate change. Some observers objected to the lack of a deadline for countries to submit these plans.

How India Presented its Demands at the Conference?

- India called for an urgent need to create a new and dedicated fund to help developing countries successfully implement a post-2020 global framework to halt and reverse biodiversity loss.

- So far, the Global Environment Facility which caters to multiple conventions, including the UNFCCC and UN Convention to Combat Desertification, remains the only source of funding for biodiversity conservation.

- India also said that conservation of biodiversity must also be based on 'Common but Differentiated Responsibilities and Respective Capabilities' (CBDR) as climate change also impacts nature.

- According to India, developing countries bear most of the burden of implementing the targets for conserving biodiversity and, therefore, require adequate funding and technology transfer.

What is the Convention on Biological Diversity (CBD)?

- CBD is a legally binding treaty to conserve biodiversity that has been in force since 1993 and has been ratified by 196 nations.

- It sets out guidelines for countries to protect biodiversity, ensure sustainable use, and promote fair and equitable benefit sharing.

- It aims at achieving a historic deal to halt and reverse biodiversity loss on par with the 2015 Paris Agreement on climate change.

- The CBD Secretariat is based in Montreal, Canada.

- The Parties (Countries) under CBD, meet at regular intervals and these meetings are called Conference of Parties (COP).

- In 2000, a supplementary agreement to the Convention known as the Cartagena Protocol on Biosafety was adopted. It came into force on 11th September 2003.

- The Protocol seeks to protect biological diversity from the potential risks posed by living modified organisms resulting from modern biotechnology.

- The Nagoya Protocol on Access to Genetic Resources and the Fair and Equitable Sharing of Benefits Arising from their Utilization (ABS) was adopted in 2010 in Nagoya, Japan at COP10. It entered into force on 12th October 2014.

- It not only applies to genetic resources that are covered by the CBD, and to the benefits arising from their utilization but also covers traditional knowledge (TK) associated with genetic resources that are covered by the CBD and the benefits arising from its utilization.

- The COP-10 also adopted a ten-year framework for action by all countries to save biodiversity. Officially known as “Strategic Plan for Biodiversity 2011-2020”, it provided a set of 20 ambitious yet achievable targets collectively known as the Aichi Targets for biodiversity.

- India enacted Biological Diversity Act in 2002 for giving effect to the provisions of the CBD.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. “Momentum for Change: Climate Neutral Now” is an initiative launched by (2018)

(a) The Intergovernmental Panel on Climate Change

(b) The UNEP Secretariat

(c) The UNFCCC Secretariat

(d) The World Meteorological Organisation

Ans: (c)

- “Momentum for Change: Climate Neutral Now”, is an initiative launched by the UNFCCC secretariat in 2015.

- The initiative is a pillar under Momentum for Change which seeks to achieve climate neutrality.

- Climate neutrality is a three step process, which requires individuals, companies and governments to measure their climate footprint; reduce their emissions as much as possible and offset what they cannot reduce with UN certified emission reductions. Therefore, option (c) is the correct answer.

Indian Economy

Global Minimum Tax

For Prelims: Global Minimum Tax, European Union, OECD, BEPS Programme.

For Mains: Significance of Global Minimum Tax and related Issues.

Why in News?

Recently, EU members have agreed to implement a minimum tax rate of 15% on big businesses in accordance with Pillar 2 of the global tax agreement framed by the Organisation for Economic Cooperation and Development (OECD) in 2021.

- In 2021, 136 countries including India had agreed on a plan to redistribute tax rights across jurisdictions and enforce a minimum tax rate of 15% on large multinational corporations.

What is Global Minimum Tax?

- A Global Minimum Tax (GMT) applies a standard minimum tax rate to a defined corporate income base worldwide.

- The OECD developed a proposal featuring a corporate minimum tax of 15% on foreign profits of large multinationals, which would give countries new annual tax revenues of USD 150 billion.

