Greater Tipraland: Tripura

Why in News

Recently, several tribal outfits in Tripura have joined hands to push their demand for a separate state, Greater Tipraland for indigenous communities in the region.

- Among the political parties that have come together for the cause are TIPRA Motha (Tipraha Indigenous Progressive Regional Alliance) and IPFT (Indigenous People’s Front of Tripura).

Key Points

- The Demand:

- The parties are demanding a separate state of ‘Greater Tipraland’ for the indigenous communities of the north-eastern state.

- They want the Centre to carve out the separate state under Article 2 and 3 of the Constitution.

- Among the 19 notified Scheduled Tribes in Tripura, Tripuris (aka Tipra and Tiprasas) are the largest.

- According to the 2011 census, there are at least 5.92 lakh Tripuris in the state, followed by Bru or Reang (1.88 lakh) and Jamatias (83,000).

Article 2 & 3

- Article 2: Parliament may by law admit into the Union, or establish, new States on such terms and conditions as it thinks fit.

- However, Parliament cannot establish a new union territory by passing a law, that can only be done through a constitutional amendment.

- States like Sikkim (previously not within India) became a part of the country under Article 2.

- Article 3: It empowered the Parliament to make law relating to the formation of new states and alteration of existing states.

- Immediate Cause:

- The churn in the state’s politics with the rise of TIPRA Motha and the Assembly polls due in early 2023 are the two major reasons behind the development.

- Historical Background:

- Tripura was a kingdom ruled by the Manikya dynasty from the late 13th century until the signing of the Instrument of Accession with the Indian government in 1949.

- The demand stems from the anxiety of the indigenous communities in connection with the change in the demographics of the state, which has reduced them to a minority.

- It happened due to the displacement of Bengalis from the erstwhile East Pakistan between 1947 and 1971.

- From 63.77% in 1881, the population of the tribals in Tripura was down to 31.80% by 2011.

- In the intervening decades, ethnic conflict and insurgency gripped the state, which shares a nearly 860-km long boundary with Bangladesh.

- The joint forum has also pointed out that the indigenous people have not only been reduced to a minority, but have also been dislodged from land reserved for them by the penultimate king of the Manikya dynasty Bir Bikram Kishore Debbarman.

- Initiatives to Address the Issue:

- Tripura Tribal Areas Autonomous District Council:

- The Tripura Tribal Areas Autonomous District Council (TTADC) was formed under the sixth schedule of the Constitution in 1985 to ensure development and secure the rights and cultural heritage of the tribal communities.

- ‘Greater Tipraland’ envisages a situation in which the entire TTADC area will be a separate state. It also proposes dedicated bodies to secure the rights of the Tripuris and other aboriginal communities living outside Tripura.

- The TTADC, which has legislative and executive powers, covers nearly two-third of the state’s geographical area.

- The council comprises 30 members of which 28 are elected while two are nominated by the Governor.

- The Tripura Tribal Areas Autonomous District Council (TTADC) was formed under the sixth schedule of the Constitution in 1985 to ensure development and secure the rights and cultural heritage of the tribal communities.

- Reservation:

- Also, out of the 60 Assembly seats in the state, 20 are reserved for Scheduled Tribes.

- Tripura Tribal Areas Autonomous District Council:

Other Demands in the North East

- Greater nagalim (Parts of Arunachal Pradesh, Manipur, Assam and Myanmar)

- Bodoland (Assam)

- Tribal Autonomy Meghalaya

Way Forward

- Economic and social viability rather than political considerations must be given primacy.

- There should be certain clear-cut parameters and safeguards to check the unfettered demands.

- It is better to allow democratic concerns like development, decentralisation and governance rather than religion, caste, language or dialect to be the valid bases for conceding the demands for a new state.

- Apart from this the fundamental problems of development and governance deficit such as concentration of power, corruption, administrative inefficiency etc must be addressed.

Private Members Bill

Why in News

Recently, Rajya Sabha reserved its decision to allow the introduction of a Private Member’s Bill to amend the Preamble to the Constitution.

- The Bill seeks to change the words in the Preamble “EQUALITY of status and of opportunity” to “EQUALITY of status and of opportunity to be born, to be fed, to be educated, to get a job and to be treated with dignity”.

