Indian Economy

Depreciation of Indian Rupee

For Prelims: Depreciation of Indian Rupee, Currency depreciation, inflation, Depreciation Vs Devaluation, Appreciation Vs Depreciation

For Mains: Impact of Depreciation of Indian Rupee on economy

Why in News?

The Indian rupee fell to an all-time low of 77.44 against the U.S. Dollar.

What is Depreciation?

- About:

- Currency depreciation is a fall in the value of a currency in a floating exchange rate system.

- Rupee depreciation means that the rupee has become less valuable with respect to the dollar.

- It means that the rupee is now weaker than what it used to be earlier.

- For example: USD 1 used to equal to Rs. 70, now USD 1 is equal to Rs. 77, implying that the rupee has depreciated relative to the dollar i.e. it takes more rupees to purchase a dollar.

- Impact of Depreciation of Indian Rupee:

- Depreciation in rupee is a double-edged sword for the Reserve Bank of India.

- Positive:

- Weaker rupee should theoretically give a boost to India’s exports, but in an environment of uncertainty and weak global demand, a fall in the external value of rupee may not translate into higher exports.

- Negative:

- It poses risk of imported inflation, and may make it difficult for the central bank to maintain interest rates at a record low for longer.

- India meets more than two-thirds of its domestic oil requirements through imports.

- India is also one of the top importers of edible oils. A weaker currency will further escalate imported edible oil prices and lead to a higher food inflation.

- Positive:

- Depreciation in rupee is a double-edged sword for the Reserve Bank of India.

Appreciation Vs Depreciation

- In a floating exchange rate system, market forces (based on demand and supply of a currency) determine the value of a currency.

- Currency Appreciation: It is an increase in the value of one currency in relation to another currency.

- Currencies appreciate against each other for a variety of reasons, including government policy, interest rates, trade balances and business cycles.

- Currency appreciation discourages a country's export activity as its products and services become costlier to buy.

- Depreciation Vs Devaluation:

- If the value of the Indian Rupee is weakened through administrative action, it is devaluation.

- While the process is different for depreciation and devaluation, there is no difference in terms of impact.

- India used to follow the administered or fixed rate of exchange until 1993, when it moved to a market-determined process or floating exchange rate.

- China still adheres to the former.

- If the value of the Indian Rupee is weakened through administrative action, it is devaluation.

What are the Reasons for Current Depreciation of Indian Rupee?

- Sell-off of the Equity:

- A sell-off in the global equity markets which was triggered by the hike in interest rates by the U.S. Federal Reserve (central bank), the war in Europe and growth concerns in China due to the Covid-19 surge, led to the rupee depreciation.

- Outflow of Dollar:

- The outflow of dollars is a result of high crude prices and the correction in equity markets is also causing adverse flow of dollars.

- Tightening of Monetary Policy:

- Steps taken by RBI to tighten the monetary policy to counter rising inflation has also led to depreciation.

How the Depreciation of Rupee Impact the Overall Economy?

- The current account deficit is bound to widen, depleting foreign exchange reserves and weakening the rupee.

- With higher landed prices of crude oil and other crucial imports, the economy is definitely inching towards cost-push inflation.

- Cost-push inflation (also known as wage-push inflation) occurs when overall prices increase (inflation) due to increases in the cost of wages and raw materials.

- Companies may not be allowed to fully pass on the burden of high costs to consumers, which, in turn, affects government dividend earnings, raising questions about budgeted fiscal deficits.

UPSC Civil Services Examination, Previous Year Questions

Q. Which one of the following is not the most likely measure the Government/RBI takes to stop the slide of Indian rupee? (2019)

(a) Curbing imports of non-essential goods and promoting exports

(b) Encouraging Indian borrowers to issue rupee denominated Masala Bonds

(c) Easing conditions relating to external commercial borrowing

(d) Following an expansionary monetary policy

Ans: (d)

- Currency depreciation is a fall in the value of a currency in a floating exchange rate system. Currency depreciation can occur due to factors such as economic fundamentals, interest rate differentials, political instability or risk aversion among investors. India follows the floating exchange rate system.

