Indian Economy

Sugar’s Pressmud for Green Energy Production

For Prelims: Sugar’s Pressmud for Green Energy Production, Compressed Biogas (CBG), Ethanol Biofuel, Biomethanation, Anaerobic digestion.

For Mains: Sugar’s Pressmud for Green Energy Production, Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

Why in News?

India is viewing Pressmud, a residual byproduct of Sugar, as a valuable resource for green energy production by creating Compressed Biogas (CBG).

- India holds a key position in the worldwide sugar economy, emerging as the foremost sugar producer since 2021-22, surpassing Brazil. Additionally, it stands as the second-largest sugar exporter globally.

What is Compressed Bio-Gas (CBG)?

- CBG is a Renewable, environmentally friendly gaseous fuel derived from the anaerobic decomposition of organic materials. It is produced through a process called Biomethanation or anaerobic digestion, where various organic sources such as agricultural waste, animal manure, food waste, sewage sludge, and other biomass materials are broken down by bacteria in the absence of oxygen.

- The resulting biogas primarily consists of methane (usually over 90%), carbon dioxide, traces of hydrogen sulfide, and moisture.

- To convert biogas into CBG, purification steps are employed to remove impurities such as carbon dioxide, hydrogen sulfide, and moisture.

- The purified methane gas is then compressed to a high pressure, typically around 250 bar or higher, hence the term "Compressed Biogas."

What is Pressmud?

- About:

- Pressmud, also known as filter cake or press cake, is a residual byproduct in the sugar industry that has gained recognition as a valuable resource for green energy production.

- This byproduct offers Indian sugar mills an opportunity to generate additional revenue by utilizing it as a feedstock for biogas production through anaerobic digestion, leading to the creation of Compressed Biogas (CBG).

- Anaerobic digestion is a process through which bacteria break down organic matter—such as animal manure, wastewater biosolids, and food wastes—in the absence of oxygen.

- Typically, the yield of pressmud ranges from 3-4 % by weight with the input sugarcane processed in a unit.

Note

Pressmud has the potential to yield approximately 460,000 tonnes of CBG, valued at Rs 2,484 crore, considering the minimum guaranteed price set by the central government's Sustainable Alternative Towards Affordable Transportation scheme(SATA)

- Advantages of Pressmud Utilization for CBG Production:

- Fewer Complexities: Its advantageous qualities include consistent quality, simplicity in sourcing, and fewer complexities compared to other feedstocks.

- Simplified Supply Chain: It eliminates the complexities associated with the feedstock supply chain, as found in the case of agricultural residue, where biomass harvesting machinery is required for harvesting and aggregation.

- Single Sourcing: The feedstock is sourced from one or two producers or sugar mills, as opposed to agricultural residue, which involves multiple producers / farmers within a narrow window of 45 days per year.

- Quality and Efficiency: Quality consistency and higher conversion efficiency, requiring less feedstock quantity compared to alternatives like cattle dung.

- Approximately 25 tonnes of pressmud are needed to produce a tonne of CBG. In comparison, cattle dung requires 50 tonnes for the same gas output.

- Cost-effectiveness: Lower cost (Rs 0.4-0.6 per kilogramme) compared to other feedstocks like agricultural residue and cattle dung. It eliminates pretreatment costs as it lacks the organic polymer lignin, unlike agriresidue.

- Challenges Faced by Pressmud Utilization:

- Pressmud faces challenges such as escalating prices, competition for usage in other industries, and storage complexities due to gradual decomposition, necessitating innovative storage solutions.

- As an organic residue, it is sought after in sectors like animal feed, bioenergy production (for biogas or biofuels), and agricultural soil amendments. This competition can sometimes limit its availability or increase its cost for specific applications.

- Pressmud faces challenges such as escalating prices, competition for usage in other industries, and storage complexities due to gradual decomposition, necessitating innovative storage solutions.

What is India's Pressmud Production landscape?

- Production Statistics:

- In the fiscal year 2022-23, India's sugar production reached 32.74 million tonnes, generating about 11.4 million tonnes of pressmud.

- Sugarcane Growing States:

- The primary sugarcane-growing states, notably Uttar Pradesh and Maharashtra, contribute significantly, covering approximately 65 % of India's total sugarcane cultivation area.

- Key sugarcane-producing states include Uttar Pradesh, Maharashtra, Karnataka, Tamil Nadu, and Bihar, accounting for a substantial portion of India's overall sugarcane production.

- The primary sugarcane-growing states, notably Uttar Pradesh and Maharashtra, contribute significantly, covering approximately 65 % of India's total sugarcane cultivation area.

Way Forward

- To harness the full potential of pressmud for CBG production, various interventions are crucial:

- State-level Policies: Implementation of supportive bioenergy policies by states, streamlining approval processes and offering incentives.

- Price Control Mechanisms: Establishing mechanisms to control pressmud prices and encouraging long-term agreements between sugar mills and CBG plants.

- Technological Advancements: Research and development for efficient pressmud storage technologies to prevent methane emissions and minimize gas loss.

- Training Initiatives: Conducting training sessions for CBG plant operators on plant operations, scientific equipment handling, and feedstock characterization.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q.1 The Fair and Remunerative Price (FRP) of sugarcane is approved by the (2015)

(a) Cabinet Committee on Economic Affairs

(b) Commission for Agricultural Costs and Prices

(c) Directorate of Marketing and Inspection, Ministry of Agriculture

(d) Agricultural Produce Market Committee

Ans: (a)

Q.2 With reference to the current trends in the cultivation of sugarcane in India, consider the following statements: (2020)

- A substantial saving in seed material is made when ‘bud chip settlings’ are raised in a nurse, and transplanted in the main field.

- When direct planting of setts is done, the germination percentage is better with single budded setts as compared to setts with many buds.

- If bad weather conditions prevail when setts are directly planted, single-budded setts have better survival as compared to large setts

- Sugarcane can be cultivated using settlings prepared from tissue culture.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 3 only

(c) 1 and 4 only

(d) 2, 3 and 4 only

Ans: (c)

Exp:

- Tissue Culture Technology

- Tissue culture is a technique in which fragments of plants are cultured and grown in a laboratory.

