Maps

Indian Polity

Governor’s Role in the Universities

For Prelims: Tamil Nadu Bill on Vice Chancellor in Universities, Role of Governor in appointment of Governor in State Universitates

For Mains: Role of Governor in Center-State Relations

Why in News?

Recently, the Kerala High Court restrained the Governor of the state in his capacity as Chancellor of universities, from passing final orders on the show cause notices he issued to Vice-Chancellors of eight universities.

- The Governor had issued the notices to the Vice-Chancellors citing violation of University Grants Commission (UGC) norms in their appointment.

What are the Governor’s Powers related Universities?

- State Universities:

- In most cases, the Governor of the state is the ex-officio chancellor of the universities in that state.

- While as Governor he functions with the aid and advice of the Council of Ministers, as Chancellor he acts independently of the Council of Ministers and takes his own decisions on all University matters.

- Central Universities:

- Under the Central Universities Act, 2009, and other statutes, the President of India shall be the Visitor of a central university.

- With their role limited to presiding over convocations, Chancellors in central universities are titular heads, who are appointed by the President in his capacity as Visitor.

- The Vice Chancellor too are appointed by the Visitor from panels of names picked by search and selection committees formed by the Union government.

- The Act adds that the President, as Visitor, shall have the right to authorise inspections of academic and non-academic aspects of the universities and also to institute inquiries.

What is the Original Intent of Making Governors hold the Office of Chancellor?

- The original intent of making Governors hold the office of Chancellor and vesting some statutory powers on them was to insulate universities from political influence.

- Recommendations of Commission:

- Sarkaria Commission:

- Justice R.S. Sarkaria Commission noted the use of discretion by some Governors in some university appointments had come in for criticism.

- It acknowledged the distinction between the Governor’s constitutional role and the statutory role performed as a Chancellor, and also underlined that the Chancellor is not obliged to seek the government’s advice.

- M.M. Punchhi Commission:

- Noting that the Governor should not be “burdened with positions and powers, which may expose the office to controversies or public criticism, it advised against conferring statutory powers on the Governor.

- Sarkaria Commission:

What is the UGC’s role in this?

- Education comes under the Concurrent List, but entry 66 of the Union List — “coordination and determination of standards in institutions for higher education or research and scientific and technical institutions” gives the Centre substantial authority over higher education.

- The University Grants Commission plays that standard-setting role, even in the case of appointments in universities and colleges.

- According to the UGC (Minimum Qualifications for Appointment of Teachers and other Academic Staff in Universities and Colleges and other Measures for the Maintenance of Standards in Higher Education) Regulations, 2018, the “Visitor/Chancellor” — mostly the Governor in states — shall appoint the VC out of the panel of names recommended by search-cum-selection committees.

- Higher educational institutions, particularly those that get UGC funds, are mandated to follow its regulations.

- These are usually followed without friction in the case of central universities but are sometimes resisted by the states in the case of state universities.

Way Forward

- The time may have come for all States to reconsider having the Governor as the Chancellor.

- However, they should also find alternative means of protecting university autonomy so that ruling parties do not exercise undue influence on the functioning of universities.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q1. With reference to the Legislative Assembly of a State in India, consider the following statements: (2019)

- The Governor makes a customary address to Members of the House at the commencement of the first session of the year.

- When a State Legislature does not have a rule on a particular matter, it follows the Lok Sabha rule on that matter.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (c)

- Article 176(1) of the Constitution of India enjoins that the Governor shall address both the Houses assembled together at the commencement of the first Session after each general election to the Assembly and at the commencement of the first session of each year and inform the Legislature of the causes of its Summons. Hence, statement 1 is correct.

- Article 208 deals with the Rules of Procedure in State Legislatures. It states that:

- (1) A House of the Legislature of a State may make rules for regulating subject to the provisions of this Constitution, its procedure and the conduct of its business.

- (2) Until rules are made under clause (1), the rules of procedure and standing orders in force immediately before the commencement of this Constitution with respect to the Legislature for the corresponding Province shall have effect in relation to the Legislature of the State subject to such modifications and adaptations as may be made therein by the Speaker of the Legislative Assembly, or the Chairman of the Legislative Council, as the case may be.

- So, in case, when there is no rule on a particular subject in the State Legislature, under a convention since colonial times, state legislatures follow the rules of the Lok Sabha. Hence, statement 2 is correct. Therefore, option (c) is the correct answer.

Q2. Consider the following statements: (2018)

- No criminal proceedings shall be instituted against the Governor of a State in any court during his term of office.

- The emoluments and allowances of the Governor of a State shall not be diminished during his term of office.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (c)

Exp:

- Article 361 of the Indian Constitution provides certain immunities to the President of India and the Governor of the States:

- No criminal proceedings whatsoever shall be instituted or continued against the President, or the Governor of a State, in any court during his term of office. Hence, statement 1 is correct.

- No process for the arrest or imprisonment of the President, or the Governor of a State, shall issue from any court during his term of office.

- No civil proceedings against the President, or the Governor, shall be instituted during his term of office in any court in respect of any act done by him in his personal capacity. However, after giving two months’ notice, civil proceedings can be instituted against him during his term of office in respect of his personal acts done before or after entering the office.

