Indian Economy

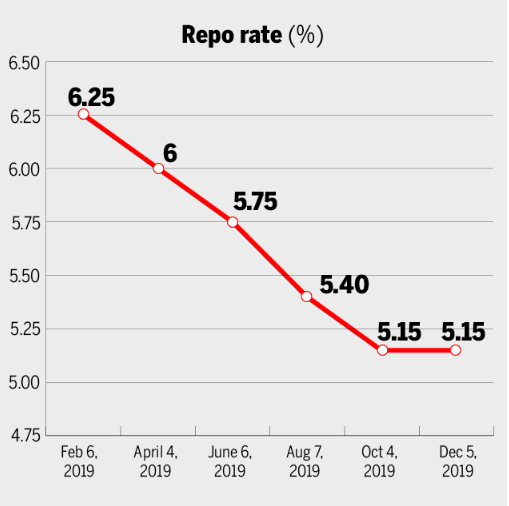

Repo Rate Unchanged

Why in News

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) has decided to keep the repo rate unchanged at 5.15% in the recent bimonthly policy review.

- This is the first bi-monthly monetary meeting in the year 2019 in which the repo rate has been kept unchanged. Since February 2019, the RBI has cumulatively cut rates by 135 basis points (bps).

- The market was expecting the central bank to cut the repo rate further owing to the weak economic growth rate.

- The repo rate has been kept unchanged owing to inflation pressure.

- The RBI has revised its inflation forecast for the second half of the 2019-20 to 4.7-5.1% from earlier 3.5-3.7%.

- The RBI has also slashed its GDP growth forecast for 2019-20 from 6.1% projected earlier to 5%.

Monetary Policy Committee

- The Monetary Policy Committee is a statutory and institutionalized framework under the Reserve Bank of India Act, 1934, for maintaining price stability, while keeping in mind the objective of growth.

- The Governor of RBI is ex-officio Chairman of the committee.

- The MPC determines the policy interest rate (repo rate) required to achieve the inflation target (4%).

- An RBI-appointed committee led by the then deputy governor Urjit Patel in 2014 recommended the establishment of the Monetary Policy Committee.

Repo rate

- It is the rate at which the central bank of a country (Reserve Bank of India in case of India) lends money to commercial banks in the event of any shortfall of funds.

- It is used by monetary authorities to control inflation.

- In the event of inflation, central banks increase repo rate as this acts as a disincentive for banks to borrow from the central bank. This ultimately reduces the money supply in the economy and thus helps in arresting inflation.

- The central bank takes the contrary position in the event of a fall in inflationary pressures.

- Ideally, a low repo rate should translate into low-cost loans for the general masses. When the RBI slashes its repo rate, it expects the banks to lower their interest rates charged on loans.

Current Economic Scenario

- Headline inflation spiked above the 4% medium-term target in October, 2019.

- The food and fuel inflation form one of the components of headline inflation in India.

- The increase was largely due to increase in food prices as fuel group prices have been in deflation for four months in a row.

- Headline Inflation is different from Core Inflation. Core Inflation excludes volatile goods from the basket of commodities tracking Headline Inflation. These volatile commodities mainly comprise food and beverages (including vegetables) and fuel and light (crude oil).

- Manufacturing has seen a 1% contraction in the second quarter after almost a flat first quarter. This is clearly reflected in capacity utilisation of the industry that has dropped to 68.9% in July-September 2019 compared with 73.6% in April-June 2019.

- The output in eight core industries — which make up 40% of the Index of Industrial Production (IIP)— contracted for the second consecutive month in October 2019.

RBI’s Stand

- Several measures already initiated by the Government and the monetary easing undertaken by the Reserve Bank since February 2019 are gradually expected to further feed into the real economy.

- The focus must be on the need to maximise the impact of rate reductions.

- The Weighted Average Lending Rate (WALR) of scheduled commercial banks between December 2018 and October 2019 increased by 5 basis points bps against a cumulative policy rate cut to the tune of 135 bps. This implies that retail borrowers are yet to experience reduction in commercial lending rates of banks. For them, the cost of borrowing has yet not come down.

- Data on corporate finance and on projects sanctioned by banks and financial institutions suggest some early signs of recovery in investment activity, though its sustainability needs to be watched closely. The need at this juncture is to address impediments, which are holding back investments.

- The introduction of external benchmarks is expected to strengthen monetary transmission. In this context, there is also a need for greater flexibility in the adjustment in interest rates on small saving schemes.

