Indian Polity

Public Examinations (Prevention of Unfair Means) Bill, 2024

For Prelims: Public Examinations (Prevention of Unfair Means) Bill, 2024, Lok Sabha, Optical Mark Recognition (OMR), UPSC CSE PYQ.

For Mains: Public Examinations (Prevention of Unfair Means) Bill, 2024, Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Why in News?

Recently, the Public Examinations (Prevention of Unfair Means) Bill, 2024, has been introduced in Lok Sabha, aiming to prevent “Unfair Means” in order to “bring greater transparency, fairness and credibility to the Public Examinations System.

- The Bill, once it becomes law, will also serve the important function of being “a model draft for States to adopt at their discretion”.

What is the Need for Such a Bill?

- Instances of Question Paper Leaks:

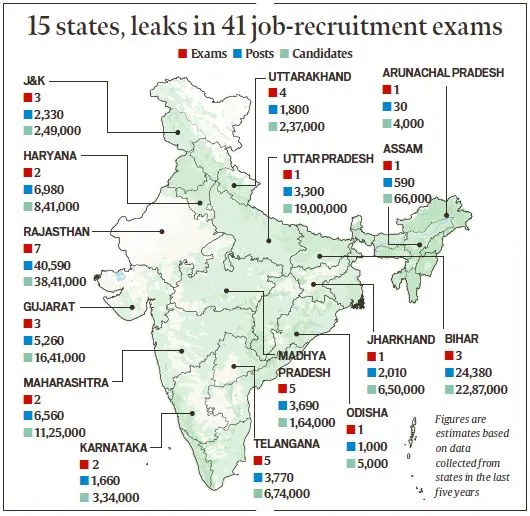

- There have been a very large number of cases of question paper leaks in recruitment exams across the country in recent years.

- At least 48 instances of paper leaks in 16 states over the last five years, in which the process of hiring for government jobs was disrupted.

- The leaks touched the lives of at least 1.51 crore applicants for about 1.2 lakh posts.

- There have been a very large number of cases of question paper leaks in recruitment exams across the country in recent years.

- Malpractices Lead to Delay in Examinations:

- Malpractices in public examinations lead to delays and cancellation of examinations, adversely impacting the prospects of millions of youth.

- At present, there is no specific substantive law to deal with unfair means adopted or offenses committed.

- Identifying and effectively addressing elements that exploit vulnerabilities within the examination system is crucial through comprehensive central legislation.

- To Bring Greater Transparency:

- The objective of the Bill is to bring greater transparency, fairness and credibility to the public examination systems and to reassure the youth that their sincere and genuine efforts will be fairly rewarded and their future is safe.

- The Bill is aimed at effectively and legally deterring persons, organised groups or institutions that indulge in various unfair means and adversely impact the public examination systems for monetary or wrongful gains.

What are the Key Provisions of the Bill?

- Defines Public Examination:

- Under Section 2(k), a Public Examination is defined as any examination conducted by a “public examination authority” listed in the Schedule of the Bill, or any such other authority as may be notified by the Central Government.

- The schedule lists five public examination authorities, Union Public Service Commission (UPSC), the Staff Selection Commission (SSC), the Railway Recruitment Boards (RRBs), the Institute of Banking Personnel Selection (IBPS), the National Testing Agency (NTA).

- NTA conducts the JEE (Main), NEET-UG, UGC-NET, the Common University Entrance Test (CUET)

- The schedule lists five public examination authorities, Union Public Service Commission (UPSC), the Staff Selection Commission (SSC), the Railway Recruitment Boards (RRBs), the Institute of Banking Personnel Selection (IBPS), the National Testing Agency (NTA).

- Apart from these designated public examination authorities, all “Ministries or Departments of the Central Government and their attached and subordinate offices for recruitment of staff” will also come under the purview of the new law.

- The central government can add new authorities in the schedule through a notification as and when required.

- Under Section 2(k), a Public Examination is defined as any examination conducted by a “public examination authority” listed in the Schedule of the Bill, or any such other authority as may be notified by the Central Government.

- Punishments:

- Section 9 of the Bill states that all offences shall be cognizable, non-bailable, and non-compoundable.

- In cognizable offences, police has a duty to investigate the case without seeking permission from the Magistrate.

- A non-compoundable offence is one in which the case cannot be withdrawn by the complainant even when the complainant and the accused have reached a compromise, and a trial must necessarily follow.

- It means that an arrest can be made without a warrant and bail will not be a matter of right; rather, a magistrate will determine whether the accused is fit to be released on bail.

- Punishment for “any person or persons resorting to unfair means and offences” can be three to five years in prison, and a fine up to Rs 10 lakh.

- If the convict fails to pay the fine, “an additional punishment of imprisonment shall be imposed, as per the provisions of the Bharatiya Nyay Sanhita, 2023.

- Punishment for the Service Providers:

- A service provider, engaged by the public examination authority for the conduct of examinations, shall also be liable to be punished with imposition of a fine up to Rs 1 crore and proportionate cost of examination shall also be recovered from it, if the service provider is involved in illegal practices.

- Section 9 of the Bill states that all offences shall be cognizable, non-bailable, and non-compoundable.

- Defines Unfair Means:

- Section 3 of the Bill lists at least 15 actions that amount to using unfair means in public examinations for monetary or wrongful gain.

- These acts include: leakage of question paper or answer key or part thereof and taking possession of question paper or an Optical Mark Recognition (OMR) response sheet without authority, providing solution to questions by any unauthorised person during a public examination.

- The section also lists tampering with any document necessary for short-listing of candidates or finalising the merit or rank of a candidate; tampering with the computer network or computer system; creation of fake website and issuance of fake admit cards or offer letters to cheat or for monetary gain as illegal acts.

- Section 3 of the Bill lists at least 15 actions that amount to using unfair means in public examinations for monetary or wrongful gain.

- Investigation and Enforcement:

- The bill mandates that offenses under the proposed law will be investigated by officers not below the rank of Deputy Superintendent of Police or Assistant Commissioner of Police.