- Article 158 states that the emoluments and allowances of the Governor shall not be diminished during his term of office. Hence, statement 2 is correct. Therefore, option (c) is the correct answer.

Mains

Q. Whether the Supreme Court Judgment (July 2018) can settle the political tussle between the Lt. Governor and elected government of Delhi? Examine. (2018)

Q. Discuss the essential conditions for exercise of the legislative powers by the Governor. Discuss the legality of re-promulgation of ordinances by the Governor without placing them before the Legislature. (2022)

Indian Polity

All Employees Can opt for PF Pensions Scheme

For Prelims: Employees’ Pension (Amendment) Scheme, 2014, EPFO, Supreme Court.

For mains: Supreme Court on PF Pension Scheme and its Implications.

Why in News?

In a significant ruling, the Supreme Court has upheld the Employees’ Pension (Amendment) Scheme, 2014 but quashed the threshold limit of Rs 15,000 monthly salary for joining the pension fund.

What is the Employees' Pension Scheme?

- About:

- EPF Pension, which is technically known as Employees’ Pension Scheme (EPS), is a social security scheme provided by the Employees’ Provident Fund Organisation (EPFO).

- The scheme was first launched in 1995.

- The scheme, provided by EPFO, makes provisions for pensions for the employees in the organized sector after the retirement at the age of 58 years.

- Employees who are members of EPF automatically become members of EPS.

- Both employer and employee contribute 12% of employee’s monthly salary (basic wages plus dearness allowance) to the Employees’ Provident Fund (EPF) scheme.

- EPF scheme is mandatory for employees who draw a basic wage of Rs. 15,000 per month.

- Of the employer's share of 12 %, 8.33 % is diverted towards the EPS.

- Central Govt. also contributes 1.16% of employees’ monthly salary.

- EPF Pension, which is technically known as Employees’ Pension Scheme (EPS), is a social security scheme provided by the Employees’ Provident Fund Organisation (EPFO).

- EPS (Amendment) Scheme, 2014:

- The EPS amendment of 2014, had raised the pensionable salary cap to Rs 15,000 a month from Rs 6,500 a month, and allowed only existing members (as on September 1, 2014) along with their employers exercise the option to contribute 8.33% on their actual salaries (if it exceeded the cap) towards the pension fund. This was extendable by another six months at the discretion of the Regional Provident Fund Commissioner.

- It, however, excluded new members who earned above 15,000 and joined after September 2014 from the scheme completely.

- The amendment, however, required such members to contribute an additional 1.16% of their salary exceeding ₹ 15,000 a month towards the pension fund.

What is the SC’s Judgement?

- Under Article 142, the Supreme Court ruling gives EPFO members, who have availed of the EPS, another opportunity over the next four months to opt and contribute up to 8.33% of their actual salaries as against 8.33% of the pensionable salary capped at Rs 15,000 a month towards pension.

- Under the pre-amendment scheme, the pensionable salary was computed as the average of the salary drawn during the 12 months prior to exit from membership of the Pension Fund. The amendments raised this to an average of 60 months prior to exit from the membership of the Pension Fund.

- The court held the amendment requiring members to contribute an additional 1.16 % of their salary exceeding Rs 15,000 a month as ultra vires the provisions of the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952.

What are the Implications?

- People who have subscribed to EPF will be able to get pension on their full salary instead of Rs. 15000 cap.

- Employees and Employers, who have contributed to the EPF without any approval from Assistant Provident Commissioner, may not get the benefit of judgment.

- Amendment done in 2014 may remain applicable to the companies which manage their EPF corpus through trusts.

UPSC Civil Services Examination Previous Year Question (PYQ)

Q. With reference to casual workers employed in India, consider the following statements: (2021)

- All casual workers are entitled for Employees Provident Fund coverage.

- All casual workers are entitled for regular working hours and overtime payment.

- The government can by a notification specify that an establishment or industry shall pay wages only through its bank account.

Which of the above statements are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)

Ethics, Integrity & Aptitude

Ethical Mode of Governance for India

For Mains: Ethical Mode of Governance for India

Why in News?

The Former Governor of West Bengal has spoken about the significance of ethical governance in India.

What is Ethical Governance?

- Ethical governance is a way of governing which infuses high standards of moral values and behaviour in the governance process.

- For example, a bureaucrat is bound to serve the people that come to his office, but he couldn't be penalized if he doesn't make provisions for a glass of water to an elderly couple who might be tired after waiting too long in the queue. Those will be the ethics of public service and altruism that will make him do that.

- Similarly, an official should allow disbursal of Public Distribution System (PDS) ration to beneficiaries particularly for women and senior citizens, even if there is a failure of Aadhaar identification due to mismatch of biometric data. It is important to understand that denial of such services may cost a person his life. Hence, compassion and human dignity forms the basis of ethical governance.

- Ethical governance is the much-needed approach for establishing trust and mutual cooperation between citizens and public servants.

What are the Key Elements of Ethical Governance?

