Indian Economy

Guidelines on Food Systems and Nutrition: CFS

Why in News

The Committee on World Food Security (CFS) has endorsed the first-ever Voluntary Guidelines on Food Systems and Nutrition (VGFSyN) which aim to support countries to eradicate hunger and malnutrition in all its forms by utilizing a food systems approach.

- The endorsement took place during the CFS 47th Session.

Key Points

- About the Guidelines:

- Food Systems Approach:

- The Guidelines highlight the complex and multidimensional interlinkages between sustainable food systems and healthy diets.

- Food systems are a complex web of activities involving production, processing, handling, preparation, storage, distribution, marketing, access, purchase, consumption, food loss and waste, as well as the outputs of these activities, including social, economic and environmental outcomes.

- Seven Policy Areas:

- Transparent, democratic and accountable governance.

- Sustainable food supply chains to achieve healthy diets and in the context of climate change.

- Equal and equitable access to healthy diets.

- Food safety.

- People-centred nutrition knowledge, education and information.

- Gender equality and women’s empowerment across food systems.

- Resilient food systems in humanitarian contexts.

- Significance:

- The guidelines are intended to build upon and complement the work and mandate of other international bodies, for example the UN Decade of Action on Nutrition (2016-2025) and Sustainable Development Goal (2) of ‘Zero Hunger’.

- They call for realisation of the right to adequate food in the context of national food security for all, particularly for the most vulnerable and affected groups.

- They focus on policy planning and governance so that food systems can be made more resilient and responsive and are in accordance with needs of consumers and producers too, especially small and marginal farmers.

- Food Systems Approach:

- Committee on World Food Security (CFS):

- It is the foremost inclusive international and intergovernmental platform for all stakeholders to work together to ensure food security and nutrition for all.

- The Committee reports to the United Nations (UN) General Assembly through the Economic and Social Council (ECOSOC) and to the Food and Agriculture Organisation (FAO) Conference.

- CFS holds an annual Plenary session every October in FAO, Rome.

- CFS receives its core funding equally from the FAO, the International Fund for Agricultural Development (IFAD) and the World Food Programme (WFP).

India’s Scenario

- State of Hunger and Malnutrition:

- According to FAO estimates in ‘The State of Food Security and Nutrition in the World, 2020’ Report:

- 189.2 million people are undernourished in India i.e. 14% of the population is undernourished.

- 51.4% of women in reproductive age between 15 to 49 years are anaemic.

- 34.7% of the children aged under five are stunted (too short for their age) while 20% suffer from wasting (weight too low in proportion to height).

- Besides, India ranked 94th among 107 countries in the Global Hunger Index 2020.

- According to FAO estimates in ‘The State of Food Security and Nutrition in the World, 2020’ Report:

- Initiatives Taken:

- POSHAN Abhiyaan, launched in 2017-18, aims to reduce stunting, under-nutrition, anemia and low birth weight babies through synergy and convergence among different programmes, better monitoring and improved community mobilisation.

- Antoydaya Anna Yojana (AAY) aims to provide food at subsidized prices to poor families.

- The Integrated Child Development Scheme (ICDS) envisages comprehensive early childhood care and development by focussing on children in the age group of 0-6 years, pregnant women and adolescent girls.

- The Mid-day Meal (MDM) scheme aims to improve nutritional levels among school children which also has a direct and positive impact on enrolment, retention and attendance in schools.

- Under the Pradhan Mantri Matru Vandana Yojana (PMMVY), Rs. 6,000 is transferred directly to the bank accounts of pregnant women for availing better facilities for their delivery.

- The National Mission on Agriculture Extension and Technology enables delivery of appropriate technologies and improved agronomic practices for farmers.

- The National Mission on Sustainable Agriculture aims to enhance agricultural productivity, and the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) aims to improve water-use efficiency.

Biodiversity & Environment

World Sustainable Development Summit 2021

Why in News

Recently, the World Sustainable Development Summit, the annual flagship event of The Energy and Resources Institute (TERI) was held.

