Governance

Annual Review of State Laws 2023

For Prelims: Budget, Public Accounts Committee, Comptroller and Auditor General, Ordinances, Organized Crime, Lokayukta, Goods and Services Tax

For Mains: Effectiveness of Public Accounts Committee, Budgetary Transparency and Scrutiny, Efficiency of Legislative Process, Administrative and Governance Reforms

Why in News?

PRS Legislative Research has recently released its "Annual Review of State Laws 2023." The report conducted an in-depth analysis of the functioning of State legislatures across India, shedding light on various key aspects of their performance.

Note:

- PRS Legislative Research, commonly referred to as PRS, is an Indian non-profit organisation established in September 2005 as an independent research institute to make the Indian legislative process better informed, more transparent and participatory. PRS is based in New Delhi.

What are the Key Highlights of the Report?

- Budget Passage Without Discussion:

- In 2023, of the Rs 18.5 lakh crore budget presented by 10 States, close to 40% was passed without discussion.

- In Madhya Pradesh, 85% of the Rs 3.14 lakh crore Budget was passed without discussion, topping the list.

- In 2023, of the Rs 18.5 lakh crore budget presented by 10 States, close to 40% was passed without discussion.

- Once the Finance Minister announces the Budget, it goes for general discussion. Following this, there is a scrutiny of demands by committees.

- After this, there is discussion and voting on Ministry expenditure.

- The Budget in Parliament goes through six stages: Presentation, General discussion, Scrutiny, Voting, Passing Appropriation Bill, Passing Finance Bill.

- Kerala, Jharkhand, and West Bengal followed with 78%, 75%, and 74% respectively. However, in 10 States where data was available, 36% of the expenditure demands were voted on and passed without being discussed.

- The trend raises concerns regarding the transparency and scrutiny of state finances.

- Public Accounts Committee (PAC):

- In 2023, the PAC held 24 sittings and tabled 16 reports on average in the States considered.

- In five (Bihar, Delhi, Goa, Maharashtra and Odisha) of the 13 States the PAC did not table any reports.

- In Maharashtra, the PAC neither convened nor released any report throughout the year.

- Tamil Nadu led with 95 reports tabled, emphasising the wide disparity among states in upholding accountability.

- Bihar and Uttar Pradesh witnessed significant PAC sittings without a single report being tabled.

- In 2023, the PAC held 24 sittings and tabled 16 reports on average in the States considered.

- The PAC, typically chaired by the Leader of the Opposition or a senior member from the Opposition, scrutinises the accounts of State governments and State reports of the Comptroller and Auditor General.

- Swift Legislative Action:

- 44% of bills were passed either on the same day of introduction or the following day.

- The figure is consistent with the trend observed in 2022 (56%) and 2021 (44%).

- Gujarat, Jharkhand, Mizoram, Puducherry, and Punjab passed all bills on the same day they were introduced.

- In 13 out of 28 State legislatures, bills were passed within five days of introduction.

- Kerala and Meghalaya took longer than five days to pass more than 90% of their bills, highlighting a slower but potentially more deliberative process.

- 44% of bills were passed either on the same day of introduction or the following day.

- Ordinances:

- Uttar Pradesh topped with 20 ordinances, followed by Andhra Pradesh (11) and Maharashtra (9).

- Ordinances covered a wide range of subjects including the establishment of new universities, public examinations, and ownership regulations.

- Kerala's significant decrease in ordinances from 2022 to 2023 raises questions about the necessity and effectiveness of such measures.

- Uttar Pradesh topped with 20 ordinances, followed by Andhra Pradesh (11) and Maharashtra (9).

- Governors utilise their power to promulgate ordinances when State Legislative Assemblies are not in session.

- Overview of Law Making:

- On average, states passed 18 Bills each in 2023, not counting the Appropriation Bills for the budget.

- Maharashtra topped with 49 Bills while Delhi and Puducherry passed just 2 each.

- While the Constitution requires the Governor to give assent to Bills at the earliest, 59% of the Bills received assent within a month of being passed. Delays were seen in states like Assam, Nagaland and West Bengal.

- Only 23 out of the over 500 Bills passed were referred to legislative committees for deeper examination before being passed.

- On average, states passed 18 Bills each in 2023, not counting the Appropriation Bills for the budget.

What are the Other Key Legislations Passed by Subjects?

- Health:

- Rajasthan passed a Right to Health Bill, 2023 guaranteeing free healthcare services and emergency treatment.

- Law and Justice:

- Haryana and Rajasthan introduced laws to combat organised crime on the lines of the Maharashtra Control of Organised Crime Act, 1999 (MCOCA).

- The Gujarat Prohibition on Holding Protest in a Public Place Bill, 2023 prohibits protesting and agitating in a public place that may lead to obstruction of the public movement, blockage of roads, or other law and order issues.

- Land:

- Andhra Pradesh also amended the Assigned Lands (Prohibition of Transfers) Act, 1977 which prohibited the transfer of land that had been assigned by the government to the landless poor people for cultivation.

- Himachal Pradesh amended its Himachal Pradesh Ceiling on Land Holdings Act, 1972, to remove gender discrimination in the calculation of permissible holdings.

- Labour and Employment:

- Rajasthan enacted a law for social security and the welfare of gig/platform workers like delivery personnel.

- Rajasthan provided for minimum guaranteed employment under a new law.

- Local Governance:

- Chhattisgarh enacted a law Chhattisgarh Leasehold Rights to the Homeless Persons of Urban Areas Act, 2023 to provide lease rights to homeless persons in urban areas, aiming to ensure their relocation and rehabilitation while maintaining public health and safety standards.

How can Legislation be Improved for Better Governance and Accountability?

- Strengthening PAC:

- Standardise PAC operations with guidelines and protocols including sitting frequency, reporting requirements, and report timelines.

- Implement mechanisms to monitor and evaluate PAC performance regularly. Encourage greater accountability among PAC members by ensuring substantive discussions and report tabling in all settings.

- Expedited Decision-Making:

- Establish a legislative framework outlining a time limit for the Governor's assent.

- This aligns with recommendations by the Sarkaria Commission on Centre-State Relations (1988) which emphasised timely decisions on bills.

- Mandate the Governor to provide clear and specific reasons for any delay in granting assent aligned with the ethos of transparency.

- Establish a legislative framework outlining a time limit for the Governor's assent.

- Legislative Review:

- Advocate for more thorough discussions and debates on budgets before passage in the legislature.

- The Sarkaria Commission on Centre-State Relations has emphasised the importance of strengthening the role of State Finance Commissions and ensuring that their recommendations are given due consideration in the legislative discussions on budgets.

- Legislative Functioning:

- The National Commission to Review the Working of the Constitution recommends:

- Parliamentarians should be subject to public scrutiny via a parliamentary ombudsman.

- State Legislatures with fewer than 70 members should convene for at least 50 days annually; those with more should meet for at least 90 days.

- The Rajya Sabha and Lok Sabha should hold sessions for a minimum of 100 and 120 days, respectively.

- The National Commission to Review the Working of the Constitution recommends:

Conclusion

- The findings underscore the need for enhanced transparency and accountability mechanisms in State legislatures to ensure effective governance.