- Ethical governance means governance based on a certain value premise, which is also “good”. For example, probity, integrity, compassion, empathy, responsibility, social justice etc. without which ethical issues can’t be upheld.

- Probity would ensure that the sole purpose of administration is public interest, thereby devoid of any wrongdoing.

- Responsibility, not merely accountability, ensures the inculcation of internal accountability for every act of omission or commission in the form of judgement based on one’s conscience. If this is attained then there would be no question of corruption.

- In order for a nation to compete globally, eliminating corruption is not just a moral imperative, but also an economic necessity.

- Rule of law should be one of the most important elements of ethical governance in order to eliminate corruption and reduce bureaucratic delays.

- Rule of law checks arbitrariness in governance, thereby reducing chances of misusing discretion.

What are the Ethical Issues in the Indian Governance?

- A Violation of Authority or Rank Position: Officials make actions that are out of their position, responsibilities and rights that, finally, cause damage to the interests of the state or certain citizens.

- Negligence: A public official either does not perform his professional responsibilities or performs them in a delinquent manner, causing damage to the state or community.

- Bribery: Corruption and bribery have become acceptable parts of society, lubricating the wheels of commerce.

- Complacency: There is a core of exceptionally hardworking, dedicated and conscientious officers, but they are overwhelmingly outnumbered by the complacent, who are obsessed with status, rank, and emoluments and addicted to habits of personal luxury.

- Patronization: The post-retirement assignment of senior officers to Regulatory bodies and other important posts is largely done on patronage with no set guidelines.

- Administrative Secrecy: The purpose of administrative secrecy is to serve the public interest while maintaining private interests. Therefore, transparency is one of the most important virtues of ethical governance

- Nepotism: Neglecting the merit principle by appointing relatives or friends to public positions may degrade the quality of public services.

- Lack of Compassion: Indifference towards the feelings or the convenience of individuals and by an obsession with the binding and inflexible authority of departmental decisions, precedents, arrangements or forms, regardless of how badly or with what injustice they work in individual cases.

Way Forward

- Effective Laws: Effective laws will require civil servants to give reasons for their official decisions.

- New Management Approaches: To encourage all public officials and civil servants to deal positively with corruption and unethical practice when encountered.

- Strengthening the Whistleblower Protection Regime: Whistle-blower’ protection law to protect appropriate 'public interest disclosures' of wrongdoing by officials.

- Ethics Audits: To identify risks to the integrity of the most important processes.

- Second ARC Recommendation: In Its wide-ranging recommendations, it has suggested partial state funding of elections; tightening of anti-defection law and code of ethics for ministers, legislatures, judiciary and civil servants.

- To Check Corruption: Second Administrative Reforms Commission (ARC) proposed tightening the provision of Prevention of Corruption Act,1988 making corrupt public servants liable for paying damages, confiscation of property illegally acquired and speedy trials.

UPSC Civil Services Examination Previous Year Question (PYQ)

Q. Distinguish between “Code of ethics” and “Code of conduct” with suitable examples. (2018)

Q. Explain the process of resolving ethical dilemmas in Public Administration. (2018)

Q. Suppose the Government of India is thinking of constructing a dam in a mountain valley bond by forests and inhabited by ethnic communities. What rational policy should it resort to in dealing with unforeseen contingencies. (2018)

Indian Economy

Single GST Rate

For Prelims: Goods and Services Tax & It’s Framework

For Mains: Reforms suggested in GST, Framework of GST

Why in News?

Recently, the Chairman of the Prime Minister’s Economic Advisory Council, in his personal capacity, has stated that India should have a “Single Goods and Services Tax (GST) Rate” and an “Exemption-less Tax Regime”.

What are the Suggestions?

- Single GST Rate:

- GST rates should be the same on all goods as ‘progressive’ rates work best with direct taxes, not indirect taxes.

- When the GST was first announced, the National Council of Applied Economic Research (NCAER) estimated that it would lead to a 1.5% to 2% increment to the Gross Domestic Product (GDP).

- However, the estimate was based on the premise that all goods and services will be part of GST and there would be a single GST.

- Different GST rates allows a mindset of ‘prime control’ whereby GST rates are pegged higher for items considered ‘elitist’ and lower for items of mass consumption, resulting in differentiation and subjective interpretation and litigation.

- Tax rates need to go higher than the current average of 11.5% as opposed to the 17% revenue-neutral rate for GST officially estimated earlier.

- ‘Exemption-less’ Direct Tax Regime:

- The chairman called for an exemption-less direct tax regime with the argument that while tax evasion is illegal, tax avoidance, by using exemption clauses to reduce tax burden, is legitimate.

- More tax exemptions also lead to an increase in cases of tax complications.

- The artificial difference between corporate taxes and personal income taxes (PIT) should be removed.

- A lot of unincorporated businesses pay taxes under personal income taxes.

- The removal of differences using exemption-less direct tax system will also reduce administrative compliance.

- The chairman called for an exemption-less direct tax regime with the argument that while tax evasion is illegal, tax avoidance, by using exemption clauses to reduce tax burden, is legitimate.

What is the Current Framework of the GST System?

