Indian Society

Muslim Women Rights Day

Why in News

Recently, 1st August has been recorded as “Muslim Women Rights Day” in the country’s history to mark first anniversary of the passage of Muslim Women (Protection of Rights on Marriage) Act, 2019.

- The law made triple talaq a criminal offence.

Triple Talaq

- Triple talaq is a practice mainly prevalent among India’s Muslim community following the Hanafi Islamic school of law.

- Under the practice, a Muslim man can divorce his wife by simply uttering “talaq” three times but women cannot pronounce triple talaq and are required to move a court for getting divorce under the Sharia Act, 1937.

- Triple talaq divorce is banned by many Islamic countries, including Pakistan, Bangladesh and Indonesia.

Key Points

- Provisions of the Muslim Women (Protection of Rights on Marriage) Act, 2019

- The Act makes all declaration of talaq, including in written or electronic form, to be void (i.e. not enforceable in law) and illegal.

- It also makes a declaration of talaq a cognizable offence ( only if information relating to the offence is given by a married woman against whom talaq has been declared), attracting up to three years imprisonment with a fine.

- A cognizable offence is one for which a police officer may arrest an accused person without warrant.

- The Magistrate may grant bail to the accused. The bail may be granted only after hearing the woman (against whom talaq has been pronounced), and if the Magistrate is satisfied that there are reasonable grounds for granting bail.

- The offence may be compounded (i.e. the parties may arrive at a compromise) by the Magistrate upon the request of the woman (against whom talaq has been declared).

- A Muslim woman against whom talaq has been declared, is entitled to seek subsistence allowance from her husband for herself and for her dependent children.

- Constitutional Provisions:

- The Triple Talaq was held to be violative of Article 14 (the right to equality), which is held by the Supreme Court from Shah Bano case (1986) to Shayara Bano case in 2017.

- Article 25 of the Constitution guarantees religious freedom as Freedom of Practice and Propagation of Religion. Like all other Fundamental Rights, it is subject to restrictions and does not protect religious practices that can negatively affect the welfare of citizens.

- Hence, Article 25 is overridden by Article 14, which guarantees the Right to Equality as triple talaq denies a Muslim woman’s equality before the law.

- Article 25 is also subject to Article 15 (1) which states that the State “shall not discriminate against any citizen on grounds only of religion, race, caste, sex…” Since triple talaq does not work in the favour of women, it violates Article 15 (1) of the Constitution.

Way Forward

- The implementation of the Act has shown a decline of about 82% in Triple Talaq cases in India. It has strengthened “self-reliance, self-respect and self-confidence” of the Muslim women of the country.

- The law is a step towards ensuring gender equality and strengthening constitutional, fundamental and democratic rights of the Muslim women.