Amendability of Preamble

- As a part of the Constitution, the preamble can be amended under Article 368 of the Constitution, but the basic structure of the preamble can not be amended.

- As per the Supreme Court verdict in the Kesavananda Bharati vs State of Kerala, 1973 , Parliament cannot change the basic structure of the Constitution.

- As of now, the preamble is only amended once through the 42nd Amendment Act, 1976.

- It added three new words–Socialist, Secular and Integrity.

Key Points

- About:

- Any Member of Parliament (MP) who is not a minister is referred to as a private member.

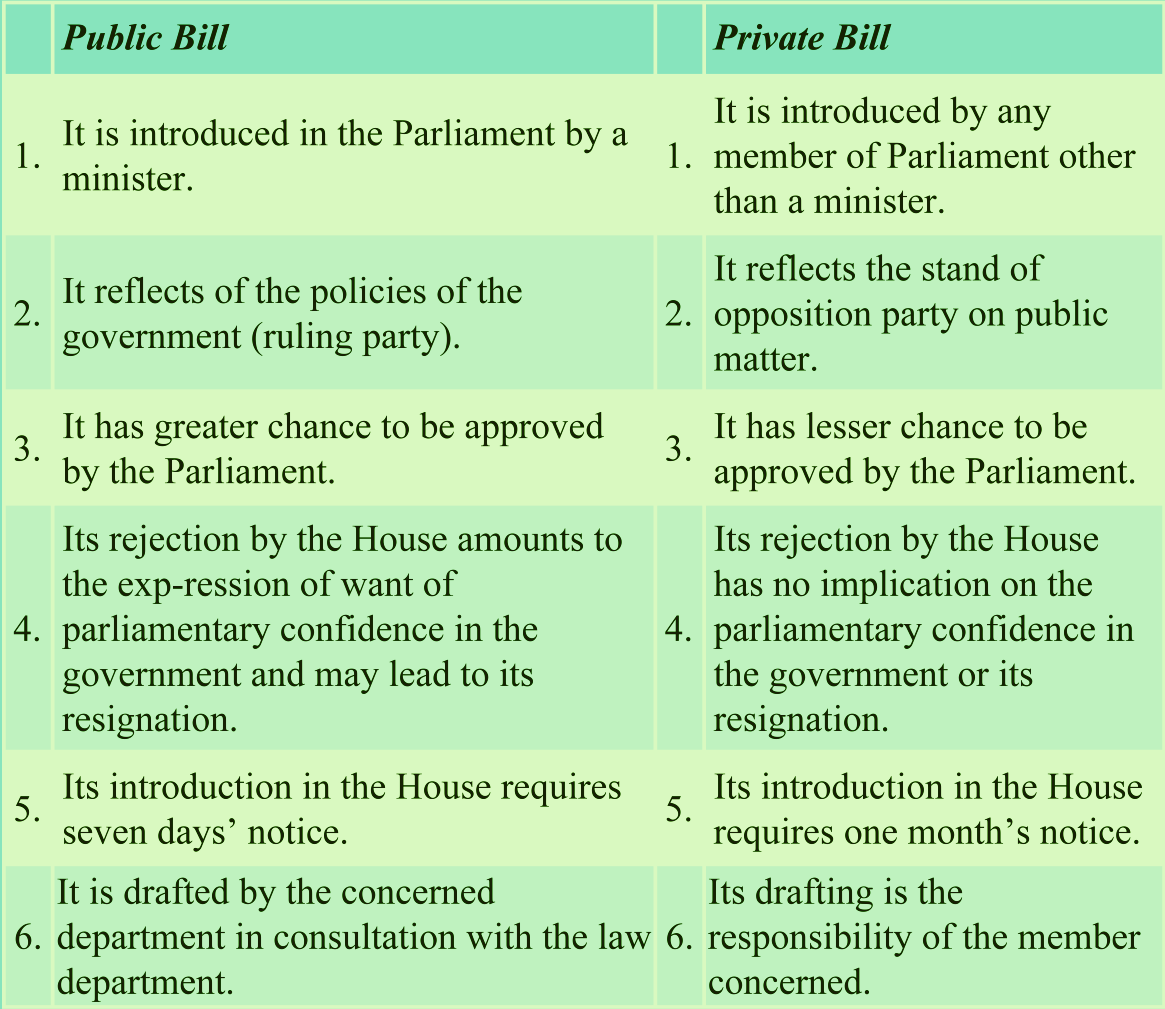

- Its drafting is the responsibility of the member concerned. Its introduction in the House requires one month’s notice.

