Indian Economy

Budget 2022-23: Direct Taxes

For Prelims: Terms, Programs and Schemes related to Direct Tax, Changes made by the Government.

For Mains: Growth & Development, Planning, Government Budgeting, Inclusive Growth, Mobilisation of Resources, Government Policies & Interventions, Significance of Direct Taxes.

Why in News

Recently, the Finance Minister presented the Union Budget 2022-23 in Parliament.

- The proposals relating to taxes and duties aim to simplify the tax system, promote voluntary compliance by taxpayers, and reduce litigation. No changes have been proposed to the income tax slabs and tax rates (individual taxpayers).

- A direct tax is a tax that a person or organisation pays directly to the entity that imposed it. Example: income tax, real property tax, personal property tax, or taxes on assets.

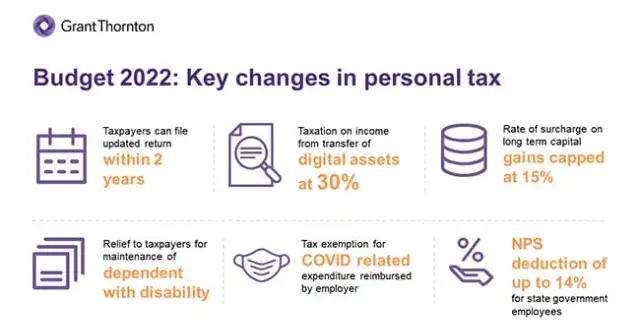

What is there for Individuals?

- Updated Return:

- The government has proposed to provide a one-time window to correct omissions in Income Tax Returns (ITRs) filed.

- Taxpayers can file the updated returns within two years from the assessment years.

- Tax relief to persons with disability:

- The government proposed to allow the payment of annuity and lump sum amount to the differently abled dependent during the lifetime of parents/guardians, i.e., on parents/ guardians attaining the age of sixty years.

- The present law provides for deduction to the parent or guardian only if the lump sum payment or annuity is available to the differently abled person on the death of the subscriber i.e. parent or guardian.

- Parity between employees of State and Central government:

- Tax deduction limit increased from 10%to 14% on employer’s contribution to the

- National Pension System account of State Government employees which brings them at par with central government employees.

- It would help in enhancing social security benefits.

What is there for Corporates Businesses & Co-operatives?

- Reduced Alternate minimum tax rate and Surcharge for Cooperatives:

- To provide a level playing field between co-operative societies and companies, the government proposed to reduce this rate for the cooperative societies also to 15%.

- Proposed to reduce the surcharge on co-operative societies from present 12% to 7% for those having total income of more than 1 crore and up to 10 crores.

- This would help in enhancing the income of cooperative societies and its members who are mostly from rural and farming communities.

- Incentives for Start-ups:

- Earlier, the eligible start-ups established before March 2022 had been provided a tax incentive for three consecutive years out of ten years from incorporation.

- In view of the Covid pandemic, the government will extend the period of incorporation of the eligible start-up by one more year, that is, up to March 2023 for providing such tax incentive.

What about the Virtual Digital Assets?

- Scheme for taxation of virtual digital assets:

- Specific tax regime for virtual digital assets introduced. Any income from transfer of any virtual digital asset to be taxed at the rate of 30%.

- No deduction in respect of any expenditure or allowance to be allowed while computing such income except cost of acquisition.

- Loss from transfer of virtual digital assets cannot be set off against any other income.

- To capture the transaction details, Tax Deduction at Source (TDS) to be provided on payment made in relation to transfer of virtual digital assets at the rate of 1% of such consideration above a monetary threshold.

- Gift of virtual digital assets also to be taxed in the hands of the recipient.

What is there to make Taxation Simpler?

- Litigation Management:

- In cases where the question of law is identical to the one pending in the High Court or Supreme Court, the filing of appeal by the department shall be deferred till such question of law is decided by the court.

- To greatly help in reducing repeated litigation between taxpayers and the department.

- Deterrence against tax-evasion:

- No set off of any loss to be allowed against undisclosed income detected during search and survey operations.

