Jurisdiction of Lokpal

For Prelims: Lokpal of India, Swadesh Darshan Scheme, Buddhist circuit, Ramayana circuit, Spiritual Circuit, Department of Personnel and Training (DoPT)

For Mains: Issues and concerns related to devolution of sufficient powers to Lokpal to make it more effective.

Why in News?

Recently, the Lokpal of India stated that it cannot consider a plea from the wife of a government official in Uttar Pradesh who died by suicide, citing jurisdictional limitations.

- The official was allegedly pressured by superiors to sign completion certificates for Central government projects under the Swadesh Darshan Scheme.

What was the Stand Taken by the Lokpal Of India?

- Jurisdictional Limitations of Lokpal in Uttar Pradesh Case:

- The Lokpal, clarified that it lacks the authority to address a complaint against the Principal Secretary, Tourism and Culture, and Director General, Tourism, Uttar Pradesh.

- The issue, involving alleged criminal activities, falls under the purview of criminal law and procedure, prompting the Lokpal to declare it cannot entertain the plea.

- Forwarding the Complaint:

- Despite its jurisdictional constraints, the Lokpal took a step forward by forwarding the complaint to the Union Tourism Secretary for further investigation.

Swadesh Darshan Scheme:

- The Swadesh Darshan Scheme was launched by the Centre in 2014-15 for the integrated development of theme-based tourist circuits. Under the scheme, the Ministry of Tourism provides financial assistance to State governments for the development of tourism infrastructure in the country.

- The second phase of the scheme was launched earlier in 2023. Important circuits for promoting tourism under the scheme include:

- Buddhist circuit

- Ramayana circuit

- Spiritual Circuit etc.

What are Lokpals?

- About:

- The Lokpal and Lokayukta Act, 2013 provided for the establishment of Lokpal for the Union and Lokayukta for States.

- These institutions are statutory bodies without any constitutional status.

- Functions:

- They perform the function of an "ombudsman” and inquire into allegations of corruption against certain public functionaries and for related matters.

What comes under the Jurisdiction of Lokpal and its Powers?

- Related to Prime Ministers (PMs) and Ministers:

- Jurisdiction of Lokpal includes PMs, Ministers, Members of Parliament (MPs), Groups A, B, C and D officers and officials of Central Government.

- Jurisdiction of the Lokpal included the Prime Minister except on allegations of corruption relating to international relations, security, public order, atomic energy and space.

- The Lokpal does not have jurisdiction over Ministers and MPs in the matter of anything said in Parliament or a vote given there.

- Related to Civil Servants and Bureaucrats:

- Its jurisdiction also includes any person who is or has been in charge (director/ manager/ secretary) of anybody/ society set up by central act or any other body financed/ controlled by central government and any other person involved in act of abetting, bribe giving or bribe-taking.

- The Lokpal Act mandates that all public officials should furnish the assets and liabilities of themselves as well as their respective dependents.

- Related to Central Bureau of Investigation (CBI):

- It has the powers to superintendence over, and to give direction to CBI.

- If Lokpal has referred a case to CBI, the investigating officer in such case cannot be transferred without the approval of Lokpal.

- It has the powers to superintendence over, and to give direction to CBI.

What are the Concerns Regarding the Working of Lokpal?

- Lack of Fulltime Chairperson: The Lokpal has not had a full-time chairperson since May 2022, raising concerns about its ability to function effectively.

- Inaction in Dealing with Corrupt Officials: According to a parliamentary committee report tabled in Parliament in April 2023, the Lokpal "has not prosecuted even a single person accused of graft till date."

- According to data provided by the Lokpal office to the panel on Department of Personnel and Training (DoPT), since 2019-20, the anti-corruption body received 8,703 complaints out of which 5,981 complaints were disposed of.

- However, the fact that no one has been prosecuted for corruption despite the large number of complaints received has raised concerns about the Lokpal's ability to take action against corrupt officials.

- Lack of Transparency: Some experts have also criticized the Lokpal's lack of transparency and accountability, which they say undermines its credibility and effectiveness.

Way Forward

- In order to tackle the problem of corruption, the institution of the ombudsman should be strengthened both in terms of functional autonomy and availability of manpower.

- Greater transparency, more right to information and empowerment of citizens and citizen groups is required along with a good leadership that is willing to subject itself to public scrutiny.

- Appointment of Lokpal in itself is not enough. Merely adding to the strength of investigative agencies will increase the size of the government but not necessarily improve governance.

- The slogan adopted by the government of “less government and more governance”, should be followed in letter and spirit.

- Moreover, Lokpal and Lokayukta must be financially, administratively and legally independent of those whom they are called upon to investigate and prosecute.

- Lokpal and Lokayukta appointments must be done transparently so as to minimize the chances of the wrong sorts of people getting in.

- There is a need for a multiplicity of decentralized institutions with appropriate accountability mechanisms, to avoid the concentration of too much power, in any one institution or authority.

UPSC Civil Services Examination Previous Year’s Question (PYQs)

Mains:

Q. ‘A national Lokpal, however strong it may be, cannot resolve the problems of immorality in public affairs.’ Discuss.(2013)

NATO Suspends CFE Treaty Amid Russian Withdrawal

For Prelims: Treaty on Conventional Armed Forces in Europe, NATO (North Atlantic Treaty Organization), Cold War, Warsaw Pact, World War II, The North Atlantic Treaty.

