Internal Security

Parliamentary Panel Report on Police Reforms

For Prelims: Parliamentary standing committee, Committees on Police Reforms.

For Mains: Police reforms, Issues Concerning Police Forces.

Why in News?

Recently, the Parliamentary standing committee on home affairs has tabled a report on Police- training, modernisation and reforms. The report highlights the number of reforms required and challenges faced by the Police forces.

What are the Key Points of the Report?

- Addressing Women Under-representation: The report asked the Centre to advise states and Union Territories to create a road map for ensuring 33% representation of women in police while expressing anguish over their underrepresentation.

- The appointment of women in police may be done by creating additional posts rather than converting the vacant posts of men.

- Ensuring higher women representation will also help in improving the police-population ratio.

- States and union territories should assign important challenging duties to women instead of those of inconsequence. It recommended at least one all-women police station in each district.

- Managing Stress of Police Personnels: It recommended offline and online modules to help them de-stress through yoga, exercises, counseling and treatment.

- Separation of Law Enforcement & Investigation Wing: It called for the separation of investigation from law and order to maintain accountability and increase police autonomy in probing crimes.

- This will lead to specialisation and professionalism, speed up the investigation and secure the convictions.

- Virtual Trails: The panel backed virtual trials, particularly those involving high-risk groups, via video conferencing.

- It will help in dedicating less police force for escorting under-trial prisoners to courts and also save resources.

- Addressing Poor Conditions of Police: The committee expressed disappointment over the poor housing satisfaction levels among police personnel and recommended an allocation of funds for housing.

- In the 21st century India, there are police stations without telephones or proper wireless connectivity especially in many sensitive states like Arunachal Pradesh, Odisha and Punjab.

- People-friendly Policing: Policing system should be transparent, independent, accountable and people-friendly.

- Lax Implementation of Law: The committee expressed concern that even after 15 years, only 17 States have either enacted the Model Police Act, 2006, or amended the existing Act.

- The progress in police reforms has been slow.

- It recommends that the MHA (Ministry of Home Affairs) may put the information in public domain about the states that are leading and lagging in the modernization process.

- Community Policing: Community policing should be promoted, as it involves a cooperative effort between police and the communities where both can work together to solve the crime and crime-related problems.

- Border Police Training: Advise the state police and central armed police forces to train and liaison with people living in the border areas for gathering intelligence on infiltration, use of drones and drug trafficking.

- Pool of Anti-drone Technology: For drones, the panel directed the MHA to create a central pool of anti-drone technology "at the earliest" and give its access to all states and Union Territories.

- Under-Utilisation of Funds: The committee observed that the under-utilisation of funds by the states for police modernisation needs to be identified.

- It recommended that the MHA should consider constituting a committee which can visit the underperforming states and assist them to utilize the funds in a planned manner.

What is the Meaning of Police Reforms?

- Police reforms aim to transform the values, culture, policies and practices of police organizations.

- It envisages police to perform their duties with respect for democratic values, human rights and the rule of law.

- It also aims to improve how the police interact with other parts of the security sector, such as the courts and departments of corrections, or executive, parliamentary or independent authorities with management or oversight responsibilities.

- Police come under the state list of schedule 7 of the Indian constitution.

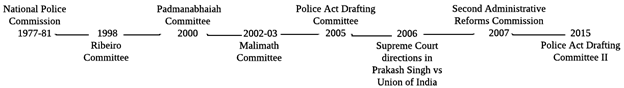

Committees/Commissions on Police Reforms

What are the Issues Concerning Police Forces?

- Colonial Legacy: The Police Act of 1861 was legislated by the British right after the revolt of 1857 to bring in efficient administration of police in the country and to prevent any future revolts.

- Accountability to the Political Executives vs Operational Freedom: The Second Administrative Reforms Commission (ARC-2007) has noted that political control has been abused in the past by the political executive to unduly influence police personnel, and have them serve personal or political interests.

- Psychological Pressure: In the Indian police force, the lower ranks of police personnel are often verbally abused by their superiors or they work in inhuman conditions.