- The framework of GMT aims to discourage nations from tax competition through lower tax rates that result in corporate profit shifting and tax base erosion.

What are the Key Points of the Plan?

- Two Pillar Plan:

- Pillar 1:

- 25% of profits of the largest and most profitable Multinational Enterprise (MNEs) above a set profit margin would be reallocated to the market jurisdictions where the MNE’s users and customers are located.

- It also provides for a simplified and streamlined approach to the application of the arm’s length principle to in-country baseline marketing and distribution activities.

- It includes features to ensure dispute prevention and dispute resolution in order to address any risk of double taxation, but with an elective mechanism for some low-capacity countries.

- It also entails the removal and standstill of Digital Services Taxes (DST) and similar relevant measures, to prevent harmful trade disputes.

- Pillar 2:

- It provides a minimum 15% tax on corporate profit, putting a floor on tax competition.

- This will apply to multinational groups with annual global revenues of over 750 million euros. Governments across the world will impose additional taxes on the foreign profits of MNEs headquartered in their jurisdiction at least to the agreed minimum rate.

- This means that if a company’s earnings go untaxed or lightly taxed in one of the tax havens, their home country would impose a top-up tax that would bring the effective rate to 15%.

- Pillar 1:

- Objectives:

- It aims to ensure that big businesses with global operations do not benefit by domiciling themselves in tax havens in order to save on taxes.

- The minimum tax and other provisions aim to put an end to decades of tax competition between governments to attract foreign investment.

What is the Significance of the Move?

- End of Race to the Bottom:

- It tries to put an end to the “race to the bottom” which has made it harder for governments to shore up the revenues required to fund their rising spending budgets.

- A race to the bottom refers to heightened competition between nations, states, or companies, where product quality or rational economic decisions are sacrificed in order to gain a competitive advantage or reduction in product manufacturing costs.

- It tries to put an end to the “race to the bottom” which has made it harder for governments to shore up the revenues required to fund their rising spending budgets.

- Stopping Financial Diversion to Tax Havens:

- Increasingly, income from intangible sources such as drug patents, software and royalties on intellectual property has migrated to Tax Havens, allowing companies to avoid paying higher taxes in their traditional home countries.

- Mobilising Financial Resources:

- With budgets strained after the Covid-19 crisis, many governments want more than ever to discourage multinationals from shifting profits – and tax revenues – to low-tax countries regardless of where their sales are made.

- Global Tax Reforms: Since the inception of the Base Erosion and Profit Shifting (BEPS) programme, the proposal for GMT is another positive step towards global taxation reforms.

- BEPS refers to tax avoidance strategies that exploit gaps and mismatches in tax rules to artificially shift profits to low or no-tax locations. OECD has issued 15 Action Items to address this.

- Counters Global Inequality:

- The minimum tax proposal is particularly relevant at a time when the fiscal state of governments across the world has deteriorated as seen in the worsening of public debt metrics.

- It is believed that the plan will also help counter rising global inequality by making it tougher for large businesses to pay low taxes by availing the services of tax havens.

What are the Issues?

- Threat of tax Competition:

- It is considered the threat of tax competition that keeps a check on governments which would otherwise tax their citizens heavily to fund profligate spending programs.

- Impending Sovereignty:

- It impinges on the right of the sovereign to decide a nation’s tax policy.

- A global minimum rate would essentially take away a tool country use to push policies that suit them.

- Question of Efficacy:

- The deal has also been criticized for lacking teeth: Groups such as Oxfam said the deal would not put an end to tax havens.

What is the Organization for Economic Cooperation and Development?

- The OECD is an intergovernmental economic organisation, founded to stimulate economic progress and world trade.

- Founded: 1961.

- Headquarters: Paris, France.

- Total Members: 36.

- India is not a member, but a key economic partner.

Way Forward

- Since the OECD’s plan essentially tries to form a global tax cartel, it will always face the risk of losing out to low-tax jurisdictions outside the cartel and cheating by members within the cartel.