- About GST:

- The Goods and Services Tax (GST) is a value-added tax levied on most goods and services sold for domestic consumption.

- The GST is paid by consumers, but it is remitted to the government by the businesses selling the goods and services.

- It is essentially a consumption tax and is levied at the final consumption point.

- It was introduced through the 101st Constitution Amendment Act, 2016.

- It has subsumed indirect taxes like excise duty, Value Added Tax (VAT), service tax, luxury tax etc.

- The Goods and Services Tax (GST) is a value-added tax levied on most goods and services sold for domestic consumption.

- Existing Tax Structure:

- Central GST (CGST) covers Excise duty, Service tax etc.

- State GST (SGST) covers Value Added Tax (VAT), luxury tax etc.

- Integrated GST (IGST) covers inter-state trade.

- IGST is not a tax but a system to coordinate state and union taxes.

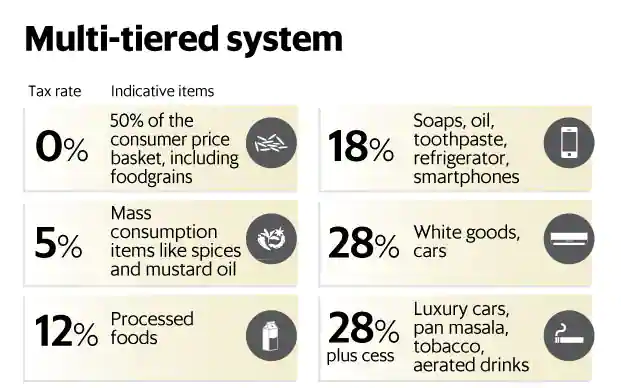

- There are four major GST slabs:

- 5%, 12%, 18% and 28%.

- Some demerit and luxury goods, which are in the 28% bracket, attract additional levy of cesses, the proceeds of which go to a separate fund meant to compensate states for revenue shortfall and repayment of compensation related loans.

- GST Council:

- Article 279A of the Indian Constitution states that the GST Council to be formed by the President to administer & govern GST.

- Its chairman is Union Finance Minister of India with ministers nominated by the state governments as its members.

- The council is devised in such a way that the centre will have 1/3rd voting power and the states have 2/3rd.

- The decisions are taken by 3/4th majority.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q1. Consider the following items: (2018)

- Cereal grains hulled

- Chicken eggs cooked

- Fish processed and canned

- Newspapers containing advertising material

Which of the above items is/are exempted under GST (Good and Services Tax)?

(a) 1 only

(b) 2 and 3 only

(c) 1, 2 and 4 only

(d) 1, 2, 3 and 4

Ans: (c)

Exp:

- Certain goods are kept under nil or 0% GST rate to benefit the masses. No GST is imposed on items like edible vegetables, roots and tubers, cereals, fish (not frozen or processed, fresh fruits and vegetables (other than frozen or processed), meat (other than in frozen state and put up in unit containers), cane jaggery (gur), tender coconut water, silkworm laying cocoon,raw silk, silk waste, wool, not carded or combed, cotton used in Gandhi Topi, cotton used in Khadi Yarn, coconut, coir fibre, jute fibre raw or processed but not spun, puja samagri, live animals (except horses), all goods of seed quality, coffee beans, not roasted, unprocessed green tea leaves, fresh ginger, fresh turmeric (other than in processed form), human blood and its components, all types of contraceptives, organic manure, other than those bearing brand name, kumkum, bindi, sindhur, alta, firewood or fuel wood, wood charcoal, betel leaves, judicial, nonjudicial stamp papers, court fee stamps when sold by the government treasuries or authorized vendors, postal items like envelope, post card etc. solid by government, rupee notes when sold to the RBI and cheques, printed books, including braille books, newspaper, maps, earthen pot and clay lamps, bangles (except those made from precious metals), agricultural implements manually operated or animal driven, hand tools, such as spades shovels, handloom, spacecraft, hearing aids. All the mentioned items in the given question, except processed and canned fish are included in the exemptions under the GST.

- Therefore, option (c) is the correct answer.

Q2. What is/are the most likely advantages of implementing ‘Goods and Services Tax (GST)’?(2017)

- It will replace multiple taxes collected by multiple authorities and will thus create a single market in India.

- It will drastically reduce the ‘Current Account Deficit’ of India and will enable it to increase its foreign exchange reserves.

- It will enormously increase the growth and size of economy of India and will enable it to overtake China in the near future.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (a)

Exp:

- GST is a dual levy where the Central Government levies and collects Central GST (CGST) and the State Government levies and collects State GST (SGST) on intra-state supply of goods and services. The Centre also levies and collects Integrated GST (IGST) on the interstate supply of goods or services. Thus, GST is a unifier that has integrated various taxes being levied by the Centre and the State and has provided a platform for forging an economic union of the country.

- Advantages

- It will help to create a unified common national market in India by subsuming all the taxes in a single tax called the Goods and Services Tax (GST), giving a boost to foreign investment and “Make in India” campaign. Hence, statement 1 is correct.

- It provides common procedures for registration of taxpayers, refund of taxes, uniform formats of tax return, common tax base, and a common system of classification of goods and services that will lend greater certainty to the taxation system.

