Internal Security

Changes in the Prevention of Money Laundering Act

Recently, the Union government has issued a notification on certain changes in the Prevention of Money Laundering Act (PMLA), which will further empower the Enforcement Directorate (ED) in tackling the cases of Money Laundering.

What are the proposed amendments?

- The amendment seeks to treat money laundering as a stand-alone crime.

- Till now Money Laundering was not an independent crime; rather depended on another crime, known as the 'predicate offence' or 'scheduled offence', the proceeds of which are made the subject matter of crime of money laundering.

- It also expands the ambit of “proceeds of crime” to those properties which “may directly or indirectly be derived or obtained as a result of any criminal activity relatable to the scheduled offence.

- The most crucial amendments are the deletion of provisions in sub-sections (1) of Section 17 (Search and Seizure) and Section 18 (Search of Persons).

- These provisions required the pre-requisite of an FIR or charge sheet by other agencies that are authorised to probe the offences listed in the PMLA schedule.

- An explanation is added to Section 45 that clarifies that all PMLA offences will be cognisable and non-bailable.

- Therefore, ED will be empowered to arrest an accused without a warrant, subject to certain conditions.

- Another vital amendment makes concealment of proceeds of crime, possession, acquisition, use, projecting as untainted money, or claiming as untainted property as independent and complete offences under the Act.

- Section 72 will now give power to the Centre to set up an Inter-Ministerial Coordination Committee for inter-departmental and inter-agency coordination for operational and policy level cooperation, for consultation on anti-money laundering and counter-terror funding initiatives.

What is Money Laundering?

- Money laundering is the process of making large amounts of money generated by criminal activity, such as drug trafficking or terrorist funding, appear to have come from a legitimate source.

- Criminal activities like illegal arms sales, smuggling, drug trafficking and prostitution rings, insider trading, bribery and computer fraud schemes produce large profits.

- Thereby it creates the incentive for money launderer to "legitimize" the ill-gotten gains through money laundering.

- The money so generated is called 'dirty money' and money laundering is the process of conversion of 'dirty money', to make it appear as 'legitimate' money.

How does Money Laundering take place?

- Money laundering is a three-stage process :

- Placement: The first stage is when the crime money is injected into the formal financial system.

- Layering: In the second stage, money injected into the system is layered and spread over various transactions with a view to obfuscate the tainted origin of the money.

- Integration: In the third and the final stage, money enters the financial system in such a way that original association with the crime is sought to be wiped out and the money can then be used by the offender as clean money.

- Bulk Cash Smuggling, Cash Intensive Businesses, Trade-based laundering, Shell companies and trusts, Round-tripping, Bank Capture, Gambling, Real Estate, Black Salaries, Fictional Loans, Hawala, False invoicing are some of the common methods of Money Laundering.

The legal framework in India to deal with Money Laundering

- In India, the specific legislation dealing with money laundering is the Prevention of Money-Laundering Act((PMLA), 2002

- The law was enacted to combat money laundering in India and has three main objectives :

- To prevent and control money laundering.

- To provide for confiscation and seizure of property obtained from laundered money.

- To deal with any other issue connected with money-laundering in India.

- Under the PMLA Act, the Enforcement Directorate is empowered to conduct a Money Laundering investigation.

- Apart from the provisions of PMLA, there are other specialised provisions such as RBI/SEBI/IRDA anti-money laundering regulations

Enforcement Directorate

- Directorate of Enforcement is a specialized financial investigation agency under the Department of Revenue, Ministry of Finance, Government of India.

- On 1 May 1956, an ‘Enforcement Unit’ was formed, in Department of Economic Affairs, for handling Exchange Control Laws violations under Foreign Exchange Regulation Act, 1947.

- In the year 1957, this Unit was renamed as ‘Enforcement Directorate’.

- ED enforces the following laws:

- Foreign Exchange Management Act,1999 (FEMA)

- Prevention of Money Laundering Act, 2002 (PMLA)