- It provides a new way to rapidly produce and supply disease-free seed cane of existing commercial varieties.

- It uses meristem to clone the mother plant.

- It also preserves genetic identity.

- The tissue culture technique, owing to its cumbersome outfit and physical limitation, is turning out to be uneconomical.

- Bud Chip Technology

- As a viable alternative of tissue culture, it reduces the mass and enables quick multiplication of seeds.

- This method has proved to be more economical and convenient than the traditional method of planting two to three bud setts.

- The returns are relatively better, with substantial savings on the seed material used for planting. Hence, statement 1 is correct.

- The researchers have found that the setts having two buds are giving germination about 65 to 70% with better yield. Hence, statement 2 is not correct.

- Large setts have better survival under bad weather but single budded setts also give 70% germination if protected with chemical treatment. Hence, statement 3 is not correct.

- Tissue culture can be used to germinate and grow sugarcane settlings which can be transplanted later in the field. Hence, statement 4 is correct. Therefore, option (c) is the correct answer.

Indian Polity

Disclosure of Political Funding

For Prelims: Representation of the People Act 1951, Supreme Court, Electoral Bonds, Publicity Act of USA, European Union, Regulation of the European Parliament, Political Parties, Elections and Referendums Act, 2000 of UK, Democracy, Rule of Law, Election Commission.

For Mains: Importance of disclosing political donations for promoting transparency in the democratic process and preventing electoral corruption.

Why in News?

In light of the current political circumstances and concerns regarding donations, the conclusion of the Supreme Court hearings on the challenge to electoral bonds prompts a critical examination of the potential impact this challenge's resolution may have on democracy and the rule of law in India.

What is Political Funding?

- About:

- Political funding refers to the financial contributions provided to political parties or candidates to support their activities, campaigns, and overall functioning.

- Political funding is crucial for political parties to effectively participate in democratic processes, conduct election campaigns, and engage in various political activities.

- Statutory Provisions in India:

- Representation of the People Act, 1951: RPA Act outlines the rules and regulations regarding elections in India, including provisions related to the declaration of election expenses, contributions, and the maintenance of accounts.

- Income Tax Act, 1961: The Income Tax Act governs the tax treatment of political parties and their donors.

- Political parties need to comply with tax regulations, and individuals or entities making political donations may be eligible for tax benefits under certain conditions.

- Companies Act, 2013: The Companies Act regulates corporate donations to political parties, specifying the maximum amount a company can contribute, and mandates disclosure of political contributions in financial statements.

- Methods of Raising Political Funding:

- Individual Persons: Section 29B of RPA allows political parties to receive donations from individual persons while allowing taxpayers to claim a 100% deduction

- State/Public Funding: Here, the government provides funds to parties for election related purposes. State Funding is of two types:

- Direct Funding: The government provides funds directly to the political parties. However, direct funding is prohibited in India.

- Indirect Funding: It includes other methods except direct funding, like free access to media, free access to public places for rallies, free or subsidized transport facilities. It is allowed in India in a regulated manner.

- Corporate Funding: In India, donations by corporate bodies are governed under section 182 of the Companies Act, 2013.

- Electoral Bonds Scheme: The electoral bonds system was introduced in 2017 by way of a Finance bill and it was implemented in 2018.

- They serve as a means for individuals and entities to make donations to registered political parties while maintaining donor anonymity.

- Electoral Trusts Scheme, 2013: It was notified by the Central Board of Direct Taxes (CBDT).

- An Electoral Trust is a Trust set up by companies with the sole objective to distribute the contributions received by it from other Companies and individuals to the political parties.

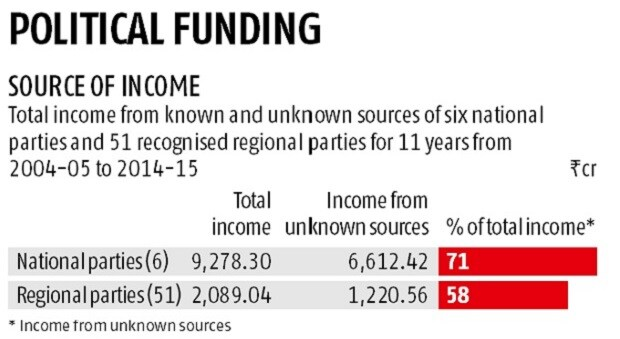

Why is There a Need for Disclosure of Political Funding?

- Global Standards on Political Funding Disclosure:

- The amendments to the Representation of the People Act 1951 in India, allowing for electoral bonds, have established complete anonymity for political donors.

- This stands in stark contrast to international practices, where the prevailing requirement is full disclosure of political donations.

- Across the world, including the United States, regulations mandate transparency in political funding, with disclosure requirements dating back to 1910.

- The European Union, in 2014, enacted regulations on the funding of European political parties, incorporating limits on donations, disclosure mandates, and immediate reporting for large contributions.

- The amendments to the Representation of the People Act 1951 in India, allowing for electoral bonds, have established complete anonymity for political donors.

- Fundamental Requirements in Political Funding Regulations:

- Most legal regulations globally converge on two fundamental requirements for political party funding:

- comprehensive disclosure of donors above specific minimal amounts and the imposition of limits or caps on donations.

- These measures aim to ensure transparency, prevent corruption, and maintain public confidence in the political system and democracy.

- Most legal regulations globally converge on two fundamental requirements for political party funding:

- Upholding Citizen’s Trust:

- Public disclosure of political funding is imperative as political parties serve as the foundation of representative democracy.

- Transparent financial accounts play a crucial role in upholding citizens' trust in both parties and politicians, safeguarding the rule of law, and combating corruption within the electoral and political processes.

- This transparency ensures accountability, reinforcing the democratic principles that rely on openness and fairness.

- Preventing Undue Influence:

- Without disclosure, money can become a tool for some to unduly influence the political process. Disclosure helps prevent the co-optation of politics by business interests and widespread vote buying.