- It will boost export and manufacturing activity, generate more employment and thus increase GDP with gainful employment leading to substantive economic growth, but it is not necessary that it will enable India to overtake China in the near future. Hence, statement 3 is not correct.

- It might decrease Current Account Deficit (CAD) by boosting exports and bringing more FOREX. But, it is not necessary that there will be drastic change in the reduction of CAD. Hence, statement 2 is not correct.

- Therefore, option (a) is the correct answer.

Mains

Q. Explain the rationale behind the Goods and Services Tax (Compensation to States) Act of 2017. How has COVID-19 impacted the GST compensation fund and created new federal tensions? (2020)

Q. Enumerate the indirect taxes which have been subsumed in the Goods and Services Tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017. (2019)

Q. Explain the salient features of the Constitution (One Hundred and First Amendment) Act, 2016. Do you think it is efficacious enough “to remove cascading effect of taxes and provide for common national market for goods and services”? (2017)

Q. Discuss the rationale for introducing the Goods and Services Tax (GST) in India. Bring out critically the reasons for the delay in roll out for its regime. (2013)

Geography

Types of Eclipses

For Prelims: Lunar Eclipse, Solar Eclipse, Full Moon, Reyleigh Scattering.

For Mains: Total Lunar Eclipse.

Why in News?

Recently, a Total Lunar Eclipse (TLE) occurred on 8th November, 2022.

- Earlier Indian witnessed a Partial Solar Eclipse in October 2022.

What is the Lunar Eclipse?

- About:

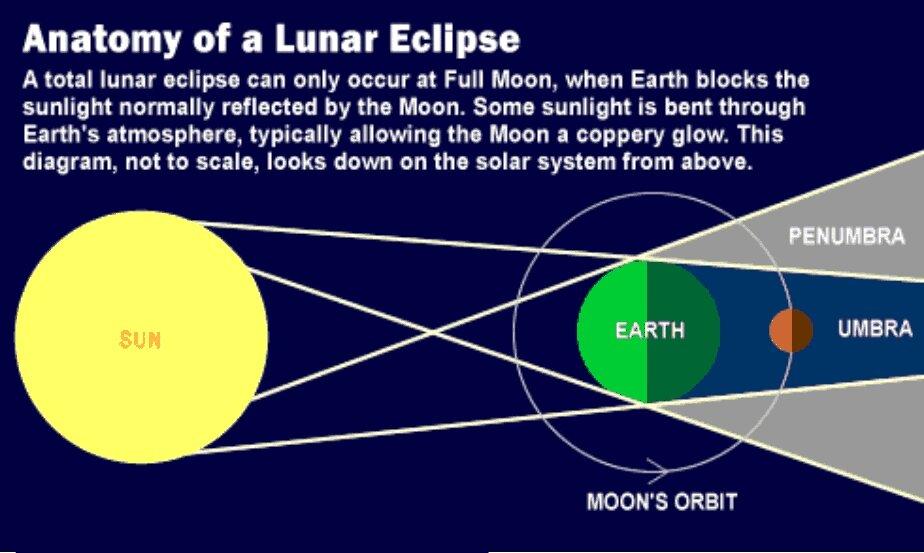

- Lunar eclipse takes place when the Moon moves into the Earth’s shadow. The Earth has to be directly between the Sun and the Moon, and a lunar eclipse can only take place during a full Moon.

- First, the Moon moves into the penumbra – the part of the Earth’s shadow where not all of the light from the Sun is blocked out. Part of the Moon’s disc will look dimmer than a regular full Moon.

- And then the Moon moves into the Earth’s umbra, where direct light from the Sun is totally blocked out by the Earth. This means the only light reflecting off the Moon’s disc has already been refracted, or bent, by the Earth’s atmosphere.