Biodiversity & Environment

Climate Change and Land: IPCC’s Report

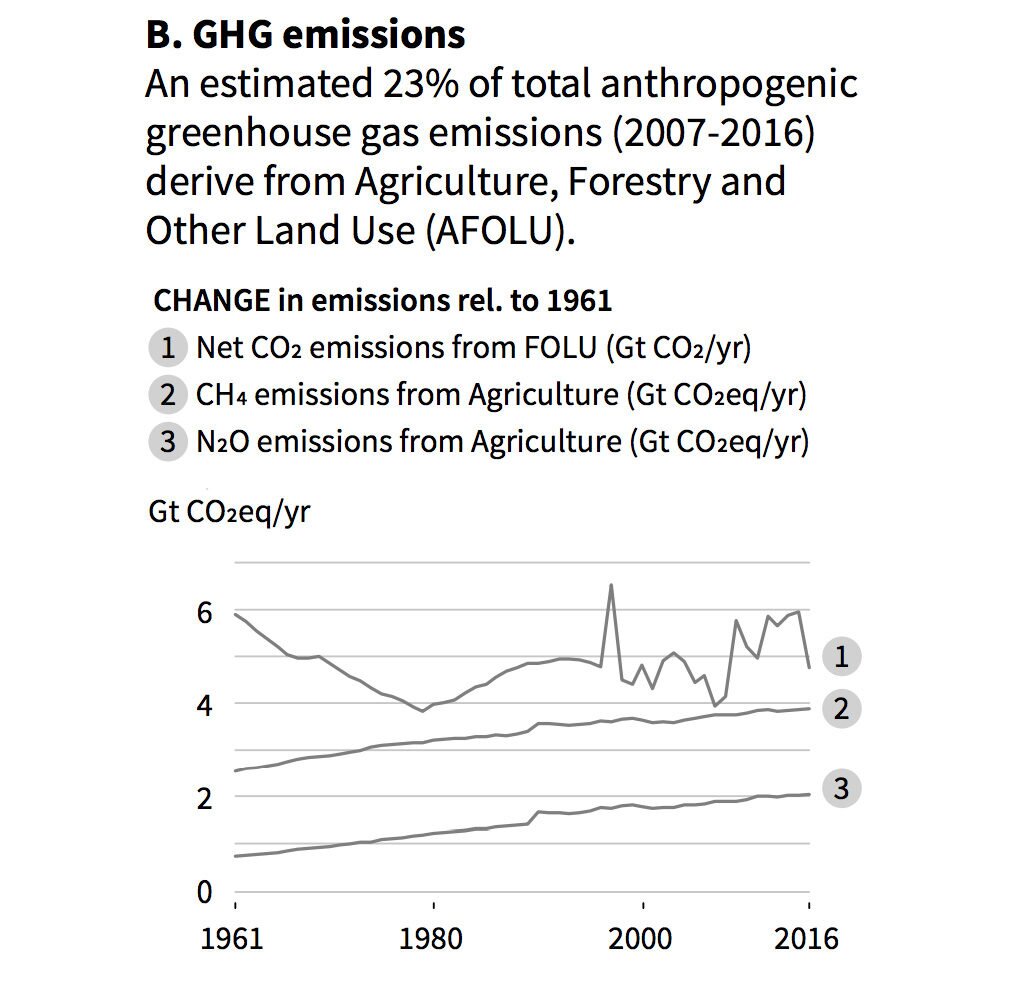

The Intergovernmental Panel on Climate Change’s (IPCC) report on ‘Climate Change and Land’ reveals the relation between climate change and land use pattern.

- This is the first time that the IPCC, has focused its attention solely on the land sector.

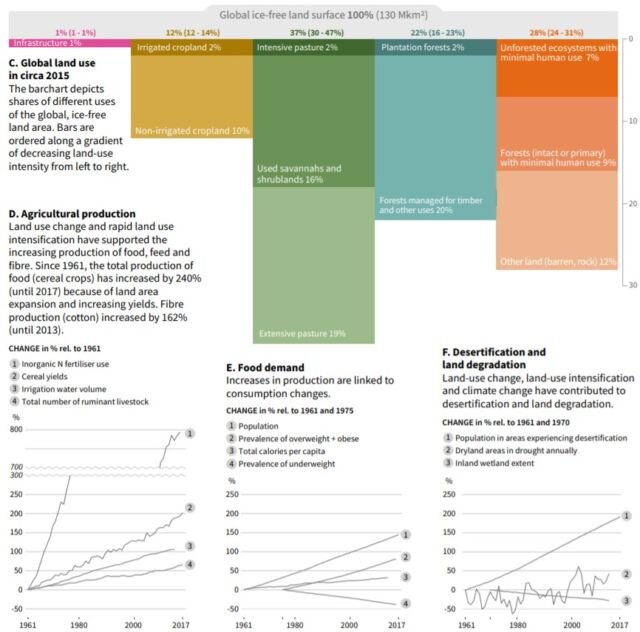

- The report focuses on the contribution of land-related activities to global warming i.e how the different uses of land, like agriculture, industry, forestry, cattle-rearing, and urbanisation, was affecting emission of greenhouse gases.

Key Findings

- Climate Change and Land degradation: Land degradation is linked to several climate variables, such as temperature, precipitation, wind, and seasonality.

- Reduced Photosynthesis: Extreme heat events can reduce photosynthesis in trees, restrict growth rates of leaves and reduce the growth of the whole tree.

- In regions where plants decline, land degradation is expected to occur as vegetation provides a vital safeguard against erosion.

- Increased Aridity: global warming will exacerbate heat stress thereby increasing deficits in soil moisture that in turn will increase the rate of drying/ aridity.

