Indian Polity

Statehood Demand by Puducherry

For Prelims: States Reorganisation Act, Union Territory, Article-3.

For Mains: Constitutional Provisions related to the creation of new states and related issues.

Why in News

Recently, the Chief Minister of Puducherry has demanded Statehood for the Union Territory (UT) of Puducherry.

- The demand for Statehood is a long pending issue for Puducherry making it unable to exercise any powers for creating employment potential by inviting more industries to Puducherry and also creating infrastructure facilities for tourism.

Union Territory

- UT refers to those federal territories that are too small to be independent or are too different (economically, culturally and geographically) to be merged with the surrounding states or are financially weak or are politically unstable.

- Due to these reasons, they couldn't survive as separate administrative units and needed to be administered by the Union Government.

- UTs are administered by the President. In the UTs Lieutenant Governors are appointed by the President of India as their administrators.

- However, Puducherry, Jammu and Kashmir and Delhi are the exception in this regard and have an elected legislature and government due to the status of partial statehood.

- At present, India has 8 UTs-- Delhi, Andaman and Nicobar, Chandigarh, Dadra and Nagar Haveli and Daman and Diu, Jammu and Kashmir, Ladakh, Lakshadweep, and Puducherry.

Key Points

- Background:

- When the Constitution of India was adopted in 1949, the Indian federal structure included:

- Part A: Former British India provinces that had a Governor and a legislature.

- Part B: The former Princely States that were governed by a Rajpramukh.

- Part C: Chief Commissioners' provinces and some princely states that were governed by Chief Commissioner.

- Part D: Territory of Andaman and Nicobar Islands that was governed by a Lieutenant Governor who was appointed by the Central Government.

- After the States Reorganisation Act of 1956, Part C and Part D states were combined into a single category of 'Union Territory'. The concept of the UT was added by the Constitution (Seventh Amendment) Act, 1956.

- When the Constitution of India was adopted in 1949, the Indian federal structure included:

- Reasons for Demand:

- Linguistic and cultural reasons are the primary basis for creating new states in the country.

- Other factors are:

- Competition for local resources.

- Government negligence towards certain regions

- Improper allocation of the resources,

- Difference in culture, language, religion, etc.

- The economy's failure to create enough employment opportunities

- Popular mobilization and the democratic political process is also one of the reasons.

- ‘The sons of the soil' sentiments.

- Issues Arising Due to Creation of New States:

- Different statehood may lead to the hegemony of the dominant community/ caste/ tribe over their power structures.

- This can lead to emergence of intra-regional rivalries among the sub-regions.

- The creation of new states may also lead to certain negative political consequences like a small group of legislators could make or break a government at will.

- There is also a possibility of increase in the inter-State water, power and boundary disputes.

- The division of states would require huge funds for building new capitals and maintaining a large number of administrators as was the case in the division of Andhra Pradesh and Telangana.

- Creation of smaller states only transfers power from the old state capitol to new state capital without empowering already existing institutions like Gram Panchayat, District Collector, etc. rather diffusion of development in the backward areas of the states.

- Constitutional Provisions:

- The Indian constitution empowers the Union government to create new states out of existing states or to merge one state with another. This process is called reorganisation of the states.

- As per Article 2 of the Indian Constitution, Parliament may by law admit into the Union, or establish, new States on such terms and conditions.

- As per Article 3 of the Indian Constitution, the Union Government has the power to form a State, increase or decrease the size of any State, and alter the boundaries or name of any State.

Puducherry

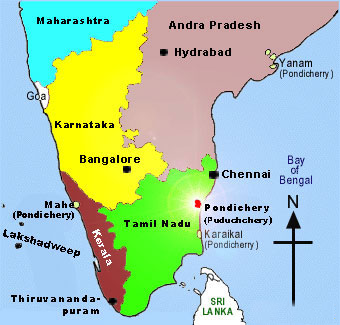

- Puducherry city is capital of Puducherry UT in southeastern India.

- UT was formed in 1962 out of the four former colonies of French India:

- Pondicherry (now Puducherry) and Karaikal along India’s southeastern Coromandel Coast, Yanam, farther north along the eastern coast, and Mahe, lying on the western Malabar Coast, surrounded by Kerala state.

- It originated as a French trade centre in 1674, when it was purchased from a local ruler.

