Governance

Global Fund for AIDS, TB, and Malaria

India has recently announced a contribution of $22 million to the Global Fund for AIDS, TB, and Malaria (GFTAM).

- India has stepped an inch closer by enhancing the Global Fund efforts to strengthen health systems and save 16 million more lives across the globe.

- The Global Fund to fight AIDS, Tuberculosis, and Malaria was created to raise, manage and invest the world’s money in eliminating three of the deadliest infectious diseases the world has ever known.

- India shares a sustained partnership with the Global Fund since its formation, both as a recipient and as a donor.

Global Funds

- Global Fund (with a total investment of $2 billion) was created in 2002 to pool the world’s resources & invest them strategically in programs to end Tuberculosis (TB), Acquired Immuno-Deficiency Syndrome (AIDS), and Malaria as epidemics.

- It is a partnership of governments, civil society, technical agencies, the private sector and people affected by the diseases.

- India has set a precedent for other donors to contribute generously to the cause.

Tuberculosis (TB)

- Tuberculosis (TB) is caused by bacteria (Mycobacterium tuberculosis) that most often affect the lungs. Tuberculosis is curable and preventable.

- TB is spread from person to person through the air. When people with lung TB cough, sneeze or spit, they propel the TB germs into the air.

- About one-third of the world's population has latent TB, which means people have been infected by TB bacteria but are not (yet) ill with the disease and cannot transmit the disease.

- World TB Day is observed on 24 March to earmark the discovery of Mycobacterium tuberculosis, a bacterium due to which TB is caused, by German microbiologist Dr. Robert Koch in 1882.

- The Universal Immunization Programme (UIP) launched by the Government of India in 1985 includes vaccination for 12 diseases including TB.

Human Immuno-Deficiency Virus, Acquired Immuno-Deficiency Syndrome (HIV-AIDS)

- HIV is a type of virus called a retrovirus, and the combination of drugs used to treat it is called Antiretroviral Therapy (ART).

- HIV attacks CD4, a type of White Blood Cell (T cells) in the body’s immune system. T cells are those cells that move around the body detecting anomalies and infections in cells.

- With neither a vaccine nor a cure in sight, Antiretroviral Therapy (ART) is the only option available for people living with HIV-AIDS.

- World AIDS Day is observed on 1st December.

- “Mission Sampark” was launched in 2017 to bring back People Living with HIV who have left treatment after starting Anti Retro Viral Treatment (ART).

- 'Project Sunrise' was launched in 2016 to tackle the rising HIV prevalence in north-eastern states, especially among people injecting drugs.

Malaria

- Malaria is caused by Plasmodium parasites.

- The parasites are spread to people through the bites of infected female Anopheles mosquitoes, called "malaria vectors",

- World Malaria Day is observed on 25th April.

- It can be noted that only for four diseases viz. HIV-AIDS, TB, Malaria, and Hepatitis (28 July), the World Health Organization (WHO) officially endorses disease-specific global awareness days.

Indian Economy

Steering Committee on Fintech

Recently, the Steering Committee on Fintech has submitted its final report to the Ministry of Finance.

- The Committee was constituted in pursuance to the announcement made in Budget Speech 2018-19.

Recommendations of the Report

- The Committee has recommended Fintech can be leveraged to enhance financial inclusion of Micro, Small and Medium Enterprises (MSMEs).

- In this pursuit, it is recommended that the Reserve Bank of India (RBI) may consider the development of a cash-flow based financing for MSMEs.

Cash flow-based financing

- In cash flow lending, a financial institution grants a loan that is backed by the recipient’s past and future cash flows.

- This means a company borrows money from expected revenues they anticipate they will receive in the future.

- Credit ratings are also used in this form of lending as an important criterion.

- The advantage of this method is that a company can possibly obtain financing much faster, as an appraisal of collateral is not required.