- Tax incentives to International Financial Services Centres (IFSC):

- Subject to specified conditions, the following to be exempt from tax:

- Income of a non-resident from offshore derivative instruments.

- Income from over the counter derivatives issued by an offshore banking unit.

- Income from royalty and interest on account of lease of ship.

- Income received from portfolio management services in IFSC.

- Subject to specified conditions, the following to be exempt from tax:

What has the Government done for Tax Rationalisation?

- Rationalising TDS Provisions:

- Benefits passed on to agents as a business promotion strategy taxable in the hands of agents.

- Tax deduction provided to the person giving benefits, if the aggregate value of such benefits exceeds Rs 20,000 during the financial year.

- Rationalisation of Surcharge:

- Surcharge on AOPs (consortium formed to execute a contract) capped at 15% .

- Done to reduce the disparity in surcharge between individual companies and AOPs.

- Surcharge on long term capital gains arising on transfer of any type of assets capped at 15%.

- To give a boost to the start up community.

- Surcharge on AOPs (consortium formed to execute a contract) capped at 15% .

Indian Economy

Budget 2022-23: Indirect Taxes

For Prelims: Indirect Taxes, Budget, GST, Special Economic Zones, Make in India.

For Mains: Trustworthy tax regime.

Why in News

The Union Budget 2022-23, while continuing with the declared policy of a stable and predictable tax regime, intends to bring more reforms that will take ahead the vision to establish a trustworthy tax regime.

- An indirect tax is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of market price of the goods or service purchased. For example, Goods and Services Tax (GST), Import duties.

What are the Key Proposals?

- Record GST Collection: GST collections touched a record of Rs 1.40 lakh crore in January 2022 on rapid economic recovery (despite the coronavirus pandemic).

- GST showcases the spirit of Cooperative Federalism and fulfills the dream of India as one market-one tax.

- Special Economic Zones: Customs Administration of SEZs shall be fully IT driven and function on the Customs National Portal with a focus on higher facilitation and with only risk-based checks.

- Customs Reforms and Duty Rate Changes: Faceless Customs has been fully established. Customs’ reforms have played a very vital role in:

- Domestic capacity creation,

- Providing a level playing field to MSMEs,

- Easing the raw material supply side constraints,

- Enhancing ease of doing business

- Being an enabler to other policy initiatives such as PLIs and Phased Manufacturing Plans.

- Project Imports and Capital Goods: National Capital Goods Policy, 2016 aims at doubling the production of capital goods by 2025.

- This would create employment opportunities and result in increased economic activity.

- However, several duty exemptions, even extending to over three decades in some cases, have been granted to capital goods for various sectors like power, fertilizer, textiles, leather, footwear, food processing and fertilizers.

- These exemptions have hindered the growth of the domestic capital goods sector.

- The budget proposed gradual phasing out of the concessional rates in capital goods and project imports.

- The Budget provided for applying a moderate tariff of 7.5% which will be conducive to the growth of the domestic sector and ‘Make in India’.

- Sector-specific Proposals:

- Electronics: Customs duty rates to be balanced to provide a graded rate structure - to facilitate domestic manufacturing of wearable devices and electronic smart meters.

- Announced a new Phased Manufacturing Programme (PMP) for producing wrist wearable devices, hearable devices and electronic smart meters in the country.

- The PMP incentivises the manufacture of low value accessories initially, and then moves on to the manufacture of higher value component.

- Gems and Jewelry: Customs duty on cut and polished diamonds and gemstones being reduced to 5%.

- Nil customs duty to be imposed on simply sawn diamond.

- MSME & Exports: Exemption being rationalised on implements and tools for agri-sector which are manufactured in India.

- Further, to incentivise exports, exemptions are being provided on many items.

- Tariff to Encourage Blending of Fuel: Tariff measures will be introduced to encourage the blending of fuel.

- Meanwhile, unblended fuel will attract an additional differential excise duty of Rs 2/ litre from 1st October, 2022, to further encourage the blending of fuel.