- Public Perception: The Second ARC has noted that police-public relations is in an unsatisfactory State because people view the police as corrupt, inefficient, politically partisan and unresponsive.

- Overburdened Force: While the sanctioned police strength was 181 police per lakh persons in 2016, the actual strength was 137 police.

- This is way too low when compared with the United Nations’ recommended standard of 222 police per lakh persons.

- Constabulary Related Issues: The constabulary constitutes 86% of the State police forces and has wide-ranging responsibilities.

- Infrastructural Issues: Modern policing requires strong communication support, state-of the-art or modern weapons, and a high degree of mobility.

- However, CAG audit reports of year 2015-16, have found shortages in weaponry with state police forces.

- Also, the Bureau of Police Research and Development has also noted a 30.5% deficiency in stock of required vehicles with the state forces.

What Other Reforms can be Brought?

- Modernisation of Police Forces: The Modernisation of Police Forces (MPF) scheme was initiated in 1969-70 and has undergone several revisions over the years.

- However, there is a need to fully utilize the finances sanctioned by the government.

- MPF scheme envisages:

- Procurement of modern weapons

- Mobility of police forces

- Logistics support, upgradation of police wireless, etc

- A National satellite network

- Need For Political Will: The Supreme Court in the landmark Prakash Singh case (2006) gave seven directives where considerable work in police reforms is still needed.

- However, due to the lack of political will these directives were not implemented in letter and spirit in many states.

- Revamping Criminal Justice System: Along with Police reforms, there is a need to reform the criminal justice system too. In this context, the recommendations of the Menon and Malimath Committees can be implemented. Some of the key recommendations are as follows:

- Creation of a fund to compensate victims who turn hostile from the pressure of culprits.

- Setting up separate authority at the national level to deal with crimes threatening the country's security.

- A complete revamp of the entire criminal procedure system.

Indian Polity

Collegium System for the Appointment of Judges

For Prelims: Collegium System, Chief Justice of India.

For Mains: Evolution of the Collegium System and its Criticism.

Why in News?

Recently, the Supreme Court Collegium has recommended appointing Justice Munishwar Nath Bhandari as Chief Justice of Madras High Court.

What is a Collegium System and How Did It Evolve?

- It is the system of appointment and transfer of judges that has evolved through judgments of the Supreme Court (SC), and not by an Act of Parliament or by a provision of the Constitution.

- Evolution of the System:

- First Judges Case (1981):

- It declared that the “primacy” of the CJI’s (Chief Justice of India) recommendation on judicial appointments and transfers can be refused for “cogent reasons.”

- The ruling gave the Executive primacy over the Judiciary in judicial appointments for the next 12 years.

- Second Judges Case (1993):

- SC introduced the Collegium system, holding that “consultation” really meant “concurrence”.

- It added that it was not the CJI’s individual opinion, but an institutional opinion formed in consultation with the two senior-most judges in the SC.

- Third Judges Case (1998):

- SC on the President's reference (Article 143) expanded the Collegium to a five-member body, comprising the CJI and four of his senior-most colleagues.

- First Judges Case (1981):

Who Heads the Collegium System?

- The SC collegium is headed by the CJI (Chief Justice of India) and comprises four other senior most judges of the court.

- A HC collegium is led by its Chief Justice and four other senior most judges of that court.

- Names recommended for appointment by a HC collegium reaches the government only after approval by the CJI and the SC collegium.

- Judges of the higher judiciary are appointed only through the collegium system and the government has a role only after names have been decided by the collegium.

What are the Procedures for Judicial Appointments?

- For CJI:

- The President of India appoints the CJI and the other SC judges.

- As far as the CJI is concerned, the outgoing CJI recommends his successor.

- In practice, it has been strictly by seniority ever since the supersession controversy of the 1970s.

- For SC Judges:

- For other judges of the SC, the proposal is initiated by the CJI.

- The CJI consults the rest of the Collegium members, as well as the senior-most judge of the court hailing from the High Court to which the recommended person belongs.

- The consultees must record their opinions in writing and it should form part of the file.