- The government bills\public bills can be introduced and discussed on any day, private member’s bills can be introduced and discussed only on Fridays.

- In case of multiple Bills, a ballot system is used to decide the sequence of bills for introduction.

- The Parliamentary Committee on Private Member's Bills and Resolutions goes through all such Bills and classifies them based on their urgency and importance.

- Its rejection by the House has no implication on the parliamentary confidence in the government or its resignation.

- Upon conclusion of the discussion, the member piloting the bill can either withdraw it on the request of the minister concerned, or he may choose to press ahead with its passage.

- Previous Private Bills:

- The last time a private member’s bill was passed by both Houses was in 1970.

- It was the Supreme Court (Enlargement of Criminal Appellate Jurisdiction) Bill, 1968.

- 14 private member’s bills — five of which were introduced in Rajya Sabha — have become law so far. Some other private member bills that have become laws include-

- Proceedings of Legislature (Protection of Publication) Bill, 1956, in the Lok Sabha.

- The Salaries and Allowances of Members of Parliament (Amendment) Bill, 1964, introduced in the Lok Sabha.

- The Indian Penal Code (Amendment) Bill, 1967 introduced in the Rajya Sabha.

- The last time a private member’s bill was passed by both Houses was in 1970.

- Significance:

- The purpose of the private member’s bill is to draw the government’s attention to what individual MPs see as issues and gaps in the existing legal framework, which require legislative intervention.

- Thus it reflects the stand of the opposition party on public matters.

- The purpose of the private member’s bill is to draw the government’s attention to what individual MPs see as issues and gaps in the existing legal framework, which require legislative intervention.

Public Bill vs Private Bill

Public Accounts Committee (PAC)

Why in News

Recently, the Public Accounts Committee (PAC) has completed 100 years.

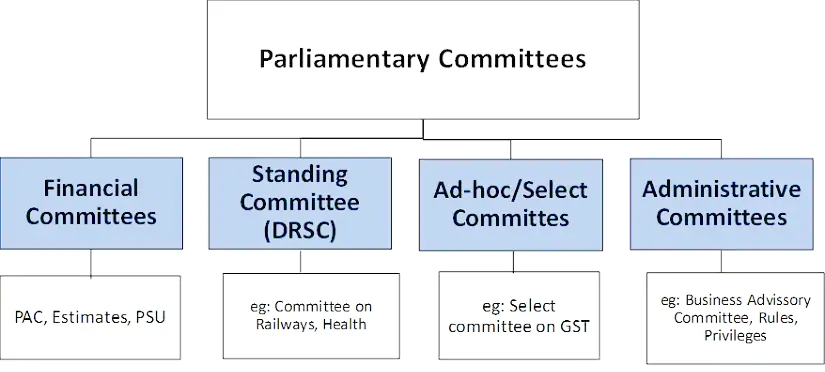

- PAC is one of the three Financial Parliamentary committees, the other two are the Estimates Committee and the Committee on Public Undertakings.

- Parliamentary committees draw their authority from Article 105 (on privileges of Parliament members) and Article 118 (on Parliament’s authority to make rules for regulating its procedure and conduct of business).

Key Points

- PAC:

- Establishment:

- The Public Accounts Committee was introduced in 1921 after its first mention in the Government of India Act, 1919 also called Montford Reforms.

- The Public Accounts Committee is now constituted every year under Rule 308 of the Rules of Procedure and Conduct of Business in Lok Sabha.

- Appointment:

- The Chairman of the Committee is appointed by the Speaker of Lok Sabha.

- It is to be noted that the Committee, not being an executive body, can only make decisions that are advisory by nature.

- The Chairman of the Committee is appointed by the Speaker of Lok Sabha.

- Members:

- It presently comprises 22 members (15 members elected by the Lok Sabha Speaker, and 7 members elected by the Rajya Sabha Chairman) with a term of one year only.