- The colony of Pondicherry was the scene of frequent fighting between the French and Dutch in the late 17th century, and it was occupied several times by British troops. However, it remained a French colonial possession until it was transferred to India in 1962.

Way Forward

- Economic and social viability rather than political considerations must be given primacy.

- It is better to allow democratic concerns like development, decentralisation and governance rather than religion, caste, language or dialect to be the valid bases for conceding the demands for a new state.

- Apart from this the fundamental problems of development and governance deficit such as concentration of power, corruption, administrative inefficiency etc must be addressed.

Source: TH

Indian Economy

GST Compensation Extension

For Prelims: GST compensation cess regime, centrally-sponsored schemes,

For Mains: Revenue Shortfall and Economic Slowdown owing to Covid-19 pandemic, Cooperative federalism, fiscal federalism.

Why in News

Many states have demanded that the GST compensation cess regime be extended for another five years. Also, states have demanded that the share of the Union government in the centrally-sponsored schemes should be raised.

- These demands are made as Covid-19 pandemic has impacted their revenues.

- The provision for GST compensation is going to end in June 2022.

Key Points

- About:

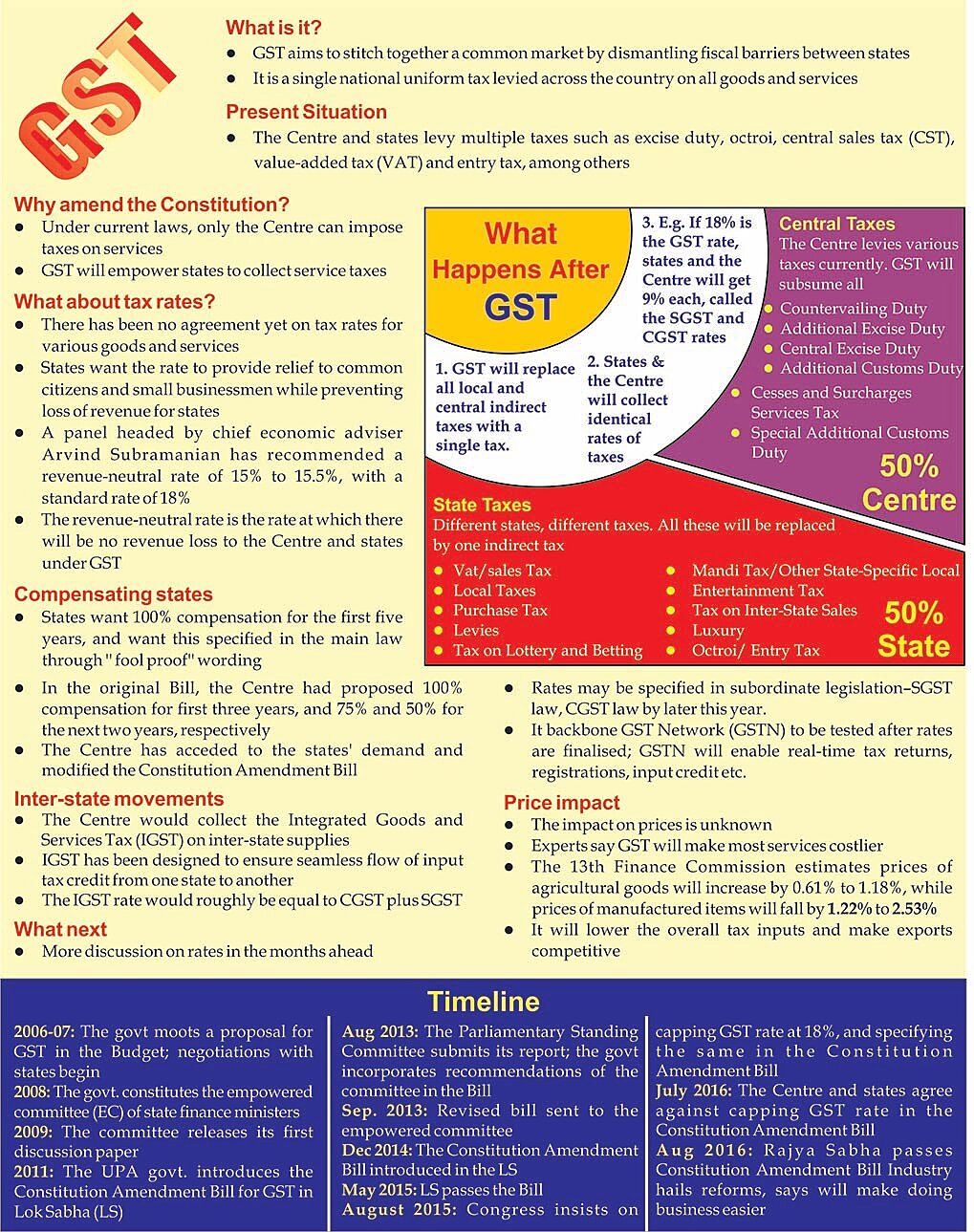

- GST Taxation: The GST became applicable from 1st July 2017 after the enactment of the 101st Constitution Amendment Act, 2016.

- With GST, a large number of central and state indirect taxes merged into a single tax.

- GST Compensation: In theory the GST should generate as much revenue as the previous tax regime. However, the new tax regime is taxed on consumption and not manufacturing.

- This means that tax won’t be levied at the place of production which also means manufacturing states would lose out and hence several states strongly opposed the idea of GST.

- It was to assuage these states that the idea of compensation was mooted.

- The Centre promised compensation to the States for any shortfall in tax revenue due to GST implementation for a period of five years.

- This promise convinced a large number of reluctant States to sign on to the new indirect tax regime.

- GST Taxation: The GST became applicable from 1st July 2017 after the enactment of the 101st Constitution Amendment Act, 2016.

- Compensation Cess:

- States are guaranteed compensation for any revenue shortfall below 14% growth (base year 2015-16) for the first five years ending 2022.

- GST compensation is paid out of Compensation Cess every two months by the Centre to states.

- The compensation cess was specified by the GST (Compensation to States) Act, 2017.