- The forthcoming union budget (2020-21) will provide better insight into further measures to be undertaken by the Government and their impact on growth.

Indian Economy

Forex Reserves

Why in News

India’s Foreign Exchange (Forex) reserves have crossed the $450-billion mark for the first time ever on the back of strong investment inflows which enabled the Reserve Bank of India (RBI) to buy dollars from the market.

- India’s forex reserves were at $451.7 billion on 3rd December 2019, an increase of $38.8 billion over end-March 2019.

- The rise in forex reserves will give the central bank the leeway to act against any sharp depreciation of the rupee.

- At $451.7 billion, the country’s import cover is now over 11 months.

- India’s forex reserves fell to $274.8 billion in September of 2013, prompting the Centre and RBI to unleash measures to attract inflows. It has been a steady rise for the reserves since then, with $175 billion added in the last six years.

Foreign Exchange Reserves

- Foreign exchange reserves are assets held on reserve by a central bank in foreign currencies, which can include bonds, treasury bills and other government securities.

- It needs to be noted that most foreign exchange reserves are held in U.S. dollars.

- These assets serve many purposes but are most significantly held to ensure that the central bank has backup funds if the national currency rapidly devalues or becomes altogether insolvent.

- India’s Forex Reserve include:

- Foreign Currency Assets (such as dollar)

- Gold

- Special Drawing Rights

- Special drawing rights, or SDR, are an artificial currency instrument created by the International Monetary Fund, which uses them for internal accounting purposes.

- The value of the SDR is calculated from a weighted basket of major currencies, including the U.S. dollar, the euro, Japanese yen, Chinese yuan, and British pound.

- The SDR interest rate (SDRi) provides the basis for calculating the interest rate charged to member countries when they borrow from the IMF and paid to members for their remunerated creditor positions in the IMF.

- Reserve Position in the International Monetary Fund

- A reserve tranche position implies a portion of the required quota of currency each member country must provide to the International Monetary Fund (IMF) that can be utilized for its own purposes.

- The reserve tranche is basically an emergency account that IMF members can access at any time without agreeing to conditions or paying a service fee.

Indian Economy

Guidelines for Licencing of Small Finance Banks

Why in News

Recently, the Reserve Bank of India has released final Guidelines for ‘on tap’ Licencing for Small Finance Banks (SFBs).

- RBI had issued in-principle approval to ten applicants for SFB in 2015. It was mentioned that after gaining experience in dealing with these banks, RBI would grant ‘on-tap’ licensing.

- An “on-tap” facility would mean the RBI will accept applications and grant licences for banks throughout the year.

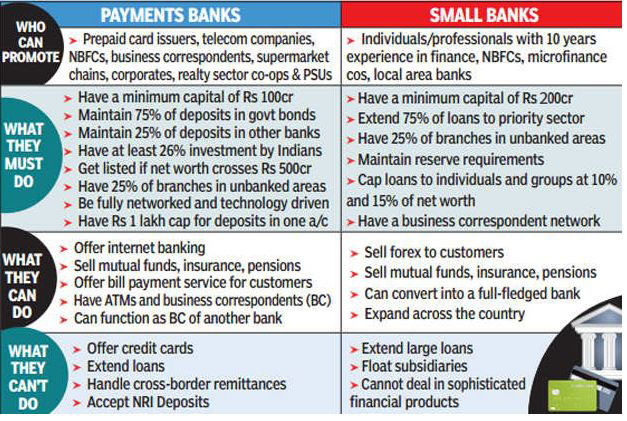

Guidelines for ‘on-tap’ Licencing

- Capital requirement: The minimum paid-up voting equity capital / net worth requirement shall be ₹ 200 crores.

- For Primary (Urban) Co-operative Banks (UCBs), desirous of voluntarily transiting into SFBs initial requirement of net worth shall be at ₹ 100 crores, which will have to be increased to ₹ 200 crores within 5 years from the date of commencement of business.

- Scheduled bank status to SFBs: SFBs will be given scheduled bank status immediately upon commencement of operations. Also, SFBs will have general permission to open banking outlets from the date of commencement of operations.

- Payments Banks conversion to SFBs: The payment banks can apply for conversion into SFB after 5 years of operations if they are otherwise eligible as per these guidelines.