- The theme of the 2021 Summit was ‘Redefining our common future: Safe and secure environment for all’.

- TERI is a non-profit research institute, established in 1974. It conducts research work in the fields of energy, environment and sustainable development for India and the Global South.

Key Points

- India’s Stand at the Event:

- Emphasis on Climate Justice:

- “Climate justice” is a term, and more than that a movement that acknowledges climate change can have differing social, economic, public health, and other adverse impacts on underprivileged populations.

- As per India, ‘climate justice’ is inspired by a vision of trusteeship - where growth comes with greater compassion to the poorest. It also means giving the developing countries enough space to grow.

- Reassurance to Climate Mitigation Efforts:

- India reassured commitments to its targets under the Paris deal to reduce emissions intensity of GDP by 33 to 35 percent from 2005 levels.

- India’s steady progress on its commitment to Land Degradation Neutrality and setting up of 450 gigawatts of Renewable Energy generating capacity till 2030 was also highlighted.

- Initiatives of India under International Solar Alliance were also discussed.

- Commitment to Enhancing Disaster Resilience:

- To enhance India’s disaster management capabilities, commitments to Coalition for Disaster Resilient Infrastructure (CDRI) were assured.

- CDRI: A multi-stakeholder global partnership of country governments, UN agencies, multilateral banks, private sector and knowledge institutions that aims to build resilience into infrastructure systems to ensure sustainable development.

- To enhance India’s disaster management capabilities, commitments to Coalition for Disaster Resilient Infrastructure (CDRI) were assured.

- Emphasis on Climate Justice:

- India's Efforts Towards Sustainable Development:

- In March 2019, India achieved nearly 100% electrification through sustainable technologies and innovative models.

- Through the Ujala Programme, 367 million LED bulbs were distributed which reduced over 38 million tonnes carbon dioxide per year.

- Through the PM Ujjwala Yojna, more than 80 million households below the poverty line have access to clean cooking fuel. India is working to increase the share of natural gas in India's energy basket from 6% to 15%.

- The Jal Jeevan Mission has connected over 34 million households with tap connections in 18 months.

- Through conservation efforts, the population of lions, tigers, leopards and Gangetic river dolphins has gone up.

World Sustainable Development Summit

- About:

- The World Sustainable Development Summit (WSDS) is the annual flagship event of The Energy and Resources Institute (TERI).

- It was earlier known as Delhi Sustainable Development Summit.

- Objective:

- It has been conceptualized as a single platform to accelerate action towards sustainable development and climate change.

- It aims to bring together global leaders and thinkers in the fields of sustainable development, energy and environment sectors on a common platform.

- Sustainable Development:

- "Sustainable development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs". This most widely accepted definition of Sustainable Development was given by the Brundtland Commission in its report ‘Our Common Future’ (1987).

- Climate Change:

- It is a long-term change in the average weather patterns that have come to define Earth’s local, regional and global climates.

- Climate data records provide evidence of climate change key indicators, such as global land and ocean temperature increases; rising sea levels; ice loss at Earth’s poles and in mountain glaciers; frequency and severity changes in extreme weather such as hurricanes, heatwaves, wildfires, droughts, floods and precipitation; and cloud and vegetation cover changes, to name but a few.

Governance

Lateral Entry Into the Administrative Services

Why in News

Recently, the Union Public Service Commission (UPSC) has issued an advertisement to recruit 30 persons at the Joint Secretary and Director level in the Central administration through Lateral Entry.

Key Points

- About:

- The term lateral entry relates to the appointment of specialists, mainly those from the private sector, in government organisations.

- Government is looking for outstanding individuals, with expertise in revenue, financial services, economic affairs, agriculture, cooperation and farmers’ welfare, road transport and highway, shipping, environment, forests and climate change, and new and renewable energy, civil aviation and commerce.

- Advantages of Lateral Entry:

- Addresses Complexity:

- People with expertise and specialist domain knowledge are required to navigate the complex needs of present day administrative challenges.