- All the taxpayers, except those who export specific notified goods and those who have opted for GST composition scheme, are liable to collect and remit the GST compensation cess to the central government.

- Compensation Cess Fund: The GST Act states that the cess collected and the amount as may be recommended by the GST Council would be credited to the fund.

- States are guaranteed compensation for any revenue shortfall below 14% growth (base year 2015-16) for the first five years ending 2022.

- Concerns of States:

- Revenue Shortfall: The state’s GST revenue gap in 2020-21 is expected to be about Rs. 3 lakh crore, while cess collections are only projected to reach Rs. 65,000 crore, leaving a shortfall of Rs. 2.35 lakh crore.

- Economic Slowdown: At a time when growth is faltering, the delays in paying compensation to states as guaranteed by the GST Act will make it more difficult for them to meet their own finances.

- Decreasing Centre Devolution: Most states are of the view that the Centre’s share in centrally-sponsored schemes has gradually reduced and states' share has increased.

- Due to this, their most significant demand is increasing share in centrally-sponsored schemes.

Goods and Services Tax

- GST was introduced through the 101st Constitution Amendment Act, 2016.

- It is one of the biggest indirect tax reforms in the country.

- It was introduced with the slogan of ‘One Nation One Tax’.

- The GST has subsumed indirect taxes like excise duty, Value Added Tax (VAT), service tax, luxury tax etc.

- It is essentially a consumption tax and is levied at the final consumption point.

- This has helped mitigate the double taxation, cascading effect of taxes, multiplicity of taxes, classification issues etc., and has led to a common national market.

- The GST that a merchant pays to procure goods or services (i.e. on inputs) can be set off later against the tax applicable on supply of final goods and services.

- The set off tax is called input tax credit.

- The GST avoids the cascading effect or tax on tax which increases the tax burden on the end consumer.

- Tax Structure under GST:

- Central GST to cover Excise duty, Service tax etc,

- State GST to cover VAT, luxury tax etc.

- Integrated GST (IGST) to cover inter-state trade.

- IGST per se is not a tax but a system to coordinate state and union taxes.

- It has a 4-tier tax structure for all goods and services under the slabs- 5%, 12%, 18% and 28%.

Social Issues

Prohibition Laws and Issues

For Prelims: Right to Privacy, States that have banned sale of alcohol, Directive Principles of State Policy(DPSP), Fundamental duties.

For Mains: Concerns associated with Prohibition Acts in India, Art 47 versus Right to Privacy (Right to life including Right to Eat and Drink of one’s choice)

Why in News

Recently, the Bihar Government has decided to use Drones to monitor illegal liquor manufacturing.