- After all, countries both within and outside the cartel will have the incentive to boost investments and economic growth within their respective jurisdictions by offering lower tax rates to businesses.

- This is a structural problem that will persist as long as the global tax cartel continues to exist.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. The term ‘Base Erosion and Profit Shifting’ is sometimes seen in the news in the context of (2016)

(a) mining operation by multinational companies in resource-rich but backward areas

(b) curbing of the tax evasion by multinational companies

(c) exploitation of genetic resources of a country by multinational companies

(d) lack of consideration of environmental costs in the planning and implementation of developmental projects

Ans: (b)

Indian Polity

Appropriation Bill

For Prelims: Appropriation Bills, Consolidated Fund of India, Lok Sabha,Rajya Sabha, Vote on Account, Article 116, Finance Bill, money bills

For Mains: Appropriation Bill, Finance Bill, Consolidated Fund of India,

Why in News?

Recently, the Union Finance Minister moved the Appropriation (No.5) Bill, 2022, and Appropriation (No.4) Bill, 2022, in the Rajya Sabha.

- The bill authorized payment and appropriation of certain further sums from and out of the Consolidated Fund of India for the services of the financial year 2022-2023 for consideration and return.

What is an Appropriation Bill?

- About:

- The Appropriation Bill gives power to the government to withdraw funds from the Consolidated Fund of India for meeting the expenditure during the financial year.

- As per Article 114 of the Constitution, the government can withdraw money from the Consolidated Fund only after receiving approval from Parliament.

- The amount withdrawn is used to meet the current expenditure during the financial year.

- The Appropriation Bill gives power to the government to withdraw funds from the Consolidated Fund of India for meeting the expenditure during the financial year.

- Procedure Followed:

- The Appropriation Bill is introduced in the Lok Sabha after discussions on Budget proposals and Voting on Demand for Grants.

- The defeat of an Appropriation Bill in a parliamentary vote would lead to the resignation of a government or a general election.

- Once it is passed by the Lok Sabha it is sent to the Rajya Sabha.

- Rajya Sabha has the power to recommend any amendments in this Bill. However, it is the prerogative of the Lok Sabha to either accept or reject the recommendations made by the Rajya Sabha.

- After the bill receives assent from the president it becomes an Appropriation act.

- The unique feature of the Appropriation Bill is its automatic repeal clause, whereby the Act gets repealed by itself after it meets its statutory purpose.

- The government cannot withdraw money from the Consolidated Fund of India till the enactment of the appropriation bill. However, this takes time and the government needs money to carry on its normal activities. To meet the immediate expenses the Constitution has authorised the Lok Sabha to make any grant in advance for a part of the financial year. This provision is known as the ‘Vote on Account’.

- A vote on account is defined in Article 116 of the Indian Constitution.

- During an election year the Government either opts for ‘interim Budget’ or for ‘Vote on Account’ as after the election the Ruling Government may change and so the policies.

- The Appropriation Bill is introduced in the Lok Sabha after discussions on Budget proposals and Voting on Demand for Grants.

- Amendment:

- No amendment can be proposed to an Appropriation Bill which will have the effect of varying the amount or altering the destination of any grant so made or of varying the amount of any expenditure charged on the Consolidated Fund of India, and the decision of the Lok Sabha Speaker as to whether such an amendment is admissible is final.

What is the Difference between Appropriation Bill and Finance Bill?

- While the Finance Bill contains provisions on financing the expenditure of the government, an Appropriation Bill specifies the quantum and purpose for withdrawing money.

- Both appropriation and finance bills are classified as money bills which do not require the explicit consent of the Rajya Sabha. The Rajya Sabha only discusses them and returns the bills.

What is the Consolidated Fund of India?

- It was constituted under Article 266 (1) of the Constitution of India.

- It is made up of:

- All revenues received by the Centre by way of taxes (Income Tax, Central Excise, Customs and other receipts) and all non-tax revenues.