Small Finance Bank

- The small finance bank will primarily undertake basic banking activities of acceptance of deposits and lending to unserved and underserved sections including small business units, small and marginal farmers, micro and small industries and unorganised sector entities.

- It can also undertake other non-risk sharing simple financial services activities such as the distribution of mutual fund units, insurance products, pension products, etc. with the prior approval of the RBI

- Eligible candidates for setting up SFB are:

- Resident individuals/professionals with 10 years of experience in banking and finance.

- The companies and societies owned and controlled by residents.

- Existing Non-Banking Finance Companies (NBFCs), Micro Finance Institutions (MFIs), Local Area Banks (LABs) and payment banks that are owned and controlled by residents.

- It needs to open at least 25% of its banking outlets in unbanked rural centres.

- The bank will be required to extend 75% of its adjusted net bank credit to the Priority Sector Lending (PSL).

- At least 50% of its loan portfolio should constitute loans and advances of up to ₹ 25 lakhs.

- The maximum loan size and investment limit exposure to a single and group would be restricted to 10% and 15% of its capital funds, respectively. They cannot extend large loans.

- If the initial shareholding by promoters in the bank is in excess of 40% of paid-up voting equity capital, it should be brought down to 40% within a period of 5 years.

- The small finance banks will be subject to Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR).

- Banks are required to hold a certain proportion of their deposits in the form of cash is known as the CRR. This minimum ratio (that is the part of the total deposits to be held as cash) is stipulated by the RBI.

- The share of Net Demand and Time Liabilities that a bank is required to maintain safe and liquid assets, such as government securities, cash, and gold is termed as SLR.

Indian Polity

Removal of Anglo-Indians Reservation in Legislative Bodies

Why in News

Recently, the Union Cabinet has approved the removal of reservation for Anglo-Indians in legislative bodies.

- Anglo-Indians were provided two nominated seats in the Lok Sabha and one nominated seat in the State Legislative Assemblies to ensure adequate representation of the community in elected legislative bodies.

- Anglo-Indians constitute a religious, social, as well as a linguistic minority. Being numerically an extremely small community, and being interspersed all over India, the Anglo-Indians were provided reservations in legislative bodies.

- The reservation for the Anglo-Indian community was extended till the year 2020 through the 95th Amendment, 2009. Originally,this provision was to operate till 1960.

Constitutional Provisions

- Article 366: It defines Anglo-Indian as a person whose father or any of whose other male progenitors in the male line is or was of European descent but who is domiciled within the territory of India and is or was born within such territory of parents habitually resident therein and not established there for temporary purposes only.

- Article 331: It states that the President can nominate two members of the Anglo-Indian community to the Lok Sabha if the community is not adequately represented.

- Article 333: It states that the Governor of a State may if he is of the opinion that the Anglo Indian community needs representation in the Legislative Assembly of the State and is not adequately represented therein, nominate one member of that community to the Assembly.

- Article 334(b): The reservation of the Anglo Indian community in the Legislative bodies was extended for 40 years in 1949 through the insertion of this article.

- National Commission for SCs (Article 338) : It investigates all matters relating to the Constitutional and other legal safeguards for the Anglo-Indian community and report to the President upon their working.

Governance

Centre Stops Online Sale of Medicines

Why in News

Drugs Controller General of India (DCGI) has directed all states and Union territories to prohibit the sale of medicines through unlicensed online platforms as per the Delhi High Court order.

- In its Zaheer Ahmed case (2018), the Delhi High Court had said that online sale of medicines should be prohibited until draft rules to regulate e-pharmacies are finalized and put in place.

- Online sale of prescription medicines is a relatively recent phenomenon in India and laws are yet to be framed to regulate the industry.

Key Points

- The government has prepared draft e-pharmacy rules that are under consideration of a group of ministers (GoM) headed by the defence minister.

- The Delhi High Court had stated that the drugs were sold online in violation of the Drugs and Cosmetics (D&C) Act, 1940. Under the D&C Act, 1940 and D&C Rules, 1945 sale of spurious drugs is a punishable offence and State Licensing Authorities are empowered to take action in this regard.

- However, e-pharmacies continued to sell online, after securing a stay from the Madras High Court in January 2019.

- In December 2018, a single-judge Bench of the Madras High Court had told traders not to proceed with their online business in drugs till the rules are notified by the Central government.

- E-pharmacies have claimed that their business model is well covered by the Information Technology (IT) Act, 2000 under the concept of intermediaries, and the pharmacy retail operations are covered by the Drugs and Cosmetics Act.