- To support risk reduction in the insurance business, it recommended that insurance companies and lending agencies to be encouraged to use drone and remote sensing technology for crop area, damage and location assessments.

- The Department of Financial Services can work with public sector banks to bring in more efficiency to their work and reduce fraud and security risks.

- Significant opportunities can be explored to increase the levels of automation using Artificial Intelligence (AI), cognitive analytics & machine learning in their back-end processes.

- National Bank for Agriculture and Rural Development (NABARD) to take immediate steps to create a credit registry for farmers with special thrust for use of fintech.

- A comprehensive legal framework for consumer protection in the context of the rise of fintech and digital services.

- The adoption of Regulation Technology (RegTech) and Supervisory technology (SupTech) by all financial sector regulators.

RegTech

- It is the management of regulatory processes within the financial industry through technology.

- The main functions of Regtech include regulatory monitoring, reporting, and compliance.

- RegTech uses cloud computing technology through software-as-a-service (SaaS) to help businesses comply with regulations efficiently and less expensively.

- The rise in digital products has increased data breaches, cyber hacks, money laundering, and other fraudulent activities.

SupTech

- It helps supervisory agencies to digitize reporting and regulatory processes, resulting in more efficient and proactive monitoring of risk and compliance at financial institutions.

- Suptech is currently found in two areas of applications: data collection and data analytics.

- The Department of Financial Services and the Reserve Bank of India may examine the suitability of virtual banking system.

- The virtual banking system is a system where banks do not need to set up branches and yet deliver the full-scale retail banking services ranging from extending loans, savings accounts, issuing cards and offering payment services through their app or website.

- The usage of common fintech platform for Micro Units Development and Refinance Agency (MUDRA) loans, small saving schemes, pension schemes and provident fund.

- Reforming the current peer-to-peer (P2P) lending platforms.

- Further, an Inter-Ministerial Steering Committee will be set up on fintech applications by Ministry of Finance, to continue to carry on the tasks of implementing this report.

Indian Economy

Secondary Market For Corporate Loans

The Reserve Bank of India (RBI) constituted Panel, headed by T.N. Manoharan, has given some suggestions for developing the secondary market for corporate loans in the country. Suggestions are as follows:

- Setting up a Self-Regulatory Body (SRB) of participants to finalise details for the secondary market for corporate loans, including the standardisation of documents.

- Creating a Loan Contract Registry to remove information asymmetries between buyers and sellers.

- Creating an online loan sales platform to conduct auctions and sale of loans.

- Widening the Spectrum: Enabling participation of non-banking entities such as mutual funds, insurance companies, and pension funds.

- Banks and the Non-Banking Financial Companies (NBFCs) are currently the only participants in the primary and secondary loan markets.

- Single loan securitisation can be considered to incentivise investors to acquire loans through the secondary market mechanism.

- Securitisation is currently permitted only for a pool of homogenous assets.

- Securitization is a process by which a company clubs it's different financial assets/debts to form a consolidated financial instrument which is issued to investors. In return, the investors in such securities get interest.

- Allowing Foreign Portfolio Investors (FPIs) to directly purchase distressed loans from banks.

- Currently, FPIs have to come through the Asset Reconstruction Companies (ARCs) to participate in the distressed loan market.

- Linking the pricing of all loans to an external benchmark as the current Marginal Cost of Funds Based Lending Rate (MCLR) may not be comparable across banks.

Asset Reconstruction Companies

- An Asset Reconstruction Company is a special type of financial institution that buys the debtors of the bank at a mutually agreed value and attempts to recover the debts or associated securities by itself.

- The ARCs are registered under the RBI and regulated under the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002 (SARFAESI Act, 2002).

- The ARCs take over a portion of the debts of the bank that qualify to be recognised as Non-Performing Assets.

Secondary Market for Corporate Loans

- Secondary loan market in India is largely restricted to the sale of loans to Asset Reconstruction Companies and no formalised mechanism has been developed to deepen the market.