- Electronics: Customs duty rates to be balanced to provide a graded rate structure - to facilitate domestic manufacturing of wearable devices and electronic smart meters.

Indian Economy

Import Duty Changes in Budget 2022

For Prelims: One station one product, One District One Product (ODOP) scheme, Import Duty.

For Mains: Impact of change in import duty of products in the Budget 2022-23 and its significance.

Why in News?

The Finance Minister introduced a host of changes in Customs duty on several items in the Union Budget for 2022-23.

- This would mean that imports become more expensive or cheaper depending on the change in customs duties.

What are the Changes in the Import Duty?

- The customs duty on umbrellas was doubled to 20%, while exemptions provided on import of parts of umbrellas were withdrawn.

- Similarly, the customs duty on single or multiple loudspeakers, whether or not mounted in their enclosures was hiked to 20% from 15%.

- Import duty was reduced for cut and polished diamonds, asafoetida, cocoa beans, methyl alcohol and acetic acid.

- Duty on capital goods and project imports was rationalized by phasing out concessional rates and applying a moderate tariff of 7.5%.

- Under Project Import Scheme, goods imported by a company are placed under a single tariff in the Customs Tariff Act, 1975 to facilitate faster assessment and clearances of goods.

- The tariff changes will come into effect from 1st May 2022, as per the Finance Bill 2022-23.

What is the Reason behind increasing the Import Duty?

- For Protecting Domestic Industries:

- The hike in import duty for items, such as umbrellas, are in line with the increase in import duty on toys last year.

- The hike is being done for industries which manufacture items that do not deploy any major technology.

- Umbrellas, for instance, are manufactured in small units spread across 10-12 districts with Kerala being the major manufacturing state.

- The government seems to be offering protection to such industries.

- For Popularising One Station-One Product:

- It also falls in line with the other Budget announcement of popularising one station-one product to popularise local businesses and supply chains as announced in Budget 2022.

- One station-one product as a concept aims to promote a local product from each stop of the Indian Railways by making the railway station of that area a promotional and sales hub for the product.

- The concept of ‘One station one product' has based itself on the successful One District One Product (ODOP) scheme. Based on a district's strengths, ODOP has been a transformational step towards realising the true potential of a district, fueling economic growth, generating employment and rural entrepreneurship.

- It also falls in line with the other Budget announcement of popularising one station-one product to popularise local businesses and supply chains as announced in Budget 2022.

How have import duty changes been made in Recent Years?

- In 2021, customs duty exemptions were given to the steel scrap industry, which has now been extended for another year.

- It is likely to provide relief to micro, small and medium-scale secondary steel producers.

- Over the last five years, import duty hikes have been made on several occasions such as almonds, apples, and others. Other items such as cellphone parts and solar panels have seen the most regular hikes, with an aim to protect and nurture the domestic industry growth.

- Prior to the large-scale hikes, India’s peak customs duty — the highest of the normal rates — on non-agriculture products had come down steeply from 150% in 1991-92 to 40% in 1997-98 and subsequently, to 20% in 2004-05 and 10% in 2007-08.

Biodiversity & Environment

Coal Gasification

For Prelims: Coal Gasification, Syngas, Hydrogen Economy, Concerns Associated with Coal Gasification Plants

For Mains: Coal Gasification, Syngas, Hydrogen Economy, Concerns Associated with Coal Gasification Plants

Why in News

Recently, the Delhi-based non-profit, Centre for Science and Environment (CSE), has raised concerns about the Union Government’s announcement on coal gasification projects in the Budget 2022-23.

- The budget proposed four pilot projects for coal gasification and conversion of coal into chemicals required for the industry.

- According to CSE, the process of coal gasification is not attractive from a climate change point of view.