- Rainfall and Flooding: as a consequence of climate change can also delay planting, increase soil compaction, and cause crop losses.

- Reduced Photosynthesis: Extreme heat events can reduce photosynthesis in trees, restrict growth rates of leaves and reduce the growth of the whole tree.

Land Degradation

IPCC report defines land degradation as a negative trend in land condition, caused by direct or indirect human-induced processes including anthropogenic climate change, expressed as long-term reduction or loss of at least one of the following: biological productivity, ecological integrity, or value to humans.

- However, report states that some aspects of climate change can improve the condition of the land like CO2 fertilisation, where higher levels of CO2 in the atmosphere increase plant growth.

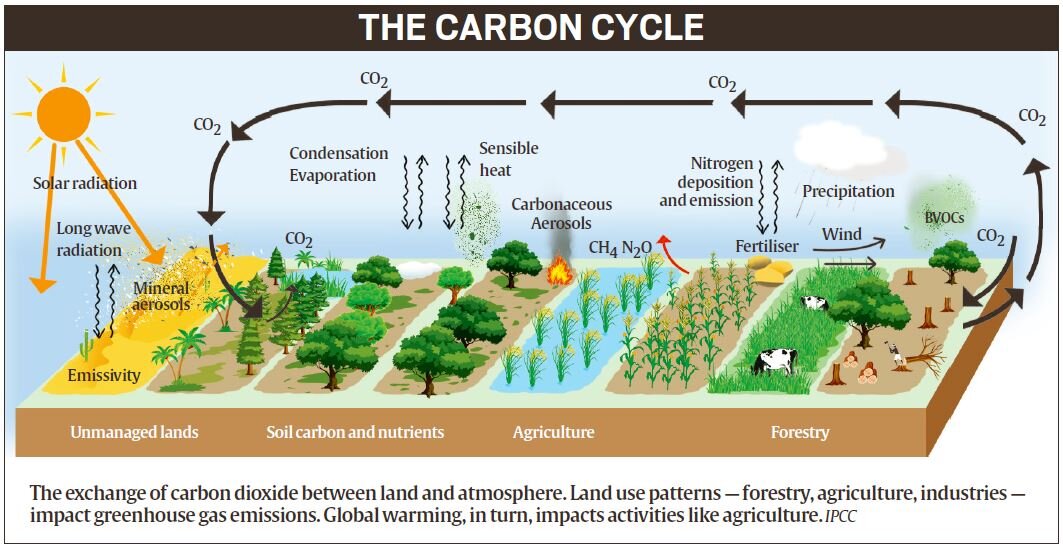

- How Does the Land contribute to Climate Change: Land acts as both the source as well as a sink of carbon thereby, large scale land-use changes like deforestation or urbanisation, or even a change in cropping pattern, have a direct impact on the overall emissions of greenhouse gases.

- Carbon Source: Land-based activities such as agriculture and forestry are sources of greenhouse gas emissions hence act as carbon source.

- Carbon Sink: Soil, trees and vegetation absorb carbon dioxide, thus act as carbon sinks.