- Maintaining a Level Playing Field:

- The equitable playing field gets eroded when one party has indomitable access to excess campaign finance. Disclosure ensures that all parties have equal opportunities.

Exemption From Disclosure Under Electoral Bonds Scheme

- Through an amendment to the Finance Act 2017, the Union government has exempted political parties from disclosing donations received through electoral bonds.

- This means the voters will not know which individual, company, or organization has funded which party, and to what extent.

- However, in a representative democracy, citizens cast their votes for the people who will represent them in Parliament.

Supreme Court’s Observations

- Recently, the Supreme Court has instructed the Election Commission of India (ECI) to provide the recent data on funds received by political parties through electoral bonds

- The Indian Supreme Court has long held that the “right to know”, especially in the context of elections, is an integral part of the right to freedom of expression (Article 19) under the Indian Constitution.

What are the Reforms Required in Political Funding?

- Electoral Justice:

- Electoral justice plays a pivotal role in upholding the core tenets of democracy, ensuring that all aspects of the electoral process align with the law and safeguard the enjoyment of electoral rights.

- This system, essential for a healthy democracy, is instrumental in maintaining and facilitating free, fair, and genuine elections.

- Addressing the Issues of Electoral Bonds:

- Electoral bonds, allowing for undisclosed donor details, pose a threat to democratic transparency and the integrity of free and fair elections.

- Apart from making them constitutionally sound, addressing this issue requires a comprehensive approach that goes beyond legality and focuses on preserving the democratic essence of transparency in the electoral process.

- Mechanism for Reporting and Independent Audit:

- This includes the identification of donors above a specified nominal limit, immediate reporting of significant donations to the election commission.

- It also entails publicizing political party accounts, independent auditing of party accounts, and establishing limits on funding and expenditure.

- State Funding of Elections:

- State funding of elections refers to a system in which the government provides financial support to political parties and candidates to facilitate their participation in the electoral process.

- This funding is typically derived from public resources and aims to reduce the reliance on private donations, minimizing the potential influence of vested interests in political campaigns.

Legal Insights: Electoral Bonds Case

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Consider the following statements: (2017)

- The Election Commission of India is a five-member body.

- Union Ministry of Home Affairs decides the election schedule for the conduct of both general elections and bye-elections.

- The Election Commission resolves the disputes relating to splits/mergers of recognized political parties.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 only

(c) 2 and 3 only

(d) 3 only

Ans : D

Mains

Q. In the light of recent controversy regarding the use of Electronic Voting Machines (EVM), what are the challenges before the Election Commission of India to ensure the trustworthiness of elections in India? (2018)

Indian Economy

Risks Associated with the Decommissioning of Coal Plants

For Prelims: Risks Associated with the Decommissioning of Coal Plants, Transition towards Cleaner Energy, Risks of Stranded Assets, Public sector banks and Non-Banking Financial Institutions (NBFCs).

For Mains: Risks Associated with the Decommissioning of Coal Plants.

Why in News?

India is progressing slowly towards Cleaner Energy. However, this noticeable shift towards cleaner energy sources in electricity generation is causing apprehensions about the risks associated with the decommissioning of Coal Plants.

What are the Current Trends in Transition towards Cleaner Energy?

- Financing for new coal power projects has declined over the past five years, while there has been a steady rise in financing for projects based on Renewable energy sources.

- Coal continues to dominate the energy mix, there has been a notable increase in renewable energy generation capacity in India.

- Renewables constituted 41% of the total capacity in 2022-23, marking an increase from 32% in 2011-12. Moreover, the yearly increase in renewable energy capacity has surpassed that of coal power since 2017.

- While clean energy in the electricity mix has increased to about 23%, over 55% of India’s current energy needs are still being met by coal. The acceleration of this transition towards greener energy is essential to keep the global temperature increase below 1.5°C.

What are the Economic Implications of Transition Towards Cleaner Energy?

- Risks of Stranded Assets:

- Stranded assets are at risk of losing value and becoming liabilities due to unforeseen shifts in market conditions, regulatory changes, evolving consumer preferences, and technological advancements.

- Stranded assets are assets that have suffered from unanticipated or premature write-downs, devaluations or conversion to liabilities.

- This poses potential risks to banks and financial institutions that have direct or indirect ties to the fossil fuel sector.

- Stranded assets are at risk of losing value and becoming liabilities due to unforeseen shifts in market conditions, regulatory changes, evolving consumer preferences, and technological advancements.

- Financial Implications:

- The financial risk associated with decommissioning coal plants in India is relatively high due to the average age of these plants being only 13 years.

- Public sector banks and Non-Banking Financial Institutions (NBFCs), bear a substantial 90% of the loan burden associated with coal projects.

- Moreover, private banks have reduced their financing to coal-fired thermal power plants significantly.

- Regional Vulnerabilities:

- Regions like Chhattisgarh, Odisha, and Jharkhand have a high share of stressed assets (to the tune of 58%,55% and 27%) in state coal power capacities.

- This places them at a heightened risk of facing financial losses due to asset devaluation as India moves towards sustainable energy practices.

- Regions like Chhattisgarh, Odisha, and Jharkhand have a high share of stressed assets (to the tune of 58%,55% and 27%) in state coal power capacities.

Way Forward

- Governments need to create robust policies and regulations that provide clarity and predictability for investors transitioning away from coal. Clear guidelines and supportive policies can incentivize the shift towards renewable energy sources while mitigating risks for stakeholders.

- Conducting thorough risk assessments, including stress testing and scenario planning, can help financial institutions and Investors anticipate potential impacts of stranded assets. This proactive approach allows for better risk management and mitigation strategies.

- Financial institutions should diversify their investment portfolios by gradually reallocating funds from fossil fuel-dependent assets to renewable energy projects. This step can help minimize the risks associated with stranded assets and align with global sustainability objectives.

Governance

Fast Track Special Courts

For Prelims: Fast Track Special Courts, Protection of Children from Sexual Offences Act (POCSO Act), Sexual Offenses, Criminal Law (Amendment) Act in 2018.