- The Collegium sends the recommendation to the Law Minister, who forwards it to the Prime Minister to advise the President.

- For Chief Justice of High Courts:

- The Chief Justice of the High Court is appointed as per the policy of having Chief Justices from outside the respective States.

- The Collegium takes the call on the elevation.

- High Court judges are recommended by a Collegium comprising the CJI and two senior-most judges.

- The proposal, however, is initiated by the outgoing Chief Justice of the High Court concerned in consultation with two senior-most colleagues.

- The recommendation is sent to the Chief Minister, who advises the Governor to send the proposal to the Union Law Minister.

What is Critical about the Collegium System?

- Opaqueness and a lack of transparency.

- Scope for nepotism.

- Embroilment in public controversies.

- Overlooks several talented junior judges and advocates.

What were Attempts to reform the Appointment System?

- The attempt made to replace it by a ‘National Judicial Appointments Commission’ (through Ninety-ninth Amendment Act, 2014) was struck down by the court in 2015 on the ground that it posed a threat to the independence of the judiciary.

Way Forward

- Filling up of vacancies is a continuous and collaborative process involving the executive and the judiciary, and there cannot be a time frame for it. However, it is time to think of a permanent, independent body to institutionalise the process with adequate safeguards to preserve the judiciary’s independence guaranteeing judicial primacy but not judicial exclusivity.

- It should ensure independence, reflect diversity, demonstrate professional competence and integrity.

Indian Economy

Retrospective Taxation by Amending Income Tax Act

For Prelims: Retrospective Tax, Budget, Cess, Surcharge, Income Tax Act and Amendments to it, Finance Act.

For Mains: Government Policies & Interventions, Fiscal Policy, IT Act and amendments to it, Retrospective Taxation.

Why in News?

The Union Budget 2022-23 brought in some amendments to the Income Tax (IT) Act 1961 that would be effective retrospectively.

What is a Retrospective Tax?

- A retrospective tax is one that is charged for transactions in the long past. It can be a new or additional charge on transactions done in the past.

- Ideally, retrospective tax is to make adjustments when policies in the past and the present are so vastly different that tax paid before under the old policy could be said to have been less. Retrospective tax could correct that situation by charging tax under the existing policy.

- Retrospective taxation allows a nation to implement a rule to impose a tax on certain products, goods or services and deals and charge companies from a time before the date on which the law is passed.

- Countries use this form of taxation to rectify any deviations in the taxation policies that, in the past, allowed firms to take benefit from any loophole. It affects companies that had unknowingly or knowingly used the tax rules differently.

- Not only India, but many other countries like the US, UK, Australia, Netherlands, Belgium, Canada, and Italy have retrospectively taxed firms.

What are the Major Amendments in the Income Tax Act?

What is the Retrospective Change about Cess and Surcharge?

- Changes:

- Making a retrospective amendment to the IT Act from 2005-06, the Budget has clarified that cess and surcharge will not be allowed to be claimed as deductions in the form of expenditure, a practice that some companies and businesses were resorting to in the absence of legal clarity.

- Citing some court rulings over the years that had given benefit to taxpayers in claiming cess as expenditure and not tax, the tax department said the retrospective amendment is being done to correct the anomaly.

- This amendment will take effect retrospectively from 1st April, 2005 and will accordingly apply in relation to the assessment year 2005-06 and subsequent assessment years.

- The change is being brought from AY 2005-06 as education cess was brought in for the first time by the Finance Act, 2004.

- Significance:

- The court rulings differentiated between income tax and education cess on income tax, and in absence of a specific disallowance for ‘education cess’, courts had taken a view beneficial for taxpayers in many cases.

- In order to nullify the effect of such court rulings and to consider such rulings against the intention of the law, a clarificatory amendment has been introduced in the income tax law, providing that any surcharge or education cess on income tax shall not be allowed as business expenditure.

What is a Cess?

- Cess is a form of tax levied over and above the base tax liability of a taxpayer.

- Cess is resorted to only when there is a need to meet the particular expenditure for public welfare.