- All loans raised by the Centre by issue of Public notifications, treasury bills (internal debt) and from foreign governments and international institutions (external debt).

- All government expenditures are incurred from this fund (except exceptional items which are met from the Contingency Fund or the Public Account) and no amount can be withdrawn from the Fund without authorization from the Parliament.

- The Comptroller and Auditor-General of India (CAG) audits the fund and reports to the relevant legislatures on the management.

What are the Stages of Stages of Budget in Parliament?

- Presentation of Budget.

- General discussion.

- Scrutiny by Departmental Committees.

- Voting on Demands for Grants.

- Passing an Appropriation Bill.

- Passing of Finance Bill.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q1. Which of the following are the methods of Parliamentary control over public finance in India? (2012)

- Placing Annual Financial Statement before the Parliament

- Withdrawal of moneys from Consolidated Fund of India only after passing the Appropriation Bill

- Provisions of supplementary grants and vote-on account

- A periodic or at least a mid-year review of programme of the Government against macroeconomic forecasts and expenditure by a Parliamentary Budget Office

- Introducing Finance Bill in the Parliament

Select the correct answer using the codes given below:

(a) 1, 2, 3 and 5 only

(b) 1, 2 and 4 only

(c) 3, 4 and 5 only

(d) 1, 2, 3, 4 and 5

Ans: (a)

- The Parliament is the custodian of public money, it keeps control over public finances through various means. There are various constitutional provisions which enable parliament to keep a check on the executive by controlling public finances;

- Article 266: All revenues and receipts of government to go to a ‘Consolidated Fund’ and moneys can be withdrawn from the ‘Fund’ only in accordance with laws passed by Parliament. Hence, 2 is correct.

- Article 112: President to place Annual Financial Statement before Parliament every financial year. Charged and voted estimates of expenditure to be shown separately. Expenditure on revenue account to be shown as distinct from other expenditure. Hence, 1 is correct.

- Finance Bill is introduced at the time of presentation of Annual Financial Statement in fulfilment of the requirement of Article 110 of Constitution detailing the imposition, abolition, remission, alteration or regulation of taxes proposed in the budget. Hence, 5 is correct.

- Article 113: Charged expenditure not to be submitted to the vote of Parliament. Expenditure of estimates to be submitted in the form of demands for Grants to the Parliament for its assessment. Prior recommendation of the President is necessary for placing demands for Grants.

- Article 114: Withdrawal of moneys from the Consolidated Fund only after passing of the Appropriation Bill.

- Article 115: Provision of supplementary, additional or excess grants.

- Article 116: Provision of vote on account, vote on credit and exceptional grants. Hence, 3 is correct.

- However, there is no provision of mid-year review of programmes by the budget office of the parliament. Hence, 4 is not correct. Therefore, option (a) is the correct answer.

Q2. What is the difference between “vote-on-account” and “Interim Budget”? (2011)

- The provision of a “vote-on-account” is used by a regular Government while an “interim budget” is a provision used by a caretaker Government.

- A “vote-on-account” only deals with the expenditure in the Government's budget, while an “interim budget” includes both expenditure and receipts.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

Governance

Year-End- Review of Department of Consumer Affairs 2022

For Prelims: Department of Consumer Affairs, Price Monitoring Mechanism, Price Stabilization Fund, Bureau Of Indian Standards, Consumer Protection Act, 2019

For Mains: Year-End- Review of Department of Consumer Affairs 2022

Why in News?

Recently, the year-end-review of the Department of Consumer Affairs under the Ministry of Consumer Affairs, Food and Public Distribution for the year 2022 was released.

What are the Key Achievements of the Department?

- Scheme for strengthening of Price Monitoring Mechanism:

- Price Monitor Cell monitors wholesale and retail prices of twenty-two essential commodities including Rice, Wheat, Atta, Gram Dal etc. based on data collected from 179 market centres spread across the country representing North, West, East, South and North-eastern regions of the country.