- Model Draft for States:

- The bill also serves as a model draft for states to adopt at their discretion, with the aim of assisting states in preventing criminal elements from disrupting the conduct of their state-level public examinations.

- High Level National Technical Committee:

- Formation of a High-Level National Technical Committee on Public Examinations.

- This committee will focus on developing protocols to secure digital platforms. It will devise strategies for implementing foolproof IT security systems.

- The committee will formulate national standards and service levels for both IT and physical infrastructure. These standards will be deployed for the conduct of examinations to ensure efficiency and reliability.

- Formation of a High-Level National Technical Committee on Public Examinations.

What are the Concerns Related to the Bill?

- Discretion of State Governments:

- While the bill aims to serve as a model for states to adopt, the discretion given to state governments may lead to variations in implementation across different states.

- This could potentially weaken the effectiveness of the law in preventing unfair means in public examinations.

- While the bill aims to serve as a model for states to adopt, the discretion given to state governments may lead to variations in implementation across different states.

- Exploitable Loopholes in Sanctions:

- The provisions of the bill, such as the punishment for offenders, may contain loopholes that can be exploited to evade criminal sanctions.

- For example, if the fine imposed on a service provider is not commensurate with the financial gains they derive from unfair means, it may not serve as a sufficient deterrent.

- The provisions of the bill, such as the punishment for offenders, may contain loopholes that can be exploited to evade criminal sanctions.

- Lack of Clarity on National Technical Committee:

- While the bill proposes the formation of a High-Level National Technical Committee on Public Examinations, there is a lack of clarity regarding its composition, qualifications, and mandate.

- Without clear guidelines on the composition and qualifications of committee members, there may be concerns regarding their expertise and impartiality in devising foolproof IT security systems and national standards for examination conduct.

- Potential for Legal Challenges:

- The bill may face legal challenges related to its provisions on cognizability, non-bailability, and non-compoundability of offenses. There could be debates on whether such stringent measures are proportionate to the gravity of the offenses and whether they adhere to principles of natural justice.

Conclusion

- While the bill outlines measures for investigation and enforcement by designated law enforcement officers, there is a need for comprehensive oversight mechanisms to ensure accountability and transparency in the examination process.

- This includes monitoring the conduct of examinations, handling of complaints, and auditing of examination procedures to detect and prevent malpractices effectively.

Governance

Rethinking India's Examination System

For Prelims: Rethinking India's Examination System, Prioritizes Competition over Comprehension, New Education Policy 2020.

For Mains: Rethinking India's Examination System, Issues Arising Out of Design & Implementation of Policies.

Why in News?

As examination season looms, the debate surrounding India's Examination system intensifies, highlighting its shortcomings and proposing pathways for reform.

What are the Issues Related to the Examination System in India?

- School-Leaving Examinations leading and Lesser Secondary Education:

- The school-leaving examination was designed in the latter half of the 19th century as a way to determine who can be selected for further education, which was very scarce at that time, and also for lower-level jobs in offices.

- It was basically a means of elimination. And it has remained that way all the way up to now. The Grade 10 exam, for instance, fails a large number of children and stops them from going any further.

- This is a kind of structural arrangement in a system in which secondary education is not very widespread and higher secondary education is even less so. Opportunities for further education at the undergraduate level or various kinds of technical education are also relatively scarce.

- The school-leaving examination was designed in the latter half of the 19th century as a way to determine who can be selected for further education, which was very scarce at that time, and also for lower-level jobs in offices.

- Illusion of Equal Opportunity:

- It is in the exam that all children, irrespective of their background, face the same test of three hours.

- The identity of paper-setters and evaluators is not revealed, thus, confidentiality enhances the legitimacy of a situation where children from contrasting circumstances are given an equal-looking opportunity.

- Prioritizes Competition over Comprehension:

- India’s Education system prioritises competition over comprehension, fostering a culture of rote memorization rather than genuine understanding.

- Furthermore, the structure of schools and curricula exacerbates the problem, leaving scant room for exploration and holistic learning.

- Intensely Competitive and Stressful:

- India’s Examination system compares very poorly with the evaluation and assessment systems which are in place in other societies, including European and North American societies as well as China.

- They have reformed their evaluation systems from within by improving teachers’ understanding of what they are looking for in a child right from the start.

- The Indian system right from the beginning becomes intensely competitive and stressful and starts promoting cramming as a way to move forward with high marks.

- India’s Examination system compares very poorly with the evaluation and assessment systems which are in place in other societies, including European and North American societies as well as China.

- Poor Academic Infrastructure:

- Many of the Boards don’t have adequate staff, enough academic faculty to monitor their own procedures. Many of the State Boards are actually in very poor shape as far as their academic infrastructure is concerned.

- Even the CBSE (Central Board of School Education) and ICSE (Indian Certificate of Secondary Education) operate as bureaucratic, mechanical set-ups, potentially compromising the quality of examination processes.

What can be Done to Reform India’s Examination System?

- Addressing Institutional Dysfunction:

- There is a need to recognize and rectify the systemic inadequacies within examination boards, including staffing shortages and infrastructure deficiencies.

- Prioritise the enhancement of academic faculty and administrative capabilities to ensure effective monitoring and evaluation processes.

- There is a need to foster a culture of transparency and accountability within examination boards to uphold standards of integrity and fairness.

- Comprehensive Curriculum Reform:

- Streamline and rationalise the curriculum to accommodate diverse learning needs and interests, while ensuring coherence and depth of content.

- There is a need to Emphasise the development of critical thinking, problem-solving skills, and real-world application of knowledge over rote memorization.

- Integrate interdisciplinary approaches to learning that promote holistic understanding and cross-cutting competencies.

- Flexible Assessment Methods:

- There is a need to Introduce modular examination formats that allow students to demonstrate proficiency in individual subjects over an extended period.

- Shift from high-stakes, one-size-fits-all examinations to a more nuanced assessment framework that values continuous learning and growth.

- Provide opportunities for formative assessment and feedback throughout the learning process to facilitate personalized learning trajectories.