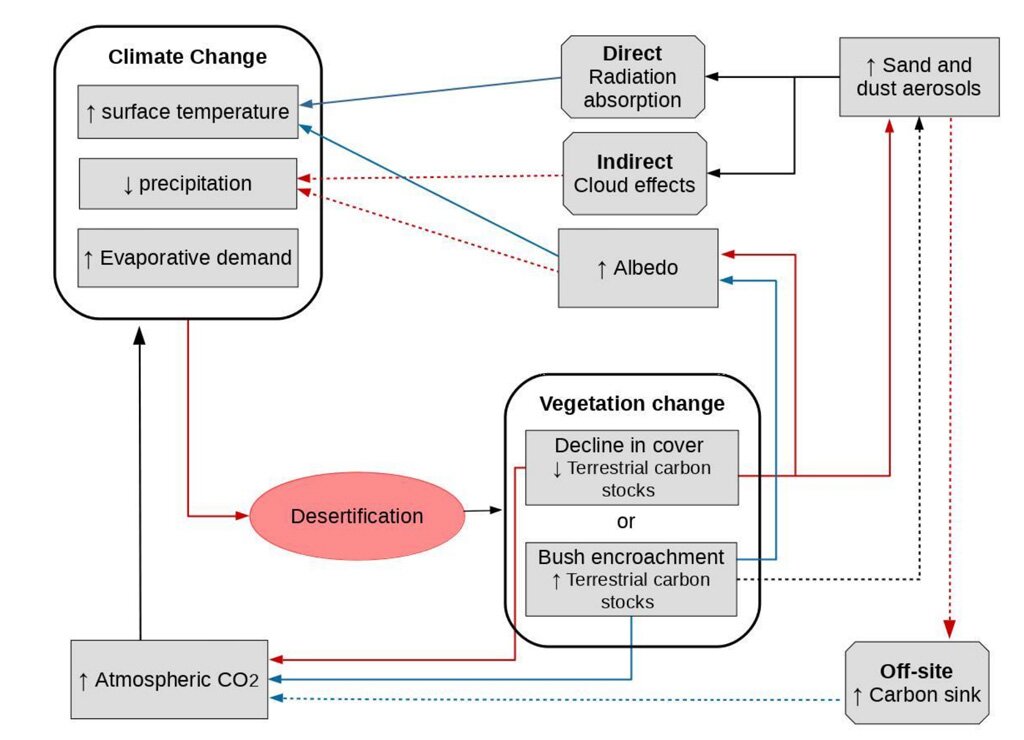

- Climate Change and Desertification: The IPCC land report defines desertification as land degradation in arid, semi-arid, and dry sub-humid areas, collectively known as drylands, resulting from many factors, including human activities and climatic variations.

- According to report risks from desertification are projected to increase due to climate change.

- The decline in vegetation can leave the soil more at risk of erosion, increasing the likelihood of sand and dust storms that in turn would tend to decrease precipitation in the local climate, thus further reinforcing desertification.

- Impacts of Climate Change-driven Land Degradation:

- Poverty: Report states that climate change is frequently noted as a risk multiplier for both land degradation and poverty.

- Migration: Climate-related land degradation and migration are directly linked to each other.

- When people are pushed into poverty or have their livelihoods stripped as a result of changes in their environment, one adaptation option is to move to another area and this can be internally or across borders.

- Climate Change and Food Security: Climate change is affecting food security through increasing temperatures, changing precipitation patterns, and greater frequency of some extreme events.

- Agricultural Production: Increasing temperatures are affecting agricultural productivity in higher latitudes, raising yields of some crops (maize, cotton, wheat, sugar beets), while yields of others (maize, wheat, barley) are declining in lower-latitude regions.

- Nutritional Quality: Increased atmospheric CO2 levels can lower the nutritional quality of crops.

- Livestock Production: Future climate change could affect livestock production.

- An increase in desertification and heatwaves could have a direct impact on animal morbidity, mortality and distress that in turn could adversely affect the food security.

- Higher Prices: Report states that cereal prices could increase by 1-29% by 2050 as a result of climate change, leading to higher food prices and increased risk of food insecurity and hunger

Indian Polity

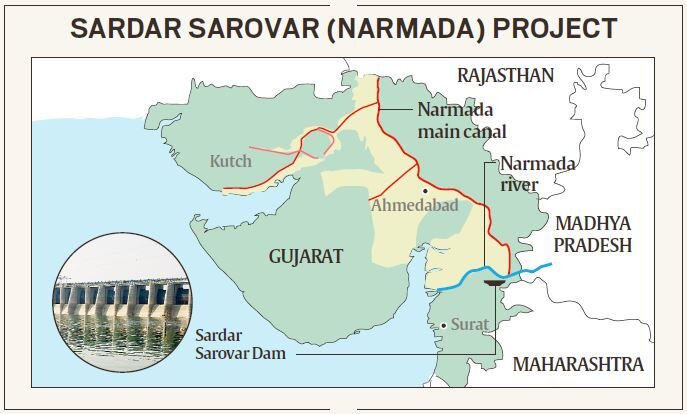

Gujarat-Madhya Pradesh Tussle over the Narmada

Recently, Madhya Pradesh and Gujarat have engaged in a tussle over the sharing of Narmada river waters.

What is the Controversy?

- Madhya Pradesh has threatened to restrict the flow of water into the Sardar Sarovar Dam, located in Gujarat.

- The Sardar Sarovar Project includes two powerhouses, the River Bed Power House (RBPH; 1,200 MW) and the Canal Head Power House (250 MW).

- Power is shared among Madhya Pradesh, Maharashtra and Gujarat in a 57:27:16 ratio.

- The RBPH has been shut since 2017, Gujarat has sought that generation should not start until the water reaches the full reservoir level (FRL).

- Gujarat’s view is that its share of 9 MAF (million-acre feet) water in a normal monsoon year is insufficient to generate power as drinking water and irrigation are priorities.

- Gujarat has also argued that reaching the FRL is necessary for testing whether the increased height of the dam can withstand the thrust at that level.

- In light of this Narmada Control Authority has granted the permission not to start generation at a powerhouse until the dam fills to its full level.

- Madhya Pradesh is discontented by frequent power outages and has refused to release the surplus share for power generation and to allow the dam to be tested at FRL.

Sardar Sarovar Project

- The Sardar Sarovar Project (SSP) is a gravity dam on the Narmada River crossing Gujarat in India.