- During the year, 57 price reporting centers were added. Number of price reporting centers increased from 122 on 1st January 2021 to 179 till December 2022.

- Price Stabilization Fund (PSF):

- PSF is a central sector scheme for providing working capital and other incidental expenses for procurement and distribution of agri-horticultural commodities.

- During 2022, 12.83 Lakh Metric Tonnes (LMT) of pulses has been Transferred from Price Support Scheme (PSS), Department of Agriculture Cooperation & Farmers Welfare (DACFW) to PSF, Department of Consumer Affairs (DoCA) /Procured/Import under PSF.

- Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY):

- During 2022, Rs. 35.59 crore were released to States/Union Territories as reimbursement for expenditure on intra-State movement & handling, fair price shop dealer's margin and Additional Margin Distribution through Point of Sale (PoS) Device for distribution of pulses under PMGKAY and Atma Nirbhar Bharat Scheme.

- Consumer Awareness:

- The new mascot of the DoCA “Jagriti” was launched to strengthen the campaign titled “Jago Grahak Jago” to reinforce top-of-mind awareness with all the consumers.

- Bureau Of Indian Standards (BIS):

- BIS Act 2016 came into force with effect from 12th October 2017, subsequently Governing Council was reconstituted.

- The total number of standards in force, as on 25th November 2022 is 21,833.

- BIS (India) is holding the chairship of the South Asian Regional Standards Organization (SARSO) Technical Management Board for a three-year term from Oct 2020 to Oct 2023 and Board of Conformity Assessment (BCA).

- Management System Certification:

- BIS operates 20 Management Systems Certification Schemes, In 2021-22, two new more schemes i.e., Occupational Health & Safety Management System and Energy Management System have been accredited by National Accreditation Board for Certification Bodies (NABCB).

- BIS Act 2016 came into force with effect from 12th October 2017, subsequently Governing Council was reconstituted.

- Consumer Protection:

- World Consumer Rights Day:

- The World Consumer Rights Day was celebrated on 15th March 2022 at Vigyan Bhawan, New Delhi.

- The theme of the event was “Fair Digital Finance”.

- Settlement of cases through National Lok Adalat:

- National Legal Service Authority (NALSA) along with other Legal Service institutions conducts Lok Adalats.

- DoCA wrote to all State/UT Govts. for referring pending consumer cases to be taken up through National Lok Adalat.

- As a result, 5,930 cases were settled on a single day on 12th December, 2022 through Lok Adalat across the Country.

- Consumer Protection Act, 2019:

- E-Filing:

- A Consumer Commission online application portal named “edaakhil.nic.in” has been developed to facilitate the consumers/advocates to file the consumer complaint online through the e-Daakhil portal from home or anywhere at their own comfort.

- Fake Reviews:

- BIS launched the framework titled Indian Standard (IS) 19000:2022 ‘Online Consumer Reviews — Principles and Requirements for their Collection, Moderation and Publication.

- The standards will be applicable to every online platform which publishes consumer reviews.

- The standard provides for responsibilities of organization including developing a code of practice, and necessary stipulations for terms and conditions like accessibility, criteria, and ensuring content does not contain financial information etc.

- BIS launched the framework titled Indian Standard (IS) 19000:2022 ‘Online Consumer Reviews — Principles and Requirements for their Collection, Moderation and Publication.

- World Consumer Rights Day:

- Legal Metrology:

- Amendment to Rules:

- The Legal Metrology (Packaged Commodities) Rules, 2011 were amended to allow the electronic products industries to declare certain mandatory declarations in the digital form through the QR Code for a period of one year, if not declared in the package itself.

- This permission is to enable greater use of technology in this digital era to declare the mandatory declaration through the QR Code which can be scanned to view the declarations.

- The Legal Metrology (Packaged Commodities) Rules, 2011 were amended to allow the electronic products industries to declare certain mandatory declarations in the digital form through the QR Code for a period of one year, if not declared in the package itself.