- Professional Development for Educators:

- There is a need to invest in comprehensive training programs for educators to deepen their understanding of pedagogical principles and assessment practices.

- Promote collaboration and knowledge-sharing among teachers to foster a culture of continuous improvement and innovation.

- Equip teachers with the tools and resources necessary to implement learner-centred approaches and cater to diverse student needs effectively.

- Holistic Evaluation Criteria:

- Expand the criteria for evaluating student performance to encompass a broader range of competencies, including creativity, collaboration, and emotional intelligence.

- Develop alternative assessment methods, such as portfolios, projects, and presentations, to capture the multifaceted nature of student achievement.

- Encourage a shift towards authentic, contextually relevant assessments that reflect real-world challenges and opportunities.

- Role of National Curriculum Framework for School Education 2023 (NCF):

- It aims to help in positively transforming the school education system of India as envisioned in NEP 2020, through corresponding positive changes in the curriculum including pedagogy.

- It aims to realise the highest quality education for all children, consistent with realizing an equitable, inclusive, and plural society as envisaged by the Constitution of India.

What Initiatives have been Taken to Reform the Education System?

Conclusion

- By adopting a multifaceted approach that addresses the structural, pedagogical, and cultural dimensions of the examination system, India can pave the way for a more equitable, empowering, and inclusive education system that nurtures the potential of every learner.

- It is imperative that stakeholders collaborate proactively to enact meaningful reforms that prioritize the holistic development and well-being of students, laying the foundation for a brighter future for generations to come.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Which of the following provisions of the Constitution does India have a bearing on Education? (2012)

- Directive Principles of State Policy

- Rural and Urban Local Bodies

- Fifth Schedule

- Sixth Schedule

- Seventh Schedule

Select the correct answer using the codes given below:

(a) 1 and 2 only

(b) 3, 4 and 5 only

(c) 1, 2 and 5 only

(d) 1, 2, 3, 4 and 5

Ans- (d)

Mains

Q1. How have digital initiatives in India contributed to the functioning of the education system in the country? Elaborate on your answer. (2020)

Governance

Mera Gaon, Meri Dharohar Programme

For Prelims: Mera Gaon, Meri Dharohar Programme, National Mission on Cultural Mapping, Scheme of Financial Assistance for the Promotion of Art and Culture, Rashtriya Sanskriti Mahotsavs

For Mains: Government policies in Promoting the cultural heritage of India, Significance of Mera Gaon Mera Dharohar, National Mission on Cultural Mapping.

Why in News?

The Government of India has decided to map and document all villages under the Mera Gaon, Meri Dharohar (MGMD) Programme.

- The program seeks to compile comprehensive information detailing the life, history, and ethos of Indian villages and make it available to virtual and real-time visitors.

- The Ministry of Culture is also implementing a Scheme of Financial Assistance for the Promotion of Art and Culture consisting of 8 components through which cultural organisations are given financial assistance for the promotion of art and culture.

What is the Mera Gaon, Meri Dharohar (MGMD) Programme?

- The MGMD Programme is a national mission on cultural mapping conducted in coordination with Indira Gandhi National Centre for the Arts (IGNCA) under the Ministry of Culture.

- A web portal on MGMD has also been launched. MGMD aims to compile comprehensive information about Indian villages, covering aspects of life, history, and ethos, accessible to both virtual and real-time visitors.

- Under the MGMD, information is collected under seven broad categories:

- Arts and Crafts Village

- Ecologically Oriented Village

- Scholastic Village linked with Textual and Scriptural Traditions of India

- Epic Village linked with Ramayana, Mahabharata and/or Puranic legends and oral epics

- Historical Village linked with Local and National History

- Architectural Heritage Village

- Any other characteristic that may need highlighting such as fishing village, horticulture village, shepherding village etc.

- MGMD is a component of National Mission on Cultural Mapping (NMCM), undertaken as a part of Azadi Ka Amrit Mahotsav (AKAM).

- Under the MGMD cultural mapping of 6.5 lakh villages is being carried out and more than 2 Lakh villages have already been mapped and uploaded on the Mission portal that serves as the National Cultural Work Place.

What is the National Mission on Cultural Mapping (NMCM)?

- About:

- NMCM has been set up by the Ministry of Culture, to identify and document India’s cultural heritage and its creative potential to regenerate and revitalise rural economies, thereby making Village India self-reliant.

- The Cultural Mapping will function at three levels:

- National Directories of artists and living human treasures of cultural industries.

- Creation of National Digital Inventories/Registers of art expression and artist communities/bearers of tradition.

- Evolve policies toward the preservation of art practices and develop welfare schemes for their practitioners.

- Mission Mandate:

- To create a national database through Cultural Mapping with the aid of extensive ground surveys and documentation.

- To Preserve, safeguard, revitalise and disseminate the rich cultural heritage of this country for future generations.

- To create a strong “Cultural Vibrancy” throughout the nation with the help of digital platforms and outreach activities.

What is the Scheme of Financial Assistance for the Promotion of Art and Culture?

- It is a central sector scheme, that aims to support various cultural activities and organizations in the country. The scheme has 8 components, each with a different objective and funding amount.

- The scheme for Financial Assistance for the Promotion of Art and Culture consists of 8 Components, they are:

- Financial Assistance to Cultural organizations with National Presence:

- Provide financial support to reputed cultural organizations with a national presence to disseminate and propagate art & culture.

- This grant is given to such organizations that are properly constituted managing bodies registered in India with an All India Character and have adequate working strength and a track record of spending Rs. 1 crore or more during any 3 of the last 5 years on cultural activities.

- Maximum Grant: Up to Rs. 1 crore.

- Cultural Function & Production Grant (CFPG):

- Provide financial support for various cultural activities including seminars, conferences, research, workshops, festivals, exhibitions, and productions.

- Maximum Grant: Rs. 5 lakh, extendable up to Rs. 20 lakh under exceptional circumstances.

- Financial Assistance for the Preservation & Development of Cultural Heritage of the Himalayas:

- Promote and preserve the cultural heritage of the Himalayas through research, training, and dissemination.