- Curbing imports of non-essential goods will lessen the demand for Dollars and promoting export will help in increasing the flow of Dollars into the country, thus, helps in control rupee depreciation.

- The Masala Bond is directly pegged to the Indian currency. If Indian borrowers issue more rupee denominated Masala Bonds, this would increase liquidity in the market or increase in the rupee stock against few currencies in the market and this would help in supporting the rupee.

- External Commercial Borrowing (ECB) is a type of loan in foreign currencies, made by non-resident lenders. Thus, easing conditions of ECB’s helps in receiving more loans in foreign currencies would increase the inflow of forex, leading to rupee appreciation.

- Expansionary monetary policy is set of policy measures used by the RBI to stimulate the economy. It will lead to the money supply in an economy. However, it may not influence the variations of rupee value.

- Therefore, option (d) is the correct answer.

Q. Consider the following statements:

The effect of devaluation of a currency is that it necessarily

- improves the competitiveness of the domestic exports in the foreign markets

- increases the foreign value of domestic currency

- improves the trade balance

Which of the above statements is/are correct?

(a) 1 only

(b) 1 and 2

(c) 3 only

(d) 2 and 3

Ans: (a)

Exp:

- Currency devaluation is the deliberate reduction in the value of a country’s currency against another currency. The main effects of currency devaluation are:

- Exports become cheaper to foreign customers

- Imports become expensive

- In the short-term, a devaluation tends to cause inflation

- Higher employment and faster GDP growth

- A country pursues a policy of devaluation to boost its exports as its products and services become cheaper to buy. In other words, the competitiveness of domestic exports improves in the foreign markets. Devaluation will not increase the foreign value of domestic currency. Hence, 1 is correct and 2 is not correct.

Governance

MPLAD Scheme

For Prelims: MPLAD Scheme, Central Sector Schemes.

For Mains: Significance of MPLAD Scheme and the Related Issues.

Why in News?

Recently, the Ministry of Finance has revised the Member of Parliament Local Area Development Scheme (MPLADS) rules, where the interest that the fund accrues will be deposited in the Consolidated Fund of India.

- So far, the interest accrued on the fund used to be added to the MPLADS account and could be used for the development projects.

What is Consolidated Fund of India?

- All revenues received by the Government by way of taxes like Income Tax, Central Excise, Customs and other receipts flowing to the Government in connection with the conduct of Government business i.e. Non-Tax Revenues are credited into the Consolidated Fund constituted under Article 266 (1) of the Constitution of India.

- Similarly, all loans raised by the Government by issue of Public notifications, treasury bills (internal debt) and loans obtained from foreign governments and international institutions (external debt) are credited into this fund.

- All expenditure of the government is incurred from this fund and no amount can be withdrawn from the Fund without authorization from the Parliament.

What is MPLAD Scheme?

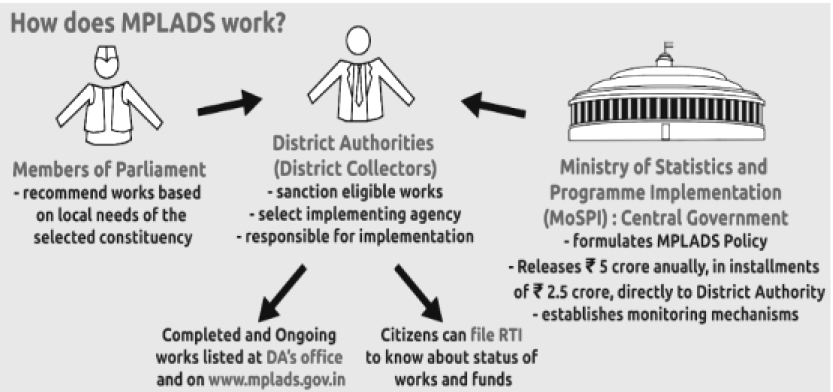

- About:

- It is a Central Sector Scheme which was announced in December 1993.

- Objective:

- To enable MPs to recommend works of developmental nature with emphasis on the creation of durable community assets in the areas of drinking water, primary education, public health, sanitation and roads, etc. primarily in their Constituencies.

