Indian Polity

EWS Quota

Why in News

Recently, the Supreme Court (SC) has questioned the methodology adopted by the government in fixing Rs. 8 lakh as the annual income limit to identify the Economically Weaker Section (EWS) for providing 10% quota in public jobs and educational institutions.

Key Points

- About:

- The 10% EWS quota was introduced under the 103rd Constitution (Amendment) Act, 2019 by amending Articles 15 and 16.

- It inserted Article 15 (6) and Article 16 (6).

- It is for economic reservation in jobs and admissions in education institutes for Economically Weaker Sections (EWS).

- It was enacted to promote the welfare of the poor not covered by the 50% reservation policy for Scheduled Castes (SCs), Scheduled Tribes (STs) and Socially and Educationally Backward Classes (SEBC).

- It enables both Centre and the states to provide reservation to the EWS of society.

- The 10% EWS quota was introduced under the 103rd Constitution (Amendment) Act, 2019 by amending Articles 15 and 16.

- Significance:

- Addresses Inequality:

- The 10% quota is progressive and could address the issues of educational and income inequality in India since the economically weaker sections of citizens have remained excluded from attending higher educational institutions and public employment due to their financial incapacity.

- Recognition of the Economic Backwards:

- There are many people or classes other than backward classes who are living under hunger and poverty-stricken conditions.

- The proposed reservation through a constitutional amendment would give constitutional recognition to the poor from the upper castes.

- Reduction of Caste Based Discrimination:

- Moreover, it will gradually remove the stigma associated with reservation because reservation has historically been related with caste and most often the upper caste look down upon those who come through the reservation.

- Addresses Inequality:

- Concerns:

- Unavailability of Data:

- The Statement of Object and Reason in the EWS bill clearly mentioned that the economically weaker sections of citizens have largely remained excluded from attending the higher educational institutions and public employment on account of their financial incapacity to compete with the persons who are economically more privileged.”

- This is at best a wild guess or a supposition because the government has not produced any data to back this point.

- Breaches Reservation Cap:

- In the Indira Sawhney case 1992, the nine-judge Constitution bench put a cap of 50%.

- The EWS quota breaches this limit, without even putting this issue into consideration.

- Arbitrary Criteria:

- The criteria used by the government to decide the eligibility for this reservation is vague and is not based on any data or study.

- Even the SC questioned the government whether they have checked the GDP per capita for every State while deciding the monetary limit for giving the EWS reservation.

- Statistics show that the per capita income in states differs widely - Goa is the state having the highest per capita income of almost Rs. 4 lakh whereas Bihar is at the bottom with Rs.40,000.

- Unavailability of Data:

Way Forward

- Reservation adversely affects all the categories except the EWS by shrinking the competitive pool accessible to them. Empirically, it does not seem justifiable as candidates from EWS are already well represented in higher educational institutions.

- It is high time now that the Indian political class overcame its tendency of continually expanding the scope of reservation in pursuit of electoral gains, and realised that it is not the panacea for problems.

- Instead of giving reservation based on different criterias government should focus on quality of education and other effective social upliftment measures. It should create a spirit of entrepreneurship and make them job-givers instead of a job seeker.

Governance

Palk Bay Scheme and Marine Fisheries Bill

Why in News

The Union Government is considering increasing the unit cost of deep-sea fishing vessels from Rs 80 L to Rs 1.3 Cr under the Palk Bay scheme to make it more attractive to fisherfolk.

- Earlier, the Marine Fisheries Bill 2021 was tabled in the Parliament during the Monsoon session.

Key Points

- About Palk Bay Scheme:

- The Scheme, “Diversification Of Trawl Fishing Boats From Palk Straits Into Deep Sea Fishing Boats”, was launched in 2017 as a Centrally Sponsored Scheme.

- It was launched as part of the umbrella Blue Revolution Scheme.

- The Blue Revolution is part of the Government's efforts to promote fishing as an allied activity for farmers in order to double their incomes.

- It is a Tamil Nadu-specific scheme aimed at providing 2,000 vessels in three years to fishermen of the State and motivating them to abandon bottom trawling.

- Bottom trawling, an ecologically destructive practice, involves trawlers dragging weighted nets along the sea-floor, causing great depletion of aquatic resources.