- Meets Personnel Requirement:

- Lateral entry will help in addressing the problem of shortage of IAS officers at the Centre.

- Organisation Culture:

- It will help in bringing the values of economy, efficiency and effectiveness in the Government sector.

- It will help in building a culture of performance within the Government sector.

- Participatory Governance:

- In the present times, governance is becoming more participatory and a multi actor endeavour, thus lateral entry provides stakeholders such as the private sector and non-profits an opportunity to participate in the governance process.

- Addresses Complexity:

- Issues Involved:

- Need for Transparent Process:

- The key to the success of this scheme would lie in selecting the right people in a manner which is manifestly transparent.

- Difference in Organisational Values:

- The value systems between the government and the private sector are quite different.

- It is important to ensure that the people who come in are able to have the skills to adjust to a totally different system of functioning. This is because the government imposes its own limitations.

- Profit Motive vs Public Service:

- Private sector approach is profit oriented. On the other hand, the motive of Government is public service. This is also a fundamental transition that a private sector person has to make while working in government.

- Internal Resistance:

- Lateral entry is likely to face strong resistance from in service Civil Servants and their associations. It may also demotivate existing officials.

- Issue of Conflict of Interest:

- The movement from the private sector raises issues of potential conflict of interest. Thus, a stringent code of conduct for entrants is required.

- Narrow Scope:

- Lateral entry at only top level policy making positions may have little impact on field level implementation, given the multiple links in the chain of command from the Union Government to a rural village.

- Need for Transparent Process:

Way Forward

- Lateral entry is not a panacea for the ills of governance. However, it opens a small window to get the best from the American and British system and puts pressure on the system to reform and perform.

- For lateral entry to deliver and more importantly win the confidence of the most oppressed sections of society, it must be fair, transparent, and egalitarian. Agencies such as UPSC can play a role based on a selection process approved by Parliament.

Governance

Schemes for Reducing Tax Disputes

Why in News

Recently, the Finance Secretary has said that the new system of faceless assessment and appeal would help bring down tax disputes substantially.

Key Points

- Tax Disputes (Data):

- As per official data, the amount involved in tax disputes was over Rs. 11 lakh crore in FY19-end, up 23% over a year-ago.

- Since India has a very high number of tax litigations, the resolution times are significantly higher, involving time and cost (on the part of the government as well as taxpayers).

- Initiatives Taken to Reduce Tax Disputes:

- Dispute Resolution Committee:

- In Budget 2021, the Minister of Finance has proposed the formation of a Dispute Resolution Committee (DRC) in order to provide quicker relief to taxpayers in tax disputes.

- It will be formed under a new section, 245MA, of the Income Tax Act.

- The DRC will cater to small taxpayers having a taxable income of up to Rs. 50 lakh and a disputed income of up to Rs. 10 lakh.

- The Committee will have the powers to reduce, waive any penalty or give immunity from any offence punishable under the Income Tax Act.

- The alternative mechanism through the DRC shall help taxpayers in preventing new disputes and settling the issue at the very initial stage.

- India has been ranked at 88 in the World Rule of Law Index 2020 in terms of accessibility of alternative dispute resolution mechanisms.

- Faceless Assessment and Appeal:

- The Prime Minister in August 2020 announced three key structural tax reforms under the ‘Transparent Taxation - Honouring the Honest’ platform - faceless assessment, faceless appeal and taxpayers’ charter.

- The faceless assessment system was launched to remove the need of the physical presence of the taxpayers in front of the tax officials.

- Since the launch of faceless random assessment, over 50,000 disputes have been settled.

- The faceless appeals system aims to eliminate discretionary powers of the taxman, curb corrupt practices and provide ease of compliance to taxpayers.

- Income Tax appeals will be finalised in a faceless manner with the exception of appeals related to serious fraud, major tax evasion, search matters, international tax issues and matters pertaining to black money.

- The tax charter elaborated on the rights and responsibilities of the taxpayers to help them familiarise with the whole process of Income Tax collection.