- Addressing disparities in budgetary processes, accountability mechanisms, legislative efficiency, and the utilisation of ordinances is crucial for upholding democratic principles and efficient governance at the state level.

|

Drishti Mains Question: Q. How does the trend of hurriedly passing state budgets in legislative assemblies, as observed in the 2023 budget passage across Indian states, impact transparency, accountability, and fiscal responsibility? |

UPSC Civil Services Examination, Previous Year Questions (PYQ)

Prelims

Q. Which of the following are the discretionary powers given to the Governor of a State? (2014)

- Sending a report to the President of India for imposing the President’s rule

- Appointing the Ministers

- Reserving certain bills passed by the State Legislature for consideration of the President of India

- Making the rules to conduct the business of the State Government

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 1 and 3 only

(c) 2, 3 and 4 only

(d) 1, 2, 3 and 4

Ans: (b)

Q. When the annual Union Budget is not passed by the Lok Sabha, (2011)

(a) the Budget is modified and presented again

(b) the Budget is referred to the Rajya Sabha for suggestions

(c) the Union Finance Minister is asked to resign

(d) the Prime Minister submits the resignation of Council of Ministers

Ans: (d)

Q. With reference to the Union Government, consider the following statements: (2015)

- The Department of Revenue is responsible for the preparation of the Union Budget that is presented to the Parliament.

- No amount can be withdrawn from the Consolidated Fund of India without the authorization from the Parliament of India.

- All the disbursements made from Public Account also need the authorization from the Parliament of India.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 2 only

(d) 1, 2 and 3

Ans: (c)

Mains

Q. Discuss the essential conditions for exercise of the legislative powers by the Governor. Discuss the legality of re-promulgation of ordinances by the Governor without placing them before the Legislature. (2022)

Q. Effectiveness of the government system at various levels and people’s participation in the governance system are interdependent". Discuss their relationship in the context of India. (2016)

Q. Public expenditure management is a challenge to the Government of India in the context of budget-making during the post-liberalization period. Clarify it. (2019)

Indian Economy

Rising Share of Personal Income Tax and Indirect Tax

For Prelims: Income Tax, Direct Taxes, Indirect Taxes, GST.

For Mains: Reforms, Issues and Challenges in the Taxation system in India, Budget 2023.

Why in News?

Amidst ongoing political debates and controversies surrounding socio-economic policies, recent tax data released by the Ministry of Finance sheds light on significant trends in India's tax landscape.

- As per the report, the collection of personal income tax and indirect taxes have increased, while collections from corporate taxes have reduced.

What are the Findings of the Report?

- Growth in Direct Tax Collection:

- India’s net direct tax collections grew 17.7% in 2023-24 to hit Rs.19.58 lakh crores.

- This can be attributed to a surge in personal income taxes whose share of the tax rose to 53.3% from 50.06% in the previous year.

- The data also show that revenues from personal income tax and securities transaction tax (STT) grew at almost double the pace compared to revenues from corporate taxes last year.

- Securities Transaction Tax (STT) is a tax levied on the purchase and sale of securities such as stocks, derivatives, and equity-oriented mutual funds. It was introduced in India in 2004 as a part of the Finance Act, 2004.

- The purpose of STT is to collect revenue for the government and to discourage speculative trading by adding a small tax on each transaction.

- Direct Tax: A direct tax is a tax that an individual or organisation pays directly to the entity that imposed it. It is a “progressive tax” because those who earn less are taxed less and vice-versa.

- Types of Direct Taxes:

- Income Tax: It is based on an individual’s or organisation’s earnings.

- Property Tax: Property tax is assessed on real estate properties (land, buildings, etc.).

- Types of Direct Taxes:

- Securities Transaction Tax (STT) is a tax levied on the purchase and sale of securities such as stocks, derivatives, and equity-oriented mutual funds. It was introduced in India in 2004 as a part of the Finance Act, 2004.

- India’s net direct tax collections grew 17.7% in 2023-24 to hit Rs.19.58 lakh crores.

- Dip in Corporate Tax:

- Share of Corporate Taxes contribution to overall tax collection dipped to 46.5% from 49.6% in 2022-23.

- Corporate taxes refer to taxes imposed on the profits of corporations by governmental entities. These taxes are typically based on the net income of a corporation after accounting for various deductions and credits.

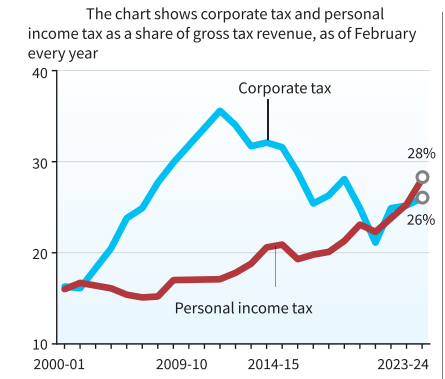

- The share of corporate tax has been on a decreasing trend, while that of personal income tax has been increasing.

- The sharp fall in corporate tax after FY19 can be attributed to the deep corporate tax cuts introduced by the ruling government in September 2019.

- As of February 2024, the gap between the two tax shares further increased, with income tax forming 28% of the gross tax- a new peak and corporate tax at 26%.

- Share of Corporate Taxes contribution to overall tax collection dipped to 46.5% from 49.6% in 2022-23.

- Decrease in Share of Direct Taxes, and Increase in Share of Indirect Taxes:

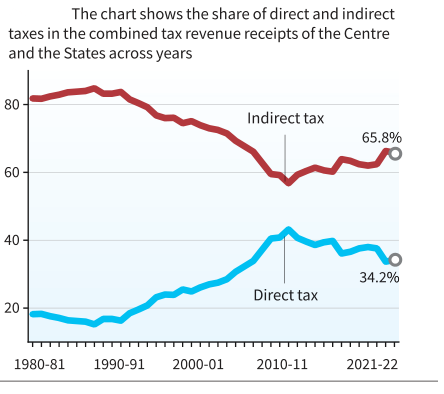

- Indirect taxes, which include union excise duties and the Goods and Services Tax are considered “regressive” as all consumers, regardless of their income levels, pay the same amount.

- The share of Indirect taxes, which had been falling steadily since the 1980s, has increased from 2010-11 onwards.

- The increasing share of indirect taxes implies a heavier burden on lower-income individuals.

- On the other hand, the share of Direct taxes, which had been increasing till 2010-11, has consistently recorded a downturn in recent years.

- Thus, the increased tax burden on poorer citizens and those in the middle-class category is a result of the growing proportion of personal income tax and indirect taxes within the overall.

- Relation Between Annual Income Vs Income Tax Returns Filed:

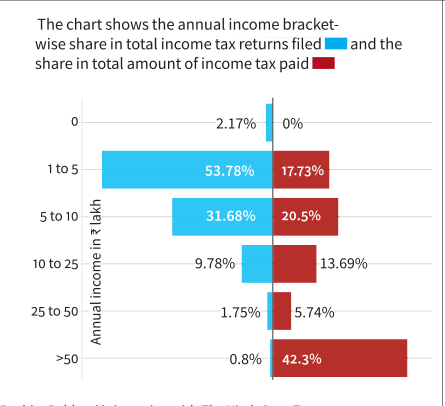

- The majority (53.78%) of individuals filing personal income tax have an annual income ranging from Rs 1 lakh to Rs. 5 lakh and they contribute 17.73% in total value income tax paid.

- There are only a small number (0.84%) of wealthier individuals earning more than Rs. 50 lakh and they have the highest share in the total value of income tax paid (42.3%).