For Mains: Fast Track Special Courts, Welfare schemes for vulnerable sections of the population by the Centre and States and the performance of these schemes.

Why in News?

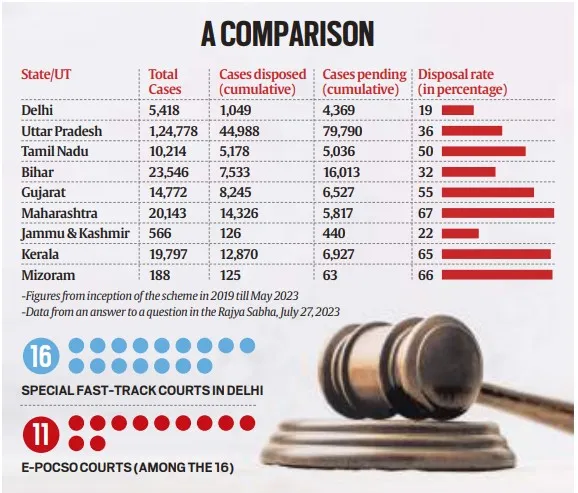

Recently, the Union Cabinet has approved the continuation of Fast Track Special Court (FTSCs) for three more years till 2026.

- Initially commenced in October 2019 for one year, the scheme was extended for an additional two years until March 2023.

What is a Fast Track Special Court (FTSCs)?

- About:

- FTSCs are specialized courts established in India with the primary aim of expediting the trial process for cases related to sexual offenses, particularly those involving rape and violations under the Protection of Children from Sexual Offences Act (POCSO Act).

- The establishment of FTSCs was prompted by the government's recognition of the alarming frequency of Sexual Offenses and the prolonged duration of trials in regular courts, which resulted in delayed justice for victims.

- Establishment:

- The Central Government enacted the Criminal Law (Amendment) Act in 2018, which introduced stricter punishments, including the death penalty for rape offenders.

- Subsequently, the FTSCs were set up to ensure the swift dispensation of justice for such cases.

- Centrally Sponsored Scheme:

- The scheme to establish FTSCs was formulated in August 2019 as a Centrally Sponsored Scheme following directions from the Supreme Court of India in a suo moto Writ Petition (Criminal).

- Ministry:

- Implemented by the Department of Justice, Ministry of Law & Justice.

- Achievements So far:

- Thirty States/Union Territories have participated in the Scheme, operationalizing 761 FTSCs, including 414 exclusive POCSO Courts, which have resolved over 1,95,000 cases.

- These courts support State/UT Government efforts to provide timely justice to victims of sexual offenses. even in remote and far-flung areas.

What are the Challenges Related to Fast Track Special Court?

- Inadequate Infrastructure and Low Disposal Rate:

- Special courts in India often suffer from the same challenges as regular courts, as they are usually designated rather than established as new infrastructure.

- This leads to overburdened judges who are assigned other categories of cases in addition to their existing workload without the necessary support staff or infrastructure.

- Consequently, the disposal rate of cases in these special courts slows down.

- The envisioned target of clearing around 165 POCSO cases per year per court has significantly fallen short, with each of the over 1,000 FTSCs in the country currently clearing only 28 cases on average annually.

- Prolonged Pendency:

- Over 2.43 lakh POCSO cases pending trial in FTSCs as of 31st January 2023.

- Projections indicate several decades are required to clear backlogs in states like Arunachal Pradesh, Delhi, Bihar, West Bengal, Uttar Pradesh, and Meghalaya.

- Estimated trial durations vary significantly across states, with projections ranging from 21 to 30 years.

- Conviction Rate Challenges:

- Despite the intended completion of trials within one year, the research reveals a low conviction rate.

- Out of 2,68,038 cases under trial, only 8,909 resulted in convictions, raising concerns about the efficacy of FTSCs.

- Despite the intended completion of trials within one year, the research reveals a low conviction rate.

- Limited Jurisdiction:

- These courts are established with a specific jurisdiction, which can limit their ability to deal with related cases. This can lead to delays in justice delivery and a lack of consistency in the application of laws.

- Ideally, cases in these special courts should be disposed of within a year. However, as of May 2023, Delhi had only disposed of 1,049 cases out of a total of 4,369 pending cases. This indicates a significant lag in meeting the target.

- These courts are established with a specific jurisdiction, which can limit their ability to deal with related cases. This can lead to delays in justice delivery and a lack of consistency in the application of laws.

- Vacancies and Lack of Training:

- The lack of judges due to vacancies affects the courts' capacity to handle cases effectively.

- As of 2022, lower courts across India had a vacancy rate of 23%.

- Regular judges from normal courts are often deputed to work in FTSCs.

- However, these courts require judges with specialized training to handle cases quickly and effectively.

- The lack of judges due to vacancies affects the courts' capacity to handle cases effectively.

- Prioritization of Certain Offences Over Others:

- The establishment of special courts in India is often determined by ad-hoc decisions made by both the judicial and executive branches of government.

- This approach means that certain categories of offences are arbitrarily prioritised for faster disposal over others.

What are the Initiatives to Curb Women and Child Abuse?

Way Forward

- Adequate infrastructure, including courtrooms, support staff, and modern technology, should be provided to FTSCs to ensure smooth and efficient operations.

- Additional funding should be allocated for the establishment and maintenance of these specialized courts.

- To enhance the disposal rate, FTSCs should focus on strict case management, reducing unnecessary delays caused by adjournments, and ensuring the timely presentation of evidence.

- Specialized training for judges and support staff can help streamline procedures and enhance the speed of proceedings.