- The secondary market is the market where investors buy and sell securities they already own.

- A vibrant, deep and liquid secondary market for debt would go a long way in increasing the efficiencies of the debt market in general and would aid in the resolution of stressed assets in particular.

- A well-developed secondary market for debt would also aid in transparent price discovery of the inherent riskiness of the debt being traded.

- The secondary market for loans can also be an important mechanism for credit intermediaries to manage credit risk and liquidity risk on their balance-sheets, especially for distressed assets.

Indian Economy

MUDRA Scheme and Employment

Recently, Pradhan Mantri Mudra Yojana Survey has been conducted by the Labour Bureau under the Ministry of Labour and Employment.

- The survey studied as many as 97,000 beneficiaries and was conducted between April-November 2018. Its salient findings are:

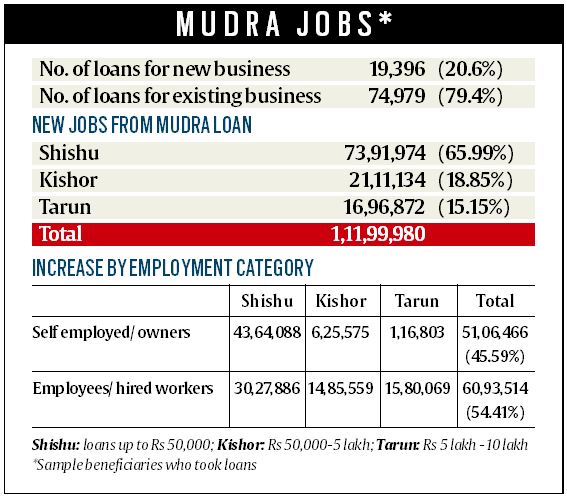

- Just one out of five beneficiaries i.e. 20.6% from the sample survey availed Mudra loan for setting up a new establishment, the rest used the funds for expanding their existing business.

- A total of Rs 5.71 lakh crore in loans was sanctioned under three categories of Mudra — Shishu, Kishor and Tarun, whereas the average size of a loan was Rs 46,536.

- The share of three types of loans out of total loan sanctioned under MUDRA in 2018-17 is as follows:

- Shishu loans: 42%

- Kishor loans: 34%

- Tarun loans: 24%

- The share for creation of new jobs by three types of loans under MUDRA in 2018-17 is as follows

- Shishu loans: 66%

- Kishor loans: 18.85%

- Tarun loans: 15.51%

- The loan extended for every additional job created works out to Rs 5.1 lakh.

- Sector-wise additional job creation under MUDRA is:

- Services: 34.34 %

- Trading: 33.23%

- Allied agriculture: 20.33%

- Manufacturing: 11.7 %

- Services and trading accounted for more than two-thirds of the additional jobs created.

- The survey defines “Self Employed” as persons who engaged independently in a profession or trade.

- Employees or hired workers refer to persons engaged, excluding self-employed, by the unit whether for wages or not, in work connected directly or indirectly with the process including all administrative, technical and clerical staff.

- Just one out of five beneficiaries i.e. 20.6% from the sample survey availed Mudra loan for setting up a new establishment, the rest used the funds for expanding their existing business.

Governance

Higher Mortality from Cardio-Vascular Diseases

In India & the world, Cardiovascular diseases (CVD) are the leading cause of death. More people die annually from CVDs globally than from any other ailment.

- According to a study conducted by PURE (Prospective Urban Rural Epidemiology), “the CVD mortality is highest in the Low-Income Countries (LIC) and lowest in the High-Income Countries (HIC).”

- Cardiovascular diseases (CVDs) are a group of disorders that are related to the heart and blood vessels.

- The study was conducted over 1.6 lacs individuals for over a decade, living in 21 countries.

Findings from the Study

- Most cardiovascular disease cases and deaths in Low-Income Countries (LIC) are attributed to:

- Lower quality of health care, and it’s low availability.