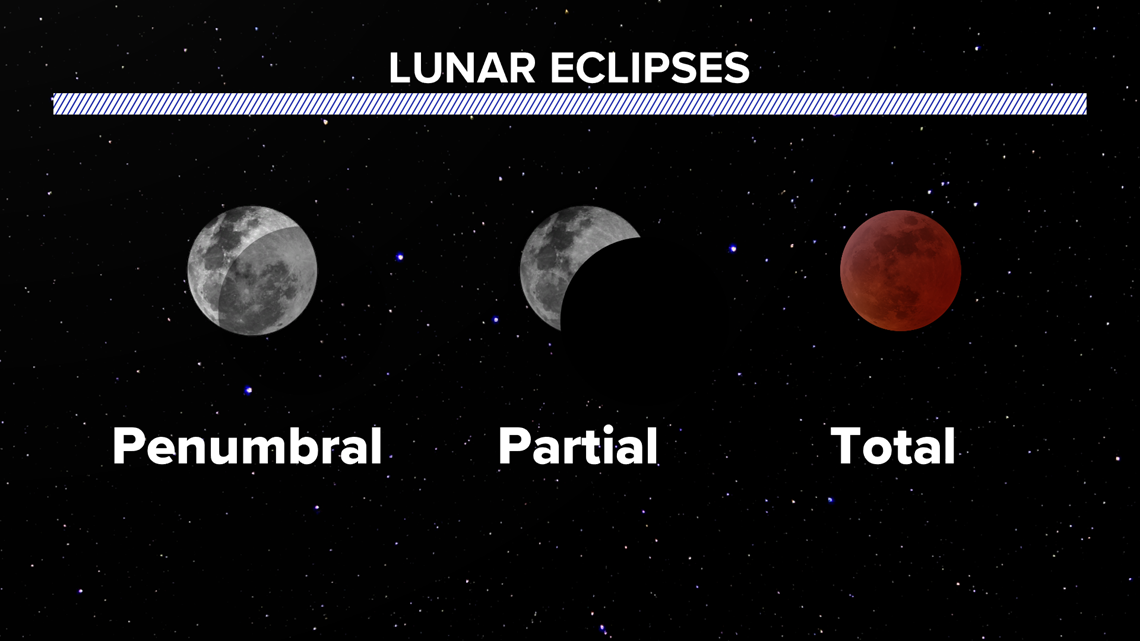

- Total Lunar Eclipse:

- A Total Lunar Eclipse happens when the earth is positioned between the sun and the moon and casts a shadow on the latter.

- During this, the whole of the lunar disc enters the Earth’s umbra, so the Moon appears reddish (Blood Moon).

- The moon takes on a reddish hue due to a phenomenon called Rayleigh scattering.

- Rayleigh scattering is the scattering of light by particles in a medium without a change in wavelength. This is also the reason why the sky appears blue.

- The moon turns red during the eclipse since the only sunlight reaching it is passing through the earth’s atmosphere. The sunlight scatters due to the dust or clouds in the atmosphere producing the red colour.

- Total lunar eclipses occur, on average, about once every year and a half, according to NASA (National Aeronautics and Space Administration).

- Partial lunar eclipse:

- An imperfect alignment of Sun, Earth and Moon results in the Moon passing through only part of Earth's umbra.

- The shadow grows and then recedes without ever entirely covering the Moon.

- Penumbral eclipse:

- The Moon travels through Earth’s penumbra, or the faint outer part of its shadow.

- The Moon dims so slightly that it can be difficult to notice.