- Efforts should be made to fill vacancies promptly and ensure that judges with relevant expertise are assigned to these courts.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Mains

Q.1 We are witnessing increasing instances of sexual violence against women in the country. Despite existing legal provisions against it, the number of such incidences is on the rise. Suggest Some innovative measures to tackle this menace. (2014)

Indian Economy

SEBI Board Approves Regulatory Framework

For Prelims: Securities & Exchange Board of India (SEBI), Alternative Investment Funds (AIFs), IOSCO Principles for Financial Benchmarks, SEBI (Mutual Funds) Regulations, 1996, SEBI (Real Estate Investment Trusts) Regulations, 2014, Small & Medium REITs (SM REITs), Social Stock Exchange (SSE), Zero Coupon Zero Principal Instruments (ZCZP).

For Mains: Need for and significance of robust regulatory framework for capital markets by SEBI as per international standards and principles.

Why in News?

Securities & Exchange Board of India’s (SEBI's) board approved a framework for Index Providers to enhance transparency and accountability in governing and administering financial benchmarks in the securities market.

What are the New Regulations Framed by SEBI?

- Framework for Registration of Index Providers:

- SEBI announced the approval of regulations establishing a framework for the registration of Index Providers. This framework will be applicable specifically to 'Significant Indices,' which SEBI will identify based on objective criteria.

- The regulatory structure aligns with the International Organization of Securities Commissions (IOSCO) Principles for Financial Benchmarks.

- SEBI announced the approval of regulations establishing a framework for the registration of Index Providers. This framework will be applicable specifically to 'Significant Indices,' which SEBI will identify based on objective criteria.

- Dematerialization Requirement for AIF Investments:

- SEBI introduced a requirement for Alternative Investment Funds (AIFs) to hold fresh investments made after September 2024 in dematerialized form.

- However, existing investments are exempt, except in cases mandated by applicable law or when the AIF, alone or with other SEBI-registered entities, has control in the investee company.

- The mandate for the appointment of custodians, previously applicable to specific AIF categories, will now extend to all AIFs.

- SEBI introduced a requirement for Alternative Investment Funds (AIFs) to hold fresh investments made after September 2024 in dematerialized form.

- Amendments to SEBI (Real Estate Investment Trusts) Regulations:

- The SEBI board approved amendments to the Real Estate Investment Trusts (REITs) Regulations, creating a regulatory framework for Small & Medium REITs (SM REITs) with an asset value of at least ₹50 crore.

- SM REITs will be able to establish separate schemes for owning real estate assets through special purpose vehicles (SPVs).

- Flexibility in Social Stock Exchange (SSE) Framework:

- SEBI provided flexibility in the framework for the Social Stock Exchange (SSE) to boost fundraising by Not-for-Profit Organizations (NPOs).

- This includes a reduction in the minimum issue size and application size for public issuance of Zero Coupon Zero Principal Instruments (ZCZP) by NPOs on SSE, encouraging wider participation, including retail investors.

- Nomenclature Change and Comfort Measures for NPOs:

- SEBI approved a change in the nomenclature from "Social Auditor" to "Social Impact Assessor" to convey a positive approach toward the social sector.

- This measure is intended to provide comfort to NPOs involved in the SSE and reinforce SEBI's support for social impact initiatives.

Key Terminologies

- Index Providers: These are entities responsible for creating, maintaining, and calculating the values of financial indices. A financial index is a statistical measure of the performance of a specific segment of the financial markets.

- Alternative Investment Fund (AIF): AIF means any fund established in India which is a privately pooled investment vehicle which collects funds from sophisticated investors, whether Indian or foreign, for investing it in accordance with a defined investment policy for the benefit of its investors.

- Categories

- Category I AIFs: These generally invest in start-ups or early stage ventures which the government or regulators consider as socially or economically desirable.

- e.g. venture capital funds, infrastructure funds.

- Category II AIFs: These are AIFs which do not fall in Category I and III and which do not undertake leverage or borrowing other than to meet day-to-day operational requirements and as permitted in the SEBI (Alternative Investment Funds) Regulations, 2012.

- e.g. real estate funds, private equity funds.

- Categories III AIFs: AIFs which employ diverse or complex trading strategies and may employ leverage including through investment in listed or unlisted derivatives.

- e.g. hedge funds, private investment in Public Equity Funds.

- Category I AIFs: These generally invest in start-ups or early stage ventures which the government or regulators consider as socially or economically desirable.

- Categories

- Real Estate Investment Trusts (REITs): These are investment vehicles that allow individuals to invest in large-scale, income-producing real estate without having to directly manage or own the properties.

- REITs pool capital from multiple investors to invest in a diversified portfolio of real estate assets, which may include residential or commercial properties, shopping centers, office buildings, hotels etc.

- Social Stock Exchange (SSE): The SSE would function as a separate segment within the existing stock exchange and help social enterprises raise funds from the public through its mechanism.

- It would serve as a medium for enterprises to seek finance for their social initiatives, acquire visibility and provide increased transparency about fund mobilisation and utilisation.