- Lack of insurance - which acts as an affordability barrier.

- Some of the factors like, hypertension and education have extensive global effects.

- Household/Indoor air pollution acts as an emerging source of risk for cardiovascular disease in LIC.

- Other factors include Poor Diet, consumption of dairy-products causing CVD cases, etc.

- Some of these factors vary as per a country's economic level.

- Deaths from the cardiac disease were three times that of cancer-related deaths in LIC including India, while in high-income countries- death from cancer was twice that of CVD.

- The fact that cancer-related deaths are frequent in high-income countries indicates a transition in the predominant causes of death in the middle age group.

Way Forward

- Health policies should focus on risk factors that have the greatest effects on averting cardiovascular diseases and deaths globally.

- In specific groups of countries, additional emphasis must be laid on risk factors of greatest importance. Eliminating indoor pollution is the crucial step to be taken in this regard.

- The need of the hour is to insure each & every individual medically so that the finances do not act as a barrier in availing health facilities.

Biodiversity & Environment

Tigers in High Altitudes

The Global Tiger Forum (GTF), in partnership with the Governments of Bhutan, India and Nepal, and along with the World Wide Fund for Nature (WWF), is undertaking a situation analysis study for assessing tiger habitat status in high altitude ecosystems.

- The study has been supported by the Integrated Tiger Habitat Conservation Program (ITHCP) of the International Union for Conservation of Nature (IUCN) and KfW (German Development Bank).

- Need: Most of the high-altitude habitats, within the range, have not been surveyed for an appraisal of tiger presence, prey and habitat status.

- Findings:

- In its latest report, the study identified possible viable habitats, corridor linkages, anthropogenic pressures, and induced landscape-level changes for evolving an in-situ conservation roadmap.

- It also provided the action strategy for a high altitude tiger master plan, with gainful portfolio for local communities and ensuring the centrality of tiger conservation in development.

- Indian Government will take inputs from the study to develop a high altitude tiger master plan.

- Tiger habitats in high altitude will require protection through sustainable land use, as they are a high-value ecosystem with several hydrological and ecological processes providing ecosystem services.

- Also, they will require adaptation strategies to mitigate the ill effects of climate change.

Integrated Tiger Habitat Conservation Program

- Launched in 2014, the ITHCP is a strategic funding mechanism that aims to save tigers in the wild, their habitats and to support human populations in key locations throughout Asia.

- It has already facilitated 12 projects in six countries (Bangladesh, Bhutan, India, Indonesia, Nepal and Myanmar) to better manage Tiger Conservation Landscapes.

- It is contributing to the Global Tiger Recovery Programme (GTRP), a global effort to double tiger numbers in the wild by 2022.

Global Tiger Forum

- The GTF is the only intergovernmental international body established with members from willing countries to embark on a global campaign to protect the Tiger.

- It was formed in 1993 on recommendations from an international symposium on Tiger Conservation at New Delhi, India.

- It is located in New Delhi, India.

Important Facts For Prelims

One Nation One Ration Card Scheme

With effect from 1st October 2019, two new clusters, Kerala and Karnataka and Rajasthan and Haryana, will join the initiative of inter-state portability of ration cards.

- It implies that people from a state will be able to buy subsidised food from ration shops in the neighbouring state.

- At present, a pair of Andhra Pradesh and Telangana, as well as of that Maharashtra and Gujarat are part of the initiative.

- Through this initiative, the government is laying out the roadmap for the One Nation One Ration Card system, which it hopes to implement by June 2020.

- One Nation One Ration Card Scheme will allow portability of food security benefits across the country.

- By 1st January 2020, the Centre hopes that the eight states in these initial experimental clusters, as well as Jharkhand, Punjab and Tripura, can be clubbed into a single grid.

- This means that migrants from these 11 States can access their rations guaranteed under the National Food Security Act (NFSA) in any of the other State within the grid.