- Effective Personal Income Tax Rate:

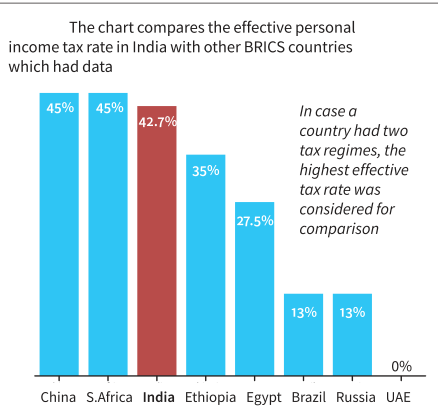

- A comparison of India with BRICS economies shows that India has among the highest effective personal income tax rates.

- The effective personal income tax rate is the percentage of an individual's income that they actually pay in taxes after accounting for deductions, credits, exemptions, and other factors that affect their tax liability.

- A comparison of India with BRICS economies shows that India has among the highest effective personal income tax rates.

Why is Rising Share of Personal Income Tax and Indirect Taxes a Matter of Concern?

- Income Inequality: If personal income tax is a significant portion of government revenue, it may disproportionately burden lower and middle-income individuals, exacerbating income inequality.

- This can occur if the tax system is not progressive enough or if there are loopholes that allow the wealthy to avoid paying their fair share.

- Consumer Burden: Indirect taxes are typically regressive as they take a higher percentage of income from low-income individuals compared to high-income individuals.

- This can place a heavier burden on those with lower incomes, potentially leading to decreased consumer spending and economic activity.

- Economic Efficiency: High personal income tax rates can discourage work, savings, and investment, leading to a less efficient allocation of resources in the economy.

- Also, excessive reliance on indirect taxes may distort consumer behaviour and lead to market inefficiencies.

- Tax Evasion and Avoidance: As personal income tax rates rise, individuals may be more incentivised to engage in tax evasion or avoidance strategies to reduce their tax liabilities.

- This can undermine the integrity of the tax system and reduce overall government revenue.

- Macroeconomic Stability: Heavy reliance on personal income tax and indirect tax revenue can make government finances vulnerable to economic downturns.

- During periods of recession or high unemployment, personal income tax revenues may decline, leading to budget deficits or cuts in essential services.

What are the Steps Taken by the Government to Boost the Direct-Tax Collection?

- Promoting Voluntary Income-tax Compliance:

- Vivad se Vishwas Scheme: Under Vivad se Vishwas, declarations for settling pending tax disputes are filed.

- This will benefit the Government by generating timely revenue and to the taxpayers by bringing down mounting litigation costs.

- Focus on Digital Transactions: The government is promoting digital payments to discourage cash-based transactions that are harder to track for tax purposes.

- For Personal Income Tax: The Finance Act, 2020 has provided an option to individuals and co-operatives to pay income tax at concessional rates if they do not avail of specified exemptions and incentives.

- Increased Scrutiny and Compliance Measures: Tax authorities have intensified scrutiny and compliance measures, including tax audits, surveys, and data analytics, to identify tax evaders and non-compliant taxpayers.

- Awareness and Education Campaigns: The government conducts awareness and education campaigns to promote tax compliance and deter tax evasion.

- These campaigns aim to inform taxpayers about their rights and responsibilities, the consequences of non-compliance, and the benefits of participating in the formal economy.

- Expansion of scope of TDS/TCS: To widen the tax base, several new transactions were brought into the ambit of Tax Deduction at Source (TDS) and Tax Collection at Source (TCS).

- These transactions include huge cash withdrawals, foreign remittances, purchase of luxury cars, e-commerce participants, sale of goods, acquisition of immovable property, etc.

- Tax Deduction at Source (TDS): A person (deductor) who is liable to make payment of a specified nature to any other person (deductee) shall deduct tax at source and remit the same into the account of the Central Government.

- Tax Collection at Source (TCS): It is an additional amount collected as tax by a seller of specified goods from the buyer at the time of sale over and above the sale amount and is remitted to the government account.

- These transactions include huge cash withdrawals, foreign remittances, purchase of luxury cars, e-commerce participants, sale of goods, acquisition of immovable property, etc.

- Transparent Taxation - Honoring The Honest Platform: It is aimed at bringing transparency in income tax systems and empowering taxpayers.

|

Drishti Mains Question: How does the tax system promote compliance in India? What are some recent developments in the Indian taxation system? |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Which one of the following effects of creation of black money in India has been the main cause of worry to the Government of India? (2021)

(a) Diversion of resources to the purchase of real estate and investment in luxury housing.

(b) Investment in unproductive activities and purchase of precious stones, jewellery, gold, etc.

(c) Large donations to political parties and growth of regionalism.

(d) Loss of revenue to the State Exchequer due to tax evasion.

Ans: (d)

Mains:

Q. What is the meaning of the term ‘tax expenditure’? Taking the housing sector as an example, discuss how it influences the budgetary policies of the government. (2013)

Governance

Corporal Punishment

For Prelims: National Commission for Protection of Child Rights, Juvenile Justice (Care and Protection of Children) Act, 2015, Right to Education Act, 2009

For Mains: Issue of Corporal punishment, Constitutional and legal provisions regarding corporal punishment.

Why in News?

Recently, the Tamil Nadu School Education Department released guidelines for the elimination of corporal punishment in schools (GCEP).

- The guidelines are focused on safeguarding the physical and mental well-being of students and extend beyond eliminating corporal punishment to address any form of harassment of students.

What are the Key Facts About the Guidelines?

- The guidelines aim to create safe and nurturing environments for students by addressing physical punishment, mental harassment, and discrimination.

- The GECP includes safeguarding the mental well-being of students and conducting awareness camps to familiarise stakeholders with the guidelines of the National Commission for Protection of Child Rights (NCPCR).

- The GECP emphasises the establishment of monitoring committees at each school comprising school heads, parents, teachers, and senior students to oversee the implementation of guidelines and address any issues.

- The Department also listed affirmative actions against corporal punishment, including multidisciplinary intervention, life-skills education, and mechanisms for children’s voices.

What is Corporal Punishment?

- About:

- Corporal is defined by the UN Committee on the Rights of the Child, as “any punishment in which physical force is used and intended to cause some degree of pain or discomfort, however light.”

- According to the Committee, this mostly involves hitting (smacking, slapping, spanking) children with a hand or implements like sticks, belts, etc.

- According to the World Health Organization (WHO), corporal or physical punishment is highly prevalent globally, both in homes and schools.

- Around 60% of children aged 2–14 years regularly suffer physical punishment by their parents or other caregivers.

- There is no statutory definition of ‘corporal punishment’ targeting children in India.

- Corporal is defined by the UN Committee on the Rights of the Child, as “any punishment in which physical force is used and intended to cause some degree of pain or discomfort, however light.”

- Types of corporal punishment:

- Physical punishment, as defined by the National Commission for Protection of Child Rights (NCPCR), encompasses any action that inflicts pain, injury, or discomfort upon a child.

- This includes coercing children into uncomfortable positions such as standing on a bench, against a wall in a chair-like stance, or with a school bag on their head.

- It also involves practices like holding ears through legs, kneeling, forced ingestion of substances, and confining children to enclosed spaces within the school premises.

- Mental harassment pertains to non-physical mistreatment that adversely affects a child's academic and psychological well-being.