The Drugs and Cosmetics Act, 1940

- It regulates the import, manufacturing and distribution of drugs in India.

- Its objective is to ensure that the drugs and cosmetics sold in India are safe, effective and fulfills the safety standards and parameters.

Some Provisions of Draft Rules on Sale of Drugs by e-pharmacy

- Those who want to sell pharmacy online will have to register with the Central Drugs Standard Control Organization (CDSCO), the country's apex drug regulator and central licensing authority.

- Also, they must retain prescriptions and verify details of patients and doctors.

- No e-pharmacy shall advertise any drug on radio or television or the Internet or print or any other media for any purpose.

- The supply of any drug shall be made against a cash or credit memo generated through the e-pharmacy portal and such memos shall be maintained by the e-pharmacy registration holder as a record.

e-Pharmacy Sector

- Advantages:

- e-pharmacies offer discounts, doorstep delivery, accountability in case of delay in services or non-availability of a particular brand or combination of drugs at the click of a button.

- They offer the customers the convenience to compare and select their medicines.

- Disadvantages:

- They present stiff competition and threaten the business of traditional pharmacies. Their growth can impact the livelihood of nearly a million chemists, distributors and their employees

- Monitoring of fake and illegal pharmacies could be a challenge and cyber experts need to be employed to tackle such cases.

- A scanned copy of a prescription is not considered authentic under the D&C Act as well as under the IT Act.

- Drug abuse: One prescription can be uploaded on two different e-pharmacy sites, leading to drug abuse. Such multiple dispensing of prescriptions can lead to misuse of drugs and increase the number of drug addicts, especially youth.

Indian History

Dr B. R. Ambedkar's 63rd Mahaparinirvan Diwas

Why in News

Mahaparinirvan Diwas is observed every year on December 6 to commemorate death anniversary of Dr. B R Ambedkar.

- He is known as the Father of the Indian Constitution and was independent India’s first law minister.

- Dr. Ambedkar was a social reformer, jurist, economist, author, polyglot orator, a scholar and thinker of comparative religions.

“Constitutional morality is not a natural sentiment. It has to be cultivated. We must realise that our people have yet to learn it. Democracy in India is only a top-dressing on an Indian soil which is essentially undemocratic.”

― B.R. Ambedkar, Annihilation of Caste

“I measure the progress of a community by the degree of progress which women have achieved”

― B.R. Ambedkar

About Dr. Ambedkar

- Dr. B.R. Ambedkar was born on 14 April 1891 in Mhow, Central Province (now Madhya Pradesh).

- He founded Bahishkrit Hitkarni Sabha (1923).

- He led the Mahad Satyagraha in March 1927 to challenge the regressive customs of the Hindus.

- He participated in all three round-table conferences.

Round Table Conferences

- First Round Table Conference: It was held in London on Nov. 12, 1930 but the Congress did not participate in it.

- In March 1931, Mahatma Gandhi and Lord Irwin (Viceroy of India 1926-31) entered into a Pact, called Gandhi-Irwin Pact, by which the Congress called off the Civil Disobedience Movement and agreed to participate in the Round Table Conference.

- Second Round Table Conference: It was held in London on the 7th of September, 1931.

- Third Round Table Conference: It was held in London on the 17th of November, 1932 to consider the reports of various sub-committees appointed from time to time. It ultimately led to the passage of Govt. of India Act, 1935.

- The Congress did not participate as most of the leaders were in jail.

- In 1932 he signed Poona pact with Mahatma Gandhi, which abandoned the idea of separate electorates for the depressed classes (Communal Award). However, the seats reserved for the depressed classes were increased from 71 to 147 in provincial legislatures and to 18% of the total in the Central Legislature.

- In 1936, he was elected to the Bombay Legislative Assembly as a legislator (MLA).

- In 1947, Dr. Ambedkar accepted PM Nehru's invitation to become Minister of Law in the first Cabinet of independent India.

- On August 29, 1947, he was appointed Chairman of the Drafting Committee for the new Constitution.

- He resigned from the cabinet in 1951, over differences on the Hindu Code Bill.

- In 1956, he converted to Buddhism.

- He passed away on 6th December 1956.

- Chaitya Bhoomi is a memorial to B. R. Ambedkar located in Dadar, Mumbai.