- Since June 2016, the MPLAD funds can also be used for implementation of the schemes such as Swachh Bharat Abhiyan, Accessible India Campaign (Sugamya Bharat Abhiyan), conservation of water through rain water harvesting and Sansad Aadarsh Gram Yojana, etc.

- To enable MPs to recommend works of developmental nature with emphasis on the creation of durable community assets in the areas of drinking water, primary education, public health, sanitation and roads, etc. primarily in their Constituencies.

- Implementation:

- The process under MPLADS starts with the Members of Parliament recommending works to the Nodal District Authority.

- The Nodal District concerned is responsible for implementing the eligible works recommended by the Members of Parliament and maintaining the details of individual works executed and amount spent under the Scheme.

- Functioning:

- Each year, MPs receive Rs. 5 crore in two instalments of Rs. 2.5 crore each. Funds under MPLADS are non-lapsable.

- Lok Sabha MPs have to recommend the district authorities projects in their Lok Sabha constituencies, while Rajya Sabha MPs have to spend it in the state that has elected them to the House.

- Nominated Members of both the Rajya Sabha and Lok Sabha can recommend works anywhere in the country.

What are the Issues with MPLADS?

- Implementation Lapses: The Comptroller and Auditor-General of India (CAG) has flagged instances of financial mismanagement and artificial inflation of amounts spent.

- No Statutory Backing: The scheme is not governed by any statutory law and is subject to the whims and fancies of the government of the day.

- Monitoring and Regulation: The scheme was launched for promoting participatory development but there is no indicator available to measure level of participation.

- Breach of Federalism: MPLADS encroaches upon the domain of local self governing institutions and thereby violates Part IX and IX-A of the Constitution.

- Conflict with Doctrine of Separation of Powers: MPs are getting involved in executive functions.

Governance

National Physical Literacy Mission

For Prelims: Article 21 of the Constitution, Public Interest Litigation.

For Mains: National Physical Literacy Mission, Sports, Youth.

Why in News?

Recently, the Supreme Court has asked the Centre and States to respond to a report recommending sports to be expressly made a fundamental right under Article 21 of the Constitution.

- Further, the report submitted by the court’s amicus curiae (friend of the court) suggested that the “narrow” phrase ‘sport’ be replaced by ‘physical literacy’, which is a term “firmly established as a right in the leading sporting nations of the world”.

What is the Premise of the Supreme Court’s Ruling?

- The report was filed in a Public Interest Litigation (PIL) to amend the Constitution to make sports a fundamental right and amend the Directive Principles of State Policy to include an obligation to “strive for promotion of sports education”.

- It had urged that sports should be transferred to the Concurrent List to facilitate cooperative work between the Centre and states (at present, sports is a state subject).

What did the Report Suggest?

- Responsibility Matrix: Central Government should launch ‘National Physical Literacy Mission’.

- The mission should implement a responsibilities’ matrix that includes curriculum design, compliance monitoring, and review, grievance redressal and self-correction mechanisms which starts at the school level to groom children for various sports.

- Dedicated Time for Sports: All school boards including CBSE, ICSE, State Boards, IB, IGCSE should be directed to ensure that from the academic year commencing 2022-2023, at least 90 minutes of every school day will be dedicated to free play and games.

- Sports Facilities for Free: State governments ought to ensure that from the current academic year, all educational institutions in their non-working hours, should allow neighborhood children to use their playgrounds and sports facilities for free.

- Draft ‘Physical Literacy Policy’: A 180 days' time should be given to educational institutions to draft ‘Physical Literacy Policy’.

- The policy will include the institution’s commitment to a ‘no-child-left-behind’ approach.

- It should ensure that the institution’s physical literacy activities are designed and delivered in a manner that is inclusive of students.

- Internal Committee: There is a need to create an internal committee to address specific cases where there is a failure in responsibilities to deliver the right to physical literacy of students.

- Dashboard: There is a need to create a dashboard with real time data on mapping of available playgrounds and open spaces and their utilization rates, availability and qualifications of physical education teachers, curricula, timetables, and equipment in educational institutions across the country.