For Mains: Treaty on Conventional Armed Forces in Europe, World wars, Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests.

Why in News?

Recently, NATO (North Atlantic Treaty Organization) has announced the formal suspension of the Treaty on Conventional Armed Forces in Europe (CFE), a key Cold War-Era Security Treaty in response to Russia's pullout from the deal.

What is the Background of Russia's Pullout from CFE?

- About CFE Treaty:

- The CFE Treaty, signed in 1990 and fully ratified in 1992, aimed to prevent massing of conventional armed forces by NATO and Warsaw Pact countries near mutual borders during the Cold War.

- It placed limits on the deployment of conventional military forces in Europe and played a significant role in reducing tensions and arms build-up in the region.

- This treaty was one of several Cold War-era agreements involving Russia and the United States.

- Russia's Withdrawal:

- Russia had suspended its participation in the CFE Treaty in 2007 and formally announced its intention to withdraw in 2015.

- The recent move to finalise the withdrawal came after the Russian President signed a bill denouncing the treaty in May 2023.

- Russia has blamed the US and its allies for the withdrawal, citing their "destructive position" on the treaty.

- Ukraine Conflict's Impact:

- Russia's invasion of Ukraine in February 2022, which led to a significant military presence in Ukraine, influenced its decision to withdraw from the treaty.

- The conflict has direct implications for NATO member states that share borders with Ukraine, such as Poland, Slovakia, Romania, and Hungary.

What are Russia’s Concerns and NATO’s Position?

- Russia claims CFE is no longer serves its interests because it was signed to restrict the use of conventional weapons and equipment and not other advanced weapons.

- Russia cited that preserving the CFE Treaty has become unacceptable from the standpoint of its fundamental security interests, citing developments in Ukraine and NATO's expansion.

- NATO underlines its commitment to reducing military risk, preventing misperceptions, and maintaining security.

- The suspension of the CFE Treaty underscores the ongoing tensions between Russia and NATO, which have significant implications for global security and regional stability, particularly in Eastern Europe.

What is the Cold War?

- The Cold War was a period (1945-1991) of geopolitical tension between the Soviet Union and its satellite states (the Eastern European countries), and the United States with its allies (the Western European countries) after World War II.

- Post World War II, the world got divided into two power blocs dominated by two superpowers viz. the Soviet Union and the US.

- The two superpowers were primarily engaged in an ideological war between the capitalist USA and the communist Soviet Union.

- The term "Cold" is used because there was no large-scale fighting directly between the two sides.

What are Other Cold-War Era NATO and USSR Treaties?

- The North Atlantic Treaty (1949):

- The North Atlantic Treaty, also known as the Washington Treaty, established NATO on 4th April, 1949.

- It was a collective defence alliance formed by Western nations, including the US, Canada, and various European countries.

- The Warsaw Pact (1955):

- The Warsaw Pact, formally known as the Treaty of Friendship, Cooperation, and Mutual Assistance, was signed on 14th May, 1955.

- It was a response to NATO and established a similar mutual defence alliance among the Eastern Bloc countries, led by the Soviet Union.

- The Warsaw Pact included the Soviet Union, East Germany, Poland, Hungary, Czechoslovakia, Bulgaria, and Romania, among others.

- The Four Power Agreement on Berlin (1971):

- This agreement, signed on 3rd September, 1971, between the United States, the United Kingdom, France, and the Soviet Union, addressed the status of Berlin during the Cold War.

- It aimed to improve relations and ease tensions in the divided city.

- The Intermediate-Range Nuclear Forces (INF) Treaty (1987):

- It was signed on 8th December, 1987, by the U.S. President and Soviet General Secretary, the INF Treaty eliminated an entire class of intermediate-range nuclear missiles from Europe.

- The treaty marked a significant step in reducing Cold War tensions and nuclear arms.

- The Strategic Arms Limitation Talks (SALT) and START Treaties:

- SALT were a series of bilateral conferences and international treaties signed between the United States and the Soviet Union.

- These treaties had the goal of reducing the number of long-range ballistic missiles (strategic arms) that each side could possess and manufacture.

- First treaty, known as SALT I, was signed in 1972.

- By signing SALT I, the US and the USSR agreed to a limited number of ballistic missiles, as well as a limited number of missile deployment sites.

Note: In February 2023, Russia had announced to suspend its participation in the New START Treaty, the last remaining major military agreement with the United States.

- The New START Treaty came into force in February, 2011 between the United States of America and the Russian Federation on measures for the further reduction and limitation of strategic offensive arms.

- The Helsinki Accords (1975):

- The Helsinki Final Act, signed in August, 1975, was not a treaty but a declaration of principles agreed upon by 35 countries, including NATO members and Warsaw Pact countries.

- It aimed to improve relations between East and West and included commitments to respect human rights and territorial integrity.

What is NATO?