Indian Economy

Increased Fiscal Deficit

Why in News

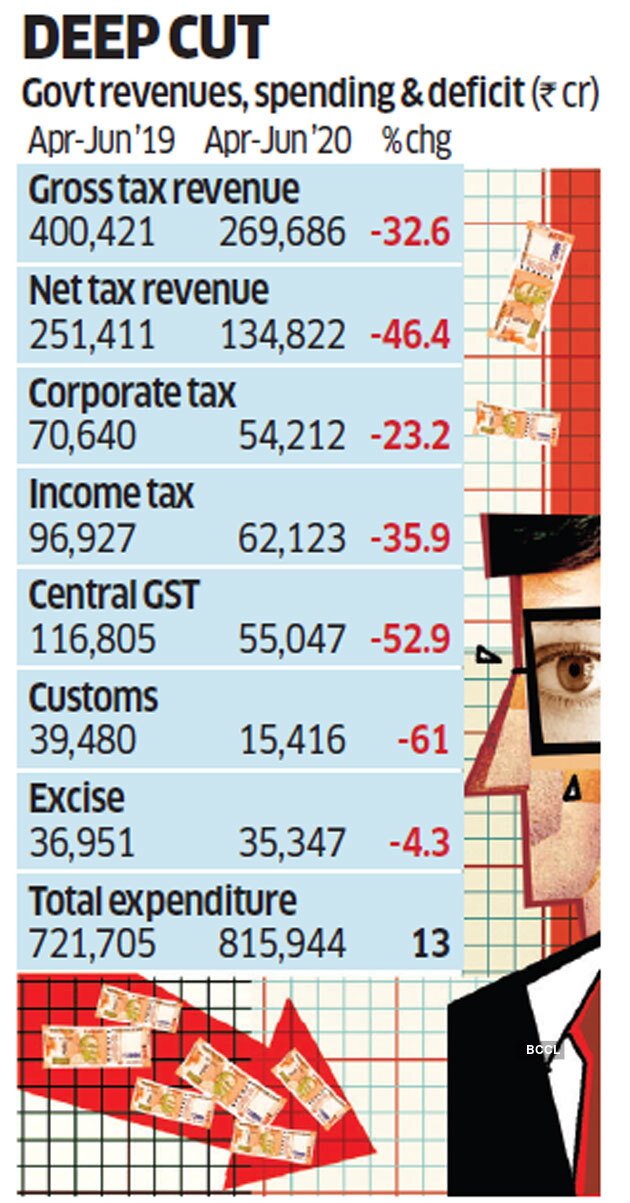

As per the official data, the Centre’s fiscal deficit for the first three months of fiscal 2020-21 (April-June) was Rs. 6.62 lakh crore, which is 83% of the budgeted target for the year (Rs. 7.96 lakh crore).

- As per the economists, the fiscal deficit may end up as high as 8% of the Gross Domestic Product (GDP), far exceeding the budget’s goal of 3.5%.

Key Points

- Fall in Income Component:

- The Union government has received Rs. 1.53 lakh crore (in terms of tax, non-tax revenue and loan recoveries) from April to June 2020.

- This is less than 7% of budget estimates for the full year.

- When economic activity has been stopped because of the pandemic and lockdown, government revenues are also going to come down.

- The Centre has also transferred Rs. 1.34 lakh crore to States as their share of taxes, which is Rs. 14,588 crore lower than the previous year.

- Increase in Expenditure:

- The Centre’s total expenditure for April-June was Rs. 8.15 lakh crore, almost 27% of budget estimates for the year.

- Due to spending on free food grains and rural job programmes for millions of migrant workers.

- There has been a 40% growth in the first quarter capital expenditure to Rs. 88,273 crore.

- This is historically high (in comparison to data from the last 20 years), in terms of year-on-year percentage growth for the first quarter.

- Increased capital expenditure implies increased spending on creation of assets such as infrastructure.

- The Centre’s total expenditure for April-June was Rs. 8.15 lakh crore, almost 27% of budget estimates for the year.

- Borrowings: The reduced collections have forced the government to raise the amount it’s borrowing this fiscal to a record Rs. 12 lakh crore from earlier estimates of Rs. 7.8 lakh crore to meet spending needs.

Fiscal Deficit

- The government describes fiscal deficit of India as “the excess of total disbursements from the Consolidated Fund of India, excluding repayment of the debt, over total receipts into the Fund (excluding the debt receipts) during a financial year”.

- In simple words, it is a shortfall in a government's income compared with its spending.

- The government that has a fiscal deficit is spending beyond its means.

- It is calculated as a percentage of Gross Domestic Product (GDP), or simply as total money spent in excess of income.

- In either case, the income figure includes only taxes and other revenues and excludes money borrowed to make up the shortfall.

- Formula:

- Fiscal Deficit = Total expenditure of the government (capital and revenue expenditure) – Total income of the government (Revenue receipts + recovery of loans + other receipts).

- Expenditure component: The government in its Budget allocates funds for several works, including payments of salaries, pensions, etc. (revenue expenditure) and creation of assets such as infrastructure, development, etc. (capital expenditure).

- Income component: The income component is made of two variables, revenue generated from taxes levied by the Centre and the income generated from non-tax variables.

- The taxable income consists of the amount generated from corporation tax, income tax, Customs duties, excise duties, GST, among others.

- Meanwhile, the non-taxable income comes from external grants, interest receipts, dividends and profits, receipts from Union Territories, among others.

- It is different from revenue deficit which is only related to revenue expenditure and revenue receipts of the government.

- The government meets the fiscal deficit by borrowing money. In a way, the total borrowing requirements of the government in a financial year is equal to the fiscal deficit in that year.