International Charter of Physical Education, Physical Activity and Sport

- The International Charter of Physical Education, Physical Activity and Sport is a rights-based reference that orients and supports policy- and decision-making in sport.

- It promotes inclusive access to sport by all without any form of discrimination. It sets ethical and quality standards for all actors designing, implementing and evaluating sport programmes and policies.

- Adopted at the 20th session of the UNESCO’s General Conference (1978).

NEP 2020 and Sports

- Sports have been given a place of pride in the recent National Education Policy (NEP 2020).

- Sports, which was considered extra-curricular activity earlier is now being treated as part of the curriculum and grading in sports will be counted in the education of the children.

- Institutes of higher education and sports university are being established. There is a need to take sports sciences and sports management to the school level as that will improve the career prospects of the youth and will enhance India's presence in the sports economy.

Schemes to Promote Sports

- Sports Authority of India (Ministry of Youth Affairs & Sports)

- Khelo India Scheme

- Assistance to National Sports Federations;

- Special Awards to Winners in International sports events and their Coaches;

- National Sports Awards, Pension to Meritorious Sports Persons;

- Pandit Deendayal Upadhyay National Sports Welfare Fund;

- National Sports Development Fund; and

- Running Sports Training Centres through Sports Authority of India.

Governance

Seven Years of Jan Suraksha Schemes

For Prelims: Pradhan Mantri Suraksha Bima Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, Atal Pension Yojana, Pension Fund Regulatory and Development Authority, National Pension System.

For Mains: Pradhan Mantri Suraksha Bima Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, Atal Pension Yojana, Significances of these schemes, Welfare Schemes.

Why in News?

Recently, the Pradhan Mantri Suraksha Bima Yojana (PMSBY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Atal Pension Yojana (APY) completed 7 years of providing social security net.

- To ensure that the people from the unorganised section of the country are financially secure, the Government launched two insurance schemes –PMJJBY and PMSBY; and introduced APY to cover the exigencies in old age.

- These schemes were launched by the Prime Minister in May 2015 from Kolkata, West Bengal.

What is Pradhan Mantri Suraksha Bima Yojana (PMSBY)?

- Scheme: It is a one-year accidental insurance scheme renewable from year to year offering coverage for death or disability due to accident.

- Eligibility: Individuals in the age group of 18-70 years having a savings bank or a post office account are entitled to enroll under the scheme.

- Benefits: Accidental death cum disability cover of Rs.2 lakh (Rs.1 lakh in case of partial disability) for death or disability due to an accident.

- Achievements: As of today, the cumulative enrolments under the scheme have been more than 28.37 crore and an amount of Rs. 1,930 crore has been paid for 97,227 claims.

What is Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)?

- About: It is a one-year life insurance scheme renewable from year to year offering coverage for death due to any reason.

- Eligibility: Individuals in the age group of 18-50 years having a savings bank or a post office account are entitled to enroll under the scheme.

- Benefits: Life cover of Rs. 2 Lakh in case of death due to any reason against a premium of Rs. 330/- per annum.

- Achievements: As of today, the cumulative enrolments under the scheme have been more than 12.76 crore and an amount of Rs. 11,522 crores have been paid for 5,76,121 claims.

What is Atal Pension Yojana (APY)?

- Background: The Atal Pension Yojana (APY) was launched to create a universal social security system for all Indians, especially the poor, the under-privileged and the workers in the unorganised sector.

- It is an initiative of the Government to provide financial security and cover future exigencies for the people in the unorganized sector.

- Administered By: Pension Fund Regulatory and Development Authority (PFRDA) through the National Pension System (NPS).

- Eligibility: This scheme is open to all bank account holders in the age group of 18 to 40 years and the contributions differ, based on the pension amount chosen.

- Benefits: Subscribers would receive the guaranteed minimum monthly pension of Rs. 1000 or Rs. 2000 or Rs. 3000 or Rs. 4000 or Rs. 5000 at the age of 60 years, based on the contributions made by the subscriber after joining the scheme.