- The effort is on to establish a National Faceless Income Tax Appellate Tribunal Centre that will offer personal hearings through video-conferencing.

- Vivad Se Vishwas Scheme:

- The scheme provides for settlement of disputed tax, disputed interest, disputed penalty or disputed fees in relation to an assessment or reassessment order on payment of 100% of the disputed tax and 25% of the disputed penalty or interest or fee.

- The Direct Tax Vivad se Vishwas Act, 2020 was enacted in March 2020 to settle direct tax disputes locked up in various appellate forums.

- As many as 1.25 lakh cases, a quarter of all direct disputes, have opted for Vivad se Vishwas scheme, enabling settlement of Rs. 97,000 crore in tax demands.

- Dispute Resolution Committee:

Indian Heritage & Culture

Centre Withdrew Draft Heritage Bylaws on Jagannath Temple

Why in News

The Centre has withdrawn the draft heritage bylaws issued by the National Monuments Authority (NMA) for Shree Jagannath Temple in Puri, Odisha.

- The Odisha Government is demanding withdrawal of the bylaws for temples in Ekamra Kshetra area of Bhubaneswar as well.

Key Points

- Draft Heritage Bylaws:

- Background:

- The government in 2010 formed the National Monuments Authority under the Ancient Monuments and Archaeological Sites and Remains (Amendment and Validation) Act, 2010.

- NMA’s primary role was to prepare heritage bylaws for the Archaeological Survey of India (ASI) listed structures.

- The government in 2010 formed the National Monuments Authority under the Ancient Monuments and Archaeological Sites and Remains (Amendment and Validation) Act, 2010.

- Meaning:

- The Ancient Monuments and Archaeological Sites and Remains (Amendment and Validation) Act 2010 mandates that monument-specific heritage bylaws be prepared to regulate construction activity near ASI-protected monuments.

- The draft heritage bylaws need to be approved by Parliament.

- Background:

- The Case of Odisha:

- The State government considered that the byelaws would have hampered the grand infrastructure development planned around 12th century Shree Jagannath Temple in Puri.

- Similar heritage bylaws have been drafted for two temples in Bhubaneswar - the 13th century Vaishnava temple of Ananta Basudev and Shiva temple of Brahmeswar, both in the Ekamra Kshetra area.

- In 2020, the state government planned a beautification project around the area spread across 1,126 acre and develop it into a major tourist attraction.

- Jagannath Temple:

- Construction:

- It is believed to be constructed in the 12th century by King Anatavarman Chodaganga Deva of the Eastern Ganga Dynasty.

- Mythology:

- Jagannath Puri temple is called ‘Yamanika Tirtha’ where, according to the Hindu beliefs, the power of ‘Yama’, the god of death, has been nullified due to the presence of Lord Jagannath.

- Architecture:

- This temple was called the “White Pagoda” and is a part of Char Dham pilgrimages (Badrinath, Dwaraka, Puri, Rameswaram).

- There are four gates to the temple- Eastern ‘Singhdwara’ which is the main gate with two crouching lions, Southern ‘Ashwadwara’, Western 'Vyaghra Dwara and Northern ‘Hastidwara’. There is a carving of each form at each gate.

- In front of the entrance stands the Aruna stambha or sun pillar, which was originally at the Sun Temple in Konark.

- Festival: The World famous Rath Yatra (Car Festival) & Bahuda Yatra.

- Construction:

- Other Important Monuments in Odisha:

- Konark Sun Temple (UNESCO World Heritage Site).

- Tara Tarini Temple.

- Lingaraj Temple.

- Udaygiri and Khandagiri Caves.

The Ancient Monuments and Archaeological Sites and Remains (Amendment and Validation) Act, 2010

- Objective:

- To preserve, conserve, protect and maintain all ancient monuments and archaeological sites and remains declared of national importance, and their surrounding areas up to a distance of 300 meters (or more as may be specified in certain cases) in all directions.