- About:

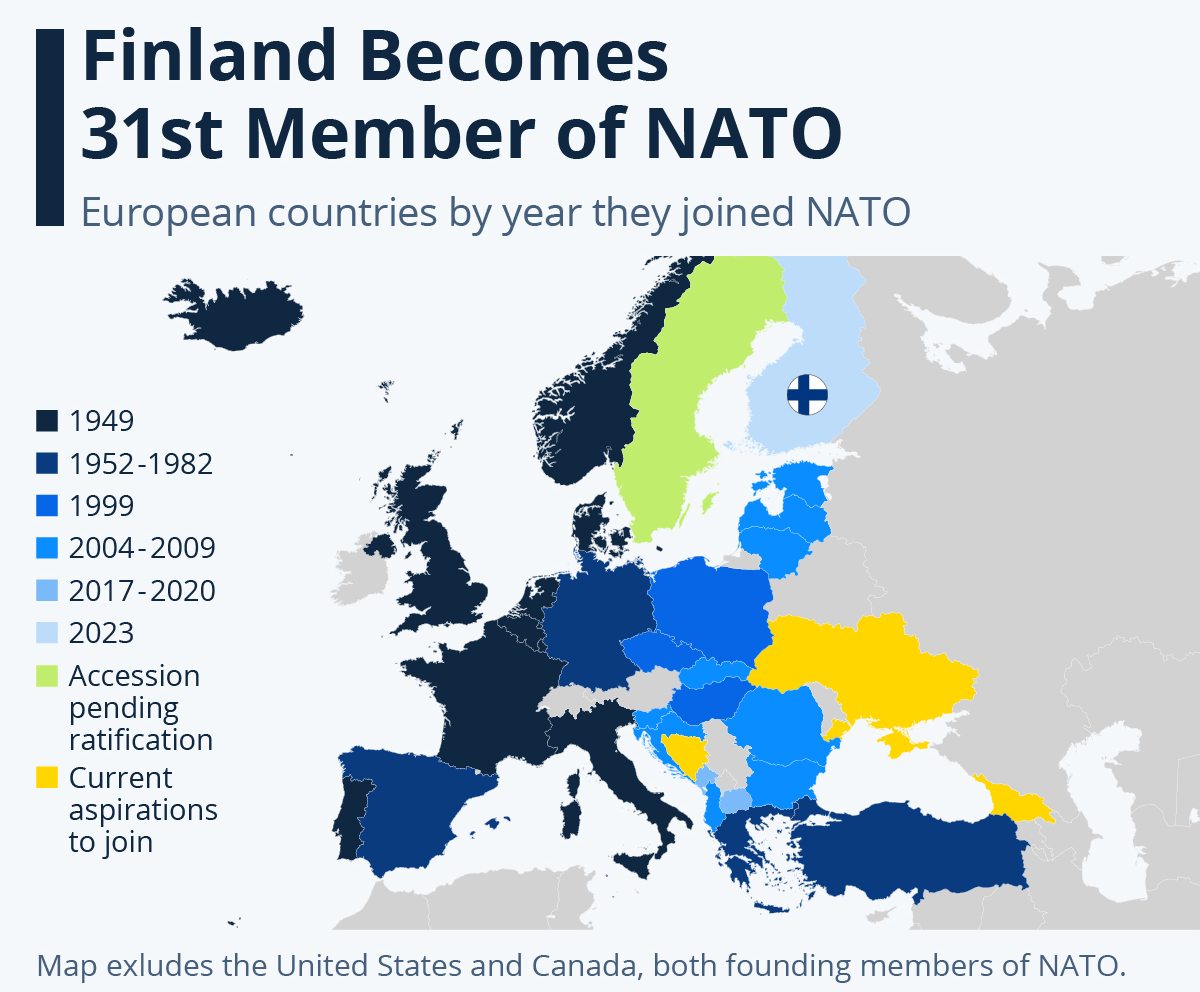

- NATO, or the North Atlantic Treaty Organization, is a political and military alliance consisting of 31 member countries.

- It was formed in 1949 to promote mutual defence and collective security among its members.

- Members:

- In 1949, there were 12 founding members of the Alliance: Belgium, Canada, Denmark, France, Iceland, Italy, Luxembourg, the Netherlands, Norway, Portugal, the United Kingdom and the United States.

- Since then, 19 more countries have joined the Alliance: Greece and Turkey (1952); Germany (1955); Spain (1982); Czechia, Hungary and Poland (1999); Bulgaria, Estonia, Latvia, Lithuania, Romania, Slovakia and Slovenia (2004); Albania and Croatia (2009); Montenegro (2017); North Macedonia (2020); and Finland (2023).

- Headquarters: Brussels, Belgium:

- Headquarters of Allied Command Operations: Mons, Belgium.

- Special Provision:

- Article 5: Article 5 of the NATO treaty is a key provision that states that an attack on one member is an attack on all members.

- This provision has only been invoked once, after the 9/11 terrorist attacks in the United States.

- However, NATO's protection does not extend to members' civil wars or internal coups.

- Article 5: Article 5 of the NATO treaty is a key provision that states that an attack on one member is an attack on all members.

- Alliances of NATO:

UPSC Civil Services Examination Previous Year Question (PYQ)

Mains:

Q. Evaluate the economic and strategic dimensions of India’s Look East Policy in the context of the post Cold War international scenario. (2016)

AI and World Without Work

For Prelims: Artificial Intelligence, John Maynard Keynes, Karl Marx, Applications of AI.

For Mains: Arguments in Favour and Against of AI Replacing Human Labor, Potential Implications of AI across Different Domains.

Why in News?

- During the Bletchley Park AI Summit, Elon Musk envisioned Artificial Intelligence replacing all human labor: both physical and cognitive, resulting in people seeking work solely for personal fulfillment rather than out of necessity. However, this vision prompts debates about the desirability and feasibility of a world without work.

What are the Major Theories on Work?

- John Maynard Keynes: Advocated for reducing work hours under capitalism, viewing work as drudgery.