- This form of punishment encompasses behaviours such as sarcasm, name-calling, scolding using derogatory language, intimidation, and the use of humiliating remarks.

- It also includes actions like ridiculing, belittling, or shaming the child, creating an environment of emotional distress and discomfort.

- Physical punishment, as defined by the National Commission for Protection of Child Rights (NCPCR), encompasses any action that inflicts pain, injury, or discomfort upon a child.

- Justification of Corporal Punishment:

- In the United States, school corporal punishment is currently legal in 22 states.

- A few sections of the Indian Penal Code (IPC),1860 provide the grounds for justification of Corporal Punishment.

- Section 88 provides safeguards for "Acts not intended to cause death, done by consent in good faith for a person's benefit,".

- Section 89 protects "Acts done in good faith for the benefit of a child or insane person, by or with the consent of a guardian.

- Juvenile Justice (Care and Protection of Children) Act, 2015: Under Section 2(9), the term "best interest of the child" denotes the foundation for any decision concerning the child, ensuring the fulfilment of their fundamental rights and needs, identity, social well-being, and physical, emotional, and intellectual development.

- Effects of Corporal Punishment:

- Mental Health:

- Increased Anxiety and Depression: Corporal punishment can cause children to feel unsafe, scared, and unloved. This can lead to increased anxiety and depression further leading to poor academic performance.

- Lower Self-Esteem: Children who are physically or mentally punished may develop lower self-esteem and a negative sense of self-worth.

- Aggression and Violence: Exposure to violence can increase the likelihood that children will become aggressive or violent themselves. Also, the child may develop a revenge attitude against the teacher and peers.

- Difficulty with Relationships: Children who experience corporal punishment may have difficulty forming healthy relationships with others.

- Physical Health:

- Physical Injuries: Corporal punishment can lead to physical injuries, ranging from minor bruises to more serious injuries.

- Substance Abuse: Children who experience corporal punishment are more likely to abuse drugs and alcohol as adults.

- Mental Health:

What are the Constitutional and Legal Provisions Regarding Corporal Punishment?

- Statutory Provisions:

- Right to Education Act (RTE), 2009:

- Section 17 of the Act imposes an absolute bar on corporal punishment. It prohibits ‘physical punishment’ and ‘mental harassment’ and makes it a punishable offence.

- It prescribes disciplinary action to be taken against the guilty person in accordance with the service rules applicable to such person.

- Juvenile Justice (Care and Protection of Children) Act, 2015:

- According to Section 23 of the act, any person who is in control of a juvenile and who abandons, assaults, exposes or wilfully neglects the juvenile which in turn causes mental or physical pain to him/her shall be punished with imprisonment up to six months, or fine, or with both.

- Right to Education Act (RTE), 2009:

- Legal Provisions:

- Indian Penal Code,1860

- Section 305 pertaining to abetment of suicide committed by a child

- Section 323 pertaining to voluntarily causing hurt

- Section 325 which is about voluntarily causing grievous hurt.

- Indian Penal Code,1860

- Judicial Cases:

- In Ambika S. Nagal Vs State of Himachal Pradesh, 2020, the State High Court held that "whenever a ward is sent to school, the parents must have said to give an implied consent on their ward being subjected to punishment and discipline."

- In a case against the State of Kerala, the Kerala High Court in 2014 titled Rajan Vs Sub-Inspector of Police, upheld the infliction of Corporal punishment holding that it was beneficial to the child even in cases where the consequences were extreme, as the teacher has a judging authority whether or not to inflict the punishment.

- Constitutional Provisions relating to Protection of Child Rights:

- Article 21 A: Provision for compulsory education in the age group of 6-14.

- Article 24: It prohibits child labour in hazardous work until the age of 14.

- Article 39 (e): It is the duty of the state to ensure that children of tender age are not abused due to economic disparity.

- Article 45: It is the duty of the state to provide for the care of children in the age group of 0-6.

- Article 51A(k): The fundamental duty of parents is to ensure that their child receives education for the age group of 6 to 14.

- Statutory Bodies:

- National Commission for Protection of Child Rights (NCPCR): The NCPCR guidelines for eliminating corporal punishment against children require every school to develop a mechanism and frame clear-cut protocols to address the grievances of students.

- Every school has to constitute a ‘Corporal Punishment Monitoring Cell’ consisting of two teachers, two parents, one doctor, and one lawyer (nominated by District Legal Service Authority (DLSA).

- National Commission for Protection of Child Rights (NCPCR): The NCPCR guidelines for eliminating corporal punishment against children require every school to develop a mechanism and frame clear-cut protocols to address the grievances of students.

- International Laws:

- Article 19 of the UN Convention on the Rights of Child 1989 (UNCRC) declares that any form of discipline involving violence is unacceptable.

- It lays down that children have the right to be protected from being hurt and mistreated, physically or mentally.

What is the National Commission for Protection of Child Rights?

- NCPCR is a statutory body set up in March 2007 under the Commissions for Protection of Child Rights (CPCR) Act, 2005.

- It is under the administrative control of the Ministry of Women & Child Development.

- The Commission's mandate is to ensure that all laws, policies, programs, and administrative mechanisms are in consonance with the child rights perspective as enshrined in the Constitution of India and also the UN Convention on the Rights of the Child.

- It inquiries into complaints relating to a child's right to free and compulsory education under the Right to Education Act, 2009.

- It monitors the implementation of the Protection of Children from Sexual Offences (POCSO) Act, 2012.

|

Drishti Mains Question: Q. Discuss the issue of corporal punishment mentioning the related constitutional and legal provisions. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims:

Q. Other than the Fundamental Rights, which of the following parts of the Constitution of India reflect/reflects the principles and provisions of the Universal Declaration of Human Rights (1948)? (2020)

- Preamble

- Directive Principles of State Policy

- Fundamental Duties

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)

Q. Consider the following: (2011)

- Right to education

- Right to equal access to public service

- Right to food.

Which of the above is/are Human Right/Human Rights under “Universal Declaration of Human Rights”?

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (d)

Mains:

Q. Though the Human Rights Commissions have contributed immensely to the protection of human rights in India, yet they have failed to assert themselves against the mighty and powerful. Analysing theirstructural and practical limitations, suggest remedial measures. (2021)

Indian Economy

Corporate Governance for Startups

For Prelims: Corporate Governance, SEBI, Confederation of Indian Industry (CII), Startups.

For Mains: Corporate Governance, Issues related to Business in India, Indian Startup Ecosystem, Challenges and Opportunities.

Why in News?

Recently, Confederation of Indian Industry (CII) has launched a corporate governance charter for startups, including a self-evaluative scorecard.

- This occurs during a period when companies like Byju’s, BharatPe, and Zilingo have expressed worries about governance norms in the last 12-18 months.

What are the Key Provisions of the Charter?

- Charter will provide suggestions on Corporate Governance tailored for Startups and offer guidelines suitable for different stages of a startup which is aiming to enhance governance practices.

- Corporate Governance in India is a set of rules, practices and processes by which a company is guided and controlled.

- Self Evaluative Governance Scorecard:

- The charter includes an online self-evaluative governance scorecard that startups can use to evaluate their current governance status and its improvement over time.

- It will allow startups to measure their governance progress, with score changes indicating improvements in governance practices as assessed against the scorecard from time to time.