- Another objective of the scheme is to “reduce fishing pressure” around the proximity of the International Maritime Boundary Line (IMBL) so that Tamil Nadu fishermen do not cross the IMBL and fish in Sri Lankan waters.

- The Funding pattern of the scheme is Centre 50%, State 20%, Institutional funding 10% and Beneficiary 20%.

- The Scheme is limited to vessels costing upto Rs. 80 Lakh.

- The scheme is not part of Pradhan Mantri Matsya Sampada Yojana.

- Marine Fisheries Bill:

- The Bill proposes to only grant licenses to vessels registered under the Merchant Shipping Act, 1958, to fish in the Exclusive Economic Zone (EEZ).

- It also proposes punishments for fishermen breaching the EEZ without a licence, not complying with Indian Coast Guard (ICG) orders, and obstructing ICG officials.

- The Bill prohibits fishing by foreign fishing vessels, thus nationalising our EEZ.

- It proposes social security for fish workers and calls for protection of life at sea during severe weather events.

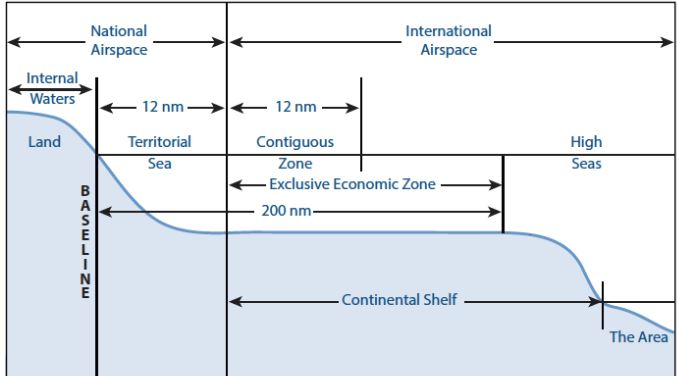

Maritime Zones

- Under UNCLOS (United Nations Convention on the Law of the Sea - 1982), which India ratified in 1995, the sea and resources in the water and the seabed are classified into three zones - the Internal Waters (IW), the Territorial Sea (TS) and the Exclusive Economic Zone (EEZ).

- The IW is on the landward side of the baseline - it includes gulfs and small bays.

- The TS extends outwards to 12 nautical miles from the baseline - coastal nations enjoy sovereignty over airspace, sea, seabed and subsoil and all living and non-living resources therein.

- The EEZ extends outwards to 200 nautical miles from the baseline. Coastal nations have sovereign rights for exploration, exploiting, conserving and managing all the natural resources therein.

- Since fisheries is a state subject, fishing in the IW and TS come within the purview of the states concerned.

- Other activities in the TS and activities, including fishing beyond the TS up to the limit of the EEZ, are in the Union list.

Indian Economy

Air India Disinvestment

Why in News

Recently, the government approved the highest price bid of Talace Pvt Ltd, a wholly owned subsidiary of Tata Sons Pvt. Ltd for sale (Disinvesting) of 100% equity shareholding of Government of India in Air India (AI).

- The Tatas will own 100% stake in AI, as also 100% in its international low-cost arm Air India Express and 50% in the ground handling joint venture, AI SATS.

Key Points

- Reasons for Disinvestment:

- It is hoped that with AI passing into the private sector, its operations and costs will get streamlined, services on board will improve and basic services like wi-fi will also be made available.

- A strong international carrier in India will give a boost to the large airports built in Delhi, Hyderabad, Mumbai and Bengaluru which along with AI will be able to win back some of the tourist dollars from Indians travelling abroad who are currently travelling on foreign carriers.

- A successful turnaround of Air India could also help the Indian economy as it is a well-established fact that aviation has a multiplier effect on the economy.

- There is a pressure on the government to raise resources to support the economic recovery and meet expectations of higher outlays for healthcare.

- Significance:

- It will save taxpayers money from paying for daily losses of AI.

- It will help push other tough decisions the government is keen on taking.

- It will possibly give the option of flying one more low-cost carrier domestically.