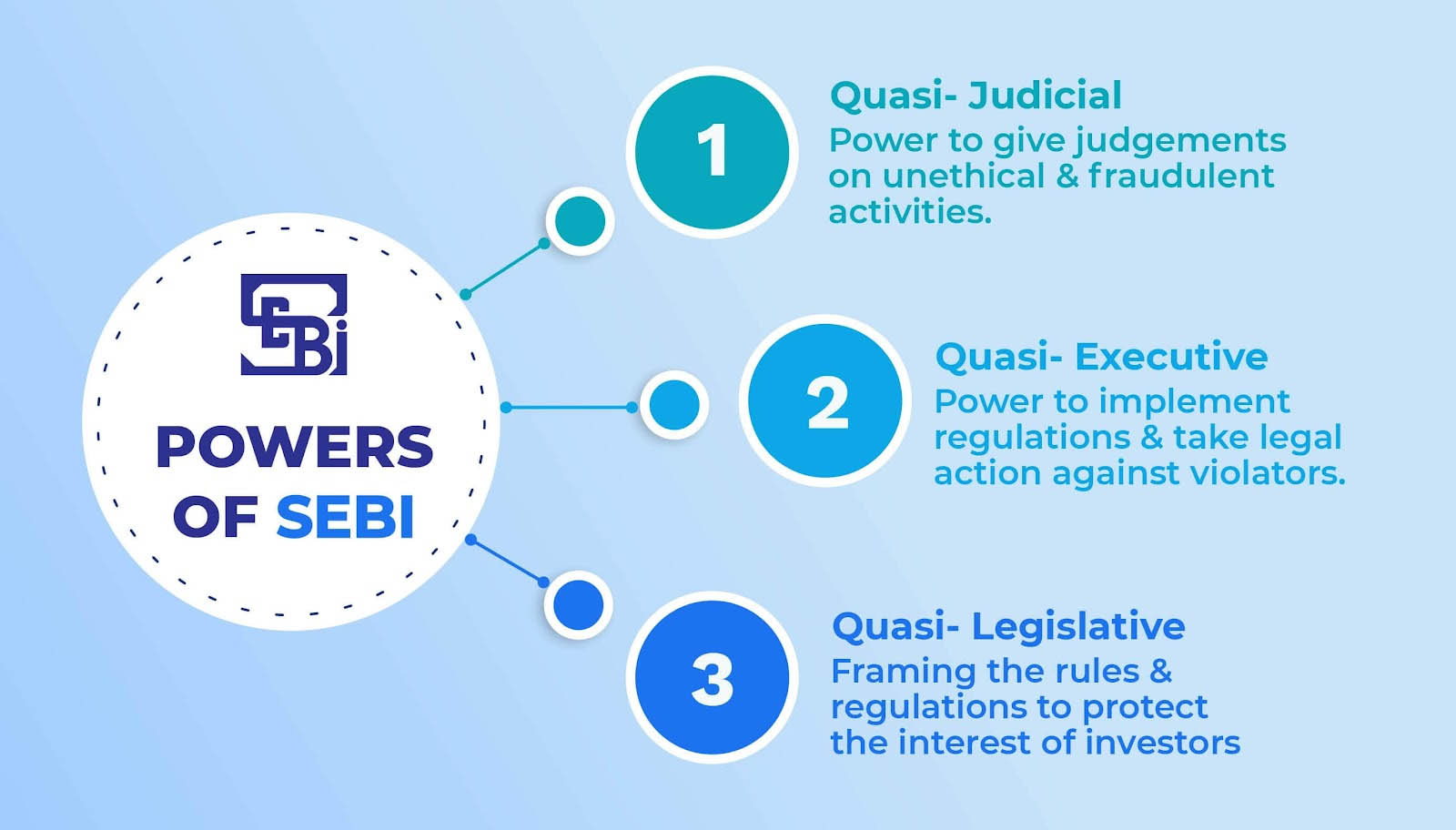

What is SEBI?

- About:

- SEBI is a Statutory Body (a Non-Constitutional body which is set up by a Parliament) established in 1992 in accordance with the provisions of the Securities and Exchange Board of India Act, 1992.

- The basic functions of SEBI is to protect the interests of investors in securities and to promote and regulate the securities market.

- The headquarters of SEBI is situated in Mumbai. The regional offices of SEBI are located in Ahmedabad, Kolkata, Chennai and Delhi.

- Background:

- Before SEBI came into existence, Controller of Capital Issues was the regulatory authority, it derived authority from the Capital Issues (Control) Act, 1947.

- In 1988, the SEBI was constituted as the regulator of capital markets in India under a resolution of the Government of India.

- Initially SEBI was a non statutory body without any statutory power but became autonomous and given statutory powers by SEBI Act 1992.

- Structure:

- SEBI Board consists of a Chairman and several other whole time and part time members.

- SEBI also appoints various committees, whenever required to look into the pressing issues of that time.

- Further, a Securities Appellate Tribunal (SAT) has been constituted to protect the interest of entities that feel aggrieved by SEBI’s decision.

- SAT consists of a Presiding Officer and two other Members.

- It has the same powers as vested in a civil court. Further, if any person feels aggrieved by SAT’s decision or order can appeal to the Supreme Court.

What is IOSCO?

- About:

- Founded: April 1983

- Headquarters: Madrid, Spain

- IOSCO Asia Pacific Hub is located in Kuala Lumpur, Malaysia.

- It is the international organization that brings together the world's securities regulators, covering more than 95% of the world’s securities markets, and is the global standard setter for the securities sector.

- It works closely with the G20 (Group of Twenty) and the Financial Stability Board (FSB) in setting up the standards for strengthening the securities markets.

- The FSB is an international body that monitors and makes recommendations about the global financial system.

- The IOSCO Objectives and Principles of Securities Regulation have been endorsed by FSB as one of the key standards for sound financial systems.

- IOSCO's enforcement role extends to matters of interpretation of International Financial Reporting Standards (IFRS), where IOSCO maintains a (confidential) database of enforcement actions taken by member agencies.

- IFRS is an accounting standard that has been issued by the International Accounting Standards Board (IASB) with the objective of providing a common accounting language to increase transparency in the presentation of financial information.

- Objectives:

- To cooperate in developing, implementing and promoting adherence to internationally recognized and consistent standards of regulation, oversight and enforcement in order to protect investors, maintain fair, efficient and transparent markets, and seek to address systemic risks;

- To enhance investor protection and promote investor confidence in the integrity of securities markets, through strengthened information exchange and cooperation in enforcement against misconduct and in supervision of markets and market intermediaries; and

- To exchange information at both global and regional levels on their respective experiences in order to assist the development of markets, strengthen market infrastructure and implement appropriate regulation.

- Membership:

- IOSCO provides members the platform to exchange information at the global level and regional level on areas of common interests.

- SEBI is an ordinary member of IOSCO.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. Which of the following is issued by registered foreign portfolio investors to overseas investors who want to be part of the Indian stock market without registering themselves directly? (2019)

(a) Certificate of Deposit

(b) Commercial Paper

(c) Promissory Note

(d) Participatory Note

Ans: (d)

Social Justice

Decline in Muslim Enrollment in Higher Education

For Prelims: Decline in Muslim Enrollment in Higher Education, Unified District Information System for Education Plus (UDISE+), All India Survey of Higher Education (AISHE), Naya Savera- Free Coaching and Allied Scheme.