- Contribution by Central Government: The minimum pension would be guaranteed by the Government, i.e., if the accumulated corpus based on contributions earns a lower than estimated return on investment and is inadequate to provide the minimum guaranteed pension, the Central Government would fund such inadequacy.

- Alternatively, if the returns on investment are higher, the subscribers would get enhanced pensionary benefits.

- Payment frequency: Subscribers can make contributions to APY on a monthly/ quarterly / half-yearly basis.

- Achievements: As of today, more than 4 crore individuals have subscribed to the scheme.

Pension Fund Regulatory and Development Authority (PFRDA)

- It is the Statutory Authority established by an enactment of the Parliament, to regulate, promote and ensure orderly growth of the National Pension System (NPS).

- It works under the Department of Financial Services under the Ministry of Finance.

What are the Significances of these Schemes?

- These three social security schemes are dedicated to the welfare of the citizens, recognising the need for securing human life from unforeseen risks/losses and financial uncertainties.

- The PMJJBY and PMSBY provide access to low-cost life/accidental insurance cover to the people, the APY provides an opportunity for saving in the present for getting a regular pension in old age.

- The number of people who have enrolled and benefitted from these schemes over the last seven years is a testimony to their success.

- These low-cost insurance schemes and the guaranteed pension scheme are ensuring that financial security, which was available to a select few earlier, is now reaching the last person of the society.

UPSC Civil Services Examination, Previous Years Questions (PYQs)

Q.Regarding ‘Atal Pension Yojana’, which of the following statements is/are correct? (2016)

- It is a minimum guaranteed pension scheme mainly targeted at unorganized sector workers.

- Only one member of a family can join the scheme.

- Same amount of pension is guaranteed for the spouse for life after subscriber’s death.

Select the correct answer using the code given below:

(A) 1 only

(B) 2 and 3 only

(C) 1 and 3 only

(D) 1, 2 and 3

Ans: C

Indian Economy

Ethanol Blending

For Prelims: Ethanol Blending, Biofuels, Crude oil, 2018 National Policy on Biofuels

For Mains: Ethanol Blending and its significance

Why in News?

The level of ethanol blending in petrol in India has reached 9.99%.

What is Ethanol Blending?

- Ethanol: It is one of the principal biofuels, which is naturally produced by the fermentation of sugars by yeasts or via petrochemical processes such as ethylene hydration.

- Ethanol Blending Programme (EBP): It is aimed at reducing the country’s dependence on crude oil imports, cutting carbon emissions and boosting farmers’ incomes.

- Blending Target: The Government of India has advanced the target for 20% ethanol blending in petrol (also called E20) to 2025 from 2030.

What is the Significance of Ethanol Blending?

- Reduce dependency on Petroleum:

- By blending ethanol into gasoline, it can reduce the amount of petrol required to run a car, thereby reducing dependence on imported, expensive, and polluting petroleum.

- Today, India imports 85% of its oil requirements.

- By blending ethanol into gasoline, it can reduce the amount of petrol required to run a car, thereby reducing dependence on imported, expensive, and polluting petroleum.

- Save Money:

- India's net import of petroleum was 185 million tonnes in 2020-21 at a cost of USD551 billion.

- Most of the petroleum products are used in transportation and therefore, the E20 programme can save the countryUSD4 billion annually.

- Less Polluting:

- Ethanol is a less polluting fuel and offers equivalent efficiency at a lower cost than petrol.

- Availability of large arable land, rising production of foodgrains and sugarcane leading to surpluses, availability of technology to produce ethanol from plant-based sources, and the feasibility of making vehicles compliant to ethanol blended petrol (EBP) are some of the supporting arguments used in the roadmap for E20, which refers to the target as "not only a national imperative, but also an important strategic requirement".

- Ethanol is a less polluting fuel and offers equivalent efficiency at a lower cost than petrol.

What are the Related Issues?

- National Policy on Biofuel:

- The new ethanol blending target primarily focuses on food-based feedstocks, in light of grain surpluses and wide availability of technologies.