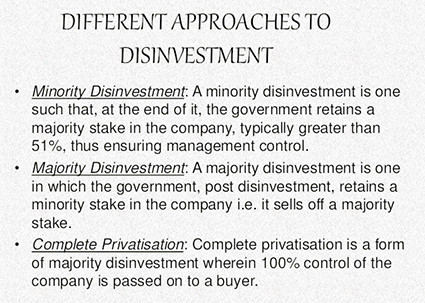

Disinvestment

- Disinvestment means sale or liquidation of assets by the government, usually Central and state public sector enterprises, projects, or other fixed assets.

- The government undertakes disinvestment to reduce the fiscal burden on the exchequer, or to raise money for meeting specific needs, such as to bridge the revenue shortfall from other regular sources.

- Strategic disinvestment is the transfer of the ownership and control of a public sector entity to some other entity (mostly to a private sector entity).

- Unlike the simple disinvestment, strategic sale implies a kind of privatization.

- The disinvestment commission defines strategic sale as the sale of a substantial portion of the Government shareholding of a central public sector enterprises (CPSE) of upto 50%, or such higher percentage as the competent authority may determine, along with transfer of management control.

- The Department of Investment and Public Asset Management (DIPAM) under the Ministry of Finance is the nodal department for the strategic stake sale in the Public Sector Undertakings (PSUs).

- Strategic disinvestment in India has been guided by the basic economic principle that the government should not be in the business to engage itself in manufacturing/producing goods and services in sectors where competitive markets have come of age.

- The economic potential of such entities may be better discovered in the hands of the strategic investors due to various factors, e.g. infusion of capital, technology up-gradation and efficient management practices etc.

Indian Economy

Monetary Policy Report: RBI

Why in News

The Reserve Bank of India (RBI) has released the Monetary Policy Report (MPR) for the month of October 2021.

- It kept the policy rate unchanged for the Eighth time in a row maintaining an accommodative stance till the recovery is durable.

Key Points

- Unchanged Policy Rates:

- Repo Rate - 4%.

- Reverse Repo Rate - 3.35%.

- Marginal Standing Facility (MSF) - 4.25%.

- Bank Rate- 4.25%.

- GDP Projection:

- Real Gross Domestic Product (GDP) growth for 2021-22 has been retained at 9.5%.

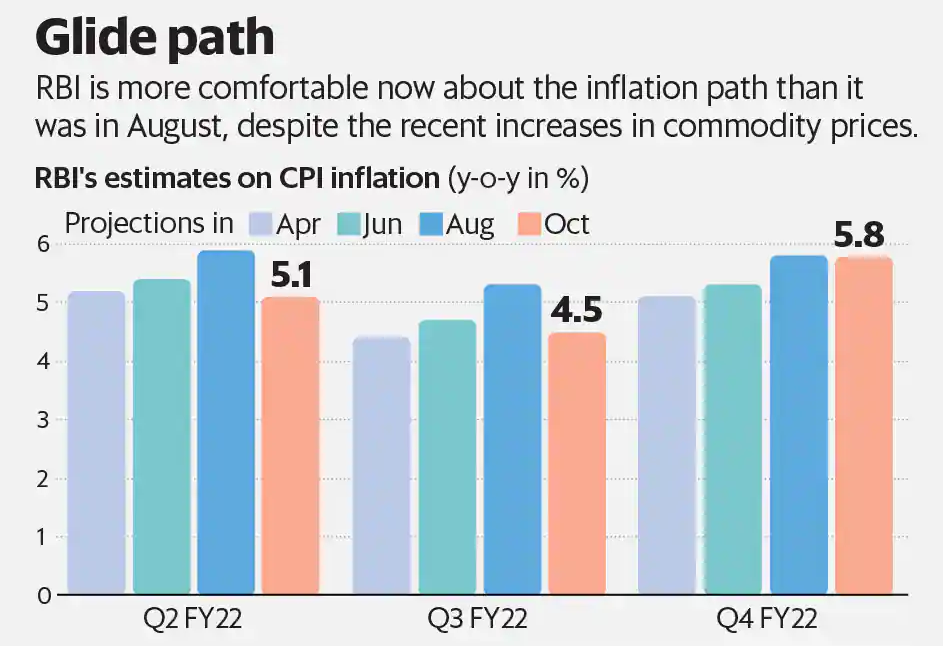

- Inflation:

- RBI has revised the projection for Consumer Price Index (CPI) inflation to 5.3% from 5.7% in August 2021.