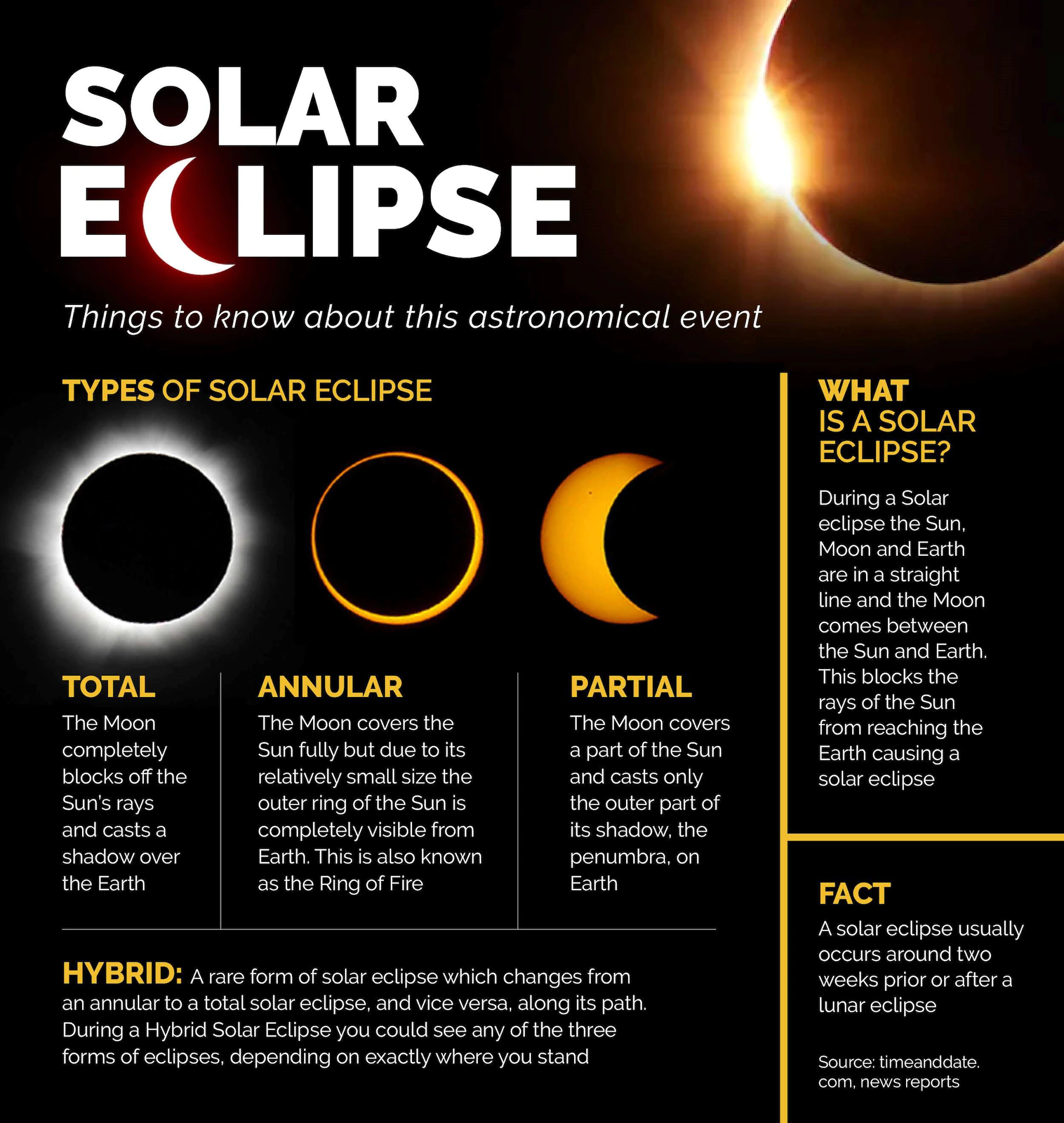

What is Solar Eclipse?

- About:

- A solar eclipse happens when the Moon passes between the Sun and Earth, casting a shadow on Earth that either fully or partially blocks the Sun’s light in some areas.

- Types:

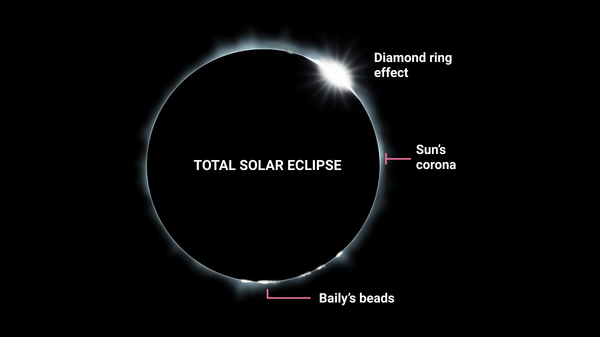

- Total Solar Eclipse:

- Total solar eclipses occur when the New Moon comes between the Sun and Earth and casts the darkest part of its shadow, the umbra, on Earth. A full solar eclipse, known as totality, is almost as dark as night.

- During a total eclipse of the Sun, the Moon covers the entire disk of the Sun.

- When the Moon completely covers the disk of the Sun, only the Sun's corona is visible.

- It is called Total eclipse because at the maximum point of the eclipse (midpoint of time of totality), the sky goes dark and temperatures can fall.

- Annular Solar Eclipse:

- An annular solar eclipse happens when the Moon passes between the Sun and Earth, but when it is at or near its farthest point from Earth.

- Because the Moon is farther away from Earth, it appears smaller than the Sun and does not completely cover the Sun.

- As a result, the Moon appears as a dark disk on top of a larger, bright disk, creating what looks like a ring around the Moon.

- Partial Solar Eclipse:

- A partial solar eclipse happens when the Moon passes between the Sun and Earth but the Sun, Moon, and Earth are not perfectly lined up.

- Only a part of the Sun will appear to be covered, giving it a crescent shape. During a total or annular solar eclipse, people outside the area covered by the Moon’s inner shadow see a partial solar eclipse.

- Hybrid Solar Eclipse:

- Because Earth's surface is curved, sometimes an eclipse can shift between annular and total as the Moon’s shadow moves across the globe.

- This is called a hybrid solar eclipse.

- Total Solar Eclipse:

Important Facts For Prelims

Law Commission of India

Why in News?

Retired High Court Chief Justice Rituraj Awasthi has been appointed as the chairperson of the 22nd law commission of India which was constituted in 2020.

What is the Law Commission of India?

- About:

- The Law Commission of India is a non-statutory body constituted by the Government of India from time to time.

- The first Law Commission of independent India was established in 1955 for a three-year term.

- The first Law Commission was established during the British Raj era in 1834 by the Charter Act of 1833 and was chaired by Lord Macaulay.

- The Law Commission of India is a non-statutory body constituted by the Government of India from time to time.

- Objectives:

- It works as an advisory body to the Ministry of Law and Justice.

- The Law Commission undertakes research in law and review of existing laws in India for making reforms therein and enacting new legislations on a reference made to it by the Central Government or suo-motu.

- Composition:

- Apart from having a full-time chairperson, the commission will have four full-time members, including a member-secretary.

- Law and Legislative Secretaries in the Law Ministry will be the ex-officio members of the commission.

- It will also have not more than five part-time members.

- A retired Supreme Court judge or Chief Justice of a High Court will head the Commission.

What are the Important Recommendations of the Commission?

- The Law Commission in its 262nd Report recommended abolition of the death penalty for all crimes except terrorism-related offences and waging war against the state.

- Its report on electoral reforms (1999) had suggested simultaneous Lok Sabha and state assembly elections to improve governance and stability.

- The Criminal Procedure (Identification) Act, 2022 which replace the Identification of Prisoners Act,1920 was also proposed by the Law Commission of India.

-

The 21st Law commission in its recommendation in 2018 said that Uniform Civil Code (UCC) is “neither necessary nor desirable at this stage”.