- A high fiscal deficit can also be good for the economy if the money spent goes into the creation of productive assets like highways, roads, ports and airports that boost economic growth and result in job creation.

- The Fiscal Responsibility and Budget Management Act, 2003 provides that the Centre should take appropriate measures to limit the fiscal deficit upto 3% of the GDP by 31st March, 2021.

- The NK Singh committee (set up in 2016) recommended that the government should target a fiscal deficit of 3% of the GDP in years up to March 31, 2020 cut it to 2.8% in 2020-21 and to 2.5% by 2023.

Way Forward

- Given the level of contraction in the economy, the fiscal deficit is expected to be higher this year. In the current scenario, the most important thing is to bring back confidence among consumers as well as businesses. This will help in fuelling the economic recovery.

Indian Economy

Contraction in Core Sector Industries

Why in News

The output of eight core industries contracted for the fourth consecutive month - shrinking by 15% in June 2020.

- The eight core sector industries are coal, crude oil, natural gas, refinery products, fertilisers, steel, cement and electricity.

- These eight industries account for 40.27% in the Index of Industrial Production (IIP).

Key Points

- Contraction in Total Output:

- During April-June 2020, the sector's output dipped by 24.6% as compared to a positive growth of 3.4% in the same period previous year.

- However, 15% contraction in June 2020 implies some economic recovery as in May 2020, the industries’ output contracted by 22%.

- Economists expect the negative trend to continue for at least two more months.

- Industry-wise Performance:

- The fertiliser industry is the only one which saw actual growth in June, with output rising 4.2% in comparison to June 2019.

- This, however, is lower than the May 2020 growth of 7.5%, but reflects the positive outlook in the agriculture sector where a normal monsoon is leading to expectations of a good kharif crop.

- Rest seven sectors – coal (-15.5%), crude oil (-6.0), natural gas (-12%), refinery products (-9%), steel (-33.8%), cement (-6.9%), and electricity (-11%) – recorded negative growth in June.

- The steel sector continues to remain the worst performer, with a 33% drop in production in comparison to the previous year.

- The fertiliser industry is the only one which saw actual growth in June, with output rising 4.2% in comparison to June 2019.

Index of Industrial Production

- The Index of Industrial Production (IIP) is an index that shows the growth rates in different industry groups of the economy in a fixed period of time.

- It is compiled and published monthly by the National Statistical Office (NSO), Ministry of Statistics and Programme Implementation.

- IIP is a composite indicator that measures the growth rate of industry groups classified under:

- Broad sectors, namely, Mining, Manufacturing, and Electricity.

- Use-based sectors, namely Basic Goods, Capital Goods, and Intermediate Goods.

- The eight core sector industries represent about 40% of the weight of items that are included in the IIP.

- The eight core industries in decreasing order of their weightage: Refinery Products> Electricity> Steel> Coal> Crude Oil> Natural Gas> Cement> Fertilizers.

- Base Year for IIP calculation is 2011-2012.

- Significance of IIP :

- IIP is the measure on the physical volume of production.

- It is used by government agencies including the Ministry of Finance, the Reserve Bank of India, etc, for policy-making purposes.

- IIP remains extremely relevant for the calculation of the quarterly and advance Gross Domestic Product (GDP) estimates.

Way Forward

- The positive impact from unlock is not as strong as the negative impact of the lockdown. The government needs to contain the spread of the coronavirus pandemic on a priority to make economic recovery sustainable.

Governance

High Level Group on Agricultural Exports : Finance Commission

Why in News

Recently, the High Level Group (HLEG) on Agricultural Exports set up by the Fifteenth Finance Commission has submitted its report to the Commission.

- The HLEG was set up to recommend measurable performance incentives for states to encourage agricultural exports and to promote crops to enable high import substitution.

Finance Commission

- The Finance Commission is a constitutional body, that determines the method and formula for distributing the tax proceeds between the Centre and states, and among the states as per the constitutional arrangement and present requirements.

- Under Article 280 of the Constitution, the President of India is required to constitute a Finance Commission at an interval of five years or earlier.

- The 15th Finance Commission was constituted by the President of India in November 2017, under the chairmanship of NK Singh. Its recommendations will cover a period of five years from April 2020 to March 2025.