- The blueprint is a departure from the 2018 National Policy on Biofuels, which prioritized grasses and algae; cellulosic material such as bagasse, farm and forestry residue; and, items like straw from rice, wheat and corn.

- The new ethanol blending target primarily focuses on food-based feedstocks, in light of grain surpluses and wide availability of technologies.

- Risk of Hunger:

- The food grains meant for the impoverished are being sold to distilleries at prices cheaper than what states pay for their public distribution networks.

- Competition between the distilleries and the public distribution system for subsidized food grains could have adverse consequences for the rural poor and expose them to enhanced risk of hunger.

- India ranked 101st of 116 countries on the World Hunger Index 2021.

- The food grains meant for the impoverished are being sold to distilleries at prices cheaper than what states pay for their public distribution networks.

- Cost:

- Production of biofuels requires land, this impacts the cost of biofuels as well as that of food crops.

- Water use:

- Massive quantities of water are required for proper irrigation of biofuel crops as well as to manufacture the fuel, which could strain local and regional water resources.

- Efficiency:

- Fossil Fuels produce more energy than some of the biofuels. E.g. 1 gallon of ethanol produces less energy as compared to 1 gallon of gasoline (a fossil fuel).

Way Forward

- Ethanol From Wastes:

- India has a real opportunity here to become a global leader in sustainable biofuels policy if it chooses to refocus on ethanol made from wastes.

- This would bring both strong climate and air quality benefits, since these wastes are currently often burned, contributing to smog.

- India has a real opportunity here to become a global leader in sustainable biofuels policy if it chooses to refocus on ethanol made from wastes.

- Water Crisis:

- The new ethanol policy should ensure that it doesn’t drive farmers toward water-intensive crops and create a water crisis in a country where its shortage is already acute.

- Rice and sugarcane, along with wheat, consume about 80% of India’s irrigation water.

- The new ethanol policy should ensure that it doesn’t drive farmers toward water-intensive crops and create a water crisis in a country where its shortage is already acute.

- Prioritize Crop Production:

- With our depleting groundwater resources, arable land constraints, erratic monsoons, and dropping crop yields due to climate change, food production must be prioritized over crops for fuel.

- Alternative Mechanism:

- To achieve the key goal, that is emissions reduction, alternative mechanisms-enhanced Electric Vehicles uptake, installation of additional renewable generation capacity to allow zero-emissions recharging, etc.-need to be evaluated.

UPSC Civil Services Examination, Previous Years Questions (PYQs)

Q. According to India’s National Policy on Biofuels, which of the following can be used as raw materials for the production of biofuels? (2020)

- Cassava

- Damaged wheat grains

- Groundnut seeds

- Horse gram

- Rotten potatoes

- Sugar beet

Select the correct answer using the code given below:

(a) 1, 2, 5 and 6 only

(b) 1, 3, 4 and 6 only

(c) 2, 3, 4 and 5 only

(d) 1, 2, 3, 4, 5 and 6

Ans: (a)

- The National Policy on Biofuels, 2018, allows production of ethanol from damaged food grains like wheat, broken rice, etc., which are unfit for human consumption.

- The Policy also allows conversion of surplus quantities of food grains to ethanol, based on the approval of the National Biofuel Coordination Committee.

- The Policy expands the scope of raw material for ethanol production by allowing use of sugarcane juice, sugar containing materials like sugar beet, sweet sorghum, starch containing materials like corn, cassava, damaged food grains like wheat, broken rice, rotten potatoes, unfit for human consumption for ethanol production. Hence, 1, 2, 5 and 6 are correct. Therefore, option (a) is the correct answer.

Indian Heritage & Culture

Martand Sun temple

For Prelims: Site of National Importance, Karkota Dynasty.

For Mains: Lalitaditya Muktapida, Martand Sun Temple.

Why in News?

The Jammu and Kashmir Lieutenant Governor participated in a religious ceremony held in the ruins of the 8th century Martand Sun temple, a protected monument under the Archaeological Survey of India. This temple has been recognised as a “Site of national importance”.

What is the Martand Sun Temple?