- Purpose:

- It was framed with the purpose of ascertaining whether money granted to the Government by the Parliament has been spent by the former within the “scope of demand” or not, the PAC restricts any Minister from being elected as a member of it.

- Functions:

- To examine the accounts showing the appropriation of the sums granted by the House to meet the expenditure, the annual Finance Accounts of the government and,

- Such other accounts laid before the House as the Committee may think fit except those relating to such Public Undertakings as are allotted to the Committee on Public Undertakings.

- Apart from the Reports of Comptroller and Auditor General of India (CAG) on Appropriation Accounts of the Government, the Committee examines the various Audit Reports of the CAG on revenue receipts, expenditure by various Ministries/Departments of Government and accounts of autonomous bodies.

- The Committee looks upon savings arising from incorrect estimating or other defects in procedure no more leniently than it does upon excesses.

- To examine the accounts showing the appropriation of the sums granted by the House to meet the expenditure, the annual Finance Accounts of the government and,

- Establishment:

- Importance of Parliamentary Committees:

- Provides Forum:

- Parliament deliberates on matters that are complex, and therefore need technical expertise to understand such matters better.

- Committees help with this by providing a forum where members can engage with domain experts and government officials during the course of their study.

- Build Consensus Across Political Parties:

- Committees also provide a forum for building consensus across political parties.

- The proceedings of the House during sessions are televised, and MPs are likely to stick to their party positions on most matters.

- Committees have closed door meetings, which allows them to freely question and discuss issues and arrive at a consensus.

- Examine Policy Issues:

- Committees also examine policy issues in their respective ministries, and make suggestions to the government.

- The government has to report back on whether these recommendations have been accepted or not.

- Based on this, the Committees then table an Action Taken Report, which shows the status of the government’s action on each recommendation.

- Provides Forum:

- Issues Arises by not involving the Committees:

- Weakening of Parliamentary System Government:

- A parliamentary democracy works on the doctrine of fusion of powers between parliament and the executive, but the Parliament is supposed to maintain oversight of the government and keep its power in check.

- Thus, by circumventing the Parliamentary committees in the passing of significant legislation, there is a risk of weakening democracy.

- Enforcing Brute Majority:

- In the Indian system, it is not mandatory for bills to be sent to committees. It’s left to the discretion of the Chair — the Speaker in the Lok Sabha and Chairperson in the Rajya Sabha.

- By giving discretionary power to the Chair, the system has been specially rendered weak in a Lok Sabha where the ruling party has a brute majority.

- Weakening of Parliamentary System Government:

Way Forward

- Parliament has the central role in our democracy as the representative body that checks the work of the government. In order to fulfil its constitutional mandate, it is imperative that Parliament functions effectively.

- Also, proper scrutiny of the bills is an essential requirement of quality legislation. Circumventing the parliamentary committees while passing legislations undermines the very spirit of democracy.

Rules to Admit Questions by Members of Parliament

Why in News

Recently, a question raised by a Member of Parliament was disallowed “because of national interest’’.

- Also, over the last few sessions, MPs have often alleged their questions have been disallowed.

Key Points

- Right to Ask Questions:

- In both Houses, elected members enjoy the right to seek information from various ministries and departments in the form of starred questions, unstarred questions, short notice questions and questions to private members.

- The first hour of every sitting is usually devoted to asking and answering questions in both Houses, and this is referred to as the ‘Question Hour’.

- The Rajya Sabha Chairman or the Lok Sabha Speaker has the authority to decide whether a question or a part is or is not admissible under the norms of the House, and disallow any question or a part.

- In both Houses, elected members enjoy the right to seek information from various ministries and departments in the form of starred questions, unstarred questions, short notice questions and questions to private members.

- Rules to Admit Questions:

- In Rajya Sabha:

- The admissibility of questions in Rajya Sabha is governed by Rules 47-50 of the Rules of Procedure and Conduct of Business in the Council of States.

- Among various norms, the question “shall be pointed, specific and confined to one issue only”.

- In Lok Sabha:

- In Lok Sabha, once the notice for questions is received, ballots determine priority.

- The questions are examined for admissibility under Rules 41-44 of the Rules of Procedure and Conduct of Business in Lok Sabha.