- Funding: Rs. 10 lakhs per year for an organization, extendable up to Rs. 30 lakhs in exceptional cases.

- Financial Assistance for the Preservation & Development of Buddhist/Tibetan Organisations:

- Support voluntary Buddhist/Tibetan organizations, including monasteries, in propagating and developing Buddhist/Tibetan cultural traditions.

- Funding: Rs. 30 lakhs per year for an organization, extendable up to Rs. 1 crore in exceptional cases.

- Financial Assistance for Building Grants including Studio Theatres:

- Provide financial support for creating cultural infrastructure such as studio theatres, auditoriums, rehearsal halls, etc.

- Maximum Grant: Up to Rs. 50 lakh in metro cities and up to Rs. 25 lakh in non-metro cities.

- Financial Assistance For Allied Cultural Activities:

- Support organizations in creating assets to enhance audio-visual spectacles for cultural activities during festivals and major events.

- Maximum Assistance: Audio: Rs. 1 crore, Audio+Video: Rs. 1.50 crore.

- Scheme for Safeguarding the Intangible Cultural Heritage:

- This scheme was launched by the Ministry of Culture in 2013 to safeguard the intangible cultural heritage and diverse cultural traditions of India through revitalization and promotion.

- Domestic Festivals and Fairs:

- The objective of this scheme is to assist in holding the ‘Rashtriya Sanskriti Mahotsavs’ organized by the Ministry of Culture.

- Financial Assistance to Cultural organizations with National Presence:

UPSC Civil Services Examination, Previous Year Question (PYQ)

Mains

Q.1 Safeguarding the Indian Art Heritage is the need of the moment. Discuss. (2018)

Indian Economy

Fiscal Deficit and its Management

For Prelims: Fiscal Deficit and its Management, Interim Budget 2024-25, Fiscal Deficit, Gross Domestic Product (GDP).

For Mains: Fiscal Deficit and its Management, Impact of Fiscal Deficit on Indian Economy.

Why in News?

Since India has been faring with the fiscal challenges in dealing with the National Debts, the Ministry of Finance in its Interim Budget 2024-25 has decided to reduce India’s Fiscal Deficit to 5.1% of Gross Domestic Product (GDP) in 2024-25.

What is Fiscal Deficit?

- About:

- Fiscal deficit refers to the shortfall in a government’s revenue when compared to its expenditure.

- When a government’s expenditure exceeds its revenues, the government will have to borrow money or sell assets to fund the deficit.

- Taxes are the most important source of revenue for any government. In 2024-25, the government’s tax receipts are expected to be Rs 26.02 lakh crore while its total revenue is estimated to be Rs 30.8 lakh crore.

- When a government runs a fiscal surplus, on the other hand, its revenues exceed expenditure.

- It is, however, quite rare for governments to run a surplus. Most governments today focus on keeping the fiscal deficit under control rather than on generating a fiscal surplus or on balancing the budget.

- Projections:

- Government estimates that the Fiscal Deficit would be pared to below 4.5% of GDP by 2025-26 announced in Budget 2021-22.

- The government’s revised estimates also lowered the fiscal deficit projection for 2023-24 to 5.8% of GDP.

- Fiscal Deficit and National Debt:

- The National Debt is the total amount of money that the government of a country owes its lenders at a particular point in time.

- Government debt encompasses various liabilities, including domestic and external loans, alongside obligations to schemes such as small savings, provident funds, and special securities.

- These liabilities entail both interest payments and repayment of principal amounts, imposing a considerable financial burden on the government's finances.

- It is usually the amount of debt that a government has accumulated over many years of running fiscal deficits and borrowing to bridge the deficits.

- The higher a government’s fiscal deficit as a share of GDP, the less likely its lenders will be paid back without trouble.

- Countries with larger economies can run higher fiscal deficits. As of 2022, the leading deficit holders included Italy -7.8%, Hungary -6.3%, South Africa -4.8%, Spain -4.7%, France -4.7%.

- The National Debt is the total amount of money that the government of a country owes its lenders at a particular point in time.

- Trends in National Debt:

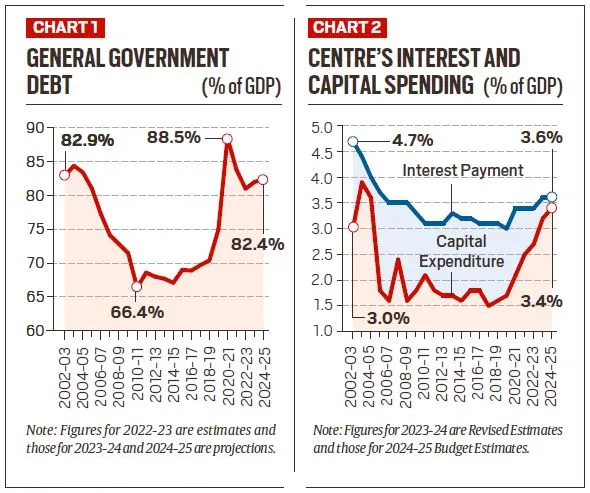

- The debt-GDP ratio stood at 84.4% in 2003-04, witnessing subsequent declines and rises under different administrations.

- Post 2014, the government witnessed a surge in the debt-GDP ratio, reaching a peak of 88.5% in 2020-21, driven primarily by the economic disruptions caused by the Covid-19 Pandemic.

- Despite slight improvements in subsequent fiscal years, the ratio remains elevated, projected at 82.4% for 2024-25, posing significant challenges for fiscal management.

Key Formulas

- Fiscal Deficit= Total Expenditure- Total Receipts (excluding borrowings).

- Revenue Deficit: This deficit of a government or business can be determined by subtracting the total revenue receipts from the total income expenditure.

- Revenue deficit= Total revenue receipts – Total revenue expenditure.

- Debt to GDP Ratio: It It measures how much a nation owes in relation to its GDP

- Debt to GDP= Total Debt of Country/Total GDP of Country

How does the Government Fund its Fiscal Deficit?