- Cess is not a permanent source of revenue for the government, and it is discontinued when the purpose of levying it is fulfilled.

- It can be levied on both indirect and direct taxes.

What is a Surcharge?

- A surcharge is an extra fee, charge, or tax that is added on to the cost of a good or service, beyond the initially quoted price.

- It is added to an existing tax and is not included in the stated price of the good or service.

- It is levied for extra services or to defray the cost of increased commodity pricing.

What are the other Amendments done Retrospectively?

- Changes:

- The government has also allowed exemption of the amount received for medical treatment and on account of death due to Covid-19 retrospectively from April 2020.

- Any sum of money received by an individual, from any person, in respect of any expenditure actually incurred by him on his medical treatment or treatment of any member of his family, in respect of any illness related to Covid-19 subject to such conditions, as may be notified by the Central Government in this behalf, shall not be the income of such a person.

- It has also allowed exemption for amount received by a member of the family of a deceased person, from the employer of the deceased person (without limit), or from any other person or persons with such money not exceeding Rs 10 lakh, where the cause of death of such person is illness relating to Covid-19, and the payment is received within twelve months from the date of death of such person.

- Separately, gifts and freebies to doctors shall not be treated as business expenditure under the Income-tax Act.

- The government has also allowed exemption of the amount received for medical treatment and on account of death due to Covid-19 retrospectively from April 2020.

- Significance:

- This has clarified that any expense incurred in providing various benefits in violation of the provisions of Indian Medical Council (Professional Conduct, Etiquette and Ethics) Regulations, 2002 shall be inadmissible under law.

- This step is likely to discourage pharma companies from giving freebies to medical professionals, and claim these expenses as deductions.

What are Key changes for Questioning Sources of Funding for Companies?

- Changes:

- Government has made changes to the IT law, making space for questioning by the tax department to explain the source of funds at the hands of the creditor.

- A provision has been introduced stating that the source of funding for loan and borrowings for a recipient will be treated as explained only if the source of funds is also explained in the hands of the creditor.

- Significance:

- This could have an impact on funding of businesses, especially startups, if the creditor is not a venture capital fund, a venture capital company registered with SEBI.

- Earlier, if any company used to have bogus entries, the taxpayer would just provide details such as PAN and other financial details of the creditor and that was enough for the tax department.

- Now, it’s upon the recipient to prove that it’s the right source of income and they had the right net worth to provide this amount.

- This could have an impact on funding of businesses, especially startups, if the creditor is not a venture capital fund, a venture capital company registered with SEBI.

Social Justice

PM-POSHAN Scheme

For Prelims: Features of the PM-POSHAN Scheme, Anemia Mukt Bharat Abhiyan, The National Food Security Act (NFSA), 2013, Pradhan Mantri Matru Vandana Yojana (PMMVY) Poshan Abhiyaan.

For Mains: Issues related to child nutrition and related steps need to taken, Initiatives taken by government to improve the child nutrition.

Why in News?

Recently, the central government requested state governments/union territory administrations to explore the possibility of introducing millets under the PM POSHAN Scheme preferably in the districts where eating millets is a culturally accepted food habit.

- NITI Aayog has also been advocating the need to introduce millets in the mid-day meal programme (now PM POSHAN Scheme), moving away from rice and wheat.

What are the Benefits of Millets?

- Millets or nutri-cereals, which include Jowar, Bajra, and Ragi, are rich in minerals and B-complex vitamins, as well as proteins and antioxidants, making them an ideal choice for improving the nutritional outcome of children.

- Multidimensional benefits associated with millets can address the issues related to nutrition security, food systems security, and farmers’ welfare.

- Further, many unique features linked with millets makes them a suitable crop which is resilient to India’s varied agro-climatic conditions.

- India pushed a resolution to declare 2023 as the international year of millets which has been adopted by the United Nations General Assembly.

What is the PM Poshan Scheme?

- In September 2021, the Union Cabinet approved the Pradhan Mantri Poshan Shakti Nirman or PM-POSHAN for providing one hot cooked meal in Government and Government-aided schools with the financial outlay of Rs 1.31 trillion.