- In Lok Sabha, questions that are not admitted include: those that are repetitive or have been answered previously; and matters that are pending for judgment before any court of law or under consideration before a Parliamentary Committee.

- In Rajya Sabha:

- Categories of Questions:

- Starred Question:

- The member desires an oral answer from the minister. Such a question is distinguished by the MP with an asterisk. The answer can also be followed by supplementary questions from members.

- UnStarred Question:

- The MP seeks a written answer, which is deemed to be laid on the table of the House by the concerned minister.

- Short Notice Question:

- These are on an urgent matter of public importance, and an oral answer is sought. For asking such a question, a notice of less than 10 days is prescribed as the minimum period.

- Question to Private Member:

- A question can be addressed to a private member under Rule 40 of Lok Sabha’s Rules of Procedure, or under Rule 48 of Rajya Sabha’s Rules, provided that the question deals with a subject relating to some Bill, resolution or other matter for which that member is responsible.

- Starred Question:

Way Forward

- Under Article 75 of the constitution, asking questions in parliament is a constitutional right of a member of the House. Viewed from this angle, the Question Hour in parliament stands on a different footing.

- In a way, every Question Hour is the manifestation of a direct kind of democracy in operation, in the sense that representation of the people directly questions the government on matters of governance, and the government is duty bound to answer the questions in the House.

- The concerned officials also should give a good reason on why a question should be disallowed. The reason also cannot be accessed through RTIs due to privilege of the House — tough to take it to court as well.

The High Court and Supreme Court Judges Amendment Bill 2021

Why in News

Recently, the High Court and Supreme Court Judges (Salaries and Conditions of Service) Amendment Bill, 2021 was introduced in Lok Sabha.

- The Bill seeks to amend the High Court Judges (Salaries and Conditions of Service) Act, 1954, and the Supreme Court Judges (Salaries and Conditions of Service) Act, 1958.

Key Points

- About the Bill:

- It seeks to bring clarity on when Supreme Court and High Court judges are entitled to an additional quantum of pension or family pension on attaining a certain age.

- The Bill clarifies that the increase in pension of retired judges which come after attaining a certain age shall be implemented from the first day of the month in which they complete the age specified and not from the first day of his entering the age specified.

- Current Provisions:

- The High Court Judges (Salaries and Conditions of Service) Act, 1954, and the Supreme Court Judges (Salaries and Conditions of Service) Act, 1958 regulate the salaries and conditions of service of the judges of High Courts and the Supreme Court of India.

- Through the High Court and Supreme Court Judges (Salaries and Conditions of Service) Amendment Act, 2009, section 16B and section 17B were respectively inserted (in the 1954 Act and 1958 Act).

- The 2009 act aims to provide that every retired Judge or after his death, the family will be entitled to an additional quantum of pension or family pension in accordance with the scale specified therein.

- Accordingly, the additional quantum of pension to retired Judges of the High Court and Supreme Court is being sanctioned on completing the age of 80 years, 85 years, 90 years, 95 years and 100 years, as the case may be.

- The additional quantum increases with age (from 20% to 100% of the pension or family pension).

High Court Judges

- Article 217 of the Constitution: It states that the Judge of a High Court shall be appointed by the President in consultation with the Chief Justice of India (CJI), the Governor of the State.

- In the case of appointment of a Judge other than the Chief Justice, the Chief Justice of the High Court is consulted.

- The high court judge retires at the age of 62 years.

- Consultation Process: High Court judges are recommended by a Collegium comprising the CJI and two senior-most judges.

- The proposal, however, is initiated by the Chief Justice of the High Court concerned in consultation with two senior-most colleagues.

- The recommendation is sent to the Chief Minister, who advises the Governor to send the proposal to the Union Law Minister.

- The Chief Justice of India would, in consultation with the two senior most Judges of the Supreme Court, form his opinion in regard to a person to be recommended for appointment to the High Court.

Supreme Court Judges

- Article 124 of the Constitution:

- The Chief Justice of India (CJI) and the Judges of the Supreme Court are appointed by the President under clause (2) of Article 124.

- Supreme Court Judges retire upon attaining the age of 65 years.

- The CJI is appointed by the President after consultation with such judges of the Supreme Court and high courts as he deems necessary.