- These 11 States have already achieved the first step of implementing intra-State portability, where NFSA beneficiaries can use their ration cards in any ration shop within their own state, not just the shop where the card is registered.

Important Facts For Prelims

Shortage of Anti-Rabies Vaccine

Recently, the National Pharmaceutical Pricing Authority (NPPA) has asked manufacturers and marketers to increase the stocks of anti-rabies vaccine to address its shortage.

- The shortage is due to lack of firm orders from government and late payments.

- According to the Health Ministry’s data, India is the hotbed of human rabies.

- India accounts for more than one-third of the world’s rabies deaths.

- Each year, as many as 20,000 people die due to the vaccine-preventable fatality.

- India has a population of 30 million stray dogs which cause 96% of rabies in humans.

- Rabies

- It is caused by a Ribonucleic Acid(RNA) virus that is present in the saliva of a rabid animal (dog, cat, monkey, etc).

- It is invariably transmitted following a bite of a rabid animal that leads to deposition of the saliva and the virus in the wound.

- The death invariably occurs in four days to two weeks due to cardio-respiratory failure.

- However, the time interval between the bite and occurrence of symptoms/signs of rabies i.e. incubation period varies from four days to two years or rarely even more.

- Thus, it is important to remove the virus from the wound as early as possible by immediately washing the wound with water and soap followed by application of antiseptics that reduce/eliminate chances of nerve infection.

National Pharmaceuticals Pricing Authority

- NPPA is an organization under Department of Pharmaceuticals, Ministry of Chemicals and Fertilizers which was set up in 1997 to revise the prices of controlled bulk drugs and formulations and to enforce prices and availability of the medicines in the country, under the Drugs (Prices Control) Order (DPCO), 1995.

- The prices are now fixed/revised under Drugs (Prices Control) Order (DPCO), 2013.

- It also monitors the prices of decontrolled drugs in order to keep them at reasonable levels.

Important Facts For Prelims

Svalbard: Fastest Warming Town on the Earth

Svalbard located in Norway is facing extreme consequences of climate change.

- It is the result of rising sea level of Arctic sea due to Global Warming.

- Since 1970, average annual temperatures have risen by 4 degrees Celsius in Svalbard, with winter temperatures rising more than 7 degrees.

- The “Climate in Svalbard 2100” report also warns that the annual mean air temperature in Svalbard is projected to increase by 7 to 10 degrees Celsius by the end of this century.

- Since 1979, the Arctic sea ice extent has declined by nearly 12% per decade, with the most pronounced winter reduction in Svalbard and the Barents Sea area.

- Svalbard’s main town, Longyearbyen with a population of slightly more than 2,000 people, it is the northernmost town on the planet and also the fastest-warming town on the earth.

Note: Svalbard Global Seed Vault is the world’s largest seed storage facility situated at Norway.

Important Facts For Prelims

Induction of Apache Helicopter

Recently, Indian Air Force has formally inducted the AH-64E Apache Attack Helicopter into its inventory at Air Force Station Pathankot.

AH-64E Apache Attack Helicopter

- Better known as an attack helicopter are received from the Boeing production facility in Mesa, Arizona, USA.

- Apache will replace Russian origin MI-35 helicopters that are on the verge of retirement.

- These are all-weather capable, easily maintainable and have high agility and survivability against battle damage.

- The capabilities of the AH-64E Apache Attack Helicopter includes:

- It can carry out precision attacks at standoff ranges and operate in hostile airspace with threats from the ground.

- It can transmit and receive battlefield picture through data uplinking and networking.

- It can also shoot fire and forget anti-tank guided missiles, air to air missiles, rockets while providing versatility to helicopter in network-centric aerial warfare.

- It also carries fire control radar, which has a 360° coverage and nose-mounted sensor suite for target acquisition and night vision systems.

- The addition of Apache Attack Helicopter is a significant step towards modernisation of Indian Air Force helicopter fleet.