- The scheme replaced the national programme for mid-day meal in schools or Mid-day Meal Scheme.

- It has been launched for an initial period of five years (2021-22 to 2025-26).

What are the Features of the PM Poshan Scheme?

- Coverage:

- Primary (1-5) and upper primary (6-8) schoolchildren are currently entitled to 100 grams and 150 grams of food grains per working day each, to ensure a minimum of 700 calories.

- It also covers students of balvatikas (children in the 3-5 year age group) from pre-primary classes.

- Nutritional Gardens:

- Use of locally-grown nutritional food items will be encouraged from "school nutrition gardens" for boosting the local economic growth, and will also include involvement of Farmers Producer Organizations (FPO) and Women Self Help Groups in the implementation of the scheme.

- Supplementary Nutrition:

- The scheme has a provision for supplementary nutrition for children in aspirational districts and those with high prevalence of anaemia.

- It does away with the restriction on the part of the Centre to provide funds only for wheat, rice, pulses and vegetables.

- Currently, if a state decides to add any component like milk or eggs to the menu, the Centre does not bear the additional cost. Now that restriction has been lifted.

- The scheme has a provision for supplementary nutrition for children in aspirational districts and those with high prevalence of anaemia.

- Tithi Bhojan Concept:

- TithiBhojan is a community participation programme in which people provide special food to children on special occasions/festivals.

- Direct Benefit Transfer (DBT):

- The Centre has directed the states and the UTs to switch to Direct Benefit Transfer (DBT) system for providing compensation to the cooks and helpers working under the scheme.

- This is to ensure no leakages at the level of district administration and other authorities.

- Nutrition Expert:

- A nutrition expert is to be appointed in each school whose responsibility is to ensure that health aspects such as Body Mass Index (BMI), weight and haemoglobin levels are addressed.

- Social Audit of the Scheme:

- A social audit of the scheme has also been mandated for each school in each state to study the implementation of the scheme, which was so far not being done by all states.

What is the Need for Introducing Millets?

- Malnutrition and Anaemia among Children:

- According to the National Family Health Survey (NFHS)-5, India has unacceptably high levels of stunting, despite marginal improvement over the years.

- In 2019-21, 35.5% of children below five years were stunted and 32.1% were underweight.

- Global Nutrition Report-2021:

- According to the Global Nutrition Report (GNR, 2021), India has made no progress on anaemia and childhood wasting.

- Over 17% of Indian children under 5 years of age are affected due to childhood wasting.

- The data in NFHS 2019-21 shows the highest spike in anaemia was reported among children aged 6-59 months from 67.1% (NFHS-5) from 58.6% (NFHS-4, 2015-16).

- Human Capital Index:

- India ranks 116 out of 174 countries on the human capital index.

- Human capital consists of the knowledge, skills, and health that people accumulate over their lives, enabling them to realize their potential as productive members of society.

- India ranks 116 out of 174 countries on the human capital index.

- According to the Global Nutrition Report (GNR, 2021), India has made no progress on anaemia and childhood wasting.

What are the other related Initiatives?

- Anemia Mukt Bharat Abhiyan

- The National Food Security Act (NFSA), 2013

- Pradhan Mantri Matru Vandana Yojana (PMMVY)

- Poshan Abhiyaan

Way Forward

- Looking at this data related to the nutrition of children, it is imperative to push for convergence of health and nutrition programmes right from pregnancy until the child reaches five years of age.

- A well-planned and effective Social and Behavioural Change Communication (SBCC) strategy is essential since behaviours are ingrained in society and in family traditions.

- Effective monitoring and implementation of programmes to address malnutrition and prioritizing the reduction of child undernutrition in the national development agenda is the need of the hour.

Biodiversity & Environment

One Ocean Summit

For Prelims: One Ocean Summit, United Nation, World Bank, World Ocean Day, Decade of Ocean, Climate Change

For Mains: Conservation, Environmental Pollution & Degradation, Government Policies & Interventions, Significance of the Oceans, Initiatives to Protect the Ocean

Why in News?