- The other judges are appointed by the President after consultation with the CJI and such other judges of the Supreme Court and the high courts as he deems necessary. The consultation with the chief justice is obligatory in the case of appointment of a judge other than the Chief justice.

- The SC collegium is headed by the CJI and comprises four other senior most judges of the court.

- Appointment of Chief Justice from 1950 to 1973:

- The practice has been to appoint the senior most judge of the Supreme Court as the chief justice of India. This established convention was violated in 1973 when A N Ray was appointed as the Chief Justice of India by superseding three senior judges. Again in 1977, M U Beg was appointed as the chief justice of India by superseding the then senior-most judge.

- This discretion of the government was curtailed by the Supreme Court in the Second Judges Case (1993), in which the Supreme Court ruled that the senior most judge of the Supreme Court should alone be appointed to the office of the Chief Justice of India.

Wage Rate Index (WRI)

Why in News

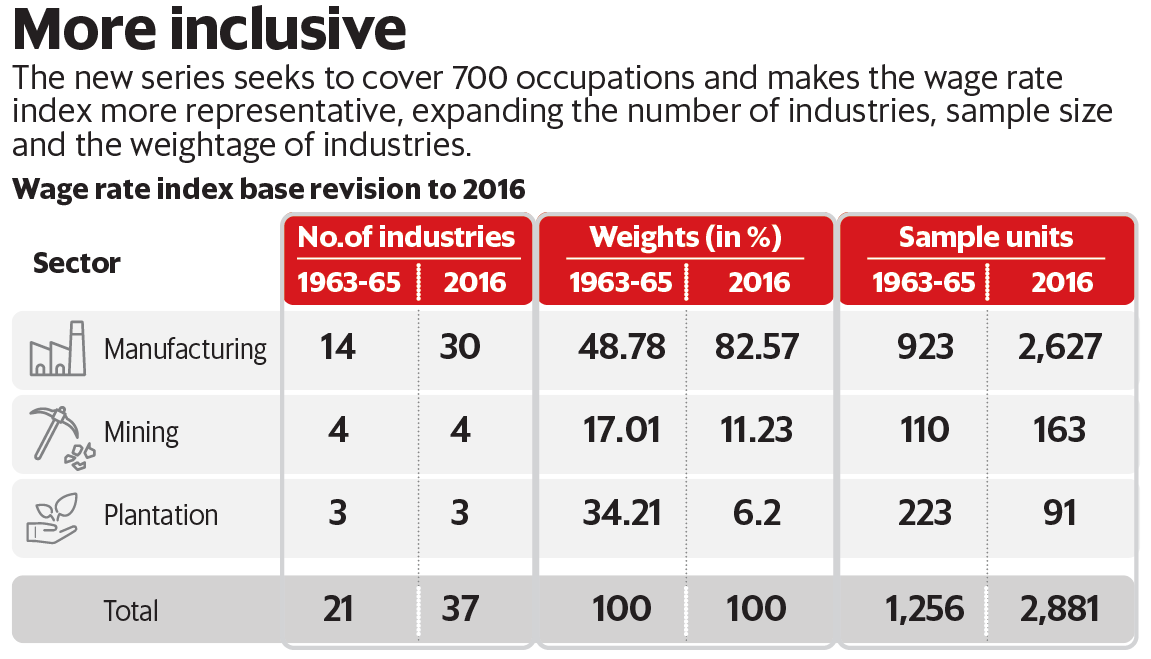

Recently, the government has revised the base year for Wage Rate Index (WRI) to 2016 which will replace the old series with a base of 1963-65.

- The Wage Rate Index Number measures the relative changes in wage rates over a period of time, high or low Wage Rate Index in an industry does not necessarily indicate high or low wage rate in that industry as compared to other industries.

- A base year is the first of a series of years in an economic or financial index and is typically set to an arbitrary level of 100.

Key Points

- About:

- The Ministry of Labour & Employment has released a new series of Wage Rate Index (WRI) with base year 2016, being compiled and maintained by the Labour Bureau, an attached office of the ministry.

- It is based on the recommendations of the International Labour Organization and the National Statistical Commission.

- The new series on WRI has been compiled on a half-year basis (on the first of January and July every year) as against the annual in the existing series.