For Mains: Decline in Muslim Enrollment in Higher Education, Welfare schemes for vulnerable sections of the population by the Centre and States and the performance of these schemes.

Why in News?

According to a report prepared from the analysis of data from the Unified District Information System for Education Plus (UDISE+) and the All India Survey of Higher Education (AISHE), the enrollment in higher education among Muslim students has dropped significantly.

What is the UDISE Plus Report?

- It is a comprehensive study that provides information on enrollment and dropout rates of school students, number of teachers in schools, and information on other infrastructural facilities like toilets, buildings and electricity.

- It was launched in 2018-2019 to speed up data entry, reduce errors, improve data quality and ease its verification.

- It is an application to collect the school details about factors related to a school and its resources.

- It is an updated and improved version of UDISE, which was initiated in 2012-13 by the Ministry of Education.

What is the All India Survey for Higher Education?

- AISHE is an initiative by the Ministry of Education. The annual web-based survey aims to determine the state of higher educational institutions in India and find areas for improvement. Students enrolled in higher educational institutions will respond to the AISHE survey.

- This survey can rate their college on different categories like teachers, exam results, education finance, programmes, student enrolment, and infrastructure. The data collected in this survey is used to make informed policy decisions and conduct better research in higher education.

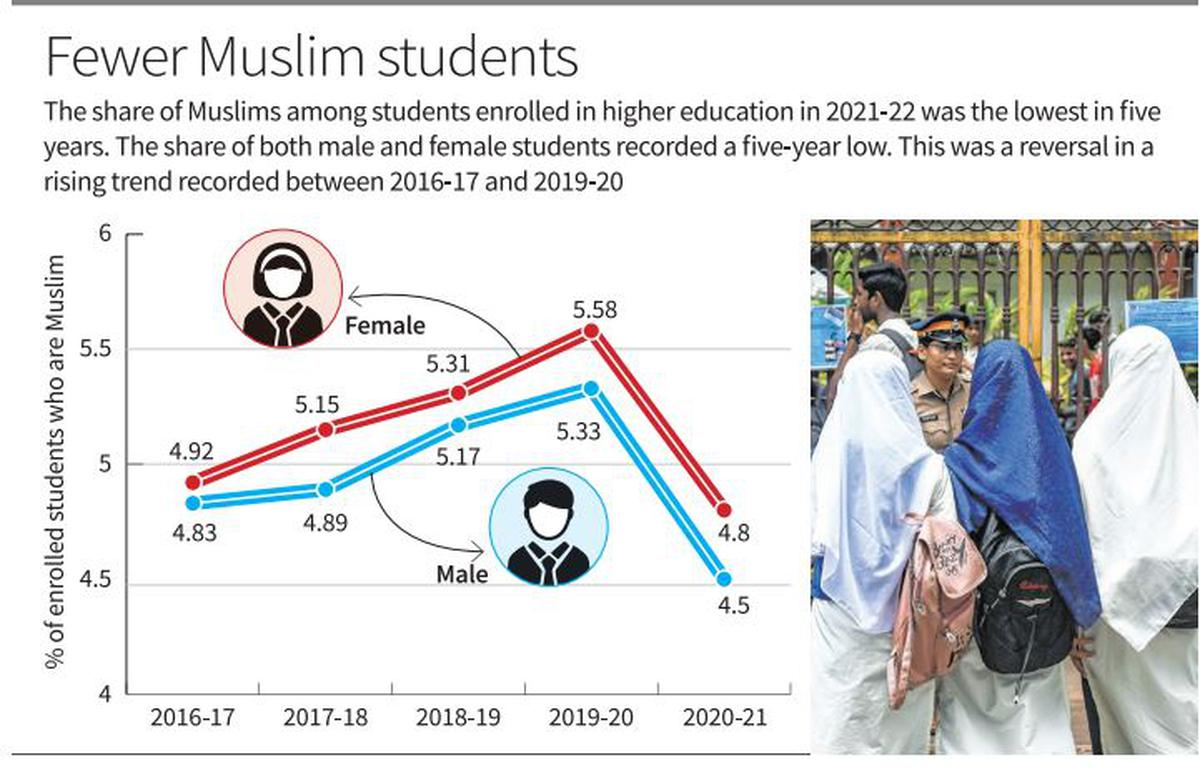

What are the Key Highlights of the Report on Dropout Among Muslims?

- Enrollment Data:

- There is a significant drop of over 8.5% in enrollment of Muslim students (age group 18-23) in higher education in 2020-21.

- Enrollment decreased from 21 lakh students in 2019-20 to 19.21 lakh in 2020-21.

- From 2016-17 to 2020-21, there was an overall increase in enrollment, but a decline in the latest year, marking a decrease of 1,79,147 students from 2019-20 to 2020-21.

- Relative Enrollment Percentage:

- The percentage of Muslim students enrolled in higher education compared to the total student population saw a slight decrease from 4.87% in 2016-17 to 4.64% in 2020-21.

- Enrollment Pattern across Education Levels:

- Across States and Union Territories, a consistent trend is observed where Muslim student representation gradually declines from Class 6 onwards, reaching its lowest in Classes 11 and 12.

- Enrollment percentage of Muslim students drops from 14.42% in upper primary (Class 6-8) to 10.76% in higher secondary (Class 11-12).

- State Disparities:

- States like Bihar and Madhya Pradesh have relatively low Gross Enrolment Ratio for Muslim students, which indicates that many Muslim children in these States are still out of the education system.

- Assam (29.52%) and West Bengal (23.22%) recorded high dropout rates among Muslim students, while Jammu and Kashmir recorded 5.1% and Kerala 11.91%.

- Recommendations:

- There is a need for enhancing scholarships, grants, and financial aid explicitly tailored for Muslim students to alleviate financial burdens and increase access to higher education.

- Many Muslim students come from low-income families and struggle to afford the cost of higher education.

- Implementing inclusive policies and targeted support is crucial to bridge the education gap and provide equal opportunities for all students, irrespective of religious background or economic status.