- It involves a series of large irrigation and hydroelectric multi-purpose dams.

- The project took form in 1979 as part of a development scheme to increase irrigation and produce hydroelectricity.

- The hydroelectric power of the SSP is to be shared by the states of Gujarat, Maharashtra and Madhya Pradesh; the irrigation benefits would accrue to the states of Gujarat and Rajasthan.

Indian Polity

Rajasthan: Anti Mob Lynching and Honour Killing Bills Passed

The Rajasthan Assembly has passed two separate bills against mob lynching and honour killing to tackle the rising incidents of mob lynching and honour killings.

- The bills propose to make offences non-bailable and also impose heavy penalties and punishment, including the death penalty or life imprisonment, in case of honour killings.

The Rajasthan Protection from Lynching Bill, 2019

Makes mob lynching a cognisable, non-bailable and non-compoundable offence punishable with life imprisonment and a fine up to Rs 5 lakh.

- Definition of Mob and Lynching in the bill:

- Mob: Bill defines the mob as a group of two or more individuals.

- Lynching: It is an act or series of acts of violence or those of aiding, abetting or attempting an act of violence, whether spontaneous or preplanned, by a mob on the grounds of religion, race, caste, sex, place of birth, language, dietary practices, sexual orientation, political affiliation or ethnicity.

- Imprisonment and Fine: For the offence of an assault by mob, leading to the victim suffering grievous hurts, the bill provides for jail terms up to 10 years and a fine of ₹25,000 to ₹3 lakh and if victims suffer simple injuries the imprisonment is up to seven years and a fine up to ₹1 lakh

- Conspiracy of Lynching: For plotting a conspiracy of lynching or aiding, abetting or attempting such an offence, the bill seeks to punish the offenders in the same manner as if he actually committed the offence of lynching.

- Prevention of Lynching: Bill empowers the state police chief to appoint a state coordinator of the rank of Inspector General of Police to prevent the incidents of lynching

- Other Offences Related to Lynching: Bill also enlists various other offences related to the lynching such as dissemination of offensive materials, propagation of hostile environment and obstructing legal processes, which would be punishable with jail terms varying from three to five years.

- Victim Compensation and Rehabilitation: Bill also stipulates the provision of compensation to victims by the state government as per the Rajasthan Victim Compensation Scheme.

- It also binds the state government to take necessary measures to rehabilitate the victims of mob lynching, suffering displacements from their native places.

Need

- Among the total number of mob lynching cases happened in India after 2014, 86% of cases of mob lynching reported in the Rajasthan.

The Anti Honour Killing Bill, 2019

- Death Penalty: As per the provisions of the bill whoever causes the death of a couple or either of them on the basis that marriage of such couple has dishonoured, or brought disrepute to the caste, community or family shall be punished with death, or with imprisonment for life.

- Life Imprisonment and Fine: If the couple or either of them is grievously hurt, the punishment will be from 10 years rigorous imprisonment to imprisonment for life and with fine of maximum ₹3 lakh whereas in case of simple injuries punishment will be three to five years imprisonment with fine which may extend to ₹2 lakh.

- Sub Divisional Magistrate or the District Magistrate shall receive any request or information from any person or persons seeking protection from any unlawful assembly, or from any other person who is likely to or who have been objecting to any lawful marriage.

- Unlawful Assembly: Bill says no person or group shall assemble at any time with the view or intention to deliberate on or condemn any marriage, not prohibited by law, on the basis that such marriage has dishonoured the caste or community tradition or brought disrepute to all or any of the persons forming part of the assembly or the family or the people of the locality concerned.

Need

- In Past five years in Rajasthan, 71 cases of illegal diktat given by ‘Khap Panchayats’ (caste councils which function like kangaroo courts) were registered and 10 cases of honour killing occurred in which four men and eight women were killed.

- Honour killing cases have increased in the past few years and have become a hurdle in societal development.

Indian Economy

Linking Farmers with Futures Market

The recent, Indian Council for Research on International Economic Relations (ICRIER) study suggests the need to empower the Farmer Producer Organizations (FPOs) to trade in the commodities futures market.

Farmer Producer Organisation

- The concept of 'Farmer Producer Organizations (FPO)' consists of collectivization of producers, especially small and marginal farmers so as to form an effective alliance to collectively address many challenges of agriculture such as improved access to investment, technology, inputs, and markets.

- An FPO is a legal entity formed by primary producers, viz. farmers, milk producers, fishermen, weavers, rural artisans, craftsmen.

- The FPO can be a production company, a cooperative society or any other legal form which provides for sharing of benefits among the members. In some forms like producer companies, institutions of primary producers can also become a member of PO.

- The FPOs are generally mobilized by promoting institutions/ resource agencies (RAs). Small Farmers Agribusiness Consortium (SFAC) provides support for the promotion of FPOs.