- The new WRI basket (2016=100) has enhanced the scope and coverage in terms of occupations and industries as compared to old WRI series (1963-65=100).

- Of the 37 industries covered in the new series, 16 new ones - including textile garments, footwear and petroleum - have been added under the manufacturing sector.

- In the new series, the oil mining industry has been introduced in the basket in place of mica mines industry, to make the mining sector more representative of the three different kinds of mining namely coal, metal and oil.

- Total 3 plantation industries namely tea, coffee and rubber have been retained in the new WRI basket with enhanced coverage.

- The top five industries - motor vehicles, coal mines, textile garments, iron & steel and cotton textiles together account for 46% of the total weight.

- Expected Benefits:

- The revised base will be more representative and play a critical role in determining the minimum wages and national floor wages along with other parameters.

- The government periodically revises the base year for major economic indicators to reflect the changes in the economy and to capture the wage pattern of workers.

- It provides useful tips to employers on deciding on the appropriate human resource strategy.

- WRI 2020:

- The All India Wage Rate Index Number for all the 37 industries stood at 119.7 in 2020 (half yearly 2) which shows an increment of 1.6% over the index in 2020 (half yearly 1).

- At sector level, the highest Wage Rate Index in 2020 (half yearly 2) was reported in the Plantation Sector followed by the Manufacturing Sector and Mining Sector.

- Highest Wage Rate Index:

- The highest Wage Rate Index was recorded in Drugs & Medicines, followed by Sugar, Motor Cycles, Jute Textiles and Tea Plantation.

- Lowest Wage Rate Index:

- The lowest Wage Rate Index was recorded in Rubber Plantation, followed by Paper, Castings & Forgings , Woollen Textiles and Synthetic Textiles.

Ship Acquisition, Financing and Leasing (SAFAL): IFSC Report

Why in News

Recently, the report titled Ship Acquisition, Financing and Leasing (SAFAL) was submitted by the Committee for Development of Avenues for Ship Acquisition, Financing and Leasing to the International Financial Services Centres Authority (IFSCA).

Key Points

- About the Committee:

- Formation: It was constituted by IFSCA in June 2021 with representatives from the Government of India, Gujarat Maritime Board, industry and finance experts, and academicians.

- Objective: Focus remained on enabling cost-effective and competitive delivery of shipping services on ships owned and leased from India-offshore IFSC which is on par with overseas competitors.

- Observations of the Committee:

- Net Importer of Shipping Services: Despite having a large coastline, growing domestic market and international seaborne trade, deep-rooted maritime traditions, and skilled seafarers, India continues to have a smaller share in the international shipping sector, thus becoming a net importer of shipping services especially ship finance.

- Required Changes: It has presented the critical and necessary changes required to bring this greenfield venture to India IFSC.

- These cover legal and regulatory domains, direct and indirect taxes, ship finance, and ease of doing business drawing upon global best practices.

- Imparting Brand Value: It finds that the time is opportune for imparting a brand value to Indian-flagged vessels.

- This can be done by carving out a share in global cross trades, securing gainful transactions for India’s marketplace, promoting decarbonization and greening of the blue oceans, and leveraging India-IFSC Maritime for achieving the Maritime India Vision 2030 and beyond.

- Maritime India Vision 2030 is a ten-year blueprint for the maritime sector which was released by the Prime Minister of India at the Maritime India Summit in November 2020.

- It will supersede the Sagarmala initiative and aims to boost waterways, give a fillip to the shipbuilding industry and encourage cruise tourism in India.

- This can be done by carving out a share in global cross trades, securing gainful transactions for India’s marketplace, promoting decarbonization and greening of the blue oceans, and leveraging India-IFSC Maritime for achieving the Maritime India Vision 2030 and beyond.

- Importance of the Shipping Sector for India:

- Nearly half of India’s border is covered by sea, with a coastline of about 7,517 km, with 12 major and 205 minor ports.

- India is also strategically located on the world’s shipping routes.

- It is estimated that about 95% of India’s goods trade by volume and 70% by value is done through maritime transport.

- India has significant exposure to maritime freight rate. Seaborne freight is estimated to be $85 billion annually.

- The share of Indian ships in carrying India’s export-import cargo was about 6.53% in FY 2019-20.