- Borrowing from Bond Market:

- In order to fund its fiscal deficit, the government mainly borrows money from the bond market where lenders compete to lend to the government by purchasing bonds issued by the government.

- In 2024-25, the Centre is expected to borrow a gross amount of Rs 14.13 lakh crore from the market, which is lower than its borrowing goal for 2023-24, as it expects to fund its spending in 2024-25 through higher GST collections.

- As a government’s finances worsen, demand for the government’s bonds begins to drop forcing the government to offer to pay a higher interest rate to lenders, and leading to higher borrowing costs for the government.

- In order to fund its fiscal deficit, the government mainly borrows money from the bond market where lenders compete to lend to the government by purchasing bonds issued by the government.

- Role of Reserve Bank of India:

- The RBI plays a significant role in the credit market, indirectly facilitating government borrowing. While central banks may not directly purchase government bonds from the primary market, they engage in Open Market Operations (OMO) to acquire bonds from private lenders in the secondary market.

- This infusion of liquidity by central banks effectively supports government borrowing efforts.

- Central bank interventions through OMO involve creating fresh money, potentially leading to increased money supply and inflationary pressures in the economy over time.

- Monetary Policy:

- Monetary policy also plays a crucial role in reducing the costs for governments to borrow money from the market.

- Central bank lending rates which were near zero in many countries before the pandemic have risen sharply in the aftermath of the pandemic.

- This makes it more expensive for governments to borrow money and could be one reason why the Centre is keen to bring down its fiscal deficit.

What is the Legislation Related to Fiscal Management in India?

- Fiscal Responsibility and Budget Management (FRBM) Framework:

- The FRBM Act, instituted in 2003, set ambitious targets for debt reduction, aiming to limit the general government debt to 60% of GDP by 2024-25.

- However, subsequent fiscal trajectories deviated from these targets, with the Centre's outstanding debt surpassing the originally envisioned thresholds.

- FRBM Review Committee Report has recommended a debt to GDP ratio of 60% for the general (combined) government by 2023, comprising 40% for the Central Government and 20% for the State Governments.

Why is it Important to Worry About Fiscal Deficit?

- Impact on Inflation:

- There is a strong direct relationship between the government’s fiscal deficit and Inflation in the country.

- When a country’s government runs a persistently high fiscal deficit, this can eventually lead to higher inflation as the government will be forced to use fresh money issued by the central bank to fund its fiscal deficit.

- The fiscal deficit in 2020 reached a high of 9.17% of GDP during the pandemic. It has since decreased significantly and is expected to reach 5.8% in 2023-24.

- Fiscal Discipline Improves Ratings:

- A lower fiscal deficit indicates better government fiscal discipline. This can lead to higher ratings for Indian government bonds.

- When the government relies more on tax revenues and borrows less, it boosts lender confidence and lowers borrowing costs.

- Management of Public Debt:

- A high fiscal deficit can also adversely affect the ability of the government to manage its overall public debt.

- In December 2023, the IMF warned that India’s public debt could rise to more than 100% of GDP in the medium term due to risks.

- A lower fiscal deficit may help the government to more easily sell its bonds overseas and access cheaper credit from the international bond market.

What can be Done to Manage Fiscal Deficit and National Debt in India?

- Fiscal Discipline and Consolidation:

- Adhering to fiscal consolidation targets, as outlined in the FRBM Act is crucial.

- The government should aim to gradually reduce the fiscal deficit-to-GDP ratio to ensure sustainable public finances.

- Implementing prudent fiscal policies, including expenditure rationalisation, revenue enhancement measures, and subsidy reforms, can help in reducing the reliance on borrowing and mitigating fiscal imbalances.

- Enhancing Revenue Mobilisation:

- Strengthening tax administration and compliance to broaden the tax base and improve revenue collection.

- Exploring avenues for diversifying revenue sources, such as introducing new taxes or levies on luxury goods, wealth, or environmental taxes.

- Rationalising Expenditures:

- Conducting a comprehensive review of government expenditures to identify inefficiencies and prioritise spending in key areas such as healthcare, education, and infrastructure.

- Implementing measures to curb non-essential spending and subsidies, while ensuring targeted support for vulnerable populations.

- Debt Management Strategies:

- Developing a prudent debt management strategy to optimise borrowing costs and minimise refinancing risks.

- Diversifying the investor base and sources of financing, including domestic and international markets, to mitigate exposure to market volatility.

- Long-Term Structural Reforms:

- Undertaking structural reforms aimed at improving the efficiency and competitiveness of the economy, including labour market reforms, ease of doing business initiatives, and governance reforms.

- Addressing structural bottlenecks and challenges in sectors such as agriculture, manufacturing, and services to unleash growth potential and enhance fiscal sustainability.

Conclusion

- By implementing a combination of Fiscal Consolidation measures, India can effectively manage its national debt and fiscal deficit, ensuring fiscal sustainability, economic growth, and long-term prosperity.

- However, it's essential to strike a balance between short-term stabilization efforts and long-term structural reforms to achieve sustainable fiscal outcomes.

UPSC Civil Services, Previous Year Questions (PYQ)

Prelims

Q1. In the context of governance, consider the following: (2010)

- Encouraging Foreign Direct Investment inflows

- Privatization of higher educational Institutions

- Down-sizing of bureaucracy

- Selling/offloading the shares of Public Sector Undertakings

Which of the above can be used as measures to control the fiscal deficit in India?

(a) 1, 2 and 3

(b) 2, 3 and 4

(c) 1, 2 and 4

(d) 3 and 4 only

Ans: D

Q2. Which one of the following is likely to be the most inflationary in its effect? (2021)

(a) Repayment of public debt

(b) Borrowing from the public to finance a budget deficit

(c) Borrowing from the banks to finance a budget deficit

(d) Creation of new money to finance a budget deficit

Ans: (d)

Q3. Which of the following is/are included in the capital budget of the Government of India? (2016)

- Expenditure on acquisition of assets like roads, buildings, machinery, etc.