- Recently, the Ministry of Finance has released a part of grants-in-aid as a part of the Tied Grant as recommended by the 15th Finance Commission (FC) for the Financial Year (FY) 2020-2021.

Key Points

- Purpose to Constitute HLEG:

- To assess export & import substitution opportunities for Indian agricultural products (commodities, semi-processed, and processed) in the changing international trade scenario and suggest ways to step up exports sustainably and reduce import dependence.

- To recommend strategies and measures to increase farm productivity, enable higher value addition, ensure waste reduction, strengthen logistics infrastructure etc. related to Indian agriculture, to improve the sector's global competitiveness.

- To identify the impediments for private sector investments along the agricultural value chain and suggest policy measures and reforms that would help attract the required investments.

- To suggest appropriate performance-based incentives to the state governments for the period 2021-22 to 2025-26, to accelerate reforms in the agriculture sector as well as implement other policy measures in this regard.

- Recommendations:

- Crop Value Chains:

- It emphasises to focus on 22 crop value chains with a demand driven approach.

- The demand driven approach refers to a development strategy where the people themselves are expected to take the initiative and the responsibility for improving supply situation rather than being passive recipients of the Government services.

- It also suggests to solve Value Chain Clusters (VCC) holistically with focus on value addition.

- State-led Export Plan:

- It is a business plan for a crop value chain cluster, that will lay out the opportunity, initiatives and investment required to meet the desired value chain export aspiration.

- These plans will be action-oriented, time-bound and outcome-focused.

- Such plans should be collaboratively prepared with private sector players and Commodity Boards presenting participation of all stakeholders.

- Participation of Private Sector:

- The private sector players need to play a pivotal role in ensuring demand orientation and focus on value addition.

- It also needs to ensure project plans are feasible, robust, implementable and appropriately funded; providing funds for technology based on business cases and for creating urgency and discipline for project implementation.

- Central Government’s Role:

- The Central government should act as an enabler.

- Thus, robust institutional mechanisms need to be enforced to fund and support implementation.

- Crop Value Chains:

- India’s Estimated Agricultural Export Potential:

- India’s agricultural export has the potential to grow from USD 40 billion to USD 70 billion in a few years.

- The estimated investment in agricultural export could be to the tune of USD 8-10 billion across inputs, infrastructure, processing and demand enablers.

- Additional exports are likely to create an estimated 7-10 million jobs.

- It will also lead to higher farm productivity and farmer income.

Biodiversity & Environment

Investment to Reduce Plastic Waste in India

Why in News

A Singapore-based-NGO namely ‘Alliance to End Plastic Waste’ plans to invest between USD 70 million to 100 million in India over the next five years to reduce plastic waste.

- Overall, the Alliance has a USD 500 million budget for environmental projects including the USD 100 million for India. The rest is for South East Asia and China.

Alliance to End Plastic Waste

- Alliance to End Plastic Waste was founded in 2019 as a nonprofit organisation to help solve this serious and complex issue – 8 million tons of plastic waste entering the ocean every year.

- Nearly fifty companies across the plastics value chain have joined the Alliance and together they have committed to invest USD 1.5 billion towards solutions that will prevent the leakage as well as recover and create value from plastic waste.

Key Points

- World Nature Conservation Day:

- The investment to end plastic waste in India was announced on the World Nature Conservation Day (28th July).

- It is celebrated every year to create and increase awareness about the importance of natural resources.

- The day also encourages people to save and protect Earth’s natural resources that are fast-depleting owing to over-exploitation and even misuse.

- Ongoing Initiatives in India:

- Currently, ‘Alliance to End Plastic Waste’ is working on the Project Aviral which aims to reduce plastic waste in the Ganga river.

- Aviral seeks to pilot an approach to address waste management challenges. In particular, it will focus on strengthening an integrated plastic waste management system.

- Currently, ‘Alliance to End Plastic Waste’ is working on the Project Aviral which aims to reduce plastic waste in the Ganga river.

- Worldwide Initiatives:

- UN-Habitat Waste Wise Cities (WWC):

- Alliance to End Plastic Waste is also collaborating with the UN-Habitat to implement solutions toward a circular economy, creating business and livelihood opportunities while enhancing resource recovery.