- He foresaw technological advancements leading to increased welfare by diminishing work hours.

- Karl Marx: Saw work as the essence of humanity, providing meaning by allowing the manipulation of nature.

- Marx envisioned a world where AI enhances human work rather than replaces it, enabling self-enjoyment without external appropriation.

What are the Arguments in Favour and Against of AI Replacing Human Labor?

- Arguments in Favor of AI Replacing Human Labor:

- Efficiency and Cost Reduction: AI offers unparalleled efficiency in performing repetitive tasks, reducing operational costs for businesses by replacing labor-intensive processes.

- Improved Accuracy and Consistency: AI systems can execute tasks with a higher degree of accuracy and consistency compared to humans, especially in fields requiring precise calculations or data analysis.

- 24/7 Availability and Speed: AI operates non-stop, enabling continuous work without fatigue, leading to faster outcomes and service delivery.

- Safety in Hazardous Environments: In environments hazardous to humans, such as deep-sea exploration, space missions, or dangerous manufacturing, AI-driven automation ensures safety and efficiency.

- Arguments Against AI Replacing Human Labor:

- Complex Decision-making and Creativity: AI struggles with nuanced decision-making, absolute creativity, and intuition, domains where human cognition and emotional intelligence excel.

- Ethical and Moral Decision-Making: AI lacks ethical judgment and moral reasoning, making it unsuitable for roles involving moral dilemmas or subjective judgment.

- Human Interaction and Empathy: Jobs requiring human interaction, empathy, and emotional connection, like caregiving or counseling, are challenging for AI to replicate authentically.

- Regulatory and Trust Concerns: Concerns about AI's reliability, bias, and accountability raise regulatory and trust issues, impacting its widespread adoption and acceptance.

What are the Potential Implications of AI across Different Domains?

- Positive Impact:

- Increased Efficiency and Productivity: AI streamlines processes, automates tasks, and enhances efficiency, leading to increased productivity across industries.

- Optimizes resource allocation, reducing wastage and operational costs.

- Innovation and New Job Creation: AI fosters innovation, leading to the creation of new industries, products, and services.

- Generates jobs in AI development, programming, data analysis, and maintenance, catering to evolving technological needs.

- Improved Decision-Making: AI's data-driven insights enable better decision-making for businesses and policymakers.

- Enhances accuracy and speed in forecasting trends, optimizing strategies for growth and development.

- Enhanced Customer Experience: Personalized experiences driven by AI improve customer satisfaction and engagement.

- Chatbots, recommendation systems, and AI-driven customer service elevate user experiences.

- Healthcare and Research Advancements: AI aids in medical diagnostics, drug discovery, and treatment personalization, improving healthcare outcomes.

- Accelerates scientific research by analyzing vast datasets and identifying patterns.

- Increased Efficiency and Productivity: AI streamlines processes, automates tasks, and enhances efficiency, leading to increased productivity across industries.

- Negative Impact:

- Job Displacement and Skills Gap: Automation and AI can replace certain job roles. Displaced workers might struggle to transition to new roles due to lack of relevant skills.

- Privacy and Ethical Concerns: AI's reliance on data raises concerns about privacy infringement and data misuse.

- Ethical dilemmas arise in AI decision-making, especially in areas like facial recognition and algorithmic bias.

- Economic Inequality: AI's benefits might not be equally distributed, widening the gap between skilled and unskilled workers.

- Concentration of AI benefits within certain industries or geographic regions could exacerbate economic disparities.

- Dependency and Vulnerability: Over reliance on AI systems without sufficient human oversight can lead to vulnerabilities, such as system errors or cyber threats.

- Lack of understanding or control over AI systems can make societies more vulnerable to technological failures.

- Social Impact and Job Quality: Jobs created by AI might lack the same quality, stability, or fulfillment as traditional roles, impacting individuals' satisfaction and sense of purpose.

- Changes in work patterns and job nature might affect mental health and societal well-being.

Conclusion

Striking a balance between leveraging AI's capabilities and preserving the value of human labor remains crucial for shaping a future that optimizes technology while ensuring social welfare and meaningful human contributions. Investing in continuous learning and adaptable skill sets can empower individuals to thrive in tandem with AI advancements, fostering a balanced future where human expertise and technological innovation complement each other.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. With the present state of development, Artificial Intelligence can effectively do which of the following? (2020)

- Bring down electricity consumption in industrial units

- Create meaningful short stories and songs

- Disease diagnosis

- Text-to-Speech Conversion

- Wireless transmission of electrical energy

Select the correct answer using the code given below:

(a) 1, 2, 3 and 5 only

(b) 1, 3 and 4 only

(c) 2, 4 and 5 only

(d) 1, 2, 3, 4 and 5

Ans: (b)

Cyprus as a Tax Haven

For Prelims: Tax haven, Double Taxation Avoidance Agreement, India's Tax Treaty with Cyprus, Tax evasion

For Mains: Concerns and Implications of Cyprus being used as a tax haven,

Why in News?

The recent Cyprus Confidential investigation has brought to light a complex web of financial activities involving offshore entities in Cyprus and their connection to wealthy individuals in India.

- This global offshore investigation, conducted in collaboration with the International Consortium of Investigative Journalists (ICIJ), exposes the use of Cyprus as a tax haven by the rich and powerful from around the world.