- Amendment to Rules:

Indian Economy

India’s Oil Dependence

For Prelims: Oil Dependence, European Union, Oil and Natural Gas Corporation, CoP26 commitments, Renewable Energy

For Mains: India’s Oil Dependence and related steps taken

Why in News?

Russia has for the second month in a row remained India's top oil supplier in November 2022 surpassing traditional sellers Iraq and Saudi Arabia.

- Russia now makes up for 22% of India’s total crude imports, ahead of Iraq’s 20.5% and Saudi Arabia’s 16%.

- The European Union ban on imports of Russia's seaborne oil from 5th December has driven Russia to seek alternative markets, mainly in Asia, for about 1 million barrels per day.

What is the Current Scenario of India’s Oil Import/Consumption?

- India is the world's third-largest oil consumer at around 5 million barrels a day, behind the US and China. The oil demand is growing at 3-4% a year in the country.

- By this estimate, in a decade, India could be consuming about 7 million barrels a day.

- According to the Petroleum Planning and Analysis Cell (PPAC), India imported 212.2 million tonnes of crude oil in 2021-22, up from 196.5 million tonnes in the previous year.

- For April 2022-23, the oil import dependence was around 86.4% against 85.9% in the corresponding year-ago period.

- It has been argued that due to increasing demand, the consumption of oil has gone up, which has marginalised the efforts being made to increase output.

- Higher crude oil import bill is expected to dent the macroeconomic parameters.

What Initiatives have been taken to Cut down Crude Oil Imports?

- In March 2015, the Prime Minister of India inaugurated the ‘Urja Sangam 2015’ — India’s then biggest global hydrocarbon meet aimed at shaping India’s energy security.

- All the stakeholders were urged to increase the domestic production of oil and gas to reduce import dependence from 77% to 67% by 2022 and further to 50% by 2030.

- The government has also introduced various policies for increasing domestic production of oil and natural gas under the Production Sharing Contract (PSC) Regime, Discovered Small Field Policy, Hydrocarbon Exploration and Licensing Policy (HELP), New Exploration Licensing Policy (NELP), etc.

- However, an underlying issue with domestic oil production is that oil and gas projects — from exploration to production — have a long gestation period.

- Besides, pricing and tax policies are not stable and the oil and gas business requires huge capital, so investors are often wary of taking risks.

- The Government of India promotes the Ethanol Blending Programme (EBP) with the aim of reducing the country’s dependence on crude oil imports, cutting carbon emissions and boosting farmers’ incomes.

- The Government has advanced the target for 20% ethanol blending in petrol (also called E20) to 2025 from 2030.

What can be Done to Reduce India’s Oil Import Dependence?

- Encouraging Domestic Production: It must be kept in mind that India’s demand for oil is only going to go up as we go for 10% GDP growth and that India will continue to be an oil economy for many more years to come.

- The only way India can reduce its dependence on imports is to increase the size of India-owned exploration and production assets overseas. That is what China has done.

- The public sector oil giant Oil and Natural Gas Corporation (ONGC) is also taking various steps to increase the production by redevelopment of existing matured fields and development of new/marginal fields.

- Alternate Green Sources: Another way out for India is to expand its basket and focus on green energy. With the economy gaining momentum, demand for power is on the upswing. With the CoP26 commitments in place, the demand for Renewable Energy is at an all-time high, which calls for substantial capacity addition.

- The wind sector gained momentum, thanks to private investments and government initiatives coupled with regulatory support.

- However, backed by global supply of solar cells and modules and favourable policies, solar power emerged more competitive than wind power.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. The term ‘West Texas Intermediate’, sometimes found in news, refers to a grade of (2020)

(a) Crude oil

(b) Bullion

(c) Rare earth elements

(d) Uranium

Ans: (a)

Social Justice

Rise in Organ Donation

For Prelims: Organ Donation, Covid-19 pandemic, Transplantation of Human Organs Act, 1994.

For mains: Rise in Organ Donation and Need for increasing Deceased Donations.