- Each year India is estimated to pay about $75 billion seaborne freight to foreign shipping companies.

- India is thus well placed to step up its investment in the shipping industry.

- Nearly half of India’s border is covered by sea, with a coastline of about 7,517 km, with 12 major and 205 minor ports.

- Related Measures taken by the Government:

- Revision of the criteria for Right of First Refusal (ROFR): The criteria for granting the Right of First Refusal in chartering of vessels through tender process has been revised, for promoting tonnage under Indian flag and ship-building in India, so as to make India a Atmanirbhar/self-reliant in terms of tonnage and ship-building in India.

- Subsidy Support to Indian Shipping Companies: A scheme for the promotion of flagging of merchant ships in India by providing Rs.1624 crore over a period of five years as subsidy support to Indian shipping companies in global tenders floated by Ministries and CPSEs has been approved by the Cabinet.

- Ship Building Financial Assistance Policy (2016-2026): Government of India approved the Financial Assistance Policy for Indian Shipyards in December 2015, for grant of financial assistance to Indian Shipyards.

International Financial Services Centre (IFSC)

- An IFSC enables bringing back the financial services and transactions that are currently carried out in offshore financial centres by Indian corporate entities and overseas branches/subsidiaries of Financial Institutions (such as banks, insurance companies, etc.) to India.

- It offers a business and regulatory environment that is comparable to other leading international financial centres in the world like London and Singapore.

- IFSCs are intended to provide Indian corporates with easier access to global financial markets, and to complement and promote further development of financial markets in India.

- The first IFSC in India has been set up at the Gujarat International Finance Tec-City (GIFT City) in Gandhinagar.

- The central government has established the International Financial Services Centres Authority to regulate all financial services in International Financial Services Centres (IFSCs) with headquarters in Gandhinagar (Gujarat).

Kala Sanskriti Vikas Yojna

Why in News

Recently, the Ministry of Culture has launched a Scheme of Financial Assistance for the Development of Buddhist/Tibetan Culture and Art under “Kala Sanskriti Vikas Yojna (KSVY)”.

- Under this scheme, financial assistance is provided to the voluntary Buddhist and Tibetan Organizations including Monasteries engaged in the propagation and scientific development of Buddhist/ Tibetan Culture and tradition, located in any part of the country. The quantum of funding is Rs.30 lakhs per year for an organization.

Key Points

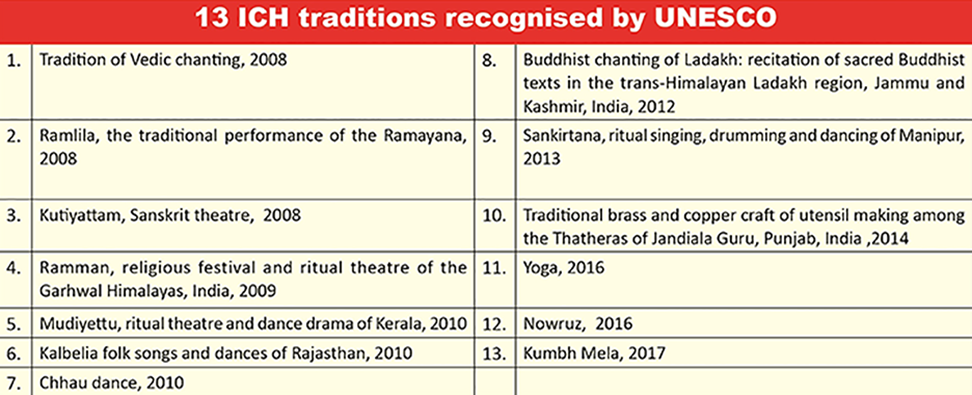

- KSVY is an umbrella scheme under the Ministry of Culture for the promotion of art and culture in the country. It is a central sector scheme.

- The ministry implements many schemes under KSVY, where the grants are sanctioned/approved for holding programs/activities.

- Scheme of Financial Assistance for Promotion of Art and Culture.

- Scheme of Financial Assistance for Creation of Cultural Infrastructure.

- Scheme for Safeguarding the Intangible Cultural Heritage, which aims to promote the 13 intangible cultural heritage of India, recognised by the United Nations Educational, Scientific and Cultural Organization (UNESCO).