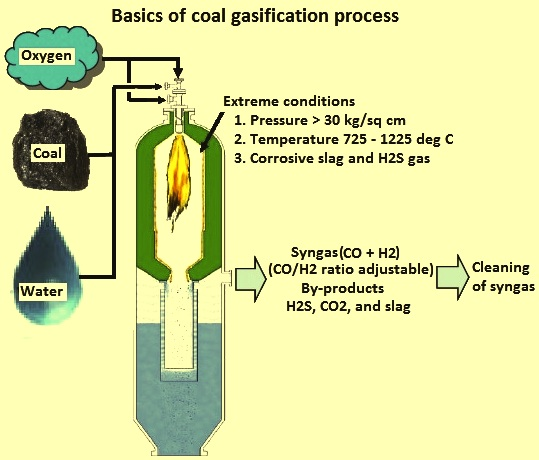

What is Coal Gasification?

- Process: Coal gasification is a process in which coal is partially oxidised with air, oxygen, steam or carbon dioxide to form a fuel gas.

- This gas is then used instead of piped natural gas, methane and others for deriving energy.

- In-situ gasification of coal – or Underground Coal Gasification (UCG) – is the technique of converting coal into gas while it is still in the seam and then extracting it through wells.

- Production of Syngas: It produces Syngas which is a mixture consisting primarily of methane (CH4), carbon monoxide (CO), hydrogen (H2), carbon dioxide (CO2) and water vapour (H2O).

- Syngas can be used to produce a wide range of fertilizers, fuels, solvent and synthetic materials.

- Significance: Steel companies typically use coking coal in their manufacturing process. Most of the coking coal is imported and is expensive.

- To cut costs, plants can use syngas, which comes from coal gasification plants in the place of coking coal.

- It is primarily used for electricity generation, for the production of chemical feedstocks.

- The hydrogen obtained from coal gasification can be used for various purposes such as making ammonia, powering a hydrogen economy.

What is the Hydrogen Economy?

- It is an economy that relies on hydrogen as the commercial fuel that would deliver a substantial fraction of a nation’s energy and services.

- Hydrogen is a zero-carbon fuel and is considered an alternative to fuel and a key source of clean energy.

- It can be produced from renewable sources of energy such as solar and wind.

- It is an envisioned future where hydrogen is used as fuel for vehicles, energy storage and long-distance transport of energy.

- The different pathways to use hydrogen economy includes hydrogen production, storage, transport and utilization.

- In 1970, the term 'Hydrogen Economy' was coined by John Bockris.

- He mentioned that a hydrogen economy can replace the current hydrocarbon-based economy, leading to a cleaner environment.

What are the Concerns associated with Coal Gasification Plants?

- Environmental Perspective: Coal gasification actually produces more carbon dioxide than a conventional coal-powered thermal power plant.

- According to CSE estimates, one unit of electricity generated by burning gasified coal generates 2.5 times more carbon dioxide than what would result when burning the coal directly.

- Efficiency Perspective: The syngas process converts a relatively high-quality energy source (coal) to a lower quality state (gas) and consumes a lot of energy in doing so.

- Thus, the efficiency of conversion is also low.

Indian Economy

Virtual Digital Assets

For Prelims: Virtual Digital Assets, clause (47A), Digital Rupee, cryptocurrency.

For Mains: Regulation of crypto currencies.

Why in News

Recently, the Finance Minister, in her Budget 2022 announced a 30% tax on income from virtual digital assets.

- Additionally, she also proposed a Tax Deduction at Source (TDS) on payment made in relation to the transfer of virtual digital assets at 1% above a monetary threshold.

What is Tax Deduction at Source?

- A person (deductor) who is liable to make payment of specified nature to any other person (deductee) shall deduct tax at source and remit the same into the account of the Central Government.

What are Virtual Digital Assets?

- The finance bill defined the term “virtual digital asset” by entering a new clause (47A).

- As per the proposed new clause, a virtual digital asset is proposed to mean any information or code or number or token (not being Indian currency or any foreign currency), generated through cryptographic means.

What is the Rationale Behind Taxation?

- Virtual digital assets have gained tremendous popularity in recent times and the volumes of trading in such digital assets has increased substantially.

- Further, a market is emerging where payment for the transfer of a virtual digital asset can be made through another such asset.

- These factors have made it imperative to provide for a specific tax regime.

How are Virtual Digital Assets different from Digital Currency?

- A currency is a currency only when it is issued by the central bank even if it is a crypto.