- Loans received from foreign governments

- Loans and advances granted to the States and Union Territories

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)

Mains

Q1. One of the intended objectives of the Union Budget 2017-18 is to ‘transform, energise and clean India’. Analyse the measures proposed in the Budget 2017-18 to achieve the objective. (2017)

Q2. Distinguish between Capital Budget and Revenue Budget. Explain the components of both these Budgets. (2021)

Q.3 Do you agree with the view that steady GDP growth and low inflation have left the Indian economy in good shape? Give reasons in support of your arguments. (2019)

Important Facts For Prelims

World's First Melanistic Tiger Safari in Odisha

Why in News?

Odisha is set to unveil the world's first melanistic tiger safari near the Similipal Tiger Reserve (STR).

What is Odisha's Vision for the Melanistic Tiger Safari?

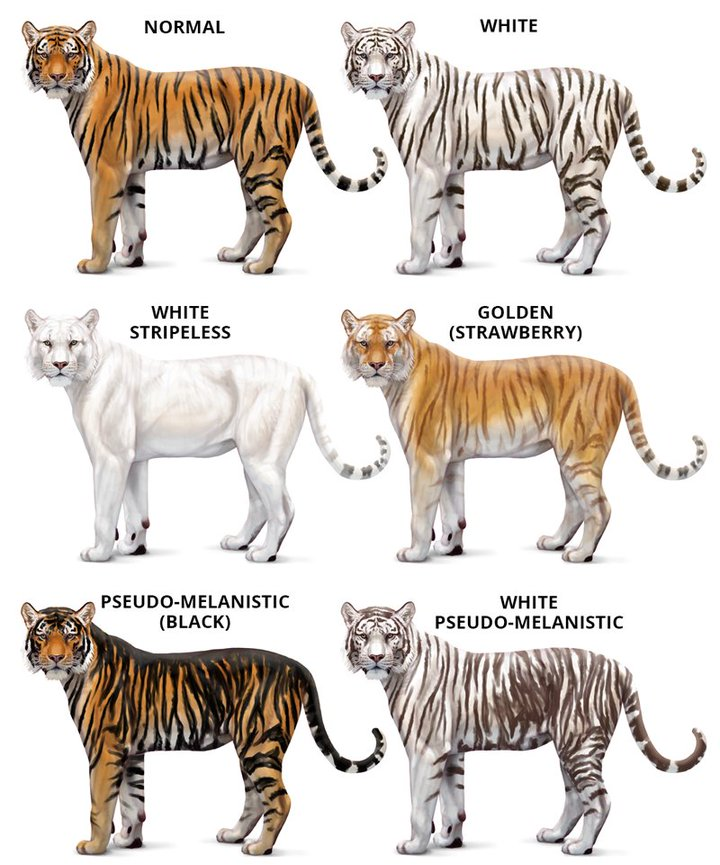

- Melanism and Melanistic Tiger: Melanism is a genetic condition, that results in increased melanin production, leading to black or nearly black skin, feathers, or hair in animals.

- The Royal Bengal Tigers of Similipal boast a distinctive lineage with elevated melanin levels, giving rise to black and yellow interspersed stripes, making them pseudo-melanistic.

- According to the All India Tiger Estimation, 2022, Similipal Tiger Reserve houses 16 tigers, with 10 of them displaying melanistic traits.

- The Royal Bengal Tigers of Similipal boast a distinctive lineage with elevated melanin levels, giving rise to black and yellow interspersed stripes, making them pseudo-melanistic.

- Location of Safari: Spanning approximately 200 hectares near Dhanbad-Balasore National Highway-18, the safari site lies in close proximity to STR, providing a landscape akin to Simlipal.

- In the beginning, three melanistic tigers from Nandankanan Zoo, along with rescued or orphaned tigers, will occupy the open enclosures of the safari.

- Objective: It aims to raise awareness about the conservation needs of melanistic tigers, providing a platform for researchers and enthusiasts to engage with these rare big cats.

- Approval: The project necessitates approvals from the Central Zoo Authority and other regulatory bodies overseeing wildlife initiatives in the country.

- A National Tiger Conservation Authority committee will also conduct a feasibility study of the proposed site before granting final clearance.

What are the Other Colour Variations in Tigers?

- Orange with Black or Brown Stripes: This is the most common and widely recognized tiger coloration, e.g, the Royal Bengal Tiger.

- Each tiger's stripe pattern is unique, serving as a form of camouflage, in their natural habitat.

- White Tigers: They are not considered a separate subspecies. The colour of the white tiger's fur is the result of a genetic mutation called leucism.

- Leucism is a genetic condition that results in reduced pigmentation in animals, causing them to have white or pale-colored skin, feathers, fur, or scales.

- Golden Tigers: They are also not considered a subspecies of tigers because their golden colour variation is caused by the presence of a recessive gene called "wideband".

- The wideband gene reduces melanin production during the cycle of hair growth.

- Recently, it was spotted in Kaziranga National Park.

|

|

Similipal Tiger Reserve

- Location: Similipal is situated in the Deccan Peninsula Biogeographic Zone.

- Vegetation: Predominantly moist mixed deciduous forest with tropical semi-evergreen patches and sporadic dry deciduous forests and grasslands.

- Floral Richness: Holds 7% of India's flowering plants and 8% of its orchid species.

- Faunal Diversity: Home to 55 mammal species, 361 bird species, 62 reptile species, 21 amphibian species, and numerous insects and microfauna.

- Major species other than tigers include sambar, chital, barking deer, gaur, and mouse deer, leopards, fishing cat etc.

- Management efforts have revived mugger crocodile populations along rivers Khairi and Deo.

- It has also been designated as a Global Network of Biospheres site since 2009.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Consider the following pairs: (2013)

National Park - River flowing through Park

- Corbett National Park : Ganga

- Kaziranga National Park : Manas

- Silent Valley National Park : Kaveri

Which of the above pairs is/are correctly matched?