- This has initiated the debate of the utility of using physical and financial resources to implement the provisions of the prohibition act.

Key Points

- About:

- Prohibition is the act or practice of forbidding something by law, more particularly the term refers to the banning of the manufacture, storage (whether in barrels or in bottles), transportation, sale, possession, and consumption of alcoholic beverages.

- Constitutional Provisions:

- Article 47: The Directive Principle in the Constitution of India states that “The state shall undertake rules to bring about prohibition of the consumption except for medicinal purposes of intoxicating drinks and of drugs which are injurious to health”.

- State Subject: Alcohol is a subject in the State list under the seventh schedule of the Indian Constitution.

- Other Prohibition Acts in India:

- Bombay Abkari Act, 1878: The first hint at the prohibition of liquor was through the Bombay Abkari Act, 1878 (in the Province of Bombay).

- This Act dealt with levying of duties on intoxicants, among other things and aspects of prohibition via amendments made in 1939 and 1947.

- Bombay Prohibition Act, 1949: There were “many lacuna” in the Bombay Abkari Act, 1878, from the point of view of the government’s decision to enforce prohibition.

- This led to the birth of Bombay Prohibition Act, 1949.

- The Supreme Court (SC) upheld the Act broadly barring a few sections in 1951 in the judgment of State of Bombay and another versus FN Balsara.

- Gujarat Prohibition Act, 1949:

- Gujarat adopted the prohibition policy in 1960 and subsequently chose to enforce it with greater rigidity, but also made processes easier for foreign tourists and visitors to get liquor permits.

- In 2011, the Act was renamed as Gujarat Prohibition Act. In 2017, the Gujarat Prohibition (Amendment) Act was passed with provision of up to ten years jail for manufacturing, purchase, sale and transportation of liquor in the dry state.

- Bihar Prohibition Act, 2016: The Bihar Prohibition and Excise Act was brought into effect in 2016.

- Over 3.5 lakh people have been arrested under the stringent prohibition law since 2016 leading to crowded jails and clogged courts.

- Other States: Alcohol prohibition in India is in force in the states of Mizoram, Nagaland as well as in the union territory of Lakshadweep

- Bombay Abkari Act, 1878: The first hint at the prohibition of liquor was through the Bombay Abkari Act, 1878 (in the Province of Bombay).

- Arguments against Prohibition of Liquor:

- The Right of Privacy:

- Any invasion by the state in an individual’s right to choice of food and beverage amounts to an unreasonable restriction and destroys the individual’s decisional and bodily autonomy.

- Right to privacy has been held as a fundamental right by the Supreme Court in several judgments since 2017.

- Aggravate the Sense of Violence: Various research and studies have shown that alcohol tends to aggravate the sense of violence.

- Most of the domestic violence crimes against women and children are committed behind closed doors.

- Loss of Revenue: Tax revenues from alcohol is a major part of any government’s revenues. These enable the government to finance several public welfare schemes. Absence of these revenues may severely impacts state’s ability to run public welfare programmes.

- Source of Employment: Today, the Indian Made Foreign Liquors (IMFL) industry contributes over 1 lakh crore in taxes every year. It supports the livelihood of lakhs of farming families and provides direct and indirect employment to lakhs of workers employed in the industry.

- The Right of Privacy:

- Arguments in Favour of Liquor Prohibition :

- Impact on Livelihoods: Alcohol denudes family resources and reserves and leaves women and children as its most vulnerable victims. A social stigma at least as far as the family unit is concerned is still attached to the consumption of alcohol.

- Discourage Regular Consumption: Strict state regulation is imperative to discourage regular and excessive consumption of alcohol.

- As the prohibition is mentioned in the State List under Schedule Seven, it is the duty of the state to make provisions related to prohibition.

Way Forward

- Between issues such as morality, prohibition or freedom of choice, there are also factors like economy, jobs, etc, which cannot be ignored. What is required is an informed and constructive dialogue on the causes and effects.

- Policy makers should focus on framing laws which encourage responsible behavior and compliance.

- Drinking age should be made uniform across the country and no person below that should be permitted to buy alcohol.

- Tough laws should be made against drunken behaviour in public, domestic violence under influence, and drinking and driving.

- The governments should set aside part of revenue earned from alcohol for social education, de-addiction, and community support.