- It intends to use the UN-Habitat Waste Wise Cities (WWC) Tool to map waste flows and assess potential plastic leakage from waste management systems.

- The collaboration supports the WWC Challenge to clean up and establish sustainable waste management in 20 cities around the world by 2022.

- It is also expected to identify short- and long-term pathways to increase the amount of plastic waste collected, recycled and recovered.

- Zero Plastic Waste Cities Initiative:

- It is also implementing the Zero Plastic Waste Cities initiative in India and Vietnam which aims to tackle the plastic issue by improving and supplementing municipal waste management, repurposing collected waste and preventing it from flowing into the ocean.

- It will also develop sustainable social businesses that improve the livelihoods of many while preventing plastic waste from escaping into the environment.

- The two initial cities involved in this project are Puducherry in India and Tan An in the Mekong Delta region of Vietnam.

- UN-Habitat Waste Wise Cities (WWC):

Plastic Waste

- Global Scenario:

- Over 8.3 billion tonnes of plastic has been produced since 1950, and about 60% of that has ended up in landfills or in the natural environment.

- Only 9% of all plastic waste ever produced has been recycled and about 12% has been incinerated, while the remaining 79% has accumulated in landfills, dumps or the natural environment.

- Plastic waste, whether in a river, an ocean, or on land can persist in the environment for centuries, hence by 2050, the amount of plastic in seas and oceans across the world will weigh more than the fish.

- Indian Scenario:

- India currently generates around 26,000 tonnes of plastic waste every day and over 10,000 tonnes of which is not collected.

- India’s per capita plastic consumption of less than 11 kg, is nearly a tenth of the United States of America (109 kg).

- For India, bringing plastic waste back into the supply chain could bring annual benefits of Rs.40 lakh crore in 2050.

- Global as well as Indian Government’s Interventions:

- The Group of 20 (G20) environment ministers, agreed to adopt a new implementation framework for actions to tackle the issue of marine plastic waste on a global scale.

- Plastic Waste Management Rules, 2016 state that every local body has to be responsible for setting up infrastructure for segregation, collection, processing, and disposal of plastic waste.

- Plastic Waste Management (Amendment) Rules 2018 introduced the concept of Extended Producer Responsibility (EPR).

- EPR is a policy approach under which producers are given a significant financial and physical responsibility (with respect to segregation and collection of waste at the source) for the treatment or disposal of post-consumer products.

- A new national framework on plastic waste management is in the works, which will introduce third-party audits as part of the monitoring mechanism.

Way Forward

- Government has to look into it with a very holistic perspective while forming policies to take all aspects into consideration and ensure strict implementation of regulations.

- Economically affordable and ecologically viable alternatives which will not burden the resources are needed and their prices will also come down with time and increase in demand.

- Citizens have to bring behavioural change and contribute by not littering and helping in waste segregation and waste management. Everybody, by doing their bit, can ensure elimination of single use plastic.

Science & Technology

China Launches BeiDou Navigation Satellite System

Why in News

China has formally launched full global services of its BeiDou-3 Navigation Satellite System (BDS).

Key Points

- Background:

- The name BeiDou comes from Chinese word for the Big Dipper or Plough constellation.

- China's BeiDou navigation project was launched in the early 1990s. The system then became operational within China in 2000 and in the Asia-Pacific region in 2012.

- The navigation satellite system was completed in three steps: BDS-1 which provided services to China, BDS- 2 to provide services to the Asia-Pacific region and BDS-3 which provides services worldwide.

- Features:

- A hybrid constellation consisting of around 30 satellites in three kinds of orbits: Geostationary Earth Orbit (GEO), Inclined Geo-Synchronous Orbit (IGSO) and Medium Earth Orbit (MEO).

- Provides navigation signals of multiple frequencies, and is able to improve service accuracy by using combined multi-frequency signals.

- Offers accurate positioning, navigation and timing, as well as short messaging communication, international search and rescue, satellite-based augmentation, ground augmentation and precise point positioning, etc.

- The services are used in various fields by China including defence, transportation, agriculture, fishing, and disaster relief.

- It will be the fourth global satellite navigation system after the USA GPS, Russia’s GLONASS and European Union’s Galileo.

- It is said to be much more accurate than the USA’s GPS.