- There is a need for enhancing scholarships, grants, and financial aid explicitly tailored for Muslim students to alleviate financial burdens and increase access to higher education.

What are the Major Schemes in India for the Welfare of Minorities?

- Pre-Matric Scholarship Scheme, Post-Matric Scholarship Scheme, Merit-cum-Means based Scholarship Scheme: For educational empowerment of students, through Direct Benefit Transfer (DBT) mode.

- Naya Savera- Free Coaching and Allied Scheme: The Scheme aims to provide free coaching to students/candidates belonging to economically weaker sections of minority communities for preparation of entrance examinations of technical/ professional courses and competitive examinations.

- Padho Pardesh: Scheme of interest subsidy to students of economically weaker sections of minority communities on educational loans for overseas higher studies.

- Nai Roshni: Leadership development of women belonging to minority communities.

- Seekho Aur Kamao: It is a skill development scheme for youth of 14 - 35 years age group and aiming at improving the employability of existing workers, school dropouts etc.

- Pradhan Mantri Jan Vikas Karyakram (PMJVK): It is a Scheme designed to address the development deficits of the identified Minority Concentration Areas.

- The areas of implementation, under PMJVK, have been identified on the basis of minority population and socio-economic and basic amenities data of Census 2011 and will be known as Minority Concentration Areas.

- USTTAD (Upgrading the Skills and Training in Traditional Arts/Crafts for Development): Launched in May 2015 aims to preserve the rich heritage of traditional skills of indigenous artisans/craftsmen.

- Under this scheme HunnarHaats are also held all over the country to provide a nation-wide marketing platform to Minority artisans & entrepreneurs and to create employment opportunities.

- Prime Minister-Virasat Ka Samvardhan (PM Vikaas): New PM Vikas has been added to the Ministry of Minority Affairs' Budget in 2023.

- It is a skilling initiative focussing on the skilling, entrepreneurship and leadership training requirements of the minority and artisan communities across the country.

- The scheme is intended to be implemented in conjunction with the ‘Skill India Mission’ of the Ministry of Skill Development & Entrepreneurship and through integration with the Skill India Portal (SIP).

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q.1 In India, if a religious sect/community is given the status of a national minority, what special advantages it is entitled to? (2011)

- It can establish and administer exclusive educational institutions.

- The President of India automatically nominates a representative of the community to Lok Sabha.

- It can derive benefits from the Prime Minister’s 15-Point Programme.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (c)

Q.2 In India, which of the following review the independent regulators in sectors l ike telecommunications, insurance, electricity, etc.? (2019)

- Ad Hoc Committees set up by the Parliament

- Parliamentary Department Related Standing Committees

- Finance Commission

- Financial Sector Legislative Reforms Commission

- NITI Aayog

Select the correct answer using the code given below:

(a) 1 and 2

(b) 1, 3 and 4

(c) 3, 4 and 5

(d) 2 and 5

Ans: (a)

Rapid Fire

9th National Level Pollution Response Exercise (NATPOLREX-IX)

Recently, the 9th National Level Pollution Response Exercise (NATPOLREX-IX) was conducted by the Indian Coast Guard (ICG) off Vadinar, Gujarat.

- The NATPOLREX-IX accomplished its objective of testing the level of preparedness and coordination between various resource agencies to respond to a marine oil spill invoking provisions of the National Oil Spill Disaster Contingency Plan (NOSDCP).

- The ICG deployed surface as well as air platforms including Pollution Response Vessels (PRVs), Offshore Patrol Vessels (OPVs), indigenous Advanced Light Helicopter Mk-III, and Dornier Aircraft configured for marine pollution response.

- The event also showcased India’s industrial prowess in terms of the ‘Make in India’ and vision of ‘Aatmanirbhar Bharat’.

- Apart from drawing up the NOSDCP, the Coast Guard has established four Pollution Response Centers at Mumbai, Chennai, Port Blair and Vadinar.

Read More: Exclusive Economic Zone (EEZ), SAGAR' - Security and Growth for all in the Region

Rapid Fire

DGCA Cautions Airlines Against Fake Navigational Signals

The Directorate General of Civil Aviation (DGCA) issued an advisory to Indian airlines detailing mitigating measures to be taken in the event of spoofing of (fake) navigational signals, following incidents near the Iranian airspace and a U.S. advisory.

- Global Positioning System (GPS) spoofing is “the surreptitious replacement of a true satellite signal that can cause a GPS receiver to output an erroneous position and time”.

- In its circular, the DGCA has provided comprehensive mitigation measures which includes developing “contingency procedures in coordination with equipment manufacturers, and assessing operational risk by conducting a safety risk assessment”.

- The DGCA has also provided a mechanism for air navigation service providers to establish a “threat monitoring and analysis network” for preventive and reactive threat monitoring and analysis of reports of GNSS interference.

Read More: GPS AIDED GEO AUGMENTED NAVIGATION (GAGAN), ISRO

Rapid Fire

Pulses, Oil seeds, Fruit Output to Lag Demand Till 2030-31

As per the report published by the National Bank for Agriculture and Rural Development (NABARD) and the Indian Council for Research on International Economic Relations (ICRIER), commodities like oilseed, pulses and fruits are expected to experience a supply and demand gap in the coming years.

- Therefore, there is a need to increase the level of production and productivity of oilseeds, pulses, and fruits since their demand in the future shows an increasing trend.

- As per capita incomes rise, the consumption basket of people tends to diversify towards nutritious and high-valued commodities, including fruits and vegetables and dairy products and away from staples such as rice and cereals.

- Oil seeds production is expected to rise to around 35 to 40 million tonnes (MT) by 2030-31, with the gap between demand and supply likely to expand to 3 MT by 2025-26.

- The report reiterated the recommendation of a 2012 report from the Commission for Agricultural Costs and Prices (CACP) to raise the import duty whenever the import price of crude palm oil falls below USD 800 per tonne to protect Indian producers.

Read More: Minimum Support Price, Primary Agricultural Credit Society (PACS)