Note:

- A tax haven is generally an offshore country that offers foreign individuals and businesses little or no tax liability in a politically and economically static environment.

- An offshore company is incorporated in a jurisdiction other than its home country.

- The main purpose of setting up an offshore company is to take advantage of the favourable tax laws or economic environment in a foreign country.

What Tax Benefits Does Cyprus as a Tax Haven Offer?

- Corporate Taxation:

- Offshore companies and offshore branches managed and controlled from Cyprus are taxed at 4.25%.

- Offshore branches managed from abroad and offshore partnerships enjoy total exemption from tax.

- Withholding Tax and Dividends:

- Cyprus imposes no withholding tax on dividends.

- Beneficial owners of offshore entities or branches are not liable for additional tax on dividends or profits.

- Capital Gains and Estate Duty:

- No capital gains tax is payable on the sale or transfer of shares in an offshore entity.

- Inheritance of shares in an offshore company is exempt from estate duty.

- Import Duty Exemptions:

- No import duty on the purchase of cars, office, or household equipment for foreign employees.

- Anonymity and Confidentiality:

- Cyprus ensures the anonymity of the beneficial owners of offshore entities.

- Offshore trusts in Cyprus do not need to be registered with any government or authority, ensuring confidentiality.

- Offshore Trusts:

- Offshore trusts are trusts whose property and income are outside Cyprus, and even the settlor and beneficiaries are not permanent residents of Cyprus.

- Offshore trusts in Cyprus are exempt from estate duty if the trustee is Cypriot.

- No tax on the income and gains generated by offshore trusts.

- The trust need not be registered with any government or other authority, and confidentiality is enshrined in the new law.

- Offshore trusts are trusts whose property and income are outside Cyprus, and even the settlor and beneficiaries are not permanent residents of Cyprus.

What is India's Tax Treaty with Cyprus?

- Before 2013:

- Exemption from Capital Gains Tax

- India and Cyprus had a tax treaty exempting investors from capital gains tax upon exit.

- Zero taxation on capital gains in both countries made Cyprus a favoured destination for equity investments in India.

- Cyprus offered a low 4.5% withholding tax, enhancing its attractiveness for individuals and businesses.

- Withholding tax served as a means to ensure tax compliance by non-residents, applicable to payments made to non-resident individuals.

- Payees were responsible for deducting tax, deposited with the government at rates defined by the Income-tax Act, 1961, or the Double Taxation Avoidance Agreement(DTAA), whichever was lower.

- India and Cyprus had a tax treaty exempting investors from capital gains tax upon exit.

- Exemption from Capital Gains Tax

Note:

- A DTAA is a tax treaty signed between two or more countries. Its key objective is that tax-payers in these countries can avoid being taxed twice for the same income.

- A DTAA applies in cases where a taxpayer resides in one country and earns income in another.

- DTAAs can either be comprehensive to cover all sources of income or be limited to certain areas such as taxing income from shipping, air transport, inheritance, etc.

- Since 2013:

- India designated Cyprus as a Notified Jurisdictional Area (NJA) on November 1, 2013, under Section 94A of the Income-tax Act.

- NJA status resulted in consequences such as a higher withholding tax rate (30%) for payments to entities in Cyprus.

- Transactions with entities in NJA became subject to Indian transfer pricing regulations.

- Transfer pricing is the setting of the price for goods and services sold between controlled (or related) legal entities (may be situated in different countries)within an enterprise.

- India designated Cyprus as a Notified Jurisdictional Area (NJA) on November 1, 2013, under Section 94A of the Income-tax Act.

- Since 2016:

- In 2016, a revised DTAA with Cyprus was signed, clarifying the rescission of the NJA status with retrospective effect from 2013.

- The new DTAA introduced for source-based taxation of capital gains from the alienation of shares.

- Alienation refers to the voluntary sale/ transfer or relinquishment of the asset by the owner.

- A grandfathering clause protected investments made before April 1, 2017, allowing taxation of capital gains in the country of the taxpayer's residence.

- Analysis and Implications:

- The phased evolution reflects the dynamic nature of India's tax arrangements with Cyprus.

- The move towards source-based taxation aligns with global efforts to curb tax evasion and ensure fair revenue distribution.

- Increased scrutiny on tax-related matters globally, as evidenced by offshore investigations, influenced India's approach to tax treaties.

- The grandfathering clause aimed to provide continuity and stability for investments made before significant policy changes.

- The phased evolution reflects the dynamic nature of India's tax arrangements with Cyprus.

- Legality of Indian Companies in Cyprus:

- It is not illegal to establish an offshore company in Cyprus.

- India has DTAAs with several countries, including Cyprus, which offer low tax rates.

- Companies use their tax residency certificates in such countries to enjoy tax benefits that are available legally.

- These jurisdictions are generally characterised by lax regulatory oversight and airtight secrecy laws.

How do Investors use Cyprus as a Tax Haven?

- In Cyprus money laundering is facilitated by channelling funds through multiple networks of shell companies.

- A shell company is a firm that does not conduct any operations in the economy, but it is formally registered, incorporated, or legally organized in the economy.

- Cyprus has a high level of banking secrecy and does not exchange information on financial accounts with other countries automatically.

- This aids the investors in hiding assets and income from authorities and creditors.

- Furthermore, investors may influence politics and policy-making through strategic donations and lobbying practices.

How can India Curb the Use of Cyprus as a Tax Haven?