Recently, the Prime Minister addressed the high-level segment of the One Ocean Summit.

- The summit was organised by France in Brest, France in cooperation with the United Nations and the World Bank.

- The summit was addressed by various other Heads of State and Governments from countries like Germany, the United Kingdom, South Korea, Japan, Canada among others.

What is the Importance of Oceans?

- The ocean covers more than 70% of the surface of our planet, yet too often remains on the sidelines of major European and international events.

- The ocean is a regulator of major environmental balances, and climate in particular, a provider of resources, an important enabler of trade, and an essential link between countries and human communities.

- However, it is now seriously threatened by numerous pressures, such as the effects of climate change, pollution or the overexploitation of marine resources.

- In an effort to mobilise the international community and take tangible action to mitigate such pressures on the ocean, France has decided to organise a One Planet Summit dedicated to the ocean.

What is One Ocean Summit?

- The goal of the One Ocean Summit is to raise the collective level of ambition of the international community on marine issues.

- Commitments will be made towards combating illegal fishing, decarbonising shipping and reducing plastic pollution.

- Will also focus on efforts to improve governance of the high seas and coordinating international scientific research.

What was India’s Stand at the Summit?

- India has always been a maritime civilization. India’s ancient scriptures and literature talk about the gifts of the oceans including marine life.

- India’s security and prosperity are linked to oceans. India's ''Indo-Pacific Oceans Initiative'' contains marine resources as a key pillar.

- India supports the French initiative of a ''High Ambition Coalition on Biodiversity Beyond National Jurisdiction''.

- The coalition gathers parties which are committed, at the highest political level, to achieve an ambitious outcome of the ongoing negotiations on a Treaty of the High Seas (“the implementing agreement on Biodiversity Beyond National Jurisdiction”), under the auspices of the United Nations.

- The “BBNJ Treaty”, also known as the “Treaty of the High Seas”, is an international agreement on the conservation and sustainable use of marine biological diversity of areas beyond national jurisdiction, currently under negotiation at the United Nations.

- This new instrument is being developed within the framework of the United Convention on the Law of the Sea (UNCLOS), the main international agreement governing human activities at sea.

- India is committed to eliminating single-use plastic. India recently undertook a nation-wide awareness campaign to clean plastic and other waste from coastal areas.

- Three hundred thousand young people collected almost 13 tons of plastic waste.

- India will be happy to join France in launching a global initiative on single use plastics.

- Recently, the Ministry Of Environment Forest And Climate Change has notified the Plastic Waste Management Amendment Rules, 2021 which prohibit specific single-use plastic items which have “low utility and high littering potential” by 2022.

- India has also directed its Navy to contribute100 ship-days this year to cleaning plastic waste from the seas.

Are there any Other Global initiatives to Protect Oceans?

- United Nations Ocean Conference: The 2017 UN’s Ocean Conference sought to mobilise action for the conservation and sustainable use of the oceans, seas and marine resources.

- Next conference is scheduled to be held in 2022.

- Decade of Ocean Science for Sustainable Development: The UN has proclaimed a Decade of Ocean Science for Sustainable Development (2021-2030) to support efforts to reverse the cycle of decline in ocean health and gather ocean stakeholders worldwide behind a common framework that will ensure ocean science can fully support countries in creating improved conditions for sustainable development of the Ocean.

- World Oceans Day: June 8th is World Oceans Day, the United Nations day for celebrating the role of the oceans in our everyday life and inspiring action to protect the ocean and sustainably use marine resources.

- India- Norway Ocean Dialogue: In 2019, the Indian and Norwegian governments agreed to work more closely on oceans by signing a MoU and establishing the India-Norway Ocean Dialogue.

- India’s Indo-Pacific Oceans Initiative (IPOI): It is an open, non-treaty based initiative for countries to work together for cooperative and collaborative solutions to common challenges in the region.

- IPOI draws on existing regional architecture and mechanisms to focus on seven pillars: Maritime Security, Maritime Ecology, Maritime Resources, Capacity Building and Resource Sharing, Disaster Risk Reduction and Management Science, Technology and Academic Cooperation and Trade Connectivity and Maritime Transport.