Social Justice

Faecal Sludge and Septage Management

For Prelims: Faecal Sludge and Septage Management (FSSM), NITI Aayog, Swachh Survekshan, Atal Mission for Rejuvenation and Urban Transformation (AMRUT) and National Mission for Clean Ganga (NMCG), Sustainable Development Goals (SDG)

For Mains: Issues and challenges involved in India’s waste Management system and related steps taken

Why in News

According to the NITI Aayog report Faecal sludge and septage management in urban areas, Service and business models, by 2021 more than 700 cities / towns are in various stages of Faecal Sludge and Septage Management (FSSM) implementation.

Key Points

- Faecal Sludge and Septage Management (FSSM):

- About:

- India has recognized the gaps in sanitation coverage and embarked purposefully to address them, becoming one of the first countries to announce a national policy on FSSM in 2017.

- FSSM prioritizes human excreta management, a waste stream with the highest potential for spreading diseases.

- It is a low-cost and easily scalable sanitation solution that focuses on safe collection, transportation, treatment, and reuse of human waste.

- As a result, FSSM promises a means to achieve the Sustainable Development Goals (SDG) target 6.2 of adequate and inclusive sanitation for all in a time bound manner.

- Related Initiatives:

- India has continued to show its commitment towards FSSM through the launch of Open Defecation-Free (ODF) + and ODF++ protocols, an emphasis on FSSM in Swachh Survekshan, as well as financial allocations for FSSM across Atal Mission for Rejuvenation and Urban Transformation (AMRUT) and National Mission for Clean Ganga (NMCG) missions.

- About:

- Capacity of India’s Sewage Treatment Plants:

- According to the latest report of the Central Pollution Control Board (CPCB), Sewage Treatment Plants (STPs) in India are able to treat a little more than a third of the sewage generated per day.

- India generated 72,368 MLD (million litres per day) whereas the installed capacity of STPs was 31,841 MLD (43.9%).

- 5 states and Union Territories (UT) - Maharashtra, Gujarat, Uttar Pradesh, Delhi and Karnataka - account for 60% of the total installed treatment capacity of the country.

- Issues with Solid Waste Management:

- Absence of segregation of waste at source.

- Lack of funds for waste management at Urban Local Bodies (ULB).

- Lack of technical expertise and appropriate institutional arrangement.

- Unwillingness of ULBs to introduce proper collection, segregation, transportation and treatment/disposal systems.

- Indifference of citizens towards waste management due to lack of awareness.

- Lack of community participation towards waste management and hygienic conditions.

Way Forward

- Utilising FSSM Alliance: The National Faecal Sludge and Septage Management (NFSSM) Alliance has played a catalytic role in the FSSM sector in India so far and serves as a ready resource and platform for state and city officials.

- To ensure long term sustainability and quality implementation, states and cities must undertake capacity building, quality assurance and quality control, and monitoring. Moreover, it is critical that states take steps to institutionalize

- Keeping the most vulnerable and underserved, women and urban poor at the center of this effort, states and cities must move quickly to introduce innovative solutions.

- With that, India can become an exemplar to the world for not only ending open defecation, but also for safely managed holistic sanitation.

Important Facts For Prelims

Rani Lakshmibai

Why in News

Recently, the Uttar Pradesh Chief Minister has announced that the Jhansi Railway Station in Uttar Pradesh will be known as Veerangana Lakshmibai Railway Station.

Key Points

- Early Life:

- She was born on 19th November 1828 in Varanasi, Uttar Pradesh.

- Her father’s name was Moropant Tambe. Lakshmibai’s childhood name was ‘Manikarnika’ and was affectionately addressed as ‘Manu’.

- She had a son Damodar Rao, who died within four months of his birth. Following the death of the infant, her husband adopted a cousin’s child Anand Rao, who was renamed Damodar Rao a day prior to the death of the Maharaja.

- Role in India's Struggle for Independence:

- Rani Lakshmibai was one of the brave warriors of India's struggle for Independence.

- In 1853, when the Maharaja of Jhansi died, Lord Dalhousie refused to acknowledge the child and applied the Doctrine of Lapse, and annexed the state.

- Rani Lakshmibai fought bravely against the British so as to save her empire from annexation. She died fighting on the battlefield on 17th June 1858.

- When the Indian National Army started its first female unit (in 1943), it was named after the valiant queen of Jhansi.