- Strengthening Compliance Mechanism: India can counter the use of Cyprus as a tax haven by strengthening the enforcement and compliance mechanisms, and ensuring that the tax authorities have adequate resources and powers to detect, investigate, and prosecute the cases of tax evasion and avoidance.

- Accountability Measures: India should enhance the transparency and accountability of the offshore entities, and requiring them to disclose their beneficial owners, directors, and financial activities.

- India can also impose withholding taxes and anti-avoidance measures on payments made to Cypriot entities or individuals.

- Robust Legislations: India can address the abuse of tax treaties by enacting and implementing robust laws. This involves expanding the scope and coverage of these laws and ensuring their effective implementation and monitoring.

- Promotion of Ethical Behaviour: There should be promotion and incentive for the ethical and responsible behaviour of the taxpayers, and encouraging them to pay their fair share of taxes and contribute to the national development

Key Facts About Cyprus

- Cyprus is an island country in the Eastern Mediterranean Sea, with an area of about 9,251 square kilometers.

- It is the third-largest and third-most populous island in the Mediterranean, with a population of about 1.2 million people.

- Capital: Nicosia

- Cyprus has been a member of the European Union since 2004.

- Cyprus has a pleasant Mediterranean climate, with hot summers and mild winters.

- Cyprus is physically divided with the southern part ruled by the internationally-recognised government and the northern part controlled by Turkey.

Supreme Court Upholds Key Provisions of IBC

For Prelims: Supreme Court Upholds Key Provisions of IBC, Insolvency and Bankruptcy Code (IBC), Articles 21, Personal Guarantor.

For Mains: Supreme Court Upholds Key Provisions of IBC, Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

Why in News?

Recently, the Supreme Court (SC) has upheld crucial provisions of the Insolvency and Bankruptcy Code (IBC) that were challenged on constitutional grounds.

- The Court addressed concerns regarding the violation of fundamental rights, including the right to equality, in insolvency proceedings.

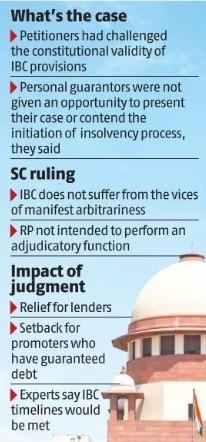

What are the Concerns Raised by the Petitions and SC’s Observations?

- Petitioners Arguments:

- The main issue was that the personal guarantor was not given an opportunity to present their case or contend the initiation of the insolvency resolution process or have a say in the appointment of the RPs (Resolution Professionals).

- A personal guarantor is an individual who provides a personal guarantee for a loan or financial obligation undertaken by another party. When someone borrows money or obtains credit, a lender may require a personal guarantee as a form of security.

- The petitioner argued that the challenged parts of the Insolvency and Bankruptcy Code (IBC) didn't follow fair principles (natural justice) and affected fundamental rights like the right to livelihood, trade, and equality under the Constitution's Articles 21, 19(1)(g), and 14.

- The main issue was that the personal guarantor was not given an opportunity to present their case or contend the initiation of the insolvency resolution process or have a say in the appointment of the RPs (Resolution Professionals).

- Court’s Observation:

- Constitutionality and Personal Guarantors: The Court upheld the constitutionality of key provisions of the IBC, including allowing insolvency proceedings against personal guarantors.

- The court ruled that IBC is not retroactive and held that Sections 95 to 100 cannot be deemed unconstitutional simply because they do not give personal guarantors a chance to be heard before creditors’ insolvency petitions.

- It ruled against claims that these provisions lacked fairness or violated natural justice, stating that fairness should be assessed case by case.

- Constitutionality and Personal Guarantors: The Court upheld the constitutionality of key provisions of the IBC, including allowing insolvency proceedings against personal guarantors.

- Role of Resolution Professionals (RPs): The Court rejected the idea of involving judicial intervention before appointing RPs, stating that adding an adjudicatory role before a certain section would disrupt the IBC's set timelines.

- It clarified that RPs are facilitators who gather information and make recommendations, not decision-makers.

- Moratorium Provisions: The Court agreed that these provisions primarily protects debts rather than debtors.

- It supported the legislature's decisions on when the moratorium should apply and highlighted the differences between individual debtors, partnerships, and corporate debtors in the IBC.

What can be the Potential Impact of SC’s Judgement on IBC?

- Creditor Confidence:

- The affirmation of the IBC's provisions, particularly regarding personal guarantors, may boost creditor confidence.

- Creditors will feel more secure about initiating insolvency proceedings against guarantors, potentially leading to a more assertive approach in recovering debts.

- Clarity and Predictability:

- The clarity provided by the Court's ruling could enhance predictability within the insolvency framework. This could encourage smoother and more efficient resolution processes, reducing uncertainties that might have previously hindered creditor actions.

- Promoter Caution:

- The ruling might instill caution among promoters and individuals providing personal guarantees for corporate debts.

- Promoters, even of solvent companies, may become more circumspect about extending personal guarantees due to the potential risks highlighted by this judgement.

What is Insolvency & Bankruptcy Code, 2016?

- The Government implemented the IBC, 2016 to consolidate all laws related to insolvency and bankruptcy and to tackle Non-Performing Assets (NPA), a problem that has been pulling the Indian economy down for years.

- Insolvency is a situation where individuals or companies are unable to repay their outstanding debt.