- The resource agencies leverage the support available from governments and agencies like NABARD to promote and nurture FPOs, but attempting an assembly line for mass production of FPOs has not given the desired results.

Future Market

- Futures contracts are used as hedging instruments in agricultural commodities. Hedging is a common practice that insures the farmer against a poor harvest by purchasing futures contracts in the same commodity.

- Forward Markets Commission (FMC) was a regulatory authority for commodity futures market in India. Forward Markets Commission (FMC) has been merged with Securities and Exchange Board of India (SEBI) with effect from September 28, 2015.

Future Trading in India

- The first futures trade by an Indian FPO took place in 2014 when the Ram Rahim Pragati Producer Company – an enterprise started by 3,000 women belonging to self-help groups in a tribal area of Madhya Pradesh – hedged soyabean price risk on the National Commodity and Derivatives Exchange (NCDEX).

- Between April 2016, when NCDEX began making formal efforts to directly engage with FPOs, and May 2018, FPOs had a miniscule 0.004% share of the agri-futures trade at NCDEX. More than half of the FPO futures trade of ₹50.8 crore was in soybeans, while another third was in maize. Bihar, Maharashtra and Madhya Pradesh account for 92% of the trade.

- Reasons: The Small farmers often hesitate to trade in the futures market due to their limited capacity as individuals. Future market is viewed with suspicion and termed as gambling.

- Instead, they depend on traders in traditional marketing channels who charge high commissions, but provide easy access to credit and market.

- However, FPOs, as aggregates of small farmers, can provide the scale of production needed if they receive sufficient information and support.

National Commodities and Derivatives Exchange

- The National Commodities and Derivatives Exchange (NCDEX) is an online commodities exchange dealing primarily in agricultural commodities in India.

- It is a public limited company, established on 23 April 2003 under the Companies Act, 1956.

- The exchange was founded by some of India's leading financial institutions such as ICICI Bank Limited, the National Stock Exchange of India and the National Bank for Agricultural and Rural Development, among others.

- NCDEX is located in Mumbai but has offices across the country to facilitate trade. Trading is done on 27 commodity contracts as of March 2018. These include 25 contracts for agricultural products. NCDEX is run by an independent board of directors with no direct interest in agriculture.

Benefits of Future Market

- Efficient Price Discovery for Farmers: Linking farmers with futures market can be mutually beneficial to both. Farmers, when linked with a consistent, liquid and deep futures market will be able to reap the benefits of efficient price discovery.

- More Liquidity to Market: Higher farmer participation will provide more liquidity to the market, helping it achieve its objective of price discovery.

- Removing Middlemen: The trading in futures market will help farmers make their cropping decisions based on next year’s prices rather than last year’s rates, as well as break the crippling hold of middlemen and traders and ultimately boost income for agricultural families.

Way Forward

- Learning from the example of China, where the state has helped small land holding farmers by providing customised products and reducing price distortions, the Government of India should have limited intervention in prices and procurement of commodities.

- The government needs to identify production centres and build warehouses and delivery centres around them in order to encourage futures trading in these areas.

Social Justice

World Breastfeeding Week

The World Breastfeeding Week (WBW) has been observed from 1st to 7th August 2019. The Food and Nutrition Board, Ministry of Women and Child Development, has organized a number of activities on the theme “Empower Parents, Enable Breastfeeding”. The focus is on protection, promotion, and support of breastfeeding.

- The objectives of World Breastfeeding Week are:

- To create awareness among the parents about breastfeeding

- Encourage parents to adopt breastfeeding

- Creating awareness about the importance of initiation and exclusive breastfeeding, and adequate & appropriate complementary feeding

- Providing advocacy material about the importance of breastfeeding

- Importance of Breastfeeding

- It promotes better health for mothers and children alike

- It prevents infections like diarrhoea and acute respiratory infections in early infancy and thus reduce infant mortality

- It decreases the risk of mothers developing breast cancer, ovarian cancer, type 2 diabetes, and heart disease and

- It protects infants from obesity-related illnesses, diabetes and increases the IQ.

MAA - "Mothers Absolute Affection"

- It is a nationwide programme of the Ministry of Health and Family Welfare to promote breastfeeding and provision of counselling services for supporting breastfeeding through health systems.

- The programme has been named ‘MAA’ to signify the support a lactating mother requires from family members and at health facilities to breastfeed successfully.

- The following are the objectives of the Programme in order to achieve the above mentioned goal:

- Build an enabling environment for breastfeeding through awareness generation activities, targeting pregnant and lactating mothers, family members and society in order to promote optimal breastfeeding practices.

- Breastfeeding to be positioned as an important intervention for child survival and development.

- Reinforce lactation support services at public health facilities through trained healthcare providers and through skilled community health workers.