Why in News?

After a fall during the first year of the Covid-19 pandemic, organ donation numbers increased back in 2021.

- In India, Transplantation of Human Organs Act, 1994 provides various regulations for the removal of human organs and its storage. It also regulates the transplantation of human organs for therapeutic purposes and for the prevention of commercial dealings in human organs.

What is the Status of Organ Donation in India?

- India has an organ donation rate of about 0.52 per million population. In comparison, the organ donation rate in Spain, the highest in the world, is 49.6 per million population.

- Unlike India where a person has to register to be an organ donor — and the family has to consent to it after death — Spain has an opt-out system where a person is presumed to be a donor unless otherwise specified.

- Although organ donation has increased, however, the number of deceased donations has remained lower than the number of donations from living persons.

- Deceased Donation is the organs donated by the kin of those who suffered brain death or cardiac death.

- Only 14.07% of the total organs harvested in 2021 were from deceased donors, much less than the 16.77% of 2019.

- Of the 12,387 organs harvested in 2021, only 1,743 — a little more than 14% — were from deceased donors. The numbers harvested in 2021 were close to the highest in the last five years (12,746, in 2019).

- There is also a geographical skew in deceased donations. All but two deceased organ donations in 2021 were in 15 states, with the top five — Telangana, Tamil Nadu, Maharashtra, Gujarat, and Karnataka — accounting for more than 85% of the total. Two organs were harvested from a deceased donor in Goa.

- One reason for the geographical skew could be that most organ transplant and harvesting centres are concentrated in these geographies.

What is the Need for Increasing Deceased Donations?

- Gap in the Number of Organs Needed:

- The first reason is the gap in the number of organs needed and the number of transplants that happen in the country.

- In absolute numbers, India conducts the third highest number of transplants in the world.

- Yet, of the estimated 1.5-2 lakh persons who need a kidney transplant every year, only around 8,000 get one.

- Of the 80,000 persons who require a liver transplant, only 1,800 get one. And of the 10,000 who need a heart transplant, only 200 get it.

- Prevalence of Lifestyle Diseases:

- Demand is on the rise because of the increasing prevalence of lifestyle diseases.

- Besides, organs like heart and lungs can be retrieved only from deceased donors.

- Only Harvested from Brain Dead Persons:

- The second reason is that without deceased donations, a precious resource is wasted.

- Nearly 1.5 lakh persons die in road traffic accidents every year in India, many of whom can ideally donate organs.

- Although donations are possible after the heart stops working, almost all organs are currently harvested from brain dead persons.

Way Forward

- For increasing accessibility of donated organs to weaker sections, the public hospitals need to increase the infrastructural capacity to carry out transplantation and provide affordable proper treatment to the poor.

- It is suggested that cross-subsidization will increase accessibility to the weaker section. For every 3 or 4 transplants, the private hospitals should carry out free of cost transplantation to the section of the population that donates a majority of organs.

- The Transplantation of Human Organs Act, 1994, need to be amended to substitute the rigid bureaucratic procedure of hospitals by self-declaration and mandatory verification involving civil society.

Important Facts For Prelims

AYURSWASTHYA Yojana

Why in News?

Ayush Ministry is currently running a Central Sector Scheme titled AYURSWASTHYA Yojana.

What is AYURSWASTHYA Yojana?

- About:

- It has two components:

- AYUSH and Public Health: To promote AYUSH intervention for community health care.

- Up-gradation of facilities to Centre of Excellence: To support establishment of advanced/ specialized AYUSH medical health units in reputed AYUSH and Allopathic institutions both in Government and Non-Government sector.

- Under the Centre of Excellence component of AYURSWASTHYA Yojana, financial assistance is provided to eligible individual organizations/institutes for establishing and upgrading their functions & facilities and/or for research & development activities in AYUSH.

- It has two components:

- Funding:

- The maximum admissible financial assistance under the Centre of Excellence component of AYURSWASTHYA Yojana, to an organization/institute is Rs.10.00 crores for a maximum period of three years.