- Government Bond Acquisition Programme (GSAP):

- It has shut down the GSAP citing the liquidity overhang (Excess liquidity), increasing liquidity due to government spending and absence of higher borrowing for Goods and Services Tax compensation.

- It is part of RBIs Open Market Operations, where it commits to a specific amount of Open Market Purchases of government securities.

- The first purchase for an aggregate amount of Rs. 25,000 crore under G-SAP 1.0 was conducted in April, 2021.

- But has assured that it would continue to flexibly conduct other liquidity management operations, including Operation Twist (OT) and regular Open Market Operations (OMOs).

- OT is when the central bank uses the proceeds from the sale of short-term securities to buy long-term government debt papers, leading to easing of interest rates on the long term papers.

- It has shut down the GSAP citing the liquidity overhang (Excess liquidity), increasing liquidity due to government spending and absence of higher borrowing for Goods and Services Tax compensation.

- Accommodative Stance:

- It decided to continue with an accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of Covid-19 on the economy, while ensuring that inflation remains within the target going forward.

- An accommodative stance means a central bank will cut rates to inject money into the financial system whenever needed.

- It decided to continue with an accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of Covid-19 on the economy, while ensuring that inflation remains within the target going forward.

- Variable Reverse Rate Repo (VRRR):

- VRRR auction size has been enhanced to Rs 6 trillion by early December 2021 and opened itself up to increasing the VRRR duration to 28 days if need be.

- In order to absorb additional liquidity in the system, the RBI announced conducting a VRRR program in August 2021 because it has higher yield prospects as compared to the fixed rate overnight reverse repo.

- VRRR auction size has been enhanced to Rs 6 trillion by early December 2021 and opened itself up to increasing the VRRR duration to 28 days if need be.

Key Terms

- Repo and Reverse Repo Rate:

- Repo rate is the rate at which the central bank of a country (RBI in case of India) lends money to commercial banks in the event of any shortfall of funds. Here, the central bank purchases the security.

- Reverse repo rate is the rate at which the RBI borrows money from commercial banks within the country.

- Bank Rate:

- It is the rate charged by the RBI for lending funds to commercial banks.

- Marginal Standing Facility (MSF):

- MSF is a window for scheduled banks to borrow overnight from the RBI in an emergency situation when interbank liquidity dries up completely.

- Open Market Operations:

- These are market operations conducted by RBI by way of sale/purchase of government securities to/from the market with an objective to adjust the rupee liquidity conditions in the market on a durable basis.

- Government Security:

- A G-Sec is a tradable instrument issued by the Central Government or the State Governments. It acknowledges the government’s debt obligation.

- Consumer Price Index:

- It measures price changes from the perspective of a retail buyer. It is released by the National Statistical Office (NSO).

- The CPI calculates the difference in the price of commodities and services such as food, medical care, education, electronics etc, which Indian consumers buy for use.

Monetary Policy Report

- It is published by the Monetary Policy Committee (MPC) of RBI. It is a statutory and institutionalized framework under the RBI Act, 1934, for maintaining price stability, while keeping in mind the objective of growth.

- It determines the policy interest rate (repo rate) required to achieve the inflation target of 4% with a leeway of 2% points on either side. The Governor of RBI is ex-officio Chairman of the MPC.

Indian Economy

Sovereign Credit Ratings

Why in News

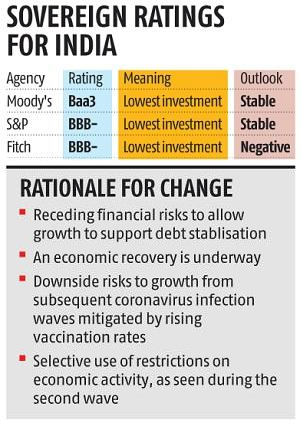

Ratings agency Moody's has changed India's sovereign rating outlook to “Stable" from “Negative" and affirmed the country's rating at “Baa3".