- To incentivize and recognize those health facilities that show high rates of breastfeeding along with processes in place for lactation management.

- ‘Vatsalya – Maatri Amrit Kosh’, a National Human Milk Bank and Lactation Counselling Centre has been established at the Lady Hardinge Medical College (LHMC), Delhi. It has been established in collaboration with the Norwegian government, Oslo University and Norway India Partnership Initiative (NIPI).

Indian Economy

Women Transforming India Awards

The Women Transforming India awards (4th edition) are being launched by NITI Aayog.

- The Women Transforming India awards are organized in collaboration with the United Nations.

- For WTI-2019 awards WhatsApp (facebook owned messaging platform) has collaborated with NITI Aayog.

- The theme of the Women Transforming India- 2019 awards is Women and Entrepreneurship (same as in 2018).

National Entrepreneurship Awards

- The National Entrepreneurship Awards aim to honour outstanding young first-generation entrepreneurs and ecosystem builders for their exceptional contribution in entrepreneurship development.

- They recognise individuals or organizations that have made outstanding contributions to the entrepreneur ecosystem of India.

- The National Entrepreneurship Awards are announced annually by the Ministry of Skill Development and Entrepreneurship.

- To be eligible for National Entrepreneurship Awards the nominee (entrepreneur) must be:

- Under the age of 40 years

- First-generation entrepreneur

- Hold 51% or more equity and ownership of the business

- Women entrants must individually or collectively own 75% or more of the enterprise.

Women Transforming India Awards

- WTI awards were launched by NITI Aayog and the United Nations in India in 2016, to honour the women entrepreneurs, who are breaking the glass ceiling and challenging stereotypes, through businesses, enterprises and innovative initiatives.

- WTI award recognizes women who are flag bearers of the next wave of business innovations and connect with potential business opportunities, through NITI Aayog’s Women Entrepreneurship Platform (WEP).

- Women Entrepreneurship Platform (unified access portal to help women realise their entrepreneurial aspirations) is an initiative by NITI Aayog to promote and support aspiring as well as established women entrepreneurs in India.

Indian Economy

New Procedure for Pending Angel Tax Cases

In a move to ease scrutiny of startups over the capital they have received from angel investors, Central Board of Direct Taxes (CBDT) has recently laid out a procedure to address pending angel tax assessments.

- The procedure has followed the announcement made by the Finance Minister in Budget 2019-20. The Finance Minister proposed a host of incentives, including a special arrangement for resolution of pending assessments of income tax cases, with a view to encouraging startups.

New Procedure

- No verification will be done by an assessing officer if a startup has been recognised by the Department for Promotion of Industry and Internal Trade (DPIIT) and the case is selected under limited scrutiny.

- In case the startup has not received DPIIT approval, officers are only allowed to carry out any inquiry or verification only after obtaining approval of his/her supervisory officer.

- In the event that a startup is recognised by DPIIT, but the assessing officers are scrutinising it for multiple issues, the officials cannot pursue scrutiny under an anti-evasion provision of the Income Tax Act, 1961, in its assessment proceedings.

Section 56(2)(vii)(b) of the Income Tax Act,1961 deals with the taxation of share premiums received in excess of the fair market value and has been used in the past to serve demand notices to startups over the angel capital they have raised.

- The applicability of angel tax would not be pursued during the assessment proceedings and inquiry or verification with regard to other issues in such cases shall be carried out by the assessing officer only after obtaining approval of his/her supervisory officer.

Steps Taken by Indian Government Against Tax terrorism

- In order to reduce the long pending grievances of taxpayers and to minimise litigations pertaining to tax matters, Government of India in July 2018, has decided to increase the threshold monetary limits for filing Departmental Appeals at various levels.

- Goods and Services Tax has been introduced.

- Insolvency and Bankruptcy Code has been implemented.

- “Kardaata e-Sahyog Abhiyaan” has been launched by CBDT etc.

Indian Economy

Task Force on Offshore Rupee Markets

The Task Force on Offshore Rupee Markets, set up by the Reserve Bank of India (RBI) in February 2019 and chaired by Smt. Usha Thorat, former Deputy Governor, RBI, submitted its report to the Governor recently.

The Task Force was set up to examine the issues relating to the offshore Rupee markets and recommend appropriate policy measures while factoring in the requirement of ensuring stability of the external value of the Rupee including measures for incentivising non-residents to access the onshore foreign exchange market.

Key Recommendations

- Indian banks should not be allowed to deal in the offshore rupee derivative market — or Non-Deliverable Forward (NDF) markets — for the present.

- The onshore rupee derivatives market is currently more deep and liquid as compared to the offshore rupee market and participation of the Indian banks in the offshore market might, over time, take away this advantage.