- The charter includes an online self-evaluative governance scorecard that startups can use to evaluate their current governance status and its improvement over time.

- 4 key Stages of Guidance to Startups:

- At the Inception stage: The focus of Startup will be on:

- Board formation,

- Compliance monitoring,

- Accounting, Finance, External audit, Policies for related-party transactions, and

- Conflict resolution mechanisms.

- In the Progression stage: A startup may additionally focus on:

- Monitoring key business metrics,

- Maintaining internal controls,

- Defining a hierarchy of decision-making, and

- Setting up an audit committee.

- For the Growth stage: The focus will be on:

- Building stakeholder awareness towards the vision, mission, code of conduct, culture, and ethics of an organisation,

- Ensure diversity and inclusion on the board and

- Fulfilling statutory requirements, according to the Companies Act 2013 and other applicable laws and regulations.

- At the Going Public stage: The Focus of the startup will be on:

- Expanding its governance in terms of monitoring the functioning of various committees,

- Focus on fraud prevention and detection,

- Minimise information asymmetry,

- Evaluating board performance.

- At the Inception stage: The focus of Startup will be on:

- Valuation: The valuations of businesses should be kept as realistic as possible.

- Startups may strive for long-term value creation rather than short-term valuations.

- Long-Term Goals: The needs of the business entity should be separated from the personal needs of its founder(s), but at the same time, the goals and needs of the founders, promoters, and initial investors should be aligned with the long-term goals of the business.

- Separate Legal Entity: The startup should be maintained as a separate legal entity with the organisation’s assets distinct from the founders’ assets.

What is a Startup?

- About:

- According to (Department for Promotion of Industry and Internal Trade) DPIIT, to be considered eligible for recognition, a Startup must meet these criteria:

- Have been in operation for no more than 10 years since its incorporation.

- Be registered as a Private Limited Company, a Registered Partnership Firm, or a Limited Liability Partnership.

- Have an annual turnover not exceeding Rs. 100 crore for any financial year since its incorporation.

- Not have been formed by splitting up or reconstructing an already existing business.

- According to (Department for Promotion of Industry and Internal Trade) DPIIT, to be considered eligible for recognition, a Startup must meet these criteria:

- Scenario of Startup in India:

- India has the 3rd largest startup ecosystem in the world and is expected to witness Year-on-Year growth of consistent annual growth of 12-15%

- India ranks 2nd in innovation quality with top positions in the quality of scientific publications and the quality of its universities among middle-income economies.

- As of May 2023, India is home to 108 Unicorns with a total valuation of USD 340.80 bn.

What is Corporate Governance?

- About:

- Corporate governance, which refers to the system of rules, practices, and processes by which a company is directed and controlled, plays a crucial role in ensuring that businesses are run ethically and in the best interests of their stakeholders.

- It enforces strong ethical standards and holds individuals accountable for their actions.

- Principles of Corporate Governance:

- Fairness: The board of directors should treat shareholders, employees, vendors, and communities with fairness and equal consideration.

- Accountability: The board is required to explain the purpose of the company's activities and report on its conduct.

- Transparency: The board should ensure that timely, accurate, and clear information is provided about financial performance, conflicts of interest, and risks to shareholders and other stakeholders.

- Risk Management: The board and management are responsible for identifying and controlling various risks.

- They should take action based on recommendations to manage these risks and inform relevant parties about their existence and status.

- Corporate Social Responsibility (CSR): It involves integrating environmental, social, and governance (ESG) considerations into business strategy and operations, and contributing positively to society and the environment.

- Regulatory Framework in India:

- The Companies Act, 2013

- Securities and Exchange Board of India (SEBI)

- Institute of Chartered Accountants of India (ICAI)

- Institute of Company Secretaries of India (ICSI): It issues secretarial standards as per the provision of the Companies Act, 2013.

- Committees Related to Corporate Governance:

- Confederation of Indian Industry (CII) National Task Force on Corporate Governance (1996):

- The task force, chaired by Rahul Bajaj, developed a voluntary code of conduct for Indian companies.

- Kumar Mangalam Birla Committee (1999):

- This committee was set up by the SEBI to develop a mandatory code of corporate governance for listed companies.

- The committee's recommendations addressed issues such as board composition, independent directors, audit committees, and risk management.

- Naresh Chandra Committee (2002):

- This committee, constituted by the Department of Company Affairs (DCA), examined various corporate governance issues related to statutory audits, the independence of auditors, and the role of independent directors.

- Its recommendations led to significant changes in the Companies Act.

- Narayana Murthy Committee (2003): This SEBI-constituted committee reviewed the implementation of the corporate governance code by listed companies.

- The committee's recommendations helped strengthen the code and improve its effectiveness.

- Confederation of Indian Industry (CII) National Task Force on Corporate Governance (1996):

- Importance of Corporate Governance:

- Strengthens Investors Confidence: Strong corporate governance maintains investors’ confidence in the financial market, as a result of which companies can raise capital efficiently and effectively.

- International Flows of Capital: It enables companies to reap the benefits of the global capital markets which will contribute to economic growth.

- Increased Productivity: It also minimises wastages, corruption, risks and mismanagement.

- Brand Image: It helps in brand formation and development of a company. It ultimately increases capital flows from foreign institutional investors (FII) and foreign direct investment (FDI).

- Challenges:

- Ensuring Objective Board: It is a widespread practice in India for the associates and relatives of company owners to be selected as board members.

- Performance Evaluation of Directors: Corporate firms sometimes do not share the results of performance evaluations to avoid public scrutiny and negative feedback.

- Removal of Independent Directors: Sometimes, Independent directors are easily removed from their positions by the promoters if they do not side with promoters’ decisions.

- Founders Control and Succession Planning: In India, founders’ ability to control the affairs of the company has the potential of derailing the entire corporate governance system.

- Unlike developed economies, in India, the identity of the founder and the company is often merged.

How to Improve Corporate Governance in India?

- Strengthen Regulatory Framework: Continuously update and enforce corporate governance regulations to align with international best practices.

- Independent Directors and Diversity in Board Composition: It ensures their autonomy and effectiveness and brings a broader range of perspectives and expertise to decision-making processes.

- Transparency and Disclosure: Mandate comprehensive and timely disclosure of financial information, ownership structures, related-party transactions, and corporate governance practices.

- Shareholder Rights and Activism: Enhance shareholder rights, including voting rights, information access, and participation in key decisions.

- Foster constructive dialogue and engagement with all stakeholders.

- Continuous Evaluation and Improvement: Establishing mechanisms for ongoing evaluation and benchmarking of corporate governance practices.

- Regularly solicit feedback from stakeholders and adapt policies and procedures accordingly.

|

Drishti Mains Question: What is Corporate Governance? What is the need of a regulatory framework for corporate governance in India? Suggest measures to improve Corporate Governance in India. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims:

Q. What does venture capital mean? (2014)

(a) A short-term capital provided to industries

(b) A long-term start-up capital provided to new entrepreneurs

(c) Funds provided to industries at times of incurring losses

(d) Funds provided for replacement and renovation of industries

Ans: (b)

Mains:

Q1. In the light of the Satyam Scandal (2009), discuss the changes brought in corporate governance to ensure transparency and accountability. (2015)

Q2. What do you understand by the terms ‘governance’, ‘good governance’ and ‘ethical governance’? (2016)

Important Facts For Prelims

India Hosts 46th ATCM and 26th Meeting of CEP in 2024

Why in News?