- “Baa3" rating is the lowest investment grade, just a notch above junk status (Speculative).

Key Points

- Sovereign Credit Rating (SCR):

- SCR is an independent assessment of the creditworthiness of a country or sovereign entity.

- It can give investors insights into the level of risk associated with investing in the debt of a particular country, including any political risk.

- In addition to issuing bonds in external debt markets, another common motivation for countries to obtain a sovereign credit rating is to attract Foreign Direct Investment (FDI).

- At the request of the country, a credit rating agency will evaluate its economic and political environment to assign it a rating.

- Moody’s considers a Baa3 or higher rating to be of investment grade, and a rating of Ba1 and below is speculative.

- S&P gives a BBB- or higher rating to countries it considers investment grade, and grades of BB+ or lower are deemed to be speculative or "junk" grade.

- Economic Survey’s Stance on SCRs:

- India has consistently been rated below expectation as compared to its performance on various parameters during the period 2000-20.

- India remained a clear outlier on several parameters such as GDP growth rate, inflation, general government debt, political stability, rule of law, control of corruption, investor protection, ease of doing business, sovereign default history, etc.

- India’s ability to pay can be gauged not only by the extremely low foreign currency-denominated debt of the sovereign but also by the comfortable size of its foreign exchange reserves that can pay for the short term debt of the private sector as well as the entire stock of India’s sovereign and non-sovereign external debt.

- India's fiscal policy should be guided by considerations of growth and development rather than be restrained by "biased and subjective" sovereign credit ratings.

- It recommended that developing economies must come together to address this bias and subjectivity inherent in sovereign credit ratings methodology to prevent exacerbation of crises in future.

- India has consistently been rated below expectation as compared to its performance on various parameters during the period 2000-20.

Credit Rating

- A credit rating is a quantified assessment of the creditworthiness of a borrower in general terms or with respect to a particular debt or financial obligation.

- A credit rating can be assigned to any entity that seeks to borrow money—an individual, corporation, state or provincial authority, or sovereign government.

- A rating agency is a company that assesses the financial strength of companies and government entities, especially their ability to meet principal and interest payments on their debts.

- Fitch Ratings, Moody’s Investors Service and Standard & Poor’s (S&P) are the big three international credit rating agencies controlling approximately 95% of global ratings business.

- In India, there are six credit rating agencies registered under Securities and Exchange Board of India (SEBI) namely, CRISIL, ICRA, CARE, SMERA, Fitch India and Brickwork Ratings.

Indian Economy

World Bank GDP Projection for India

Why in News

According to the World Bank, India’s economy, South Asia’s largest, is expected to grow by 8.3% in the fiscal year 2021-22.

- The South Asia economic focus report projects the region to grow by 7.1% in 2021 and 2022. It is a biannual economic update presenting recent economic developments and a near-term economic outlook for South Asia.

- Other Major reports of the World bank include Human Capital Index, World Development Report. Recently, it has decided to discontinue the practice of issuing ‘Doing Business reports’.

Key Points

- GDP Growth:

- The projected growth (8.3%) is supported by an increase in public investment to bolster domestic demand and schemes like the Production Linked Incentive (PIL) to boost manufacturing.

- India’s Gross Domestic Product (GDP) increased by 20.1% in the first quarter (April-June quarter) of financial year 2021-22 in the backdrop of “a significant base effect, limited damage to domestic demand and strong export growth”.

- In the first quarter of financial year 2020-21, GDP of India contracted by 24.4% because of nationwide coronavirus lockdown.

- The World Bank also observed that the disruption in India’s economy during the second wave of the pandemic was limited, compared to the first.

- On Economic Recovery:

- Economic recovery across various sectors in India has been unequal.

- Manufacturing & construction sectors recovered steadily in 2021 but low-skilled individuals, self-employed people, women and small firms were left behind.

- The extent of recovery in the financial year 2021-’22 will depend on how fast household incomes recover and activity across informal sector & smaller firms normalises.

- India’s economic prospects will be determined by its pace of vaccination against Covid-19 and successful implementation of agriculture & labour reforms.

- Base Effect:

- Economic data such as ‘GDP growth rate’ are calculated on a year-on-year basis.