Doctrine of Lapse

- It was an annexation policy followed widely by Lord Dalhousie when he was India's Governor-General from 1848 to 1856.

- According to this, any princely state that was under the direct or indirect control of the East India Company where the ruler did not have a legal male heir would be annexed by the company.

- Thus, any adopted son of the Indian ruler would not be proclaimed as heir to the kingdom.

- By applying the doctrine of lapse, Dalhousie annexed the States of:

- Satara (1848 A.D.),

- Jaitpur, and Sambalpur (1849 A.D.),

- Baghat (1850 A.D.),

- Udaipur (1852 A.D.),

- Jhansi (1853 A.D.), and

- Nagpur (1854 A.D.)

Procedure For Changing the Name

- An executive order passed with simple majority by the State legislature is required to rename any village, town, city or a station, while an amendment of the Constitution with majority in Parliament is needed for changing the name of a state.

- It is noteworthy that the Union Home Ministry gives a green signal to the proposal to change the name of any railway station or place after getting no objection from the Ministry of Railways, Department of Posts, and Survey of India.

Important Facts For Prelims

One Nation-One Grid-One Frequency: National Grid

Why in News

Recently, the Power Grid Corp. of India Ltd (PGCIL) celebrated the anniversary of operationalization of One Nation-One Grid-One Frequency i.e National Grid.

Key Points

- Evolution of National Grid:

- The national grid management on a regional basis started in the sixties.

- The Indian Power system for planning and operational purposes is divided into five regional grids.

- The integration of regional grids, and thereby establishment of National Grid, was conceptualised in the early nineties.

- Initially, State grids were interconnected to form a regional grid and India was demarcated into 5 regions namely Northern, Eastern, Western, North Eastern and Southern region.

- In 1991 North Eastern and Eastern grids were connected. Further, in 2003, Western region grid was connected with it.

- In august 2006 North and East grids were interconnected thereby 4 regional grids are synchronously connected forming a central grid operating at one frequency.

- On 31st December 2013, the southern Region was connected to the Central Grid. Thereby achieving 'One Nation, One Grid, One Frequency’.

- All possible measures are taken to ensure that the grid frequency always remains within the 49.90-50.05 Hz (hertz) band.

Importance of One Frequency

- Maintaining a consistent electrical frequency is important because multiple frequencies cannot operate alongside each other without damaging equipment.

- This has serious implications when providing electricity at a national scale.

- Capacity of National Grid:

- Presently, the country has a total inter-regional transmission capacity of about 1,12,250 MW which is expected to be enhanced to about 1,18,740 MW by 2022.

- Benefits of One Nation-One Grid-One Frequency:

- Matching Demand-Supply: Synchronisation of all regional grids will help in optimal utilization of scarce natural resources by transfer of Power from Resource centric regions to Load centric regions.

- Development of Electricity Market: Further, this shall pave the way for establishment of a vibrant Electricity market facilitating trading of power across regions.

Important Facts For Prelims

Core Sectors Industries

Why in News

The output of Eight Core Industries grew at 3.1 %, the slowest pace in eight months in November, indicating slowing momentum in the Indian economy. Barring crude oil and cement, all other sectors recorded positive growth.

- Eight core sectors are: Coal, crude oil, natural gas, refinery products, fertiliser, steel, cement and electricity.

Key Points

- About Eight Core Sectors:

- These comprise 40.27% of the weight of items included in the Index of Industrial Production (IIP).

- The eight core sector industries in decreasing order of their weightage: Refinery Products> Electricity> Steel> Coal> Crude Oil> Natural Gas> Cement> Fertilizers.

- Index of Industrial Production:

- IIP is an indicator that measures the changes in the volume of production of industrial products during a given period.

- It is compiled and published monthly by the Central Statistical Organization (CSO), Ministry of Statistics and Programme Implementation.

- It is a composite indicator that measures the growth rate of industry groups classified under:

- Broad sectors, namely, Mining, Manufacturing, and Electricity.

- Use-based sectors, namely Basic Goods, Capital Goods, and Intermediate Goods.

- Base Year for IIP is 2011-2012.

- Significance of IIP:

- It is used by government agencies including the Ministry of Finance, the Reserve Bank of India, etc, for policy-making purposes.

- IIP remains extremely relevant for the calculation of the quarterly and advance GDP (Gross Domestic Product) estimates.