NDF is a foreign exchange derivatives contract whereby two parties agree to exchange cash at a given spot rate on a future date. The contract is settled in a widely traded currency, such as the US dollar, rather than the original currency.

- Extension of onshore market hours to improve access of overseas users and permit Indian banks to freely offer prices to global clients around the clock.

- Banks should be allowed to freely offer prices to non-residents at all times either by a domestic sales team or by using staff located at overseas branches.

- Also, wide access to the forex-retail trading platform to non-residents would be a major incentive to use the onshore market.

- Enabling rupee derivatives (settled in foreign currency) to be traded in the International Financial Services Centers (IFSC) in India.

- To allow users to undertake forex transactions up to USD 100 million in over the counter (OTC) currency derivative market without the need to establish underlying exposure (security that must be delivered when a derivative contract is exercised).

- To facilitate non-residents to hedge their foreign exchange exposure onshore by:

- Establishing a central clearing and settlement mechanism for non-resident transactions in the onshore market;

- Implementing margin requirements for non-centrally cleared OTC derivatives and allowing Indian banks to post margins abroad;

- Aligning the tax treatment of foreign exchange derivatives with that in major international centres; and

- Centralising the KYC requirements across financial markets with uniform documentation requirement.

‘Onshore’ currencies simply mean buying the currencies locally, whereas ‘offshore’ currencies mean buying the currencies outside the national boundaries

Currency derivatives

- These are exchange-based futures and options contracts that allow one to hedge against currency movements.

- In simple words, one can use a currency future contract to exchange one currency for another at a future date at a price decided on the day of the purchase of the contract.

- In India, one can use such derivative contracts to hedge against currencies like Dollar, Euro, U.K. pound and Yen.

- While all such currency contracts are cash-settled in rupees, the Securities and Exchange Board of India (SEBI), in July 2018, gave a go-ahead to start cross currency contracts on euro-dollar, pound-dollar and dollar-yen.

Trade in currency derivatives

- The two national-level stock exchanges, (Bombay Stock Exchange) BSE and the (National Stock Exchange) NSE, have currency derivatives segments.

- One can trade in currency derivatives through brokers.

Over the Counter (OTC) Market

- Prior to the introduction of currency derivatives on exchanges, there was only the OTC – over the counter – market to hedge currency risks and where forward contracts were negotiated and entered into.

- It was kind of an opaque and closed market where mostly banks and financial institutions traded.

- Exchange-based currency derivatives segment is a regulated and transparent market that can be used by small businesses and even individuals to hedge their currency risks.

Important Facts For Prelims

Improvement in Sex Ratio at Birth

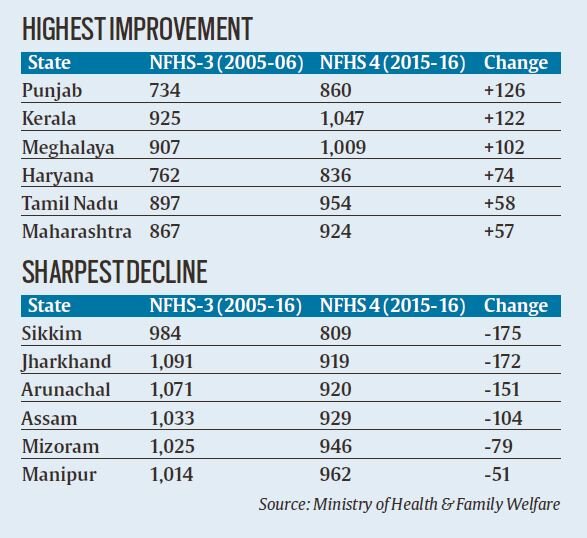

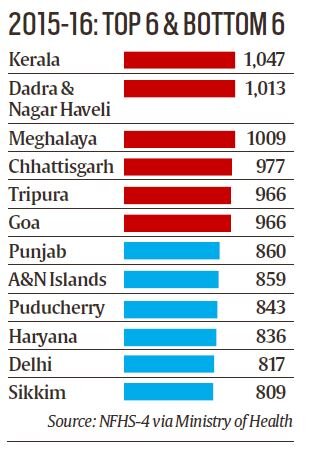

According to the fourth National Family Health Surveys (NFHS) 2015-16, the sex ratio at birth (SRB) in India has improved from 914 to 919.

- SRB is defined as the number of female births per 1,000 male births.

- Survey held that the highest improvement in SRB was noted in Punjab at 126 points, but its SRB remained at 860 (one of the lowest SRB in the states).

- This success can be attributed to the Beti Bachao Beti Padhao (BBBP) Scheme.

- Despite the North-Eastern societies traditionally being matriarchal, the sharpest decline was in Sikkim, where the SRB dropped 175 points to reach 809, the lowest among all states in 2015-16.

- Next, to Sikkim, the five states with the highest declines included four more from the Northeast.