- Bankruptcy, on the other hand, is a situation whereby a court of competent jurisdiction has declared a person or other entity insolvent, having passed appropriate orders to resolve it and protect the rights of the creditors. It is a legal declaration of one’s inability to pay off debts.

- The IBC Covers all individuals, companies, Limited Liability Partnerships (LLPs) and partnership firms.

- Adjudicating authority:

- National Company Law Tribunal (NCLT) for companies and LLPs.

- Debt Recovery Tribunal (DRT) for individuals and partnership firms.

- Adjudicating authority:

Legal Insights:

Read comprehensively about Important Institutions:

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. Which of the following statements best describes the term ‘Scheme for Sustainable Structuring of Stressed Assets (S4A)’, recently seen in the news? (2017)

(a) It is a procedure for considering ecological costs of developmental schemes formulated by the Government.

(b) It is a scheme of RBI for reworking the financial structure of big corporate entities facing genuine difficulties.

(c) It is a disinvestment plan of the Government regarding Central Public Sector Undertakings.

(d) It is an important provision in ‘The Insolvency and Bankruptcy Code’ recently implemented by the Government.

Ans: (b)

Rashtriya Vigyan Puraskar Awards

For Prelims: Rashtriya Vigyan Puraskar Awards, Padma and other national awards, Vigyan Ratna Awards, Vigyan Shri Awards, Vigyan Team Awards, Vigyan Yuva-Shanti Swarup Bhatnagar (VY-SSB).

For Mains: Rashtriya Vigyan Puraskar Awards, Achievements of Indians in science & technology.

Why in News?

Recently, the Ministry of Science and Technology has announced ‘Rashtriya Vigyan Puraskar’ (RVP) at par with the Padma and other national awards.

What is Rashtriya Vigyan Puraskar (RVP)?

- Included Awards:

- Vigyan Ratna Awards: These awards will recognise lifetime achievements & contributions made in any field of science and technology.

- Vigyan Shri Awards: These awards will recognise distinguished contributions to any field of science and technology.

- Vigyan Team Awards: These awards are to be given to a team comprising three or more scientists/researchers/innovators who have made an exceptional contribution working in a team in any field of science and technology.

- Vigyan Yuva-Shanti Swarup Bhatnagar (VY-SSB): These awards are the highest multidisciplinary science awards in India for the young scientists (maximum 45 years).

- They are named after Shanti Swarup Bhatnagar, the founder and director of the Council of Scientific & Industrial Research (CSIR), who was also a renowned chemist and visionary.

- Criteria:

- The awards encompass diverse criteria, incorporating technology-led innovations and collaborative team efforts.

- Unlike previous awards, the RVP does not enforce age restrictions except for the Vigyan Yuva-SSB award, aligning with calls to address ageism and gender biases.

- The nominations for this bouquet of awards will be invited every year on 14th January which would remain open till 28th February (National Science Day) every year.

- These awards shall be announced on 11th May (National Technology Day) every year. The Award Ceremony for all categories of awards will be held on 23rd August (National Space Day).

- Significance:

- It acknowledges and encourages participation from Persons of Indian Origin abroad, recognizing the global influence of Indian scientific talent.

- The new awards will be open to an expanded group of “scientists, technologists and innovators (or teams) working in government, private sector organisations or individuals working outside any organisation.

- The new awards will also have expanded eligibility criteria, including technology-led innovations or products, in addition to discovery-based research. The RVP also includes a set of team awards (Vigyan Team), to acknowledge the increasingly collaborative, cross-disciplinary, translational and intersectional nature of scientific research.

- Importantly, with the exception of the Vigyan Yuva-SSB award – for scientists up to the age of 45 years – the other RVP awards don’t have an age limit, while explicitly committing to ensure equitable gender representation.

How Can the RVP Enhance Inclusivity While Overcoming Past Limitations?

- Clear Criteria for Exceptional Contributions:

- To ensure that the RVP system recognises only truly “notable and inspiring contributions”, the awards’ descriptions must include a statement that the contributions are over and above the standard job description of a scientist/technologist, not merely incremental work or work integral to their appointment.

- Incorporating Diverse Scientific Engagement:

- The RVP awards should acknowledge scientists' contributions beyond research by including categories or considering teaching, mentoring, science communication, and leadership.

- These efforts, often additional to primary roles, merit recognition within the awards structure during selection.

- Revision of Age Limits and Gender Parity:

- The age limit of 45 for the Vigyan Yuva-SSB poses a gender parity challenge, hindering women with family obligations.

- To ensure fairness, redefining 'young scientist' based on career independence or offering eligibility extensions considering personal circumstances is crucial to avoid erecting barriers against gender parity.

- Transparent Selection Procedures:

- When the RVP award process is implemented, the selection process must adhere to the predetermined timelines, provide a public list of shortlisted applicants, and include gender-balanced and diverse selection committees, international jury members, and a non-partisan jury member – a non-scientist, preferably – to make sure the selection is fair.

- Embracing Diversity and Socioeconomic Representation:

- The new award system must pledge to consciously seek to ensure, in addition to gender parity, the proper socioeconomic and demographic representation among awardees, and account for contributions made in the face of serious systemic social challenges and/or constraints and considerations related to the workplace.