- The Martand Sun Temple also known as Pandou Laidan is a Hindu temple dedicated to Surya (the chief solar deity in Hinduism) and built during the 8th century CE. Martand is another Sanskrit synonym for Surya.

- It was built by the third ruler of the Karkota Dynasty, Lalitaditya Muktapida.

- It is now in ruins, as it was destroyed by the orders of Muslim ruler Sikandar Shah Miri.

- The temple is located five miles from Anantnag in the Indian union territory of Jammu and Kashmir.

- From the ruins and related archaeological findings, it can be said it was an excellent specimen of Kashmiri architecture, which had blended the Gandharan, Gupta and Chinese forms of architecture.

- The temple appears in the list of centrally protected monuments as Kartanda (Sun Temple).

Who was Lalitaditya Muktapida?

- Lalitaditya was born in the year of 699 AD as the third son of Durlabhak-Pratapaditya of kashmir.

- He was from the Nagvanshi Karkota Kayastha Dynasty of Kashmir.

- Karkota Kayastha families were mainly serving in the army of the kings of Kashmir since decades. They were known for their remarkable courage in the battlefield.

- The Kings of Kashmir had given them the title Sakhasena for their immense contribution.

- Lalitaditya’s birth name was Muktapida and his older brothers were Chandrapida and Tarapida.

- Muktapida took over the Kingdom of Kashmir in the year 724 AD.

- It was the same time, when the western invasion had begun in India and the Arabs had already occupied the province of swat, multan, peshawar and the Kingdom of Sindh.

- The Arab king Mohammad Bin Qasim, the Arab ruler was already threatening to occupy Kashmir and central India.

- He fought the daradas, kabhojas and bhuttas of ladakh who were under Tibetan rule.

- Lalitaditya himself led the army into the war defeating all Kings and established control over the regions of Ladakh.

- The alliance between Lalitaditya and Yashovarman defeated the Arabs from entering Kashmir.

- He later invaded Turkestan via Kabul. Lalitaditya acquired most of the places in the west and south of India starting from Rashtrakutas in Maharashtra, Pallavas and Kalinga in the southern part.

- He also extended his kingdom to central China after defeating the Chinese. After which he was compared with Alexander the great.

- The Kashmir Kingdom gained enormous wealth and Lalitaditya utilized the wealth to build massive infrastructure in Kashmir, construction of temples were taken up and Kashmir saw extensive development under Lalitaditya.

- Lalitaditya was a very liberal King, though he was a strong follower of Hindu tradition, he respected all religions. He is said to be a very compassionate ruler who responded to people’s voices.

- In the year 760 AD, the Lalitaditya era came to an end by his sudden death.

What are the Key Points of the Karkota Dynasty?

- The Karkota dynasty established their power in Kashmir (early 7th century) and it emerged as a power in central Asia and northern India.

- Durlabh Vardhana was the founder of the Karkota dynasty.

- The Karkota rulers were Hindus and built spectacular Hindu temples at Parihaspur (capital).

- They also patronised Buddhism as some stupas, chaityas and viharas have been found in the ruins of their capital.

Indian History

Gopal Krishna Gokhale

For Prelims: Gopal Krishna Gokhale, Indian National Congress.

For Mains: Indian Modern History, Important Personalities.

Why in News?

The Prime Minister of India paid tribute to Gopal Krishna Gokhale on his Jayanti.

- Gopal Krishna Gokhale was a great social reformer and educationist who provided exemplary leadership to India's freedom movement.

What do we know about Gopal Krishna Gokhale?

- Birth: 9th May 1866 in Kotluk village in present-day Maharashtra (then part of the Bombay Presidency).

- Ideology:

- Gokhale worked towards social empowerment, expansion of education, struggle for freedom in India for three decades and rejected the use of reactionary or revolutionary ways.

- Role in Colonial Legislatures:

- Between 1899 and 1902, he was a member of the Bombay Legislative Council followed by work at the Imperial Legislative Council from 1902 till his death (1915).

- At the Imperial legislature, Gokhale played a key role in framing the Morley-Minto reforms of 1909.