India, through the Ministry of Earth Sciences (MoES) and the National Centre for Polar and Ocean Research (NCPOR), is set to host the 46th Antarctic Treaty Consultative Meeting (ATCM 46) and the 26th Meeting of the Committee for Environmental Protection (CEP 26) in Kochi, Kerala, from 20th to 30th May 2024.

- This reflects India's commitment to global dialogue on environmental stewardship and scientific collaboration in Antarctica.

What is the Antarctic Treaty Consultative Meeting (ATCM)?

- About:

- ATCM is an annual meeting of the original 12 parties to the Antarctic Treaty, and other parties that have shown interest in Antarctica through research.

- The Antarctic Treaty, signed in 1959 and established Antarctica as a region dedicated to peaceful purposes, scientific cooperation, and environmental protection.

- Over the years, the Treaty has garnered widespread support, with 56 countries currently party to it.

- India has been a Consultative Party to the Antarctic Treaty since 1983. In 2022, India enacted the Antarctic Act, reaffirming its commitment to the Antarctic Treaty.

- The Antarctic Treaty, signed in 1959 and established Antarctica as a region dedicated to peaceful purposes, scientific cooperation, and environmental protection.

- From 1961 to 1994 the ATCM generally met once every two years, but since 1994 the meetings have occurred annually.

- ATCM is an annual meeting of the original 12 parties to the Antarctic Treaty, and other parties that have shown interest in Antarctica through research.

- 46th ATCM Agenda:

- It covers strategic planning for sustainable management of Antarctica and its resources, policy, legal, biodiversity prospecting, inspections and exchange of information and data, research, collaboration, capacity building and cooperation, addressing climate change impacts, development of tourism framework, and promoting awareness.

- India's Engagement in the ATCM:

- India as a Consultative Party, participates in the decision-making process alongside other Consultative Parties.

- Antarctic Research Stations:

- Establishment: Its first Antarctic research station, Dakshin Gangotri, in 1983.

- India operates two year-round research stations in Antarctica: Maitri (1989) and Bharati (2012).

- Indian Scientific Expeditions to Antarctica have been conducted annually since 1981.

- Establishment: Its first Antarctic research station, Dakshin Gangotri, in 1983.

What is the Committee for Environmental Protection (CEP)?

- About:

- The CEP was established under the Protocol on Environmental Protection to the Antarctic Treaty (the Madrid Protocol) in 1991.

- The CEP advises the ATCM on environmental protection and conservation in Antarctica.

- ATCM and CEP are pivotal in the international community's ongoing efforts to safeguard Antarctica's fragile ecosystem and promote scientific research in the region.

- Convened annually under the Antarctic Treaty System, these meetings serve as forums for Antarctic Treaty Consultative Parties and other stakeholders to address Antarctica's pressing environmental, scientific, and governance issues.

- 26th CEP Agenda:

- It focuses on evaluating the Antarctic environment, assessing impacts, managing and reporting; responding to climate change; developing area protection and management plans, including marine spatial protection; and conserving Antarctic biodiversity.

Protocol on Environmental Protection to the Antarctic Treaty (the Madrid Protocol) in 1991

- Protocol designates Antarctica as a “natural reserve, devoted to peace and science”.

- It sets basic principles for human activities in Antarctica and prohibits mineral resource activities, except for scientific research.

- The Protocol can only be modified by unanimous agreement of all Consultative Parties until 2048, and the prohibition on mineral resource activities cannot be removed without a binding legal regime.

- The Protocol builds upon the Antarctic Treaty and Recommendations to extend and improve the Treaty's effectiveness in protecting the Antarctic environment.

National Centre for Polar and Ocean Research (NCPOR)

- NCPOR is an autonomous institution established in 1998, under MoES.

- India’s scientific and strategic endeavours in the polar regions (the Arctic and Antarctic), the Himalayas, and the Southern Ocean are under the NCPOR in Goa.

Read more: India's New Post Office in Antarctica

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. On 21st June, the Sun (2019)

(a) does not set below the horizon at the Arctic Circle

(b) does not set below the horizon at Antarctic Circle

(c) shines vertically overhead at noon on the Equator

(d) shines vertically overhead at the Tropic of Capricorn

Ans: (a)

Q. The formation of ozone hole in the Antarctic region has been a cause of concern. What could be the reason for the formation of this hole? (2011)

(a) Presence of prominent tropospheric turbulence; and inflow of chlorofluorocarbons

(b) Presence of prominent polar front and stratospheric clouds; and inflow of chlorofluorocarbons

(c) Absence of polar front and stratospheric clouds; and inflow of methane and chlorofluorocarbons

(d) Increased temperature at polar region due to global warming

Ans: (b)

Mains:

Q. How do the melting of the Arctic ice and glaciers of the Antarctic differently affect the weather patterns and human activities on the Earth? Explain.(2021)

Important Facts For Prelims

World Press Freedom Day 2024

Why in News?

On the occasion of the World Press Freedom Day Conference on 3rd May 2024, the United Nations Educational, Scientific and Cultural Organization (UNESCO) released a new report indicating a rise in violence against environmental journalists worldwide.

- It highlighted increasing violence against environmental journalists worldwide with 44 journalists killed in 15 years.

- It shows the highest number of killings in Asia and the Pacific region.

What is the World Press Freedom Index?

- About:

- It is an annual report released by the global media watchdog Reporters Without Borders (RSF).

- India’s score in 2024:

- India's position has seen a slight improvement moving from 161 in 2023 to 159 among 180 countries in 2024.

- Despite this upward shift in ranking, India's score witnessed a decline, dropping from 36.62 to 31.28 and scores decreased across all categories except the security indicator.

- According to RSF, press freedom is under threat in the world's largest democracy.

- Since January 2024, 9 journalists and 1 media worker have been detained in India.

- Several laws such as the Telecommunications Act 2023, the Draft Broadcasting Services (Regulation) Bill 2023, and the Digital Personal Data Protection Act 2023 extensively regulate media and censor news.

- This report highlighted that economic and political pressures limit the independence of the media.

- Global Score:

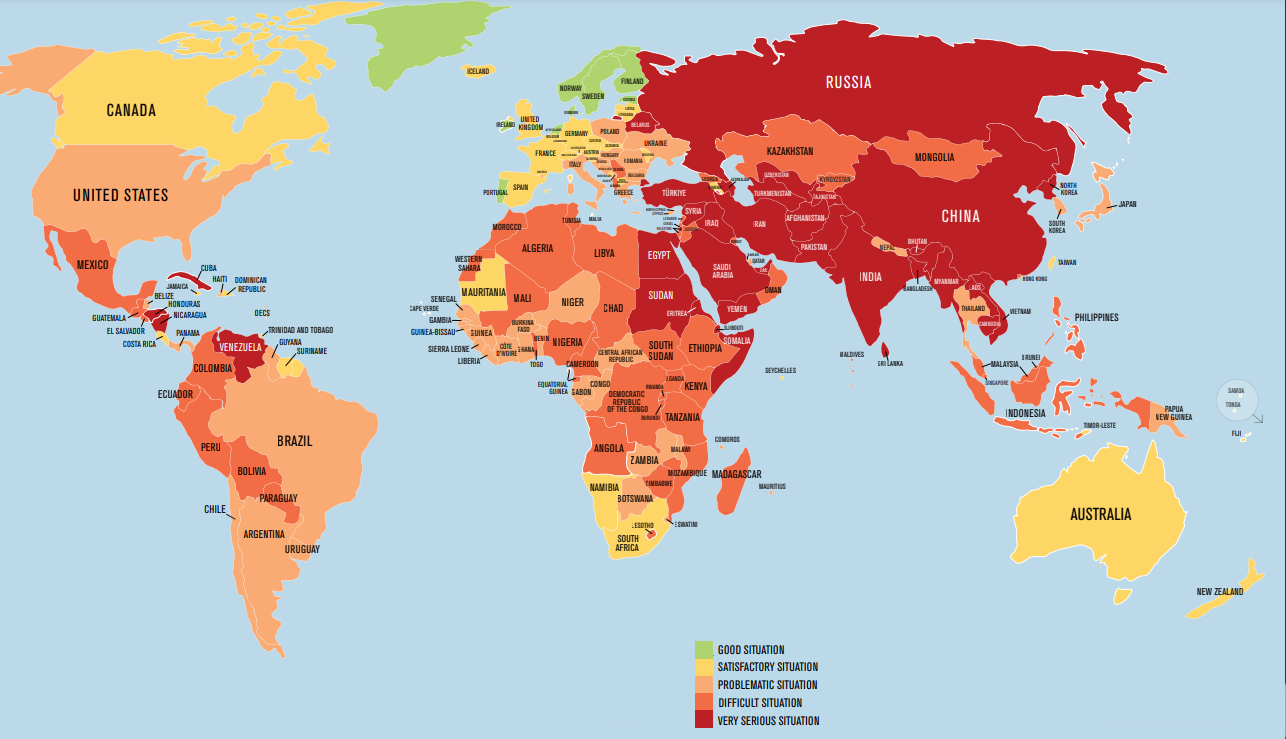

- In the 2024 report Norway, Denmark and Sweden maintain 1st, 2nd and 3rd spots respectively. Eritrea was at the bottom of the list, with Syria just ahead of it.

World Press Freedom Index (WPFI)

- The World Press Freedom Index (WPFI) is an annual ranking of countries compiled and published by RSF, an international NGO based in France, since 2002.

- It exclusively focuses on press freedom and does not evaluate the quality of journalism or broader human rights violations within the countries it assesses.

- The press freedom questionnaire encompasses five key categories: political context, legal framework, economic context, sociocultural context, and security.

Read more: Press Freedom in India

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Right to Privacy is protected as an intrinsic part of Right to Life and Personal Liberty. Which of the following in the Constitution of India correctly and appropriately imply the above statement? (2018)

(a) Article 14 and the provisions under the 42nd Amendment to the Constitution.

(b) Article 17 and the Directive Principles of State Policy in Part IV.

(c) Article 21 and the freedoms guaranteed in Part III.

(d) Article 24 and the provisions under the 44th Amendment to the Constitution.

Ans: (c)

Mains:

Q. What do you understand by the concept of “freedom of speech and expression”? Does it cover hate speech also? Why do films in India stand on a slightly different plane from other forms of expression? Discuss. (2014)

Rapid Fire

World's Deepest Blue Hole

Recently, researchers have discovered the world's deepest blue hole located in Mexico's Chetumal Bay in Mexico, known as Taam Ja' Blue Hole (TJBH).

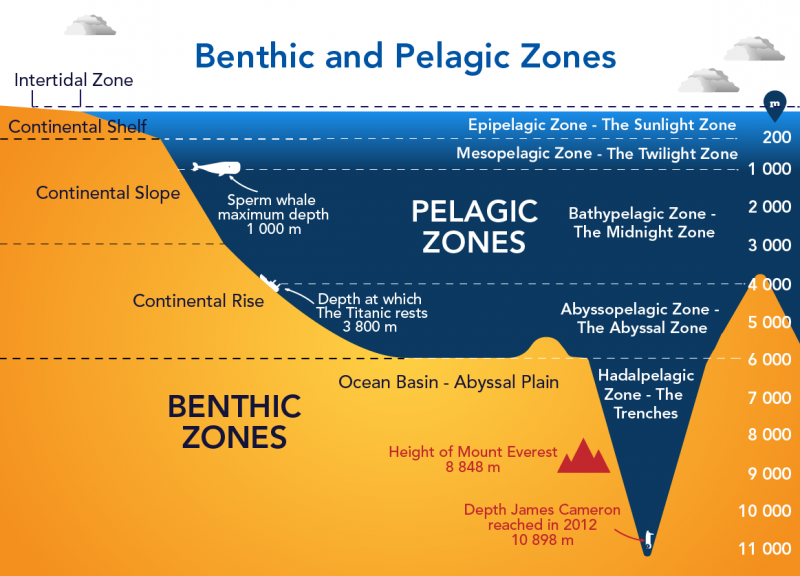

- It was originally believed to be the second deepest. However, recent measurements have shown that it exceeds 420 meters below sea level (mbsl), making it deeper than any other known blue hole.

- The new measurement reached into the mesopelagic zone, where sunlight is significantly reduced, and marine life concentration is high.

- TJBH's depth surpasses other well-known blue holes such as the Sansha Yongle Blue Hole in the South China Sea (301 mbsl) and the Dean's Blue Hole in the Bahamas (202 mbsl).

- Blue holes are underwater sinkholes, similar to sink holes on land. They vary in size, shape and depth, but most are ecological hot spots with a high diversity of abundance of plants and animals including corals, sponges, mollusks, sea turtles, sharks etc.

- Exploration of blue holes has been limited due to challenging access conditions, as most blue holes have small openings that are several hundred feet underwater, making them inaccessible for automated submersibles.

| Feature | Blue Holes | Deep Trenches |

| Formation | Cave collapse | Subduction of tectonic plates |

| Location | Continental shelves, reefs, etc. | Convergent plate boundaries |

| Depth | Variable, from shallow to very deep | Deepest parts of the ocean (Mariana Trench>36,000 ft) |

Read more: Biological hotspots

Rapid Fire

PlayTrue Campaign of NADA

Recently, the National Anti-Doping Agency (NADA) India, concluded #PlayTrue Campaign, commemorating the World Anti-Doping Agency (WADA)’s Play True Day.

- The PlayTrue Campaign highlights NADA India's commitment to equipping athletes, coaches, and the entire sporting community with a thorough understanding of anti-doping regulations, empowering them to champion clean play in India.

- The campaign served as a crucial event for athletes and stakeholders to collaborate, exchange insights, and strategies towards establishing a resilient anti-doping framework in anticipation of the Paris 2024 Olympics.

- NADA:

- National Anti-Doping Agency (NADA) was set up as a registered society with a mandate for dope free sports in India.

- WADA:

- The World Anti-Doping Agency (WADA) was set up under the International Olympic Committee to develop, harmonise, and coordinate anti-doping regulations across all sports and countries.

- National Drugs and Psychotropic Substances Act (NDPS) Act, 1985:

- It prohibits a person from producing, possessing, selling, purchasing, transporting, storing, and/or consuming any narcotic drug or psychotropic substance.