- However, anything which is outside of that loosely all of us refer it to be cryptocurrency but they are not currencies.

- These can be referred to as Virtual Digital Assets.

- Virtual Digital Assets also include Non-fungible tokens or NFTs , which are cryptographic assets on a blockchain with unique identification codes and metadata that distinguish them from each other. NFTs can also be used to represent individuals' identities, property rights, and more.

- This differs from fungible tokens like cryptocurrencies, which are identical to each other and, therefore, can be used as a medium for commercial transactions.

- The Finance Minister clarified that what the RBI will issue in the next fiscal will be the digital currency.

- This will be called Digital Rupee.

International Relations

India-Russia Cooperation at the UNSC

For Prelims: UN Security Council, Minsk Agreement, Normandy Process, Shanghai Cooperation Organization (SCO), G20, New Development Bank (NDB).

For Mains: Issues Associated with the Functioning of UNSC, Need to bring reforms in the UN Security Council, Importance of India-Russia Cooperation in UN and Multilateral Fora, India-Russia Relations, India’s stand on Russia-Ukraine Tensions.

Why in News?

Recently, the Bilateral consultations on United Nations related issues were held between India and Russia in New Delhi.

- Russia is set to assume the presidency of the UN Security Council in February, 2022.

- The discussion came in the backdrop of tensions between Russia and Ukraine over possible eastward expansion by NATO.

- Earlier, the 21st India-Russia annual summit took place at New Delhi which also included the first 2+2 ministerial dialogue of India’s foreign and defence ministers with their Russian counterparts.

What is the importance of Cooperation in UN and Multilateral Fora?

- Both Sides stresses the importance of reinvigorating multilateralism, with the central coordinating role played by the United Nations in world affairs.

- Russia welcomed India’s election as a non-permanent member of the UN Security Council with an overwhelming majority for a two-year term.

- Russia supports India’s candidacy for permanent membership of a reformed United Nations Security Council and of the Nuclear Suppliers Group.

- Both Sides support the comprehensive reform of the UNSC to reflect contemporary global realities and to make it more representative, effective and efficient in dealing with issues of international peace and security.

- Both Sides are committed to enhanced cooperation within BRICS.

- Russia congratulates India on its successful BRICS Chairmanship in 2021, including hosting of the XIII BRICS Summit on 9th September 2021 and adopting the New Delhi Declaration.

- The role of the New Development Bank (NDB) is recognised by both sides as vital to addressing development challenges, including health and economic impact of the covid-19 pandemic and encouraged the NDB to explore the possibility of financing more social infrastructure projects, including those that use digital technologies.

- India and Russia recognise the achievements of the Shanghai Cooperation Organization (SCO) in the last two decades of its operation and believe that it has the great potential for further interaction among the SCO Member States.

- They intend to focus particularly on increasing the effectiveness of countering terrorism, extremism, drug trafficking, cross-border organized crime, and information security threats, in particular by improving the functionality of the SCO Regional Anti-Terrorist Structure.

- They are also determined to cooperate within the G20 format and intensify the same on issues of global and mutual interest, keeping in view India’s presidency of the G20 in 2023.

- Both sides agree that safeguarding of global commons including our oceans, outer space and information space should be based on the principles of transparency, accessibility and upholding international law.

What stand India has taken in UNSC on Russia-Ukraine Tensions?

- At the UN Security Council (UNSC) meeting on Ukraine, India also called for the immediate de-escalation of the situation while taking into account the security interests of all.

- India called for quiet diplomacy and the peaceful resolution of the Russia-Ukraine tensions.

- “Quiet diplomacy” refers to one state's efforts to influence the behavior of another state through discreet negotiations or actions.

- India was one of three countries (Kenya and Gabon were the others) that abstained from a procedural vote on whether or not Ukraine would be discussed. China and Russia voted against the move.

- The US, which initiated the meeting, and nine other countries voted to hold the discussion.

- India reiterated its support for a July 2020 ceasefire, the 2014 Minsk Agreement and the Normandy Process.