- Global Navigation Satellite System (GNSS) is a general term describing any satellite constellation that provides Positioning, Navigation, and Timing (PNT) services on a global basis.

Implications

- Challenge to the Centrality of the USA: While China says it seeks cooperation with other satellite navigation systems, Beidou is being seen as a rival to America’s GPS, Russia’s GLONASS and the European Union’s Galileo networks.

- Military Implications: The development of its own secure and independent navigation system will boost China’s military strength, especially amidst rising US-China tensions.

- Economic Implications: The better accuracy and experience of BDS, as claimed by China will lure companies to sign-up for it. As the global market is being increasingly dominated by an information-based economy, China is expected to reap huge economic benefit from BDS.

- China’s Hold on Other Nations: China is promoting its use in the countries signed-up for its Belt and Road Initiative (BRI). Pakistan has already started using BDS. This will certainly give China economic and political leverage over nations adopting this system.

- Edge over India: This has also given China a competitive edge over India, whose IRNSS-NavIC is still a regional navigation system.

- Importance in Covid Times: The world is becoming heavily dependent on space infrastructure due to the impact of COVID-19 limitations on in-person physical meetings and travel restrictions. Thus, information and space-based services will gain importance in present times.

- China’s Authority in Space: The space program of China has seen rapid advancements in past few years with the launch of Tianwen-1 rover mission to Mars. China has also constructed an experimental space station and sent a pair of rovers to the surface of the moon (Chang’e-4). BDS is another step in marking China’s presence in Space.

IRNSS ― NavIC (India)

- The Indian Regional Navigation Satellite System (IRNSS), which was later given the operational name of NavIC or NAVigation with Indian Constellation, is the regional satellite navigation system of India.

- Launched and operated by the Indian Space Research Organisation (ISRO), IRNSS covers India and nearby regions extending up to 1,500 km.

- The constellation consists of 7 active satellites, out of which three are located in Geostationary Earth Orbit (GEO) and four in Inclined Geo-Synchronous Orbit (IGSO).

Satellite Orbits

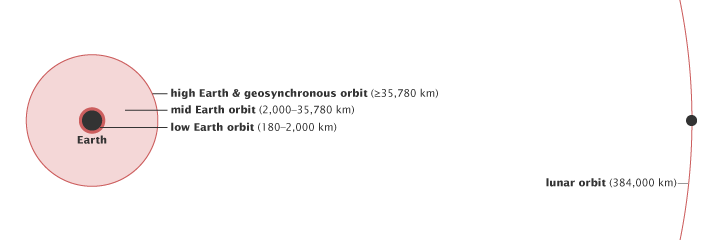

- An orbit is a regular, repeating path that an object in space takes around another one. An object moving around a planet in an orbit is called a satellite. According to the height of satellites from the earth, the orbits can be classified as

- High Earth orbit (mostly weather and communication satellites),

- Medium Earth orbit (most navigation satellites) and

- Low Earth orbit (Scientific satellites like NASA’s Earth observing Fleet).

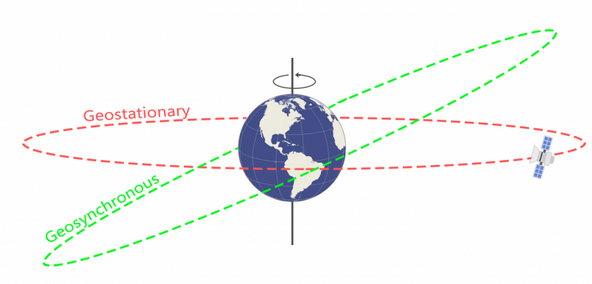

- Geo-Synchronous orbit : A geosynchronous orbit is any orbit which has a period equal to the earth's rotational period.

- Geostationary Orbit: A Geostationary Orbit is a time of Geosynchronous orbit in the same plane as that of the equator.

International Relations

1947 Tripartite Agreement on Gurkha soldiers

Why in News

Recently, the Nepal’s Foreign Minister has said that the 1947 Tripartite Agreement between India, Nepal and the United Kingdom (that deals with the military service of Gurkha soldiers from Nepal) has become redundant.

- He also said that Nepal would prefer to handle the matter bilaterally with India and the United Kingdom.