- Continuous Evaluation for Improvement:

- Despite debates on the necessity of scientist awards, India lacks sufficient data for a decision. However, ongoing assessment of the award system's impact on scientific progress, field growth, role models, diversity, and the country's scientific culture is crucial for informed decisions.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. For outstanding contribution to which one of the following fields is Shanti Swarup Bhatnagar Prize given? (2009)

(a) Literature

(b) Performing Arts

(c) Science

(d) Social Service

Ans: (c)

Mount Etna

Why in News?

Mount Etna, Europe’s most active volcano and one of the largest in the world, has been erupting frequently since February 2023, sending plumes of ash and fountains of lava into the sky.

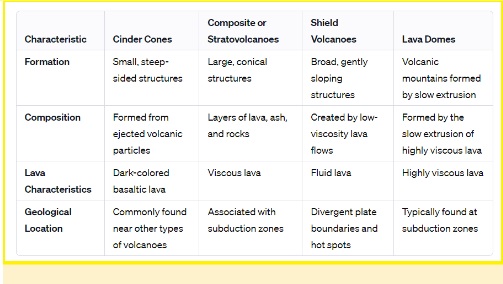

What are the Key Facts About Mount Etna?

- Mount Etna is a stratovolcano, which means it is composed of layers of lava, ash, and rocks that have accumulated over thousands of years of eruptions.

- It is located on the east coast of Sicily, an island in the Mediterranean Sea that belongs to Italy.

- It stands about 3,300 metres above sea level and covers an area of about 1,200 square kilometres.

- Mount Etna has four summit craters and hundreds of lateral vents that can produce different types of eruptions, such as explosive, effusive, or mixed.

- Mount Etna has been erupting almost continuously since 1500 BC, making it one of the most active volcanoes in the world.

What is a Volcano?

- About:

- Volcanoes are openings or vents where lava, rocks, and steam erupt onto the Earth's surface.

- They result from both their own eruptions and the general formation of the planet through the movement and collision of tectonic plates.

- Types of Volcanoes:

- Based on frequency of Eruption:

- Active volcanoes:

- They erupt frequently and are mostly located in the Pacific Ring of Fire, which includes New Zealand, Southeast Asia, Japan and the western coast of the Americas.

- About 90% of all earthquakes worldwide strike within this region.

- Volcanic activity is linked to the movement and collision of tectonic plates.

- Examples include Kilauea in Hawaii and Santa Maria in Guatemala.

- Dormant Volcano:

- These are not extinct but have not erupted in recent history. The dormant volcanoes may erupt in future.

- Example: Mount Kilimanjaro, located in Tanzania, also the highest mountain in Africa, is known to be a dormant Volcano.

- Extinct or inactive volcanoes:

- These have not worked in the distant geological past.

- Example: Dhinodhar hill, Gujarat.

- Based on Geological Formations:

- Based on frequency of Eruption:

- Based on the Type of Eruption:

- Basic:

- The basic magma is dark-coloured like basalt, rich in iron and magnesium but poor in silica. They travel far and generate broad shield volcanoes.

- Acidic:

- These are light-coloured, of low density, and have a high percentage of silica therefore they make a familiar cone volcano shape.

- Basic:

- Tools and Methods to Predict Volcanic Eruptions:

- Seismic Data:

- Monitoring earthquakes and tremors as potential precursors to volcanic eruptions.

- Ground Deformation:

- Observing changes in the ground, indicating magma movement.

- Gas Emissions and Gravity Changes:

- Analyzing volcanic gas emissions, gravity, and magnetic field alterations.

- Seismic Data:

Read more: About the Emergency Alert System during the Earthquake.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. Consider the following statements: (2018)

- The Barren Island volcano is an active volcano located in the Indian territory.

- Barren Island lies about 140 km east of Great Nicobar.

- The last time the Barren Island volcano erupted was in 1991 and it has remained inactive since then.

Which of the statements given above is/are correct?

A. 1 only

B. 2 and 3

C. 3 only

D. 1 and 3

Ans: A

Mains

Q. Mention the global occurrence of volcanic eruptions in 2021 and their impact on regional environment. (2021)

Rapid Fire Current Affairs

Cambridge's Word of the Year 'Hallucinate'

The word of the year, 'hallucinate', chosen by the Cambridge Dictionary, sheds light on the complexities of Artificial Intelligence (AI) and its potential dangers.

- The original definition of "hallucinate" is to seem to sense something that doesn't exist, usually because of a health condition or drugs. Cambridge Dictionary's expanded definition of "hallucinate" includes the production of false information by AI.

- The intelligentization of AI poses real dangers, particularly in politics and public life, where disinformation and misinformation can have far-reaching consequences.

- The expanding reach of Open AI and its tools like Chat GPT, Google Bard, and Microsoft's Copilot have been widely discussed throughout the year.

Read more: Artificial Intelligence and Ethics, Negative Impacts of Artificial Intelligence

MITRA SHAKTI 2023

Exercise MITRA SHAKTI-2023, being held in Aundh (Pune) in November 2023, marks the joint effort between Indian and Sri Lankan contingents comprising troops mainly from the Maratha Light Infantry Regiment and the 53 Infantry Division, respectively.

- This exercise focuses on rehearsing sub-conventional operations under the UN Charter's Chapter VII, emphasizing counter-terrorism tactics like raids, heliborne missions, and search-and-destroy operations. Exercise will also involve the employment of Drones and Counter Unmanned Aerial Systems

- Its objectives are to improve interoperability, reduce risks during peacekeeping operations, and exchange combat skill insights for mutual learning.

Read more: Exercise MITRA SHAKTI