- The Normandy Format refers to discussions held between Russia, Ukraine, Germany and France, who have met since 2014, when Russia annexed Crimea.

- India also called for quiet diplomacy as both the West, led by the US, and Russia have been talking tough publicly.

- India is concerned about the security of the more than 20,000 Indian nationals — including students — living in Ukraine.

Way Forward

- Although India and Russia cannot do much about each other engaging with their rivals, they have no reason to be satisfied with the poor state of their commercial ties.

- To give a start to the revival of their ties, India and Russia shall focus on laying a clear path for expansive economic cooperation and generating a better understanding of each other’s imperatives on the Indo-Pacific.

Indian Economy

BrahMos Export to Philippines

For Prelims: BrahMos, Missile, South China Sea

For Mains: Defence Technology, Defence Exports.

Why in News?

Recently, Philippines has signed a deal with BrahMos Aerospace Private Ltd. for the supply of a shore-based anti-ship variant of the BrahMos supersonic cruise missile. This is the first export order for the missile, a joint product of India and Russia.

- The Philippines wants to induct this missile amid tensions with China over the disputed islands in the South China Sea.

- Several countries have shown interest in acquiring the BrahMos missile. For example, discussions are in advanced stages with Indonesia and Thailand.

What are the features of BrahMos Missile?

- BrahMos is a joint venture between the Defence Research and Development Organisation of India (DRDO) and the NPOM of Russia.

- BrahMos is named on the rivers Brahmaputra and Moskva.

- It is a two-stage (solid propellant engine in the first stage and liquid ramjet in second) missile.

- It is a multiplatform missile i.e it can be launched from land, air, and sea and multi capability missile with pinpoint accuracy that works in both day and night irrespective of the weather conditions.

- It operates on the "Fire and Forgets" principle i.e it does not require further guidance after launch.

- Brahmos is one of the fastest cruise missiles currently operationally deployed with speed of Mach 2.8, which is nearly 3 times more than the speed of sound.

- Recently, an Advance Version of BrahMos (extended range sea-to-sea variant) was test fired.

- Following India’s entry into the MTCR (Missile Technology Control Regime) club in June 2016, the range is planned to be extended to 450 km and to 600km at a later stage.

- The BrahMos missile was initially developed with a range capped at 290 km.

What is Missile Technology Control Regime (MTCR)?

- It is an informal and voluntary partnership among 35 countries to prevent the proliferation of missile and unmanned aerial vehicle technology capable of carrying greater than 500 kg payload for more than 300 km.

- The members are thus prohibited from supplying such missiles and UAV systems that are controlled by the MTCR to non-members.

- The decisions are taken by consensus of all the members.

- This is a non–treaty association of member countries with certain guidelines about the information sharing, national control laws and export policies for missile systems and a rule-based regulation mechanism to limit the transfer of such critical technologies of these missile systems.

- It was established in April 1987 by G-7 countries – USA, UK, France, Germany, Canada, Italy, and Japan.

What is the Status of India’s Defence Exports?

- Defence exports are a pillar of the government’s drive to attain self-sufficiency in defence production.

- Over 30 Indian defence companies have exported arms and equipment to countries like Italy, Maldives, Sri Lanka, Russia, France, Nepal, Mauritius, Sri Lanka, Israel, Egypt, UAE, Bhutan, Ethiopia, Saudi Arabia, Philippines, Poland, Spain and Chile.

- The exports include personal protective items, defence electronics systems, engineering mechanical equipment, offshore patrol vessels, advanced light helicopters, avionics suits, radio systems and radar systems.

- However, India’s defense exports are still not upto the expected lines.

- The Stockholm International Peace Research Institute (SIPRI) ranked India at number 23 in the list of major arms exporters for 2015-2019.

- India still accounts for only 0.17% of global arms exports.

- Reason for dismal performance in India’s Defense exports is that, India’s Ministry of Defense so far has no dedicated agency to drive exports.

- Exports are left to individual corporations, like BrahMos or the defence public shipyards and undertakings.