What are the other Schemes Related to AYUSH?

- National Ayush Mission: The Mission addresses the gaps in health services through supporting the efforts of State/UT Governments for providing AYUSH health services/education in the country, particularly in vulnerable and far-flung areas.

- New Portals on Ayush Sector: CTRI (Clinical Trial Registry of India), RMIS (Research Management Information System), SAHI (Showcase of Ayurveda Historical Imprints), AMAR (Ayush Manuscripts Advanced Repository), and e-Medha (electronic Medical Heritage Accession) have been launched.

- AYUSH Entrepreneurship Programme: It was jointly organized by the Ministry of AYUSH and Ministry of Micro, Small and Medium Enterprises (MSME) for promoting the AYUSH sector in the country under different Schemes of the Ministry of MSME.

- Ayush Wellness Centers: AWC are launched to establish a holistic wellness model based on AYUSH principles and practices focusing on preventive, promotive, curative, rehabilitative and palliative healthcare by integration with the existing public health care system.

- ACCR Portal and Ayush Sanjivani App: It is conceptualized and developed by the Ministry of Ayush as a platform to support both Ayush practitioners and the public.

Important Facts For Prelims

INS Vagir

Why in News?

Recently, the 5th Scorpene class submarine of Project-75 named INS ‘Vagir’ has been delivered to the Indian Navy today.

- It is a Kalvari class diesel-electric attack submarine, Yard 11879, which when commissioned will be christened INS Vagir.

What is INS Vagir?

- Background:

- The first Vagir, a submarine from Russia, was commissioned into the Indian Navy on 3rd December 1973 and was decommissioned on 7th June 2001 after almost three decades of service to the nation.

- Public shipbuilder Mazagon Dock Ltd (MDL) gave a new incarnation to the submarine with the same name.

- About:

- It is named after the Sand Fish, a deadly deep-sea predator of the Indian Ocean.

- It is a part of the six Kalvari-class submarines being built in India.

- The Kalvari-class submarines have the capability of operating in a wide range of Naval combat including anti-warship and anti-submarine operations, intelligence gathering and surveillance, and naval mine laying.

- The state-of-art technology used in the submarine has ensured:

- Superior stealth features such as advanced acoustic absorption techniques, low radiated noise levels, and hydro-dynamically optimised shape.

- The ability to attack the enemy using precision guided weapons.

- Features:

- The submarine is designed to operate in all theatres of operation, showcasing interoperability with other components of a Naval Task Force.

- It can launch attacks with both torpedoes and tube launched anti-ship missiles, whilst underwater or on surface.

- It can undertake multifarious types of missions i.e Anti-Surface warfare, Anti-Submarine warfare, Intelligence gathering, Mine Laying, Area Surveillance, etc.

- Significance:

- Construction of these submarines in an Indian yard is another step towards ‘Aatmanirbhar Bharat’ and enhances self-confidence in this field, a notable achievement is that this is the third submarine delivered to the Indian Navy in a span of 24 months.

What is Project-75?

- About:

- It is a programme by the Indian Navy that entails building six Scorpene Class attack submarines.

- Scorpene is a conventional powered submarine weighing 1,500 tonnes and can go up to depths of 300m.

- The Mazagon Dock Shipbuilders Limited (MDL) is manufacturing six Scorpene submarines with technology assistance from Naval Group of France under a USD 3.75 bn deal signed in October 2005.

- Project 75 includes the indigenous construction of six submarines.

- It is a programme by the Indian Navy that entails building six Scorpene Class attack submarines.

- Other submarines of the ongoing Project-75:

- The first submarine INS Kalvari was commissioned into Indian Navy December 2017, second submarine INS Khanderi in September 2019, third one INS Karanj in March 2021 and the fourth one INS Vela joined service in November 2021.

- The sixth and last submarine, Vagsheer, is expected to be delivered to the Navy by end 2023.