- Role in INC:

- He was associated with the Moderate Group of Indian National Congress (joined in 1889).

- He became president of INC in 1905 in Banaras session.

- This was the time when bitter differences had arisen between his group of ‘Moderates’ and the ‘Extremists’ led by Lala Lajpat Rai and Bal Gangadhar Tilak among others. The two factions split at the Surat session of 1907.

- Despite the ideological difference, in 1907, he intensely campaigned for the release of Lala Lajpat Rai, who was imprisoned that year by the British at Mandalay in present-day Myanmar.

- Related Societies and Other Works:

- He established the Servants of India Society in 1905 for the expansion of Indian education.

- He was also associated with the Sarvajanik sabha journal started by Govind Ranade.

- In 1908, Gokhale founded the Ranade Institute of Economics.

- He started English weekly newspaper, The Hitavada (The people's paper).

- Mentor to Gandhi:

- As a liberal nationalist, he is regarded by Mahatma Gandhi as his political guru.

- Gandhi wrote a book in Gujarati dedicated to the leader titled ‘Dharmatma Gokhale’.

What is Morley-Minto Reforms 1909?

- The reforms included the admission of Indians to the Secretary of State's council, to the viceroy's executive council, and to the executive councils of Bombay and Madras, and the introduction of an elected element into legislative councils with provision for separate electorates for Muslims.

- The reforms were regarded by Indian nationalists as too cautious, and the provision of separate electorates for Muslims was resented by Hindu.

- The legislative councils at the Centre and the provinces were increased in size.

- The Act increased the maximum additional membership of the Imperial Legislative Council from 16 to 60.

- The legislative councils at the Centre and the provinces were to have four categories of members as follows:

- Ex officio members: Governor-General and members of the executive council.

- Nominated official members: Government officials who were nominated by the Governor-General.

- Nominated non-official members: Nominated by the Governor-General but were not government officials.

- Elected members: Elected by different categories of Indians.

- The elected members were elected indirectly.

- Indians were given membership to the Imperial Legislative Council for the first time.

- It introduced separate electorates for the Muslims.

- Some constituencies were earmarked for Muslims and only Muslims could vote for their representatives.

- Satyendra P Sinha was appointed the first Indian member of the Viceroy’s Executive Council.

UPSC Civil Services Examination, Previous Years Questions (PYQs)

Q. Who among the following rejected the title of Knighthood and refused to accept a position in the Council of the Secretary of State for India? (2008)

(a) Motilal Nehru

(b) M.G. Ranade

(c) G.K. Gokhale922

(d) B.G. Tilak

Ans: (c)

Important Facts For Prelims

Birth Anniversary of Maharana Pratap

Why in News?

The Prime Minister of India paid tributes to Maharana Pratap on his Jayanti.

What do we know about Maharana Pratap?

- Description:

- Rana Pratap Singh, also known as Maharana Pratap, was born on 9th May 1540 in Kumbhalgarh, Rajasthan.

- He was the 13th King of Mewar and was the eldest son of Udai Singh II

- Maharana Udai Singh II ruled the kingdom of Mewar, with his capital at Chittor.

- Udai Singh II was also a founder of the city of Udaipur (Rajasthan).

- Rana Pratap Singh, also known as Maharana Pratap, was born on 9th May 1540 in Kumbhalgarh, Rajasthan.

- Battle of Haldighati:

- The Battle of Haldighati was fought in 1576 between Rana Pratap Singh of Mewar and Raja Man Singh of Amber who was the general of the Mughal emperor Akbar.

- Maharana Pratap fought a brave war but was defeated by Mughal forces.

- It is said that Maharana Pratap’s loyal horse named Chetak, gave up his life as the Maharana was leaving the battlefield.

- Reconquest:

- After 1579, the Mughal pressure relaxed over Mewar and Pratap recovered Western Mewar including Kumbhalgarh, Udaipur and Gogunda.

- During this period, he also built a new capital, Chavand, near modern Dungarpur.

- Death:

- He died on 19th January 1597. He was succeeded by his son Amar Singh, who submitted in 1614 to Emperor Jahāngīr, son of Akbar.