Key Points

- The Tripartite Agreement:

- In 1947, when India became independent, it was decided to split Gurkha regiments between the British and Indian armies.

- From the first quarter of the 19th century, Gurkhas had served under the British, first in the armies of the East India Company, and then the British Indian Army.

- East India Company first recruited Gurkhas after suffering heavy casualties during the Anglo-Nepalese War also known as the Gurkha War. The war ended with the signing of the Treaty of Sugauli in 1816.

- It ensured that Gurkhas in British and Indian service would enjoy broadly the same conditions of service as that of British and Indian citizens.

- The services include all perks, remuneration, facilities and pension schemes etc.

- Gorkha recruitment was the first window that was opened to Nepali youth to go abroad.

- In 1947, when India became independent, it was decided to split Gurkha regiments between the British and Indian armies.

- Issues Involved:

- The objection from Nepal regarding the Gurkhas serving in the Indian military has become prominent in the backdrop of Nepal-India territorial dispute over the Kalapani region of Pithoragarh district that Nepal claims as its own.

- Nepal has responded by publishing a new map that included the disputed territories of Kalapani region.

- The issue became a talking point after Indian Army Chief remarked that Nepal’s strong protest against Indian road construction in the Limpiadora-Kalapani-Lipulekh area was at the behest of a third party (China).

- The Napelese people believe that Indian Army Chief, who is granted the honorary post of a General in the Nepal Army has hurt the sentiments of the Nepali Gurkha Army personnel who lay down their lives to protect India.

- Also the Gurkha veterans have been alleging that the United Kingdom has been discriminating against them in terms of pay, pension and other facilities.

- The British government started providing equal pay and pension to Gurkhas in 2007.

- The objection from Nepal regarding the Gurkhas serving in the Indian military has become prominent in the backdrop of Nepal-India territorial dispute over the Kalapani region of Pithoragarh district that Nepal claims as its own.

Gurkhas in British Army

- After the 1947 Tripartite Agreement, the British Army amalgamated the Gurkha regiment into combined Royal Gurkha Rifles (RGR). Currently, the Gurkhas comprise up to 3% of the British Army. In 2015 they completed 200 years of service in British Army.

- Queen Elizabeth II of Britain is guarded by two personal Gurkha officers.

- The Gurkhas are recruited every year at the British Gurkha camp at Pokhara in Nepal. The camp enlists fresh recruits not only for the British Army, but also for the counter-terror arm of the Singapore Police Force.

- Their signature weapon of Gurkhas, Khukri, forms part of the Gurkha regimental insignia in Britain as well as in India.

Way Forward

- India has strong cultural ties with Nepal. Both countries share open borders and recognize the citizens of each other country as a national citizen. However, the bilateral relations which have soured in the recent past over border disputes, need to be strengthened through diplomatic relations.

Governance

Operation Breathing Space: India-Israel

Why in News

Recently, an Israeli team arrived in India with a multi-pronged mission, codenamed Operation Breathing Space to work with Indian authorities on the Covid-19 response.

Key Points

- Development of Test Kits:

- India’s Defence Research and Development Organisation (DRDO) and Israel’s defence ministry research and development team are working together to develop four different kinds of rapid testing kit for Covid-19 which can give the result within 30 seconds.

- Types of Tests:

- The tests include an audio test, a breath test, thermal testing, and a polyamino test which.

- In the audio test, a patient’s voice would be recorded and evaluated through artificial intelligence and machine learning.

- In the breath test the patient will blow into a tube that will detect the virus using terra-hertz (high frequency) waves.

- Thermal testing will enable identification of the virus in a saliva sample.

- Polyamino acids test seeks to isolate proteins related to Covid-19.

- The tests include an audio test, a breath test, thermal testing, and a polyamino test which.

- India Specific Approach:

- The kits will be jointly developed after trials on Indian Covid-19 patients. The tests have already been tried on a small sample of Israeli patients.

- Other Assistance:

- The Israeli team has brought robotic equipment, and wrist monitors that will help doctors and nurses monitor a patient without increasing risks of infection to themselves.

- The team has also brought 83 advanced respirators to help patients with severe symptoms.