Read more: Doping Practices In India

Rapid Fire

Growth in Mineral Production

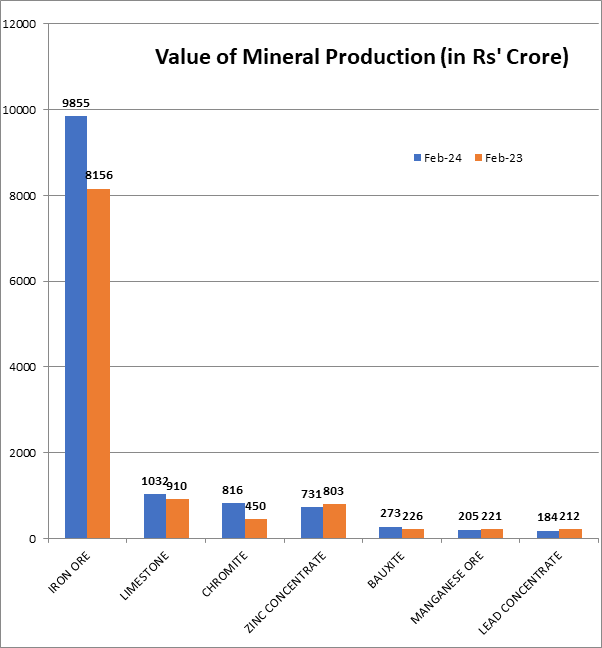

Recently, India's mineral production witnessed an 8.2% year-on-year growth for the period April-February 2023-24 according to provisional data from the Indian Bureau of Mines.

- The index of mineral production for the mining and quarrying sector in February 2024 is 139.6, which is 8.0% higher compared to February 2023.

- Important minerals showing positive growth during February 2024 over February 2023 include: Gold (86%), Copper (28.7%), Bauxite (21%), Coal (12%), Natural gas (U) (11%), Petroleum(crude) (8%).

- Other important minerals showing negative growth include Iron Ore (-0.7%) and Lead (-14%).

Index of Industrial Production:

- IIP is an indicator that measures the changes in the volume of production of industrial products during a given period.

- It is compiled and published monthly by the National Statistical Office (NSO), Ministry of Statistics and Programme Implementation.

- Base Year for IIP is 2011-2012.

Read more: Index of Industrial Production

Rapid Fire

Critical Minerals Summit

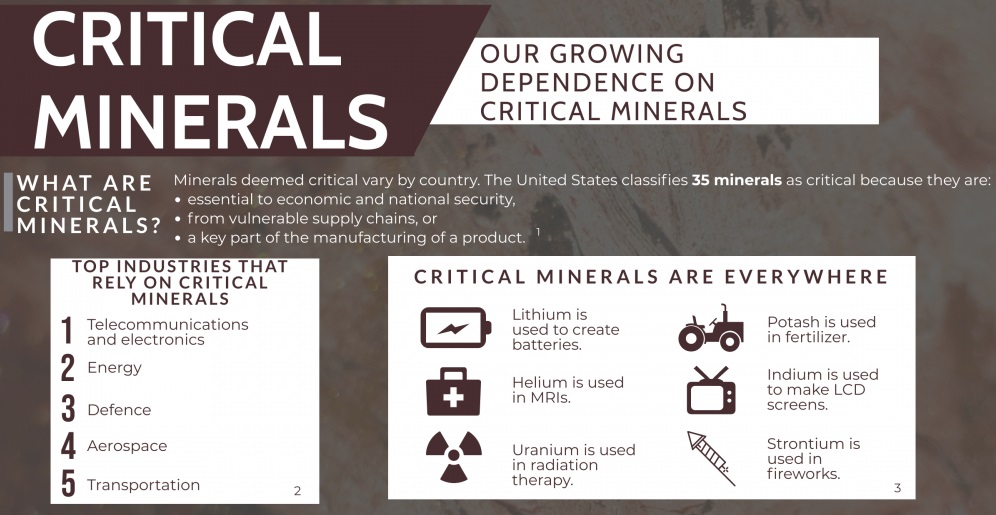

Recently, the Critical Minerals Summit was concluded in New Delhi on a note of strategic collaboration and policy insights, marking significant strides towards India's critical minerals objectives.

- The summit was organised by the Ministry of Mines in collaboration with Council on Energy, Environment and Water (CEEW), and the International Institute for Sustainable Development (IISD).

- The objective of the summit was to equip government and industry stakeholders with the knowledge, connections and tools necessary to accelerate the domestic production of Critical Minerals.

- The discussion emphasised a cluster-based approach to enhance synergies in mineral extraction, refining, and utilisation, especially in low-carbon technologies.

- The summit stressed on the need for regulatory clarity, financing structures, and ESG standards to attract investors.

- Organisations like Invest India were commended for their facilitation services in establishing processing capabilities in India.

Read more: Critical Minerals for India

Rapid Fire

NPCI International Partners with the Bank of Namibia

NPCI International Payments Ltd. (NIPL) signed an agreement with the Bank of Namibia to create a real-time instant payment system similar to India's Unified Payment Interface (UPI).

- The new system will facilitate faster Person-to-Person (P2P) and Person-to-Merchant (P2M) transactions, promoting financial inclusion for underserved populations.

- NIPL, established on 3rd April 2020, as NPCI’s fully owned subsidiary, focuses on internationalising the RuPay card scheme and UPI mobile payment solution.

- NIPL aims to revolutionise global payments through innovation and technology, enhancing payment systems worldwide, especially in resource-limited countries, leveraging its extensive experience and advanced payment knowledge.

- Namibia is the second least densely populated, located along the Southern African coast.

- Namibia shares a border with the surrounding countries of South Africa, Botswana, Zimbabwe, Zambia, and Angola.

- It has a diverse environment that is home to deserts, marshlands, savannas, mountains, and river valleys.

Read more: Unified Payments Interface (UPI)

Rapid Fire

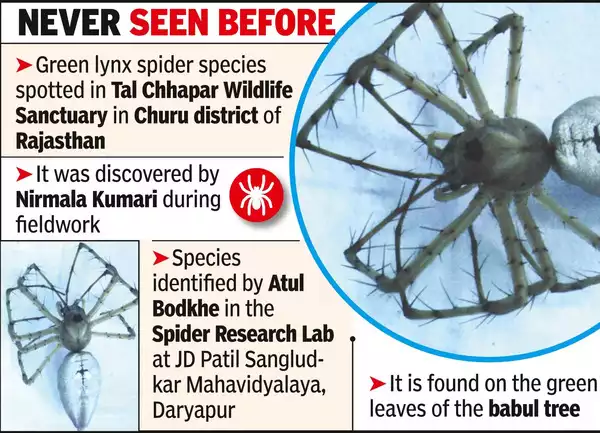

Discovery of Peucetia Chhaparajnirvin

Recently, arachnologists have identified the green lynx spider, which was never discovered earlier.

- The newly identified spider species, found in Rajasthan’s Tal Chhapar Wildlife Sanctuary, has been named Peucetia chhaparajnirvin.

- The nocturnal spider, blending with the Vachellia nilotica (babul) tree leaves due to its green hue, preys on small insects and serves as a vital predator in controlling pest populations, and maintaining ecological balance.

- The climatic conditions of the sanctuary, characterised by extreme temperatures, underscore the spider’s adaptability.

- Lynx spiders are a family of active hunting spiders (Oxyopidae) that typically don't build webs.

- These spiders, often found on vegetation, are known for their excellent eyesight and use ambush or stalking tactics to capture prey, often waiting on flowers for insects to come close.

Read more: Spider