- In this context, the KPMG report titled ‘Defence Exports: Untapped Potential recommends the first step of setting up of an exclusive “defence export help desk”.

- On the basis of inputs from the help-desk, the report says, Indian companies could work with government machinery to realise exports.

- If India is successful in providing big-ticket military systems to countries in the neighbourhood, it won’t just be a boost for defence exports but will also be a strategic step to counter China’s influence as it provides defence products in Asia, including Pakistan, Bangladesh and Myanmar.

Important Facts For Prelims

India’s First Graphene Innovation Centre in Kerala

Why in News

Recently, the Kerala government announced that the country’s first Graphene Innovation Centre would come up in Thrissur, Kerala.

- It is a joint venture of Digital University of Kerala, Centre for Materials for Electronics Technology (C-MET) and Tata Steel Limited.

- Earlier in 2020, the researchers from the City University of Hong Kong had produced a laser-induced form of graphene masks that inactivate the coronavirus species.

What is the Graphene Innovation Centre?

- An Innovation Center is a cross-functional plan that creates a safe haven for new ideas.

- With opportunities for individual and group collaboration across time zones and continents, it's a place that fosters a culture of innovation through the creation, sharing, and testing of ideas.

- The India Innovation Centre for Graphene would come up in Thrissur at a cost of Rs 86.41 crore.

- Of the 86.41-crore, the Union Government would provide Rs 49.18 crore and private business houses Rs 11.48 crore.

- The state government would provide the basic infrastructure for the project. The Centre would help attract investors to develop graphene products.

What is its Significance?

- The project would give a major fillip for scientific research as well as the state’s industrial sector.

- Kerala’s human resources capital could be effectively exploited by the proposed Centre, which would help Kerala to emerge as a knowledge-based economy.