- Thus, a low growth rate in the previous year leads to a low base for the number in the current year.

- Associated Risks:

- Risks associated with the extent of recovery include- worsening of financial sector stress, slowdown in vaccination, higher inflation constraining monetary-policy support etc.

- Suggestions:

- Medium Term Growth:

- It is time to start rethinking policies about medium term growth by learning lessons from Covid-19 like crisis.

- It's time to build social protection and adopt greener policies, because the next shock might be from the environment.

- To reduce inequality, it is very important to integrate the informal sector and women into the economy. So that should be also an important element of the medium term growth strategy.

- Need for Regulatory Experimentation:

- The Bank called on South Asian countries to lower entry barriers in the services sector, creating more national and international competition while curbing the “emergence of new monopoly powers”; aiding labour market mobility and upgrading of skills; and enabling the absorption of these new services by households and firms.

- Medium Term Growth:

Important Facts For Prelims

Nobel Peace Prize 2021

Why in News

Recently, the 2021 Nobel Peace Prize was awarded to journalists Maria Ressa of the Philippines and Dmitry Muratov of Russia for their efforts to safeguard freedom of expression, which is a precondition for democracy and lasting peace.

- In 2020, the award was given to the World Food Programme (WFP), a United Nations (UN) agency.

- Other 2021 Nobel Prizes for Literature, Chemistry, Physics and Medicine have already been announced.

Key Points

- Maria Ressa:

- She is an investigative journalist, in 2012 she co-founded Rappler, a digital media platform for investigative journalism, which she continues to head.

- Rappler has focused critical attention on President Rodrigo Duterte's regime's controversial, murderous anti-drug campaign.

- In the 2021 World Press Freedom Index, the Philippines ranked 138 of 180 nations (India was ranked lower, at 142).

- She has also authored Seeds of Terror: An Eyewitness Account of Al-Qaeda’s Newest Center, and From Bin Laden to Facebook: 10 Days of Abduction, 10 Years of Terrorism.

- Dmitry Muratov:

- Muratov has for decades defended freedom of speech in Russia under increasingly challenging conditions''.

- Russia has ranked 150 in the 2021 World Freedom Index.

- He along with around 50 colleagues started Novaya Gazeta (Newspaper) in 1993, as one of its founders. He has served as the newspaper’s editor-in-chief since 1995.

- Committee to Protect Journalists, a US-based non-profit, had felicitated Muratov as one of its International Press Freedom awardees in 2007.

- Six of Muratov’s colleagues have been killed since the newspaper started, which has often faced harassment, threats, violence and murder from its opponents.

- Despite the killings and threats, editor-in-chief Muratov has refused to abandon the newspaper’s independent policy.

- Muratov has for decades defended freedom of speech in Russia under increasingly challenging conditions''.

- Significance:

- Free, independent and fact-based journalism serves to protect against abuse of power, lies and war propaganda.

- Without freedom of expression and freedom of the press, it will be difficult to successfully promote fraternity between nations, disarmament and a better world order to succeed in our time.

Important Facts For Prelims

Giloy or Guduchi

Why in News

According to the Ministry of AYUSH, Giloy or Guduchi, a popularly known herb is safe to use.

- However, similar looking plants in circulation such as Tinospora crispa can be harmful. Tinospora crispa is a medicinal plant belonging to the botanical family Menispermaceae and is widely distributed in Southeast Asia and the northeastern region of India.

Key Points

- Giloy (Tinospora cordifolia) is a climbing shrub that grows on other trees, from the botanical family Menispermaceae.

- It is an essential herb in Ayurvedic medicine and all its parts are thought to have health benefits.

- People have long used it to treat a wide range of issues, including fever, infections, diarrhoea and diabetes.

- Guduchi’s hepato-protective properties are well established and is known for its immense therapeutic applications and the practices are regulated in accordance with various applicable provisions.

- Hepatoprotection or anti hepatotoxicity is the ability of a chemical substance to prevent damage to the liver.

- The plant is native to India but also found in China and tropical areas of Australia and Africa.

- The Ministry of AYUSH has a well-established system of Pharmacovigilance (for reporting of suspected adverse drug reactions from AYUSH medication), with its network spreading across all over India.