- GloLitter Partnerships Project: It is launched by the International Maritime Organization (IMO) and the Food and Agriculture Organization of the UNs (FAO) and initial funding from the Government of Norway. It is aimed to prevent and reduce marine plastic litter from shipping and fisheries.

Indian Economy

National Single Window System

For Prelims: National Single Window System, Ease of Doing Business.

For Mains: Significance of National Single Window System in Ease of Doing Business.

Why in News?

Recently, Jammu & Kashmir became the first Union Territory to be onboarded the National Single Window System (NSWS).

- This marks a major leap in Ease of Doing Business (EoDB) in the Union Territory.

- NSWS is linked with India Industrial Land Bank (IILB) which hosts 45 industrial parks of J&K. This will help Investors to discover available land parcels in J&K.

What is the National Single Window System?

- The platform was soft launched in September 2021 by the Ministry of Commerce and Industry.

- It is a one-stop digital platform that aims at allowing investors to apply for various pre-operations approvals required for commencing a business in the country.

- It makes the business registration process easier, allowing the beneficiary to get significant approvals online, without having to run to the government offices for approvals and can avail themselves of services with just a click.

What is the Significance?

- It would become a “one stop shop” for state and Central government compliances and bring transparency, accountability and responsiveness in the ecosystem.

- It will also offer a Know Your Approvals service to inform businesses of the details of all the approvals they need to obtain as well as a common registration form, document repository and e-communication module.

- It will provide strength to other schemes e.g. Make in India, Startup India, PLI scheme etc.

What are Other Initiatives to Improve EoDB?

- In the Union Budget speech 2020, the Investment Clearance Cell (ICC) was announced.

- ICC will provide “end to end” facilitation and support to investors, including pre-investment advisory, provide information related to land banks and facilitate clearances at Centre and State level. The cell was proposed to operate through an online digital portal.

- Amendments to Insolvency and Bankruptcy Code (IBC) and Decriminalisation under Companies Act, 2013.

- Reduction of corporate tax from 30% to 25% for mid-sized companies.

- The Ministry of Corporate Affairs (MCA), has initiated the MCA21 project, which enables easy and secure access to MCA services in an assisted manner for corporate entities, professionals, and the general public.

- It has also launched the Simplified Proforma for Incorporating Company Electronically Plus (SPICe+) web form.

- The Central Board of Indirect Taxes & Customs (CBIC) has launched eSanchit (e-Storage and Computerised Handling of Indirect Tax documents) for paperless processing, uploading of supporting documents and to facilitate the trading across Borders.

- E-assessment scheme for taxpayers.

Important Facts For Prelims

National Award for Innovations and Good Practices in Educational Administration

Why in News?

Recently, the Ministry of Education presented the 5th National Award for Innovations and Good Practices in Educational Administration (IGPEA).

- The National Institute of Educational Planning and Administration (NIEPA) has instituted the National Award for IGPEA for District and Block Level Education Officers.

- NIEPA, under the MInistry of Education, is a premier organization dealing with capacity building and research in planning and management of education not only in India but also in South Asia.

What are the key things about the award?

- About:

- It was launched by NIEPA in 2014 with an aim to encourage innovations and good practices in educational administration at grassroot level for improving the functioning of the public system of education.

- Objectives:

- To recognise innovative ideas and practices adopted by the district and block level education officers for effective management of the educational administrative system at the district and block levels.

- Significance:

- The educational officers at the field level are also an essential link between system level administration and institutional level management of education. Role of these officers is crucial in the process of implementation of policies and programmes at the field level.

- Some of the major areas wherein the officers have initiated many interventions include – the use of ICT to the extent of digital classrooms, use of Facebook and WhatsApp; mobilization of physical, human and financial resources; improving infrastructure facilities within the schools, community mobilization and support; skill building, especially language skills; capacity building of the teachers and interventions related to enhancement in the quality of the overall function of the schools.

.jpg)