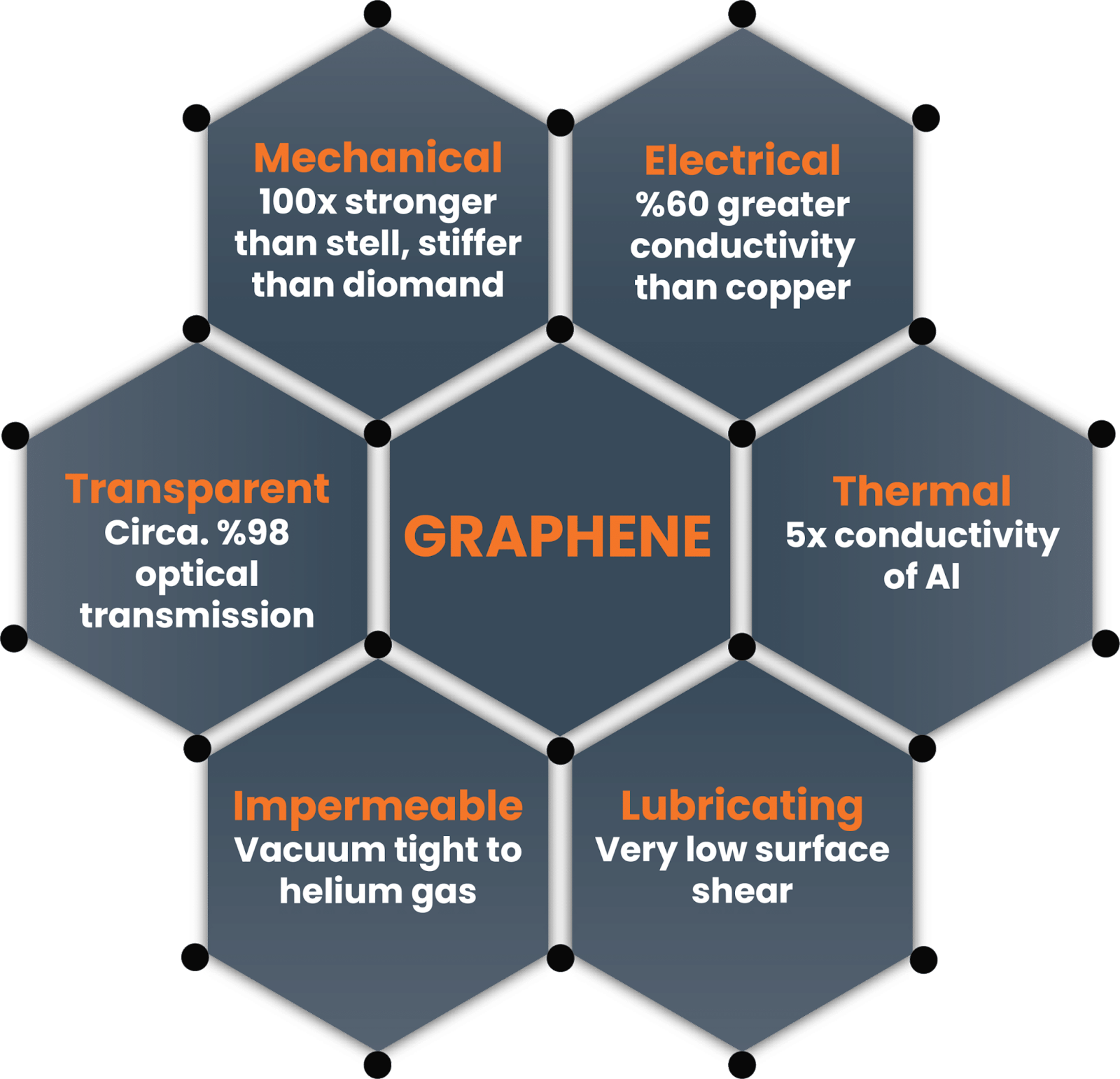

What is Graphene?

- Graphene is a one-atom-thick layer of carbon atoms arranged in a hexagonal lattice. It is the building-block of Graphite, but graphene is a remarkable substance on its own with a multitude of astonishing properties.

- It is the thinnest, most electrically and thermally conductive material in the world, while also being flexible, transparent and incredibly strong.

- Often referred to as a wonder material for its extraordinary electrical and electronics properties, graphene could replace Indium and thereby bring down the cost of OLED (organic light-emitting diode) screens in smartphones, studies have shown.

- Graphene has a lot of promise for additional applications: anti-corrosion coatings and paints, efficient and precise sensors, faster and efficient electronics, flexible displays, efficient solar panels, faster DNA sequencing, drug delivery, and more.

Important Facts For Prelims

Winter Olympics

Why in News?

The Russian President, Pakistan Prime Minister and five Presidents from Central Asia will reach China for the opening of the Winter Olympics.

What is the Significance of the Visit?

- The Russian President will discuss the ongoing crisis with Ukraine with the Chinese President.

- China has close relations with Russia but has been largely silent on the crisis in Ukraine amid a build-up of Russian forces along its borders.

- The Pakistan Prime Minister is expected to discuss investments from China and speed up the China Pakistan Economic Corridor (CPEC) plan.

- China has also declared that it sought to discuss developing communications satellites for Pakistan and to cooperate on the construction of the Pakistan Space Centre.

- Due to the alleged human rights voilations in the Xinjiang province of China, the US, the UK, Canada and Australia have announced a “diplomatic boycott” of the games.

What is the Winter Olympics?

- Winter Olympics is the premier competition for sports that are played on ice or snow.

- It is held every four years and features participants from across the world.

- Ice skating, ice hockey, skiing and figure skating are some of the popular sports that are played at the Winter Games.

- The first Winter Olympics were held in 1924 in Chamonix, France.

- Winter sports were initially played at the Summer Olympics, with the 1908 London Olympics hosting four figure skating events and Antwerp 1920 having figure skating as well as ice hockey.

- However, in 1924, a separate event was created for winter sports, called the International Winter Sports Week.

- It was held in Chamonix, France – the host country for the 1924 Summer Olympics.

- Two years later, the International Winter Sports Week in Chamonix was officially recognised as the first Winter Olympic Games.

- This years’ edition of the Winter Olympic Games will be held in Beijing, China from 4th February to 20th February 2022.

- India has been participating in the Winter Olympics since 1964.