Important Facts For Prelims

Plogging Run

Why in News

Recently, Fit India Plogging Run was concluded in Delhi’s Jawahar Lal Nehru Stadium. It was launched on 2nd October 2019 and covered 50 cities across the country.

Key Points

- The Ministry of Youth Affairs and Sports launched the nation-wide Plogging Ambassador Mission under which, Indians who have been running and cleaning their cities, towns or districts, will be nominated as Plogging Ambassadors of their region.

- The ministry felicitated Ripu Daman Bevli, popularly known as the Plogman of India and named him the Plogging Ambassador of India.

Plog Run

- Plog Run is a unique way of picking up garbage while jogging.

- It is a ‘first of its kind’ initiative by United Way India (Community Service Organisation) to highlight the need for reducing plastic consumption and compel a healthier way of managing trash.

- It combines the Fit India Movement and Swachh Bharat Abhiyan.

Important Facts For Prelims

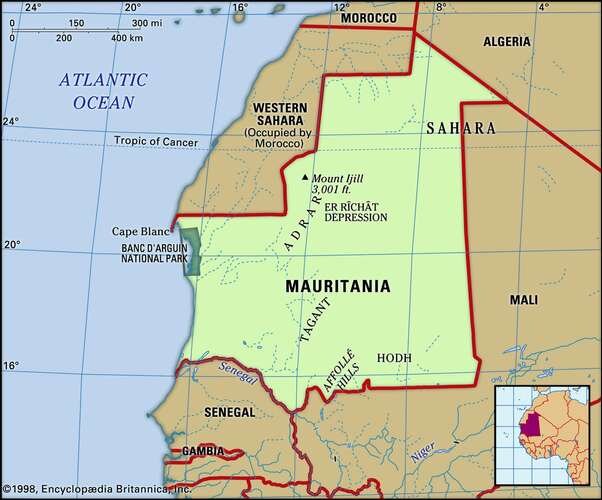

Islamic Republic of Mauritania

Why in News

- Recently, a boat capsized near Mauritania’s coast. Between 2005 and 2010, thousands have died off Mauritania’s coast in attempts to reach the Canary Islands (Spain).

- Mauritania is located on the Atlantic coast of Africa and is bounded to the northwest by Western Sahara, to the northeast by Algeria, to the east and southeast by Mali and to the southwest by Senegal.

- It is the eleventh largest country of the continent and consists of desert largely.

- The capital is Nouakchott and it got independence from France on 28 November 1960.

- It has Arab-Berber population to the north and black Africans to the south and Arabic and French are the prominent languages.

- It is a member of the United Nations and the African Union.

- In the Human Development Index 2018, it was at rank 159.

- The most prominent feature of this region is the Guelb er Richat, also known as the Eye of the Sahara, which is a deeply eroded dome consisting of a variety of intrusive and extrusive igneous rocks.

Important Facts For Prelims

Zero FIR

Why in News

In Kanchikacherla of Andhra Pradesh, a ‘Zero FIR’ was registered for a missing boy and he was found within 24 hours after the investigation was taken up.

- Zero FIR’s were registered earlier as well but this was the first case in which it was done for “quick action”.

- It means that an FIR can be filed in any police station, irrespective of the jurisdictional limitations and location of the incident.

- The respective police station takes in the FIR and marks it as a zero FIR by giving it serial number zero and immediately transfer the documents over to the concerned jurisdiction.

- It was initially highlighted after the Nirbhaya Case, 2012.

- Zero FIRs may be registered on the basis of a woman’s statement at any police station irrespective of jurisdiction. This means women can file an FIR at any police station and the complaint is required to be registered on the basis of the woman’s complaint verbatim.

- The police officers who fail to comply with the registration of Zero FIR may invite prosecution under Section 166A of IPC and also departmental action.

Important Facts For Prelims

Exercise INDRA 2019

Exercise INDRA 2019, a joint, tri services exercise between India and Russia will be conducted in India from 10th-19th December 2019 simultaneously at Babina (near Jhansi), Pune, and Goa.

- The two countries will be able to imbibe the best practices from each other, jointly evolve and drills to defeat the menace of terror under the United Nations mandate.

- The INDRA series of exercise began in 2003. It was conducted as a single service exercise alternately between the two countries. However, the first joint Tri Services Exercise was conducted in 2017.

- Exercise INDRA 2018, a joint military exercise between Indian and Russia on combating insurgency under the aegis of the United Nations (UN) was conducted at Jhansi, Uttar Pradesh.