(a) 1 and 2

(b) 3 only

(c) 1 and 3

(d) None

Ans: (d)

Q2. Among the following Tiger Reserves, which one has the largest area under “Critical Tiger Habitat”? (2020)

(a) Corbett

(b) Ranthambore

(c) Nagarjunasagar-Srisailam

(d) Sundarbans

Ans: C

Mains

Q: “Policy contradictions among various competing sectors and stakeholders have resulted in inadequate ‘protection and prevention of degradation’ to environment.” Comment with relevant illustrations. (2018)

Important Facts For Prelims

Grammy Award 2024

Why in News?

Shakti, a fusion music group comprising tabla maestro Zakir Hussain and singer Shankar Mahadevan, has won the 66th Grammy Award (2024) for Best Global Music Album for “This Moment”.

- Shakti's third studio album, "This Moment," was released on 23rd June 2023, marking their return after 46 years under the same name.

What are Grammy Awards?

- About:

- Grammy Award (originally named Gramophone Award) is a series of awards presented annually in the United States (US) by the National Academy of Recording Arts & Sciences (NARAS) or the Latin Academy of Recording Arts & Sciences (LARAS), (LARAS only for recordings in Spanish/Portuguese languages).

- This annual event to recognize musical achievements was started in 1959 to respect the performers for the year 1958. The honorees receive a golden statuette of a gramophone.

- Grammy Award (originally named Gramophone Award) is a series of awards presented annually in the United States (US) by the National Academy of Recording Arts & Sciences (NARAS) or the Latin Academy of Recording Arts & Sciences (LARAS), (LARAS only for recordings in Spanish/Portuguese languages).

- India’s Performance in 2024 Awards:

- Shakti, comprising Zakir Hussain, Shankar Mahadevan, John McLaughlin, Ganesh Rajagopalan, and Selvaganesh Vinayakram, won the 2024 Grammy for their album "This Moment."

- Described as an "unprecedented transcontinental collaboration," Shakti brings together musicians from both Eastern and Western traditions, pioneering the blueprint for what is now recognized as world music.

- Zakir Hussain clinches an additional pair of victories, securing two more Grammys at the ceremony.

- He earned one for the best global music performance with 'Pashto' and another for the best contemporary instrumental album 'As We Speak,'.

- The album also features Indian flute player Rakesh Chaurasia, the nephew of the renowned flautist Hariprasad Chaurasia.

- Shakti, comprising Zakir Hussain, Shankar Mahadevan, John McLaughlin, Ganesh Rajagopalan, and Selvaganesh Vinayakram, won the 2024 Grammy for their album "This Moment."

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. To integrate cultural leaders into its meetings, which one of the following gives “Crystal Award”? (2009)

(a) Asia Pacific Economic Cooperation

(b) International Bank for Reconstruction and Development

(c) World Health Organization

(d) World Economic Forum

Ans: D

Important Facts For Prelims

Green Propulsion System

Why in News?

A Green Propulsion System, developed under the Technology Development Fund (TDF) scheme of the Defence Research and Development Organisation (DRDO), has successfully demonstrated in-orbit functionality on a payload launched by the Polar Satellite Launch Vehicle (PSLV) - C58 Mission.

- This is a major achievement for the Indian space sector, as it showcases the potential of green and indigenous technologies for enhancing the country’s defence capabilities.

Note

- The TDF is a flagship programme of the Ministry of Defence which is being executed by the DRDO under the “Make in India” initiative for funding innovation in defence and aerospace, especially to startups and MSMEs.

What is the Green Propulsion System?

- The Green Propulsion System was developed by a Bengaluru-based start-up Bellatrix Aerospace Pvt Ltd (Development Agency).

- This project uses a 1N Class Green Monopropellant for altitude control and orbit keeping of microsatellites.

- The system consists of indigenously-developed propellant, fill and drain valves, latch valve, solenoid valve, catalyst bed, drive electronics, etc.

- This innovative technology has resulted in a non-toxic and environment-friendly propulsion system for low orbit space, unlike the conventional hydrazine-based propulsion systems that are hazardous and polluting.

- The system is ideal for space missions with high thrust requirements.

Propulsion System

- Propulsion means to push forward or drive an object forward. A propulsion system is a machine that produces thrust to push an object forward.

- A propellant is a substance that is expelled or expanded to create thrust. Propellants can be gases, liquids, or solids.

- In rockets, propellants are chemical mixtures that produce thrust. They consist of fuel and an oxidizer.

- The Indian Space Research Organisation (ISRO) is developing green propellants for use in future rocket & satellite propulsion systems.

- ISRO has made a beginning by developing an eco-friendly solid propellant based on Glycidyl Azide Polymer (GAP) as fuel and Ammonium Di-Nitramide (ADN) as oxidizer at the laboratory level, which will eliminate the emission of chlorinated exhaust products from rocket motors.

What is the PSLV-C58 Mission?

- ISRO's PSLV-C58 launched an X-ray Polarimeter Satellite (XPOSAT) into an Eastward low inclination orbit on 1st January 2024.

- XPoSat is the first dedicated scientific satellite from ISRO to carry out research in space-based polarisation measurements of X-ray emission from celestial sources.

- This mission aims to investigate the polarization of intense X-ray sources.

- X-rays, with wavelengths of 0.01-10 nanometers, are electromagnetic radiation characterized by perpendicular electric and magnetic fields.

- Measuring X-ray polarization, aids astronomers in studying magnetic field orientations and strengths in celestial bodies, crucial for understanding pulsars, black hole regions, and other X-ray-emitting cosmic phenomena.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. With reference to India’s satellite launch vehicles, consider the following statements: (2018)

- PSLVs launch the satellites useful for Earth resources monitoring whereas GSLVs are designed mainly to launch communication satellites.

- Satellites launched by PSLV appear to remain permanently fixed in the same position in the sky, as viewed from a particular location on Earth.