-

Now, the center has requested the 22nd Law Commission of India to undertake an examination of various issues relating to the same.

-

Important Facts For Prelims

New Species of Estuarine Crab

Why in News?

Recently, researchers have discovered a new species of Estuarine Crab at the Mangroves of Parangipettai near the Vellar River estuary (an area where river meets the ocean) in Cuddalore district, Tamil Nadu.

- The species has been named ‘Pseudohelice Annamalai’ in recognition of Annamalai University’s 100 years of service in education and research.

What are the Key Facts about Pseudohelice Annamalai?

- About:

- This is the first ever record of this genus, Pseudohelice, collected from high intertidal areas in front of the Centre of Advanced Study (CAS).

- Till date, only two species, namely “Pseudohelice Subquadrata” and “Pseudohelice Latreilli” have been confirmed within this genus.

- This is the first ever record of this genus, Pseudohelice, collected from high intertidal areas in front of the Centre of Advanced Study (CAS).

- Geography:

- The species discovered is distributed around the Indian subcontinent and the eastern Indian Ocean.

- Features:

- Pseudohelice annamalai is distinguished by dark purple to dark grey colouring, with irregular light brown, yellowish brown, or white patches on the posterior carapace with light brown chelipeds.

- The new species is small and has a maximum width of up to 20 mm.

- This species is not aggressive and can move fast like other intertidal crabs.

- Habitat:

- The species inhabits muddy banks of mangroves, and the burrows were located near the pneumatophores of Avicennia mangroves.

- Burrows have a depth of 25-30 cm and are branched, with larger pellets around the entrance.

- Significance:

- The occurrence of Pseudohelice in India links the distribution gap between the western Indian Ocean and the western Pacific Ocean.

- The new species provides additional evidence of the geographic isolation of the eastern Indian Ocean for some marine organisms

Important Facts For Prelims

India’s First Private Launch Vehicle

Why in News?

Space technology startup Skyroot Aerospace is set to make history by sending India’s first privately developed rocket Vikram-S into space between 12th and 16th November, 2022 under the ‘Prarambh’ Mission.

- Skyroot Aerospace is an Indian startup in the aerospace business.

What is Vikram-S?

- The Vikram-S rocket is a single-stage sub-orbital launch vehicle which would carry three customer payloads.

- Sub-orbital flight are those vehicles which are travelling slower than the orbital velocity – meaning it is fast enough to reach outer space but not fast enough to stay in an orbit around the Earth.

- It would help test and validate the majority of the technologies in the Vikram series of space launch vehicles.

- Skyroot has been working on three different Vikram rocket versions.

- The Vikram-I can launch with 480 kilograms of payload, whereas the Vikram-II is designed to do so with 595 kilos and Vikram-III has a 500 km Low Inclination Orbit launch capability with 815 kg.

What is the Prarambh Mission?

- The Prarambh mission is aimed at carrying three payloads into space, including a 2.5-kilogram payload that has been developed by students from several countries.

- The Prarambh mission and the Vikram-S rocket were developed by the Hyderabad-based startup with extensive support from Indian Space Research Organisation (ISRO) and IN-SPACe (Indian National Space Promotion and Authorisation Centre).

Important Facts For Prelims

National Geoscience Awards -2022

Why in News?

The Ministry of Mines invites nominations for the National Geoscience Awards (NGA)-2022 for contributions in the field of fundamental/applied geosciences, mining, and allied areas.

- Geoscience is an all-encompassing term used to refer to the Earth Sciences. Geoscientists can come from such fields as the atmospheric sciences, geology, hydrology, mineralogy, petrology, pedology, and oceanography.

What are the Key Points of the Awards?

- About:

- It was instituted by the Ministry of Mines in 1966 and given annually.

- It is an initiative to encourage geoscientists to strive toward excellence.

- Any citizen of India with a significant contribution in any of the fields specified in Clause-2 of the NGA Regulation 2022 will be eligible for these awards.

- Broad Disciplines: -

- Mineral Discovery & Exploration

- Mining, Mineral Beneficiation & Sustainable Mineral Development

- Basic Geosciences

- Applied Geosciences

- Categories:

- National Geoscience Award for Lifetime Achievement:

- Award for Lifetime Achievement shall be given to an individual with an exceptionally high lifetime achievement for sustained and significant contributions in any of the disciplines mentioned in Clause-2 of NGA Regulation 2022.

- The award carries a cash prize of Rs. 5,00,000/- and a certificate.

- National Geoscience Award:

- National Geoscience Award shall be given to individuals or team(s) in recognition of meritorious contribution in any of the disciplines mentioned in Clause-2 of NGA Regulation 2022.

- Each award carries a cash prize of Rs. 3,00,000/- and a certificate. In the case of a team award, the award money will be equally divided.

- National Geoscience Award for Lifetime Achievement:

- National Young Geoscientist Award:

- Young Geoscientist Award shall be given for outstanding research work in any field of geosciences to an individual below 35 years of age as on the 31st December 2021.

- The award carries a cash prize of Rs. 1,00,000 plus a research grant of Rs. 5,00,000/- spread over five years subject to satisfactory yearly progress and a certificate.