- Provisions:

- No construction or reconstruction is permitted in the prohibited area (an area up to a distance of 100 meters in all directions from the nearest protected limit of nearby protected monument or protected area declared as of national importance), but repair or renovation is considered.

- In the regulated area (an area up to a distance of 200 meters in all directions from the prohibited area of any protected monument and protected area declared as of national importance), repair/renovation/construction/reconstruction are considered.

- All applications for construction related work in the prohibited and regulated areas are to be submitted to the Competent Authorities (CA) and then to National Monuments Authority (NMA) for consideration.

- NMA functions under the Ministry of Culture.

Important Facts For Prelims

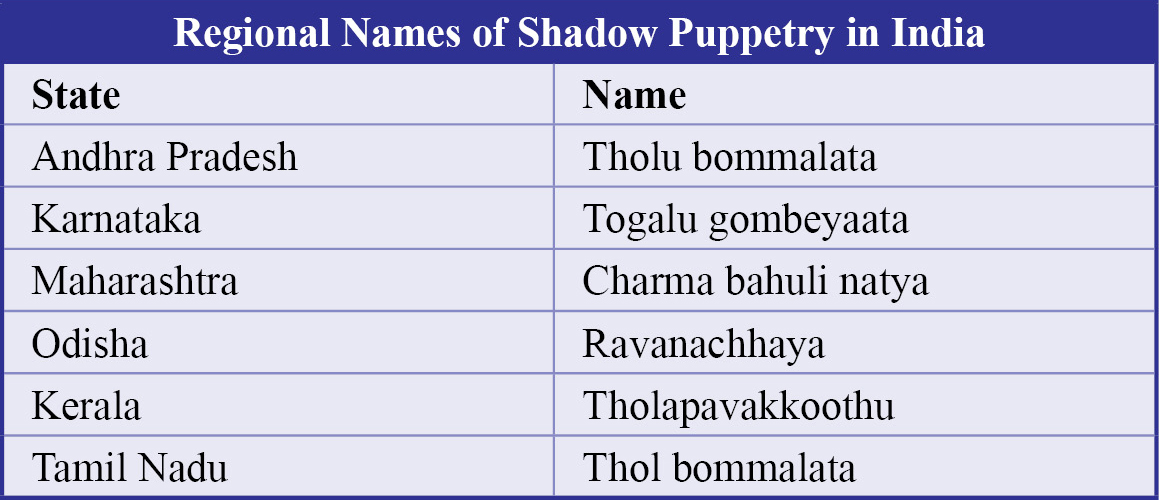

Tholpavakkoothu: Kerala

Why in News

Recently, a shadow leather puppet in Kerala’s famous temple art Tholpavakkoothu has been animated by a robot.

Key Points

- About:

- It is a traditional temple art in Kerala having its roots in Palakkad and neighbouring regions.

- This art is confined largely to Pulavar families from Shoranur region of Palakkad district.

- Among the ancient artforms of Kerala, tholpavakkoothu or shadow puppet play occupies a prominent place. It is a fine example of the integration of Aryan and Dravidian cultures.

- It is a ritual art performed during the annual festivals in the Kaali temples of Palakkad district.

- It is also known as Nizhalkkoothu and Olakkoothu.

- The theme of the play is based on the Kamba Ramayana (the Tamil version of the epic).

- It is a traditional temple art in Kerala having its roots in Palakkad and neighbouring regions.

- Origin:

- In Malayalam, Thol means leather, pava means doll and koothu the play. Though the origin of this ritualistic art form is not known exactly, some believe it to be as old as 1200 years.

- It used to be performed in the Bhadrakali temples of Palakkad, telling tales from the Ramayana.

- The Show:

- This entertainment art is performed on a special stage called koothumadam in the temple courtyard.

- It is performed using the mythological figures along with the use of fire and lighting of lamps behind the screen.

- The chief puppeteer is known as ‘Pulavan’.

- Musical Instruments Used:

- Ezhupara, Chenda and Maddalam etc.