- GSLV Mk III is a four-staged launch vehicle with the first and third stages using solid rocket motors; and the second and fourth stages using liquid rocket engines.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3

(c) 1 and 2

(d) 3 only

Ans: (a)

Q.2 In the context of space technology, what is “Bhuvan”, recently in the news? (2010)

(a) A mini satellite launched by ISRO for promoting the distance education in India

(b) The name given to the next Moon Impact Probe, for Chandrayan-II

(c) A geoportal of ISRO with 3D imaging capabilities of India

(d) A space telescope developed by India

Ans: (c)

Mains:

Q.1 India has achieved remarkable successes in unmanned space missions including the Chandrayaan and Mars Orbiter Mission, but has not ventured into manned space mission. What are the main obstacles to launching a manned space mission, both in terms of technology and logistics? Examine critically. (2017)

Q.2 Discuss India’s achievements in the field of Space Science and Technology. How the application of this technology has helped India in its socio-economic development? (2016)

Rapid Fire

Manatee Gathering at Florida Park

Blue Spring State Park, Florida, USA reported a gathering of nearly 1,000 manatees. The gathering of manatees may be due to several reasons, like-

- Drop in temperature to 14.1°C, a decline in seagrass (manatees' primary food), due to algae blooms on Florida coast, and to seek protection from watercraft collisions.

- Manatees (sea cows) are typically solitary animals.

- Sea cows, comprising manatees and dugongs, consist of four manatee species and one dugong species, belonging to the herbivorous Dugongidae family.

- Manatees dwell in zones such as the Caribbean, Gulf of Mexico, Amazon, East and West Africa, while dugongs inhabit coastal regions of the Indian and Pacific Oceans.

- IUCN Status: Manatees and dugongs are both are Vulnerable.

- Dugongs: Schedule 1 of the Wild Life (Protection) Act, 1972.

- Sea cows, comprising manatees and dugongs, consist of four manatee species and one dugong species, belonging to the herbivorous Dugongidae family.

Read more: Manatees

Rapid Fire

Ancient Subika Painting

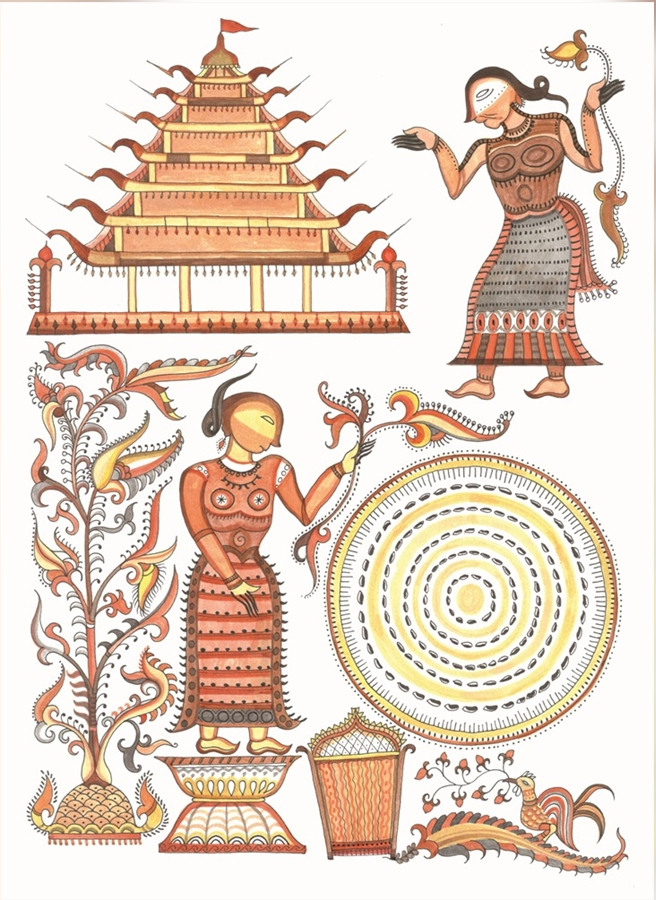

In a bid to preserve Manipur's rich cultural heritage, a concerted effort is underway to revive the ancient Subika painting style in Manipur, which is on the brink of extinction.

- The Subika painting style is intricately linked to the Meitei community's cultural history through its six surviving manuscripts: Subika, Subika Achouba, Subika Laishaba, Subika Choudit, Subika Cheithil and Thengrakhel Subika.

- Despite holding significant historical value, the painting has faced neglect over the years, leading to a decline in awareness.

- The paintings are done on handmade paper, and the materials for manuscripts, such as handmade paper or tree bark, are prepared locally.

Read more: Indian Painting

Rapid Fire

Child Safety Portals

Source: PIB

Recently, the Union Ministry of Women and Child Development provided valuable insights into the Track Child Portal and GHAR - GO Home and Re-Unite portal during a written reply in the Lok Sabha.

- The Track Child Portal enables tracking of missing and found children across states and UTs, supported by various stakeholders.

- The "Khoya-Paya" feature allows citizens to report missing or sighted children, fostering community involvement.

- It is also integrated with the Crime and Criminal Tracking & Network Systems of the Ministry of Home Affairs, which allows interoperability in terms of matching of F.I.Rs of missing children

- Further, a portal namely GHAR - GO Home and Re-Unite (Portal for Restoration and Repatriation of Child) has been developed and launched by National Commission for Protection of Child Rights to digitally monitor and track the restoration and repatriation of children as per the protocols under the Juvenile Justice (Care and Protection of Children) Act, 2015.

Read more: Social Protection for Children

Rapid Fire

CLEA - Commonwealth Attorneys and Solicitors General Conference 2024

Recently, the Indian Prime Minister inaugurated the Commonwealth Legal Education Association (CLEA) - Commonwealth Attorneys and Solicitors General Conference (CASGC) 2024 in New Delhi, emphasising the significance of global cooperation in addressing contemporary legal challenges.

- The conference, themed "Cross-Border Challenges in Justice Delivery," convened leading legal minds to deliberate on issues including judicial transition, ethical dimensions of legal practice, and executive accountability.

- It witnessed the participation of Attorney Generals and Solicitors from the Commonwealth nations spanning the Asia-Pacific, Africa, and the Caribbean along with various international delegations.

- It was highlighted that trade and crime transcend geographical boundaries necessitating a reevaluation of legal frameworks.

- International cooperation is essential in resolving diverse issues, including cyber fraud and terrorism.

Read more: Attorney General of India