- Benefits:

- The success of rapid tests will help India’s overworked health-care professionals, who are experiencing fatigue. It will also help to address the public impatience over the Covid-19 test.

- The quicker test will help authorities to take quicker prevention measures, which will reduce the spread of the virus among people.

Way Forward

- As a vaccine or a cure is not yet visible and the country is gradually moving towards unlocking, it is time the testing should be made available on demand as close to home as possible.

- With most cases turning out to be asymptomatic, wider and cheaper availability of testing must be a thrust area for the government now. Easy, early diagnosis of infections, even when asymptomatic, will go a long way in containment. The concerns regarding increased dependence on rapid antigen tests in some places must also be addressed.

- Further, the proclivity shown by some States and cities to conceal data has been self defeating. There must be efforts to harvest accurate data, and with ease of availability. Normalcy, albeit a new one, could be reached faster with the right efforts.

Important Facts For Prelims

Contraction of Eurozone Economy

Why in News

The Gross Domestic Product (GDP) of the Eurozone reduced by 12.1% in the April-June 2020 quarter, compared to the previous quarter.

- The Eurozone consists of 19 members of European Union (EU), which uses the Euro as their official currency. 8 EU members (Bulgaria, Croatia, Czech Republic, Denmark, Hungary, Poland, Romania, and Sweden) do not use the euro.

- The 27-country European Union saw a decline of 11.9% in its economy for the same period.

Key Points

- This is the largest drop on record in the eurozone's economy, as Covid-19 lockdowns shut businesses and hampered consumer spending.

- No country escaped the impact of the pandemic. Spain suffered the region’s heaviest drop at 18.5%.

- European governments are countering the recession with massive stimulus measures. They have stepped in with loans to keep businesses continuing and wage support programmes that pay workers’ salaries.

- The European Union leaders have agreed on a 750 billion euro recovery fund backed by common borrowing to support their economy from 2021.

- The European Central Bank is pumping 1.35 trillion euro in newly printed money into the economy, a step which helps keep borrowing costs low.

- The European Central Bank is an official EU institution and the central bank of the Eurozone countries.

Important Facts For Prelims

Initiative Under Gramodyog Vikas Yojana

Why in News

Recently, the Ministry of Micro, Small and Medium Enterprises has approved a programme for the benefit of artisans involved in manufacturing of Agarbatti under the Gramodyog Vikas Yojana.

Key Points

- Description:

- The programme will initially include four pilot projects, including one in the north eastern part of the country.

- Khadi and Village Industries Commission (KVIC) will provide training and assistance as well as work and raw material to artisans working in this area, in tie-up with Agarbatti manufacturing machines.

- KVIC is a statutory body established by Khadi And Village Industries Commission Act, 1956. It is an apex organisation under the Ministry of Micro, Small and Medium Enterprises charged with the planning, promotion, organisation and implementation of programs for the development of Khadi and other village industries in the rural areas

- Benefits:

- Revival of Agarbatti manufacturing in the villages and small towns.

- Generation of sustainable employment and increase in wages for the traditional Artisans.

- Mitigation of the gap between the indigenous ‘production and demand’.

- Reduction in import of ‘Agarbatti’ in the country.

- Background:

- The Govt of India had earlier placed the ‘Agarbatti’ item from “Free” trade to “Restricted” trade in the import policy and enhanced the import duty from 10% to 25% on ‘round bamboo sticks’ used for manufacturing of Agarbatti.

Gramodyog Vikas Yojana

- Gramodyog Vikas Yojana is one of the two components of Khadi Gramodyog Vikas Yojana which aims to promote and develop the village industries through common facilities, technological modernization, training etc.

- Components of Gramodyog Vikas Yojana:

- Research & Development and Product Innovation: R&D support would be given to the institutions that intend to carry product development, new innovations, design development, product diversification processes etc.

- Activities of existing dedicated verticals of Village Industries: This includes Agro Based & Food Processing Industry, Mineral Based Industry, Handmade Paper, Leather & Plastic Industry among others.

- Capacity Building: Under the Human Resource Development and Skill Training components, exclusive capacity building of staff as well as the artisans.

- Marketing & Publicity: The village institutions will be provided market support by way of preparation of product catalogue, Industry directory, market research, new marketing techniques, buyer seller meet, arranging exhibitions etc.